February Investment Plan

What Japan, gold, and Warsh are telling us about the next six months

Today, everything is about risk.

As I shared a few days ago, risk will force me to adjust the portfolio; I already started to. There’s a moment in the market where we should take things the easy way, there are no reason to overcomplicate things or take unnecessary risks.

So this is what the February investment plan will be about: rebalancing. And risk.

And I believe 2026 will be about this as well, or at least with much better selectivity. I shared a small write-up about how easy mode was over and we were entering hard mode, a real stock picker era. I’d start by reading it before this investment plan.

The next year could be harder. But it won’t be less good.

This monthly report is going to be long with lots of macro & liquidity talk; I conclude as usual with market overview and my investing strategy so feel free to jump there if that’s what you’re here for, although I personally believe everything is interesting!

Macro & Market

The environment has changed over the last months and it’s hard not to acknowledge it by now. It started months ago already, and even if I’m not saying the bull run is over and we should just close our positions and go home, I personally do not see the point in holding high-risk assets anymore, when so many defensive names are screaming to give us safer returns.

The Japanese Carry Trade

First, liquidity is changing. Even if global macro is too complex to summarize in a few lines, it is tighter today than a month ago if only because of Japanese interest rates.

As borrowing became more expensive, Western institutions who borrowed cheap yen to invest elsewhere had to cut large loans & reduce new ones, meaning less liquidity entering the markets.

This is the 10Y, but shorter timeframes show the same behavior. Bank of Japan made clear they will hold or increase rates in coming months, so we can assume this source of liquidity is dead, won’t come back to what it was at least. A 0.5% difference when we’re talking about billions in loans is massive, so imagine a 1.25%...

As this is a net loss, others, like U.S. fiscal policy, won’t compensate. When the market is used to both, losing one is tough…

Kevin Warsh & Monetary Policy

U.S. fiscal policy isn’t changing: full swing on debt. But monetary policy is about to as Powell finishes his term and Trump has been vocal about how he views FED decisions on interest rates.

Beyond what economists would say about those comments, the point is that Trump finally named Powell’s successor: Kevin Warsh. The market didn’t love it, although I think the market is wrong.

Quick background on Warsh and on why the market doesn’t like him: he was hawkish during the 2008 crash, opposing rate cuts during the crisis over inflation concerns. He wasn’t totally wrong, though the alternatives were maybe uglier - we’ll never know as rates were cut.

June 2008: “Inflation risks, in my view, continue to predominate as the greater risk to the economy.”

September 2008, the month Lehman Brothers collapsed, Warsh said: “I’m still not ready to relinquish my concerns on the inflation front.”

The market tanked following his nomination as investors worry Warsh ends up head-to-head with Trump and refuses to cut rates, which is what Trump wants.

I think Warsh will walk in and cut rates. Why? Because it’s the only reason Trump put him there. If Warsh wanted independence, Trump would have found someone else, someone more malleable.

The second problem is that obeying Trump creates even bigger issues as it means the FED independence is gone. If Trump - or any government, controls both monetary & fiscal policy, it’ll push America toward disaster: the last step necessary for collapse. It would take years, but it would be unavoidable as politicians abuse both frameworks and crumble the currency for political (and personal) gains. On the good side, assets would appreciate if that were to happen, but I am not sure what would be best.

U.S. Dollar, Gold & Silver

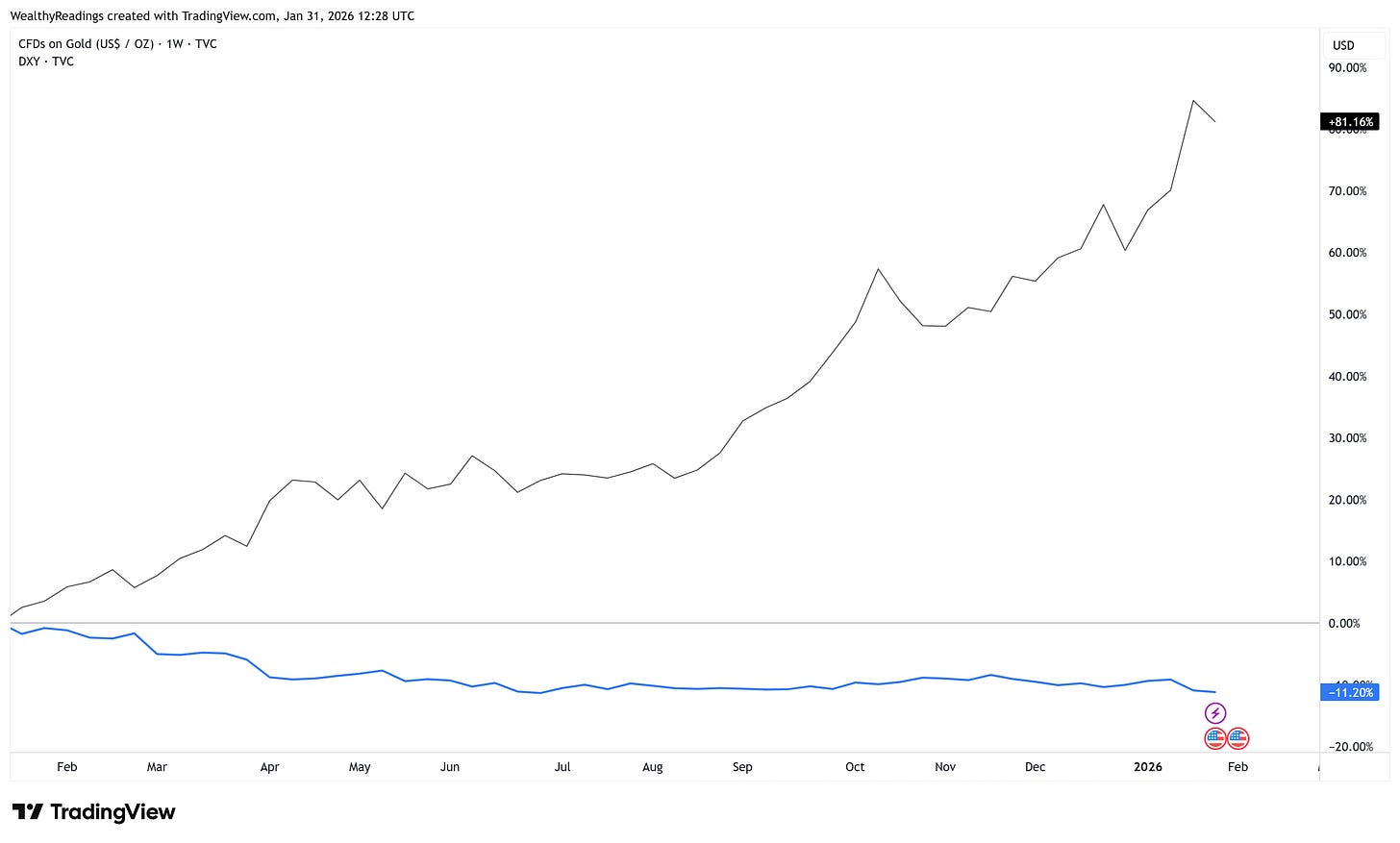

Without being dramatic as an empire fall takes decades to play out, not months, the market is clearly thinking about this. It shows in the most important assets in the world.

The dollar has been falling like a rock. Gold has been rising to new highs as many hide in the only real currency. And other precious metals followed.

As we saw this week, speculation also plays a massive role. Gold fell ~10% over two days, erasing ~$3.5T of value - around 2x Bitcoin’s entire market cap. This isn’t just about safe-haven buying; there’s leverage and speculation and it ended up in one of the biggest wipeout of history for the previous metal.

But clearly, investors are buying gold and selling dollars. There’s a reason. For now, this is mostly momentum & narrative speculation. Based on real concerns but we’re not there yet.

Short term, we’ll certainly see bubble dynamics and violent reactions. But the narrative is set: if Warsh confirms he’s Trump’s puppet, gold will continue rising long term. If not? It’ll rise as well on inflationary concerns.

Inflation & Tariffs

To pile on uncertainty, January PPI data came in hot, meaning production costs are higher than last month and those added costs will be passed to consumers, meaning CPI should increase and inflation isn’t put to bed.

That impacts rate expectations directly: with inflation, no rate cuts. Combined with Warsh concerns - who could hike rates, the market isn’t optimistic.

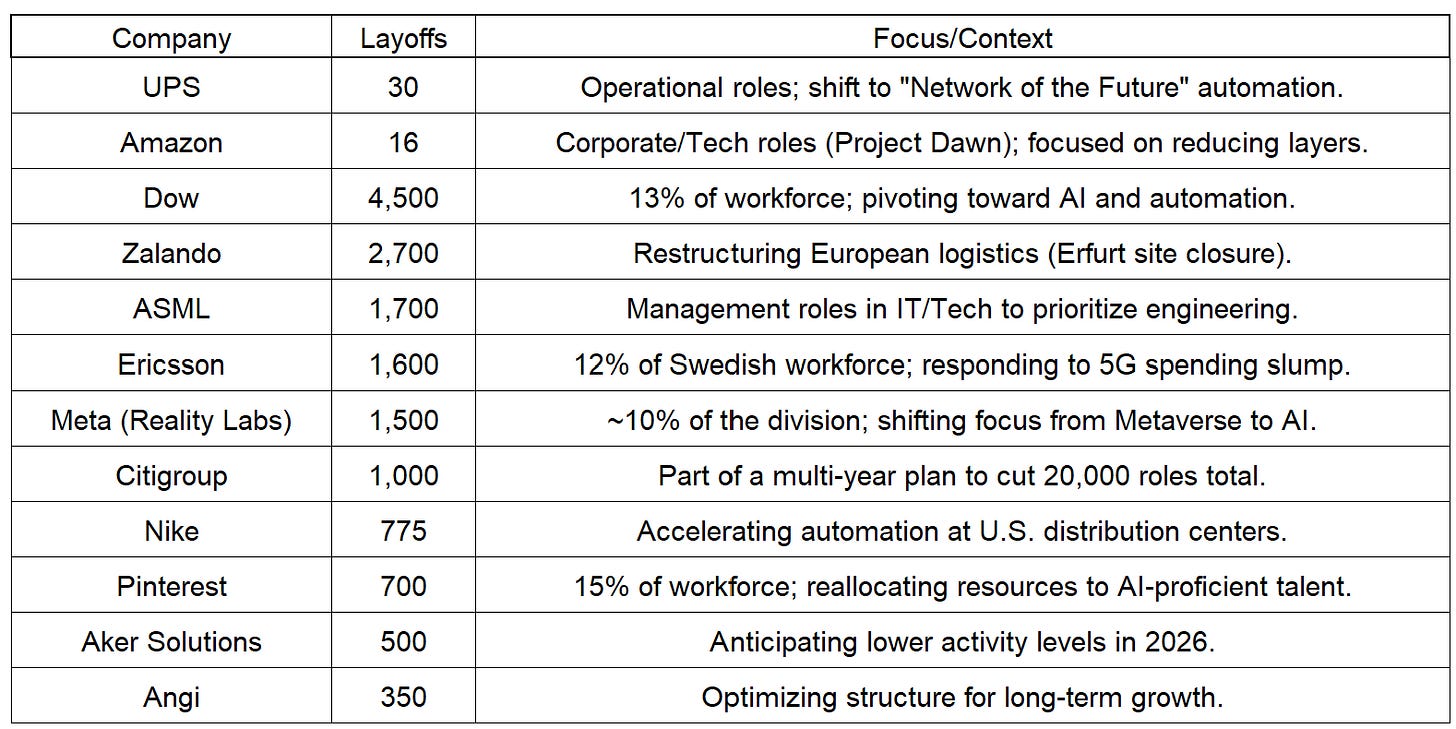

Add massive layoffs happening for cost-cutting, AI efficiency and other reasons, and the situation is as bad as I expected more than a year ago.

Thinking prices could stabilize with fiscal spending and tariffs was wishful thinking.

Speaking of tariffs, we’re still waiting on the Supreme Court ruling after multiple false alarms. This isn’t a small ruling, consequences will be significant either way & waiting for the decision, Trump continues threatening those who don’t cooperate with more of them, creating more volatility, though the playbook is getting old.

In brief.

Lots of uncertainty.

Lower liquidity.

Not goody.

Market & Selectivity

As I shared in the note about market’s hard mode, we’re seeing different behavior within sectors. All semis don’t run together anymore. All techs don’t run together anymore. Liquidity goes to the best narratives, the best handful of names, leaves others behind.

Google ran while the Mag7 struggled, though it should get punished

Meta got punished for margins before being bought back; Microsoft was sold for the exact same reasons

ASML kept running on memory cycle hype, following Sandisk and Micron, but GPU names were flat at best

Software is the only sector running together: down, down and down

Pickiness is not a bull market sign, it is a low liquidity sign and we see it more & more. That said, the AI trade isn’t over. Many AI names are still rocketing, the difference is that their sectors don’t follow while it used to. But returns on the right picks remain massive.

Leaders will still lead. Maybe even stronger as liquidity concentrates.

What’s Working

I’ll talk about what I know and see. I work alone, so there are sectors and stocks I don’t follow or see, feel free to share opportunities if you see some I don’t!

Defensives

What’s working most right now is defensives. I’ve talked about them a lot lately, while others on social media focus on accumulating names that fell and now trade at “a discount” compared to... their price last month.

Everyone invests as see fit but I personally believe investors took terrible habits over the last two years, the most dangerous being getting used to buy every dip as they were all pushing to new highs few weeks later.

To my opinion, this time is over, or close to be.

So, defensives. As I’ve said in all my write-ups: they aren’t sexy. But it’s time to decide if you want to make money or play sexy names. I’ve written two articles on defensive opportunities - one about UPS and Novo (both targets triggered), one about Darling Ingredients, Nutrien, and Smith & Wesson (not triggered yet). There are more, and I continue hunting.

All the names on my watchlist outperformed the S&P the last six months. My only mistake was not piling into Halliburton and Schlumberger when I said we should months ago because AI seemed to yield more potential. Both are up 40%+ & my option plays returned multiples.

I won’t make that mistake again.

International Assets

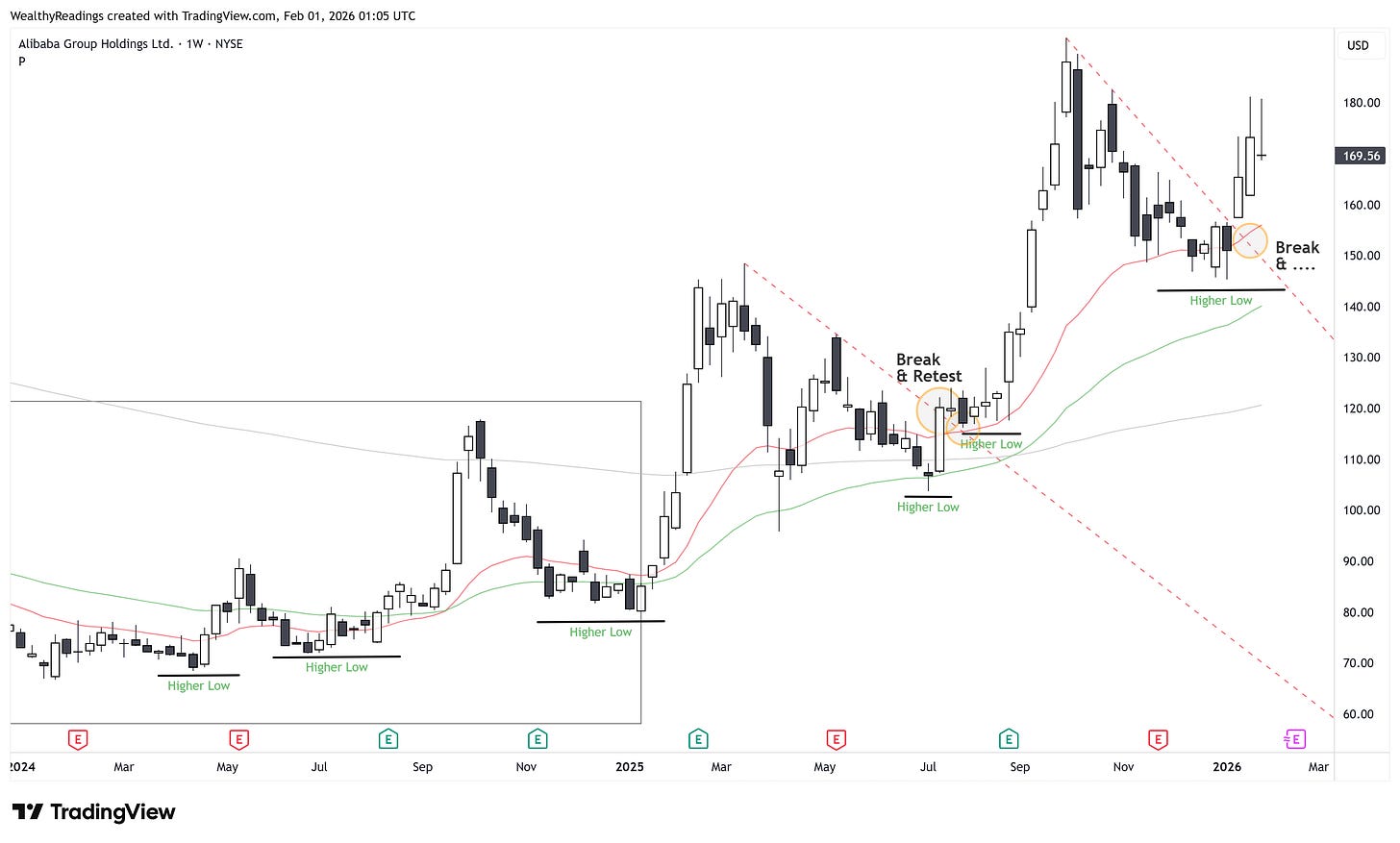

This might seem counterintuitive, but most current uncertainty is about U.S. internal affairs - tariffs, consumption, interest rates. Meanwhile, other regions are improving, namely China/Asia and Latin America. China doesn’t rely on U.S. monetary or fiscal policy, which is a massive advantage now. Plus, some U.S. issues - like a weakening dollar, are actually bullish for other countries.

I detailed the mechanism in my MercadoLibre write-up.

I don’t follow many names besides MercadoLibre & Alibaba. Both are outperforming as U.S. stocks crumble. More names certainly follow their example - worth looking at.

Commodities

We talked about gold. You’ve heard about silver. Many metals returned massive gains over recent months. It’s worked and will probably push higher, but I wouldn’t touch any today while the push and dump 10%+ per day. The sector needs a breather or some stabilization at best.

It’s all about r... I’m sure you finished that sentence.

AI isn’t over

The AI bull run isn’t over, the dynamic is simply shifting. We’ve seen that Sandisk, TSM, Google, Meta, ASML & others were bought after great earnings, meaning liquidity still wants to be tight to AI.

I continue to believe in my three positions: Nebius, Astera Labs, and UiPath. Details later. The bottom line being that liquidity still flows to these names; they aren’t ignored or sold out, but only the good ones.

But… Everything is about risk. Why pile on risk while other opportunities exist with compelling potential and less of it?

What’s Breaking

The question should be: what’s not breaking lately?

Cryptos

You know I’ve been a big Bitcoin and Strategy bull. But I closed my position entirely on Thursday. Bitcoin fell 7% more since then, and Monday’s open should be ugly. I have no problem being wrong, what matters is adapting rapidly.

Strategy got rejected by its weekly average again, printed a new low, and Bitcoin did the same. No bids, no demand, nothing, although most of this came from leverage liquidations - as usual in crypto.

Nothing more to say. Crypto moves on liquidity, and liquidity is shrinking. Although I said in my bull thesis we’d see more pain before gains - that’s how crypto works, we might be past that point. I struggle to find a catalyst. I could be wrong. But I wouldn’t consider any pump a healthy uptrend anymore, just trader noise during a downtrend, except if coming after the announce of the U.S. buying Bitcoin for example, or other massive catalyst.

As usual, I keep the right to change my mind. There is a possibility that we have a bear trap and that Bitcoin just goes back up with AI names due to… Any kind of catalysts I cannot think about.

But once again, to repeat myself: this is about risk. Do I need to take this one? Why?

Softwares

All the social media darlings: Adobe, UiPath, Duolingo, ServiceNow & co. Everything tied to software is being sold on fears AI will replace them. I love most of these companies but hate their stocks right now.

Like crypto, these will yield wonderful opportunities because most won’t be disrupted by AI, they’ll be enhanced. But if the market might need a year or two to understand, I’ll give it a year or two before buying. Patience.

High valuation & Speculative names

So many in this category. Netflix took a massive hit. Palantir is on the edge of a cliff, a pretty vertiginous one - and I hope it falls. Hims went from healthcare revolution to nothing. Robinhood is starting to be priced like we aren’t always in a bull market. Quantum is finally being put back where it belongs…

Again: everything isn’t being punished, AST Mobile and RocketLabs continue to push higher, but everything doesn’t.

In Brief

Most of what worked the past two years doesn’t work anymore. Many took terrible habits and most retail is just accumulating, waiting for the storm to pass. Almost no one talks about the potential for this not to be a storm, but a real slowdown.

To me, most charts don’t look like a storm. They look like a rotation.

Much has changed and the market must change too. Even if some names bounce or go higher, I don’t expect this year to be like the last two. I believe most will continue to trade down for quarters, some years, and while many will continue to accumulate and scream how cheap their darling became, I’ll be somewhere else entirely. Most of those will yield opportunities in time, massive ones.

But for now, it’s time to listen to the market.

It’s time to be defensive. Selective. Surgical.

Why buy AI growth at 50x sales when I can buy Novo - a defensive healthcare asset near its lowest valuation ever with growth catalysts. Or Nutrien - also near its lowest multiple while its business should accelerate on demand for a resource critical to growing food? Liquidity is confirming it wants these names.

Why take risks? I don’t need to. Returns exist in unsexy names as well.

My Investing Plan

I think my write-up is clear: I do not intend to buy risk assets. It doesn’t mean I won’t hold any, it means I do not plan to accumulate or start new position in the sector, not without crystal clear sing of demand at least. I need the market to show love to hold my positions and be more aggressive.

But my focus is on defensives now and I will sell risk assets to buy defensives if they don’t behave as I expect. No hard feelings. I know I’ll be called a trader even though I’ve held most of my portfolio much more than a year, but this is how I do things. If the market refuses to reward good earnings from AI names, there’s a reason. I have clear, argued reasons not to hold stocks the market doesn’t like.

We don’t make money sticking to feelings and bias. We make money adapting. I buy stocks I believe can return greatly, not stocks everyone buys hoping they’ll do something great in 10 years.

Starting February, my priority is Novo, depending on earnings. Transmedics would be second but my position is already big, so Alibaba will be. Other defensives then, on par with UiPath which I keep on standby until earnings or some positivity.

My AI Names - Nebius & Astera Labs

I see no reason to sell either. Both are excellent and I’m bullish on earnings; nothing points to slowing demand - Meta and Microsoft confirmed it is still through the roof and TSM and Sandisk confirmed hardware demand also is.

I’d expect both to do well. Market’s reaction will be the key factor for me. Microsoft showed that growth and great earnings weren't enough, details mattered and a 1% lower guidance resulted in a 5% plunge.

I won’t hold these names if they’re sold after good/stable earnings. If strong results aren’t rewarded, my money is better spent on defensives, it means appetite is down. In those situations, bounces happen, but medium-term potential is limited. It’s not about the companies; it’s about risk appetite.

Nothing we can do about it.

There are clear risks and negativity around AI. The OpenAI centralized risk is real and growing with positive news one day about Emirates financing, rumors the next about deals falling through with Nvidia over concerns about OpenAI’s management/ability to compete against Google and Anthropic. Jenssen answered in an interview that this wasn’t true a day later, and there’s apparently an IPO plan for year-end.

Pretty impossible to know where we’re going… At today’s AI valuations, stocks go up with optimism, nothing else. Without it, I’ll put my liquidity elsewhere.

UiPath

I continue to believe AI-enhanced software is one of the market’s next phases. Tools that push companies efficiency further, and UiPath is one of them. But like many others, it’s been sold violently due to worries around AI.

My target was $14. I bought there, added call options, still hold everything. As long as we hold the current higher low, the uptrend is intact but losing it would be tough and losing the weekly 50 for weeks wouldn’t send a very positive signal.

I am yet undecided of what I’ll do if we lose the actual low so I’ll adapt depending on my liquidity needs in the moment. My position is complete, I won’t add to it in today environment except if UiPath were to give clear signs of bottom and bounce.

This is a hold-and-observe name for February.

Alibaba

I don’t list this as an AI name because I consider it a China/diversification position. It didn’t sell when Western names fell & has behaved differently, while the opportunity remains massive and misunderstood.

Alibaba remains excellent at fair valuation with massive potential. I’d continue accumulating on a retest around $155.

Alibaba has what it takes to lead in AI and in diversification.

Transmedics

You know my view. My biggest position ~30% of portfolio. A healthcare name that’s been trading like a growth AI stock for months, god knows why, which I consider undervalued based on potential and actual growth.

The company is closing January with ~900 flights, a record. International expansion is on time, heart and lungs trials are going well, next-gen OCS and kidneys are on time, even planned earlier than expected… Everything points to things going very well.

I still don’t understand what the market doesn’t like or why it doesn’t reward this name. My only conclusion is that it doesn’t understand it yet, or that it is a small capitalization hence not enough are aware of it… I cannot be sure.

I don’t plan to buy more, I’m already heavy. But for those interested, the weekly 50 is key, sitting around $120.

Novo Nordisk

My favorite right now. The name took time to stabilize but the thesis is crystal clear: GLP-1 pills are in high demand, customers are satisfied after a month, prescriptions are raining. The question is how successful it will be in coming months and whether they can take share back from Eli Lilly.

The stock didn’t push to a higher high, meaning the market isn’t ready to reward it without clear data. Earnings are Wednesday, that will set the tone. I already have a position, not full, I’m ready to grow it significantly depending on results.

First target is ~$55, second ~$50. Assuming earnings please me, and I’ll write about them in detail, that’s where I’m buying.

Lululemon

My smallest position, opened at $190 as planned. I’ll keep it small because it’s riskier, but I believe it can pull an American Eagle or Victoria’s Secret on positivity around the Western consumer.

The stock closed its daily gap, fell for two weeks on no volume - meaning few shares were actually sold, and we’re holding the bottom. As long as we do, I’m in.

UPS, Nutrien, Darling & Smith

I’ve shared two write-ups on these names over recent weeks. All have great potential. I could buy any of them at the right price, depending on liquidity and what the market does with my AI names.

But Novo remains my #1 accumulation for now.

Looking Ahead

We’re still in earnings season with a packed month ahead. This will be the last month I hold risk if the market doesn’t show appreciation for these assets after strong results. I’d of course hold them if they were to push higher on great earnings.

Here’s my planning based on names I follow (dates may shift slightly):

Week 1 - Novo Nordisk

Week 2 - AsteraLabs, Darling Ingredient

Week 3 - Nutrien, Alibaba, Nebius

Week 4 - Transmedics

I’ll closely watch earnings and reactions for all tech names. Google, Nvidia, and others report this week - I’ll also cover them with a condensed review as I did for Microsoft and Meta. I will cover in more details the assets I would buy, but I won’t ignore the rest and you’ll receive all necessary information!

February is shaping up to be pivotal. I’d rather hold my AI names & enjoy returns, but if the market doesn’t want to give them to me, I’ll pass. AI isn’t disappearing, most names today will be opportunities again in a few quarters or years.

I’ll be there then, once again. Until then, safety and patience.

Disclaimer: I am not a licensed financial advisor, analyst, or broker. This content reflects my personal opinions and investment decisions for informational and educational purposes only. I hold positions in securities discussed and may buy or sell without notice. Nothing here constitutes a recommendation to buy, sell, or hold any security. Past performance does not guarantee future results.

Always conduct your own research and consult a qualified professional before making investment decisions. I accept no responsibility for any financial losses.

Sharp analysis on the liquidity tightening from the Japanese carry trade unwinding. The 1.25% spread increase when institutions are borrowing billions isn't just a rounding error, it's areal regime shift. I've been watching how my mid-cap tech holdings are diverging from their sector indices lately, and this selectivity framing makes way more sense than the "rotation" narrative most people are pushing. Defensives over speculation actuallyfeels rational for once.

Today I was reading your February plan — you’re really one of the few who started de-risking, and only time will tell whether you’re right or not.

But I just can’t deny myself a second of sarcasm and not ask you: 'So how’s your defensive $NVO doing?' :)