Weekly Recap 2 - January 18th

American Greenland, Bank earnings, Transmedics' conference, TSM earnings, Ads in ChatGPT, Meta's datacenter, UIPath vs Claude CoWork, Weekly planning

Hello everyone!

Quick reminder: the database is live and updated from Friday’s close.

I’m also working on something new, a better way to follow my positions and watchlist easily. Substack isn’t ideal for that. Going to take me some time, but it’ll be real great. Stay tuned!

Greenland Drama

You’ve probably heard about Trump’s new objective after Venezuela: Greenland. I’ll not comment on whether it’s good or bad, not my place, but the country is a geopolitical asset, so the “fight” makes sense.

Europe is a dying continent with little leverage, hard to know how this ends. From a market perspective, I don’t see this creating major problems. Tariffs aren’t good and tensions between western countries aren’t either, but the market impact? Limited I believe.

But there are few assets which could be hit, like the two biggest European companies, ASML and Novo Nordisk. Europe already used them as leverage during 2025 and that could happen again this year. I doubt we’ll get to this point but some uncertainties at Monday’s open could give me the retest I’ve been looking for on Novo. I’ll buy in if we get there, without any doubt.

Worth noting: Trump’s pattern has been noise on weekends, resolution by Tuesday. So I wouldn’t expect too much mess, and any mess would be a buying opportunity as the west cannot be fragmented nowadays, so they’ll find a resolution.

U.S. Bank Earnings

As always, banks kick off earnings season. They’re finally saying what we anticipated over a year ago: consumers are cracking.

High-income households start to struggle to compensate for the lack of buying power from low/medium-income households. That’s what PayPal shared a few weeks ago - and social media got mad at management for doing so.

And the low income households are really struggling.

Credit card debt at record high

Delinquency, reasonable but rising

Spending is shifting to necessities

Other expenses are cut or reduced

Spending growth is mostly due to inflation

As long as higher-income households spend more, the economy looks great. But this is slowing down and will continue to. Question’s when will that shift?

Consumers have money. If you ask me about the short run - six to twelve months, it’s pretty positive.

No one knows and I wouldn’t make investment decisions based on this. But struggling households also means less liquidity - to spend or to buy stocks, more fear - as wealth is stored in assets, while paychecks aren’t enough, so some potential selling and more volatility… Once again, there’s no point trying to reach conclusions just with this data, but I try to keep it in a corner of my mind.

Back to investing, we now have tons of stocks trading at low multiples while offering key services/products to populations, regardless of consumption growth, tariffs, any kind of regulation, etc… And the market is looking at them.

I continue to believe we’re closer to the end of this bull market than the start, and that I’ll start to rotate my liquidity as well as the risk/reward has clearly shifted.

Transmedics Conference

If you follow the company or are invested, everything is going almost better than we could have expected. The conference was great. We did not get as much information as we’d have liked, but what was said confirmed my base case.

And my base case is pretty bullish so.

AI News

Some thoughts first.

This earning season will be a make or break for me and the AI trade. It will be a bullish season; TSM started strong so I am confident but market’s reactions will be important to watch.

Can bullish data push stocks higher or are we exhausted and even excellent results won’t make a difference?

If it isn’t the case, I’ll have to review my holdings. With other sectors waking up & tons of liquidity rotating, we have great opportunities shaping up with a much better risk reward - two shared this week and more to come. I’ll still hold some AI names, I won’t close all my positions but I will rotate liquidity.

TSM Earnings

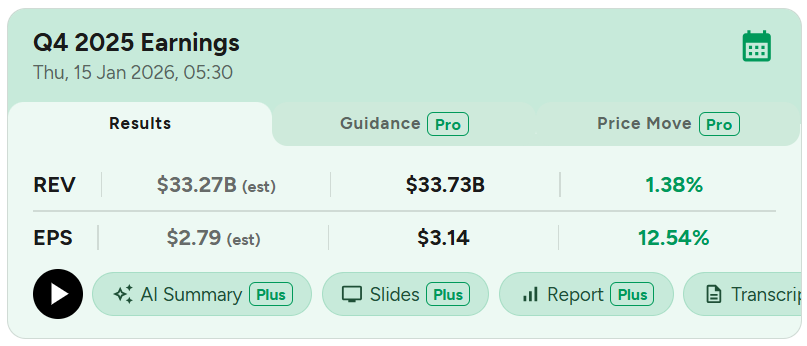

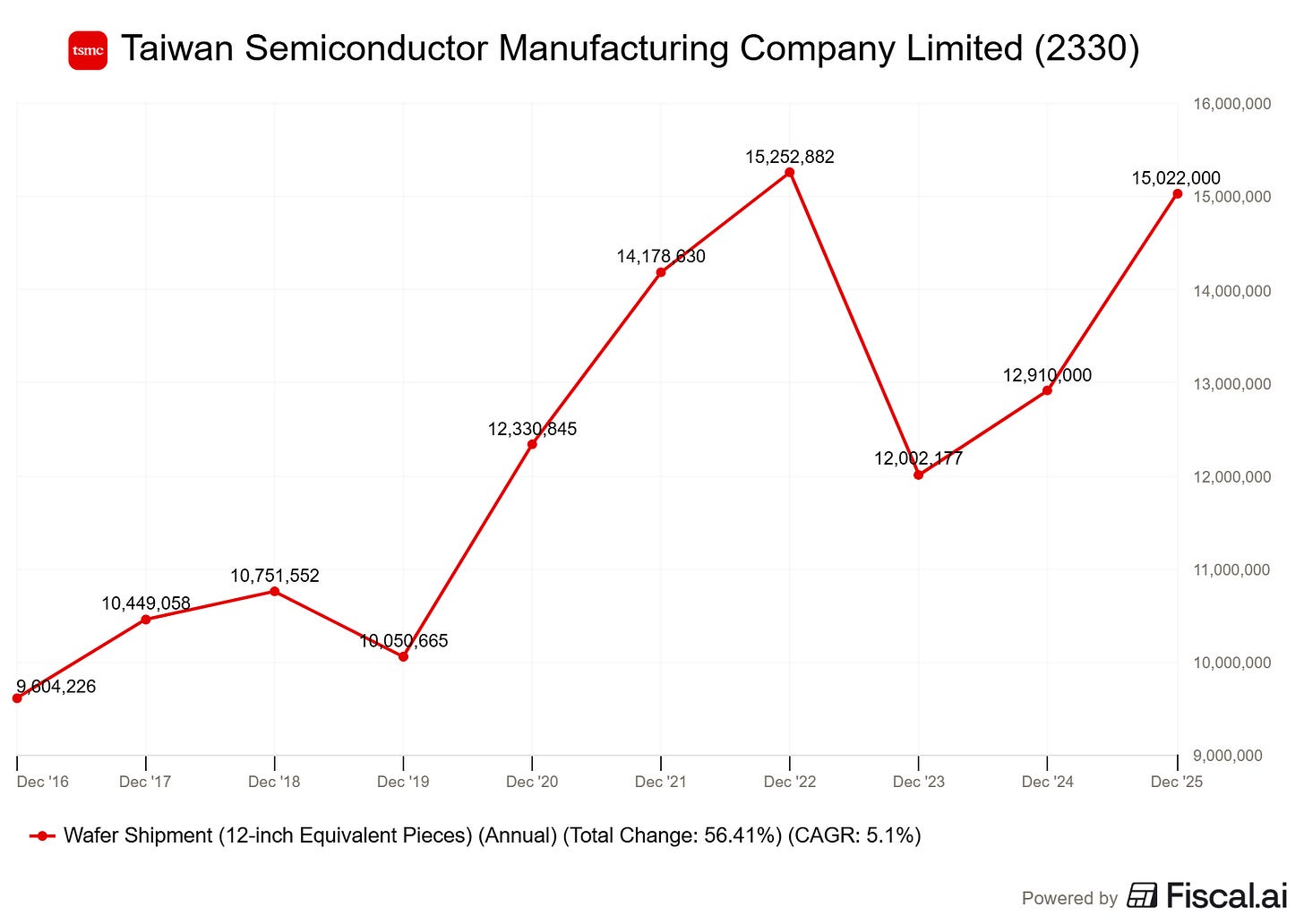

Another blow-out quarter which confirms that the AI trade isn’t over, fundamentally speaking at least, as demand is through the roof. They beat on both guidance and market’s expectations.

Growth was driven by their 3nm semiconductors, their most advanced tech for High-Performance Computing - HPC, which led to higher revenues per wafer and higher gross margins as they have no, or very limited competition in those and a massive pricing power.

Guidance is more of the same: a ~30% YoY growth FY26 based on current backlog as management shared that they were sold out through FY26… Massive demand.

They also revised their HPC guidance to 55% CAGR from 45% until 2029 and talked about being three times short of demand... We are talking about TSM, the biggest semiconductor producer of the world. Even them can’t answer demand.

“The multiyear AI megatrend remains strong... demand for semiconductors will continue to be very fundamental.” — C.C. Wei

“I believe the AI [boom] is real. Not only real, it has started growing into our daily life.” — C.C. Wei

This forced management to increase CapEx as their problem is production. They will expand their 2nm/3nm fabs to meet it and still don’t expect to do so before 2028 or 2029. The real world catches up to the investing world, as building cleanrooms can’t be done in a few weeks, add to this delays to have ASML’s lithography equipment & you’re talking months, at best…

The company is at peak production and is already fully booked for FY26. This is the state of demand for AI hardware - but this doesn’t mean stocks will continue to go higher a spick production also means lower growth until fabs are operational.

The bottom line remains that demand is through the roof and that TSM delivered above expectations. Let’s see the others now.

OpenAI Advertising.

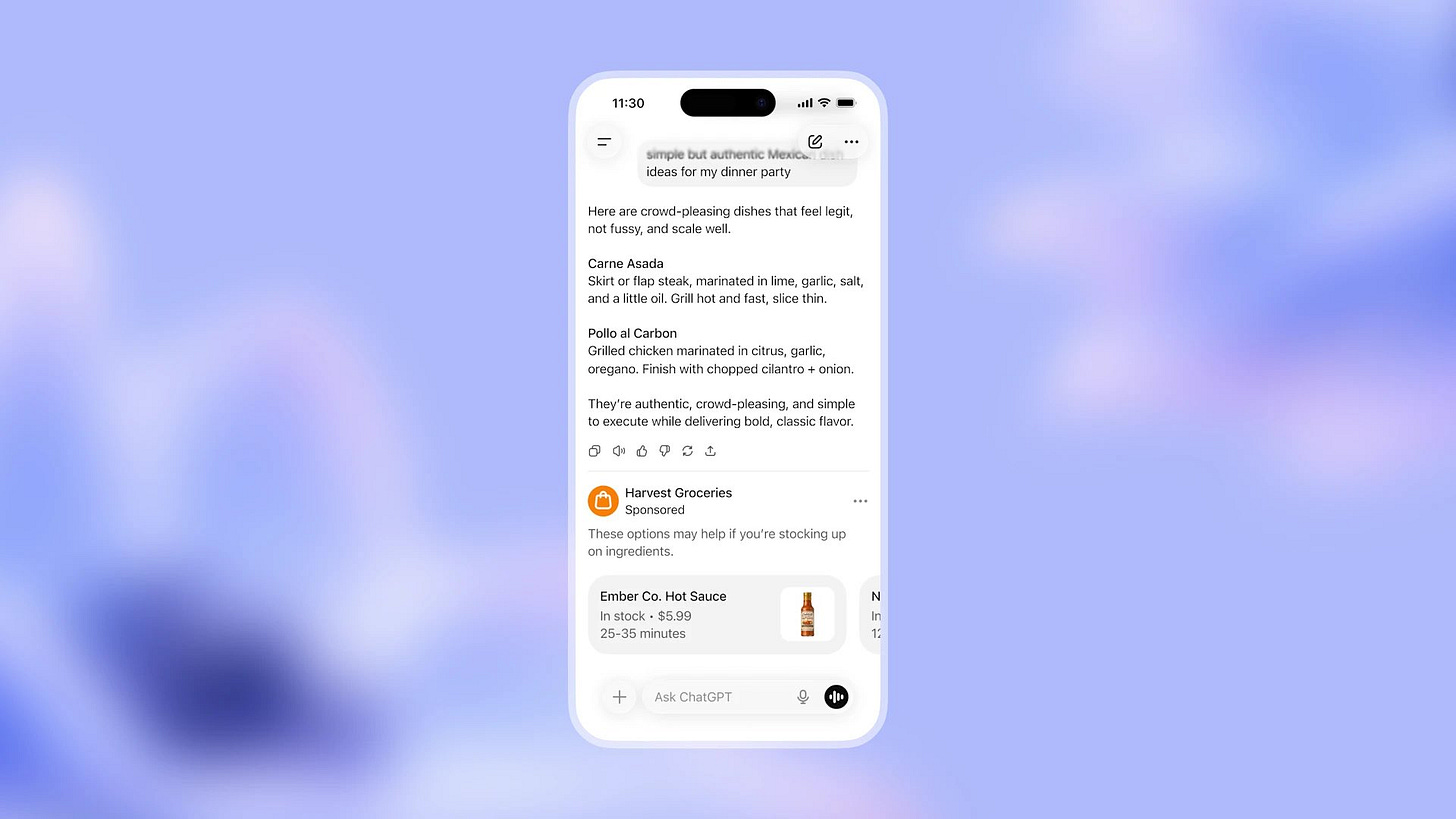

Yes, you will now see ads on ChatGPT if you aren’t a paid subscriber or for low tier subscriptions. This is the logical next step and couldn’t be avoided, I think believe it should have been done earlier but well. Better late than never.

Subscriptions aren’t a sustainable model on internet - which was built on advertisers money. The product always was users’ time and attention and we got used to have everything for free, habits are hard to change now, even for AI.

And this is great from a market perspective. Meta has proven over the last years that AI enhanced advertising was a damn profitable business. OpenAI has ~700M weekly users which is more than enough to make tons of money, combined with paid users and API usage, that could calm the market on its debt risks.

And as investors, what we want is the market to feel safe. With OpenAI being the key point of failure of the entire ecosystem, this is great news - assuming it works out.

Zuck lost It

Meta published a new plan this week, a plan the market isn’t happy with as Mark said, in his own words that CapEx is not ready to slow down.

Meta is planning to build tens of gigawatts this decade, and hundreds of gigawatts or more over time. How we engineer, invest, and partner to build this infrastructure will become a strategic advantage.

A 1GW datacenter costs ~$50B, with lots of factors to take in consideration of course but the bottom line is Zuck is telling the world they intend to spend ~$1T this decade on datacenters, while the market is frosty about AI spending.

Those plans might not happen, but it shows management’s mindset and the massive demand for compute at the moment as if Meta wants more, there’s a reason for it. Question’s always the same: what about long term? Let’s see, but market not likey.

I’d argue this is bullish for neoclouds. We know Meta wanted to sign bigger contracts with Nebius and couldn’t for a lack of capacity. There’ll be more contracts to come as Meta will partner with providers to reach these goals. Depending on the market’s appetite for risk, those new contracts could yield great appreciations.

ClickHouse Fundraising

Speaking about Nebius, ClickHouse raised more capital, pushing its valuation to $15B. They also shared their ARR are of “several hundreds million dollars”. Nebius owned a ~33% stake in the company which should be diluted now, probably a bit below 30%, but remains consequent, especially considering ARR growth.

This is how Nebius keeps its balance sheet clean and invest in datacenters. Great new.

UiPath vs Claude

Claude launched a new AI tool called Claude CoWork, which is basically giving access to folders or documents to the LLM so it helps you organize tasks, find information, any kind of workflow really.

If that reminds you what UiPath does… You’re wrong. And the market also is as it has been selling the stock on the news, down 13.5% this week and reaching the perfect price of $14 I flagged last week on the database.

Why are you wrong? This is an excellent tool for individuals and I’ll certainly use it lots, but we’re not talking about automating enterprises workflows here. Maestro is meant for that: automating complex tasks based on complex infrastructures, documentations and conditions. Claude is the layer on which UiPath builds its service, they’re partners, not competitors, not when it comes to enterprises.

Enterprises won’t let their workers use CoWork to build processes, they need a trusted and evolutive software and Anthropic is not going to upgrade Claude based on some enterprises’ needs. They’ll sell their service to companies which will do that work: and that’s what UiPath does.

LLMs like Claude are the foundation. The software built on top of it is the service.

If Claude were to disrupt UiPath, then it could disrupt Palantir, because after all, if it can interpret the content of a folder, it can build a database from it and you get an ontology, right? Coupled with LLM capacities you get your interactivity, yes?

No.

Enterprises need to have an upgradable and customizable software delivered from a company they can trust to sell a regulated tool. CoWork isn’t a bear case, on the contrary. It means UiPath’s capacities are better by using it.

Weekly Planning

I don’t have any plan for this week. I continue to look for opportunities and will share if I find some, with more focus on “boring” companies as that’s where I can find them lately.

Earning season is starting without any companies I am watching closely.

Netflix will give information on Warner Bros, which is the reason for the stock’s fall as if it goes through, the leverage and execution risk is real.

We also have both Halliburton and Schlumberger, my oil plays but I wouldn’t expect much from them as they aren’t core positions.

Intuitive Surgery is a wonderful company but still way too expensive, so I will briefly look at it by interest but nothing more.

I’ll comment on them, no worries, but I won’t do a full review! Have a great week!

Great insight as always!

I added many times last week to PATH & MSTR. Looks like LULU will get right to your $190 entry as well. Seems inevitable at this point.

I started too small on my NBIS position and it keeps running away. Idk if we get another entry in the $90’s but I’m ready if so.

Any new BTC/ETH updates this week? Everything holding nicely at the moment. Consolidating.