UIPath: Do Not Miss The Inflection Point

Maximum opportunity happens in the early innings when data confirms potential.

A few weeks ago, I shared my belief that the next major source of returns will come from two places: companies pushing compute quality forward & those capable of leveraging AI to offer real value-added services to businesses and individuals.

UiPath falls into the second category.

In this write-up, we’ll look at what the company sells, why it matters, how it compares to other “hyper-growth” success stories. We’ll dive into data, explain why the timing is right now - even if it wasn’t a few weeks back, go over the financials, valuation & my personal investment strategy.

This is a detailed review of what to expect from UiPath and how I intend to capitalize on it.

Robots, Agents & Automation

UiPath focuses on one of the most important goals in business: making life easier. The businesses with the most potential are almost always those that resolve major pain points. Amazon solved deliveries. Netflix solved content access. Uber solved the “where is my ride/parking” struggle.

Those who can efficiently simplify life for others end up making a fortune.

UiPath is doing this at a massive scale by leveraging AI to automate repetitive tasks. We know the private sector is full of them, but think about the volume of manual tasks repeated daily by government agencies, HR teams, accountants, lawyers...

You probably have plenty in your job. UiPath is coming for them, helping companies optimize while saving significant time and money.

A great example is Corewell Health, which plans to leverage IXP to automate the processing of referral information into Epic. In addition to improving efficiency and accuracy, they are on track to redirect $1.5M of labor saving this year and expect over $3M next year. Stories like this show how our innovation is helping customers turn manual document-heavy work into intelligent automated processes.

And that is just one case out of their entire user base.

To be blunt: yes, we are talking about replacing human labor with automated robots to increase margins and reduce delays. As usual, I’m here to talk about investing, not the ethics of automation. Innovation comes for everyone; better accept it & move on.

UiPath’s business has evolved through the years. They started with Robotic Process Automation, moved into Agentic AI and finally, in 2025, launched orchestration tools that are finally moving the needle.

Robots (RPAs) → Autopilot (AI agents) → Maestro (orchestrates).

Robotic Process Automation (RPA)

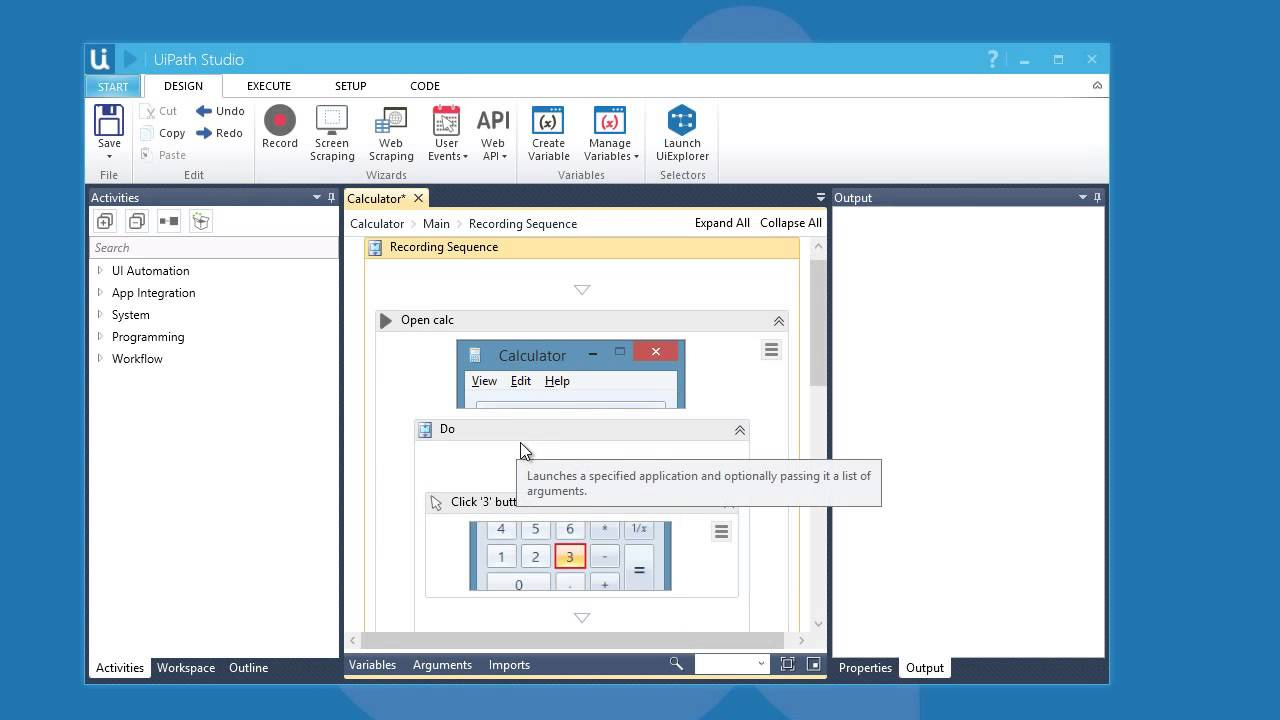

The name is self-explanatory: programmed automation. This has existed since the first computers - we call them “bots”, and they’re built to repeat the same task forever.

The difference between a bot & a standard script is that bots use the User Interface. They mimic mouse clicks and keyboard movements rather than working purely at the code or API level. A bot is trained to behave like a human user, not a machine.

This was UiPath’s core business for a decade. They provided UiPath Studio to create the bots and UiPath Orchestrator to deploy them.

This was their business from 2005 to 2015, even up to 2018. The real shift happened post-2018.

The Pre-Agentic Era

Nowadays, a simple RPA isn’t that impressive. You want tools with a bit of “reasoning” or logic so they can adapt. Over the last few years, UiPath added layers of machine learning and language recognition, allowing bots to fetch info from unstructured data and link up with various APIs.

Their service passed from simple repetitive tasks to bit more complex ones requiring some level of reflection, still automated. Like for many others, the access to AI changed everything.

Autopilot & Maestro

The real value added happened in the last two years thanks to rapid AI improvements. UiPath still sells RPAs, but they’ve become intelligent agents integrated into a cross-vertical AI service.

Autopilot is your personal command center that understands your company’s context and processes, and can act on any professional tasks.

Instead of you having to log into five different websites or fill out a dozen forms, you simply tell Autopilot what you want to achieve in plain English - like “Onboard this new hire” or “Summarize these invoices”. It doesn’t give you advice like a standard chatbot; it uses your company’s software and files to get the work done.

To make this happen, the company develops AI Agents. Each Agent is trained to be an expert on a task - like RPAs used to be but now intelligent. Autopilot will find the right Agent for the required job and that agent will decides which steps to take and which tools to use to finish the task - based on context and training.

Here is an overview of what autopilot can do from a users’ perspective.

Autopilot removes friction and accelerates any task. This is really valuable.

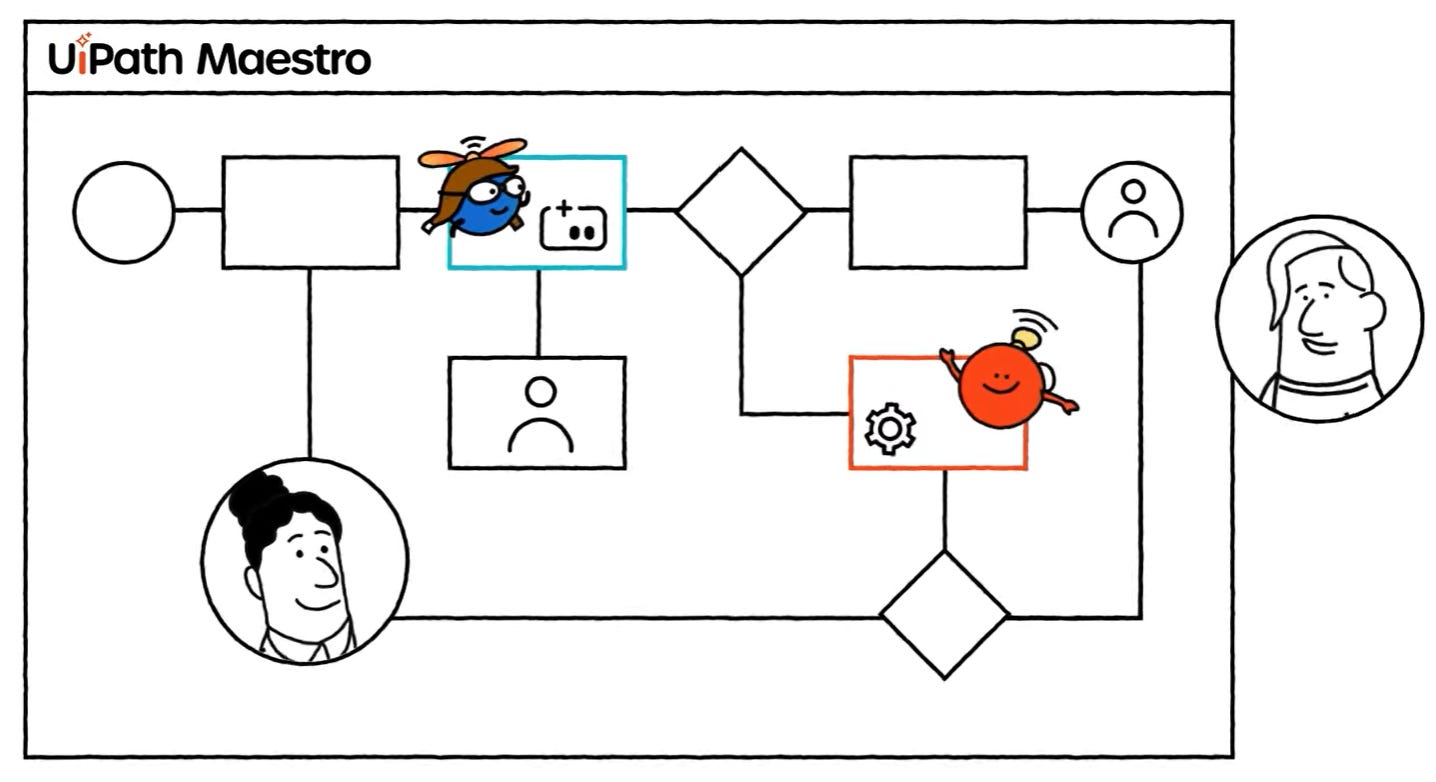

Maestro is the star. Its job is to organize the interaction between RPAs, agents and humans to build complex, multi-step models.

Instead of triggering agents manually one by one, Maestro allows to create workflows like: “Agent A starts the work; if X happens, Agent B takes over; if not, ask a human for confirmation. If the human says yes, Agent C follows up, etc...”

This creates organized, automated processes between different teams, sectors or even different enterprises.

This is UIPath final value proposition. Customers seem to love it.

Enterprises are accelerating their AI and automation strategies, and they’re looking for a unified platform rather than standalone tools. Our ability to bring deterministic automation, agentic automation, and orchestration together in one trusted, governed system is a true differentiator.

Our customers are already embracing the revolutionary potential of UiPath agents with enthusiasm. I quote a large global airline customer who recently told us that this shift toward agentic automation is not just an upgrade, it’s a paradigm shift in how we perceive the potential of our operations.

And this is only the start as this kind of tools are new - although we will talk about Palantir a bit later.

IDC is already forecasting the market for Agentic labor automation to grow to $4.1B by 2028 from zero last year. And that new market potential is on the top of an RPA market, which is still growing at a double-digit rate.

UIPath Business Model & Adoption

Having a great product is something but having a used product generating cash is an entire other subject, which is what we’ll now see. I looked at UiPath two years ago & passed - mostly because Palantir was at a more attractive valuation then. Today, the story is different.

UiPath is a SaaS with a mix of licensing - depending on numbers of developers, and subscriptions - based on usage/compute. While licensing can be lumpy due to their clients’ internal organization and spending timing, subscription are growing due to a constant increase in usage, which is what we want to see.

Also important to note that UIPath is independant on sector and geography, their service can be used by everyone, all around the world, big and small business alike. This is a massive advantage which unlocks a massive TAM.

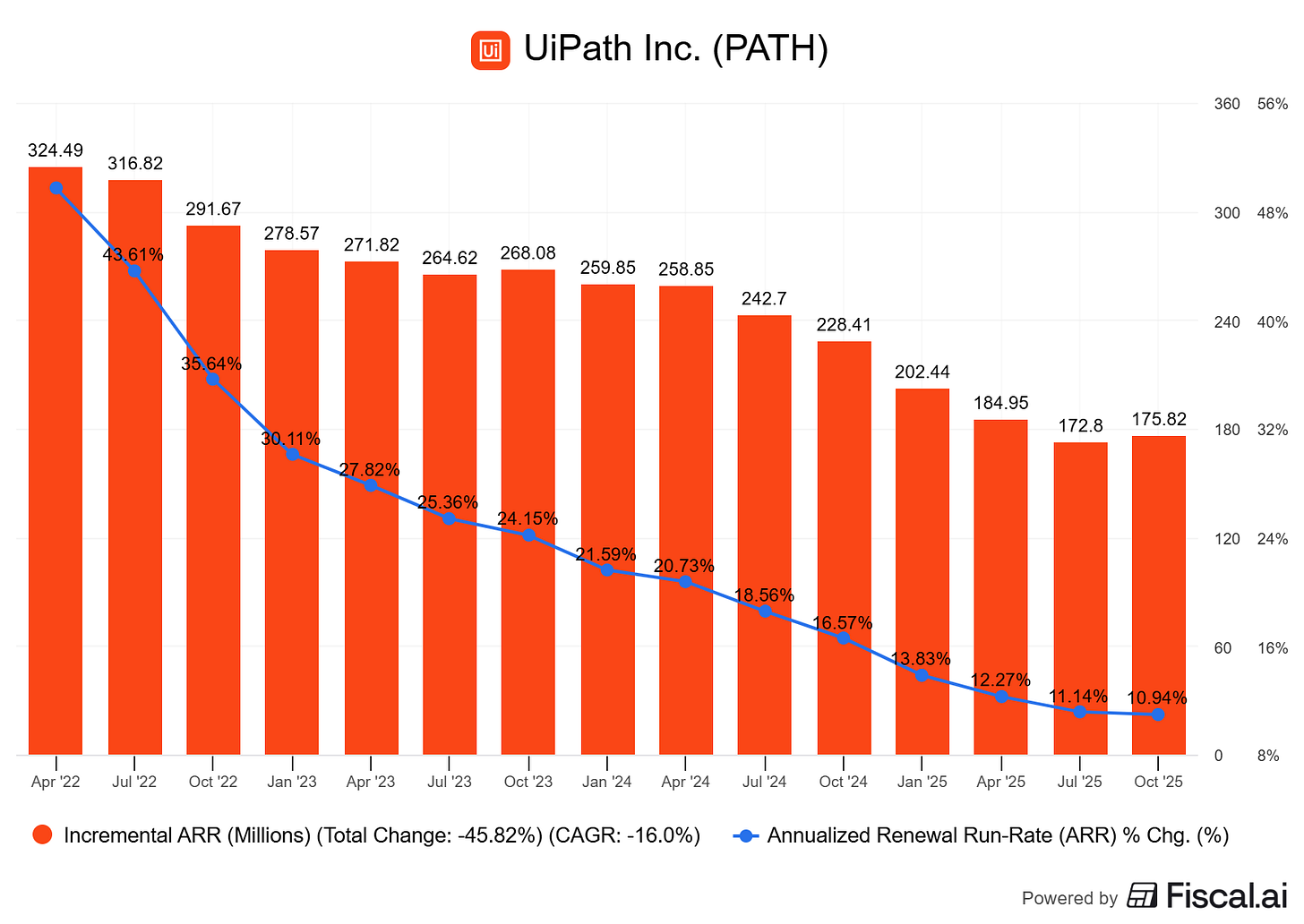

I shared a post on X recently explaining why I wasn’t interested in UIPath back then: their Annual Recurring Revenue wasn’t accelerating. Despite the new tools, clients weren’t committing more cash. Cool products are great but if they don’t make more money, they don’t deserve investment.

Then came Q3-25 - December 3rd, and things changed.

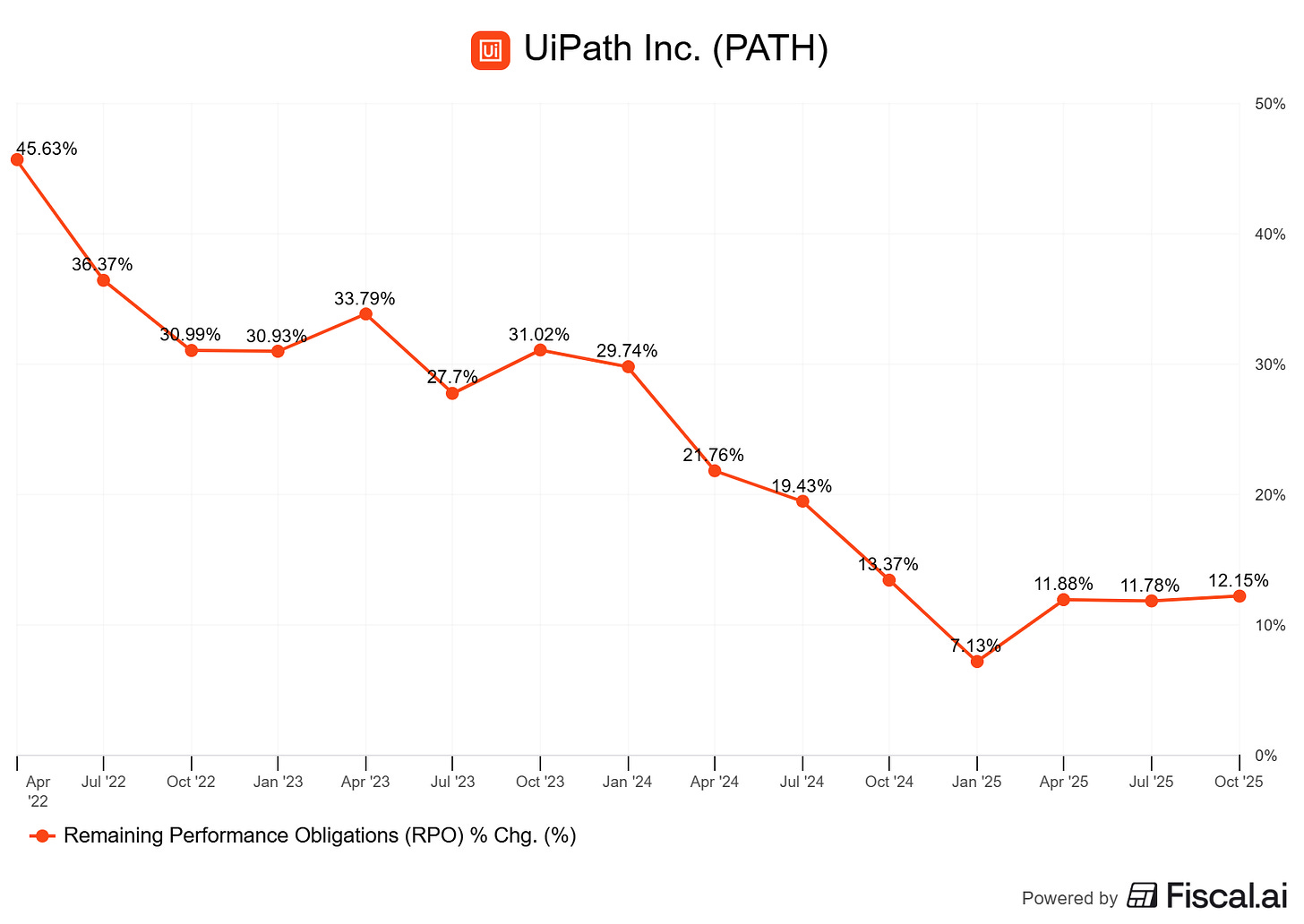

For the first time in two years, net new ARR accelerated sequentially. More contracts were signed in dollar value than the previous quarter. This correlates directly with the release of Maestro - in March 2025, capitalizing on Autopilot - early 2024.

The combination of those two tools triggered acceleration. Will it continue? It is hard to be certain but this correlation is already positive & we had more comments during the call - coupled with a positive guidance we’ll see later.

The entire business is positive, with consistent execution across the board, especially in the Americas. Improved execution, new product launches, and increased customer engagement are contributing to this growth.

In fiscal year 2026 we believe that this focus, along with the investments we are making in our product innovation, will stabilize net new ARR dollars while accelerating our non-GAAP adjusted free cash flow growth rate.

This confirms what the data shows: rising engagement & demand thanks to improved services that enable complex automations across the entire organizations, not just isolated bots for specific tasks

Another key point is the RPO growth acceleration since early 2025, which highlights stronger and longer commitments from clients, which accelerated few months after the release of autopilot.

All signs point to growing interest in Autopilot & Maestro. That’s what we want to see, especially paired with interviews showing real cost and time savings and positive comments on earnings calls.

The largest deal this quarter was an expansion by a healthcare customer who has been with us since 2018. With more than 260 automations, they expanded this quarter to increase their adoption of agentic automation, and together with Ashling Partners, has identified over 40 high-value use cases expected to generate more than $200M in savings over the next three years.

More positives, there’s no revenue concentration. UIPath didn’t disclose any client accounting for more than 10% of revenues - which they’d be required to if it were true. They serve 10,860 customers as of last quarter.

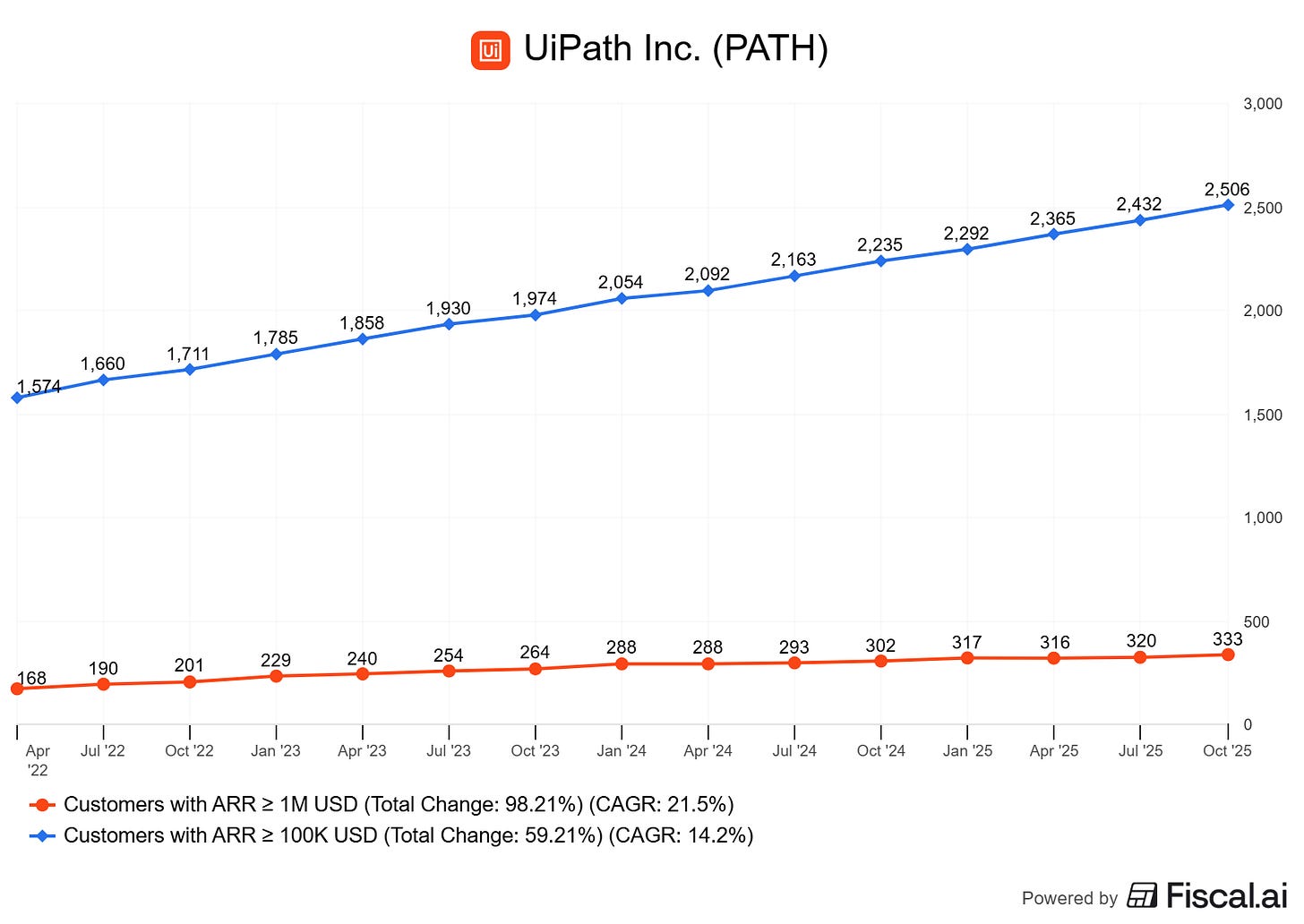

Out of those, 333 customers generate more than $1M in yearly ARR, representing 43% of total revenues. Again, no massive concentration risk.

Things already look compelling. But they get better.

The Palantir Comparison.

It’s impossible not to bring up Palantir here. Both businesses are comparable, both markets overlap and they do compete. I consider Palantir the stronger company - nothing matches their value proposition. But if anyone comes close, it’s UIPath.

That said, they tackle the same problem from different angles.

Palantir aggregates and leverages company data to help decision-making, efficiency, and then automation.

UIPath focuses on automation without the need for understanding anything outside of the specific need for automation.

Palantir can do what UIPath does, leveraging LLMs and deep process understanding. But “being able to” doesn’t mean “being optimized for.” Palantir may be less efficient for precise, workflow-specific automation, where UIPath shines.

UIPath is more accessible, less invasive, cheaper, and offers broader use cases. Even if Maestro aims to replicate Palantir’s AIP, they still have a clear difference in how they operate and help companies achieve efficiency.

At the end of the day, both aim to optimize companies’ processes and both have a massive potential. Their approaches differ structurally, but the goal is the same.

Palantir is a better, more complete product but assuming UIPath can’t grow in a world with Palantir is a mistake and a fundamental misunderstanding of both products. They will compete & I still personally see Palantir as the stronger company and service, but there is a massive market left for UIPath and its focus on workflow automation.

Financials & Valuation.

The financials are strong enough to justify an investment

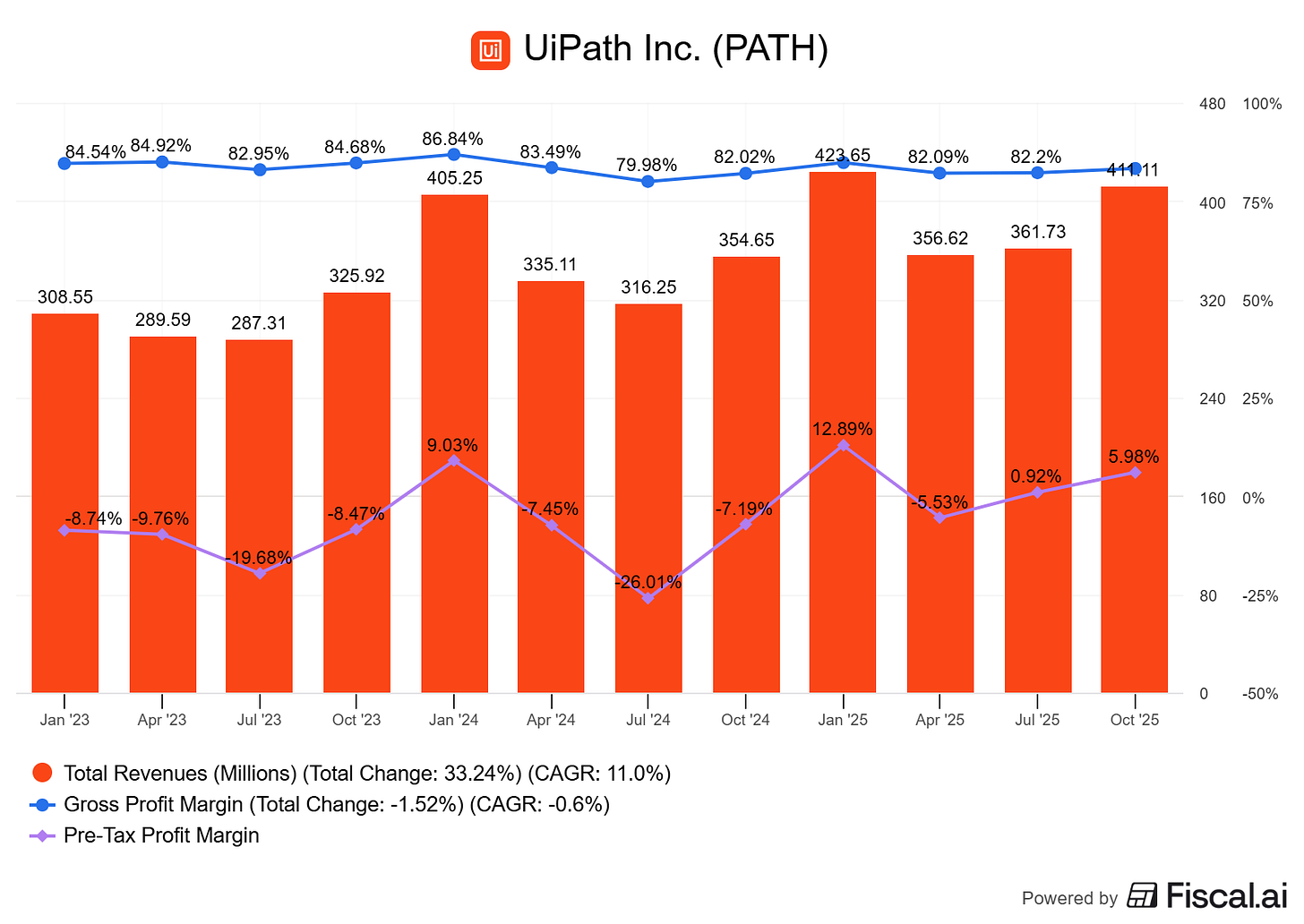

Revenue looks a bit irregular due to the business model. Since UIPath sells developer licenses, companies tend to renew or expand them at the start of the year when budgets reset. The valuable metric when looking at UIPath is ARR, not necessarily revenues.

ARR remains stable and growing healthily with fluctuations only tied to client policies around licenses. Nothing to worry about, but it does make short‑term revenue comparisons less useful. So the focus should be on sequential ARR and YoY license growth.

Being SaaS, margins are strong: ~80% gross and now two quarters in a row of positive pre‑tax margins - outside the usual January license bump). Management expects this to continue.

on track to be GAAP profitable for the full year 2026 for the first time.

One note: as the company shifts toward AI services instead of pre‑programmed bots, they’ll need to pay for that compute which, if that added cost isn’t entirely passed to clients, could pressure margins. Management is confident they can maintain GAAP profitability, but we’ll need to see how that plays out.

Most expenses come from sales and marketing, as is typical for SaaS, with healthy acquisition cost: $1 spent to bring back $2 YoY. And with ARR growth stabilizing - hopefully reaccelerating post‑Maestro, acquisition and retention could improve further.

Bottom line: the business has what it needs to be very profitable once traction takes - and we’re seeing the first signs of that.

Valuation is tricky for these names, especially with an acceleration thesis. Accelerating companies in AI come with higher multiples. Let’s try to frame expectations.

This is a bull thesis, so my stance is by default bullish. Analysts have raised targets and management called this year a “foundational year” ending with increased deployments of bots and agents.

I’m not the only one bullish and my stance is backed by data and commentary.

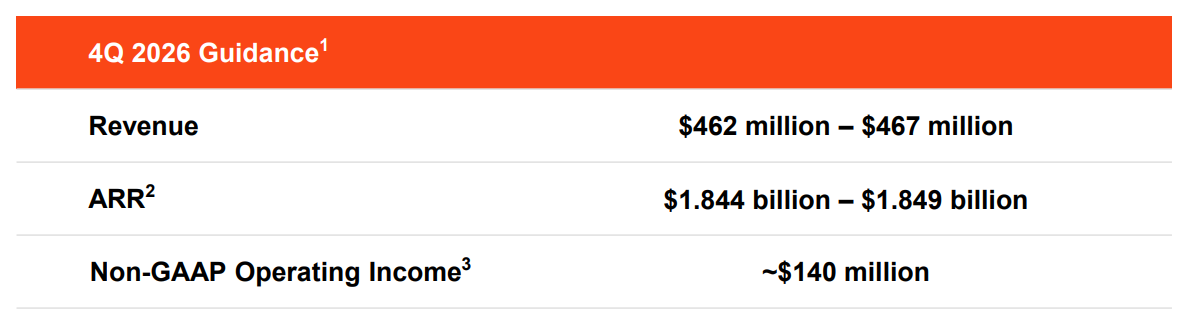

Guidance being another confirmation of the acceleration thesis: $1.84B ARR midpoint, a YoY increase of $180M and sequential growth of $64M. Both accelerating.

Hard to quantify if acceleration persists into 2026, but my frame is bullish and all data points to it, so I’ll assume it does. After two straight quarters of $60M sequential net new ARR, I wouldn’t expect less moving forward. Even with seasonality or volatility, FY26 ARR below $2B would be disappointing.

At worst, I expect ~13% ARR growth next year.

Comparable stocks with similar growth trade at 4x–8x sales depending on margins. UIPath should land in the higher half, being GAAP profitable with expanding margins. At 6x–7x sales on $1.846B ARR by EOY25, that’s ~$20–$24/share based on FY26 revenues equal to FY25 ARR - which won’t be the case as new contracts will be set up and paid during the year.

Any real acceleration in net new ARR will trigger multiples expansion which combined with higher revenues can push share price higher.

If acceleration takes off, the optimistic base case is $2.1B ARR & ~$1.8B revenues. At 8x–10x sales - premium due to acceleration, shares could reach ~$27–$33, a 70%+ return in one year. The bull case is faster acceleration & higher multiples, but I would not expect the moon - these assumptions are already very bullish.

Adoption and acceleration are the deciding factors. Signs point positive. How that materializes, only time will tell.

Investment Strategy.

Price action is the deciding factor on this position. Based on fundamentals, potential and current share price, I consider UIPath a buy. The question is timing. Honestly, this looks like a great candidate for DCA today.

We broke out of the box after printing a series of higher highs and higher lows - very positive. Now we’re in between legs, consolidating after last quarter’s optimism pump and the current AI anxiety.

Perfect entry would be around ~$14 on the weekly averages, and that could happen. I already bought because even at $16 this looks like an opportunity - assuming the acceleration thesis holds.

I can’t be certain, but that’s investing: find names with strong fundamentals, at an inflection point confirmed by data, but still early enough that risk (and therefore opportunity) remain. Valuation is reasonable, price action is positive.

UIPath checks all the boxes. I’m already in for the reasons detailed here. I will buy more if the perfect entry shows up, as long as the thesis holds & price action stays positive.

Do you ever think about selling CSP at you buy points?

May I ask how big your position is? Percent wise, of course! 😁