Nebius Q3-25 Detailed Review

When capacity is the bottleneck

Everything you need to understand Nebius’ bull thesis is here.

I’ll start with a key sentence, repeated many times over the quarters but important to understand Nebius’ management.

We follow the customers, everything we build will be justified by demand.

This quarter bottom line is simple and very bullish: Nebius sold 100% of its capacity and is accelerating to bring more online as quickly as possible to meet the ever-growing demand for AI compute. There are risks we need to dissect to remain objective but overall, this quarter is very positive.

We’ll begin with business updates - new partnerships, services, etc, and dive into the AI compute dynamics, expansion plans & why I believe Nebius is the best neoclouds play only after.

Business.

As advertised.

We sold out of available capacity in Q3 - a consistent trend during the year, reflecting strong momentum and the effectiveness of our business strategy.

The biggest issue for Nebius right now is the lack of capacity. They cannot grow faster because they do no have the physical infrastructures to sell more compute.

Meta & Microsoft Deals.

The highlight of the quarter is the $3B contract with Meta. Even better, the original deal was meant to be even larger, but Nebius had to scale it down due to limited capacity.

In fact, demand for this capacity was overwhelming, and the size of the contract was limited to the amount of capacity that we had available.

If you remember, Meta mentioned during their earnings call that they would contract external capacity because they couldn’t build theirs fast enough. I flagged that Nebius could be part of those deals thanks to its quality, written black on white here.

Management said many times they need more compute and plans to both build and rent capacity from third-parties.

A central requirement to realizing these opportunities is infrastructure capacity. As we have begun to plan for next year, become clear that our compute needs have continued to expand meaningfully. Including versus our own expectations last quarter. We are still working through our capacity plans for next year. But we expect to invest aggressively to meet these needs both by building our own infrastructure and contracting with third-party cloud providers.

This is bullish for neoclouds: Meta is clearly saying they will rent capacity, much like Microsoft did. Whether that goes to Nebius or others - of course we prefer Nebius, this means more contracts in the short term for those companies.

Nebius won, a pretty strong endorsement of its compute quality as Meta is known to rely on its own infrastructures only. Nebius was apparently better than competition as it is the first external AI compute service contracted by Meta.

The contract will be supplied with compute Q1-26 and run at full ARR next year.

Similar to our Microsoft deal, the economics of this agreement are attractive and will help accelerate the growth of our AI cloud business even further in 2026 and beyond.

In fact, demand for this capacity was overwhelming, and the size of the contract was limited to the amount of capacity that we had available, which means that if we had more, we could have sold more.

This comes after the massive $17B–$19B contract with Microsoft in September.

We also had updates on this one: the first tranche of compute was delivered, with the rest scheduled through FY26. ARR will ramp to full capacity in 2027.

Enterprises Deals.

These hyperscaler deals are net positive and necessary for growth. But Nebius’s long-term bread and butter are enterprise clients. Hyperscalers are simply forwarding their demand to another provider, which prevents Nebius to build partnerships. It’s a necessary step to scale, but not the ultimate goal.

Good news there too: Shopify expanded its commitment to Nebius, which means they were satisfied enough by the service. Nebius also signed several new contracts with companies offering AI-powered B2B and B2C services

As a matter of fact, we added a number of new customers in Q3, most notably some very disruptive startups like Cursor, Black Forest Labs, and World Labs. I’m sure everybody’s heard of Cursor.

Nebius also launched Token Factory, which we discussed on Sunday but deserves another mention, a service focused on enterprises.

We help them to transform open-source models into optimized production-ready systems with guaranteed performance and transparent cost per token

And there’s more to come.

We have a large pipeline of new software and services that we are continuing to build, which will differentiate us from other cloud companies.

That wraps up the business updates. Let’s move on to the big part of this report.

Supply Constraints & Data Center Buildout.

As said, Nebius doesn’t have enough capacity, which means they do not have enough GPUs online, enough data centers, enough infrastructures. To grow, to answer the demand for their services, they need to build more data centers.

That means more spending.

They’ve raised their CapEx forecast and launched a new financing round, planning to sell 25M of Class A shares. No information on pricing or timeline yet, but this would dilute shareholders by roughly 10%. Not insignificant, but necessary to achieve their goals.

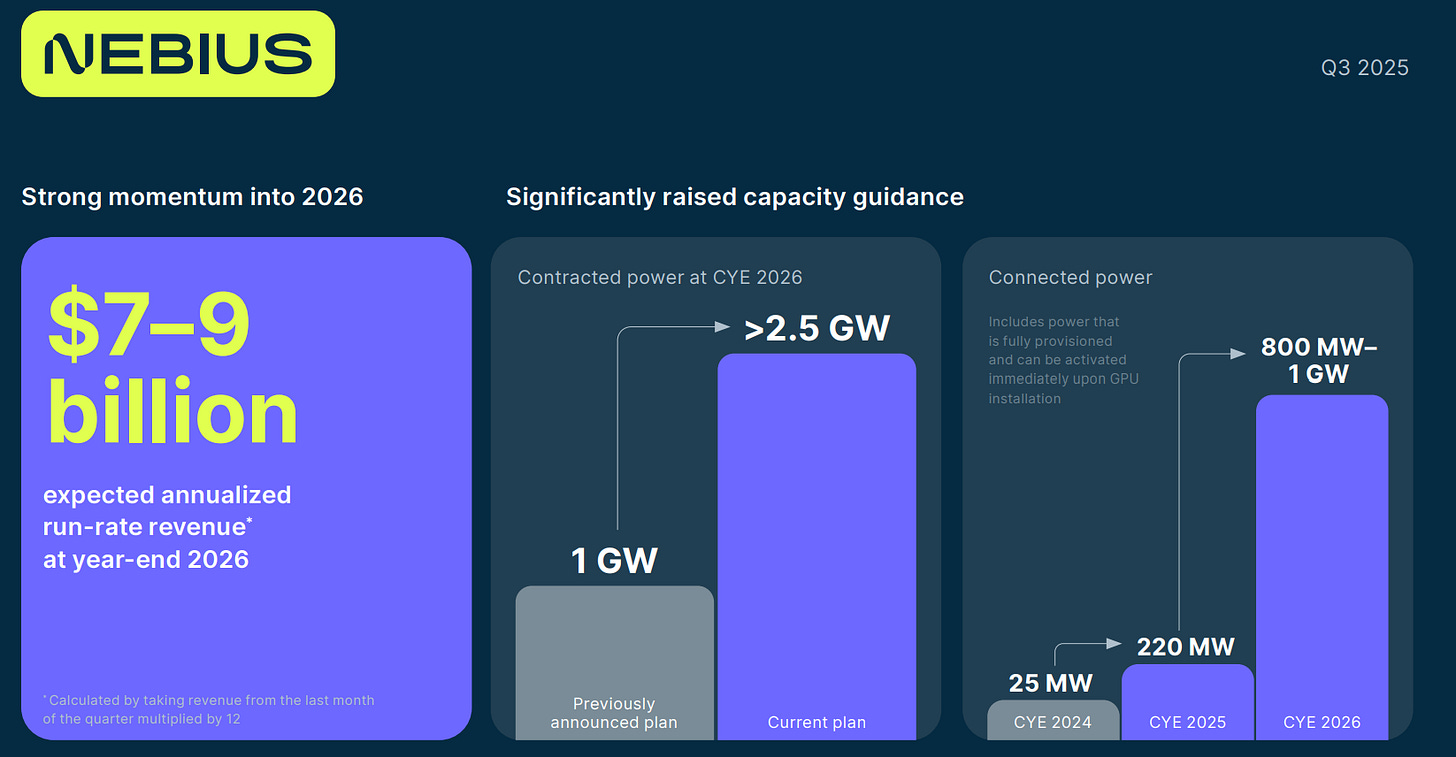

And what ambitious goals. They more than doubled their contracted power FY26 guidance, intend to quadruple their connected power in a year, which directly increases ARR. More capacity means more clients, more contracts & revenues.

Those numbers are mindblowing, and management confirmed that around half of the FY26 ARR guidance is already booked, and the rest should come naturally as more capacity comes online. Everything is justified by demand, as usual with Nebius.

Every time we bring capacity online, we sell all of it. With the new generation of NVIDIA Blackwell coming online, more customers are interested in purchasing capacity in advance and securing it for a longer period of time.

The Bear Case.

From here, I know many are skeptical and believe this could be fake or never happen. Social media is full of AI bubble theories. If you’ve been reading me for a while, you know I’m more concerned with return on investment & margins than growth.

So far, I’ve seen no sign that demand for AI compute is slowing. No data points to it. On the contrary, most indicators show enterprises actively working to integrate AI into their products and services.

What we haven’t seen yet is revenue growth from those new products. But that does not mean it won’t happen; it means companies need time to build and launch them. Not many commercialized AI products exist yet.

What we have seen, positively, are productivity & algorithmic improvements enabled by AI - especially in Meta’s and Google’s advertising businesses. What we might start to see, negatively, is pressure on margins for compute providers due to the high cost of running these infrastructures.

Based on data, the bear case lies in lower cash generation due to shrinking margins, not in a lack of demand for compute or monetization of AI services.

We’re talking about Nebius, a compute provider, meaning means its business model is exposed to these risks while not even being profitable to start with. So the main risk is not demand or revenues, but profitability and cash generation for neoclouds at large, and therefore medium term problems to refund or pay debts, etc…

But Nebius is not in the same league.

Nebius’ Situation.

Management has always been cautious and thought long-term. As I mentioned in my introduction quote, they build only when there’s demand, not to overextend, and they have far better visibility into the market than us.

We strongly believe that the market will still be supply constrained, at least in 2026.

They deliver the best service and focus on the best contracts.

Companies which secure power and land, again and again, it’s all about margins. We’re pretty much focused on the margins when we enter into a new contract, when we’re raising capital, when we’re developing new plots for data centers, when we design those data centers, when we build our own racks, software. We vertically integrate. We’re looking on efficiency on each stage.

No doubt that much more compute will be needed and much more will be built. This situation of unbalanced demand-supply is temporary. Of course, eventually, demand-supply will level up. What we are doing, in addition just to growing this raw capacity, we are building our AI cloud, which will support real businesses, real industries, real enterprise market, where AI will be creating value. We are big believers that the AI industry in general, in our sector specifically, it is going to be okay. Ultimately, we just need to be sure that we are diversified in terms of customers and workloads. This is actually what our software is basically doing. We invest conservatively and we finance our growth responsibly. While we are growing rapidly, five times more a year, we still remain largely focused on maintaining healthy margins and a sustainable business model as a whole. In all days, I would say, healthy unit economics.

We strongly believe that sooner rather than later, the margins for the infrastructure business will play a significant role in the ability to the business to grow and develop.

We are very much focused on margins and profitability, not only on growth itself. All our decisions actually are derived from there.

This is the mindset of a management that wants to win long term, not spiral into short-term debt to own maximum compute without a plan for long-term solvency in case of a downturn - on the contrary to CoreWeave which is a momemtum name.

That’s what sets Nebius apart, in my opinion, and makes it a better investment than many other neocloud or compute providers.

Nebius Expansion Plans.

That said, they are still expanding, reasonably and because there is a real demand, not slowing demand, and shared their methodology on CapEx spending during the call.

Again and again, as we see, at least this year, our revenue growth was limited by our capacity, and everything we built was ultimately sold. In theory, we should try to build as much as we can. In practice, though, we’re limited by certain physical wall limitations. Physical wall cannot grow five or ten times a year. We have limitations in supply chain and obtaining permits, amount of capital that we can deploy.

They categorize CapEx into three buckets with different liquidity requirements:

Land & Power: the cheapest, under 2% of CapEx.

Data Centers: infrastructure itself, around 20%.

GPUs & Hardware: capital-intensive consuming roughly 80%.

Their approach is simple: buy land because it’s cheap, build data centers because they’re always useful but only fill them with GPUs when demand is visible or once contracted only.

First, we should secure as much capacity as we can because the cost, actually, it is not, so it is immaterial at this scale. Second, we should build as much as our capital allows. Third, we will fill GPUs in line with contracted or clearly visible demand.

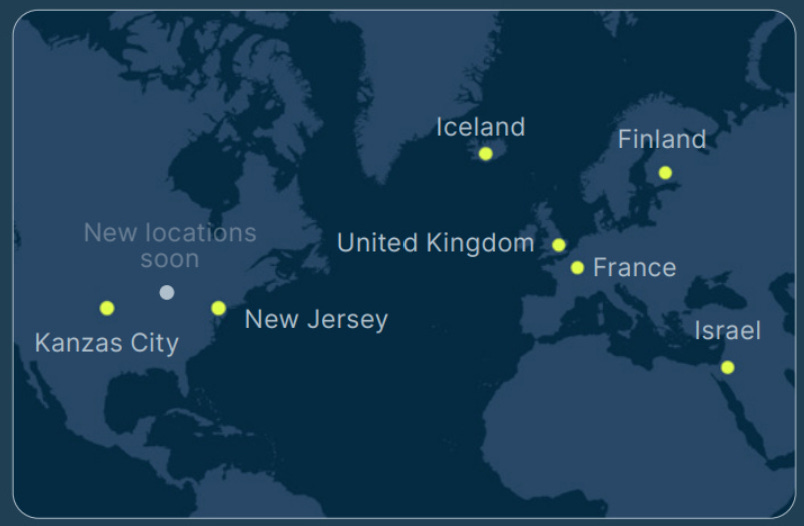

Right now, demand is strong and justifies financing and deployment. Nebius is expanding its existing data centers & has secured new locations in Europe and the U.S., expected to come online in H1-26.

There also are ongoing discussions for additional sites - no details yet, expected to be online end of 2026. Many will be needed to reach 800MW of connected power by next year. There’s apparently a strong focus in the U.K.

I mean, we’re very bullish actually about the opportunity in the U.K. It’s a vibrant AI market. It’s probably one of the most dynamic that we see outside of the U.S. and China. The government’s making a big push to support the growth of the industry and having a reasonable degree of success in this field. We see a lot of AI startups. VC environment is strong. You also see some of the kind of large tech companies establishing regional R&D and presence there. Really, there’s a lot happening in the U.K., and we think a lot still to come for Nebius in the U.K.

They’re actually effectively putting money to subsidize sort of AI startups and institutions and helping them to access the compute as a way of having the growth move faster.

Probably more capacity to be deployed in the region.

GPU Demand & Economics.

Lastly but importantly in today’s environment - due to margins & costs, management confirmed strong demand across all GPU types, including Hoppers.

Demand remains very strong across all types of GPUs. As we said, we sold out our capacity in Q3, and that is across all types. We are nearly sold out with respect to Q4. Talking about the Hoppers, we continue to see extremely positive demand for these chips.

A longer lifecycles mean longer amortization, allowing their hardware to generate revenue for more quarters - hopefully years, before being replaced and triggering another CapEx cycle.

Avride & TripleTen.

Avride is doing well with over 215,000 deliveries YTD and its first robotaxi is expected to launch in Dallas this December.

Tripleten is also healthy, with accelerating growth driven by rising interest and new services - a new B2B service called Nebius Academy, which provides AI training to enterprises.

Financials.

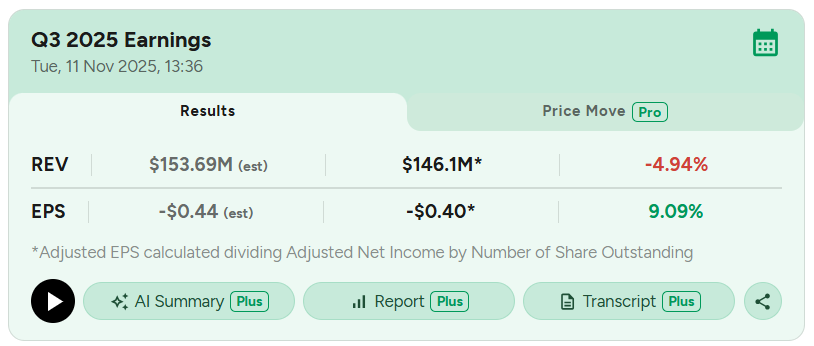

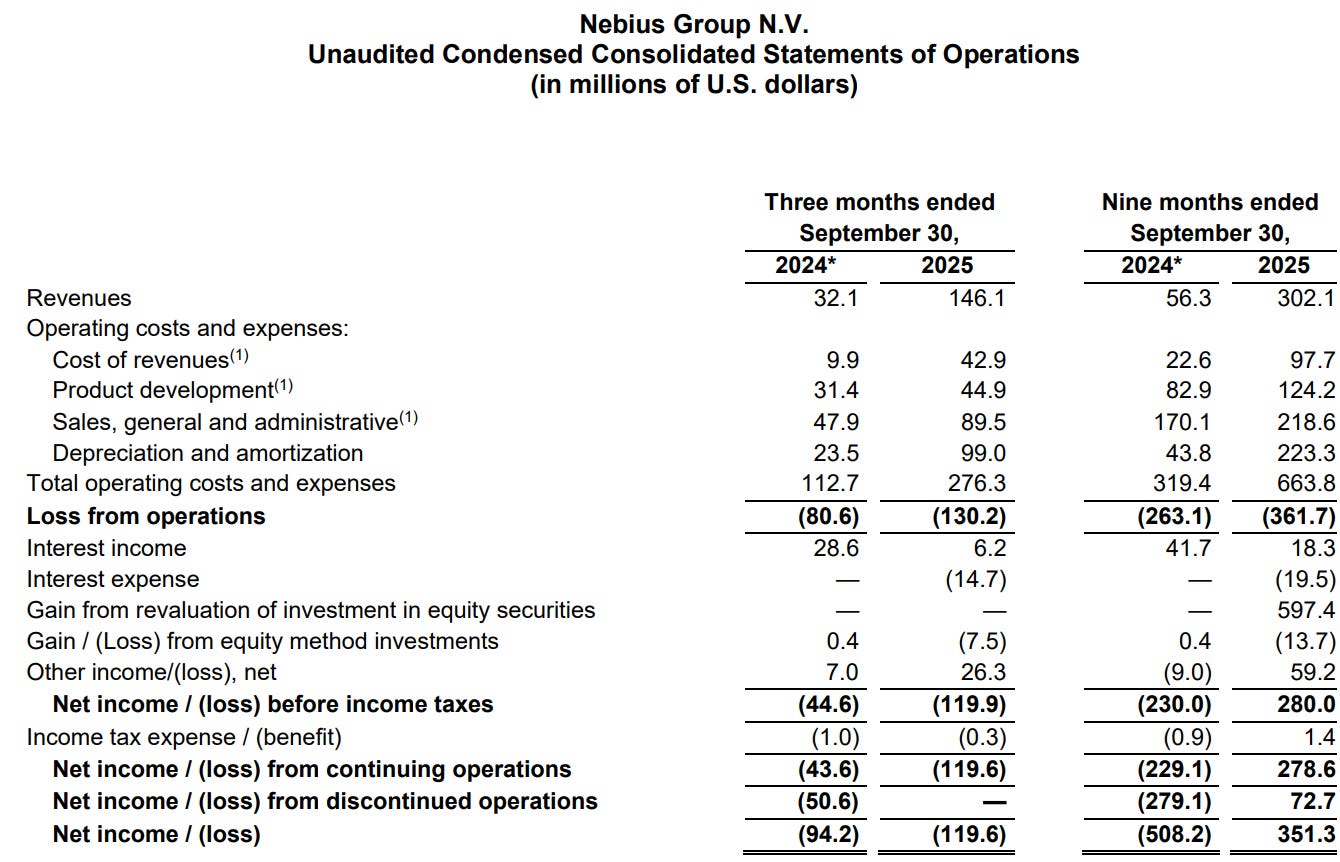

Nebius remains a growth and narrative stock, so financials are secondary. Once again, YoY comparisons are irrelevant as it compares Nebius to Yandex. Different business.

Revenue grew 39% QoQ, which might seem weak but Nebius was supply-constrained with limited deployment this quarter. Growth will accelerate in Q4 as the first tranche of their New Jersey data center comes online, and more. The key metrics remain ARR and new contracts signed.

Expenses rose to $276.3M from $216.3M last quarter, a 27.8% increase, which is lower than revenues. Good sign of operational efficiency and scaling potential, as expected from Nebius.

The company is unprofitable but EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) loss was only $5M, which means Nebius is close to generating cash from its core business & management confirmed this should be the case next quarter, and from there on. I don’t usually use EBITDA but in it is interesting in Nebius’ case.

I won’t comment on the balance sheet, as most funding came from convertible notes. More will follow and all of it will be spent in CapEx.

Guidance.

More important than the financials and very positive overall, with three key info.

The massive FY26 ARR guidance of $7B–$9B.

The reaffirmed FY25 ARR guidance of $900M–$1.1B.

The confirmation of FY revenue guidance, with the midpoint slightly lowered due to timing of capacity deployment. Not optimal but not a massive problem considering their supply constraint.

As we approach the end of the year, we are tightening our full-year group revenue guidance to a range of $500-$550 million, and we are currently pacing to the midpoint of that range. This is compared to the $450-$630 million in our previous guide. The reason we are in the middle and not at the top of that range simply relates to the exact timing of when capacity comes online. As such, we remain well on track to hit our ARR guidance of $900 million-$1.1 billion by the end of 2025, while also paving the way for substantial annualized run rate revenue growth in 2026 and beyond.

As mentioned earlier, management expects H2-26 to be EBITDA positive, although the full year will still show a loss.

They raised their CapEx guidance from $2B to $5B to answer the massive demand ans their new deals with Microsoft and Meta.

This acceleration reflects our strong conviction in the demand outlook and our decision to secure critical infrastructure, including hardware, power, land, and key sites. These investments are strategic enablers of future growth and will position us exceptionally well to capture the opportunities ahead.

As shared through this write-up: Nebius moves only if demand is there.

Investment Execution.

Fundamentals are strong. Guidance is strong. The sector is strong. And Nebius is one of the best - if not the best, compute provider on the market, due to its management, the quality of its services, contracts, its long-term focus on margins & profitability.

The biggest risk for Nebius is overbuilding capacity. But the way management approaches CapEx makes it a safer investment than many, even though risks remain, and hyperscalers externalizing demand won’t help.

But demand for AI compute is real & backed by data. I see no reason to focus on bearish narratives based on opinions, not data, when the actual risk lies elsewhere & still hasn’t materialized yet - in the form of shrinking margins, lower cash generation.

How I see it: Nebius trades at a market capitalization of $27.6B, with a guidance for FY26 ARR of $7B low end, half of which is already booked. This isn’t speculative; half is committed by clients while the rest isn’t deployed & can’t be contracted.

In short, Nebius trades at:

4x FY26 ARR

27x FY25 ARR

Much less than 27x FY26 sales

It should be EBITDA profitable by then, excluding both Avride and TripleTen, and its stakes in ClickHouse and Toloka, which should be worth north of $2B today as both, notably ClickHouse, continues to gain value.

Those aren’t crazily overvalued multiples considering the asset we’re talking about.

Of course, there are execution risks. These multiples only hold if Nebius deploys the compute as planned and in time to contract it, assuming demand doesn’t slow down. Those risks must be considered.

But for those bullish on AI and AI compute, Nebius looks at worst fairly valued today. I see no reason, data-led, not to be optimistic aside from concerns around margins and cash generation. But again, Nebius has shown it can be EBITDA profitable.

I personally remain bullish, invested, and will continue to accumulate, focusing on keeping my average below $80. I am bullish but we cannot ignore the risks and should remain conservative on growth names, in order not to get slaughtered if bad news or narratives come out. It would be cocky to call Nebius cheap at $100.

The market isn’t reacting well to those earnings; make no mistakes: they were great. Sentiment around AI has cooled lately, which doesn’t help. But sentiment shifts are part of the process, and I see no data-backed reason to be bearish on Nebius.

So Nebius remains a buy at these levels in my opinion. We continue to play with the daily 50 which should act as a strong support to maintain the short term bull trend. breaking it could send us much lower, with key support around $90 first, $75 then, filling the daily gap opened with the Microsoft deal.

I’ll be buying now and will buy even more if we get there as it would be a massive opportunity to my opinion, as long as the AI sector remains positive.

Still invested, both in shares and calls, and planning to buy more.

Stellar growth coupled with disciplined management.

Bullish print, no question.