Google Q3-25 Detailed Earning Review

The double standard

If you guys are interested, you’ll get a 15% discount on FiscalAI through my referral link below. FiscalAI is the tool I use for KPIs in all my write-ups - powerful, data-rich and with great UX.

https://fiscal.ai/?via=wealthyreadings

Everything you need to understand Google’s bull thesis is here.

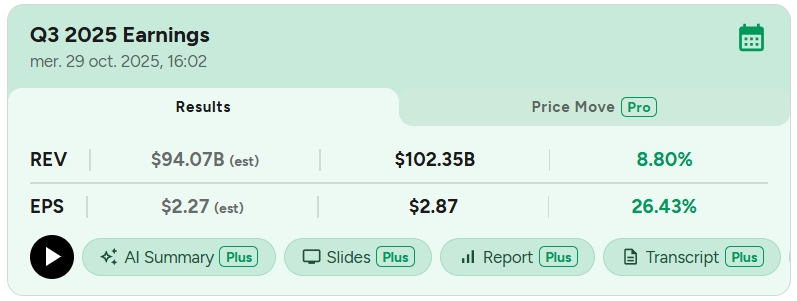

This was a terrific quarter for Alphabet, driven by double-digit growth across every major part of our business.

Anyone surprised? I’m not. I’ve been saying for months that Google was an easy buy below $190 while the market saw it as the biggest “AI loser.” It was probably one of the easiest buys this year. Hopefully, I gave you enough data for you to reach the same conclusion and some of you hit that buy button back then, around $150.

Business.

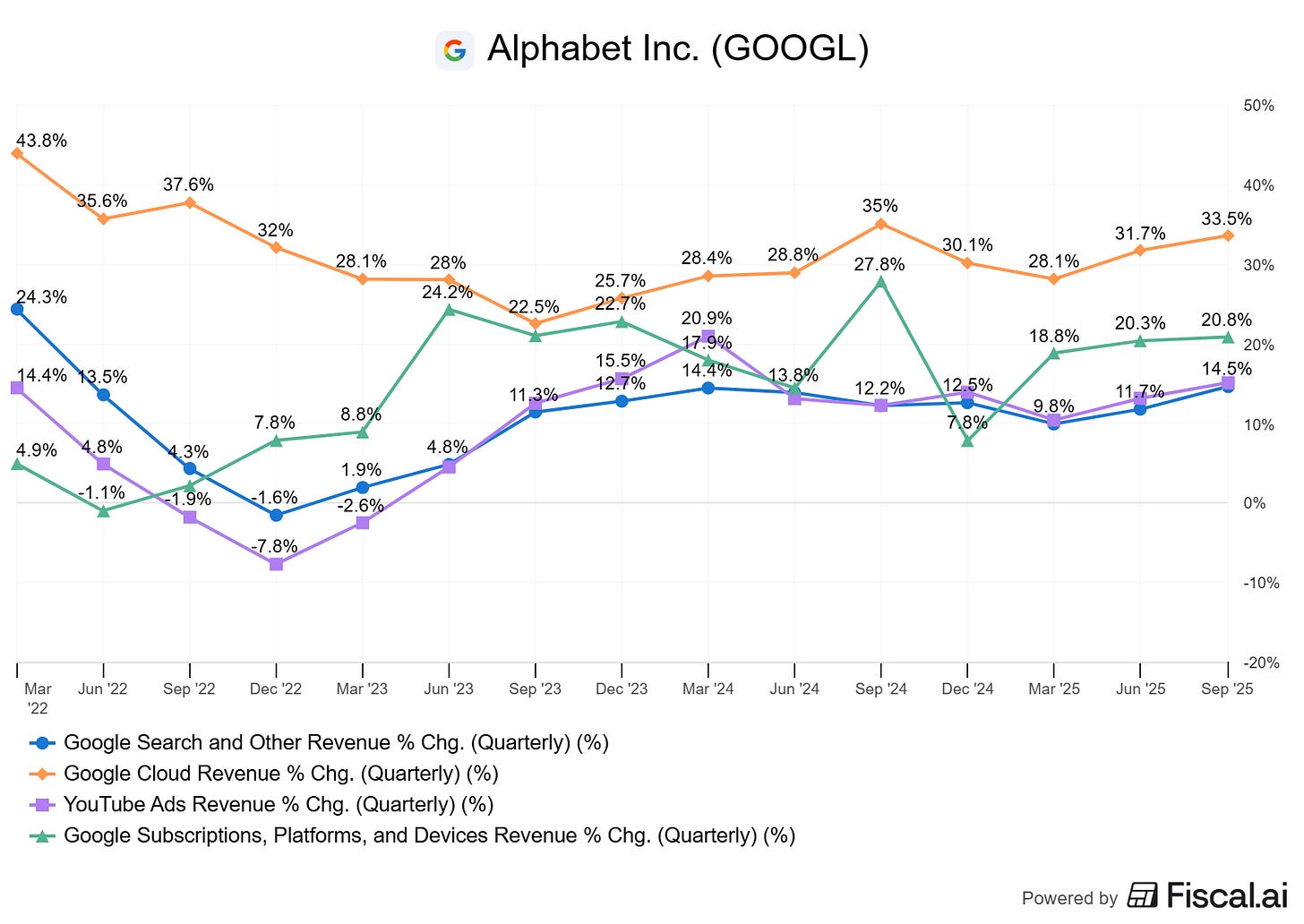

The introduction - and market’s reaction, already tell you how strong this quarter was. Google’s major verticals either have a flat or accelerating growth, especially Cloud.

We’re also seeing acceleration in advertising, both in Search & YouTube, proving that the bear case “LLMs will destroy Search” is pure fantasy - one of many in today’s market.

Google remains the king of Search with perfected AI tools much better than anything OpenAI offers, and deeply integrated into the browser. This integration works as it leverages user habits rather than trying to change them.

Why would anyone change their habits if they can keep them & get the same AI value added? I asked this months ago and the answer is clear now: they won’t.

Our investments in new AI experiences, such as AI Overviews in AI Mode, continue to drive growth in overall queries, including commercial queries, creating more opportunities for monetization.

These AI experiences are enhancing how people connect with businesses and shop on Search. We recently added shopping capabilities in AI Mode, which now help people shop conversationally in Search.

As people learn what they can do with our new AI experiences, they are increasingly coming back to Search more. Search and its AI experiences are built to highlight the web, sending billions of clicks to sites every day.

During the Q2 call, we shared that overall queries and commercial queries continue to grow YoY. This growth rate increased in Q3, largely driven by our AI investments in Search, most notably AI Overviews and AI Mode.

As we have shared before, AI Overviews drive meaningful query growth. This effect was even stronger in Q3 as users continue to learn that Google can answer more of their questions. It is particularly encouraging to see the effect was more pronounced with younger people.

We are also seeing that AI Mode is resonating well with users. In the U.S., we have seen strong and consistent week-over-week growth in usage since launch, and queries doubled over the quarter.

AI Mode and Overviews are exactly what users want and their usage keeps growing as these tools improve. Most people don’t want to open ChatGPT; they just want to keep using Google.

Keep in mind that if you spend hours on X or tech news sites, you’re living in an echo chamber of tech savvy people - I do. Most of the world doesn’t use ChatGPT - many don’t even know what it is. They simply use Google, and it got better.

Retail remains the largest advertising category - unexpected, followed by financial services - logical.

The 15% increase in Search and Other was led by growth across all major verticals, with the largest contributions from retail and financial services.

There’s still huge untapped potential for Google in AI. As we saw with Meta yesterday, AI keeps improving targeting and conversion and we’re far from any ceiling. We also do not have yet efficient agentic services and those are to come, Google is working with PayPal for example for agentic e-commerce. More verticals to work on.

YouTube remains #1 in U.S. streaming watch time according to Nielsen, and continues to grow healthily. No surprise here.

YouTube has remained number one in streaming watch time in the U.S. for more than two years, according to Nielsen.

On Google Cloud, this is where things get really interesting.

Like others, Google is seeing massive demand especially for AI-related services, with 34% YoY growth in unique customers, growing commitments from their clients and larger, longer deals.

Cloud had another great quarter of accelerating growth with AI revenue as a key driver. Cloud backlog grew 46% QoQ and 82% YoY to $155B .

Over 70% of existing Google Cloud customers use our AI products.

Today, 13 product lines are each at an annual run rate over $1 billion.

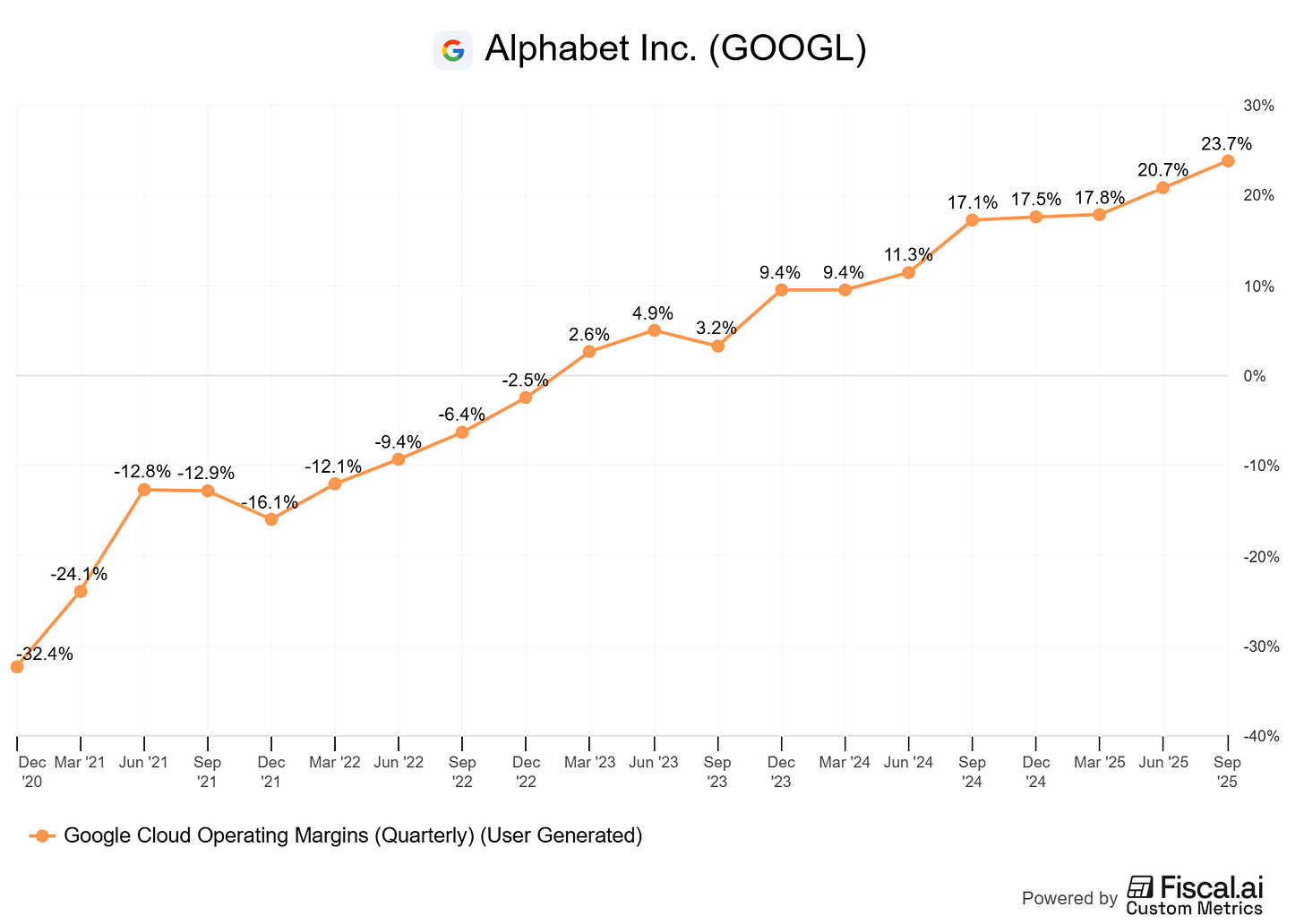

Second, Google has a key advantage: vertical integration. They designs their own models and technology stack - chips, which reduces costs/boosts efficiency.

We are the only hyperscaler who is really building offerings on our own models, and we are also highly differentiated on our own technology. To your question, I think that does give us the opportunity to continue driving growth in operating margins in Cloud, as we have done in the past.

This shows in the data.

A rapidly growing business generating more cash which is good sign as we had some contrary indication from Oracle and Meta which both pointed to margin pressure due to higher costs.

I have two theories from here: Either Google expanded more conservatively - hence fewer depreciation costs, or its vertical integration and TPUs are delivering superior efficiency.

Our extensive and reliable infrastructure, which powers all of Google’s products, is the foundation of our stack and a key differentiator.

We are investing in TPU capacity to meet the tremendous demand we are seeing from customers and partners, and we are excited that Anthropic recently shared plans to access up to 1 million TPUs.

That being said, Google plans to follow Meta’s path.

Looking out to 2026, we expect a significant increase in CapEx.

So even with a higher efficiency, cloud margins could stabilize in the near term, maybe even decline depending on their expansion aggressivity. The difference with meta being that Sundar presented this calmly, not with quotes like “margins are not a priority for us” - I paraphrase Mark here.

In terms of expenses, first, as I’ve mentioned on previous earnings calls, the significant increase in our investments in technical infrastructure will continue to put pressure on the P&L in the form of higher depreciation expenses and related data center operations costs, such as energy. In the third quarter, depreciation increased $1.6 billion YoY to $5.6 billion, reflecting a growth rate of 41%.

More investments on more expensive hardware with shorter lifecycles will pressure margins.

But again: there’s no bubble as long as these investments fuel growth. And Google is the third cloud company this quarter to highlight undersupply and massive demand.

Some words on Waymo’s next steps.

Next year, Waymo aims to open service in London, and they are working to bring service to Tokyo. They have also announced expansions to Dallas, Nashville, Denver, and Seattle, and secured permission to operate fully autonomously at San Jose and San Francisco Airports. Autonomous testing continues to scale in New York City.

And a reminder that if you are excited by quantum, you should be excited by Google and not shitcoins with no other product but a rising stock.

Last week, we announced that our Willow quantum chip achieved a major breakthrough, running an algorithm 13,000x faster than one of the world’s best supercomputers.

Financials.

So far, so good; as expected.

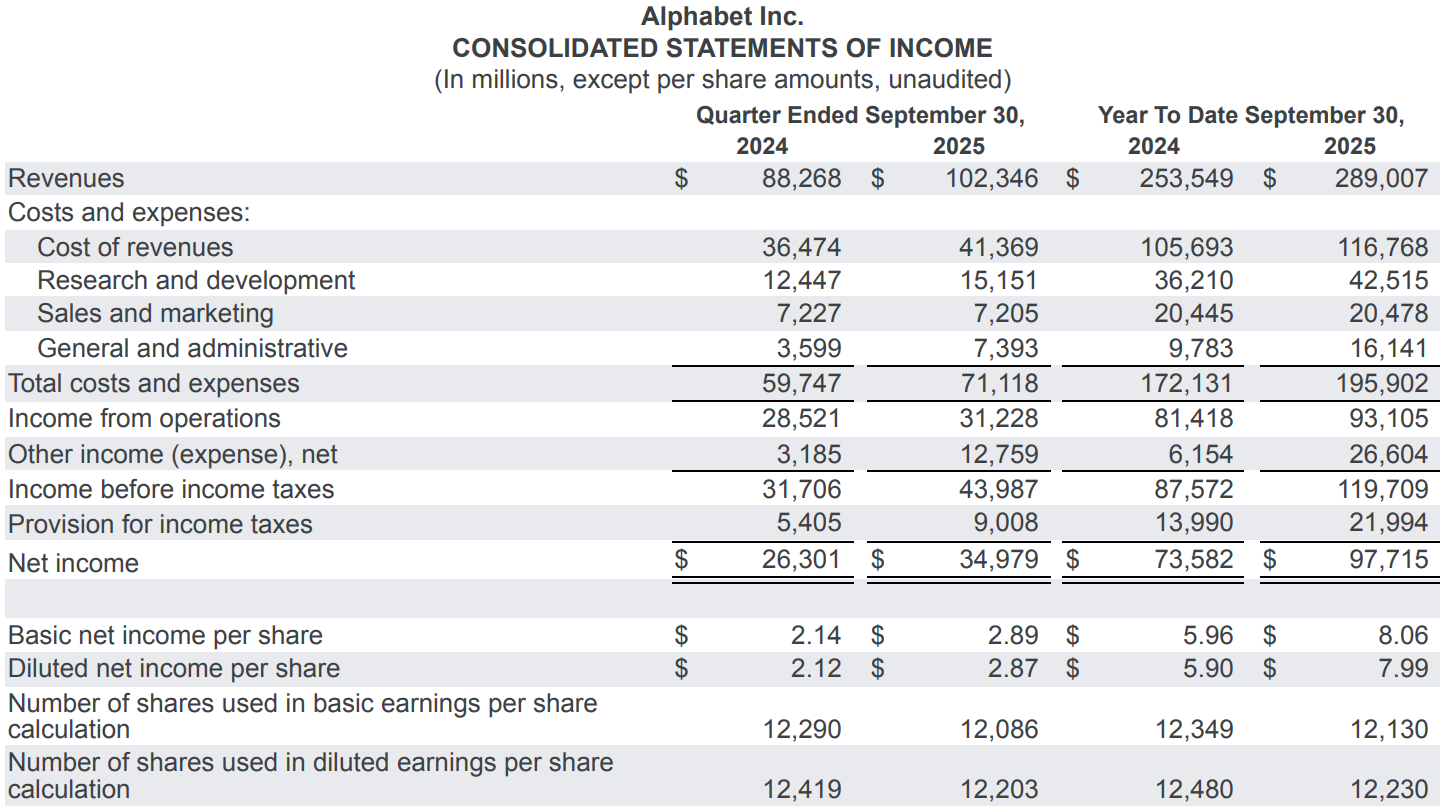

Revenues grew 14% YoY for the first nine months and Google reached its first-ever $100B plus quarter. Total costs and expenses increased at a slower pace, meaning margins and cash generation both improved.

G&A expenses include a one-time $3.5B fine paid to the European Commission, which impacted margins - profitability would be even better without it. Keep in mind that “Other income” include unrealized P&L from equity investments, - those aren’t realized gains.

Overall, this was a strong quarter across the board.

In terms of cash, Google holds $64.7B in net cash, repurchased for $11.5B of shares and paid $2.5B in dividends during the quarter.

Investment Execution.

There’s not much to add. Google is a leader in Search, advertising, entertainment, quantum, cloud, AI, autonomy and more... We already knew it, even if the market didn’t for months. Hopefully, some of you took advantage of that.

This quarter shows broad strength, both now and in the future with lots of verticals to work on. I talked about cloud margins potential pressure risks, though Google is very diversified so global margins should be less affected than Meta’s. The risk is there, but nothing says it will materialize due to their vertical integration and TPUs. It’ll be interesting to see if they can avoid it & how the market reacts if not.

The market remains focused on narratives over data, which gives us an edge. And we heard everything we wanted: rising CapEx focused on AI infrastructure, backed by real, growing demand.

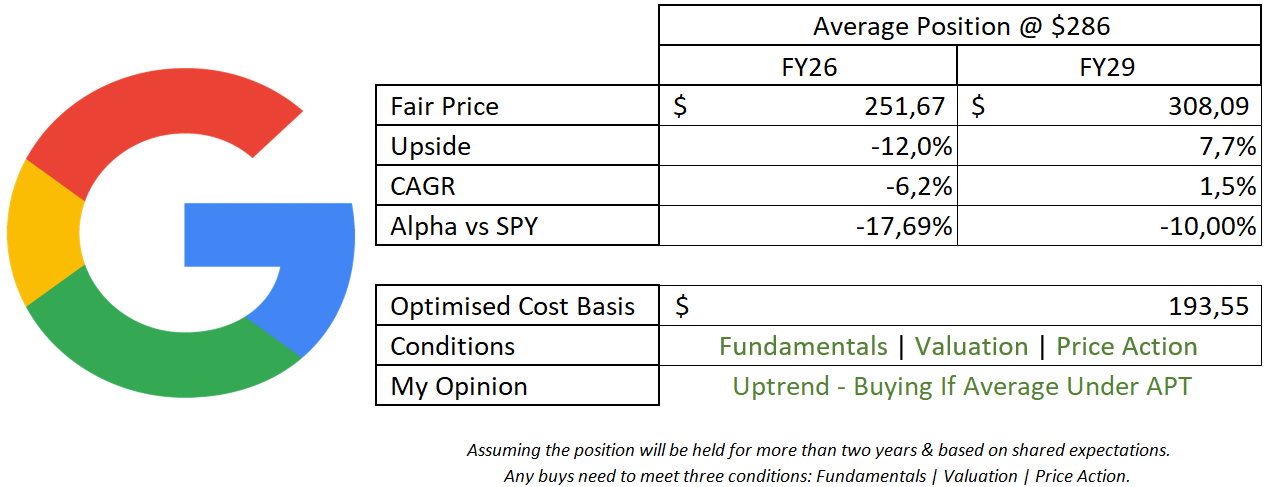

In term of valuation, nothing changes from last quarter, only market perception has shifted but expectations and potential remain the same.

This model assumes a 13% & 10% CAGR growth until FY26 & FY29 respectively, 30% net margins, 3% of return to shareholders & P/S & P/E at 6.3x & 28x respectively.

Saying Google is “not expensive” right now - as I keep reading online, is simply false. The market can always push it higher, and I’d be a holder there either way but I would not be adding or accumulating yet. I’d rather wait for a pullback.

The stock ran fast for good reasons but a retest around $260 wouldn’t be surprising given we’re still ~25% above its weekly 21.

Lots can be done at today’s price & there are no bad decisions, just different systems. I’d probably hold or maybe trim a tiny bit as there are cheaper opportunities on the market at the moment, especially if you followed me earlier this year and pressed that buy button below $150. Those shares would be up almost 100% by now.

Overall, with those mage caps, the best to my opinion is to accumulate or do nothing, and I personally wouldn’t accumulate Google today, so…

Staying still is hard. But often better.

A good point that most people do not use ChatGPT. AI should and is starting to be incorporated in existing tools, all the magic should be done at the backend.