Google | Investment Thesis

The one who tells you everything.

It’s hard not to know Google today, or Alphabet, the parent company. And like many of the Magnificent 7, the bull case & investment case isn’t that hard to write, which is why I didn’t do it until now.

But it still is interesting to have a write-up on it, might be for those who aren’t invested or don’t know how big Google really is.

So let’s go through it all.

Google.

This is Google.

We won’t be going through each & every app, srvice or product Google proposes because evertything isn’t relevant, but we will cover the essencials.

Advertising.

Google's revenues come from advertising - roughly 80% of it at least, which makes Google one of the biggest advertisers on the world. That is because Google's business is based on its network effect and its free applications, meant to attract users which Google learns to know and whose attention is then sold to companies who want to advertise.

As many say: “If it’s free, you’re the product.”

The backstage of advertising is pretty simple. Companies contact Google with the wish to advertise their products or services on their platform, and pay Google to do so. The latter will build a pool of ads which it will display to users who can be sensible to this a particular ad, based on Google’s knowledge of each individual, through the course of hours, days, years on its different platforms. Two mainly, as advertising revenues come from Google Search & YouTube.

Search.

This is where everything started for Google, thanks to an understanding of something which wasn’t obvious at the time: user interface. A very simple search bar, the simplest ever, which has never, never been modified or polluted through the years.

Simplicity is what made Google the machine it is today.

Yes, its design changed through the years and we all now know their special day designs, on which we all learned something eventually, but it was always kept simple, free from direct advertising or any visual polution. Only its design changed through the years, for the better.

Simplicity won the heart of billions.

As Google became the most used search tool, advertising became the obvious business model for online service providers and Google started making money, lots of it, and decided to build an empire by doing something simple - and possibly illegal but that’s a story for later: they started paying other online navigators to use Google as their search tool.

And that’s how the monopoly was born.

As of today, almost every web browser uses Google Search and the advertising business became the motor of the company. Statistics talk about 8 billion requests processed each day with a medium of 3 requests per user - roughly 3 billion individuals per day.

The dream for advertisers.

Large Langage Models. I will talk about LLMs right now, because many believe that ChatGPT & co. could disrupt Google Search in the next years. These certainly are competition to Google’s search engine, but this isn’t enough to disrupt the giant to my opinion.

Over the last year, Google’s market share & usage haven't declined while revenues & advertising demand have been growing - we saw that in the last quarters. Nothing suggests a slowdown in the use of their search tool, and to be honest, ChatGPT & others is still a niche tool - not even that good for now when it comes to basic requests. It will be, but it's not like Google is very far behind; they simply offer different AI tools.

If you can have equivalent answers with the same speed & fluidity on Google Search, users won't change their habits without a good reason. As of today, I find those AI answers generated by Google at least as useful as ChatGPT, although the latter sure is powerful in specific situations - like software developments for example, but not really for rapid queries, not even for deep research.

But Google isn’t only providing those fast AI answers directly on Google Search, it is also working on its own LLM called Gemini, which made the news some months ago for being very… Woke. Those are different problematics which will be fixed through the years, what is important to focus on here is that Google isn’t far behind OpenAI & co, they simply propose different services.

YouTube.

On October 9, 2006, Google acquired YouTube for $1.65B through a stock program. In 2023, YouTube generated $31.5B in revenues from advertising and is commonly known to be one of - if not the, best acquisition that ever happened.

Search is the most used search engine on the internet & YouTube is the most used streaming platform, sometimes battling with Netflix.

Let’s dive a bit into how it all works and why I personally believe YouTube is one of the best asset there is, and find it so much better than… Everything else.

Content. Starting with what makes YouTube different: the YouTubers. Google was not the first to give anyone the possibility to create & upload content online, but they are the ones who did it best and won the entire market while diffusing the videos for free, building another enormous network effect.

Everyone watches YouTube because everyone creates content on YouTube, and everyone creates content on YouTube because… Everyone watches YouTube. A virtuous circle which continues and ensures that content is constantly created & uploaded without Google having to pay a dime for it.

Sure, they do pay their content creators but simply a portion of their ad revenues, not directly for their content. This created a virtuous cycle where content creators focused on qualitative content because they want it to be their source of revenue, and this happens only if their content is consumed by users.

A true Schumpeterian platform where the best thrive, and the others... work to be part of the best.

Premium. Most revenues come from advertising but Google also started some years ago a premium subscription for YouTube with some classic functionalities: free from advertising, offline videos or video playable with locked smartphone, access to YouTube Music - a Spotify-like app filled with YouTube content.

Subscriptions have been growing rapidly and are now an important portion of revenues, reaching more than 100M subscribers early 2024. YouTube Premium is, to my opinion, the best subscription there is and I still cannot understand why anyone would use Spotify over it, but this is personal tastes I guess.

More recently, YouTube added the functionality to rent or buy movies & watch them directly from the app. This is in line with the current streaming war between the different platforms, on which Google took a completely different approach: Do not subscribe, simply rent the movies you want.

Pretty interesting way of playing the game and a very good one for what YouTube is. We’re almost back to renting DVDs, except now everything is online.

Cloud.

Google’s cloud business started around 2008 and its first services became available short after. This is now a pretty big part of the company although not comparable to the two other giants: Microsoft & Amazon.

This is a new and still evolving business, but the principle is pretty simple: give access to smaller companies or individuals to expensive technologies/infrastructures they couldn’t build by themselves. We’re talking about complex database infras, AI training systems, storage, data mining & analysis, computing power, etc…

Google has developed, through the years strong & capable hardware infrastructures and is now renting them. The demand for these products has grown and is still growing very fast for the big three, as technologies are taking more & more space in our lives, and AI will continue to do so.

It’s very hard not to be bullish on this part of Google, although as you can see, they're still far behind in terms of revenue compared to the two giants, but this also gives Google a stronger growth at the moment. They might not catch up, but their services are comparable and will continue to grow through the next years.

Other.

We’ve talked about the main parts of Google, but the company is doing more than just those.

Android & Google Play.

Let’s start with something often overlooked: Android. If you do not have Apple, you’re very probably using Android, as those two make up 98% of the market share.

And if so, then you’re probably using the entire Google product suite, for free - Maps, Photos, Drive, Files, Gmail, etc. Although you can also use those through your computer directly, without an Android smartphone. As I said earlier, if it’s for free, then you are the product as it allows Google to collect data to know you and then sell targeted ads.

But you are also using Google Play to download/buy applications and maybe have subscriptions to different services - including YouTube Premium, whose revenues are included in this part of the company's revenues. Google isn’t Apple and doesn’t charge 30% of any transaction happening, but they sometimes do take a fee, in specific situations.

“97% of developers distribute their apps and take advantage of all Google Play has to offer at no charge. Of those developers that are subject to a service fee, 99% are eligible for a fee of 15% or less by participating in different programs offered by Google Play.“

It’s worth talking about it, if not for being a big portion of revenues, at least to understand the network effect around those products and why Google became so attractive to users: it offers simplicity through an interconnected system on which you can spend 90% of your online life.

Pixel.

Google also sells some hardware with the Pixel, launched in 2016, which is still a niche player in the smartphone ecosystem but worth mentioning. We’re talking about less than 3% of market share in the U.S., but the product is getting better and more demanded in recent years.

The Pixel 9 was released in August, we’ll have to wait to have more statistics.

Waymo.

The last part of Google we’re going to talk about is its self-driving taxi project, which started in San Francisco and has now expanded to Phoenix, Los Angeles & Austin. Self-driving cars are a growing subject lately, with tons of brands trying to solve it and Google started working on it years ago, with now a working and revenue-generating product, which is Waymo.

I want to talk about it because this is competition to Tesla’s FSD, and even if we’re writting about Google here, I will defend Tesla’s FSD. Waymo has a use case, but it isn’t the same than Tesla’s. Waymo’s goal & technology is to provide an autonomous taxi system in defined area. Tesla’s goal & technology is meant to give households a selfdriving car.

Both are very different, and the main difference lies in the tehchnology.

“Before our Waymo Driver begins operating in a new area, we first map the territory with incredible detail, from lane markers to stop signs to curbs and crosswalks. Then, instead of relying solely on external data such as GPS which can lose signal strength, the Waymo Driver uses these highly detailed custom maps, matched with real-time sensor data and artificial intelligence (AI) to determine its exact road location at all times.”

What Google calls AI isn’t really what I would call AI. Waymo is “nothing” but a very long & tedious code, basing irs cars’ driving on very precise maps of defined areas, telling the car what to do in which situation. It is perfected enough to work and be commercialized but it will stop working outside of its perimeter or if there is the slightest modification in its mapped area.

It is very valuable as Waymo still provides rides without chauffeurs. But Waymo & FSD are fundamentally different in what they offer.

MOATs & Risks.

I’ve talked about a bit of both above, but I’ll try to make it a bit clearer here, product by product although we will focus on the main business of Google - leaving side projects aside.

Network Effect.

Something I talked about earlier again. There is a simple defintion of network effect:

“Network Effect refers to the increase in value of a product or service for each user as more people use it. Essentially, the more users a network has, the more useful and valuable it becomes to each individual user.”

Google’s management has spent decades building its network effect through free-to-use applications, all meant to attract users through an interconnected infrastructure while collecting data on them. Once enough data is collected, Google builds user profiles and know which ad to send to which user, to maximize a potential click & redirection to the advertisers' websites.

This works with both of their bigger businesses, YouTube & Search. Every other applications are meant to drive & grow adoption and strangle competition. Google know has one of the strongest network effect, ever. And it is still growing.

Google Search.

Even if LLMs are indeed growing in terms of usage, they are very far from disrupting Google at large, but very far from disrupting Search as well. Exactly like FSD & Waymo propose comparable services but are not targeting the same end user, ChatGPT & others offer online information but not for the same need as Google’s users.

I might review this take in the future if things change. But as of today, I do not think most are ready to pay a monthly subscription to a not very reliable LLM instead of using Google & its AI fast answer or Gemini for free.

Internet was built on advertisers' money. And I don’t see this habit changing any time soon, no one is ready to pay for it.

YouTube.

I will have to use once more the FSD & Waymo comparison because even if YouTube proposes streaming services, it is an alien with no direct competition. You can find music or movies on many other platforms. But you cannot find YouTubers anywhere else than on YouTube and even after the rise of social media like Instagram or TikTok, YouTube kept thriving because of its specific content & network effect.

YouTube is a competition to Spotify with its new YouTube Music app, but the contrary isn’t true. YouTube shorts are a competition to TikTok & Instagram, but the contrary isn’t true. YouTube movies & rentals are a competition to Netflix, but the contrary isn’t true.

It would be true if someone could come with a platform associating all of those assets, and even then, you’d still need to break YouTube’s network effect.

Monopole & Regulation.

No one can say today that Google doesn’t hold a monopoly in web search - you could try to, but it would be completely dishonest. It’s also certainly dishonest to argue that this monopoly is legal or was acquired legally - I am no law expert, but I’d assume paying web browsers to use Google Search until no competition remains isn’t perfect in terms of anti-trust laws. But again, I am no expert.

The DoJ is already on Google’s back and could certainly take actions, although… Google is now big, too big, and yes, very probably above the law as long as they collaborate with the government. Many could call me names for saying something like this, but this is how the world works and how I see things.

Google should have been broken a long time ago. As to whether it ever will be? I do not think so.

Finances.

We do not need to spend much time here as we’re talking about one of the Magnificent 7. One of the strongest companies in the world in terms of products, services, influence & finances.

I will address the FCF margins because this has been a big worry for many investors but is peanuts to my opinion. Everything else is perfection, with a strong revenue growth, strong income with growing margins, and a huge balance sheet of $85B in net debt.

Coming back to the FCF & its margin. Since two, three years now, Google has massively increased its capex and continues to do so to build new & powerful infrastructures for its AI & Cloud business. Its objective is to stay relevant in the new AI era which should come over the next years, and this impacts its FCF.

Those are the facts, you can understand them easily with this picture.

There are two ways of seeing things from here.

The bears will tell you that it isn’t normal for such a company not to expand its FCF margins & grow its FCF & FCF/Share over the years. After all, this is what investors want: for the companies on which they invest to make more & more money so its intrinsic value grows - and the value of their shares.

They also are afraid that all those investments never yield returns and that this cash would have been better used to return value to shareholders - those greedy shareholders.

I can hear this, but I strongly disagree.

The bulls & I will say that a company’s goal is to bring more & more value to the world, each day, month, year. And to do so, it needs to evolve, innovate, grow, and this comes with investments which will later on, generate cash. Investing is about the future, not the present, and I do not want to put my money on a boring management who only focus on buying back shares and growing dividends while not investing in themselves - Hello Apple (sorry, couldn’t resist).

This screenshot shows, to me, one of the strongest financials ever. It sure says that margins have decreased but it also says that Google has kept its FCF at a stable value for four years while investing everything above it for the future. All while growing its buyback programs & initiating a new dividend program, returning more & more value to shareholders each passing year.

This is a display of its business strength. Nothing else.

Valuation.

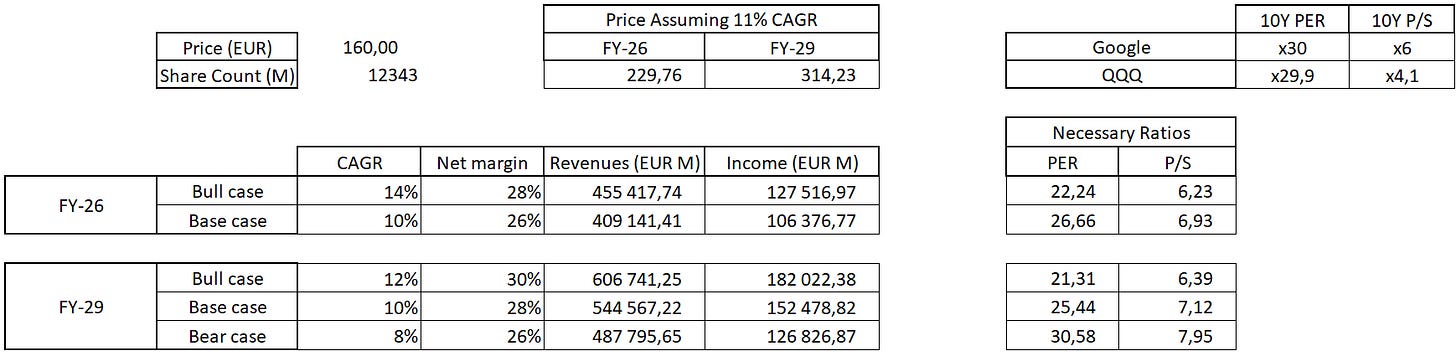

I will, as usual, use my model to value Google, based on its past, actual & potential future multiples. Methodology is detailed here.

Google is pretty attractive at today’s price. Assumptions are pretty simple and conservative although it is very hard - impossible really, to measure the potential impact of AI on growth or margins. The tendency is good at the moment but things can change.

I find it hard to imagine Google growing less than double-digit CAGR over the next two years, even over the next 5 years, but adding a high single-digit growth also helps putting some perspective.

Google around $160 is already a pretty interesting asset to buy, in my opinion, but it doesn’t cover all the scenarios and I’d personally rather focus on buying with a P/S around the historical median. Although we’d be trading at much lower P/E than the historical median at $160, without even including buyback programs.

I wouldn’t find it inconceivable to accumulate around that price but I personally will start my DCA under $150, to be focused on a 2-year P/S closer to 6x. I was given the opportunity to buy at this price early in September and I am pretty sure we will have another one later on, as the market is pretty volatile lately.

Conclusion.

Google is, in my opinion, the best company of the Magnificent 7 at the moment - although I could argue the first position with Meta, and certainly one of the best companies in the world. And while many with such a status would turn complacent and sit on their hands while taking their cash in and paying dividends, Google took the hard road and decided it had to stay relevant.

This is done through strong investments with which investors aren’t happy, but which will help Google continue to assert its dominance in its domain while improving its technologies & services.

The giant isn’t dead, far from it. It is at the top of innovation, and we will continue to hear about it for a very, very long time, in my opinion. It certainly deserves a portion of investment in a portfolio as a safe & stable asset if one wants to have some tech & AI without having the risks of smaller caps.