Meta Q3-25 Detailed Earning Review

A company and a stock are two very different things

If you guys are interested, you’ll get a 15% discount on FiscalAI through my referral link below. FiscalAI is the tool I use for KPIs in all my write-ups - powerful, data-rich and with great UX.

https://fiscal.ai/?via=wealthyreadings

Everything you need to understand Meta’s bull thesis is here.

This was a mixed quarter and we’ll need to dissect it carefully. The market’s reaction is clearly negative and that can be understood. Yet many investors are talking about accumulating after the drop and… that also makes sense.

As always in the market, it’s about timeframe, risk tolerance, perception, and how you build your own book. I’ll share data and context for you to understand what is happening and why the market is punishing what seems to be a good quarter.

Business.

First of all, Meta’s core business remains extremely strong, with continuous growth in users - now above 3.5B daily actives, and increasing time spent across its apps.

Daily actives continue to grow year over year across Facebook, Instagram, and WhatsApp. We’re continuing to see improvements to our products and recommendations, drive incremental engagement with year-over-year growth in global time spent accelerating On both Facebook and Instagram in Q3. In The US, overall time spent on Facebook and Instagram grew double digits year over driven by continued video strength as well as healthy growth in non-video time on Facebook.

More users and more time spent is gold for advertisers, especially when combined with Meta’s improvements in ad targeting and conversion.

This is really impressive and raises the question: where is the ceiling? How much more can AI improve targeting and conversion?

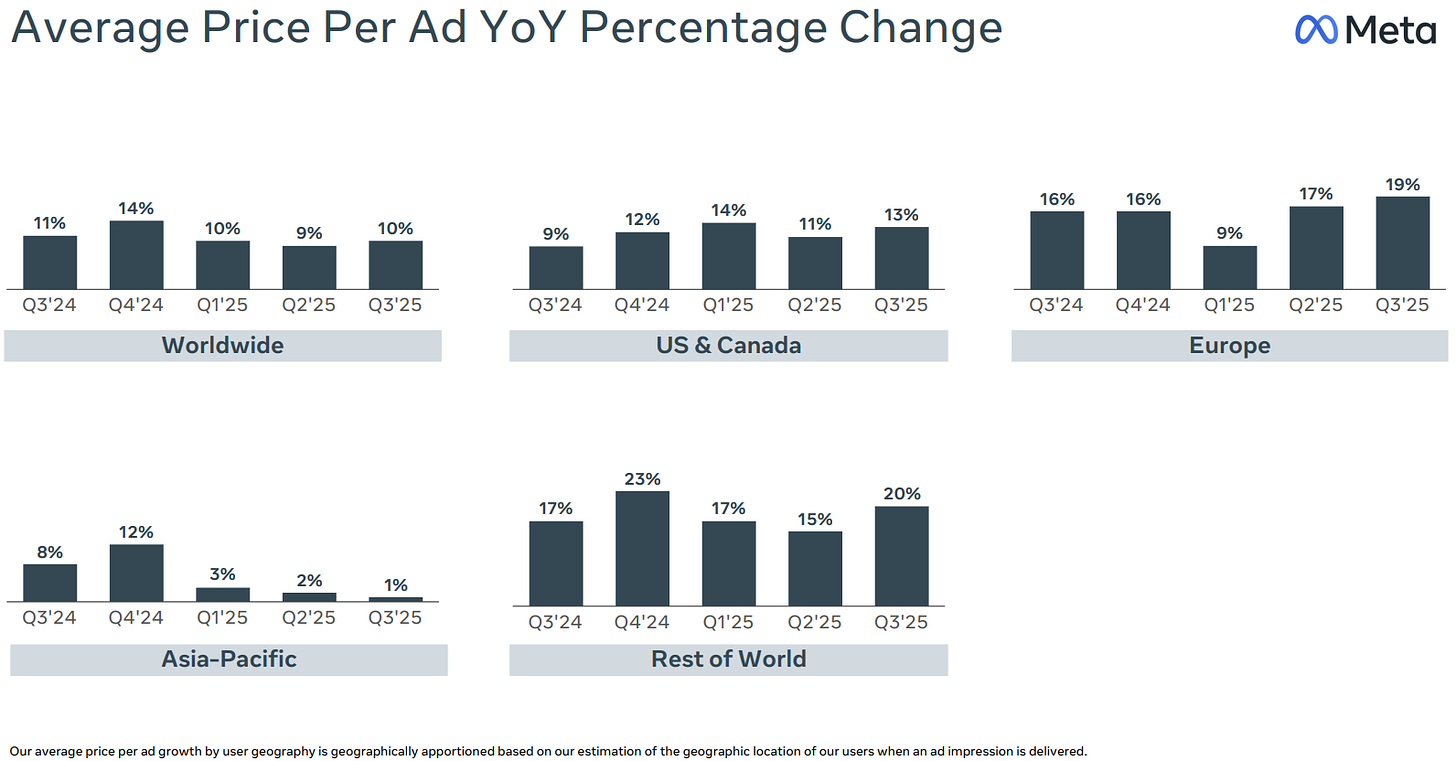

Our ads business continues to perform very well largely due to improvements in our AI ranking systems as well. Weighted conversions continue to grow faster than impressions. The average price per ad increased 10% year over year, benefiting from increased advertiser demand largely driven by improved ad performance.

There’s sort of this very large amount of headroom and the opportunity there keeps growing as we are improving and optimizing the AI. And I think that really shows no sign of being near the end.

In brief: no ceilling, none detected at least, while there is room for improvements as Mark shared the team’s goal is to reduce model size to improve efficiency & speed. Bigger models are powerful but costly and slower to run & Meta operates hundreds of them for different tasks with the objective to consolidate them into a few smaller, faster, and more efficient ones.

And then in addition to the foundation model work, we are working on advancing our inference models by developing new techniques and architectures that then allow us to scale up compute and complexity. An ROI positive way.

This aligns perfectly with Alibaba’s Aegaeon system showcased recently.

Meta will likely leverage or adapt similar methods to improve performance step by step. Each small cost or efficiency upgrade translates into meaningful gains for the company considering the massive advertising volume they treat.

And even, you know, small scale improvements that we are able to make in terms of driving, you know, basis point improvements in the performance of ads or single digit, you know, increases in conversions relative to impressions in a given quarter, you know, off of a large base mean that we’re really able to continue to grow the absolute dollars of revenue growth in a pretty meaningful way.

Meta’s business is massive and has many potential tailwinds. No clear ceiling in terms of efficiency nor users while demand for ad products keeps rising, both from existing clients and new advertisers.

Monetization began on Threads and is accelerating on WhatsApp, with positive feedback on both.

Ads are now running globally in feed on Threads, and we’re following our typical monetization playbook, of optimizing the ads formats and performance before we ramp supply.

Finally, business messaging remains a significant opportunity for us. We’re seeing strong growth across our portfolio of solutions. Including with click to WhatsApp ads. Which grew revenue 60% year over year in Q3.

Quick note on smart glasses with very positive data as this product was responsible for 1/3 of EssilorLuxottica’s growth this quarter. Demand is real.

The new Ray-Ban Meta glasses and Oakley Meta Vanguards are both selling well. They sold out in almost every store within 48 hours, with demo slots fully booked through the end of next month. So we’re gonna have to invest in increasing manufacturing and selling more of those.

Meta also released a new AI app called Vibe, focused on AI-generated content, an interesting concept I will follow as it’ll help gauge the balance between demand for real versus AI content. Very curious on this.

This was the strong part of the report; a healthy, profitable and expanding business with clear momentum. Now let’s turn to the “less positive” section of this write-up, the part the market didn’t like.

CapEx and Compute.

There’s little change in Meta’s objectives. Mark was and remains all-in on AI, willing to take the risk of overbuilding.

I think that it’s the right strategy to aggressively front-load building capacity so that way we’re prepared for the most optimistic cases. That way, if superintelligence arrives sooner, we will be ideally positioned for a generational paradigm shift in many large opportunities. If it takes longer, then we’ll use the extra compute to accelerate our core business, which continues to be able to profitably use much more compute than we’ve been able to throw at it.

Management said many times they need more compute and plans to both build and rent capacity from third-parties.

A central requirement to realizing these opportunities is infrastructure capacity. As we have begun to plan for next year, become clear that our compute needs have continued to expand meaningfully. Including versus our own expectations last quarter. We are still working through our capacity plans for next year. But we expect to invest aggressively to meet these needs both by building our own infrastructure and contracting with third-party cloud providers

This is bullish for neoclouds: Meta is clearly saying they will rent capacity, much like Microsoft did. Whether that goes to Nebius or others - of course we prefer Nebius, this means more contracts in the short term for those companies.

From a business perspective, this makes sense; Meta generates huge cash flows and can afford to invest heavily. But from a market optics point of view, Meta is not a private company and narratives matter in the markets.

And this is where it starts to hurt, with two comments.

As a result, our current expectation is that CapEx dollar growth will be notably larger in 2026 than 2025. We also anticipate total expenses will grow at a significantly faster percentage rate in 2026 than 2025, with growth primarily driven by infrastructure costs including incremental cloud expenses and depreciation.

I think it’s too early to really understand what the margin are gonna be for the for the new products that we build. I mean, my general goal is to build a business that maximizes value for the people who use our products and maximizes profit not margin. So I think we’ll kind of just try to build the best things that we can and to deliver the most value that we can for most people.

Once again, this makes sense business-wise, but what the market hears is “We’ll spend more, margins will compress & returns are uncertain.”

Plus, cherry on top, those expansions are now financed partly through debt, including a partnership and loans with Blue Owl, and convertible notes aiming to raise around $25B. Although in the later case, investors showed up massively which also confirms that this “negative” view is not universal.

Leveraging debt still implies sacrifying future cash flow for uncertain future gains.

The market isn’t angry, it’s pricing risk, which it largely ignored those last years, while nowadays Meta’s CEO is openly sharing them on an earning call.

There’s also a flaw in Mark’s reasoning to my opinion: he openly said that if they were to overbuild, external demand from other business than advertising would absorb the excess. But if everyone overbuilds, the whole AI sector is oversupplied and capacity will not find buyers. At all, or at unprofitable prices.

That’s what the market is pricing today & may continue to price for a few more weeks. It doesn’t mean it will be right, it means the risk exists.

Financials

Meta remains very strong, as usual, but we’re starting to see smoke.

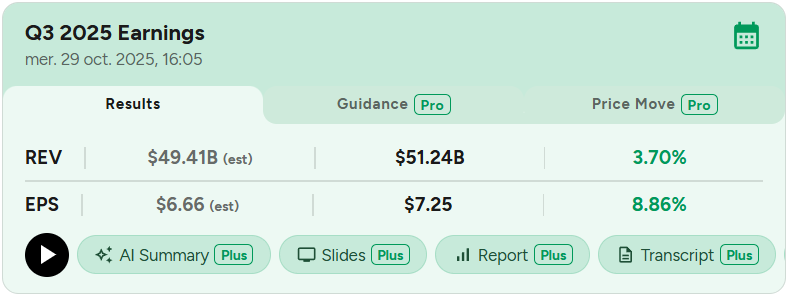

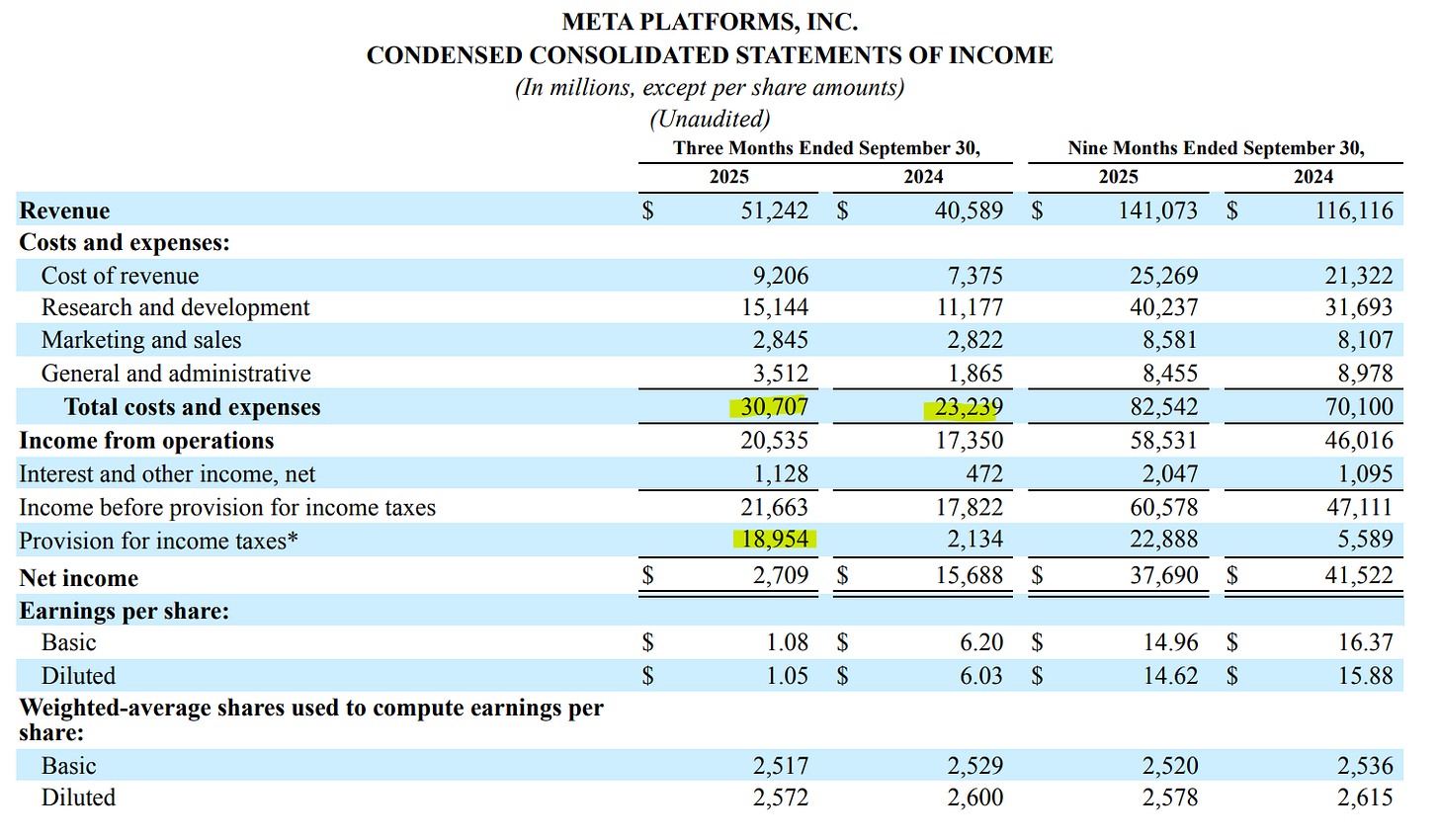

Revenue was up 26% for the quarter and 21.5% for the nine months, strong. But what concerns the market are expenses, costs and therefore margins.

Those are rising faster than revenues driven by depreciation, higher costs to run larger models and higher payroll expenses from AI hires. This is crystal clear this quarter as operating margins declined 2% YoY, is compeltely AI-related and it will continue, even accelerate as confirmed by both mark and Susan, with no clear perspective on how it should affect revenues growth.

A big concern for the market.

I won’t comment on net income this time, as tax distorted the numbers. Results would have been strong without it though still showing lower net margins YoY.

Excluding the one-time tax charge, our net income and EPS would have been $18.6 billion and $7.25 share respectively.

In term of cash, Meta generated $10.6B of FCF, repurchased $3.2B of shares and paid $1.3B in dividends, ending the quarter with $15.6B in net cash.

Guidance

Meta expects around 15% YoY revenue growth for its next quarter.

We expect fourth quarter 2025 total revenue to be in the range of $56B to $59B.

Investment Execution.

Let me start by saying that Meta is an excellent company, one of my favorites on the market and one I want to own long-term, and I know that investing in their core business is the right path - they proved it many times.

But, as I said earlier, there are two ways to see this quarter:

The business is extremely healthy. Management continues to leverage AI to boost both engagement and conversion, hence demand, pricing and revenues. This will continue and even if Meta spends a few billion in the process, these are smart & long-term investments. Returns will come in time.

All of the above, but the market is now pricing risk and that risk is real, already in the numbers. If margin compress or if signs of oversupply appear, the market will not just price the risk, it’ll anticipate lower cash flow and give lower multiples.

Both perspectives make sense. A company and its stock are not the same thing.

In the short term, markets trade on narrative; in the long term, they trade based on fundamentals and cash generation. So whether this was a “great quarter” depends entirely on your timeframe and risk tolerance.

There’s no wrong answer here.

Team A will accumulate here but might need to stomach volatility.

Team B will wait until concerns are addressed or the market punishes Meta, even if it means missing as opportunity today.

Everyone will read this quarter differently, I personally favor listening to the market & usually remain cautious. The company is wonderful but everything has a fair price and management clearly guided for margin compression. So I’ll factor that in but will keep Meta’s average multiples although some could argue lower margins would already require lower multiples.

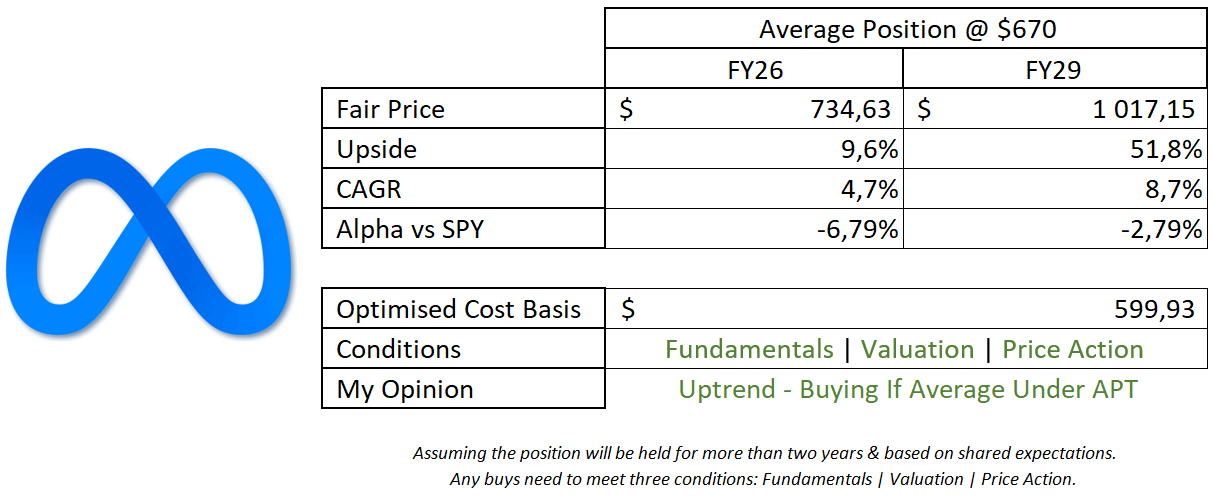

This model assumes an 18% & 13% CAGR growth until FY26 & FY29 respectively, 35% net margins, 1.5% returned to shareholders & P/S & P/E at 7.5x & 26x respectively.

Yes, this is an accumulation price reduction for me - from $640.

I continue to believe Meta is a wonderful business but I’m here to make money and that means sticking to my system, not emotions. If this dip turns out to be a great opportunity, I’m fine missing it. As always, this is my decision, this Substack is about sharing my methodologies, not claiming universal truth.

In term of price action, we’re holding the weekly 50, a key short-term support for the ongoing bull trend.

Meta has only closed below it once since the 2022 downturn during the “tariffs dip.”

This is a key level. If you’re Team A, this is the spot to buy or accumulate, especially if your average cost is below your fair value assumptions - mine now being $600.

Decision here is about what kind of investor you are. Do you listen to the market or only focus on the quality of the business?

I know which one I am.

You need to figure it out.

Great piece!

I think people shouldn't be ignoring the smart glasses push. The industry is trying to shrink an entire supercomputer, plus camera, display, speaker, and AI assistant — into a pair of glasses that won’t make you look like an off-brand Robocop. We’re not all the way there yet. We’re still constrained by power, compute, cost, size, weight, and battery life.

The comparison is that today’s headsets are the clumsy, archaic brick phone, and the ultimate, seamless smartphone-level goal for the entire category is the lightweight, stylish glasses.

The glasses will become a kind of co-pilot for daily life, sitting in the background until you need it, and then showing up exactly when you do.