Anatomy of a Trade - 10/06/25

Fossil energies: the underappreciated heart of the economy

I’ve always said that fundamentals, research & convictions matter, but beating the market comes down to execution. That’s what these write-ups will be about.

I will share through them every change in my active portfolio - stocks & options, reasonings & plans, before I even hit the buttons. I won’t update DCAs, I will only share my plans & new/closed positions in these write-ups. You can follow the rest directly on savvytrader.

https://savvytrader.com/wealthyreadingspro/active

I also recently opened a Buy & Hodl portfolio on which I will DCA $4,000 every month & focus on buying the best assets I can at the best possible price, 100% focused on fundamentals & valuation, without any active management.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Keep in mind that both portfolios have completely different goals and I can behave very differently on both for the same name - accumulating in the buy & hodl while selling in the active portfolio for example. Different rules apply.

My goal is to deliver alpha over the long term, not just six months under easy market conditions. If/when proven this content is valuable, it will be shared behind a paywall. No rush, though; it’ll stay free until proven valuable.

So here’s the deal: you get full transparency on my trades, right when I make them. If - and only in that case, it brings real & long-term alpha, it’ll be accessible only for a fee. I believe that’s fair enough, but feel free to provide feedback!

Nothing shared here is financial advice; we are all responsible for ourselves.

And before we start, a friendly reminder that you’ll find 15% off for any subscriptions to Fiscal.AI using my referral link - if interested.

https://fiscal.ai/?via=wealthyreadings

Underappreciated and Ignored.

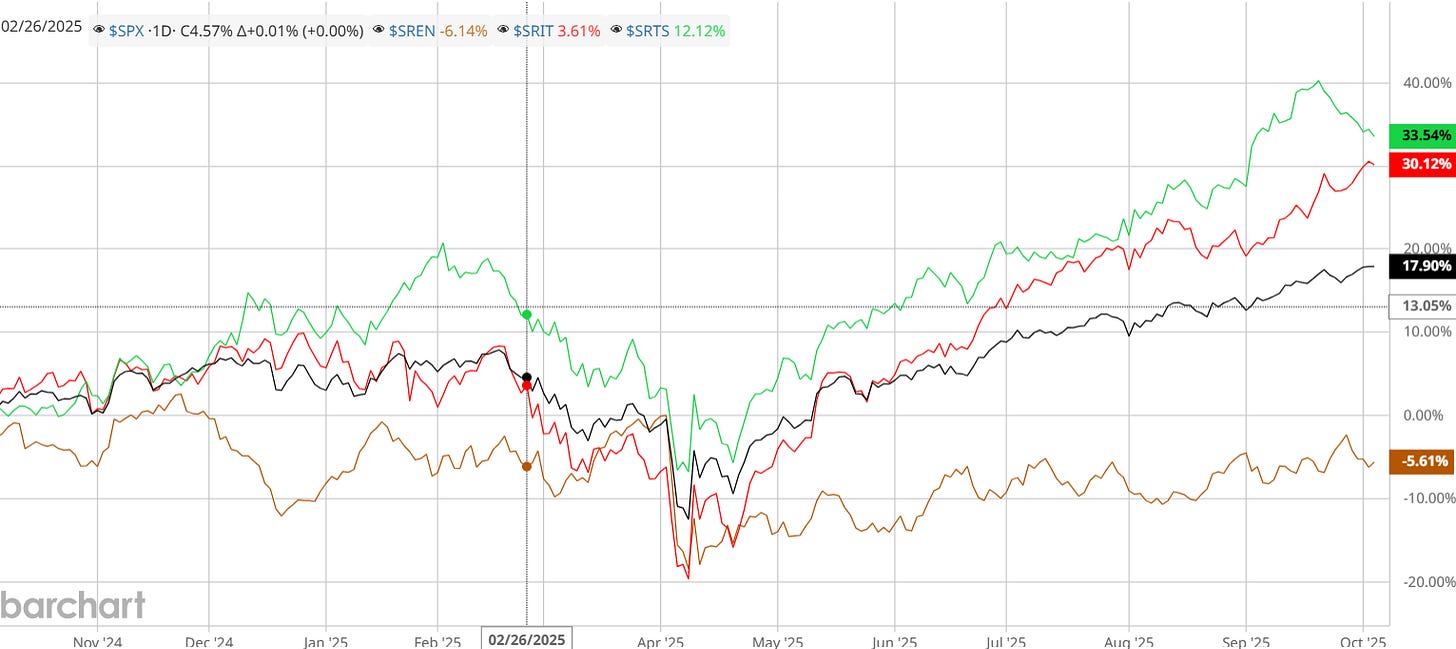

The market has ignored companies involved in fossil energy while pushing tech and tech services to new all-time highs each month.

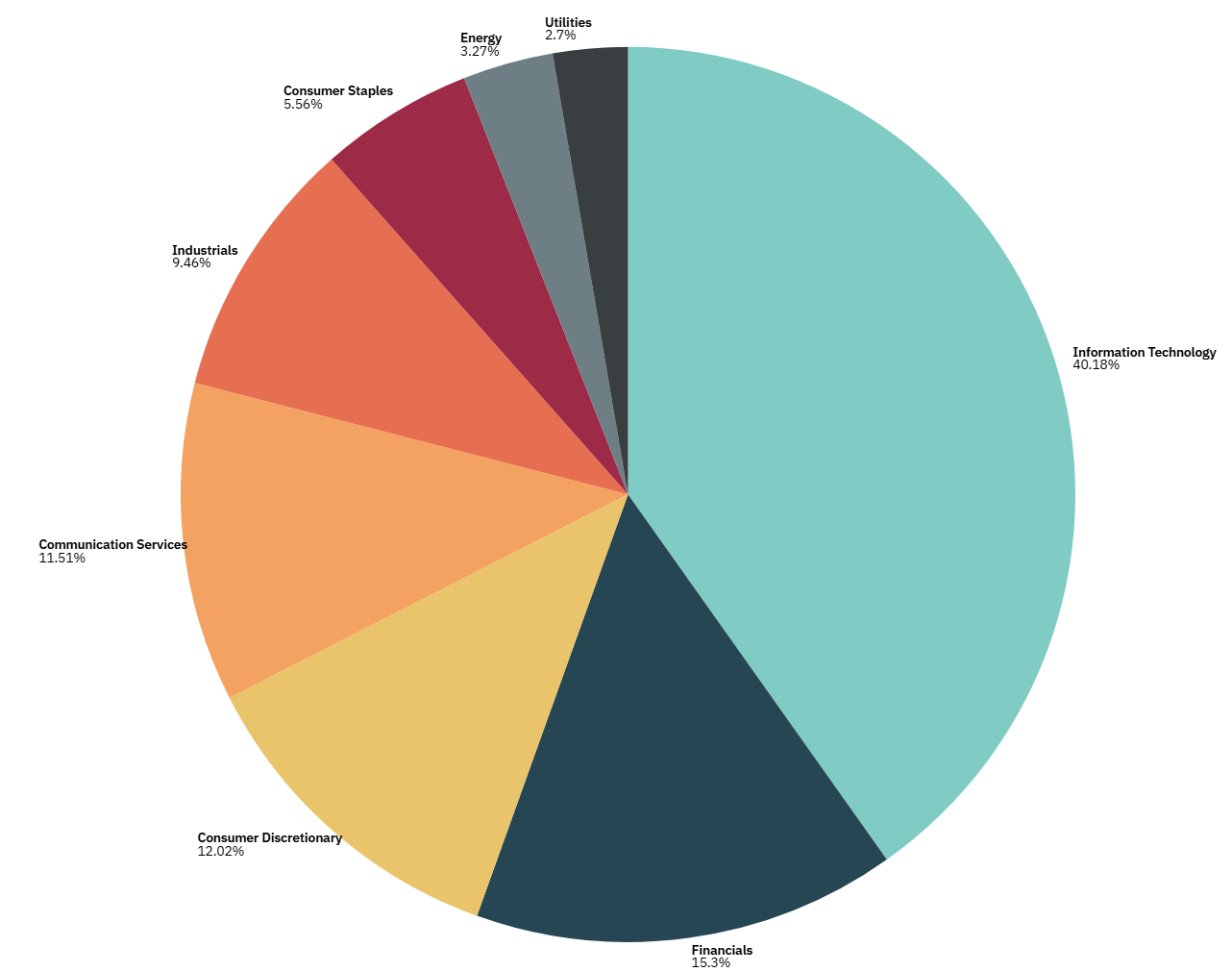

I get it. Tech is the future & where innovation happens. Energy is an old industry, still critical to our lives but with less “potential.” But everything has a price in the market, and while many are talking about tech’s valuation, which I personally am fine with, no one is talking about energy-related stocks’ valuation - which are pretty low.

Undercrowded and ignored, not much liquidity is flowing into those names anymore, and their weight in the S&P 500 has dropped to less than 4% so even those buying the index end up without much exposure.

It is pretty low and I’d say that’s because most of those companies trade at pretty cheap valuation without much narrative to push them higher while nuclear names continue to rip.

Halliburton Company.

But the market always comes back to an equilibrium and it might be starting already. We’ll talk about Halliburton today to illustrate, a company focused on the upstream part of the energy sector.

Halliburton Company (NYSE: HAL) operates in the energy sector, providing services and products to companies involved in finding, extracting, and producing oil and natural gas. The company focuses on two main business areas:

Completion and Production: This includes services like cementing wells to secure them, stimulating reservoirs to improve oil/gas flow, intervening in existing wells for maintenance, pressure pumping to inject fluids, and completing wells with tools for long-term operation.

Drilling and Evaluation: This covers providing drilling fluids to lubricate and cool drills, wireline services for logging data inside wells, perforating to create holes in well casings, drill bits for boring into the earth, testing reservoir performance, and subsea equipment for underwater operations.

Halliburton serves clients globally, helping with the full process from drilling new wells to enhancing output from existing ones, primarily for oil and gas producers.

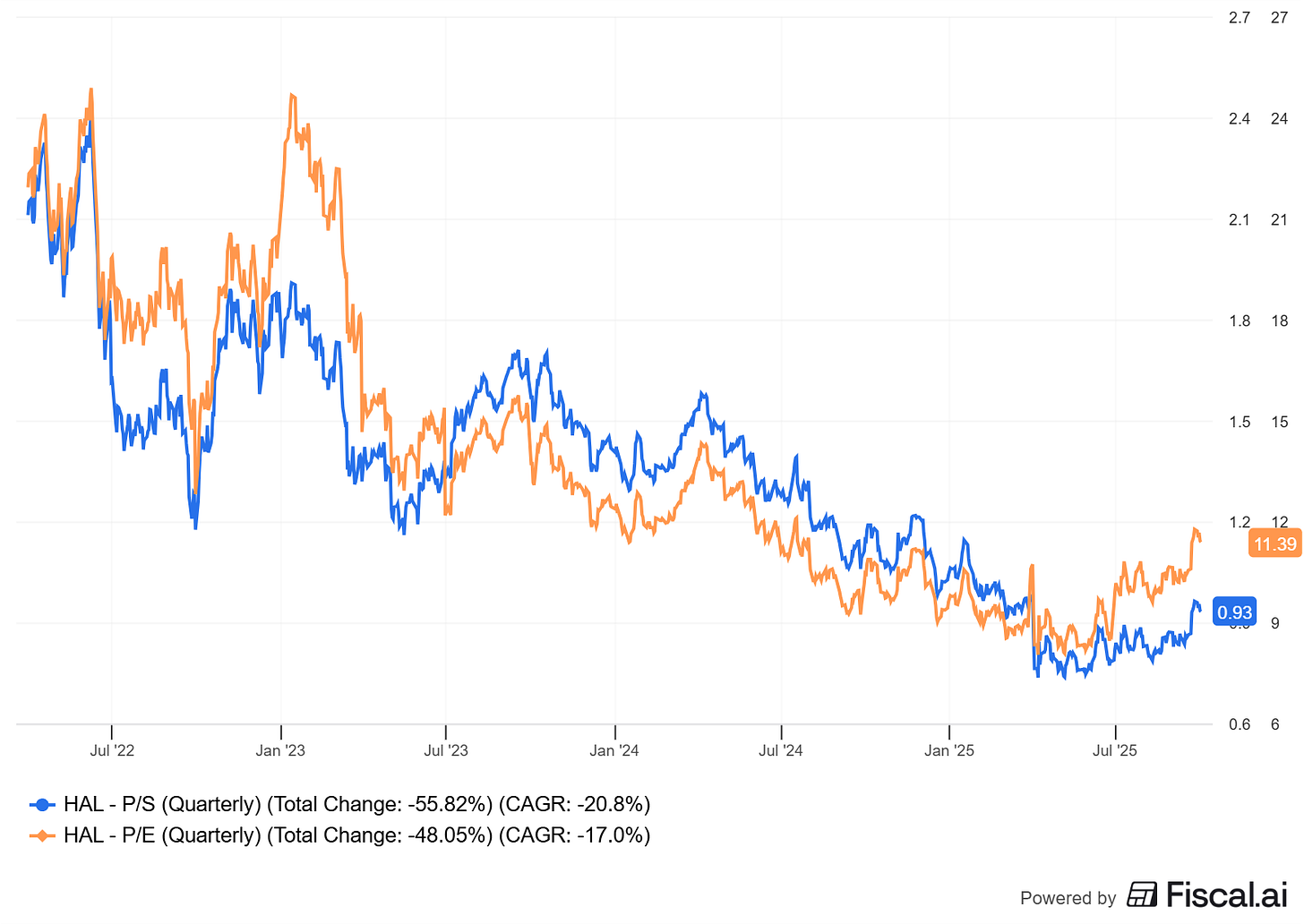

The company is trading close to its all-time lows in terms of multiples - less so now thanks to the last weeks’ pump we’ll talk about.

The problem with energy names is that they rely on their commodity’s price. Just like gold miners had minimal valuation for a decade because gold didn’t move much. And oil has been falling a lot since last year, for different reasons.

I can’t predict where oil’s price will trade next year, but we’re back to stable levels and it seems hard to imagine more drawdown from here. Producers need to maintain the price at a certain level to stay in business - which they do by managing supply.

We also have a weak dollar, favorable for Latin America and regions who depend on it to finance themselves. A weak dollar boosts financing capacities and infrastructure projects in those regions, where fossil resources remain a main business.

Hallliburton advantage is that it doesn’t rely directly on oil’s price. It relies on the need for oil. Even if prices decline, the need for wells might slow but doesn’t disappear and maintaining existing ones is still necessary. A raising demand for the commodity will raise demand for its service, but a stable one will also yield a stable environment.

Liquidity and Technicals.

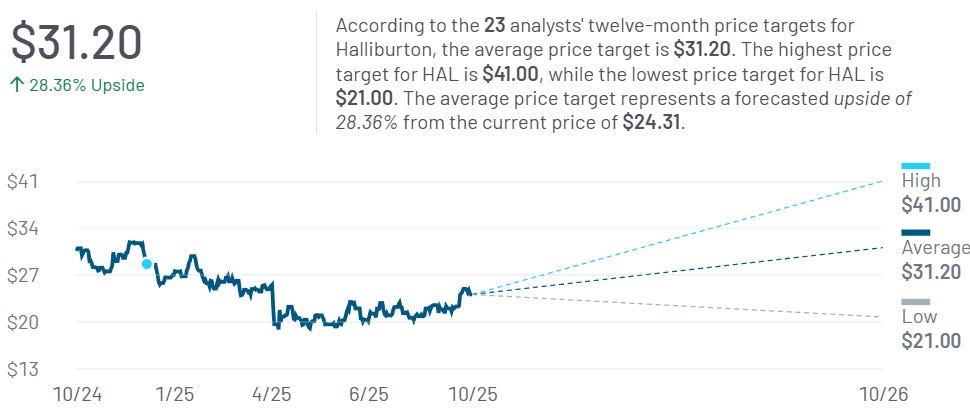

What makes me talk about HAL is mostly the option flow these last weeks, which has been pretty optimistic on energy at large, HAL in particular. Over 23,000 option calls bought with strikes from $25 to $45 (passing by $27 and $30). Lots of activity out-of-the-money, combined with bullish sold puts - all for September.

It isn’t the only name in the energy sector with this kind of bullish bets, but it’s one of the most notable. Analysts tend to agree.

And price action is really, really encouraging with a potential bottom set in March this year and a clear breakout two weeks ago, pushing above all important daily EMAs.

It’s hard not to be bullish on such a setup, even if fundamentals and the sector raise questions for some who prefer more speculative assets.

The Playbook.

In all transparency, I am not part of this trade mostly because I do not have enough liquidity for it and remain focused in more aggressive names. But it could be a great trade for those who are looking at more defensive assets.

And there are plenty of ways to play this one, two I would highlight.

Long term, buy and forget. If you have liquidity aside and want safe positions, this could be it. Low valuation, strong fundamentals, 3% dividend yield, positive environment… As good as any to store cash in a defensive asset, with positive catalysts in term of liquidity inflow - which many other defensive names do not have.

Options. Liquidity is strong on the name and price action is bullish. Any covered sold put below the actual bottom seems safe enough, if you’re willing to own shares if assigned, meaning owning a major upstream player at its lowest valuation ever. For example.

Sold Puts 15Jan’27 at $20 for $1.90

Bought Calls 15Jan’27 at $32 for $1.81

You’d get paid $0.09 per contract to place the trade and be forced to buy shares at $19.91 if the stock trades below $20 by Jan ‘27. Or don’t buy the call and just return 9.5% on your locked cash by then, as long as the stock trades above $20.

Once again, I am not in the name but wanted to share the trade for those who are looking at safer assets.