MercadoLibre | Investment Thesis

Latam's best asset.

You've heard me talk a lot about China & Asia at large over the last year because I do believe it is the region which will see the biggest growth in households' buying power over the next decade(s), and therefore has the biggest potential. But we could look at the other side of the world for opportunities as Latin America could become a great source of growth, under some conditions.

That's what we'll be doing today with MercadoLibre, an e-commerce platform which expanded with a focus on the continent.

We'll start by a (long) introduction on the region as it really matters to understand its challenges & conditions for success - and therefore its companies & stock market. I hope you'll find it as interesting as I enjoyed writing it.

And then we'll dig into the company itself, with the same format than usual.

South America's Problematics.

I have a few personal reasons to prefer Asia to Latam: Their business model, economic choices, dollar dependence & security. I’ll comment on each.

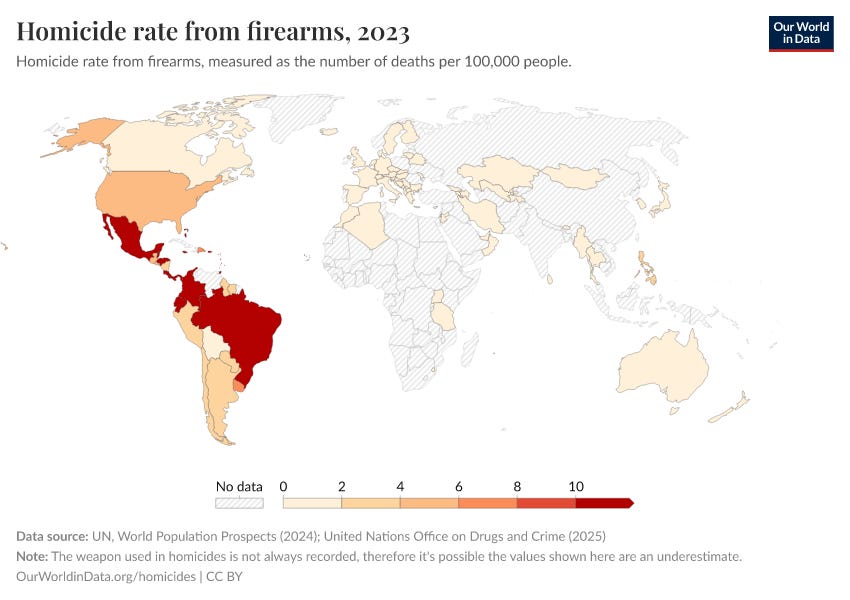

Local Security.

Everything else is somehow related to this. I'll dive right in: criminality is a problem for the entire continent, with some regions more impacted than others. Latam has some of the most unsafe countries of the world, ranging from stealing to murder or shootings, passing by organised cartels & drug traffic.

We should also include traffics of all kinds, misuse of social resources, corruption & mismanagement of all sort, which cannot realistically be measured but exist at a pretty high degree in the region.

Far from me the idea of saying that Asia has none of it. But it is much less impacted by crime in general.

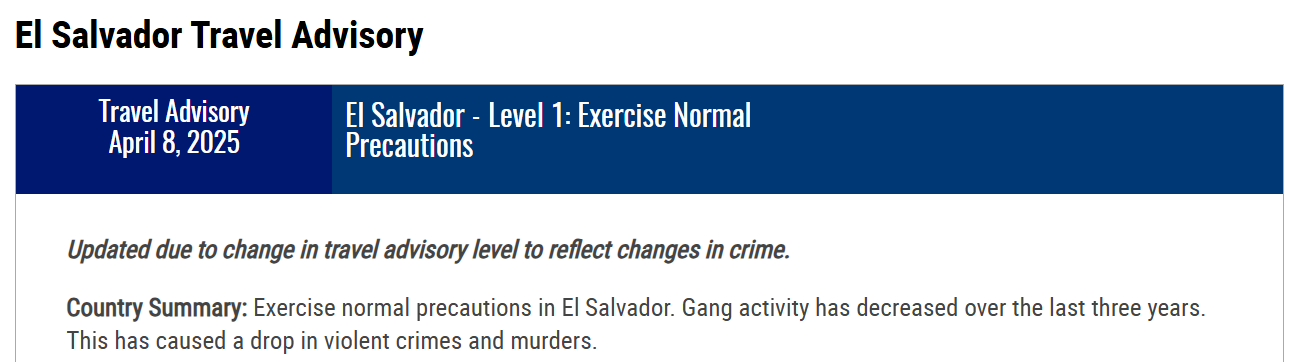

But some things seem to be changing, first with the very small country of El Salvador after the election of Nayib Bukele who transformed his country - known to be one of the most dangerous on the planet, into one of the safest places you can travel to based on the latest reports & even the official U.S. travel agency.

I won't go on about the controversy on how this was achieved - we're talking about investing here. And his methods can’t be replicated in bigger countries like Mexico or Colombia, but it shows that locals want change.

Some of the region’s countries have always been and remain very safe, but they are not the majority nor the most powerful economically and for the region to thrive, the bigger ones will need to create a much safer environment.

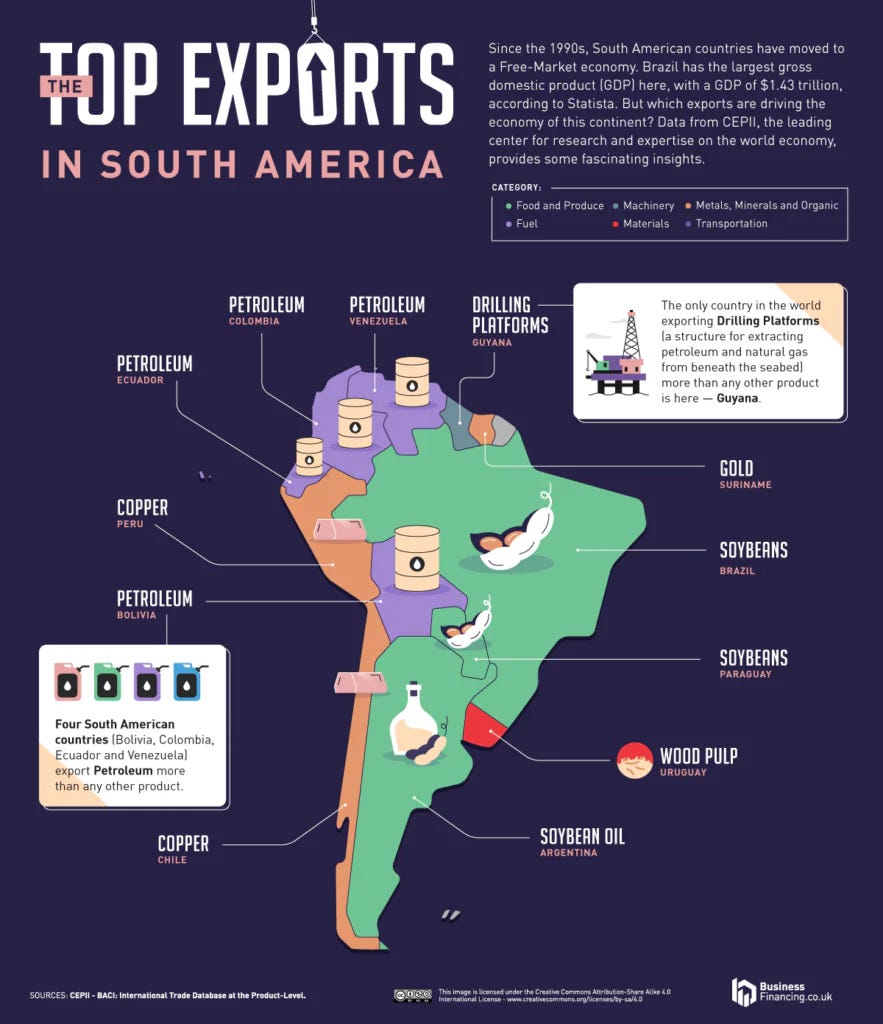

Economies & Business Model.

A country doesn't have a business model per se, but their economies rely on activities which usually depend on their population's skills, geographies & resources. Most of Latam’s businesses resolve around agriculture, minerals & energy, hence most households’ are hired by companies in those sectors.

Agriculture is somehow "easy". The work isn’t but setting up a field & having workers harvest any kind of fruits, vegetables or cereals doesn't require massive investments before generating revenues.

But mineral & energy extraction are investment-intensive activities, and need wealthy corporations to invest in the region to build platforms & form employees, which will take years & dozens of millions before generating anything in return.

This is where I come back on the insecurity part of the write-up: those add up to the risks of investing in the region. No oil extraction company wants to invest $50M to build a platform which will be paralyzed by riots, hijacked or destroyed few months later by gangs. Nor form employees which will be randomly shot after a drink at a bar. I won't go over with more examples, you understand the added risks for companies to invest in the region in term of security, while they have alternatives.

It doesn't mean none do. Nor that it is impossible. But the insecurity adds time, costs, risks & complexity. Foreign investors do not necessarily take the step.

But investments aren't necessarily from overseas or North America, they can be done locally by entrepreneurs who know the country, which is a massive advantage in terms of organisation & relations.

Which brings us to our second problem for the region: financing.

Currency Dependency.

When you borrow money, you don't ask yourself the question in which currency, the bank will loan you in your local currency. But it isn't always the case for wealthy people, and certainly isn't the case for international investments.

For the latter, loans are mostly done in the most stable currency: the almighty dollar..

For a simple reason: currencies are controlled by an entity. It is half true for America which has two independent institutions to manage its currency. But when it comes to developing countries, it is often the government which controls the currency - making corruption even easier.

Imagine you are European. And you want to invest in a Brazilian company. You find an agreement and they ask you to lend them in Real - the brazilian currency, while 1€ = 1R. Say you invest 50M Reals to be repaid in full, with interests after ten years. But during those years, the government devalues its currency and the value of the Real falls sharply and say, lost more than 10% of its value against the Euro. By now, 1.1R = 1€ but the company will still refund you 50M Reals, which you will then convert into… 45M€ - plus interests.

You lost tons of money simply because you invested in a less stable currency, even if the business was doing wonders.

This is an over-simplified example to illustrate the dynamics of currency mix, which we see every day in the quarterly reports of companies we follow. Currencies fluctuate & it is widely accepted when it comes to retail commerce as if you want to access a market, you need to accept the currency mix, but not when it comes to loans.

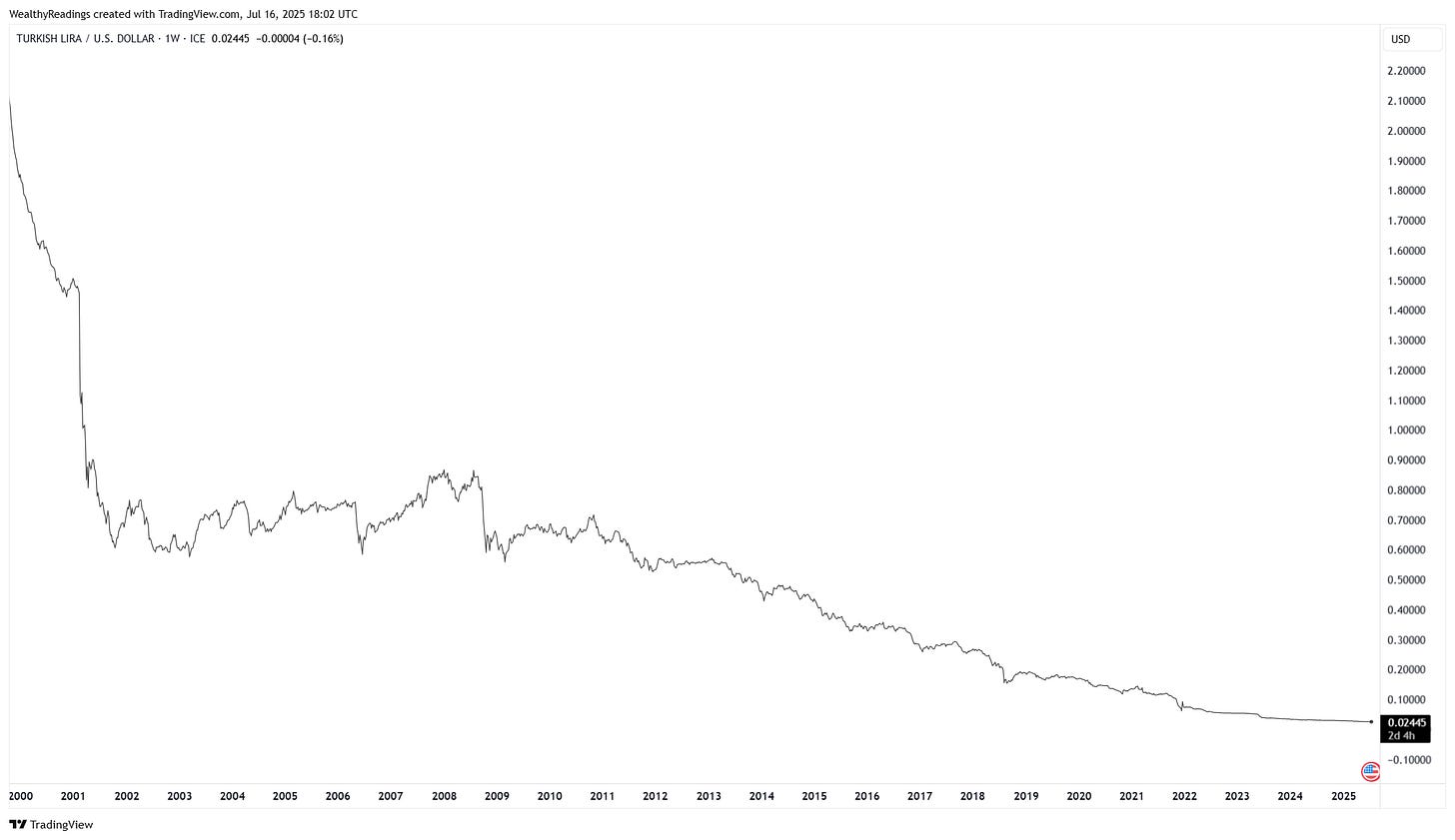

For a practical example, here is the value of the Turkish Lira compared to the Dollar.

Let me tell you that any American loaning his local currency in Turkish lira has lost all will to live over the last two decades. And this is why there are no international loans in local currencies; those loans are always done in the most stable currency chosen between both parties, usually dollars - even if none of the parties are American.

Which brings to a second problem. We now understand that Latam companies borrow in dollars - because no one wants to loan them anything else, but their currencies lose value against the dollar, which means every local currency earned in business will be converted into less dollars through the years - to repay their debts. As long as their currencies weaken against the dollar, the weight of their loan is heavier.

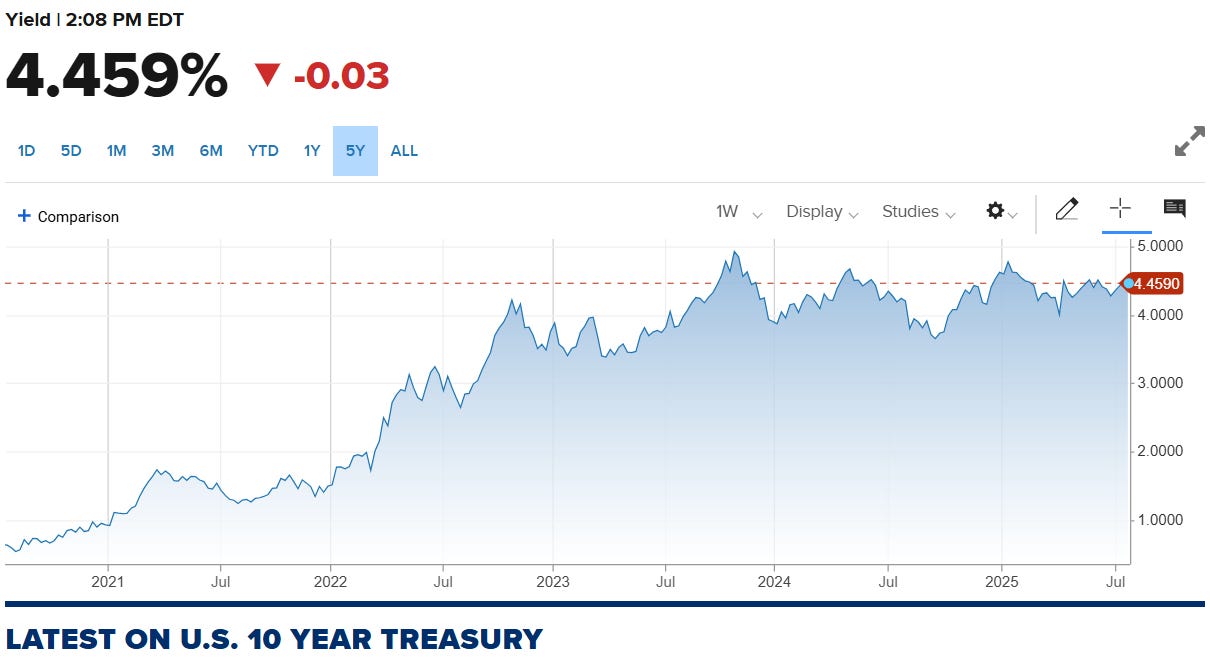

Which brings us to a third problem - it starts to be too many… Their debts are labelled in dollars, which means they also have an interest rate tied to the American Treasuries rate… Which has been rocketing over the last years after Covid's inflation, and is apparently not ready to go back down.

And of course, those interests have to be paid in… Dollars.

The entire system is a huge weight on local companies and has been really hard over the last years as the dollar kept growing in value compared to other currencies while interest rates skyrocketed while Covid hurt local businesses as demand for energy slowed down.

In brief, the last years have seen harder borrowing conditions, lower demand for their products hence less revenues hence less leverage to borrow, which hurt employment and therefore households' income & consumption.

But things are slowly changing as conditions are getting better.

Capitalism Returns.

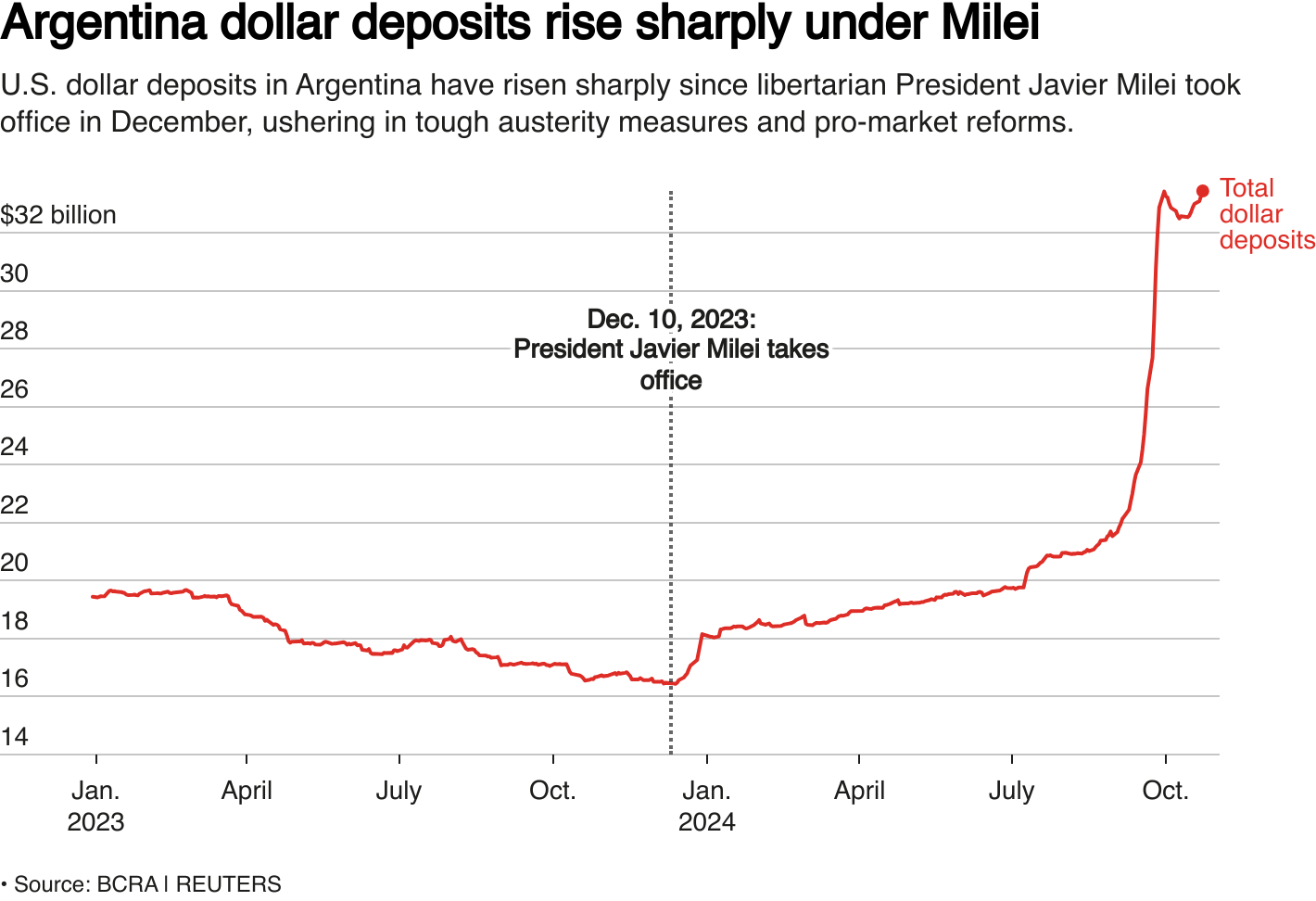

We have talked about the change in security, at least in El Salvador, which might not bring prosperity to the entire continent but shows a wish for change. Argentina is also changing. The election of Javier Milei changed the country entirely with a return of hardcore capitalism, which triggered a surge of dollar-denominated investments into the country - if you've followed until now, this is what the region wants & needs.

Once again, I won't go over the methods which have been economically as violent as Nayib Bukele's security reforms, but also as efficient as the economy is now showing encouraging signs.

Pure capitalism. Lower inflation. Rule of law. Free market.

Concepts we do not see much anymore, and which were clearly not the focus of the old administration or of any administration in the continent. There is a clear demand for change locally, while global conditions are also getting better.

Dollar & Interest Rates.

Over the last weeks, the dollar has lost a lot of its value compared to other currencies as the richest countries of the world had to adapt to Trump's trade war and manage their own currencies' purchasing power by selling some of their dollar-labelled assets into their own currencies.

This weakened the dollar globally, and once again if you've followed until here: a weak dollar is a good dollar for those countries as it means the same revenues in their local currencies will bring in more dollars, making their loans easier to repay and stabilizing their financial situation, allowing them to hire more, pay better & borrow more to expand - or else, if necessary.

Secondly, inflation is almost back at the FED’s target in the U.S. while uneployement remains healthy. The FED refuses to cut rates for now as the situation isn’t stable yet but we are closer than never. And as I shared, lower rates will also lower the interests Latam companies have to pay on their dollar denominated debts, reinforcing the virtuous circle shared on the paragraph above.

The dollar already weakened, cuts are coming & local populations want change for the better. If those three components continue on the right direction, Latam could become one of the fastest growing region of the world.

I continue to prefer Asia for now as the challenges of the region are different, for sure, but somehow easier to manage as they already received tons of dollars investments but do not rely only on the west as countries like China or Singapore are part of the development of the region.

This is it for my view of the condition of the region, which once again are important for business & the stock market to develop positively.

MercadoLibre.

We can now talk about the company, which as you understood would have a brighter future if the conditions above are met; growing security will unlock more investments, create more jobs, grow households’ buying power & offer them more opportunities. All of it helped by a weaker dollar, boosting potential financing for local companies and accelerating this virtuous cycle.

MercadoLibre is a retail company. Like Alibaba is the Chinese Amazon, we could say that MercadoLibre is the South American Amazon, minus the AI & Cloud services. Its success is directly correlated to households' buying power.

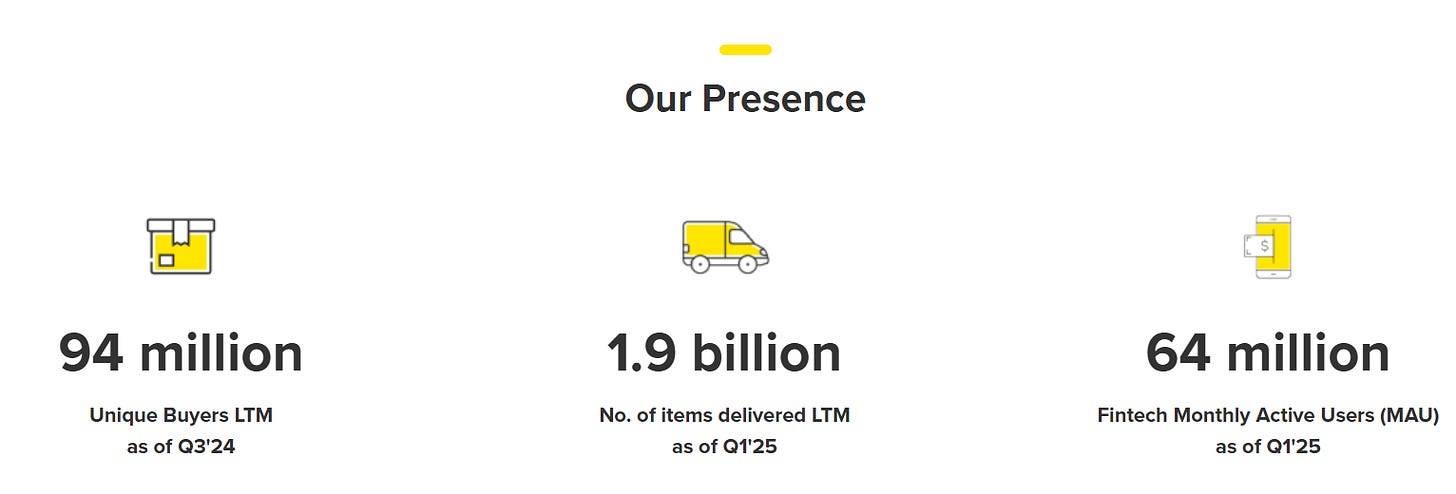

The company has 5 (or 6) different branches & is present in 18 Latam countries.

Those branches are meant to resonate with each other and create an entire ecosystem around the brand, with consumers relying on many different services for most aspects of their life - not unlike Grab is doing in Asia.

And the results are already positive with 80% of transactions processed by Mercado Pago & 90% of orders shipped via its logistics network. It is one big ecosystem relying on hundreds of different services now serving 14% of the region's population when it comes to e-commerce & 9.5% of the region's population connect to their financial services at least once a month.

The brand is already integrated, this isn't a startup trying to make a name for itself or to capture market share, it is an established company capitalizing on the name of its brand and the region's households' buying power growth.

Let's go over each branch.

Marketplace.

The biggest source of revenues - around 60%, & a very classic business: e-commerce, the biggest platform in Latin America. Consumers can buy anything they need from small businesses' to large brands', with a focus on interface & ergonomics to always make it easier for consumers.

And consumption has been growing very healthily on the platform.

But we tend to forget how easy things are on the West or in China as infrastructures are built & work really well, referentials are up to date and it is easy to find almost anyone around our countries.

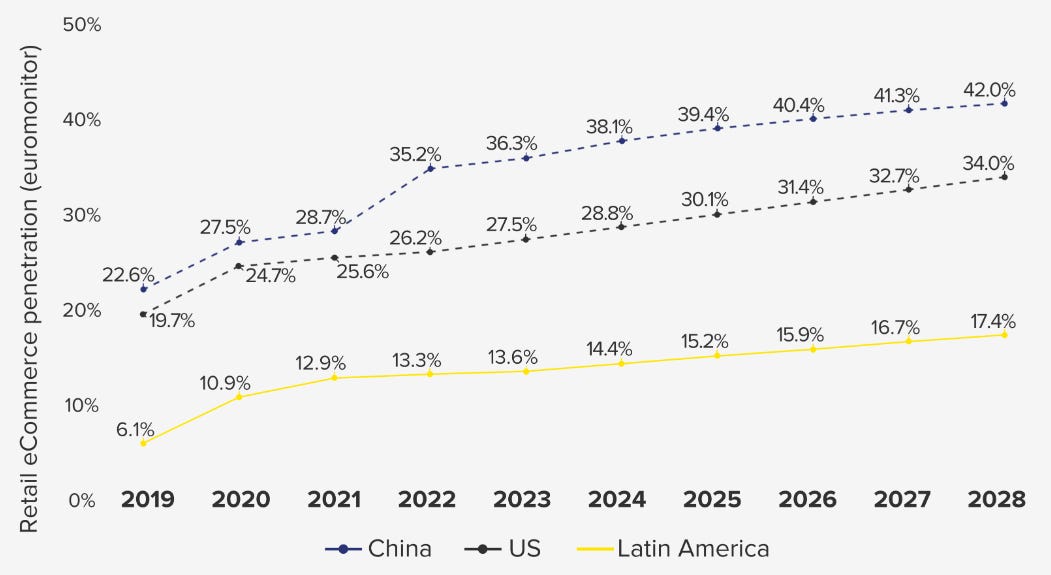

Every country is not that well organized & this impacts e-commerce penetration. It is much harder to send a package to someone who doesn't have a referenced address or without a credit card to pay online. Those constraints are not necessarily true in central cities like Rio or Buenos Aires, but it is when we go to the countryside of those countries or in rural Peru for example.

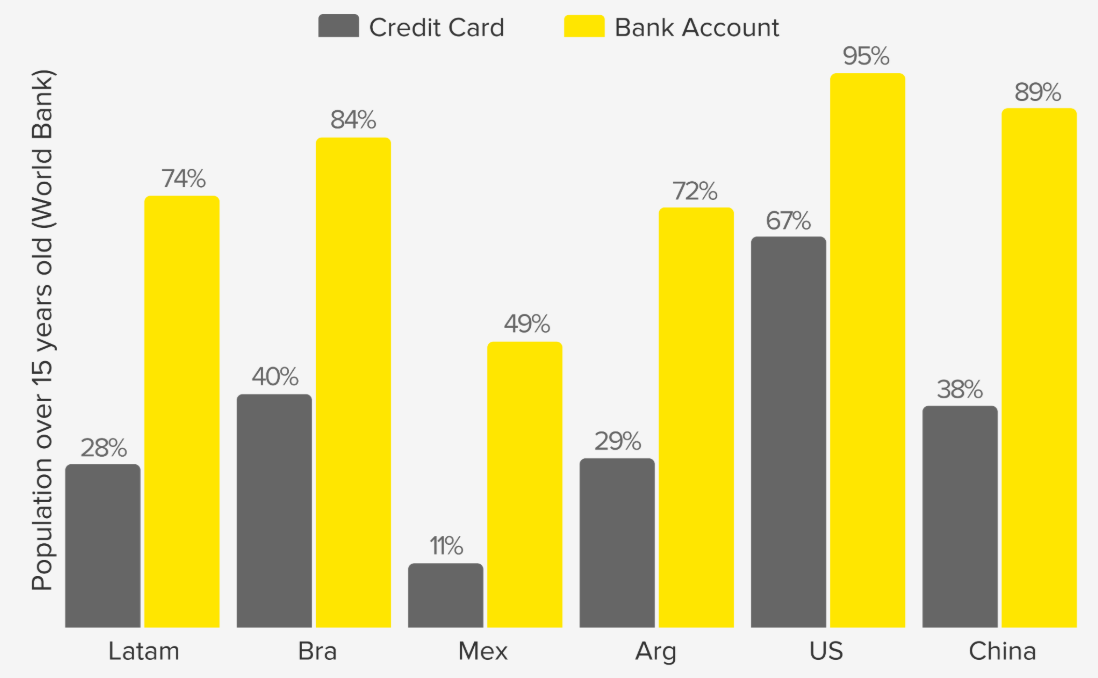

This is also why I started this investment case by a long layus on South America first, because the geography really matters and when it comes to the region, e-commerce integration is simply incomparable to others - due to lower buying power, lack of infrastructure, banking access, etc...

And this highly increases the potential growth for MercadoLibre's e-com as it can come from two verticals: the development & securitization of the region, building better infrastructures, and the population’s purchasing growth which if possible, will turn towards convenience to purchase… Anything.

Growing purchasing power & access to convenience will grow global usage of e-commerce platforms, and MercadoLibre is the biggest one of the region although competition is present - Amazon but also Chinese platforms & some other smaller players. But we'd only need the total pie to grow for MercadoLibre to grow as well, while any market shares growth would be a cherry on top.

A cherry which could happen not because MercadoLibre has a better platform, but because it proposes more useful services for households.

Finance.

I will include both credits & fintech here, and start by something which should be well known but isn't, except for many Bitcoin enthusiasts as Latam has been a very rapid adopter of Bitcoin as both a currency & a store of value.

Why?

Because most of the world's households do not have access to banking services, and that is particularly true in Latam - hence their usage of Bitcoin which doesn't require any approval, certificates or work receipt to open an account.

This is a pretty important subject in the region and MercadoLibre is offering solutions to solve it through fintech services with a clear objective in mind.

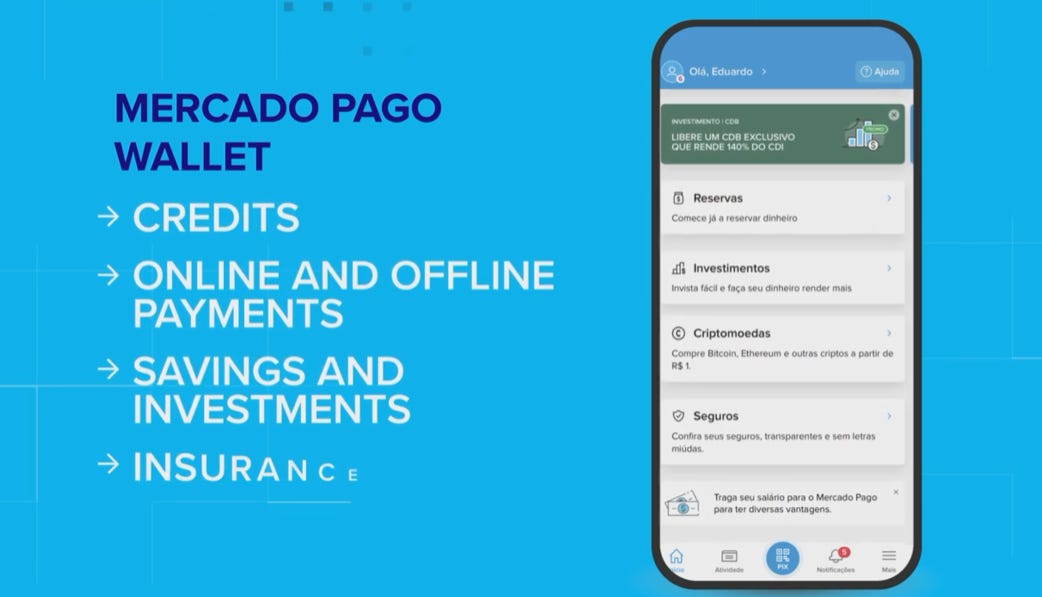

“We want to be the first and default option of many of our ecosystem’s users […] for offline and online payments [...] I is our ambission to become our users’ default financial services provider.”

We could dive onto each & every service but I think we all know the fintech world by now: having all of the important financial services through a simplified app on our smartphone, with seamless integration of dozens of services. And MercadoLibre is not different than the western ones and offer comparable services.

Once again, the company is building an entire ecosystem, not only for consumers as they also propose financial solutions for merchants or any kind of business. You can be a consumer or a merchant of the Marketplace, you will find services you need.

Advertising.

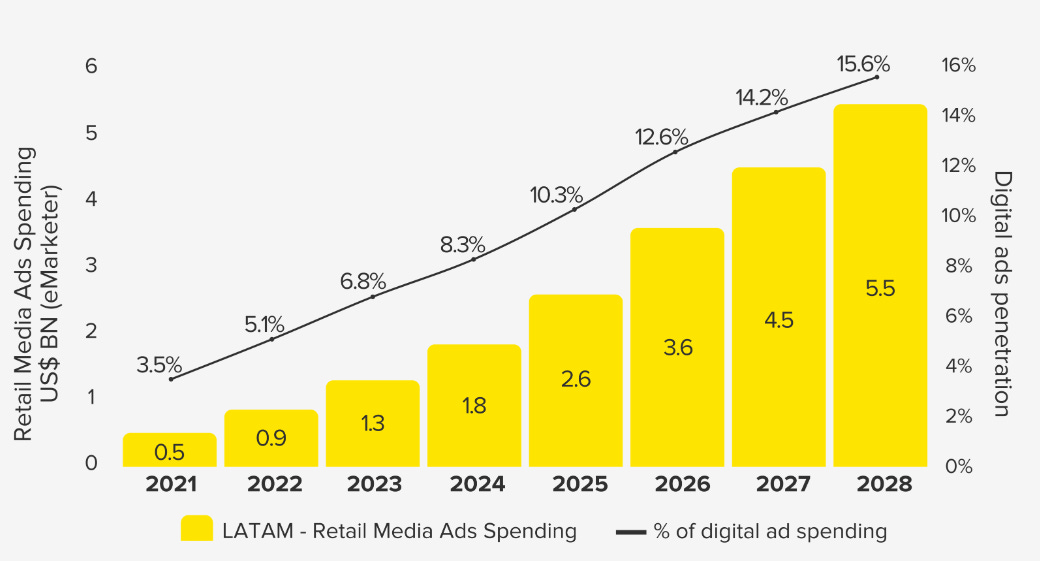

Another pretty classic & somehow logical business when you have an e-com platform, as ads will be shown directly on the interface. Advertising has been the foundation of internet for the last two decades and companies like Google or Meta built their entire business on it, successfully. And demand is not slowing.

No reasons for MercadoLibre, who has a retail app with millions of daily connections, not to leverage those users.

Logistics & Shops.

Lastly, logistics is their in-house packaging & shipping service exactly like Alibaba or Amazon as it is better to control the entire chain when you send millions of packets per month, instead of relying on a third party & pay its margins. We’re talking about storage places, trucks, planes… Everything one needs to deliver in the continent, and the company is doubling down on this branch as they intend to upgrade the service with faster & cheaper deliveries.

Shops was a software allowing merchants to build their own front website but will be discontinued at the end of this year, so I won't talk about it.

Data.

I also need to highlight the data as MercadoLibre proposes financial services & e-com purchases, hence knows everything they need to know about their consumers but also lots about their merchants. Those data will be leveraged to increase efficiency, and should not be underestimated.

MercadoLibre.

To summarize, the company is building an entire ecosystem meant to onboard both households & merchants of the continent & offer them the best experience they can in terms of e-commerce but also tons of financial services, from payment to leases passing by insurances & credit cards, in order to capitalize not only on consumption, but on their entire region's evolution from developing countries to developed ones, and have most households depending on their services when this transition is done.

And it has been working pretty well so far.

Financials.

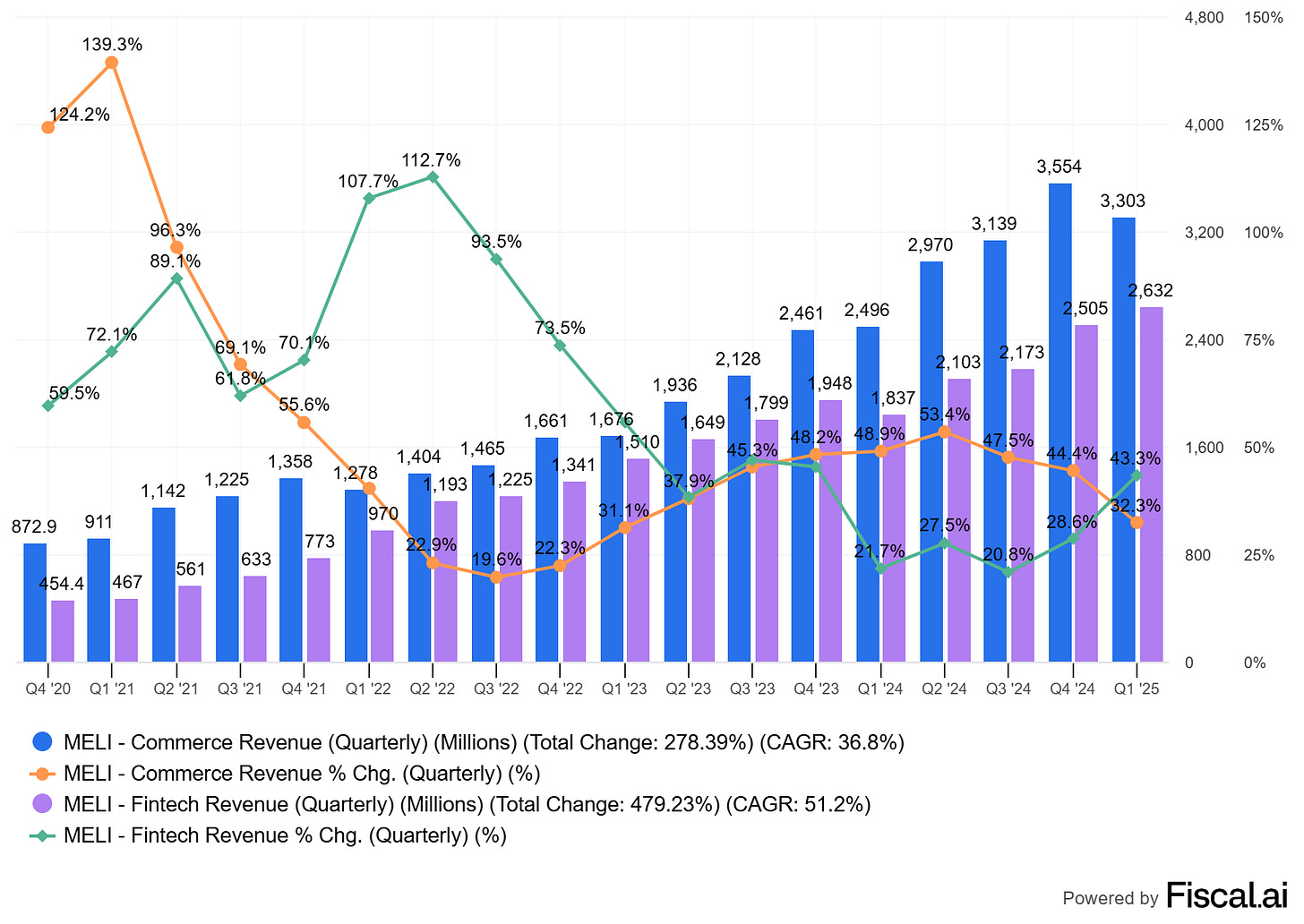

The last decade has seen a growing consumption despites harder conditions and currency devaluations through all of its branches - which shows how big demand really is & highlights the brand's retention & conversion.

There have been a small slowdown in the e-commerce growth those last quarters but fintech services are a mirror with an accelerating growth, highlighting my case above as demand for financing grew with lower interest rates & a weaker dollar - Mercado's credit portfolio grew 40% during the last three quarters.

The investing thesis is somehow already confirmed as once again, MercadoLibre isn't a new company which has to prove itself & fight for market share, it is an already established one which "simply" has to continue on its road.

If the past is any indication, we shouldn't be worried about the future as management has been perfect when it comes to applying their vision.

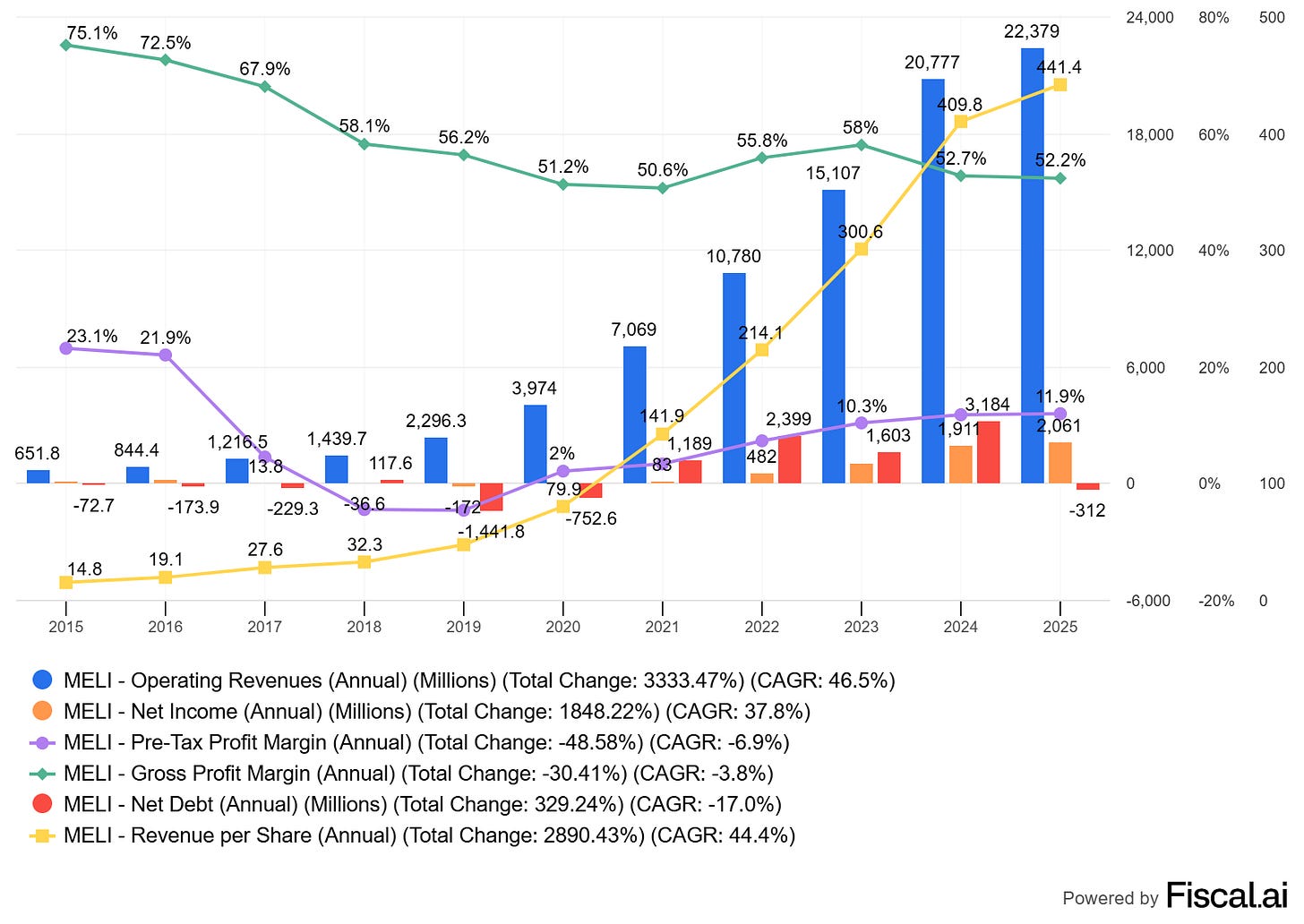

A 46.5% CAGR over the last decade with revenues per share climbing as fast, despite some dilution which stopped after 2020 as the company was reaching profitability with a very healthy balance sheet. They leveraged the markets to invest in their growth & it yielded wonderful results as once again: execution was perfect.

The second half of the decade is a story of expansion with declining gross margins as they grew their financial business and expanding net margins as they also optimized gloablly. To finally reach today's situation: a very stable company generating tons of cash, with a strong balance sheet, strong fundamentals, focused on user & merchants acquisition & retention, and eventually some returned value to shareholders in the future - none for now as the focus was on reinvesting & growing.

In a few words: a stable beast.

Conclusion.

MercadoLibre's business is pretty straightforward as they sure do a lot of things, but we already know how each of them work and the concept of super app. There is nothing really innovative, the value added is in its geography & the fact that the company is already in a position of strength.

It is the leading marketplace & a rapidly growing financial service provider with a strong & accelerating network effect for both merchants & consumers. There are some risks around the business, classic ones like competition as Amazon & some Chinese e-com are present in the region, but MercadoLibre has an advantage over them with its fintech services which bring lots of value for locals.

Most of the success of the company will be determined by the region's evolution & external factors to my opinion. If Latam's countries do well and continue to develop healthily, purchasing power of the region will grow & MercadoLibre will benefit manyfold through all its branches. If not, the company will continue to develop itself & grow but at a slower pace & valuation will be questioned.

As for right now, the company is in a really good position, with a demanded brand & strong cash generation, while the global financial conditions are softening and the entire region could benefit from it.

The traffic lights are green, left to see how things will shape.

My largest holding. Glad that you see the same long term bullish view on the company.