Grab | Investment Thesis

The easterm omnipotent middle man.

This will be the shortest investment thesis I have written, not because Grab does not deserve the words but because its fundamentals & business model are almost identical to a company I already wrote about: Uber.

I won’t go over the business model, risks & opportunities again as they are almost identical for both companies.

Uber actually owns a 14% stake in Grab & has a seat on its board as advisors. But we'll get into all of that.

Fundamentals.

Grab’s main business is equivalent to Uber, but the company is more diversified with more sources of revenue.

Mobility & Delivery.

The majority of the company’s revenue - slightly less than 90%. Like Uber, they offer ride-hailing services, deliveries - food mostly but also convenience, health & beauty, flowers, gifts, pet products, etc. The difference with Uber is its geography as the company is only present in Asia - with the biggest market shares.

This is what gives this company strong potential, as we know Uber’s success story in the west & you guys know I am bullish on Asia at large.

The region has been growing in terms of buying power & continues to do so. When households have more buying power, they tend to spend it on leisure & services which make their life easier, a category in which mobility & deliveries fall, as we learned rapidly in the west.

I do not see why it would be any different in other regions, although we have to keep in mind that other continents mean different cultures, mentalities & habits. Uber-like success is not guaranteed.

FinTech Solutions.

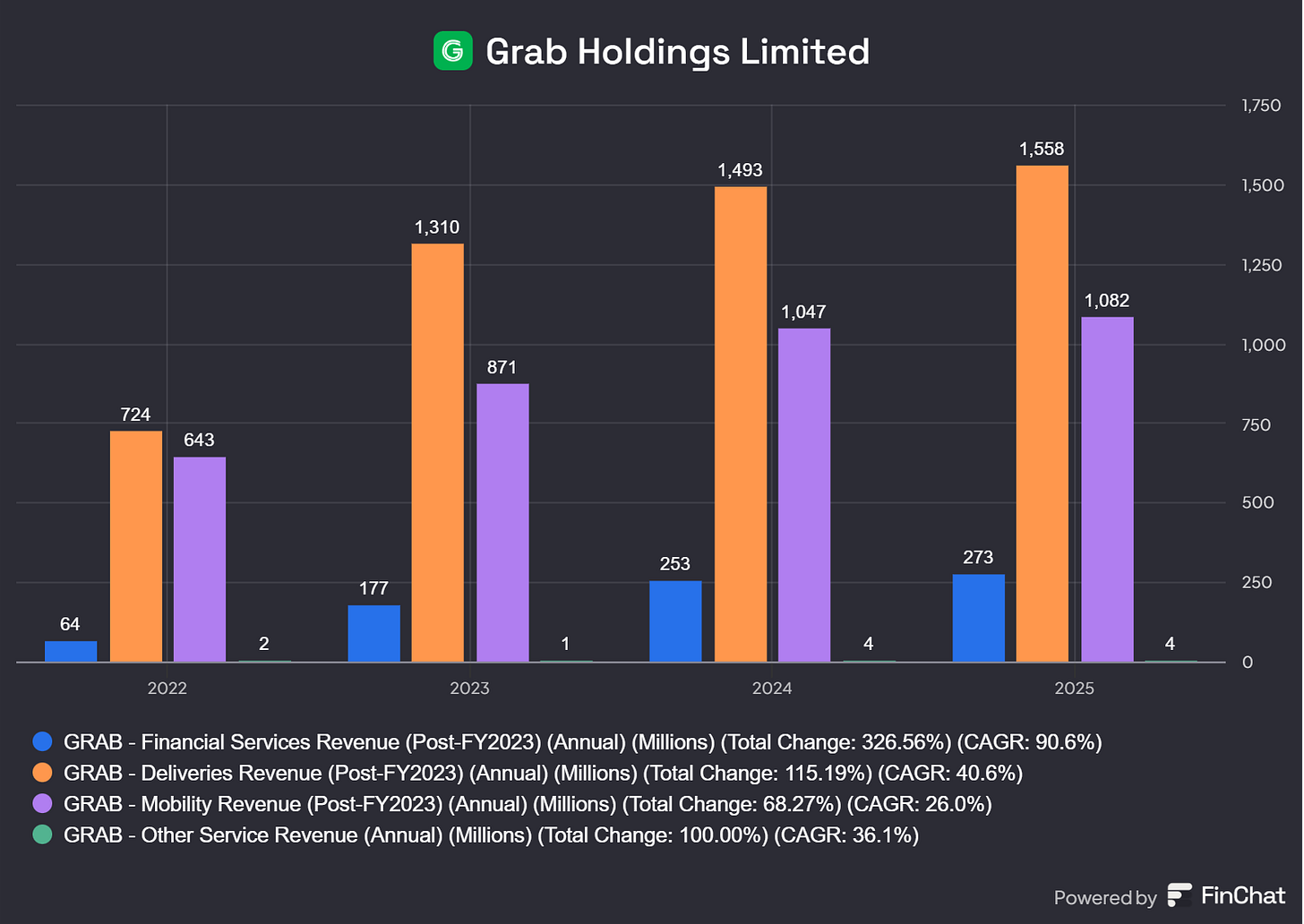

Grab doesn't stop at mobility & deliveries as is the tradition in Asia with their super apps. They did expand to different kinds of financial services which now represent around 13% of total revenues with pretty rapid growth.

Payments.

GrabPay, pretty classic. An online wallet for online & in-store payments - with specific services for some regions like BNPL, bank transfers and of course direct payments on the app. A good expansion as payment is tied to habits & having the possibility to pay for deliveries & mobility directly in-app will build them.

Loans.

Management went further with a wide range of financing solutions - consumer loans, business loans or simple financing for “everyday expenses” like smartphones or durable goods.

Those services are operated by partners & directly available through Grab’s app.

Insurances.

Personal accident policies, motor insurance, loss of income insurance & more. This is not the kind of business I am usually excited about but it remains a small portion of the company & clearly shows Grab’s grand vision.

Grab’s Vision.

Grab starts by offering a simple & convenient service & intends to convert their users to their fintech ones. Once it’s made convenient to pay for your delivery with GrabPay, you might develop the habit of using GrabPay everywhere. Once this habit builds, it is the logical next step to bring your income into the app using their banking services, leverage their partners for a small loan. A bigger loan. And the insurance that goes with them, etc...

I talk about their users, but we also have to talk about the drivers & merchants using their apps as those will be even more likely to contract these kinds of services from Grab, which is their source of revenue, not just their go-to app for deliveries.

They intend to become a super app like many exist in China already.

It is early to say that it is working but we have a correct growth with their financial services revenues while both mobility & delivery are already established & healthy businesses.

They try to hook up users from a convenient service to a lifetime commitment.

Uber’s Implication.

Having Uber on board is important for two major reasons.

First, the implication is that Uber should not try to expand in Asia. They own 14% of Grab and have an advisory seat on their board, they will benefit from their success without the financial & operational struggles of an expansion.

Second, this advisory seat should help Grab succeed in a competitive market. Uber is the best when it comes to mobility & deliveries and knows how to attract, convert & retain their users. Their knowledge & experience is valuable to replicate their success in Asia, despite the cultural difference.

Convertible Notes.

Management raised capital through convertible notes in June 2025, which ended up oversubscribed & raised from $1.25B to $1.5B, with no coupons & convertible in 2030 at $6.55.

The investors who bought those notes accepted to not be paid for the risk taken - no coupons means no yields. They bought in knowing that they will not have returns on their cash if Grab were not to improve fundamentally - hence stock going up.

The most bearish expectation from those investors should be around $11 by 2030, for a 10% yearly return at their notes’ conversion price of $6.55. Anything less would be disapointing as not one invest in those funding rounds without expectations. If not, they would get back their capital without any returns during five long years.

This doesn’t mean Grab will succeed, but it means $1.5B of liquidity bets it will without perfect conditions. This shows convictions.

Competition & GoTo.

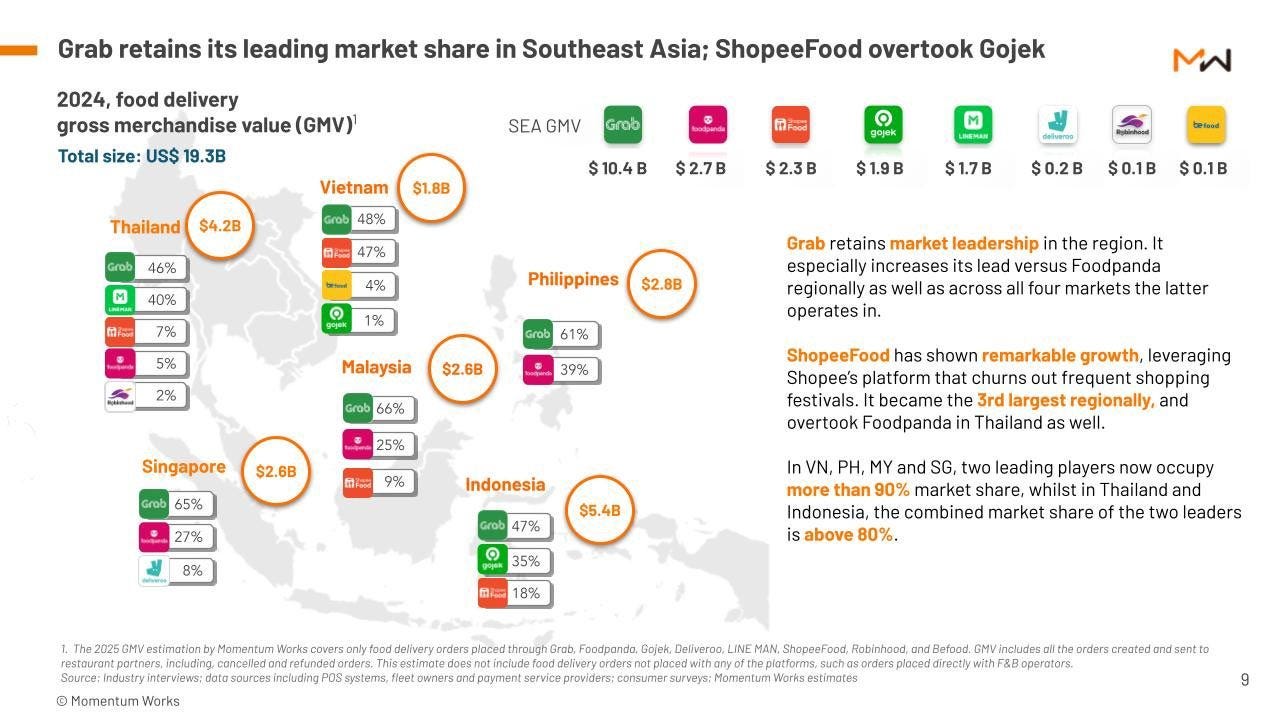

As you see above, there are lots of competition in Asia for deliveries & mobility, with names like FoodPanda, GoTo (GoJek), ShopeeFood, etc, as competitive as in the west. And exactly like here, the most important is the user base.

There also are lots of rumors that Grab would buy one of their very close competitors: GoTo. Those rumors are rarely coming from nowhere & the funds raised in June total to slightly higher than the acquisition amount rumors, around $7B - Grab has around $8.5B of cash now. Management said there were no talks ongoing "at the moment" & that the raised funds would be used to expand the business organically.

Wait & see, but it would be a great move, bringing in a huge user base.

Financials.

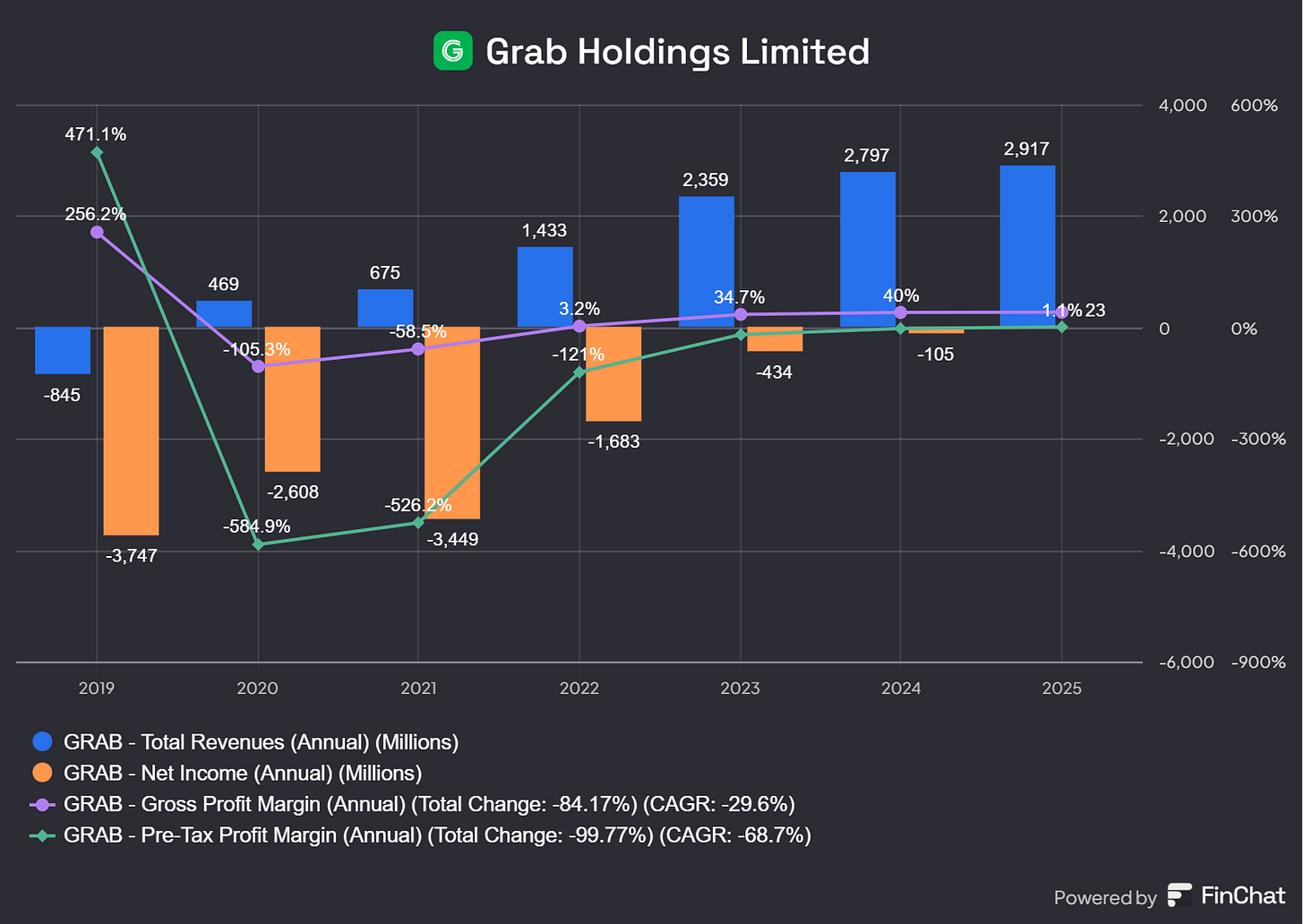

The company is still in its growth & burning cash phase to acquire users & turned profitable a few quarters ago - thanks to its interest on cash as the business itself is still slightly in the red.

It took years to Uber to turn profitable & we know the company is now a real money printer. And I expect Grab to follow Uber’s footstep & playbook.

We should continue to see strong spending & unprofitability - business-wise, over the next quarters as the company spends to attract & retain users. GoTo acquisition would make a hole in the balance sheet but would accomplish that more rapidly.

Financials are less important than fundamental data right now.

Conclusion.

As I said, really short.

Grab’s main business relies around mobility & delivery in Asia, a region which saw & continues to see rapid growth in households’ purchasing power. This portion of their business is growing healthily and management is expanding to financial services - payments, loans, insurance, etc. with the objective of becoming a super app, deeply integrated in their users, merchants & drivers’ life.

It will be important to monitor the core business growth over the next quarters, its market shares & user retention as users remain the heart of the business. We’ll also need to keep an eye on conversion from the convenient business toward their financial services as this remains the company’s end goal.

Grab has the potential to become the Asian Uber for its mobility & delivery services, which wouldn’t be a small achievement and would certainly yield wonderful returns if they were to succeed. But they could go even further with their financial services.

A real fast one though but I still hope you enjoy it! 🙏

Awesome. Was waiting for this one.