China | Investment Thesis

China's situation & goals, My favorite stocks & Detailed plan

I have been talking about China for very long now & have been patient enough, but I believe that everything is finally perfectly set up for a really big rally on their equities. There was no point being too early, but we don’t want to be late neither. It’s time.

Some heads up first. This write-up will be a bit different as I’ll start by talking about China itself, its economy & my bull case on the country/region. I’ll then share some companies I am bullish on, but it won’t be a deep dive as I usually do; it will be a rapid presentation of the company, the business, bull case & plan. I’ll conclude by what I intend to do with the portfolio.

Second, I am not here to talk about politics, ethics, opinion, ideologies... I know some simply hate China for what they represent, others hate Asia at large, others the U.S… I personally don’t care. I have my own opinions, but when it comes to investing & money, I care about performance only.

I live in a world where things are as they are & I have no impact on them directly. So I do not waste my time on speculations or ideologies. My focus is to beat the market & share my ways of doing it, nothing else. If that includes investing in Europe, in the U.S., in China, in the Middle East, or in Latin America, so be it.

I care about performance.

And if you are here, reading these lines, I hope you are too. So let’s focus & put our personal opinions aside, try to avoid our bias & look at things objectively, as an investor who wants to make money.

That being said, let’s dive in.

China.

We’ll need to take a step back first to try & understand what happened in China over the last decades. I won’t go over history & politics but only over why they became so powerful, while sacrificing half a generation for it. It’s important to understand their economical state before doing anything as macro starts bull runs - and end them.

The answer is kinda easy: they accepted to work for peanuts.

Industrialisation.

We’re back in the early 80s. Deng Xiaoping is in power and is working on turning away from the Chinese reclusion after Mao’s iron fist ruling. China is in really bad shape - poor, famished, at the border of collapsing without much to propose to the world or to its own population.

So he decides to take another approach & to open the country to the world, accept to build international relations, to sign treaties, to work with other nations, etc… Turning its back to Mao’s complete communism & integrating some capitalist measures - enough to give freedom to create, build, and reap part of the rewards. Government remained communist, don’t get me wrong.

And their government understood very fast that power came with industries while the world at this time was going through social reforms & growing prices due to expensive labour & co. Western companies wanted cheap labour.

So they turned to China & the latter accepted to become their hands. In exchange for investments, they’d provide cheap & vast labour. Western companies could now build & operate their manufacturing for lower costs hence lowering the price of their final products for consumers.

Many did & continue today to ask, “Why would those guys accept to work for nothing?” But this is a very Western-biased reasoning based on our life quality. We can’t imagine working 12h for a few dollars, but there are countries where this situation is better than everything else. It was the case in China then.

But there was more to it.

They won industries, state-of-the-art factories built from Westerners’ investment. They also learned, trained by Western teams to operate & maintain infrastructures which should have been inaccessible to them in their situation.

They got the manufacturing power without spending one cent - this is oversimplified; they obviously had to pay to grow their infrastructures themselves, etc., but all of it was possible because of Western investments & their acceptance of the situation.

They accepted to pay the price of having their population working heavily for peanuts in exchange for all of this.

And they were rewarded in 2001 when they entered the World Trade Organisation, lowering entrance barriers for many Western companies as they were now entirely integrated into much wider regulatory frameworks.

The scene was staged, and momentum built from there.

Since then, China never stopped growing as more & more capital flooded to the country. Everything got cheaper to manufacture & deflation was exported to the world; the West was had cheap products & companies had bigger margins while China grew in all senses of the term - in knowledge, buying power, capacities, volume…

The country accepted this trade: one generation of very hard labour for future dominance & relevance.

So Chinese worked. They worked inside mines, inside offices and factories built by the West when billions were invested in the country by our companies. China went from poor, “irrelevant” & empty to poor, less irrelevant, filled with factories & jobs. And in time, they were not poor, not empty & certainly not irrelevant anymore.

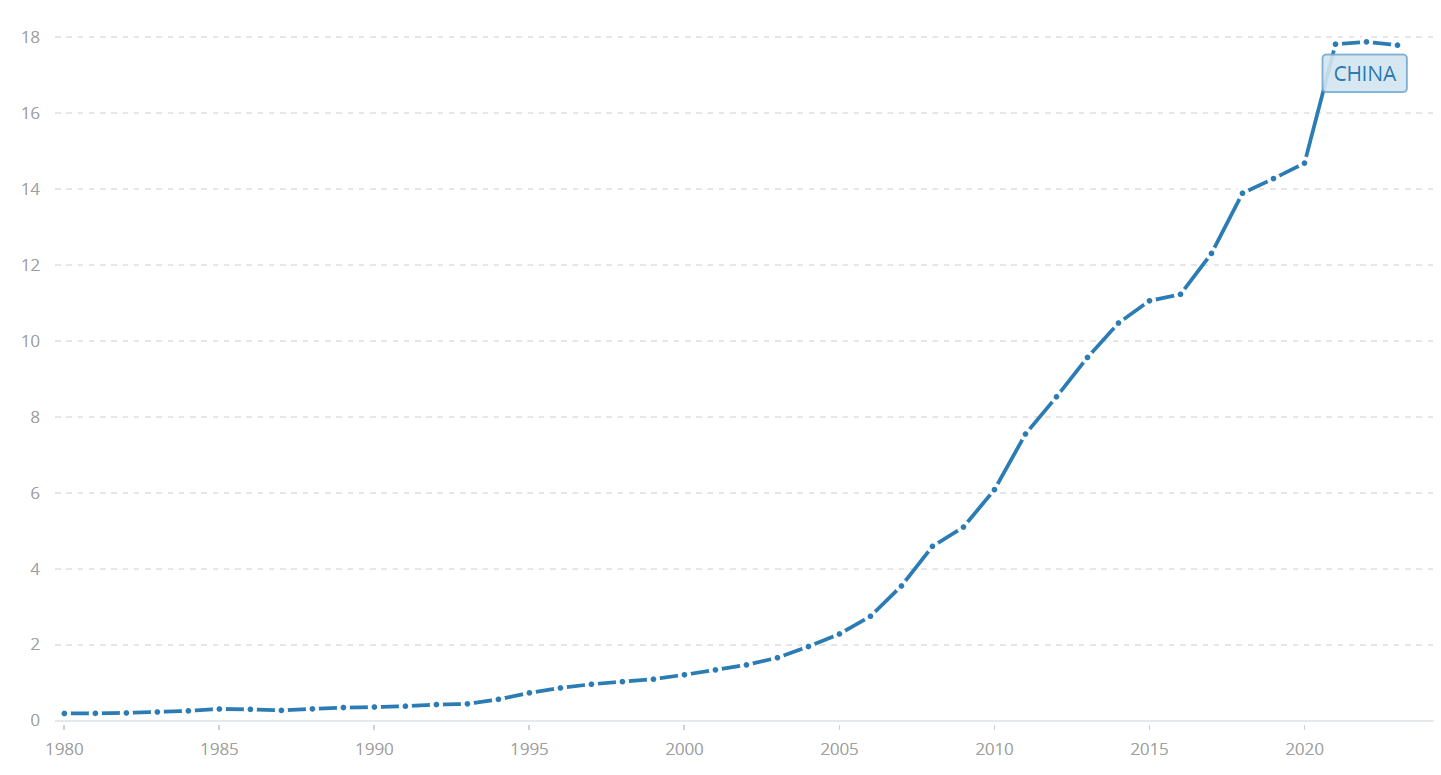

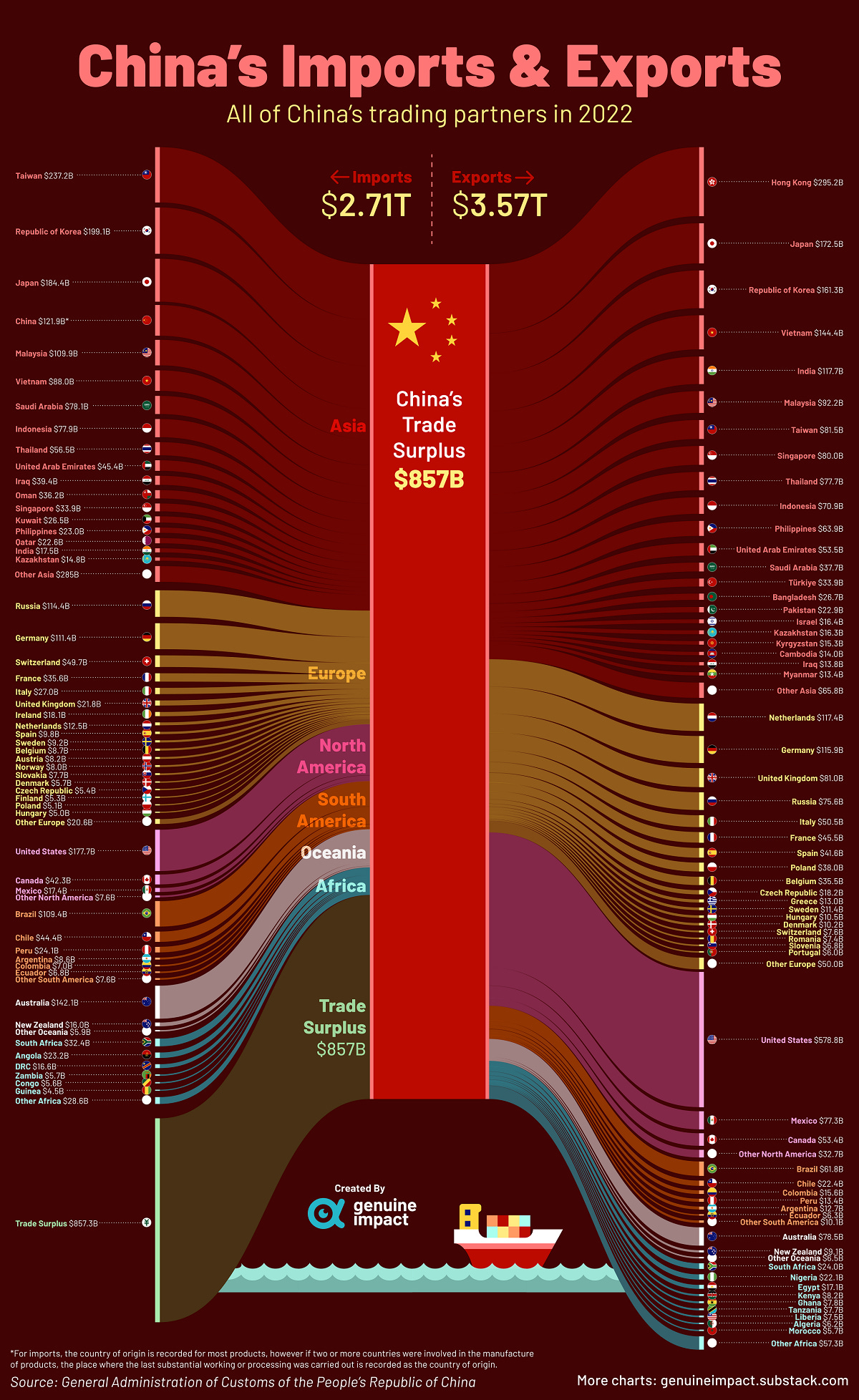

They became the biggest exporter, the biggest trade partner of most countries & the biggest trade partner of Western countries. They did become the manufacturer of the world & built insanely big surpluses by doing so - if you sell more than you buy, you end up having lots of money. And if you’re the biggest seller in the world… Well, lots & lots of money.

From Irrelevant to World Power.

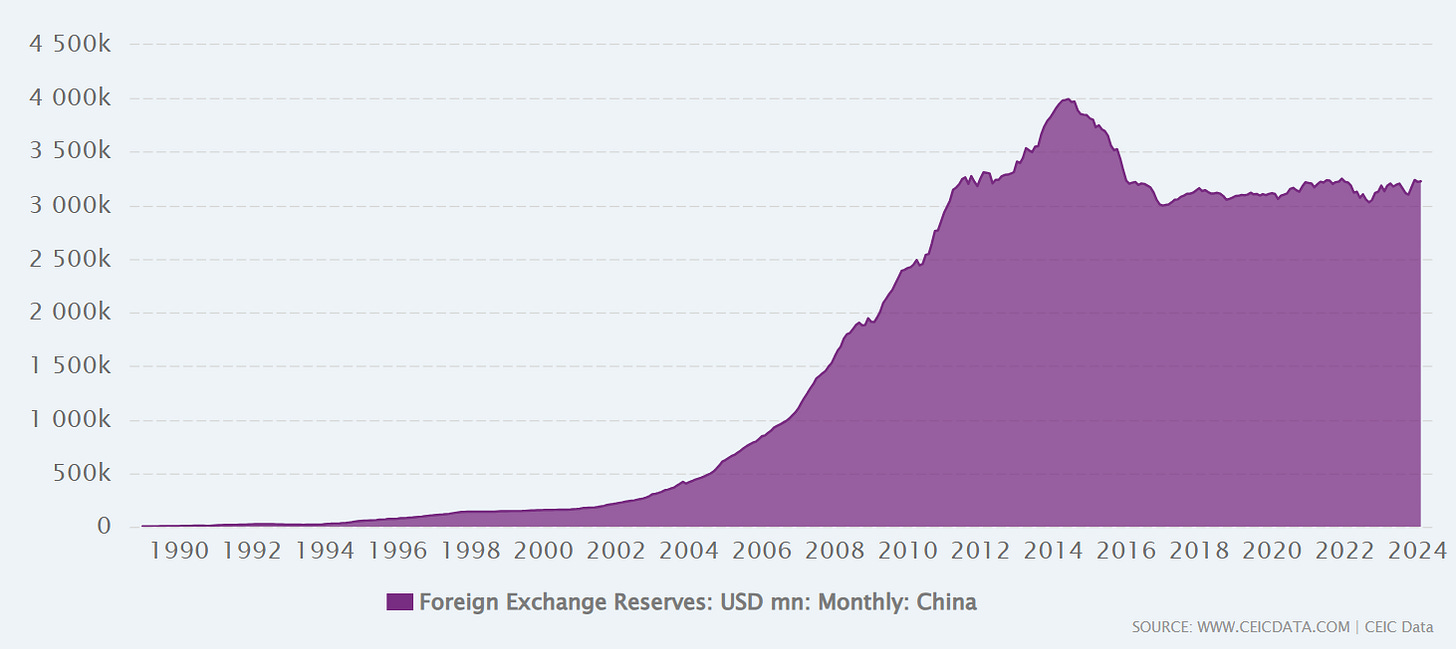

Once again, they were able to get there without investing much themselves; they let Westerners pay for it & “simply” accepted the pain of hard labour for peanuts. This allowed them to become the biggest trading partner, not to import too much, to build massive reserves.

Rinse. Repeat. For decades.

Those were then used to build massive infrastructures, to migrate their population to newly built cities, to grow their harbours & transport systems, etc… In time, Chinese life quality grew really rapidly thanks to those reserves.

Fast forward to the 2010s and China had reserves - RESERVES, meaning cash in their bank account if China was a human being, of $4T or, just so you can have an idea of what we’re talking about: $4,000,000,000,000.

Those reserves are held in various assets, but it is important to say that the biggest part of their reserves is in U.S. Treasuries - historically around 25% of it or so. They also own gold, different currencies, their own bonds, etc…

As you can see, those reserves have been stable the last decades as local investments grew, but the country also grew its military spending, soft power spending, investment spending, etc…

China went from nothing to the world factory in 30 years, they asked their population to suck it up & built an empire from their hardwork to evolve again, passing from the dominant exchange partner of the world to one of the strongest country in the last decade.

I have skipped lots of political mess & decisions here, but I just wanted to express the road to get where they are today & I believe this is a good snapshot of it. China still is the factory of the world but is now working to move away from this.

What Now?

The country is now developed, rich based on many standards, its education system is on point & they have most of the infrastructures they need. You’d think this could be the end, but it isn’t. There’s another step; there’s always another step.

The first one being self-reliance. Today, China remains the #1 exporter in the world & its well-being is tied to what it can provide. Any hiccup in their relations could really hurt them - and the world as well. What I try to share is that they are still relying on other countries, mostly Western consomation. Not good enough.

The second one is to compete with Western countries, not in terms of life quality or balance sheet size or such. But in terms of knowledge, innovation, technology. They want to host the next SpaceX, the next Apple, the next Google. They want to become the creators, the innovators, not the copycats. To be at the forefront of innovation.

Independence. Innovation. Technology.

For that, you need a few things which, ironically, they got “for free.” Guess which? Infrastructures, manufacturing power, knowledge. But you also need some other things that you don’t get for free: inflation, energy, consumer spending, will to innovate, risk-taking.

Let’s review why.

Inflation & Capitalism Lead to Innovation.

We need to ask ourselves the question: Why would someone innovate? Why would a smart guy take on his shoulders the risk of failure & poverty just to build something he believes can be good?

Altruism? Nah, or so very few.

Passion? Sure, but it won’t feed you.

Adaptation? Not wrong, but maybe too late.

Everyone innovates for different reasons, but they all need a few conditions to be true, starting with this one: the assurance that they’d reap the reward. Yes, I am saying that most entrepreneurs wouldn’t have done anything if it meant they wouldn’t have been the biggest benefactors of their success. The risks aren’t worth it otherwise, and history proves this.

This is why most innovation nowadays happens in America & in a very capitalist Europe before that.

Inflation is necessary in the same spirit. Without currency debasement & declining purchasing power, the population would have an incentive to save. Why would I spend my money today if it means I can buy a car next year without growing my working hours? Simply by waiting? Less consumption isn’t what we want.

The mechanism is the same for entrepreneurs. Why would I take risks if I could either way become very, very rich by reducing my consumption & holding onto my money for a few decades? Again, reaping the rewards is an important part of innovation.

And the same for investors, and any innovation needs investments. Why would I take the risk to lend to this crazy guy who is telling me he’s going to bring my great-grandkids to Mars? Who cares, I’d rather save for them.

Inflation tames those reflections because you have incentives to lend your money to entrepreneurs or to consume, because if you don’t, your money will be able to buy you less in a year or two than today. While your girl looks pretty sexy in that dress today, so why wait?

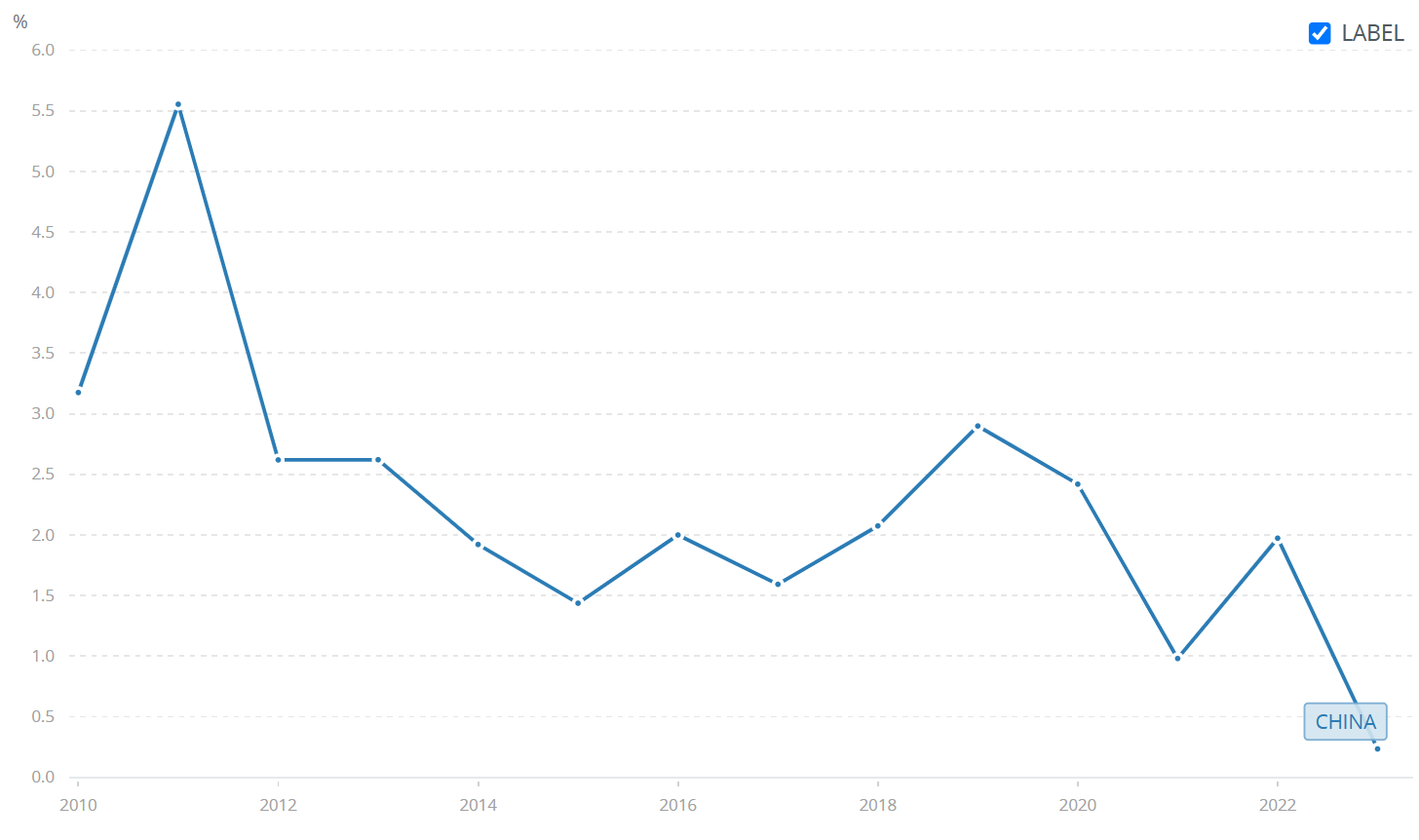

No inflation reduces investments, risk-taking & consumption. So yes, being at the forefront of innovations requires inflation, consumer spending, will to innovate & a risk-taking mindset - things China lacked & continues to lack.

Don’t get me wrong though, innovation can happen in other scenarios. It will simply be boosted in this kind of environment & again, history kinda confirms it.

Actual Situation & Objectives.

So, as you can imagine, China is now trying to create this framework for some years, and it hasn’t worked very well so far… Covid didn’t help, followed by a real estate bubble which popped while the government let Schumpeter work & companies bankrupt - something the U.S. didn’t do in 2008.

Everything is far from perfect, but the country’s objectives are crystal clear. Note that this is my interpretation of the different announces the country did, they never clearly said what I am writting here, but the data & policies they share seem to push that way.

Inflation.

First, reignite inflation for the reasons mentioned above. China has been in decreasing inflation since a decade or more & is even in deflation for some quarters, meaning that things are actually getting cheaper every day.

This is the ultimate anti-consumption scenario. Chinese keep cash because they don’t need to spend it; it grows in value by waiting. The problem is that this isn’t only an economic problem, this is a habit problem.

Older Chinese families were used to keeping cash because of the instability during Mao’s government 50 years ago & this was passed on to their children. They were never used to consuming, and changing habits is really hard, almost impossible.

But this is needed to boost inflation & start the wheel of consumerism & investment habits, a wheel very known in America now. This will require very specific measures from the government, starting with growing the monetary base circulating in China - in other words, distributing money to the population.

Although here comes the habit issue. Giving money to someone who likes to save it won’t create inflation; they need to spend it. That is why I said since last year that the government won’t stimulate like the America. They will slowly inflate the monetary supply & force consumption on very specific branches of the economy through limited-in-time & sector-specific stimulus, for example.

And that is what they announced through the end of 2024 & start of 2025. Tons of small but regular & specific stimulus meant to encourage spending combined with other advantages - reduced mortgage payments, for example.

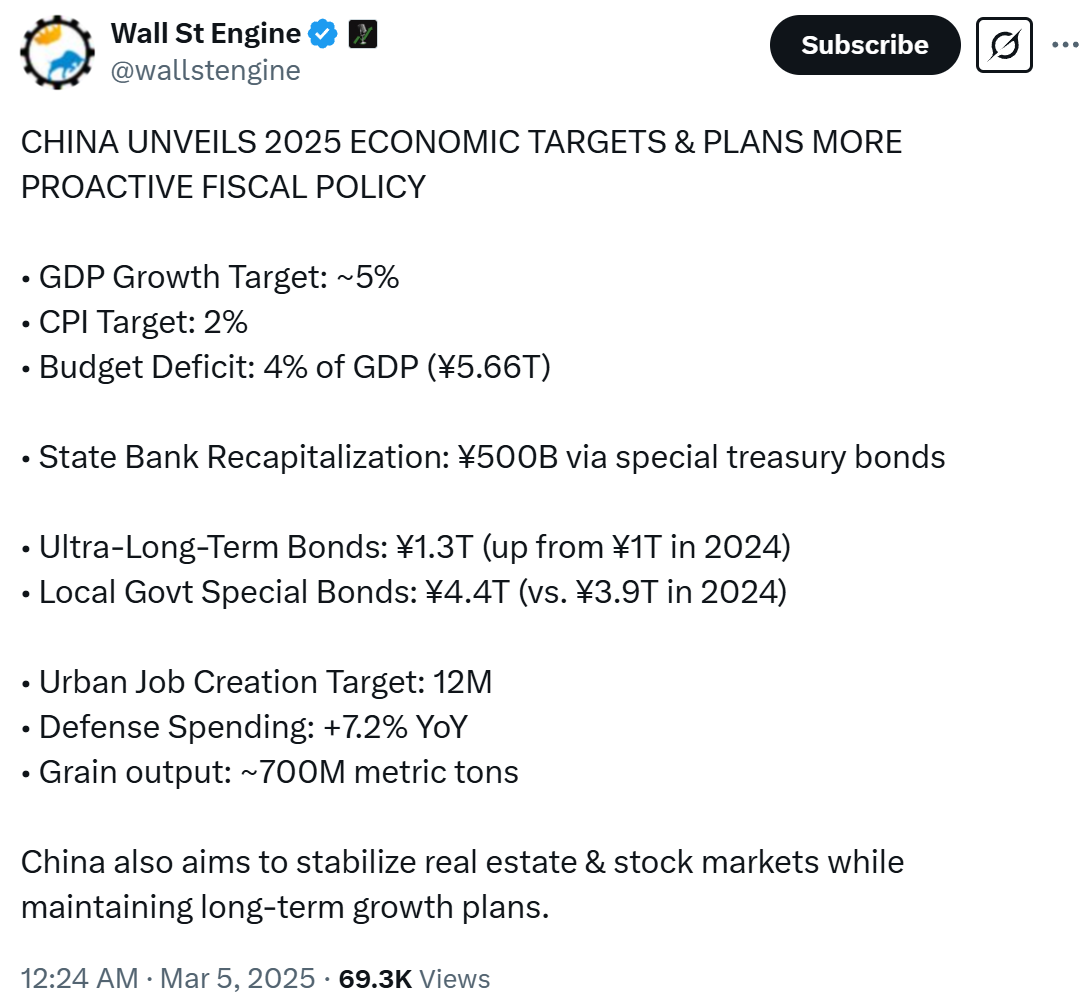

Here is what the country expects to do this year. Strong growth, growing deficit & inflation, liquidity in the banking system, simulation of the labour market…

Everything is meant to, in time, stimulate the economy, free buying power & force consumption.

Investment & Innovation.

On another hand, they are also changing regulations & encouraging investment & entrepreneurship, through easier bank loans for companies but also investment programs, pushing liquidity directly into their stock market.

This is also meant to change behaviour & habits. Once the Chinese stock market starts to yield results, Chinese will also be interested in it & change their perception of saving & consumption.

They are also modifying some of their tax system to favour local investments or tons of things that would incentivize Chinese to keep their liquidity in China instead of investing elsewhere.

Energy.

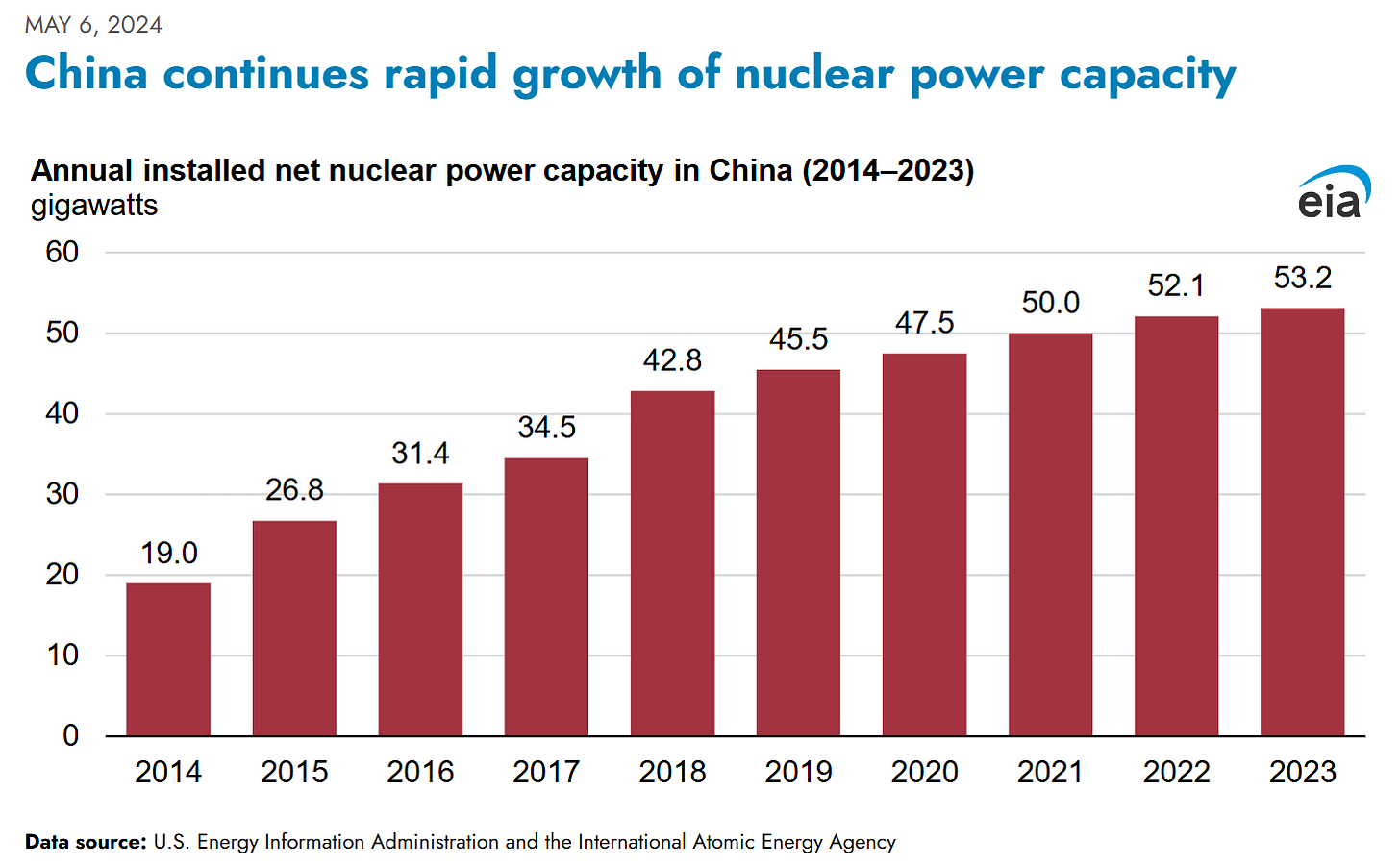

This is the other indispensable asset for growth & innovation. I’ve said it many times in my write-ups, but it’s worth repeating: value is nothing but energy transformed. I’ll keep this section short because China knows it. Hence, this.

China has massively invested in its nuclear power in the world over the last decade, and continuing on its trajectory, it could become the biggest producer during the next one.

The country was at the forefront of many sectors - manufacturing, for decades but lagged in many other, crucial ones to become an innovation hub - technologies, high end engineering & knowledge etc… hence the desire to catch up. Nuclear energy is part of their plan to get there, to catch up.

In Brief.

It’s been long, but I hope this was interesting. I’ve skipped many concepts & pieces of information that I didn’t judge necessary to include in my bull case for China - otherwise, I’d have to write a book. But here’s the most important part.

The country accepted to work hard for two decades to build infrastructure, gather knowledge & establish partnerships. Once this foundation was in place, they became the world’s #1 partner & built massive trade reserves. They used these reserves to catch up by developing infrastructure, real estate, and improving Chinese buying power and quality of life.

This is where we are.

They are now trying to emulate America, to become the new hub of innovation & entrepreneurship - while maintaining a communist state. This requires establishing sustainable inflation and shifting the mindset of their population toward innovation, risk-taking & consumerism.

Bull Case.

I assume the bull case is understood by now.

The Chinese now have very strong local buying power; they simply don’t spend much due to habits. If this mentality were to change, we’d see real growth in consumption, as well as in innovation and investment, since holding onto their cash piles wouldn’t be enough anymore - or better opportunities could arise. Growing buying power, inflation & consumerism: isn’t this the perfect environment for any investor?

Just to be very clear: this isn’t where China is today but this is where they want to be soon enough, and markets are here to anticipate success or failure. I’t only that today, the risk reward is very compelling to bet on China’s success.

This was about the fundamentals. Now, the investments.

The Chinese stock market is significantly undervalued - from every perspective, with companies trading at 1x sales. No one cared about it anymore. The U.S. stock market had the best & biggest companies in the world & was safer, so why go elsewhere?

But things have changed. I’ve shared my view for 2025 & Trump confirms it: we have inflation and a struggling economy in the U.S., something which shouldn’t change when we look at the policies set in motion. Plus high valuations in the stock market. This isn’t the safe environment it was years ago.

So, we have growing buying power, increasing consumption, rising inflation, and very favorable regulations toward investments, paired with highly undervalued assets & a potential liquidity rotation from an expensive U.S. stock market toward a very cheap Chinese stock market.

Risks.

There are obviously risks, and the biggest one is, of course, the Chinese Communist Party (CCP) & its control over… everything, with an iron grip. The government remains communist at its core.

Every risk should be managed based on its probability, though.

Communism.

Again, I’m not concerned with ethics here. The country is communist and does things that aren’t remotely close to our values, but that’s not why I’m here.

That said, it also means the state has the right to look into companies & dictate what they should or shouldn’t do - whether it’s in the company’s best interest or not. This is certainly a problem, but as I mentioned earlier, the government also wants to boost consumption & innovation. So, I doubt they’d act against positive development; their focus would likely be more on political repercussions.

This remains a risk & will always be one. I’ve said that innovation required capitalism and capitalism is based on freedom & a strong rule of law. Things which aren’t necessarily true in China, because of their actual government.

Tariffs & Trade War.

Another big threat, as many consumers of Chinese products are in the West - whether final consumers or buyers of raw materials. Any tariffs will obviously impact revenues and business in China. It’s hard to predict as of today.

One thing is certain: tariffs would need to be extremely high for Chinese products to become uncompetitive, even in the U.S. I asked Grok to provide some examples, and while I’m not sure the data is perfect for each, it gives an idea. Even if we were to really have strong tariffs, the difference would remain significant.

And that’s at current currency prices. Growing tariffs on China would automatically devalue its currency, making its products cheaper than displayed. It’s going to be tough to truly impact China with tariffs.

Secondly, hurting China too much would also hurt the deflation it continues to export, and the U.S. wouldn’t want that right now - it’d be disastrous for the entire West.

Lastly, as mentioned earlier, China is trying to shift its consumption internally. This means we should expect local consumption to grow, as well as consumption in surrounding countries, whose neighbors are also rising in terms of buying power. Tariffs from the U.S. won’t affect that.

Geopolitics & Taiwan.

This is where risks need to be weighed by probability. It has been a major Western narrative that China might militarily invade Taiwan, and that narrative persists, but nothing concrete points to it. I’m not saying it’ll never happen, just that it would have terrifying consequences and I’m not sure China is ready to take that risk anytime soon.

The next question is: then what? What if it happens, or anything similar?

My take is that there’s a possibility assets could be frozen. But we’d need an actual fire - not just smoke, for that to happen. Freezing assets is a last resort for any country, as it shatters trust forever. This is partly why countries are slowly turning away from the dollar since the U.S. froze Russian assets.

Other.

There are many more risks to investing capital in Chinese equities, but the bottom line is that most come from geopolitics. Trade wars can hurt but aren’t the core issue; the real risks come from asset freezes or the CCP meddling with foreign investors. These are what we need to weigh in terms of probability.

China wants foreign investment and wants its stock market to rise because it would fuel demand for gains, innovation, entrepreneurship, and everything we’ve discussed. Achieving this requires foreign liquidity, so I’d be surprised if anything happened to jeopardize it as it would go against their goals to my understanding - but it could happen or my understanding could be entirely wrong.

Chinese Equities.

Back to investing. I hope you enjoyed the read up to this point, but now we need to see where and how we can make money. I’m focusing on two sectors that I find very interesting & once again, most Chinese stocks are significantly undervalued based on most metrics, making them even more attractive & less risky.

Consumer Discretionary. Rising buying power in China and the surrounding regions, combined with a push to boost inflation and consumption, will undoubtedly push revenues for any company selling… anything related to leisure, fashion, wellness, or similar categories as the Chinese start spending their money.

To go a bit further, the Chinese don’t spend only on Chinese companies. They also spend on Western companies selling in China. So, rising consumption in the Middle Kingdom will also benefit companies operating there - think Tesla, Lululemon, On Running, Louis Vuitton, etc. These companies are another way to play the growing consumption in China, and I intend to hold them as well.

& Tech. Any boost to innovation requires advancements in technology. As the world focuses on AI, DeepSeek has proven that China isn’t as far behind in knowledge, as everyone assumed - they’re only lagging in hardware. Restrictions on high-tech equipment remain strict - Nvidia and ASML are prohibited from selling some of their hardware in China. But the need is there, and China will have to focus on cloud computing & AI computing power to fuel innovation.

Secondly, the rivalry, geopolitical tensions, and differences between the U.S. and China will force both countries to avoid relying on each other’s services. Amazon or Microsoft could provide cloud services in China, but the government won’t allow it. This means 100% - or most, of the cloud & computing power demand in China will need to be met by Chinese companies, creating more opportunities for us since it won’t go to the Magnificent 7.

Now, let’s go over my top picks. I’ll detail my plan after. Don’t expect many surprises - I don’t see a reason to diversify into small, obscure companies in China, so I’m sticking with the big players, mostly. I’ve ordered them by priority.

1. Alibaba.

This comes as no surprise, I suppose, and I won’t repeat the entire bull case since I’ve already covered it here.

The best of both worlds: one of the (if not the) biggest e-com platforms in China, paired with rapidly growing cloud and AI services that will undoubtedly become among the largest in the country - already are in term of market shares.

If I had to hold only one Chinese equity, it’d be Alibaba. That said, the stock has certainly enjoyed a great run over the past few weeks.

I wouldn’t rush to enter. We’ll see volatility in these equities. I shared my fair price during the last quarter’s review and still peg it around $130 - where “fair price” is a good entry point, not the fair value of the company.

I’d be a buyer on any volatility spike over the next months, quarters, or maybe even years, depending on how things unfold.

I won’t discuss them separately, but I’ll give a quick word on PDD and JD.com. Both are worth investing in & follow the same bull case as Alibaba - minus the cloud & AI business, which is why I prefer Alibaba. That said, PDD is probably a stronger pure e-commerce play so it’s a matter of preference, while JD is growing really fast. They’re all worth liquidity to my opinion.

2. Anta Sport.

Home to brands like Anta, Fila, and Kolon. If I were to compare Anta Sports to a Western company, it’d be Nike or Adidas in terms of business model.

I’m interested in Anta for a few reasons. First, its business aligns perfectly with what we’re looking for - growing consumption means growing demand for these kinds of products.

Second, most of its revenue comes from China or nearby regions. Involvement with the West is minimal, with around 30% of revenues come from outside the country & the company has a significant presence in South Asia, meaning unnafected from potential tariffs or other Western disruptions while benefiting from the rising buying power of China’s neighbors.

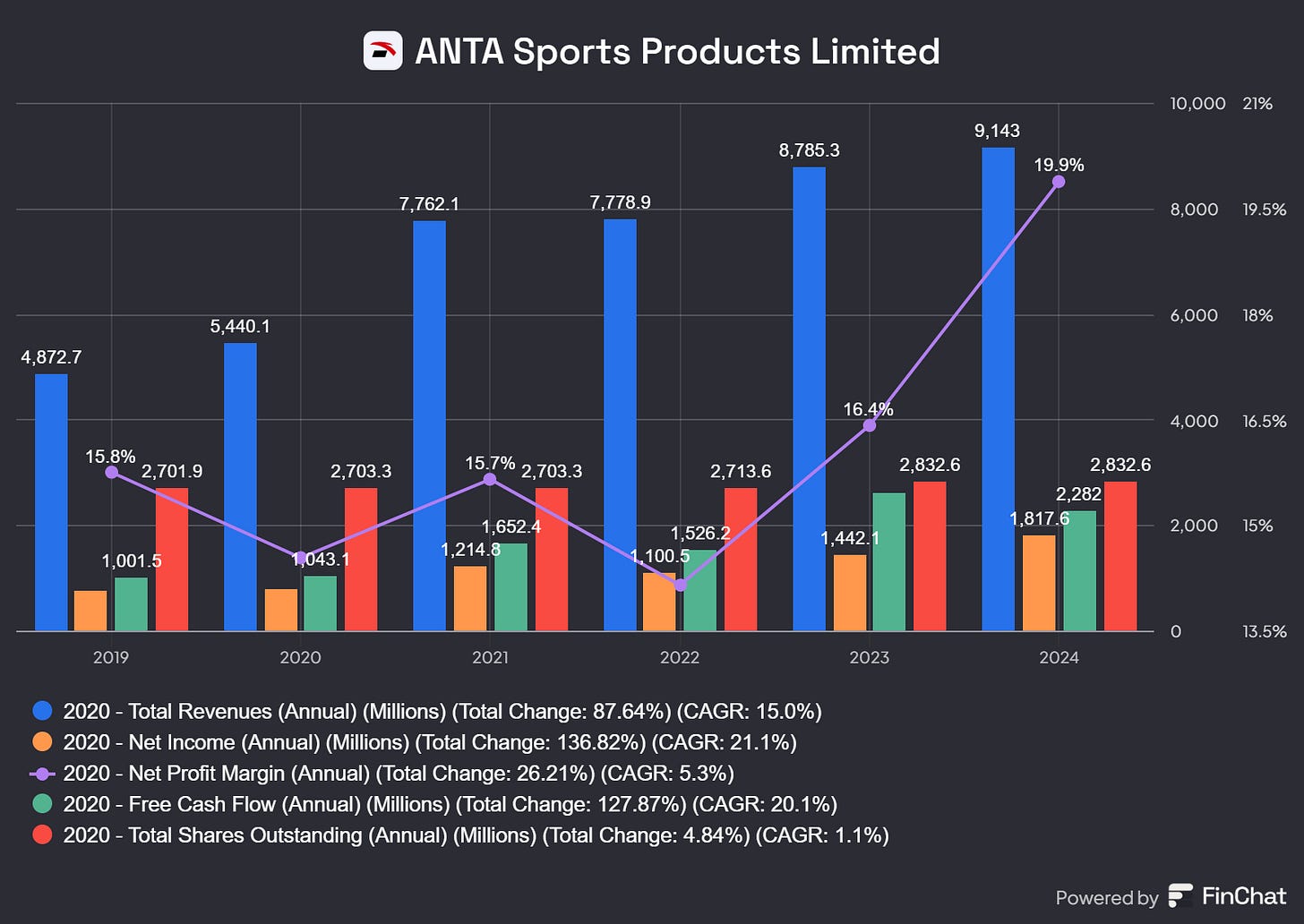

Third, the numbers.

What’s not to like? Revenue has grown at a 15% CAGR over the past five years, with growth accelerating recently. Net margins expanded due to investment gains in the past two quarters that aren’t core to the business, but otherwise, they’d hold steady around 15–16%. Growing revenues & stable margins mean growing cash generation.

Speaking of cash, the company sits on RMB 8.43 billion while generating RMB 18.4B FCF last year. The stock offers a 2.7% dividend yield at today’s price & the company announced a share buyback program aiming to repurchase 10% of its outstanding shares this year - pretty strong.

In terms of valuation, the stock trades at 19x earnings and 3.6x sales, near its 10-year lows. By comparison, Nike trades at 24x earnings and 2.3x sales with declining revenues YoY.

This suggests Nike & Anta have roughly equal valuations right now while Anta is growing double-digit, paying a 2.7% dividend & planning to buy back 10% of its shares thanks to its substantial cash pile & cash generation.

I wouldn’t call Anta undervalued, but we’re certainly at an interesting buying price - especially if you buy into my China bull case and the potential flow of liquidity into Chinese equities.

Price action is positive, but nothing major has started yet. We’re still in a long range - an accumulation zone post-COVID dump.

I’ll remain patient here with two scenarios: either the Chinese mania cools a bit, we see a pullback in their equities, and this name retests its EMAs in the middle of its range, allowing us to start accumulating; or the name wakes up, and we can buy the retest around today’s price if it happens.

What matters is being aware of the opportunity and having a plan - not rushing to buy.

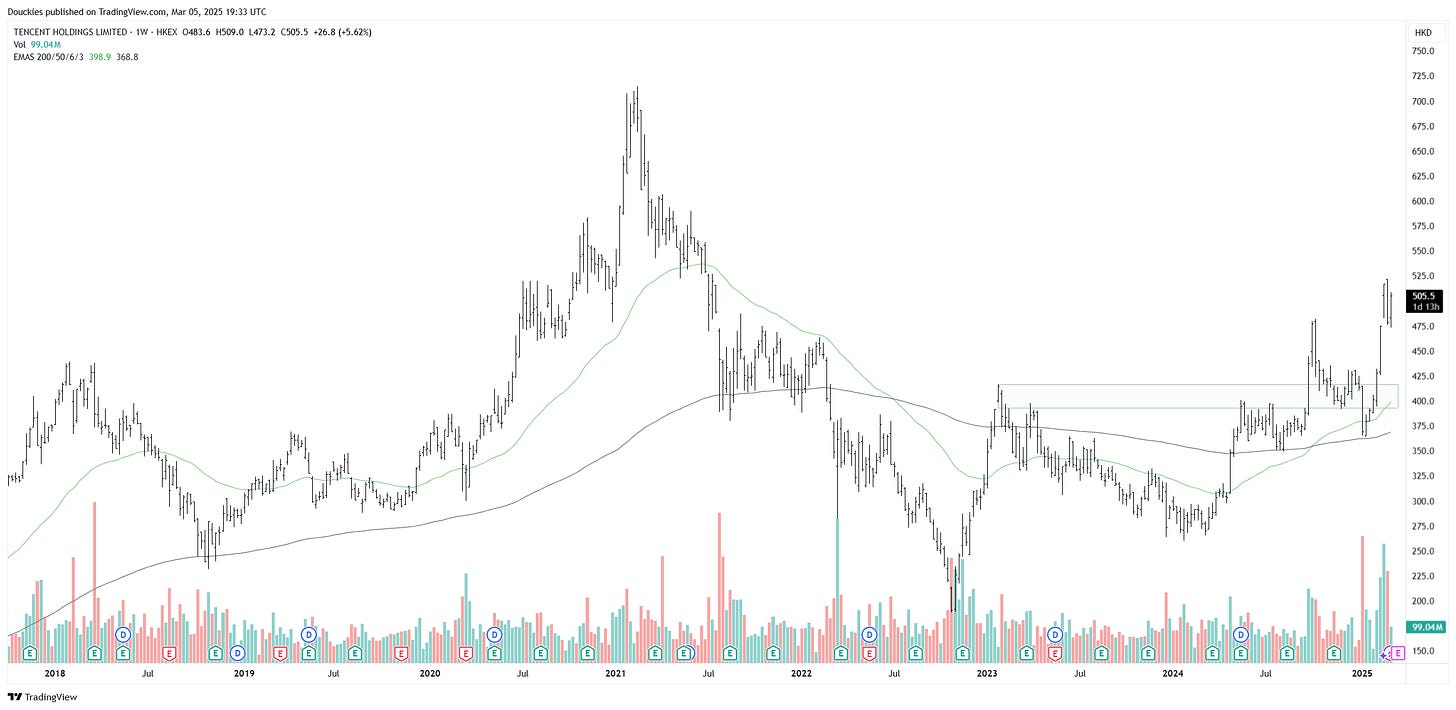

3. Tencent.

Once again, no surprises. There’s no point in overcomplicating things or trying to be original when simple ideas work. In today’s market, we can just focus on what worked in the U.S. Tencent Holdings is a holding company, so by definition, it owns many businesses.

Most of its revenue comes from its social platform, WeChat, with its 1.36B monthly users. It’s the most-used app in China and offers… everything: messaging, social networking, payments, e-com, gaming, services - you name it. We can compare this part of their business to a Meta on steroids, as they offer far more than just a social media platform.

Second, there’s its stakes in various video game studios, including Riot Games, 40% of Epic Games, and shares in Supercell, Activision Blizzard, and more. This means a cut of all in-app purchases.

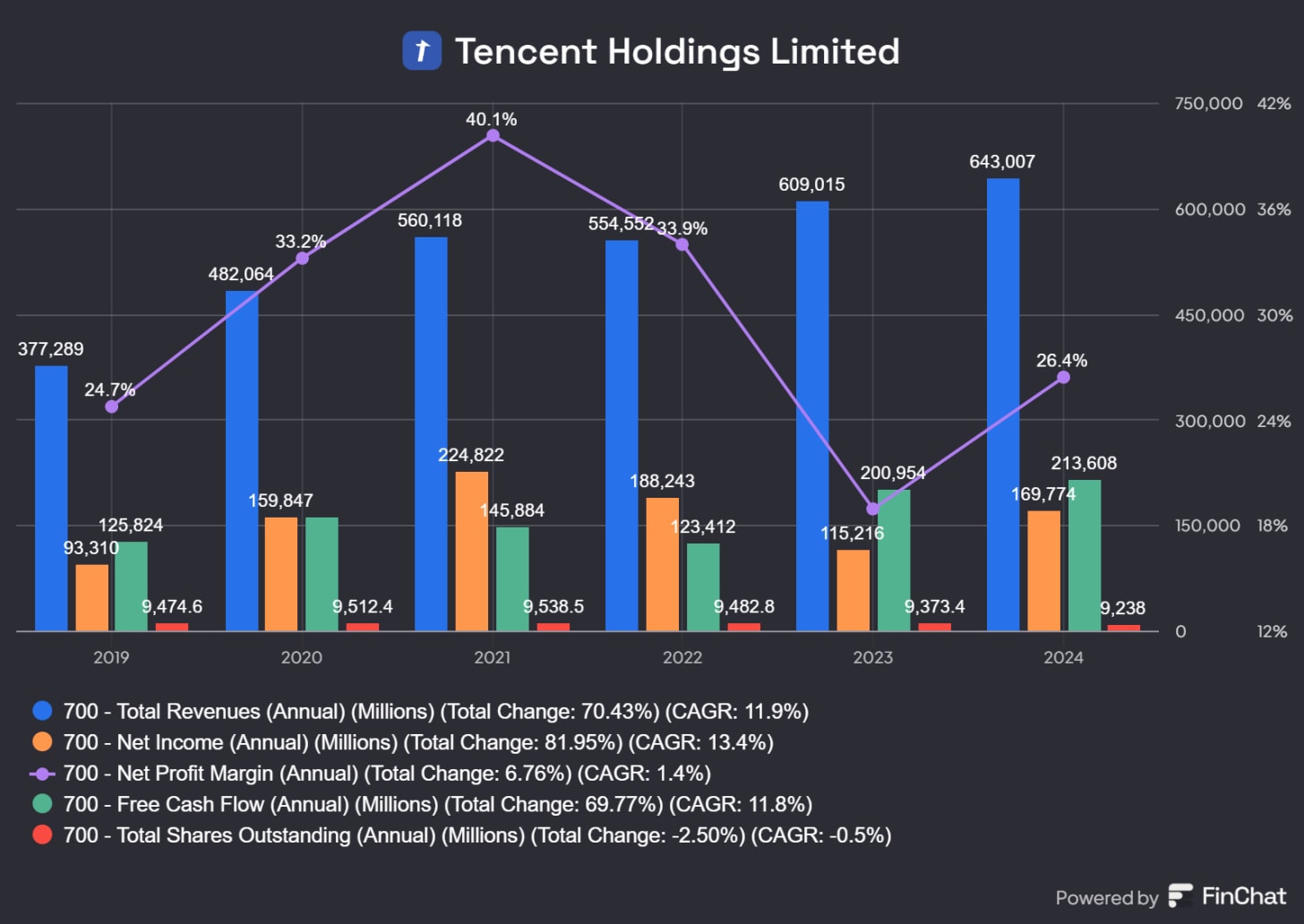

Third, Tencent is a major player in the cloud/AI business, ranking #2 in market share behind - you guessed it, Alibaba. Numbers suggest Alibaba holds 40% of the market and Tencent 20%, making it a contender.

The holding owns many more businesses, but these are the biggest and most interesting. This all adds up to a very healthy company.

A rapidly growing business with consistent double-digit growth, profitability, and tons of cash generation. Net margins fluctuate a lot because the company’s businesses are diverse, and their share of total revenue has shifted in recent years due to COVID, regulatory changes, and investments in AI & cloud infras.

Tencent isn’t big on returning capital to shareholders. It offers dividends (0.7% yield) and modest buybacks but prefers to reinvest its cash into operations.

We can’t call it undervalued, but I’d say it’s around fair value. It has the potential to trade at higher multiples - currently at 27x earnings & 7x sales, which isn’t cheap, comparable to Meta for example.

A beautiful giant trading near fair value that could offer good opportunities if it pulls back a bit.

Retesting the $450-ish region would lower its multiples, shifting it from fairly valued to a buy with enough margin of safety.

Those are my top 3, but I have a few bonus I keep my eyes on.

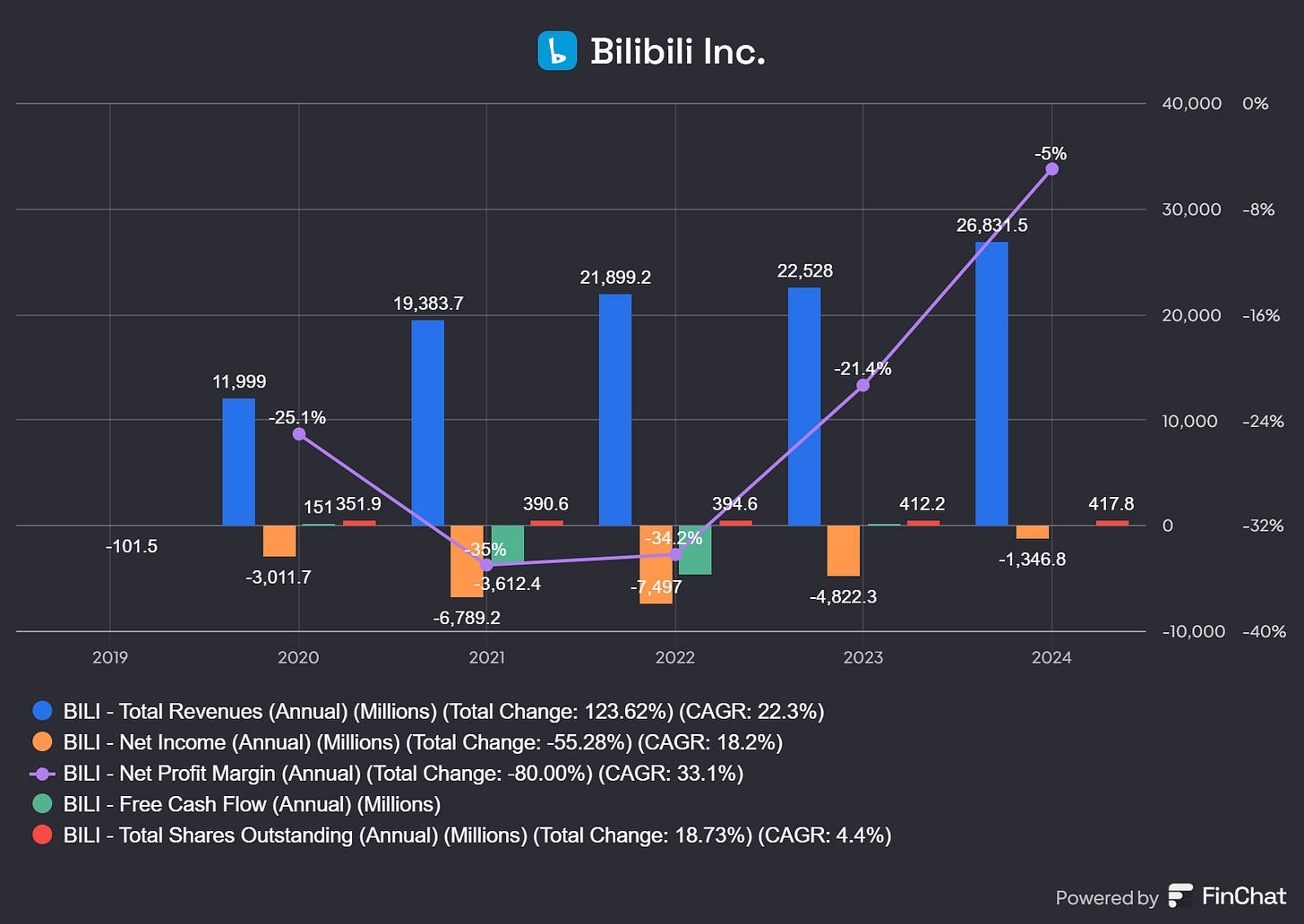

Bilibili.

Another online social network platform, though Bilibili is much more focused on video games & streaming than social media in the Meta sense of the term.

Like many Chinese apps, Bilibili aims to be the “everything place” for its roughly 330M users, monetizing them through advertising, subscriptions, in-game purchases, and more. The bull case mirrors other names here: growing consumption means growing in-app buys & advertising, etc.

I’m not sure it diversifies much from other Chinese apps, but it has a growing engagement & very attractive revenue growth.

Over 22% CAGR & almost profitable - though this year’s numbers were boosted by revenue outside its core operations. This is a volatile, aggressive play, but it could yield stellar returns if the bull run extends beyond large caps into growth companies.

The stock trades at 2.5x sales, which is low considering its growth & near-profitability. It’s been ranging for a while in what looks like an accumulation phase, with a clear bottom and several higher lows over recent months.

Certainly is a name to keep eyes on.

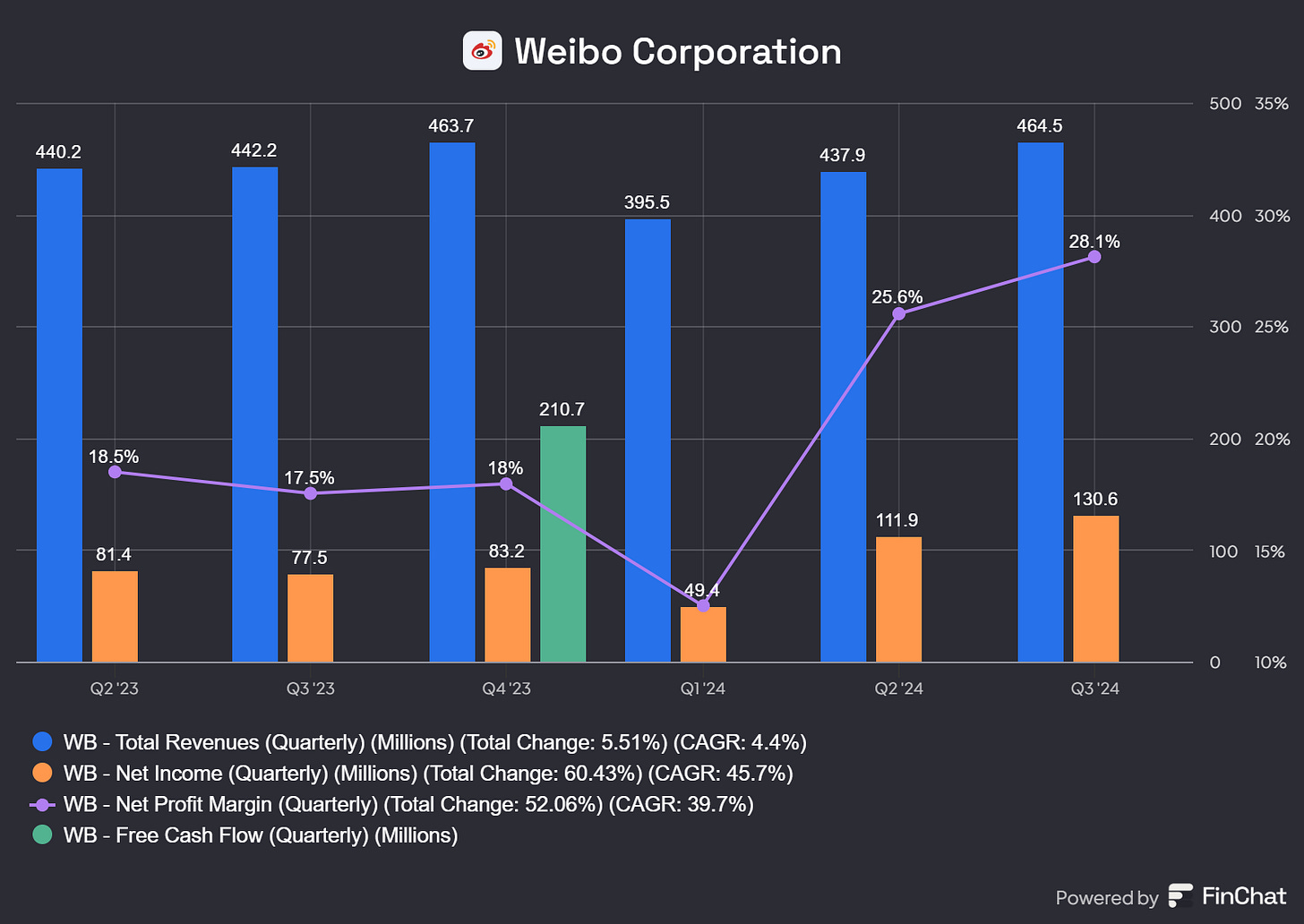

Weibo.

Another name to watch in the same sector. A microblogging platform, similar to X, it generates revenue from advertising & subscription - a recurring theme in China. Its financials are much less compelling but the last three quarters have shown a rapid uptick in subscriptions, bringing growth back to the name.

The advertising side of its business has been flat for a while, but this uptick is worth monitoring. If this trend continues, we’re talking about a company trading at 7x earnings and 1.5x sales - basically nothing.

That doesn’t matter without growth, so we need to track the trend & see if it holds. If it does, there’s plenty of room for returns. It’s still trading in a broad range, so there’s no rush. In this case, I’ll wait for fundamental confirmation, even if it means buying higher.

Better to buy with high confidence than try the devil.

My Plan.

It’s getting long, so I’ll sum it up quickly.

Shares.

I am very bullish on China, as shared, but at the moment I don’t see the point of over diversifying on complex companies without any real vision on how much they are used or their products demanded.

Truth is, China & Chinese companies remain very opaque & this is a risk, the rumor that they have three books, one for the government, one for the public & the real one is very probably true so it is hard to entirely trust their numbers - although regulation on Hong Kong & U.S. markets should help with that trust issue.

Nevertheless, I shared many companies here & went for a simpler plan after realising something: The main ones are present in a small ETF, easily accessible from Europe & the U.S. The KraneShares CSI China Internet.

This gives me exposure to my #1 & #3 while adding to the mix PDD, Meituan, Bilibili & JD.com which are great, growing & undervalued companies. The ETF is focused on e-com & tech, which is perfect for what I want & throws some small names I do not perfectly know in small proportion.

This will reduce the volatility & potential gains as it dilutes the core holdings but it also dilutes the risks. For someone who believes the market is mostly undervalued, it’s better to have some smaller capitalisation focused on the sector you want thrown in the mix than not. China isn’t yet in a very specific stock picking territory, have a large exposure to it seems a good idea for now to me.

The only company I would be interested in but not present here is Anta Sports, which I intend to buy depending on price actions as I shared on its section. This one will be stock picked individually and I know already where I’ll get the liquidity from. It’s just a matter of patience & some more confirmations from the market.

This is step one. I bought already as shared yesterday & I will buy more on any potential retest or volatility spike.

Option.

The second step is to be much more aggressive on individual companies. I have not defined which yet but I intend to buy long term option calls on a few names, with my eyes set on Anta Sports & Bilibili for now. I already own calls on Alibaba bought months ago & expiring on 2026, and I will do the same kind of move for those.

I will share this when I have finally made a decision, but this will be much more speculative & as usual, high risks high rewards so controlled allocation.

Conclusion.

This is it for this China investment case. Tons of information, long write up but I hope interesting write up. I really believe China is simply waking up & the data tends to confirm this, while the government is actively trying to boost consumption.

If they were to succeed & companies were to grow more rapidly, with a struggling U.S. economy & an expensive stock market, liquidity would easily flow over sea to a cheap environment. That leaves us with ethics & risk concerns as to how geopolitics will go etc, but those are things we can’t control besides allocating our capital properly.

China will not become the biggest part of mine, I will try to keep my U.S. + Gold & Bitcoin above my Chinese allocation & will try to remain reasonable. But there is an opportunity to catch right now, so I’m trying to catch it & will catch it big if we have more, stronger confirmations.

I will obviously change my opinion if signs point towards something different. But for now, we had bullish signs & some first confirmations. Performance comes if you go big at the right time at the right place.

Homeworks are done, it’s time to press the buttons for me.

Thanks for the write-up, will keep an 👀 on the companies mentioned

What a great weekend read! Thanks for bringing up Anta - didn’t know they own partial stakes in Salomon, Arc’teryx, Wilson etc. Guess they went shopping when buying overseas assets were encouraged by the government.