Uber | Investment Thesis

The omnipotent middle man.

I have been following Uber for long but have never really wanted to be involved with it, I thought they would struggle to reach profitability & start the cash machine, while the business could easily be replicated. I had equivalent arguments for both Netflix & Spotify, and they proved me dead wrong because I missed one crucial detail: network effects can be very, very powerful.

The Business.

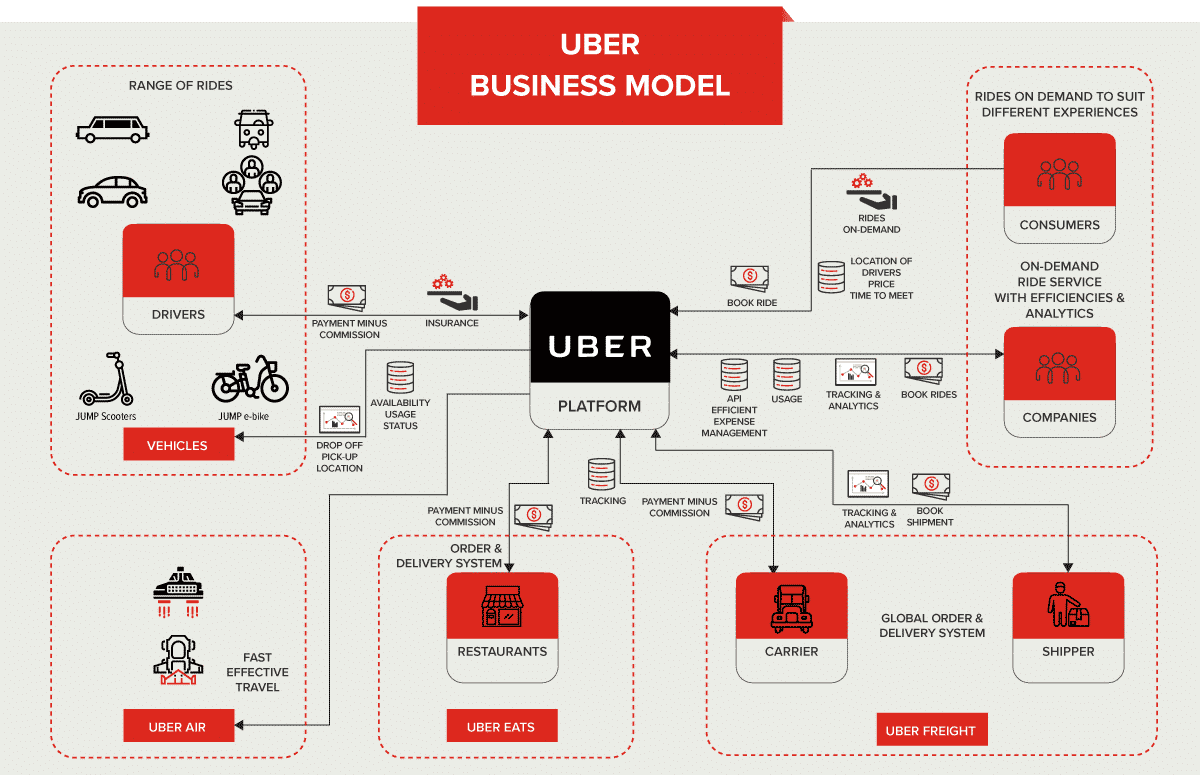

I guess everyone knows Uber; the company specialized itself in transportation, playing the middle man between drivers & travelers so that the latter can use the former to reach its destination, for a fee, of course. This remains their biggest business today, but they expanded their services through the years.

Towards food delivery first, leveraging their user & driver base, proposing the first to have any food they wanted delivered to their doorstep. This service was set up as a triple win. Restaurants who didn’t do deliveries now could, without added costs. Consumers who couldn’t have their food from home now could, and Uber keeps playing the middle man.

Their network effect did the rest, strongly incentivizing restaurants to be part of the app if they wanted to grow their business while users had to use Uber because that was - and still is - where the more choices can be found.

And they kept proposing more. Different vehicles in self-service in big cities, premium plans and subscriptions for frequent users so they can either have better service or reductions in exchange for their subscriptions, a larger freight service for different types of clients, different kinds of rides, etc.

The company grew, the service grew, the user base kept growing & the network effect strengthened. Today, Uber is the ultimate middle man for anyone who wants to move or eat without using its own vehicles.

And as any middle man, they take a fee on anything which passes through their app while transacting the money from the demander to the supplier of the service.

There’s not much more to Uber. Simple & beautiful, everyone wins. The business is divided into three branches: Mobility, Delivery, and Freight, and is now present in 70 countries and 10,000 cities.

The Key Metrics.

Uber works thanks to its network effect which grew rapidly thanks to its first-mover advantage. Or the first rapidly scaling company proposing those services as they weren’t the first one but became the biggest ones.

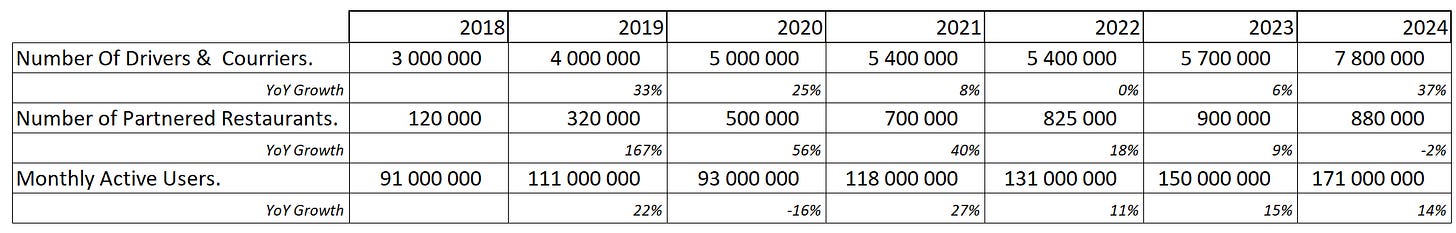

As for any network effect, we need to be sure it keeps growing it isn’t fading. This is shown through spending volume, user volume & service providers - drivers and restaurants in this case.

As you can see, the trends have been pretty positive - the data isn’t perfect as these aren’t constantly reported by Uber. What matters is the trend; we need to see Uber grow in terms of users and partners to confirm the network effect is healthy.

Now for the financials. As said, Uber is a middle man taking a fee for the service it delivers. Its revenues scale on the volume transacting through its platform & its take rate, keeping in mind that these services work as long as they are cheap, so growth has to come from volume mostly.

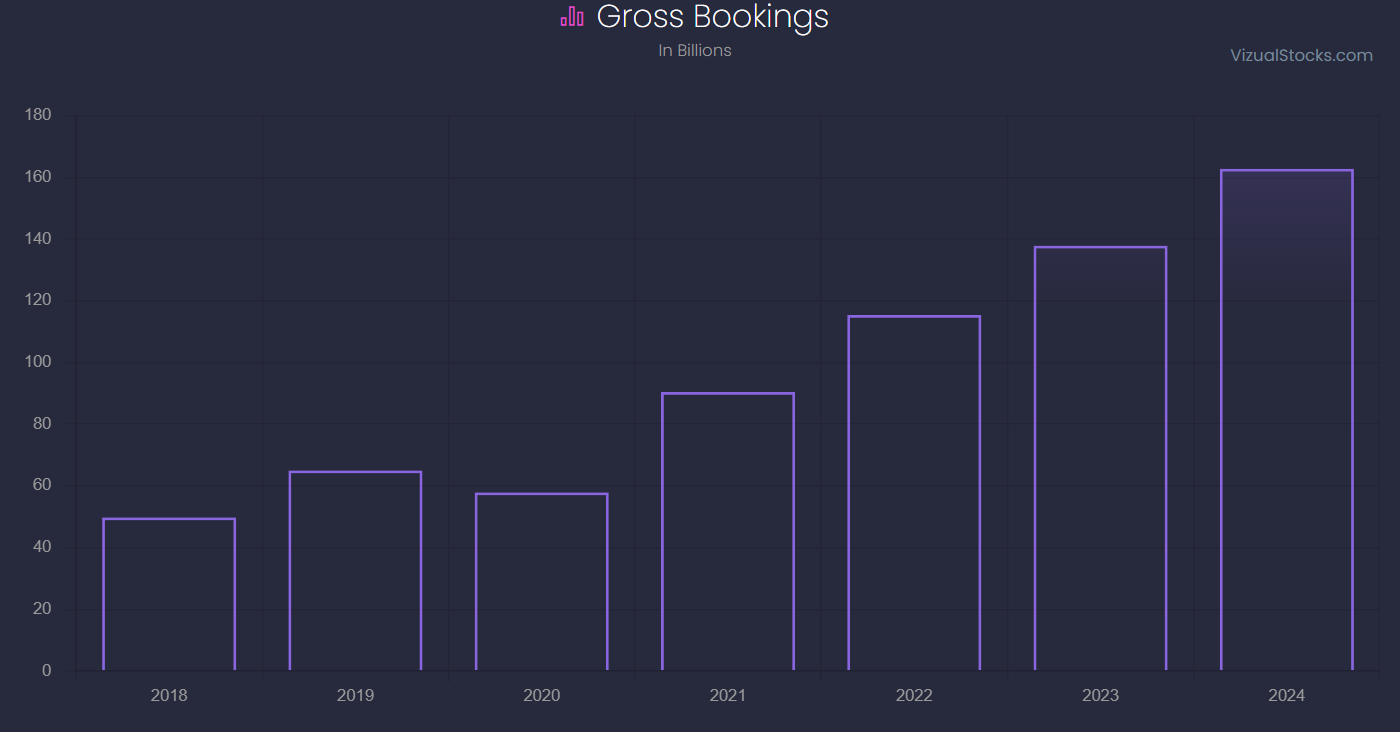

The Gross Booking Value - or GBV, represents the volume spent on the apps for every service the company proposes.

Covid has been complicated but the trend is really positive and its growth very stable since, with a 23% CAGR over the last 5 years, which is logical as we’ve seen earlier the growing amount of drivers & users.

For the the take rate, without any surprise, it remained very stable around 27% these last years and should remain around this value in the future. It can fluctuate but shouldn’t rise as it would pass the augmentation to consumers, and no one likes higher prices for the same services.

Those are the metrics that matter: a growing user & service provider base, growing usage of the platform, and a flat take rate. This is the bull case.

Financials.

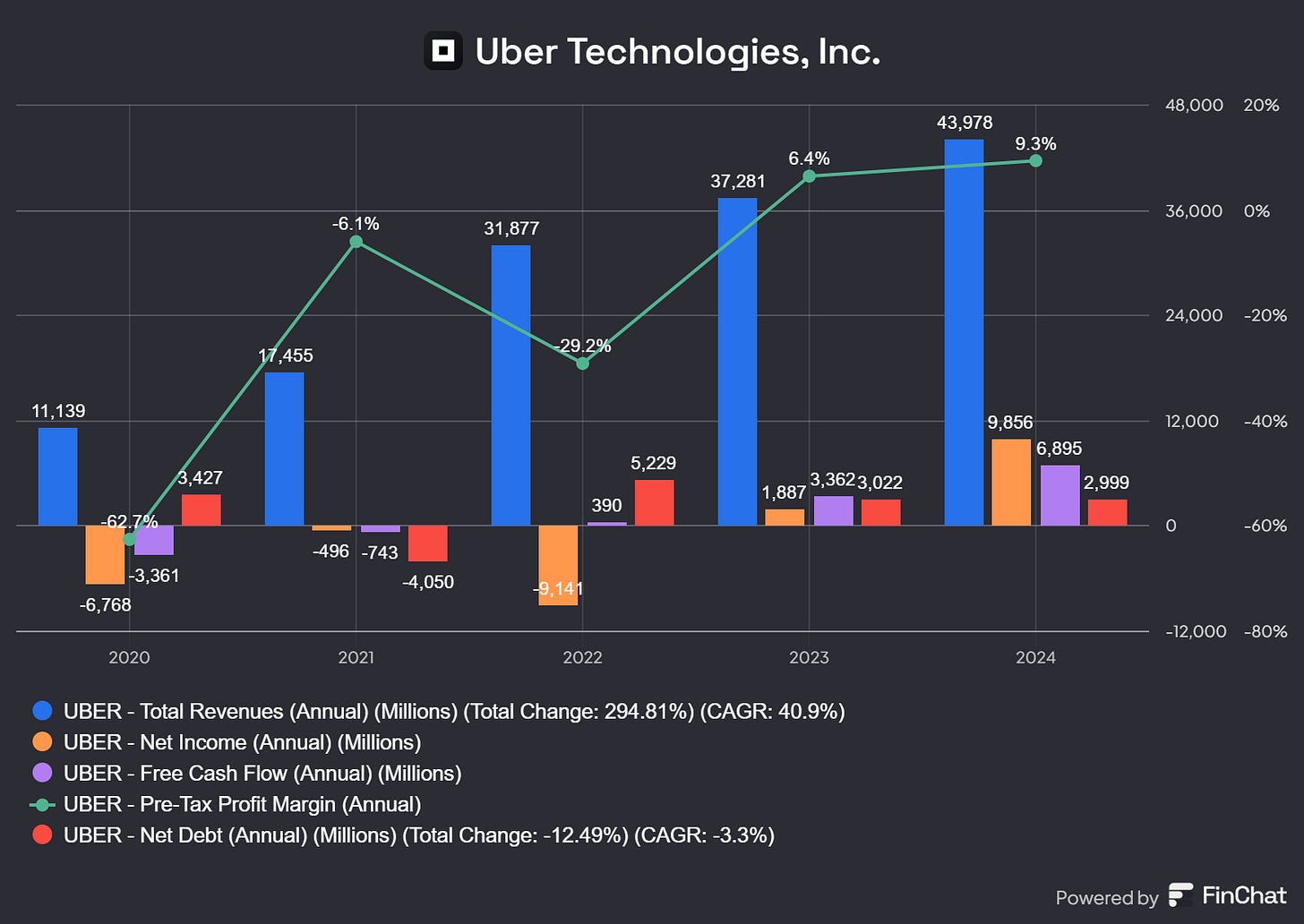

Uber is a masterclass of execution. I didn’t like the unprofitability & constant spending it seemed like a race to burn cash & get users which were not yielding returns. I was naive, like for Netflix and Spotify, as those guys understood the network effect they were building.

They were not delusional - shocking, I know.

They built their strategy, grew their user base, and then leveraged them by fixing their take rate & offering new services. Once hooked, users "call an Uber" even if they open the app of a competitor - that's branding.

There isn't anything else to say... 40% CAGR growth, expanding margins, profitability, cash flow generation with a growing business in terms of users & dollars spent on the platform. The only negative point in their financials could be the dilution of shares at roughly 2% per year, which isn't perfect. But it still is largely acceptable.

I also need to point out that Uber makes roughly 40% of its revenues outside of the United States, in local currencies. The company is heavily impacted by currency mix, and it showed often on its reports this year, as the dollar continues to grow in value. It'll still be true in the future.

Risks, Concerns & Important Questions.

Autonomous Vehicles.

Let's start with the most trendy one, the rise of autonomous vehicles and how they could impact Uber's business.

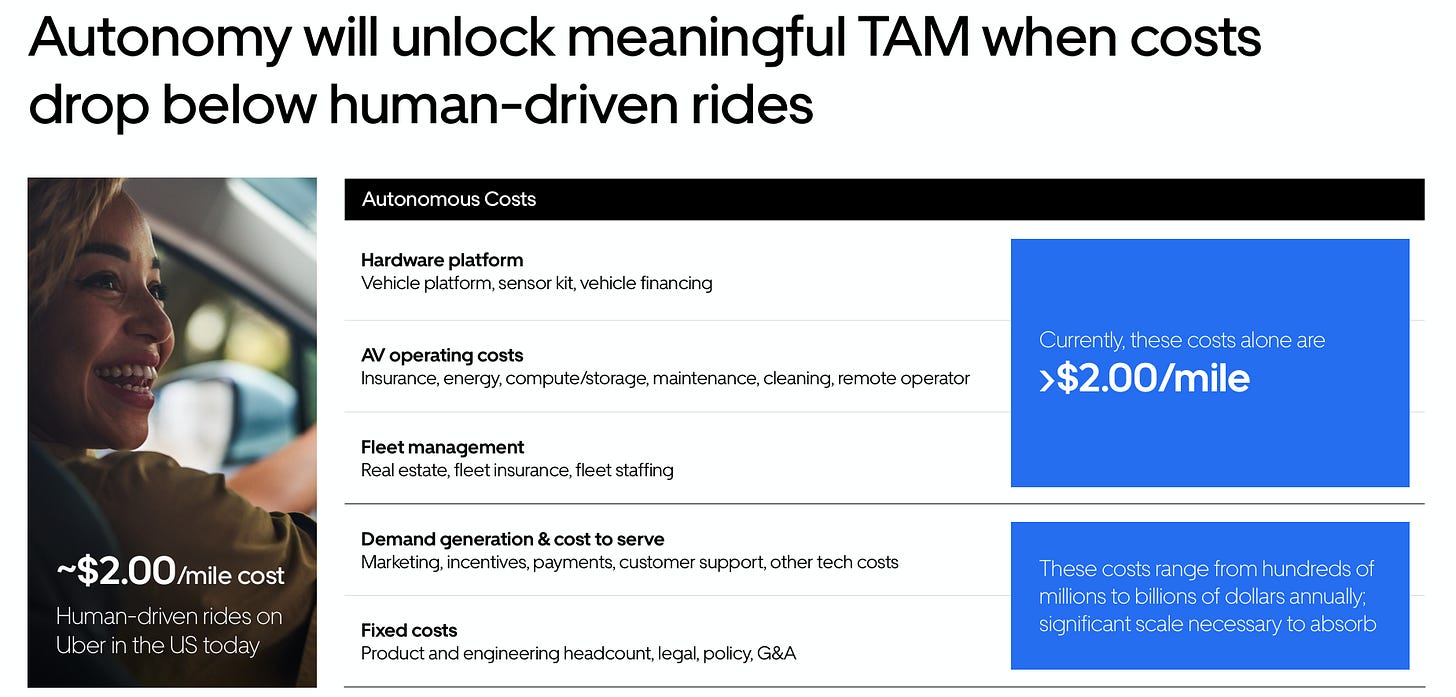

The bear case is that driverless vehicles are obviously better as they deliver constant service, never get tired, are cheaper for the end user while sold for a higher margin by the service provider - the company doesn't need to pay the driver, it can lower the cost per kilometer with higher margins.

When we talk about autonomous vehicles, we obviously think about Tesla's FSD and Google's Waymo first, two great products with one already commercialized while the second one will be tested in real-world conditions in the next months - and works very well already. And that's without counting the others countless R&D.

I completely understand the skepticism but I think a really big factor has been missed in this bear case: the users. I am very bullish on the future of autonomous vehicles but even if five or ten companies develop their products, they'll still need users.

Where do you find those?

Google knew where. I am not saying this is what will happen for everyone, but it is the better option.

Manufacturers won't need to take the risk of fighting for users nor have to develop & maintain software. They'll either sell their cars to Uber or partner with them & take a fee on each ride - without growing prices for consumers as the average ride will be less expensive. And as Uber has the bigger network effect, with whom else would those AV manufacturers partner?

Waymo partners with Uber everywhere, for mobility but also for deliveries as they are working on a process to have AVs deliver food as well.

If Google chose to partner with Uber, it was because it seemed to be the best move. If one company could leverage its user base & create an app to control their fleet, it was Google. But they didn't. They partnered. They saw the bigger picture. And if Google did, smaller companies also will.

This leaves one player.

Tesla.

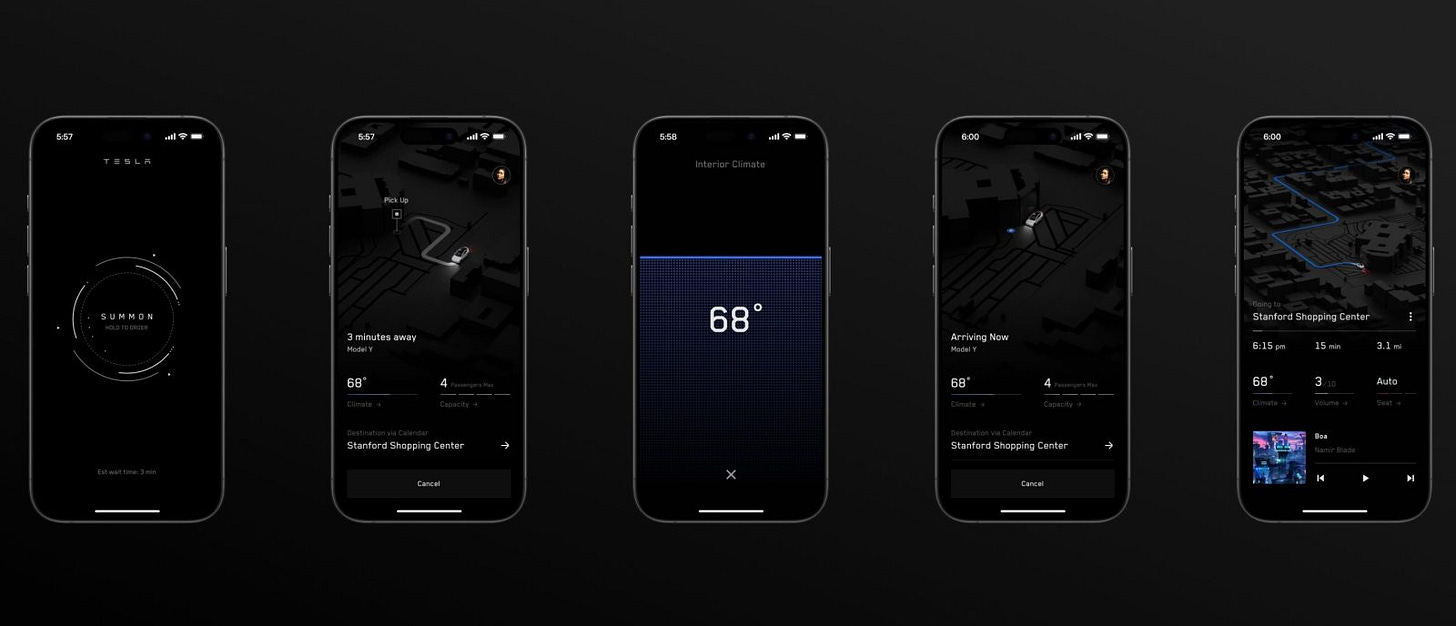

The only possible bear case when it comes to AV as a service, in my opinion, for the only reason that Tesla likes to have everything homemade & inernally controlled. It's true for the manufacturing process, it will also be true for their AV fleet. And they've already talked about it.

Now… Is it the best move? Not sure.

It already is very hard to trust a driverless vehicle for many & Tesla is controversial & I am 100% sure that some would make a point to never use their product - that’s a personal take but it seems highly plausible.

Wouldn't it be better to simply use Uber? Not having to fight for a user base, nor to maintain an app & a new service entirely? No polemics. Wouldn't it be easier to have a specific Tesla service in Uber?

Lots of questions & only time will answer, but there’s no certitudes that Tesla will open its own service. And if they do, no certitudes it’ll eat Uber’s market shares.

The Bottom Line.

Besides Tesla, most companies will certainly end up building partnerships to focus on their own value-added. Uber has the user base & the experience. There is no need to fight Goliath when you can have a triple win partnership. I believe this is what Google saw & chose.

Others will too. And at the end of the day, this is a net positive for Uber as it would mean lower prices for the services, higher margins, higher availability & better control over the fleet… A big boost for their business.

They say it themselves.

Not that we should believe everything companies tell us, but here… I tend to understand & agree with the reasoning.

Competition.

Now this one is another big subject but we treated it already. What matters isn't the service itself which is somehow easy to provide, it’s only an app & some drivers. What’s hard is to own & fidelize users.

Uber did it better than competition and this is what I missed with Spotify & Netflix. At the end, the bolder & bigger wins. And that's Uber.

It happened in the U.S. and it starts to happen in Europe where prices have been decreasing & are now at par with competition, while finding a driver with other platforms is getting harder than from Uber… This might only be my personal experience, but I notice a difference in these last years.

At the end of the day, it's possible that Uber controls most of the western market because of being aggressive. It's hard to fight against Goliath, but it's much, much harder to fight against a profitable & aggressive Goliath. Competition could end up being swallowed or forced to declare bankruptcy…

The harder competition comes from the broader market. Asia, Latin America & Middle East. Integrating those populations is much harder for western companies as it has been proven by many, but Uber took a different approach. They sold their client base to a local company, more capable to understand the market: Grab.

They didn't just sell their business. It's hard to call this anything but a "partnership", as Grab took over the business but gave 27% of the company to Uber & a spot on the board.

“As part of the acquisition, Uber will take a 27.5% stake in Grab and Uber CEO Dara Khosrowshahi will join Grab’s board.”

Uber understood they couldn't focus on this expansion, too far away from home. So they gave their business, technologies & expertise to the most likely to succeed while making sure they’d reap the rewards - 27% is a big chunk.

Grab is a publicly traded company, which could present a great alternative with much more risks & potential. But we're talking about Uber here.

This shows how Uber could treat with future competition. Going around and giving their expertise & insights to local companies in exchange for shares is also a way to grow Uber without taking much risk. They chose to remain aggressive in markets they know & to have a stake without more involvement in markets where they have less chance of success themselves.

Polemics.

As many companies, Uber is often under the spotlight & source of lots of criticism. We've had stories over the years about exploitation, insecurity, social frauds & more. Thing is, Uber will always be polarized as it gives the image of exploiting cheap labor to make big bucks.

I'll let you have your opinion on the subject, I am not here to talk about this kind of thing, I am just here to say that in the future, Uber will certainly generate noise & the stock will certainly be impacted by that noise.

Volatility is to be expected.

Valuation.

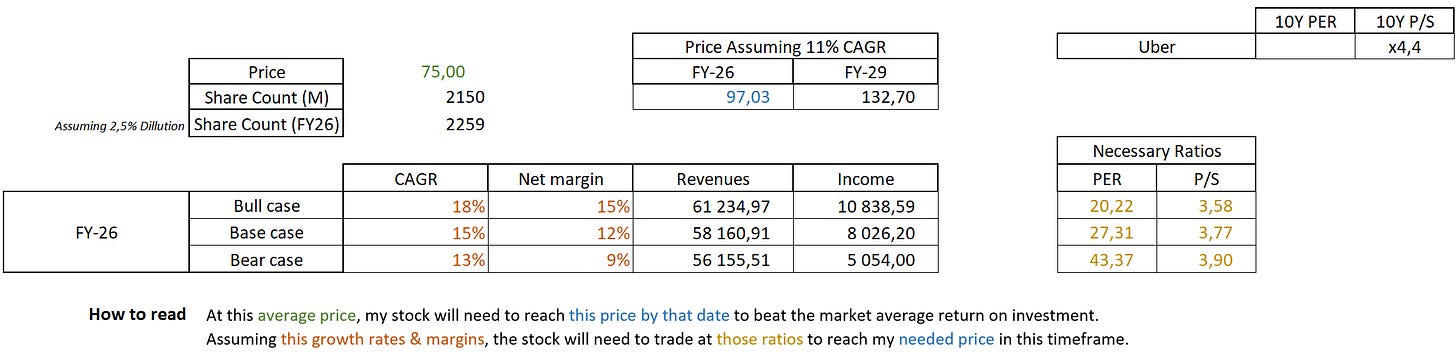

This is where things get interesting because even today, after the company delivered a few years of great results, the market is still doubting them & their capacity to emerge stronger after autonomous vehicles start driving on our roads.

During its Q4 presentation, Uber talked about double-digit GBV growth which, if you followed, would mean double-digit growth in terms of revenues with a constant take rate - which should be the case. Q1-25 outlook talks about growth between 17% & 21% in constant currency.

I extrapolated the data here but under correct circumstances, Uber has what it takes to continue growing double digits for the next two years - assuming consumption stays stable & no black swan, hard to be sure for the next two years.

As you can see, any double-digit growth would require less than Uber's 10Y multiple average to return 11% on investment & beat the S&P500. All while the company is growing profitability, balance sheet & free cash flow rapidly & could slow or stop share dilution soon - reducing the ratios doing so.

This isn't the data of an overvalued company. It's hardly the data of a fairly valued one if you accept my growth assumptions - which again, seem plausible to me & management under healthy economies.

I personally believe Uber is undervalued at today's price.

As for buying, I should have bought yesterday but chose to do some more research & complete this write-up before doing so, and the stock decided to catch up & realize that the quarter was great & the company worth a buy in the meantime…

But the stock remains blocked in its range & the actual double bottom could have its retest around $70.

Useless to say this would be a great entry point if you agree with everything I have written until now. I personally intend to buy in if I am given the opportunity. Any retest at $70 before reaching $85 will be bought on the public portfolio.

Conclusion.

We could go deeper into some specifics, but this seems enough to describe the bull case for Uber. The brand became a verb & has a huge & loyal user base, which it leverages with great services, adding lots of value to their users' lives.

The company still has room to grow in its markets & this is a lesson that should be learned from Spotify & Netflix: the ceiling is higher than we think. Expansion is also possible & can be managed differently, through acquisition & partnerships if necessary.

I do not think autonomous vehicles are a threat to its business as manufacturers will need users, and it is always more profitable to partner with those who have what you miss than to start a war which ends up hurting everyone.

Network effect is everything, owning your users is everything. As long as this trend continues positively, Uber probably has great years ahead.