Bitcoin | Investment Thesis

The most interesting asset of the world.

I’ll try to tackle one of the most complex subjects I’ve ever written about today. Writing about companies isn’t that simple, we can think about Palantir which required hours of research just to grasp the concept of its products.

But Bitcoin is something else.

It requires learning about very different concepts, from mathematics to social order passing through monetary policies, currencies from their concept to application & cryptography problems. I’ve never come across something that complex, that interesting, or that beautiful!

I don’t have the pretension to understand it all and this investment case will cover only a small part of it. Many smarter people than I have written extensively on Satoshi’s creation, and I can only recommend you to read them, starting with the best of all.

Trust me, you won’t be disapointed.

I also recommend content from Andreas Antonopoulos, Michael Saylor & many others if you wanna go further, but I’ll also issue a warning: Do not fall into chartism, shitcoins, or anything related to the casino that the crypto market has besome. We’re talking fundamentals here, we’re talking value.

I’ll do my best here to provide an overview of Bitcoin: what it is, how/why it was created & how it works. I will also cover some global subjects which seem completely unrelated to Bitcoin but aren’t. This will be long, so brace yourself and know one thing:

Once understood, it is impossible not to love Satoshi’s creation.

Before Bitcoin.

Value.

You’ll hear everywhere that Bitcoin has no “value.” What the hell does that even mean? What has “value”? What is “value”? This will be our first step, and we’ll focus on speaking economically, with a very easy and recognized definition.

Value is energy transformed.

Everything that is useful to your life does so because it uses or used energy. The chair on which you are sitting, the smartphone on which you are reading, the data you are consuming right now or the medicines you last took when you were sick - all of it is energy transformed. Energy is the most important resource for any country - something Europe struggles to understand.

Going deeper into the concept, we have two types of value in an economy: intrinsic value & market value.

Intrinsic Value

The definition is self-explanatory:

“The true, inherent worth of an asset, security, or entity, determined by fundamental analysis without regard to its market price or external factors like investor sentiment or market conditions..”

Anytime you buy a product, say a t-shirt, its intrinsic value is the sum of all costs from production to delivery, from fabrics to man-hours. It will change depending on those factors - an iPhone produced in Bangladesh will have a much lower intrinsic value than one produced in America or Europe.

Market Value.

The price at which you buy something has nothing to do with its intrinsic value and everything to do with one mechanism: the supply & demand market law, which impacts almost every price around the globe at any moment.

If everyone wants something that isn’t produced in mass, it will be expensive - we can think about brands or exclusive, personalized products here. On the contrary, if few wants something that is overly produced, it will be cheap - like any kind of daily usable product, with different nuances in between those two extremes. It also has to be said that consuming energy to create something for which there is no demand isn’t creating value; on the contrary, it is a waste of energy.

This is mainly true for commodities and resources, which are used to create products or services and therefore impact their final price. But the entire economy relies on this law, and our countries learnt it during Covid for example.

Of course, a lot of other factors will enter into action afterwards to determine the final price of any products or services but this law of supply & demand is the basic of any economy, any market.

Inflation.

Many would tell me, “Inflation is when prices rise.” This is wrong.

Prices rising is a consequence of inflation, not its essence. If you don’t believe me, believe Milton Friedman, an economics Nobel laureate. And if that’s not enough, I’ll send you to Adam Smith, hoping one of America’s founding fathers will convince you.

Inflation is a more rapid increase in the quantity of money supply than of economic value. And this ends up raising prices through a simple overbidding mechanism. Let me take an easy example.

Imagine an economy with $10 and ten iterations of a valuable product, say, ten apples. In this economy, with nothing else to buy, one apple is worth $1. Now, say, someone creates 10 more dollars. This will obviously not increase the number of apples available, yet, someone will have those $10 and will want to buy apples with it. They can either buy them all for $10 or buy 5 of them for the same amount, which will force the farmer to sell the remaining five apples at $2 each, not $1 as previously - or to not have any stock anymore hence rising the price of its next production.

The price of each grew because those who got the freshly created $10 are able to pay more for the same. Those who didn’t will stop buying apples or pay more for the same. And this mechanism can continue for as long as new money is created, constantly destroying its value until no one can buy anything with it, like in Venezuela where bills were more valuable as a fabric than to pay.

This kind of inflation does exist around the world, but not in the west - yet.

How Does Inflation Spread.

As to why would anyone (governments nowadays) want $20 instead of $10? You’d surely like to double your money without any cost - but you can’t. In an economy with more than just apples, it will allow them to pay for anything they want or need and, more importantly, to access products and services they couldn’t afford otherwise.

They govern our countries but still need money to do anything, like everyone else, and have only three ways to get some: raising taxes, borrowing & printing money - and they use all three of them.

Stick with me, I’m still talking about Bitcoin here, but the digression isn’t finished yet.

Printing money seems to be the least painful one. Borrowing costs interest, raising taxes makes people angry, while printing money… seems invisible, and its consequences will be managed by the next government because inflation takes time to spread. Why?

When money is created, it is given to institutions or individuals to buy products, services, sometimes assets - mostly real estate, as we’ll see & use as an example. With this fresh, new money, they’ll be able to offer a price above the average price for the same product. But the world and our economies are big now, and buying a house 2% above the average price in one region won’t raise the price of all other houses overnight; it will take months, or even years, to happen.

Italy, the Medicis & Loans

The digression continues, but I also need to write about the importance of money creation - or what I will start to call "loans" from now on, because this is how money is created nowadays, and it isn’t only done by governments. Although they are the ones who control and authorize it (or not), so it’s kind of the same.

Money printing is the act of giving someone non-existent money in exchange for their time and the futur value they will create with it. But it works only if more value is created; otherwise, it’s called throwing money away. So smart people got involved and developed a clever way to control loans: interest rates.

Most loans are made by banks, and when a loan is made, the bank creates the money it loans. No bank has in its reserves the money it loaned; they create it out of thin air and give it to someone in exchange for a monthly payments on which the'y’ll keep only the interest rate as a payment for the service provided, and destroy the rest. A very well-oiled system which has worked for centuries and would continue to do so under one condition: having fair interest rates.

This is a mechanism that was democratized in Italy and made the famous Medici family so very rich - although they were very rich before, as they started to lend part of their money to entrepreneurs against a fee, making them richer than ever while helping create small cities which perdured in time, like here.

This was the start but the Medici kept those interest high, because they couldn’t give money to everyone for everything - it was still their money after all, they didn’t get to create any by then.

But this is why loans & banks are so important: they allow innovation because any innovation needs money, and those having ideas, capacities, intellect, or pragmatism don’t always have the money to achieve them.

So they turn to those who have that money, and together, they achieve wonders - Firenze being one of them.

Interest Rates.

The most important mechanism in the entire system. As I said, inflation has been controlled in our countries for different reasons, but I’ll only talk about one in this write-up as the others aren’t necessarily linked to Bitcoin.

As explained, interest rates are nothing but a fee that any borrower has to pay their lender for accepting to loan them a certain amount of money, and indirectly counter inflation - not because of themselves, but because interest rates are meant to reduce the number of loans made.

If you are an entrepreneur and want to build a business, you’ll need to borrow from the bank. But you will need the returns of your business to be above the interest rates you will pay the bank; otherwise, you’ll go bankrupt - that is when you owe more than you make. If you want to buy a house, you need to have the financial capacity to shoulder the interest rates on your income and have a stable job; otherwise, you won’t be able to repay it.

The higher the risks, the higher the interest rates, to cover for the possibility of the borrower’s incapacity to repay their loan.

Interest rates aren’t meant to hurt people. They are meant to control the amount of money borrowed, hence the potential inflation, so that only those who can provide value are able to borrow money, and so that banks only accept to loan to promising projects. And so that those who do not provide value do not borrow, hereby not creating a useless amount of money for nothing.

It also means that those failing would have to take responsability, no bac up. It gives the opportunity to those who have ideas, but also the responsibility to shoulder the risk. This is what many called the American dream and what built America’s path to success.

And this is what happened for decades in our countries. Until…

This graph will help, it represents the interest rates in the U.S. since 1970, where you can clearly see the tendancy of reducing those interest rates, hence allowing more people to borrow and more money to be created.

And here. We. Go.

The Internet Bubble & The Subprimes.

Far from me the idea of saying that all of our problems come from those two crises as government spending was already printing money for projects which were not creating any value, but those two crises made things much worse than they could have been.

We’ll focus more on the second because it surely was the beginning of the end but, most importantly, it’s what motivated a guy known as Satoshi Nakamoto to create Bitcoin.

If you do not know about the 2008 economic crisis’ reasons,you should watch the movie about Michael Burry, “The Big Short.” It will clearly explain how greed & stupidity destroyed the lives of millions who asked nothing - it’s also a great movie with a wonderful cast.

The reason those were impacted? They had a bank and used the dollar.

What was called the subprimes were loans given to “high-risk families” or low-income families, to buy houses in exchange for a higher interest rate as we saw above - higher risk of default. But banks were under a strong demand they couldn’t satisfy due to regulation - forbiding them to hold onto too many subprimes, so they found a trick. Instead of keeping those loans, they contracted them and sold them to other institutions - for a small immediate profit. Once sold, they could create new ones, following the regulations, while other banks, institutions & funds were happy to buy those safe (or so they were said) loans with high interest rates, yielding wonderful profits. Things were going so well that governmental institutions even lowered interest rates, growing the potential amount of borrowers.

It also had other effects, as banks were now loaning money to almost everyone, the real estate market skyrocketed & created a very nice bubble. Easy access to loans would allow anyone to buy a house in the morning and sell it the next day with a 10% profit, to someone who also contracted a loan.

The overbidding possible through money printing created inflation.

And two things happened. The lower-income families to whom loans were given easily ended up defaulting because the cost of living grew at the same time. Second, the house prices became so ridiculous that demand for them slowed down, leaving the last buyer with a high interest rate while his plan was simply to buy & sell rapidly this asset. He couldn’t repay it either.

When too many loans cannot be repaid, the banks don’t get their money. No one wants to buy the subprimes anymore, and as the supply & demand law says, when you have a product in mass which no one wants to buy… it’s worth nothing, and no one will buy something worse nothing.

And so the markets crashed.

The problem when markets crash isn’t that some very rich get less rich. It’s that banks, funds, states, departments, each and every institution lose money because all of them hold assets - and many held the famous subprimes which became worthless very rapidly.

As a citizen, your bank doesn’t keep you money in cash, but in assets - or depends from other funds which hold assets, which at that time depreciated in value each minute passing. Those assets being the collaterals used for clients' cash. With the collaterals down 50%, it also meant that banks only held 50% of their clients' money - even less in truth... This is what we call a liquidity crisis: The banks & institutions could not give back the money of their clients. When those clients were said “We cannot give you your money”, panic spread and things got worst. Markets crashed even harder, stucked in a crisis loop.

Lots of mistakes were already made here and lots of economists gave their opinion on what the government should have done. Namely, create inflation voluntarily and accept its cost. Many asked for the U.S. government to make them plain, not to punish every American for their greed, but they decided not to, and this situation dragged on for weeks during which many paid for the greed of a few.

Until it became unbearable and the U.S. governmental institutions finally decided to do something, but so much damage was already done that it would take much longer to fix them. And so the cycle of low interest rates started, as you can see on the graph above, early 2009 with interest rates under 1%, where they stayed for almost a decade.

This is where the inflation wheel really started for good in America - and everywhere as the world relies on the dollar, as this meant that you didn’t need to create value anymore to borrow money, a necessary short-term evil to make those who lost and re-inject liquidity into the system. But our governments found out that borrowing at no cost was actually pretty cool; they’d get to finance everything they couldn’t before.

And for years, they - and everyone, could borrow money at minimal costs to buy assets, inflaitng the money supply and throwing it onto the economy without creating any value. The richest were able to borrow more than the poorest, making them richer & richer while fueling inflation & destroying the buying power of those who couldn’t contract more debt - overbiding, remember?

Everything is due to inflation. As we’ve seen, it causes prices to rise which means $10 today are worth much more than $10 in 20 years - today’s money is more valuable than tomorrow’s. Understanding this, why wouldn’t you borrow as much money as you can to buy assets that appreciate in time?

(Parenthesis.

For the sake of being complete, although I might make this more complicated, when I say that “today’s money is more valuable than tomorrow’s”, it is true only when talking about cash. If you were to buy U.S bonds, you wouldn’t have lost much buying power through the years as you’d have received the interest rates yourself. But retails don’t do that so this sentence mainly remains true, at least for households.

End of the parenthesis.)

How to get rich? Contract as much debt as you can to buy as many assets as you can. This is what the system after 2008 became. Those who got this got rich. Those who didn’t and put 10% of their salary in a safe account… Well, Michael Saylor summed it up perfectly.

"People that use fiat currency as a store of value, there's a name for 'em: we call them poor."

Bitcoin, a Social Monetary Software.

If you’re still here, I officially announce that our digression is over.

It’s impossible to understand Bitcoin without understanding those events & principles because it is to avoid this kind of events from happening again that it was created. To give opportunity to the “poor,” as Michael would say. A decentralized currency, unaffected by Wall Street’s greed or governments’ debasement policies & corruption.

Bitcoin was created to be everything our current currency is not.

“Bitcoin, A Peer-to-Peer Electronic Cash System”.

Store of Value, Currency or Pure Speculation?

Currency.

There are lots of debates about what is a currency. Some consider you should be able to pay your taxes with it, others that it should be accepted globally. I’ll stay with a simpler & timeless definition.

Any currency should respect a few characteristics.

Acceptability. Everyone should agree on a common means to transact. Currencies solved the problem of barter where two people could not find something each wanted to finalize an exchange.

This is where Bitcoin hasn’t succeeded yet but is moving in the right direction, as more & more companies now accept it as a payment method.

It used to only be some geek shops but the last two years changed everything and we’re now talking about restaurants, every kind of store, multinational… Some U.S. states even tried to accept it for taxes.

We’re talking about consuming with Bitcoin here, but exchanging Bitcoin between individuals always worked.

No Usability. This can look incoherent but isn’t; we need our currencies to be useless. This is why today we use bills; they do not have any use besides being exchanged, exactly like gold before. If we were to use consumables as currencies, we’d end up using them for what they are meant for instead of exchanging them.

Bitcoin is pretty useless in the real world as we’re talking about a digital currency.

Portability, Divisibility & Durability. Any good currency should be easy to transport, easy to divide & should keep its value through time.

Holding onto a digital currency is as hard as holding air in your hands, and it is durable in time as it has no form. Each Bitcoin is divisible by 100,000,000 - 0.000,000,01 BTC is called a satoshi. It gives room to pay for a baguette.

Bitcoin, Gold & Fiat. Up to here, if we were to compare those three currencies, we could already conclude that none answer all the criteria, but that the closest to do so is Bitcoin.

Gold is very hard to transport and to divide into smaller amounts, although it is useless, would be accepted by everyone & is durable.

Fiat currencies could have been a perfect alternative but our governments chose to go to an inflationary path, destroying its value through time - sadly, no civilization has ever chosen another path. It does, however, answer perfectly all the other characteristics of a good currency.

Bitcoin’s lack, today, is that it isn’t accepted everywhere yet - although you could live solely on Bitcoin in a few country so that is to be put in perspective. It is the only characteristic Bitcoin doesn’t comply with for now and this can change easily - while it’s harder to change the two others’ flaws.

Store of Value.

Satoshi wasn’t working on Bitcoin alone, and the cryptocurrency wouldn’t exist without the help of people like Hal Finney, who saw things very differently and considered Bitcoin to be better as a store of value than as a currency.

Hal’s view is the most accepted nowadays and many start to consider Bitcoin as such, and those who saw its potential years ago can attest that there was no better store of value this past decade than Bitcoin.

Now keep in mind that this is a ridiculous comparison for many reasons. Buying Bitcoin in 2010 had nothing to do with buying the SPY in term of risks. Even if you had bought Bitcoin in 2010, you surely would have sold long ago, not even talking about the volatility...

Even if you had bought 10 years ago, $100 would be now worth $19,600, easily beating the returns of every other asset on this list. As to how it will do during the next decade, it’s impossible to know, but it has all the characteristics of a good store of value without much risk - more on this later.

Speculation.

As for considering Bitcoin to be a speculative asset… It’s undeniable, but it doesn’t matter much. Everything could be considered a speculative asset as people who buy assets expect those to gain value with time, hence speculate.

Everything is speculation. But the fundamentals aren’t.

Bitcoin’s Caracteristics.

So what makes Bitcoin different, and what makes it a better currency than our fiats & a better store of value than gold?

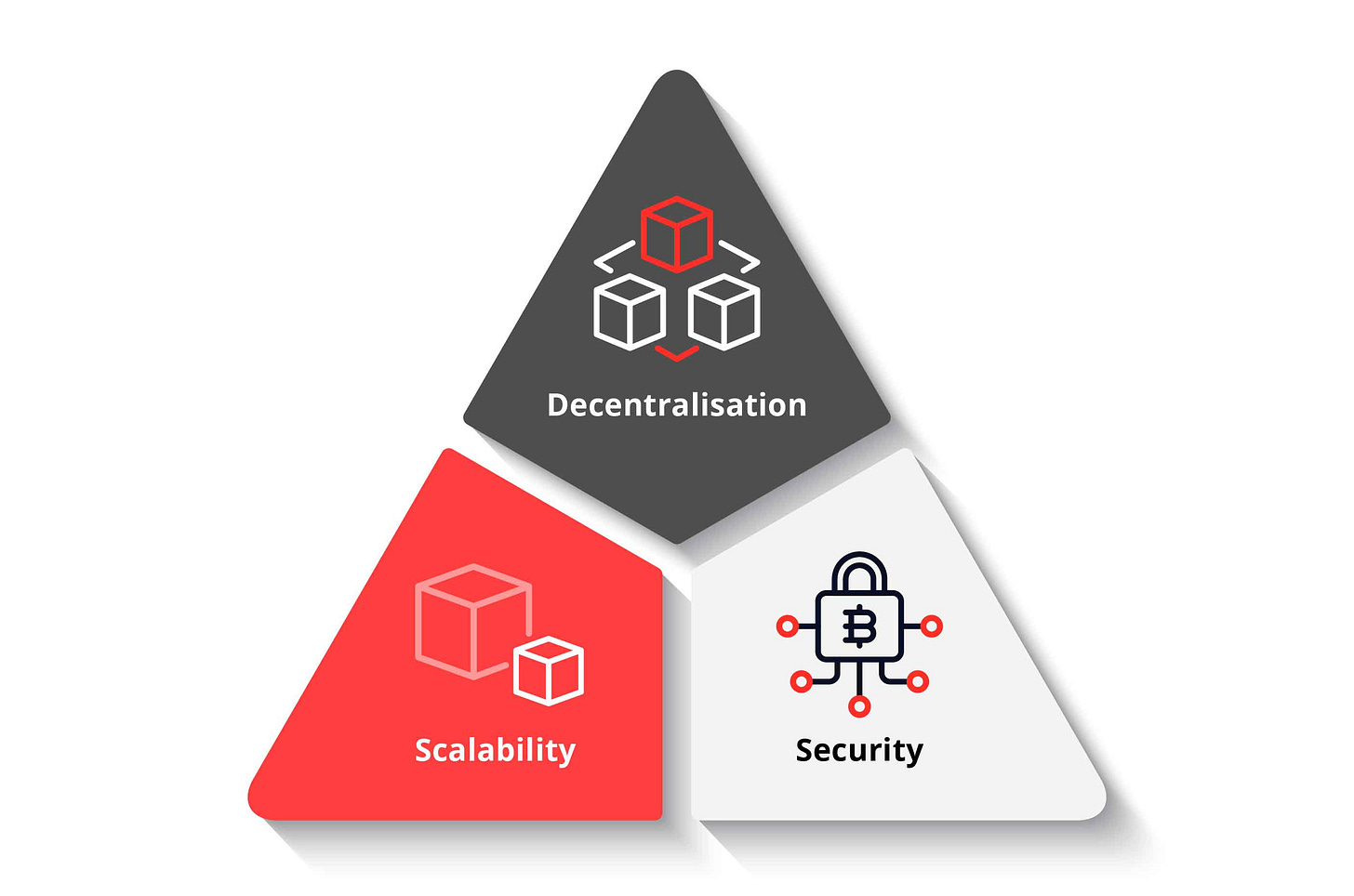

The Trinity.

Starting with the biggest problems when talking about blockchain but also currencies at large: the blockchain trilemma, which… still hasn’t been solved, even if Bitcoin is pretty close to doing so.

You can try and wrap your head around this concept, but for examples, our fiat currencies are secure & scalable but not decentralized - banks & governmental institutions have all the power over them and can freeze your accounts if they want to, for viable reasons… or not. Gold is very decentralized, possibly scalable but unsafe, as any strong thug could steal yours. Go over more examples, and you’ll see that this trilemma isn’t just applicable to digital currencies, but to currencies at large.

Satoshi worked on solving this, to create a system that is secure, decentralized & scalable. Bitcoin answers perfectly to the first two but is an absolute disaster when talking about scalability, to the point where it is impossible to use Bitcoin as a currency today as the blockchain treats… 7 transactions per second - it wouldn’t even support the French bakeries.

He knew that but he also knew this problem could be solved by external softwares interacting with Bitcoin, so he chose to sacrifice it to make the other two better… and he was right. Developpers worked on this after he disappeared and solved it through, as he assumed, an external system called the Lightning Network.

We’ll talk about it & the other characteristics in the different chapters, discussing the decentralization concept just now and its technical part in the Nakamoto Consensus chapter, and talk about security, with some examples of how secure and hardly (impossibly) hackable Bitcoin is.

Everything you need, is below.

Decentralisation.

Bitcoin isn’t controlled by anyone but by a consensus including millions of actors based on incentives, where behaving properly will automatically end with a currency well managed, without uncontrolled inflation, corruption, manipulation, or any other negative words ending with “ion”.

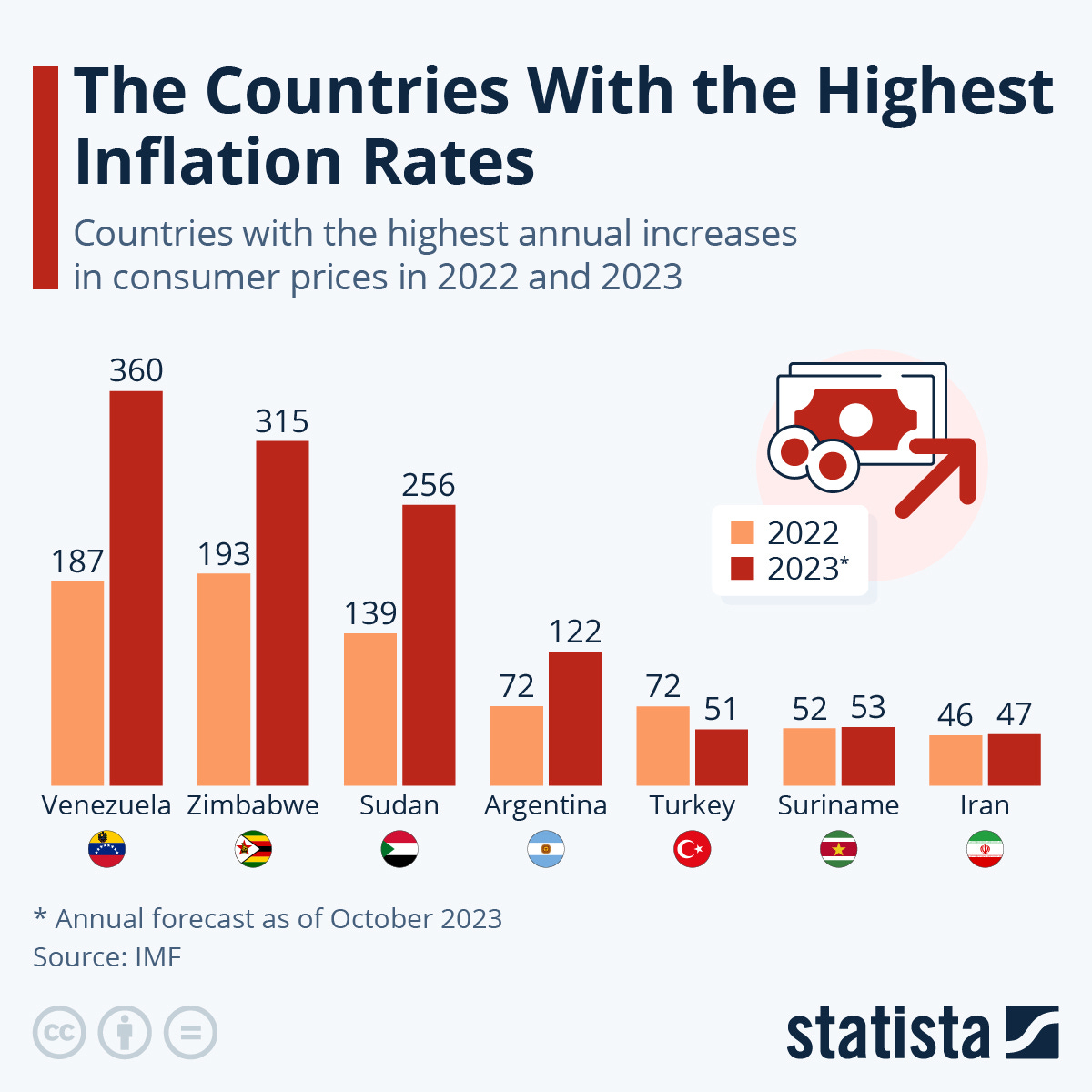

The need for Bitcoin is hard to understand for us Westerners because, even if I made it look terrible with my write-up on the subprimes above, the dollar - and other Western fiat currencies, is still one of the best-managed & strongest currencies in the world.

But it isn’t accessible to everyone, and if we are to think about other countries where corruption & other issues are rampant, those often end with inflation hardly imaginable for us.

In these countries, the price of bread can be different between morning & evening, and while you could eat at 9 AM, you won’t be able to by 9 PM. This is what real inflation is, and this is what happens when the money is managed by a government or a group of people - be it because of bad management, corruption, or else; it doesn’t even matter, it always ends up the same way - history proved it.

Decentralization is what allows Bitcoin to keep its value, to avoid corruption, to give back a safe currency to the people, far away from power struggles, bad loans, and again, corruption.

The 21,000,000.

Besides decentralization, Bitcoin was created with a maximum supply of 21,000,000 coins, with each being divisible into satoshis, as said above. This is the entire supply; we won’t ever have more of them - we will, in truth, have less because once someone loses access to their wallet, the Bitcoins on it are forever lost, and lots of Bitcoins were lost forever already.

It is developed to bring them all to circulation through decades (we’ll see this later), but once done, it will be impossible to create more of it and, indirectly, to create inflation. All prices compared to Bitcoin are meant to decrease through time as the currency itself will grow in value, contrary to our currencies.

But this fixed supply is the characteristic of a strong store of value, not of a good currency because it needs flexibility. That’s my personal opinion and I’ll develop it at the end.

Financial Inclusion.

Bitcoin is available to everyone, as long as you have at least access to a cell phone - which means most of the world. This isn’t the case for banks, which is again something that many Westerners tend to forget, although some struggle to have a bank even in the west.

But this tendency is many times multiplied when you go to less developed countries, and even if westerners would rather use their currency and their bank for their daily life, it isn’t a possibility for many populations.

For those, Bitcoin still exists, and no one will tell them, “You can’t use Bitcoin.”

In Brief.

Before talking about how it works, what it is, and digging into complex concepts, you have to understand that Bitcoin is certainly the fairest currency/store of value in the world - with gold not being far behind but with other disadvantages.

Bitcoin, The Blockchain.

So what is Bitcoin? And how does it work? I won’t enter into the tough cryptographic jargon here, I’ll simply try to detail the main concepts, starting with its basic definition.

Bitcoin is energy transformed and transported through time - rings a bell?

And exactly like gold and contrary to debt, you have to work before receiving. And in both cash, this mecanism of consuming energy to produce value is called mining. But it has another, more complex, name for Bitcoin: the Proof-of-Work (PoW).

The Blockchain.

Bitcoin isn’t the first blockchain at all, the concept existed years before its invention. Satoshi’s brilliance wasn’t in creating a blockchain, but in creating a system which no one, absolutely no one, had any reason to destroy, a system based on incentives - this and solving some other problems.

Some definition first.

“A blockchain is a distributed ledger with growing lists of records (blocks) that are securely linked together via cryptographic hashes.”

The name gives it all: It is a chain of blocks. In Bitcoin’s case, each and every block always contains the same kind of information: The cryptographic key of the block, the cryptographic key of the previous block & a pre-defined number of transactions which are written very simply like “A sent X Bitcoins to B” - with A & B not being names but addresses.

The Bitcoin blockchain contains each and every transactions since day 1 inside of those blocks, and everything is public and accessible to everyone - yes, it means that if you know the address of your friend, you can review everything he did, since... ever. And they say Bitcoin is good for criminals - more on this later…

For it to be online, it has to be stored somewhere, and we call those who store the blockchain “nodes,” which are nothing more than a computer with the Bitcoin software installed on it - which weighs roughly 500 GB. Their goal is to verify that everything functions according to what is called “The Nakamoto Consensus.”

We won’t talk cryptography, but you can simply keep in mind that what I called the cryptography key is exactly this: A key, not giving access to the content of the block like your house key gives you access to it, but more like a signature, proving that everything inside the block has been verified and is certified to follow Bitcoin’s rules. And this is done through a complex (which we will simplify) method called PoW or, mining.

The Nakamoto Concensus.

I introduced both mechanisms of the Nakamoto Consensus just above: The PoW & the nodes. Let’s see their role in the Bitcoin blockchain now.

Proof of Work - Mining.

The PoW has two main roles: To give Bitcoin its value & to reward the workers with its incentive program. Let’s start with the first one.

Bitcoin’s Value. This is probably the biggest issue with Bitcoin’s bear as they will tell everyone that, without even talking about its utility, Bitcoin has no value… But now, we know what value is: transformed energy into a demanded product.

I’ll talk about gold here again because those who will say Bitcoin has no value are usually buying lots of gold as an asset. What is gold, if not the sweat and energy consumed by mining equipment to reach caves filled with a useless shiny metal? Nothing. Gold’s value comes from the sweat & the energy consumed to reach it, the incapacity of science to reproduce it (its scarcity) and… nothing else.

Bitcoin’s value comes from the energy consumed to create one, it’s scarcity and… Nothing else. The only difference is how this energy is spent and where it comes from - and the centuries during which gold was used while Bitcoin is here since only 15 years.

Ladies & gents, on the left, a gold mine. On the right, a Bitcoin mine.

A Bitcoin mine is nothing more than a data center filled with processing power hardware (called ASICs) whose only work is to solve a mathematical problem, consuming electricity to do so.

As I said, every block has to be signed by a key, and the key is nothing more than the solution to this mathematical problem that the Bitcoin software creates randomly based on the amount of processing power used at the moment on the network. The greater the processing power, the more complex the problem. Each & every mining equipment present on the network will compete to find this key, and the one who finds it reaps the reward of its work, while everyone consumes energy in the meantime - at loss for the losers.

What is the intrinsic value of one Bitcoin, you ask? The total amount of energy used by the network to mine a block divided by the number of Bitcoins generated by that block - more on this just below.

I’ll talk later about the environmental concerns around Bitcoin and why they are probably not founded - although this is up for debate.

Incentive Mecanism. Miners aren’t doing it and spending money on electricity just because they like Bitcoin; they do it for the reward - classic capitalism. Two different rewards, both paid in Bitcoin directly and both paid to the miner who finds the key.

1. Block Rewards.

The first one is called the “Block Reward,”. I said that we won’t have more than 21,000,000 BTC in circulation, ever, and that these would be put in circulation over decades. This is done through this mechanism.

No Bitcoins existed when Satoshi started the blockchain January 3rd, 2009. The first block mined generated the first 50 BTC ever created, and the second block mined generated 50 more, etc… those always going to the miner who found the block key - in early days, Satoshi was alone mining on the blockchain and collected hundreds of thousands of BTC. Bitcoin’s supply was growing by 50 BTC every ten minutes.

Satoshi created a system to slow down Bitcoin’s generation through time, called the halving (for half). Every four years, the block reward is automatically divided by two. Today, the block reward is 3.125 BTC, and in 2028, it will be reduced to 1.56 BTC.

2. Fees

Bitcoin is a software which relies on energy consumption and every service must be paid when used. This is why you have to pay a fee, in Bitcoin, every time you use the network. This, in the long term, will become the sole revenue of the miners who will continue mining & creating blocks in exchange for the fees of those using the network.

Those fees depend on the network’s congestion; the more requests are pending, the more expensive it will be to pass yours - or the longer, as you’ll need to wait for the more rewarding ones to be selected by the consensus which focuses on profitability.

The Nodes.

We estimate the number of nodes to be around 15,000 to 20,000 today, and their role, besides keeping the history of all Bitcoin’s transactions, is also to verify that every block proposed is following the software rules, to communicate together and ensure that each and everyone’s ledger is identical and that no data has been falsified - and to punish those who try.

The nodes are the controllers, while the miners are exactly this: miners.

The Beauty of the Consensus.

To talk practically about how everything works:

All miners select transactions and inscribe them on a block until it is filled - one block usually contains around 2,000 transactions. They select them based on the fees (the more rewarding are selected first). The miner who finds the key will then propose its block with the transactions it selected to the nodes, which will then verify that everything is in order according to Bitcoin’s rules. Once validated, its cryptographic key will be pasted on the next block to ensure that everyone is now able to decypher its content.

This mechanism then repeats every ten minutes. For. Ever.

Your question by now should certainly be: What if we don’t have nodes? Or what if miners unplug themselves, what if they stop mining? Why would they even continue to mine? Firstly, nodes are often maintained by miners themselves - and by some individuals who like to participate.

The other answers are simple: Because their work is rewarded by something valuable: Bitcoins. The perfect definition of a healthy capitalism.

Think of it this way. Every miner gets a reward in the form of Bitcoin, which they can do whatever they want with. If every miner were to hold onto their Bitcoins today, the law of demand & supply would shoot Bitcoin’s price in dollars through the roof simply because many are trying to buy while the new supply generated by the miners would be locked. As of why the demand would grow bigger than the supply… This is why I am writting all this and I hope you are starting to understand.

For a practical example, as of today, the U.S. Bitcoin ETFs bought more than 80,000 BTC since January, while the chain produced roughly 169,000 of them. Half of the production was bought by those ETFs; imagine if the production was held by the miners and if we had to deal only with the actual supply?

And as the halvings pass, new Bitcoins will be lesser & lesser while demand should stay the same (or grow). Bitcoin’s price should continue to increase simply because of the law of demand & supply. By creating the halvings & fixing a limited supply, Satoshi made sure that this mechanism endures, that Bitcoin not only keeps its value through time, but increase its value.

Why would anyone unplug itself from a value creation system? Why would anyone refuse to participate in the creation of an asset which will be more valuable tomorrow?

I’m giving you a small break here because you’ve gone through a lot if you’re still reading. Thanks for the time you are taking to try & understand such a wonderful invention, I hope you’re enjoying it!

You should now understand the basics of Bitcoin: why it was invented, the basics of how it works, its actual & future value, and most importantly, why it is an important asset in today’s world where debt & inflation are the rule.

It is all about transferring your work into value that will appreciate through time, instead of keeping it in a currency that will depreciate. Always remember what Michael Saylor said, as it should be the motto of any investor’s life:

"People that use fiat currency as a store of value, there's a name for 'em: we call them poor."

Break’s done. Back at it, still lots to do.

Bitcoin’s Usage.

At this stage, you know almost everything there is to know about Bitcoin, at least superficially. Everything except how it works practically, as a user.

I’ll start by saying that even if Bitcoin is working & in its final form, lots of things are still being developed around it to facilitate its usage. Things change fast in the ecosystem, and today, it’s very easy to use Bitcoin as a currency.

Responsability.

First of all, you probably understood it by all this write-up: Bitcoin is based on responsibility. Miners are responsible for maintaining Bitcoin’s value, nodes for making the network safe, without corruption, and users are responsible for their funds and usage of the network, as no centralization also means no hotline to call if you did a boo-boo.

Wallets, Keys & Adresses.

Like every currency, you will hold your Bitcoin in your Bitcoin wallet, which is nothing more than a software ensuring the connection to the blockchain, be directly on the blockchain or through other softwares or hardwares. To go a bit further, you have two kinds of wallets: hot & cold wallets.

The first one will, by nature, be disconnected from the network and will require a physical connection to go online; they usually look like USB drives and work exactly the same - here’s a ledger cold wallet.

The second ones are software installed on your computer, which makes them much more practical because they are easy to access but also always online, making them easier to hack.

Both function the same way, and the only difference is in the security they provide. Once configured, they are composed of two keys, the most important things for any Bitcoin holder: a private key & a public key.

The private key is a randomly generated number through the SHA-256 algorithm we’ll see later. This key is your password, so long & complex that they are impossible to guess but are made simpler by the algorithm so you, a little human, can manage them. Every time you create a Bitcoin wallet, the private key will generate 21 words from our dictionary, and these will be your usable password.

If you forget these, you lose your Bitcoins. They get stolen, you lose your Bitcoins. No coming back. Responsibility.

The public key on the contrary, is well-named. Derived from the private key, it is used to create your Bitcoin address - your name on the blockchain, the name others will need to use to send you Bitcoins. This, for example, is Satoshi Nakamoto’s first Bitcoin address:

1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa

You can send him some satoshis if you want; he won’t use them, but it has become a kind of pilgrimage for many Bitcoiners.

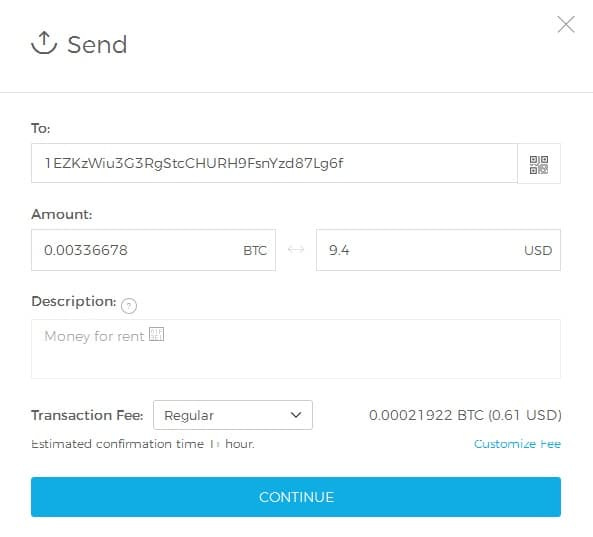

Usage.

From there, it’s very easy to use Bitcoin. Using your wallet, you will be asked to provide two pieces of information for any transaction: the destination’s address & the amount of Bitcoin to be sent.

This will cost you a fee, paid to the miner who will mine your blocks and will take a few minutes to be processed and validated, depending on the network congestion.

We’re usually talking about 30 minutes for it to be sent & confirmed, which a lot would call slow, but I can assure you that there is nothing faster to send any kind of amount, to & from anywhere in the world. Try to send $50,000 right now to a friend in Nigeria and let’s see how that goes or to buy $150M of raw material in China on a Sunday if you’re a manufacturing company.

But it sure is impossible to use to buy a baguette.

Lightining Network.

So developers did what they do best: they developed. And they came up with the Lightning Network. I won’t enter into the specifics because we’d need to get a bit more technical than this write-up wishes to be, but let’s sum up.

The Lightning Network is what its name advertises: a network, outside of the Bitcoin blockchain but interconnected with it and only communicating when necessary. Practically, I’d need to use a Lightning wallet and deposit my Bitcoins in this wallet – we’ve seen how to do that. From this moment, my Bitcoins are still Bitcoins, but they are not usable in the Bitcoin blockchain anymore; they are blocked in the Lightning Network.

Once in the LN, I can go about my day and interact with any merchants who’ve set up to receive payments through it – meaning with an LN wallet connected to a Bitcoin wallet, and Bitcoins blocked as well in this wallet.

When I want to buy my coffee, I’ll go over and pay like with a credit card except that, instead of passing through the Bitcoin blockchain, I will pass via the LN which knows that I own Bitcoins because I blocked them earlier. the transaction will be done between the LN addresses and the Bitcoin blocked on the network, without any need to interract with the Bitcoin blockchain & consensus, which makes the transaction almost instant - as fast ass with fiat at least.

At the end of the day or after the transaction, the LN will send an update to Bitcoin’s blockchain, not with the transactions themselves, but with the updated balance of the Bitcoin wallets, passing a bulk of transactions at once. As the Bitcoins were either way blocked on the LN, they couldn’t have been used on the principal chain, which doesn’t create any security issue.

It’s like if you had two bank accounts and you would transfer money from one you use to store your money to another one you use to consume. Once your consumptions are done, you send the money back to the original account and it doesn’t need to know what happened; it simply needs to know you’re down $1284.

I avoid a lot of technicalities for simplicity, but this is generally how the LN works and we’re now with rapid and costless transactions - as the LN now passes thousands of transactions through one transaction on the Bitcoin blockchain.

Not bad.

Compromising Bitcoin.

Before diving into the technicalities, I’d like to talk about why Bitcoin “cannot” be hacked, as the reason is very, very simple. Satoshi created a system where no one had any incentive to hack Bitcoin because hacking Bitcoin would mean that each and every Bitcoin in circulation becomes worthless. If the software falls, the entire castle is destroyed. This has two implications.

First, all of the network participants (miners, nodes, developers, etc.) have an incentive to work well. They work on Bitcoin because they are rewarded for doing so and have no interest in seeing Bitcoin fall. So besides doing their part right, they’ll also focus on forcing everyone else to do their own parts right and punish anyone who’s trying to commit fraud, harshly - usually a straightforward expulsion of every interaction with the blockchain.

Second, who would want to hack a system only to see it crumble? Stupid question - lots of people would love to see the world burn for no reason. But the question should be asked differently. Who in their right mind has enough will and resources to hack Bitcoin and destroy it for no gains? Because destroying Bitcoin isn’t a matter of a small tech hack; Bitcoin is open-source software which didn’t change much in 15 years. If it could have been hacked, it would have.

No, the only way to destroy Bitcoin is to take control of it, and there’s only one way of doing so. Although there are more risks we’ll talk about as well.

The 51% Attack.

Let me summarize what we’ve learned so far.

The PoW is a mechanism where miners compete to solve a puzzle, and the one solving this puzzle gets to propose their block (which is a ledger of potential transactions pending) to the nodes. Those will verify that everything is following the Bitcoin blockchain’s rules and validate it if it does. Most nodes are maintained by miners, and each of them is in competition, while mining a block requires electricity consumption - which costs money, of course.

The 51% attack is simple: it requires an entity to control more than 51% of the blockchain's entire computing power to reach sufficient odds of being able to propose your own blocks and validate them with a majority.

This is the only way to get control over Bitcoin and to “hack” it, although once this is done, Bitcoin will instantly lose all its value because it will be controlled by a centralized entity, and everyone outside of the global control of this entity won’t have any interest in it anymore. If this happens, Bitcoin is no more interesting than any currency we use today, with their control, regulation, and corruption.

A lot of effort for not much. But it gets worse.

Controlling 51% of the network computing power as of today is almost impossible for lots of reasons, the first being practical and the second being financial: we would be talking about dozens or hundreds of billions of dollars of material and electricity to perform it.

Practically, it would mean that one entity has to own 51% of the most powerful hardware available to mine Bitcoin - pretty demanded hardware as you can guess, very hard to find, and enough electricity to generate it all. You’ll find tons of content online to go further, but I think you understand my point here.

Doing it would bring nothing to the attacker, while they would have lost billions of dollars to achieve this. Now, it’s not just about “who in their right mind would do that,” it’s “who the hell can even do that?”

The only answer would be a state, and it would be very, very, very, very, very, very, very hard practically, even for them. But why would they?

Breaking SHA-256.

Another way of breaking Bitcoin would be to break the cryptographic keys it uses, developed using an algorithm called SHA-256. I won’t go into any details; SHA-256 is simply a cryptographic format, one of the most advanced we have, used for… Everything. If anyone were to break this cryptographic method, the world is… Fucked.

By breaking, I mean to hack it, although like Bitcoin, this is an old technology now and no one has achieved it yet - while the potential rewards are very juicy and many have tried.

Or, having a powerful enough computing power capable of solving SHA-256 puzzles much, much more rapidly than ours - this is what could be achieved with quantum computers, but we’re so far from there… And even if we did, Bitcoin would be ready for this eventuality - yes, Satoshi was very smart.

Other Bitcoin Subjects.

Now, we talked about Bitcoin, but we need to talk about other subjects & Satoshi Nakamoto himself, he certainly doesn’t receive enough praise for his invention and how he managed it all.

He wasn’t the only one who wanted to invent this new currency and Milton Friedman, him again, described what Bitcoin is today decades ago as the perfect currency, but it couldn’t be created back then because of the less advanced technologies, but also because no one could solve some mathematical problems… before Satoshi.

I’ll start by talking about him and what he did perfectly and some implications as they matter for this Investment Case. I’ll continue with some global issues that are important to be aware of and only end with those complex problems as they’re damn interesting.

Satoshi Nakamoto, the Genius.

Besides creating this perfect software and solving problems no one before him solved, Satoshi was also very aware of its creation, the implications, the risks & what his creation needed to work and never be copied. Because there is only one Bitcoin and there won’t be any other.

Anonimity.

First of all, as of today, no one knows who Satoshi really is (or was). And the few who could have known (mainly Hal Finney) aren’t here to tell. And this is for the best, for a few reasons.

First of all, his creation had one objective: take over the financial institutions of our world. It’s useless to say that you put yourself at risk when you do something like this, and governments are proving lately that “freedom” doesn’t mean “freedom.” We can talk about Assange and Snowden for when you go against institutions; we can also talk about Roman Storm or more recently Pavel Durov when it is about creating a tool which is then used for bad reasons by others. Satoshi would certainly have gone through worse for attacking the American almighty power: the dollar.

But most importantly, by staying anonymous, he made Bitcoin for everyone. Nothing would have been the same if we knew his identity, as he and his creation would have been politically tainted, twisted, morally exiled…

He also promoted others’ engagement, created a community, promoted integrity, and protected Bitcoin’s future. Bitcoin has been created and put into circulation without any bias.

It’s pure.

Disapearance.

The other, and single most important thing he did, was to disappear. This might sound awful to say as the truth is no one knows if he’s even still alive, but it still is the single most important aspect of Bitcoin today: the absence of its founder after this last message, more than 13 years ago.

It does matter for a lot of reasons, one of the main ones being that he left behind his Bitcoin wallets with a small sum in them, as he was the first miner. Estimates talk about 1 million… Bitcoins, disseminated through different wallets. A sum which would be valued at $57,861,370,000 at today’s price - I put all the numbers for you to grasp it.

Those Bitcoins are forever lost, and what should have been a maximum supply of 21,000,000 will be much less, counting Satoshi’s and numerous other thousands of Bitcoins lost by many individuals.

All of this made Bitcoin more valuable, by the mysticism around its founder as much as by the lost supply.

Environment & Criminality.

Two big concerns for many, and two more reasons for bears to scream at night, although they mostly are unfounded. Starting with the most ridiculous.

Criminality.

I’ll introduce this simply. Thanks to the press, always providing the most ridiculous examples.

Bitcoin is often said to be anonymous, but it’s not. Bitcoin is pseudonymous as every interaction users have with the chain is done through their address and is conserved forever in the blockchain. I’ll ask honestly, what kind of criminal thinks it is a good idea to use a public, unalterable, perpetual method of payment?

Even if it is pseudonymous, pseudonyms are easily attributed to persons nowadays, especially when transactions in Bitcoin are done through a digital way, be it internet or telephone, using infrastructures that are not at all pseudonymous.

I’ll let you go back to the article. If chain analysis says that Bitcoin is used for money laundering, then they’ll also be able to tell you who is laundering money… through the same chain analysis. No, crime and corruption usually take another form of payment method, called cash.

Now, I won’t go as far as saying that no illegal activity goes through Bitcoin, far from it. Illegal activity happens everywhere, with every method of payment. I’m just saying that the Bitcoin blockchain isn’t the best place to do so. If illegal activities were to be detected, they’d be “easily” traceable to the individual behind it because, at one point, your pseudonym will need to interact with your real self if you want to use your Bitcoin.

Environment.

This one requires more argumentation, but I’ll start with a fact: The mining industry uses two kinds of energy: clean energy and surplus (often combined), for obvious reasons: they’re the cheapest.

Remember that mining Bitcoin is all about making money at the end of the day; it’s all about getting the most Bitcoins out of the cheapest energy possible. Yes, mining does consume electricity. But how is it a problem if the energy used is from clean sources or from surplus, as either way, it would have been used or burned through other means, most of them useless? It’s like saying giving food to a starving kid isn’t a good thing. Would the food be better in the trash?

Many cases, interesting ones, are written about Bitcoin as a grid regulator, concepts I talked about here so I won’t detail on this case. Feel free to read if you want to go further.

https://x.com/WealthyReadings/status/1753466275227902385

Now, there is only one argument which I cannot argue against when talking about Bitcoin & the environment: Why waste electricity, no matter its source, to mine something useless?

I’d answer that we waste lots of electricity on useless things, Instagram being one, video games being others… Everything is useless besides feeding ourselves if you think about it. Now, is the soundest form of money ever created a waste of energy? Is a decentralised and tolerant onetary system a waste of energy? Is an accessible store of value to everyone a waste of energy?

I hope by now, you, dear reader, think differently.

Double Depense & Bizantine Problem.

Now we start some technicalities.

The Double Spend is one of the problems that couldn’t be solved for long to create a digital & decentralized currency, and its name sums up the issue: how to prevent users from spending twice the same money without having a centralized institution verifying transactions?

The Byzantine problem is a famous game theory problem where different generals have to agree on a tactic without communicating, without ever knowing if others have the same objectives - some might want to win, others be traitors, others retreat, etc. While the final decision must be the good one for the community.

After all the explanations above on the Nakamoto consensus, the question might look a bit stupid by now, but it wasn’t before Bitcoin, and countless people tried to solve this puzzle for years. The combination of each step of the Nakamoto consensus is the only successful example.

Through incentivism.

As I shared earlier, miners compete to have their listed transactions validated by the network, and to do so, they consume energy - which costs money. The winner is selected randomly after a few minutes, and no one can know which miners will solve the equation. To double spend, the malicious actor would need to find the key so he could propose his own block with the double-spending transactions on it, and he would lose tons of money through his electricity consumption to do so.

But even if he were to propose his block with the fallacious transaction, the nodes would need to confirm it, and to reach a consensus for a fallacious block, you’d need to have most nodes vote in favor of this block - which, of course, they won’t.

We are back to why a 51% attack isn’t possible, and that is how Satoshi avoided the double spend & Byzantine problem: By incentivizing everyone to behave properly.

An Inadapted Currency.

Now you know almost everything, but I’d like to share my opinion on Bitcoin as a currency because that is what it had been created to be. I am very critical of debt, inflation, our economy & governments in general, but it should be taken for what it is: A criticism of those using the tools, not the tools themselves.

Debt is important. It has been used for centuries properly and is what created Italy to be such a wonderful country thanks to the Medicis and other powerful families which created (or at least democratized) this system, while the Dutch invented what we’d now call the stock market for similar reasons. And in both cases, it ended up creating riches & innovations beyond many dreams, raising the world quality of life at an astonishing speed.

Until they used the tools wrongly, certain that they knew what they were doing. That’s where our governments are today: “We get it, don’t worry, it’s cool.” But it’s not, and we all see it. As to whether a world with Bitcoin replacing our financial institutions would be better?

It could, but it isn’t what I wish for it to be. Firstly because a world where Bitcoin has taken over would be a world which has seen many horrors as it implies that governments fell, or at least lost enough of their power to lose control of currencies…

Secondly, we need banks. Or more precisely, we need a system of loans & interest rates, we need a market. We need inflation. We need this to speed up innovation & continue rising our quality of life. We just need it all to be controlled, but to do that, we need to accept failures and responsibilities. We need to go back to Schumpeter’s creative destruction and stop creating money to finance unprofitable systems.

But I am losing myself; let’s go back on track.

I see Bitcoin as the perfect store of value, the one on which I personally store my money when it isn’t invested in other assets because I trust its value won’t depreciate. Even if other assets appreciate more, I trust Bitcoin enough to keep its long-term tendency safely as many out there trust gold to do so.

Conclusion on Bitcoin.

I said in the introduction that this was an overview. If you read it all, it surely looks like more than an overview, and yet, we only scratched the surface. There’d be so much more to say about the software & its potential impact on the world, but I have to stop somewhere and I think I have done a correct job of communicating the broad ideas of what Bitcoin is, how it works, why it is valuable while also talking about the risks around it.

We covered tons of complicated concepts, and as many of you know, I am not a native English speaker so I do hope my phrasing was clear enough throughout this write-up. If there is anything you disagree with, I’m always up for arguing or clarifying!

As to why it matters?

Because despite its strong volatility, Bitcoin is bound to go higher by design, exactly like the stock market is bound to go higher by design: because our currencies are bound to decline in value. The difference between the two is that Bitcoin isn’t political, isn’t bound to a geography, an industry, a sector, a currency…

Bitcoin is a self-sufficient asset.

And in my opinion, the only one worth keeping its wealth on, simply because it is more practical than gold. I voluntarily didn’t talk about volatility in this investment case because volatility doesn’t matter when we are talking about an asset meant to preserve value through time. I do not buy Bitcoin for next year; I buy Bitcoin for the next decade. Volatility is the argument of the short-term minded, not for a long-term investor doing their monthly or weekly DCA.

Bitcoin’s only weakness is also its unique strength: being a self-sufficient software. Its only risk, in my opinion, is the potential failure of its own software which would end tragically, without any doubt - probably with it going to $0. But after 15 years of working without ANY issues and having its entire code open-sourced and verified by hundreds of thousands… the risk is lowering each passing day.

I’ll conclude with possibly the most important words I wrote on this very long investment case - although they’re not even mine. They highlights how lucky we are to live in Western countries where our currencies are well managed while we fail to acknowledge the rest of the world, but also fail to imagine that things can change, even for us. The only thing in our control is to take care of ourselves.

"People that use fiat currency as a store of value, there's a name for 'em: we call them poor."

Bitcoin changes that.

Hats off to many hours spent on this quality write-up! I like how store of value is explained, background story on Satoshi is very interesting too. Awesome work!

Just read most of it, and will re-read. I'd love to connect to discuss if you're up for it! Hats off though to this work