Macro & Investment Narratives

Review of the Actual Macro Conditions.

This is the second investment write-up, following last week’s where we talked about portfolio construction & how different assets perform in different market & economic conditions.

This one will be a long read but also a complete one, coming right at Thanksgiving so you'll have time to read it peacefully, next to a warm fire.

We'll start with an overview of the actual economic conditions, focused on the U.S. What we can expect from Trump's government going forward, a review of the actual portfolio & details on the future narratives I will focus on, depending on how the economy shifts during the next months.

Small preface before we dive in, and I will conclude the same way. This report looks very bearish but I am not here to spread panic, I am not calling for a market crash nor the end of the U.S. & the dollar. This write-up is meant to share my view on how things are & what could be, with different investment scenarios depending on what reality will be. It’s about being prepared and knowing what & where to look, to anticipate & adapt.

Do not forget to read the conclusions; otherwise, you'd end up with a biased view after reading only the bearish or bullish part of this write-up. I'll share my base case & what I’ll look at to make my decisions at the end.

Stanley Druckenmiller & The Importance of Narratives.

I personally am a bigger fan of Druckenmiller than Buffett & try to emulate him the best I can. His strategy has always been "simple". Find the narrative, ride it along through all its verticals & bet big when you're right.

In one interview he gave some weeks ago, he talked about how "easy" it was to find the GLP-1 narrative and to ride Lilly's & Novo's trains. After all, obesity was a very big problem and he heard about this drug which seemed like a miracle drug.

It was also "easy" to ride the AI train because AI has existed for a long time & its only limitation has been computing power. He only had to find the company which would bring the next disruption in High-Performance Computing because everyone would want its hardware - obviously.

“Buy First, Analyze Later.”

And he did buy first, and followed the vertical. More computing power meant more AI services, so he also rode Microsoft & Amazon… Easy, right?

Find the narrative & the different ways to play it and milk it when you get it right. The first question is, are we done with those narratives?

I do not think so. The hardware part of AI is expensive by now and the software one which I played with Palantir is… Also expensive. There are a few more verticals to play there but we’ll see them later.

On the GLP-1 side, I still am holding onto Hims which has a role in the sector - although it isn’t a pure GLP-1 play, it simply is impacted by it which is more than enough to be part of the vertical.

I do not believe those narratives are over. But the buying opportunity is passed. A more interesting question is, what are the next ones? For that, we need to start with a broader view.

U.S. Macro

Starting with the economic health of the United States. Before I ramble, I am not a specialized macro analyst & certainly do not have the pretension to be one. I learn as much as I can and am sharing my personal opinion & vision of the world here, looking for opportunities.

I'll sometimes be wrong. I'll sometimes be right. What matters is to make more money when I'm right than I lose when I'm wrong, and to always learn from the mistakes along the way.

Fiscal Dominance.

This is probably the most important concept to understand about the U.S. economy; The U.S. fiscal policy - government spending, is much more impactful on the country's economy than its monetary policy - the FED.

This happens when the FED’s monetary decisions have a non-negligible impact on the government, to a point where some are taken - or not taken, because of the impact they’ll have on it - some could bankrupt the government. Something which should never happen as the FED should always remain independent.

And yes, this is due to the U.S. massive debt.

The reason is simple: Interest rates. As the Fed raises them to fight inflation, it raises the interest the U.S. government pays on its own debt. The government is already indebted for paying for things with money it didn't have so raising its interest payments requires more money, which it still doesn't have. Its only way not to default on its debt is to emit more of it to pay for it…

The vicious cycle starts here as emitting more debt requires money creation - also called inflation, which the FED is trying to fight by raising interest rates… Which forces the government to create more debt to pay for its actual debt, etc, etc…

This is the single most important concept to understand in the actual U.S. economy.

Interest Rates & 10Y.

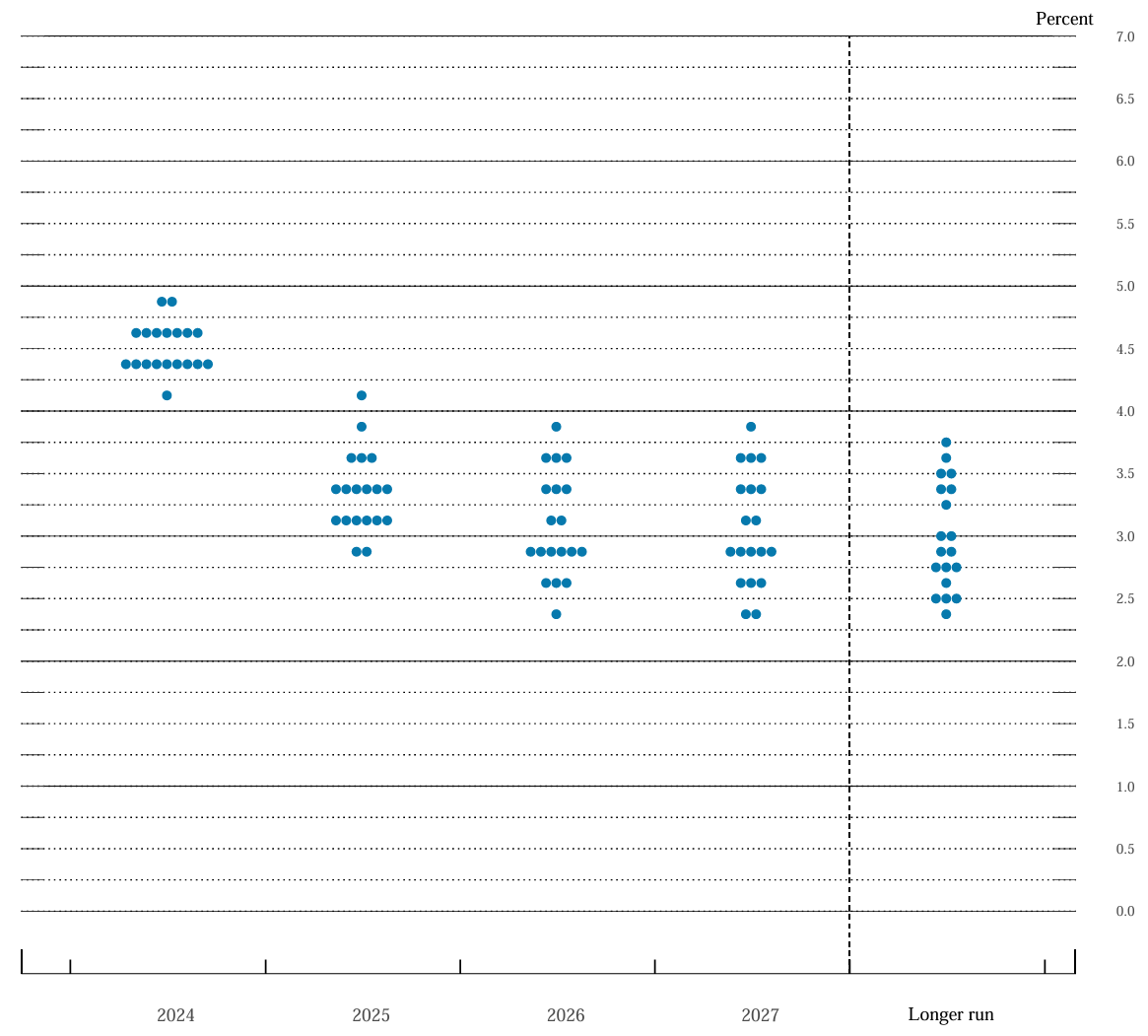

The US10Y is telling the same story, one of continuous inflation for longer as investors refuse to lower their long term yield to lend their cash. This might change in the short term but at the time of writing, the 10Y is still flat around 4.3% while the Fed started to cut rates in September.

More cuts should come, slowly, but it won’t change the actual problem, even if we were to stabilize around 3% for the next years.

No need to do the math, with a 123% debt to GDP at the time of writing, having interest rates at 3% by 2026 will be better than 5% but still too high for the government. It doesn’t leave many options.

Either, continue on this path & emit more debt to pay their interests. Which means continuous monetary creation with its pace the only difference - higher rates mean stronger fiscal deficit and lower monetary creation while lower rates mean slower fiscal deficit & stronger monetary creation. Inflation either way. That can be sustained until… Something breaks. As Lyn Alden would say,

Or, drastically reduce the debt emission & find ways to repay a portion of it. Which is part of Trump's program and we will talk about it later.

Consumer & Inflation.

As I said, in a fiscally dominant economy, monetary expansion doesn't stop with higher interest rates; it is displaced. Growing the monetary mass means inflation & liquidity, which is good for debtors & asset owners but terrible for lenders & workers. This creates two different economies: the haves and the have-nots.

The haves remain healthy as they own assets or debt at fixed rates, contracted before the hikes - or both. Inflation isn't good but isn't much of an issue either, as a devalued currency means less expensive debt & increasing value of their assets. What they lose in buying power from their salary, they easily compensate with their assets & debt depreciation.

The have nots on the contrary, do not own assets & are locked out of debt due to their situation & lack of collateral, while inflation crushes their buying power as their salaries do not keep up with it. You would have needed a 20% salary increase since 2020 to keep up with U.S. inflation.

I've seen many comments talking about slowing inflation, almost back to the Fed's 2% target, but the reality is far from it. Most of the deflation comes from energy, while other components are still way above target, most of them being necessary products & services, not leisure activities.

When households' rent, medical, transportation or energy services & food prices grow at more than 4% per year, life becomes much harder while they can't do without those. The tendency doesn't seem to change in the short term, although lower energy prices are the first step of global decreasing prices.

The longer this situation persists, the more haves will become have-nots as there is a threshold for every household. As more and more of them reach it, they will reduce their consumption to basic needs. I could even argue that this tendency has already started as global consumption adjusted for inflation has been decreasing since 2021.

This isn't a healthy tendency as it means that even if households spend dollars, they buy fewer things. This has happened a few times already during the last decades, and I'd just comment saying that the gray zones on the graph are recessions.

The only difference between our actual economy and the recessions of 2001 and 2008 is that the haves are still healthy thanks to the market. Both recessions came following a market crash as the haves reached this famous threshold due to their assets losing value rapidly.

The markets can continue upward as long as the U.S. continues to expand its debt & monetary supply, devaluing the dollar and pumping its market through constant & indirect liquidity injection.

“Nothing stops this train.”

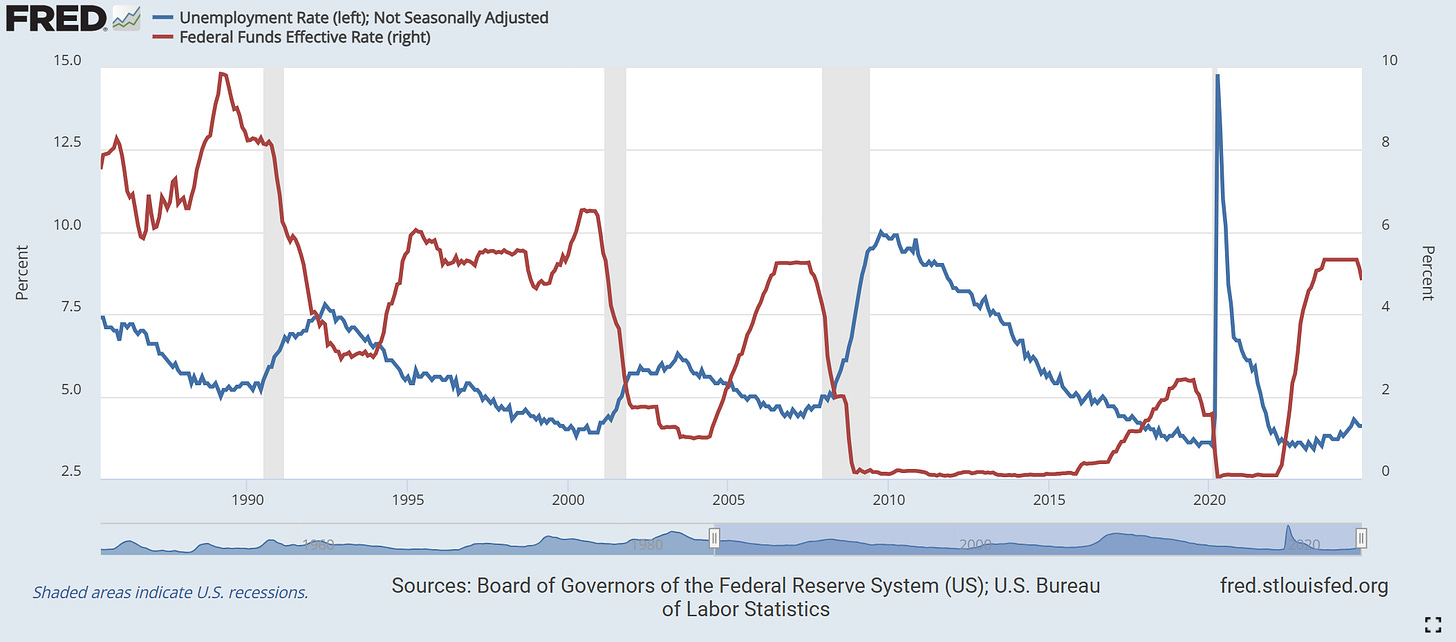

Unemployment.

The second mandate of the FED, usually correlated & lagging with interest rates. A growing unemployment rate typically leads to a recession, as it means less buying power for more households.

This can lead some haves to become have-nots and reinforce the vicious circle of lower consumption, and unemployment will be a significant part of the next portion of this write-up.

One thing for sure is that it makes the FED's job harder - as if it wasn’t hard enough. They cannot fight inflation without creating inflation. Lowering interest rates would relieve pressure on the labor market but also accelerate inflation. Keeping interest rates high will only moderately slow inflation and continue to hurt the labor market, and hiking interest rates isn't an option as it would bankrupt the country.

There are no good solutions.

In Brief.

Let’s try to recap.

The United States is operating under a fiscal dominance that mostly renders the FED’s policies anecdotal, as they cannot efficiently fight inflation. We can even go further by saying that trying to combat inflation is actually inflationary, and trying to bring relief to the labor market is also inflationary.

Logically, the market doesn't believe that inflation will come down drastically over the long term despite the Fed cutting rates.

This creates a two-speed economy with the healthy haves and the crushed have-nots, increasing pressure on lower-income households and globally reducing consumption. This tendency should continue as long as the markets remain on a bull run, which is fueled by the current direct or indirect monetary expansion.

I painted a pretty gloomy picture, but I am not one to say that things are doomed or that we are heading toward disaster, screaming about the end of the world. I am trying to present an honest picture of the current situation and to create narratives from it. This is how I see the situation for now.

Now we move to the future.

Trump’s Election & Measures.

Trump has been elected on the narrative of saving America, putting it back on track, restoring innovation, monetary and military dominance, economic power, creating a place of abundance, etc…

His campaign was based on a few key points: reducing expenses, reducing debt, reducing interest rates, reducing taxes, increasing labor demand. It seems like a dream and could be every politician's campaign; the question is, can he actually deliver?

There will be some speculation, but one thing is certain: Trump’s first actions will significantly & rapidly impact the U.S. economy, especially if he follows through on his promises. The outcome will depend on how his administration implements these measures & what priorities they set first. Those decisions will be the most important things to watch for our investment strategies.

I won’t go over all his measures in detail; I will judt give a brief opinion on the most important ones & how it would impact the economy from my perspective.

Department of Government Efficiency.

The DOGE is a new department where Vivek Ramaswamy and Elon Musk will work to cut & control government spending and decrease U.S. debt emission, which is the first and necessary step before even considering repaying it.

It seems like they are taking a Javier Milei approach, or at least that is how they are marketing it. Here’s an interview with Vivek Ramaswamy from 11/18.

“We expect mass reductions. We expect certain agencies to be deleted outright. We expect mass reductions in force [...] we expects massive cuts among Federal contactors [...] I think people would be surprised by how quickly we’re able to move.”

It couldn’t be clearer to me. In plain language, cutting costs means firing people, and those would, of course, end up unemployed, at least in the short term. We are talking about 3 million jobs that could be affected - which of course doesn’t mean 3 million fired employees.

Cuts among contractors would be even more severe as there are surely many more employees who are entirely dependent on federal funds, kinda leeches. Cutting those will increase unemployment.

In short, if this is done Javier Milei style, it will trigger a recession. It can be a short-term wrong for a long-term right, but it will crash the stock market short term.

Tariffs.

Reducing the debt is step one. The second step is to grow incomes which Trump plans to do through tariffs, which are taxes imposed on any product imported into the United States.

I won’t go over the entire pros & cons of tariffs as that isn’t the focus of this write-up. A quick conclusion is that tariffs are factually inflationary, and even if they can improve local production, they tend to increase global prices of the impacted products, both locally manufactured & imported.

In the short term, increasing prices does not help consumers who are already struggling to buy inexpensive products manufactured overseas.

Taxe Cuts.

Trump wants to cut taxes for single payers, households & corporations. This would be a good thing for consumption, the economy & the market, but things are more complicated.

This can happen only if the government finds new sources of financing; otherwise, the lack of income would need to be compensated to continue government spending. This new source is supposed to be tariffs. It isn’t a simple calculation to make, but a small reduction in taxes would require a massive income from tariffs to compensate - hence massive inflation.

And compensating would be the minimum required to slow the debt emission or even consider repaying a part of it.

Cutting taxes would be wonderful for everyone. The question of feasibility is another matter; The market would react positively to it, as it is driven by liquidity rather than rationality.

Deregulation.

Probably the most important measure of Trump’s mandate, deregulation won’t face much opposition - although it also means firing people, as deregulating implies less control and therefore a lower need for manpower.

This should also boost innovation and create jobs over the medium term, as companies will be able to move faster. It’s a bit hard to judge how things will unfold.

Energy.

Value is energy transformed and the source of growth; hence, the U.S. needs cheap energy. This is a priority for Trump, who intends to turn away from clean energy - or at least not prioritize them anymore, and favor the cheapest & most efficient sources. This primarily means oil & nuclear.

Wars.

Trump has always said he would end the war in Ukraine on his first day. It’s pretty hard to understand the ramifications of this decision economically, but it will cut significant short term spending.

Things could be different with Israel, which Trump has always supported although he was also the initiator of the Abraham Accords meant to pacify the region. It’s hard to know if he’ll confront Iran in an inflationary manner or if he’ll act as an intermediary and try again to pacify the entire region, as stability would be very beneficial for the world economy. It’s a matter of heads or tails here.

In Brief.

Starting with pleasant measures from the market - like tax cuts, would be terrible for the economy as it would mean a growing debt to compensate, hence a continuous fiscal dominance. But it would certainly be welcomed by the markets.

Starting with strong cuts in expenses with the DOGE and tariffs on the entire world would increase unemployment & inflation in the U.S. and accelerate its path to an unavoidable recession.

Once again, Trump’s first measures will be the most important thing to watch when he takes office in January. My base case is that it’s all teeth and no bite, things will continue as they are as no president voluntarily plunge their country into recession, especially when the long-term consequences are impossible to forecast in the actual geopolitical state of the world. Javier Milei did it in Argentina, but that is a special case & Argentina isn’t the U.S. I do not believe Trump capable of doing it; The future may prove me wrong but for now, in other words…

“Nothing stops this train.”

He will take office with one truth: it’s all in or nothing.

The Narratives.

Portfolio.

Performance has been pretty good, as we’re returning 22% more than the SPY since inception in early September. Its composition paints a very different picture than the gloomy one I described above.

The market is driven by liquidity more than economy. I tried to give you a review of it at the moment and to talk about the risks, but until those risks & weaknesses translate into very high probability/significantly lower consumption or tightening liquidity, the market won’t care.

We’re still risk-on, and I’ll stay invested until I start to see weaknesses in the narrative I invest in. Here are the actual holdings & a words about them.

Bitcoin & Crypto. The obvious narrative at the moment, which composes around 40% of my portfolio, divided between crypto and Bitcoin-related assets - namely IREN and CLSK which are Bitcoin miners.

Missing MicroStrategy might have been my biggest mistake in this cycle, but I expected liquidity to shift towards altcoins, including Ethereum, much faster. Performance is pretty strong either way, so I won’t complain.

Hims&Hers. This one follows its own narrative, although it picked up following the GLP-1 one. I see no reason to take any profits on it, I still consider it around fair value and am not particularly concerned about the market in the short term.

Undervalued Plays. This includes PayPal, Lululemon, SoFi, and Olo, which are all great companies that got oversold or remained undervalued over the last few months.

Diversification. We’ll dig on this part of the portfolio later, but in a few word this is the start of my rotation to potential new narratives. The first one in China with two companies, Alibaba & PDD and a broader position in the Chinese index with the KTEC ETF. The second one on gold to anticipate potential inflation with the IAU ETF - a gold ETF, and the GDX ETF - a gold miner ETF as if the price per ounce climbs, miners’ revenues, profitability & returns also climb.

Long Term Holdings. We will talk about this at the end of this post, but only Google could be considered a long-term conviction in this portfolio - and Bitcoin, but I intend to play the cycle and therefore sell it.

I didn’t talk about Airbnb which is supposed to be a long-term conviction, but the current economic health and macro conditions don’t make me very optimistic. The app & company are both wonderful but rely entirely on Western users, and when we see European buying power plummeting and U.S. consumers slowing down… I am a bit doubtful on their capacity to travel medium term & on Airbnb’s capacity to convince other populations to use their app. They might end up stagnating for a few years because of this.

I’m still undecided but would sell those shares if I find a better opportunity.

Gold.

I shared in the first write-up that gold was a good asset during inflationary times, in both growing & declining economies.

As mentioned above, my base case is continuous inflation through fiscal dominance or rate cuts, while rate hikes would also be inflationary due to faster debt emission. The only way to escape this vicious cycle is through a drastic reduction of expenses, which I judge unlikely but is part of Trump’s plans and would bring the economy into a recession - also favorable for gold.

It seems like a double-win situation, although the road might be bumpy.

Value.

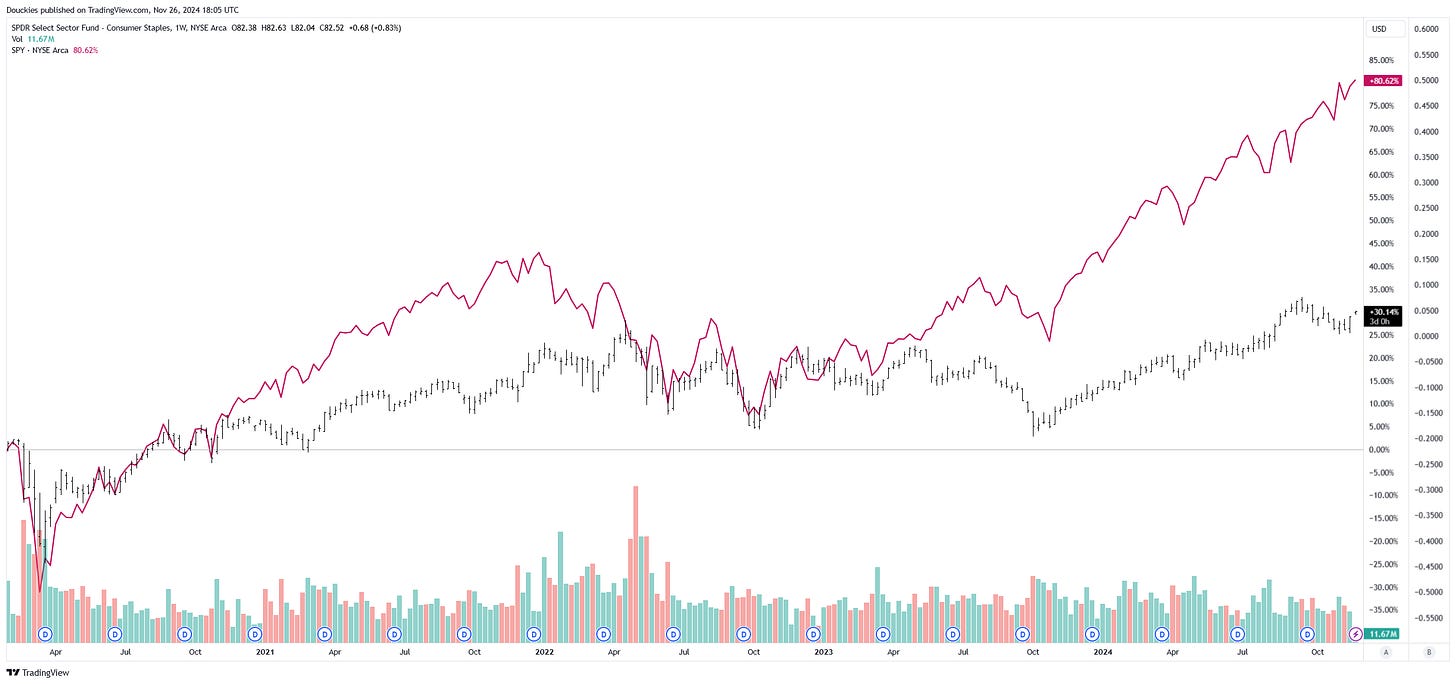

Other performing assets in recessions are value stocks, giant corporations. Some of them have been beaten down over the last few years as liquidity flowed to tech & small caps, looking for better returns as optimism came back short after the COVID outbreak. They were largely outperformed by the SPY but are gaining some traction lately, which is understandable as some trade under 10x earnings while yielding up to 4% or 5%.

And that’s acknowledging that this ETF includes Costco and Walmart, which have both largely outperformed the S&P 500 during the same period, to give you an idea of how bad the rest has been beaten down.

I am not planning to buy those yet because I’d like to see more bearish signs. Those will be the defense of the defensive play, it’s simply worth keeping an eye on how they behave for now, as liquidity usually moves before things happen.

Energy.

This is probably the strongest narrative to look at during the next months & very likely years, as it can play out through different situations. I won’t dig on this subject now & will write an entire investment case on it later, I will simply list the different cases I look at.

U.S. Reindustralization.

This narrative is pretty straightforward. Trump and his administration campaigned on bringing back jobs & industries to the United States, meaning bigger energetic demand hence a need for increased energy production & storage, which can come from different sources.

The first big subject is about nuclear energies, which many tech companies are talking about to power their datacenters. This will certainly be a big narrative in the next years in the U.S. but also internationally as China is expanding its nuclear park rapidely & others could follow.

Second is of course renewable energies, likely focused by households. There’s certainly something there, but I wouldn’t focus on it too much especially without subsidies from the state.

Last but not least: storage, probably the most interesting subject right now, which could be combined with renewable energy or not. The way I intend to play this is very simple, and I am already invested: Tesla’s Megapacks.

The conditions for this narrative to play out would be an healthy reindustralization, which isn’t my base case short term but is worth keeping an eye on, as I could be completely wrong & it could either way happen after a small recession. It’s worth starting to dig in the subjects & find good companies already.

Emergeant Markets & Oil.

There is a case to be made for growing oil consumption in the U.S. following an increasing demand, but the real bull case for oil & gas comes from emerging countries in my opinion.

Once more, growth comes from value creation, which itself is nothing but energy transformed. Every emerging country wants to develop & grow, which involves energy consumption. Unlike developed countries, they mostly rely on oil & gas.

The conditions for this narrative are a weak dollar, which is in line with the actual devaluation, combined with lower interest rates. Emerging countries have debt denominated in dollars because no one wants to lend them money in their local currency. A strong dollar is terrible for emerging markets and their growth is strongly correlated to it, as you can see here with Brazil’s GDP - in pink, as an example.

This is the entire bullish case for oil & gas producers & transporters: a growing demand coming from America, but mostly from emerging countries who can finally focus on their development thanks to a weaker dollar & lower interest rates, increasing their purchasing power.

We’re far from there yet, but I am actively looking at oil & gas producers and transporters and will initiate positions if we see the conditions materializing. This would probably be the start of a much bigger move in foreign markets as growing energy consumption will lead to more investments, more jobs, more liquidities, more demand and again, more investments etc… Creating a virtuous cycle from which we could extract tons of value.

But it has to start with a weaker dollar & a growing energy consumption.

China & India.

Those two are apart because they do not rely on the dollar and have access to debt, resources & energy with their own currency. This simple detail changes absolutely everything for a country’s development.

China.

Starting here because we talked about it already and nothing changed. We have two ways of playing China and I personally intend to do both.

Firstly, the local stock market is trading at ridiculous valuations while having grown in terms of revenues, earnings, productivity and returned value to shareholders. My favorite example is Alibaba, but it isn’t the only one.

A situation probably due to many investors being scared for their funds in case of geopolitical disagreements - Russian assets are still frozen in America since the war, incapacitating investors to access them.

It isn’t the only one though as China isn’t alarmed enough by its actual deflation & the tendency of its population to hold on to their cash more than to consume.

This is what happened to Japan after their bubble in the 90s and… they’re still stuck.

Two things would change the situation for China, in my opinion: Greed & stimuli. The first one is about their stock market being so attractive compared to the American one that greed would make most overlook the geopolitical risks. And economic stimuli would force the population to consume, bringing back inflation.

There’s nothing to monitor greed, but things are moving on the stimuli. Slowly but steadily, China announced some measures which confirm their will to work on this situation. To me, this isn’t an if but a when.

The second goes in parallel with a growing consumption in China & Asia at large by owning companies selling products in the region. This region will see the fastest growth in terms of buying power in the next years, and when households grow more comfortable, they tend to spend on leisures & pleasures, including goods. I hold on to Lululemon & On Running shares for that exactly, but there are many other companies who could do the trick - especially LVMH at current valuation to mix value & Asian exposure, and more.

India.

This is a very different subject entirely. India is a rapidly growing country with wonderful brains & investments. The bull case is simply that with access to Russian energy & Chinese commodities, they’ll thrive.

This could simply be a DCA & wait situation, although their stock market needs to cool off a bit for now.

Long Term Holdings.

I just want to clarify, before I conclude, that some of my positions are following narratives and are meant to be held under some conditions. Others are long-term convictions which I would hold through crashes & focus on always accumulate more of them, as long as the fundamentals don’t change. There are lots of good stocks and companies, but only a handful I’d include here.

Meta.

Palantir.

Transmedics.

Tesla.

Bitcoin.

Those I intend to buy & hold, no matter what happens, when I get opportunities.

Conclusion.

Base Case.

Before concluding, I’ll share my own base case and what I’ll do & look for during the next months.

Short term, I am happy with the current market. There are some signs of heat without any doubts, but we’re far from ridiculous & bubbly valuations. I will continue to slowly build my gold & Chinese position, monitor what Trump administration intends to do and research the oil & gaz sector to be ready.

The crypto market is heating and I personally do not believe I will stay in for very long. I intend to get out the second things smell smoke. But we’re not there yet, and I will share with you the day I sell it all.

Medium term, my personal take on Trump’s DOGE and tariffs is that they’re all teeth and no bite, as it is much harder to trigger a recession intentionally than to continue creating debt. I do not expect significant reductions of it nor of its emission rhythm, which means the economy will continue in fiscal dominance, hence a continuous money creation the FED cannot do anything about.

This means a continuous decrease in buying power for the have-nots and the lower portion of the haves, a thriving assets market boosted by liquidity but also a necessary recession at one point - hence the slowly growing gold & Chinese position, as a recession in the U.S. will drag liquidity somewhere else.

I’ll keep an eye on the other subjects I talked about but do not intend - for now, to start any position in foreign markets, value stocks, nuclear stocks, India etc… Those are potential narratives I will only keep an eye on.

The only narrative I will look at actively is the oil & gaz producers & transporters, to have the information & knowledge I need, if I need it.

Things change, and I will adapt if things are different from what is written here. I will look at nuclear & energy stocks if the U.S. economy gets healthier after Trump’s transition of power, or look for another valid narrative.

I will buy value stocks if things get worse faster than expected or if the DOGE shows a wish to go all-in, Milei style.

I will look at emerging markets and commodities rapidly if the dollar weakens without signs of rate hikes.

Etc…

Final Words.

This was a long read.

This write-up isn’t meant to be right or wrong; nothing written here was meant as a prediction. It isn’t a call for a market crash or the strongest recession ever either. It is meant to provide a precise idea of where and what I will look for in different, possible scenarios. To be prepared, to know what to do and what not to do, to try my best to extract performance where it is.

One more important thing: the economy & the markets are two wildly different things. Stocks don’t care that the have-nots buy less as long as others buy more. Markets are driven by liquidity, not sentiments - a lesson hardly learned by many during COVID. We can have a sickly economy and a thriving stock markets for years before things turn, as Peter Lynch said:

“Far more money has been lost by investors in preparing for corrections, or anticipating corrections, than has been lost in the corrections themselves.”

I have no idea what will happen; I just want to have an idea of what could happen and be prepared when signs show it will. For what I know, the stock market could continue to print new highs for years before turning red, boosted by constant liquidity creation from fiscal dominance. Or it could crash in February.

Investing isn’t about being right; it’s about being flexible.

Very well written and incredibly insightful. Thank you for sharing!