Hims & Hers Q2-25 | Earning & Call

Narrative is the only thing which matters in the markets.

15% discount on FiscalAI subscriptions through my link. FiscalAI is the tool used for KPIs on all my write-ups; powerful, valuable data & great UX.

https://fiscal.ai/?via=wealthyreadings

Everything you need to understand Hims' bull thesis is here.

I'll use this report to detail why but I'll be crystal clear from the start: I will close my position entirely either today or during the next days, depending on PA, after more than 200% returns in a year or so.

The first thing to comment on this quarter is that optics are complicated, and they are the only thing which matters in the market, hence the stock reaction. And I personally don't see any reasons for them to improve medium term, so I do not believe the market will be kind to the stock.

Management said it themselves.

And so I think that this is probably a conscious multi quarter transition, but as we kind of hit the back 2026, we would expect it to be accretive and probably the right long term move for the business.

So why would I hold? Why not take liquidity back & watch from the sidelines? Many questions are left unanswered for Hims’ future at the moment & the plan could go south from there. Uncertainties aren’t bullish & hope is not an investment thesis.

Business.

There are no other ways to say this: Hims could be finishing its hypergrowth period & enter into its developing period where the business will either bounce or slowly die & its stock will do the same. I’ll detail why I believe that but let’s keep in mind that our goal in the markets is to make money, not to fall in love with our stocks.

When fundamentals do not perform anymore, we cut them loose.

User Base.

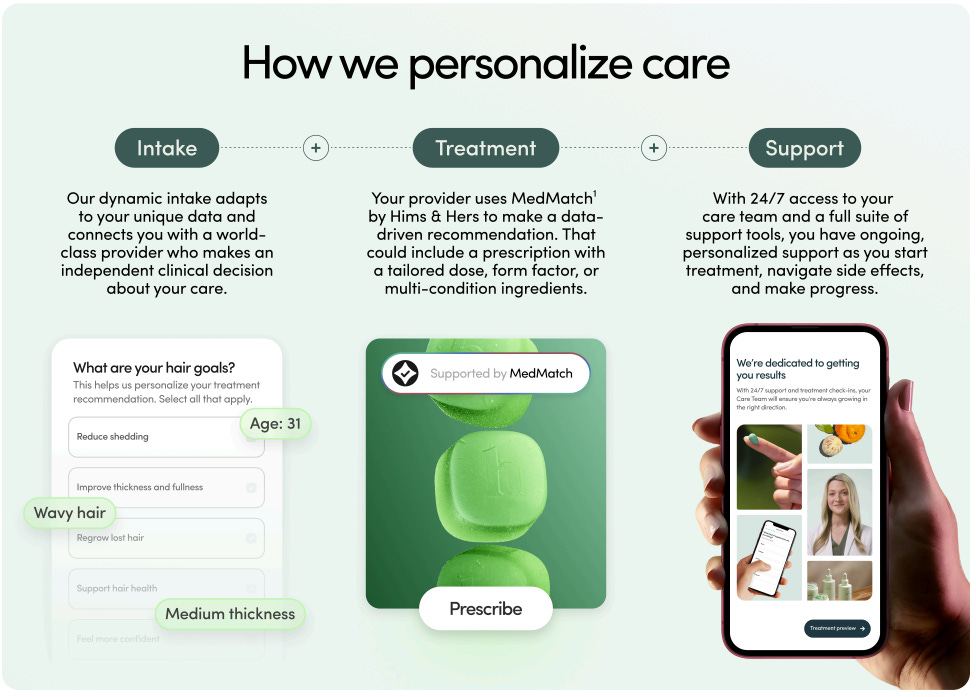

Let’s start by users, which is the bread & butter of the company. The bull case was and still is constant onboarding, retention & conversion onto personalized treatments.

Starting with acquisition which is slowing down, big time.

Using the YoY comparison won’t be interesting for hypergrowth stocks, we need to use shorter timeframes to judge its trajectory.

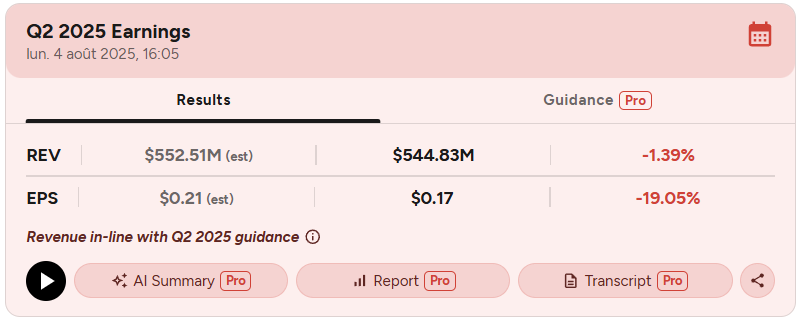

Subscribers increased 73,000 quarter over quarter to over 2,400,000, reflecting a year over year growth rate of 31%. We see continued robust subscriber growth across our dermatology, oral weight loss, and daily sexual health offerings that all sustain year over year subscriber growth rates above 55% in the second quarter.

Hims has never onboarded less than 100,000 so falling below, while their offerings have never been better, is pretty tough.

Now to be fair, most of this is due to the company losing its global GLP-1 business as the shortage ended & some users came exclusively for it. Truth is, the company did add as many users as usual - around 200,000, but lost many from previous months. This isn’t really an acquisition problem, but a retention problem due to the GLP-1 products termination - or regulation.

This theory seems confirmed with the lower average revenue per subscriber, which declined massively as GLP-1 was a much more expensive product.

Take away would be that global demand for the platform is still healthy & onboarding doesn’t see any slowdown, with a slowdown only with retention. Now that the GLP-1 users left, the trend could go back to normal.

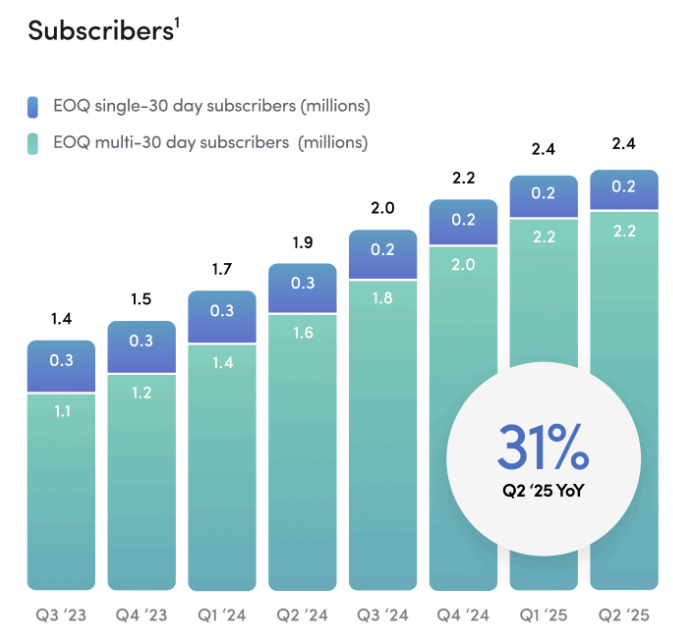

Leaving speculations, on the good side, even if retention slowed down this quarter, we see a continuous growth of the personalized plans which means conversion of retained users continues at a correct rate - slower but still alive.

So there’s a mixed feeling in terms of users; continuous onboarding, slower retention & healthy conversion. It’s hard to anticipate the next quarters but if the core business continues to attract, this churn could be a one-time event.

But there are no ways of being certain at the moment, and that would lead to another problem we will talk about in the revenue section: revenue growth, as even if Hims continues to onboard & convert, those users will yield less revenues as they’ll buy cheaper products - cheaper than GLP-1 treatments.

We also had comments on the performance of Hims’ GLP-1 treatments and retention rate, which I already talked about but would like to add some words as social media is full of what we can honestly call dishonesty, even from Andrew here...

This is particularly encouraging when considering discontinuation rates in certain publicly available studies reached approximately eighty percent by six months.

The studies used for comparison here date from 2023 or so, when branded solutions were on shortage & did not have a large mix of doses hence triggered massive sie effects on users. This is not the case anymore and most earlier studies show a retention rate between 50% & 60% for Novo’s Wegovy, after a year.

Hims has the best price/results ratio, but results by themselves are comparable, even slightly lower for Hims than branded products - still efficient though.

Expansions.

Management has lots of plans for its business & will require lots of spending.

Third, we expect that we are entering an investment period for at least the next year, particularly in marketing and technology. Augmentation of our engineering talent with expertise in AI development and the scaling of global platforms is expected in the coming quarters. Marketing investment will be higher as a result of seasonality in addition to investment to support the scaling of new geographies and offerings such as labs and hormonal support

This is a good thing, investments in growth are always important & when it comes to Hims, they’ll need to offer more if they want to become a central healthcare platform.

Products.

We should see hormonal solutions starting on the platform this year, which is about time to be honest… I know this kind of products take time to develop but I find it weird that management didn’t put all of their efforts onto this as they knew it could help for the GLP-1 transition.

Our upcoming launch in hormonal health marks a significant step forward along this path. Our approach will provide access to personalized solutions for both men and women to effectively manage these hormonal changes.

Second, Hims is planning to expand into longevity and will have its lab testing facility available in the next quarters.

For the coming quarters, we plan to begin offering lab testing as a stand alone service.

Geography.

Hims is already expanding into Canada & Europe with Zava’s acquisition & has more plans in Asia & Latin America without any specific dates, but a comment saying that generic semaglutide will be accessible legally in Brazil next year, like Canada.

In 2026, we expect to enter Canada with initial focus on holistic weight loss program, time to align with the anticipated first ever availability of generic semaglutide globally.

I already talked about the potential in this market, but numbers should be revisited lower as management shared the price target for their GLP-1 program would be in the $75-$100 range while the numbers I used are their U.S. pricing around $200.

But management still has high expectations not only for Canada but for its global expansion, including Europe.

We are still assessing the impact of this, but expect the ZAVA acquisition to deliver at least $50,000,000 of net incremental revenue for the remainder of 2025.

Which also means that the guidance you will see later would have been lower without Zava’s acquisition, which wasn’t finalized when the guidance was shared earlier this year, hence another data pointing towards lower growth from core business.

Management’s vision is pretty clear & focused.

I think long term, we believe there's a multibillion dollar revenue opportunity in just a handful of key markets, and I think you'll see us in the next, you know, one to three years going after those focused markets.

I commented already that international expansion in healthcare was complicated, in Europe especially but probably everywhere else as no country has comparable systems to the U.S. Those will take time, investments, user acquisition costs & much more before being profitable, if ever…

AI & Tech.

I’ve said many times that Hims was more than just a drug dealer, their app & AI is as important as the rest to anticipate, plan & serve its customers.

But but we aim in the next three to six months to be building out technologies that are immediately improving efficiency, improving engagement, providing support across the stack.

More investments to come in this area as well although we don’t have details, logically.

Financial.

We’ve seen the fundamental challenges, now let’s see the financial ones.

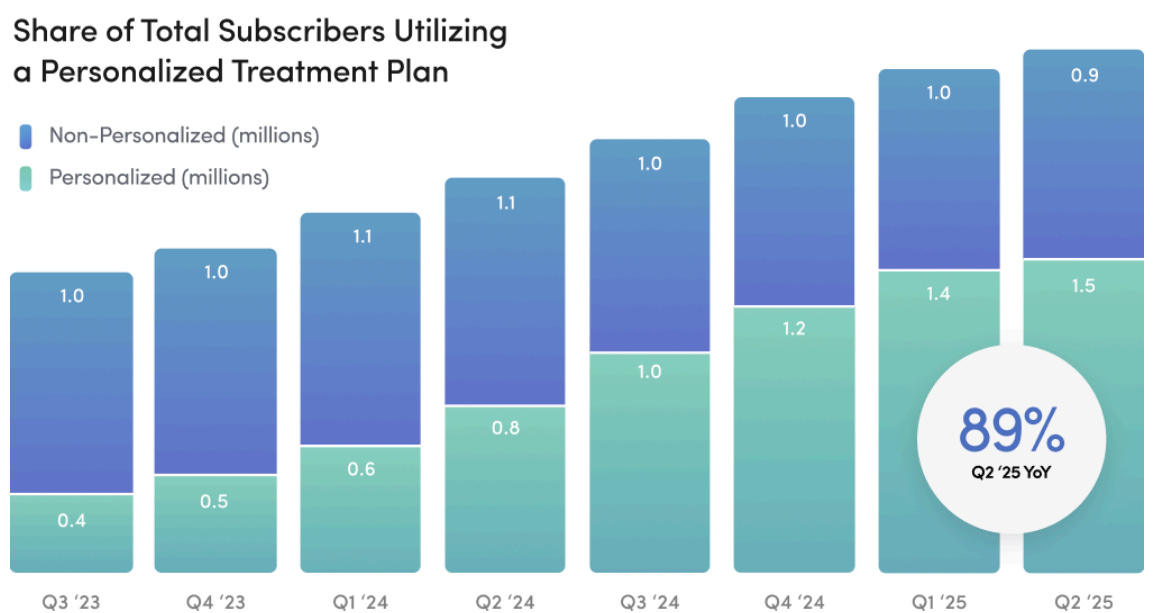

To comment on the quarter first, we have a strong 72.6% YoY growth but this is only the tree which hides the forest as we also have a 7.2% decline sequentially, a massive issue for a hypergrowth stock - except if it were to be a one-time thing.

The real problem is that more precisely, $190M come from the GLP-1 business - not weight loss, GLP-1; hence $354M from its core business compared to $356 last quarter & $300M last year, or a small 18% YoY growth.

I’ll leave it up to each to include GLP-1 or not, I personally don’t believe this source of revenue is going anywhere but it should continue to slow down as more dosages are available from branded solutions and the only new legal growth source would come from international & as said above, at a much cheaper price & a lower volume - and without any timeframe.

There isn’t much to comment on the rest with increased expenses as the company is trying to scale, which is normal but slightly hurts pre-tax margins as we come from a lower revenue base. On net income generation, it is important to note the tax benefit of $9.6M which grows cash generation massively, but isn’t part of the business.

Balance sheet remains correct following the convertible debt offering in May with $1.3B of cash for $1B of debt - in the form of notes not loans. Their balance sheet took a hit with the acquisition of Zava which should have cost around $270M as their cash pocket has been emptied sequentially. Could be a pretty great deal if they can achieve their $50M revenues target H2-25.

Guidance.

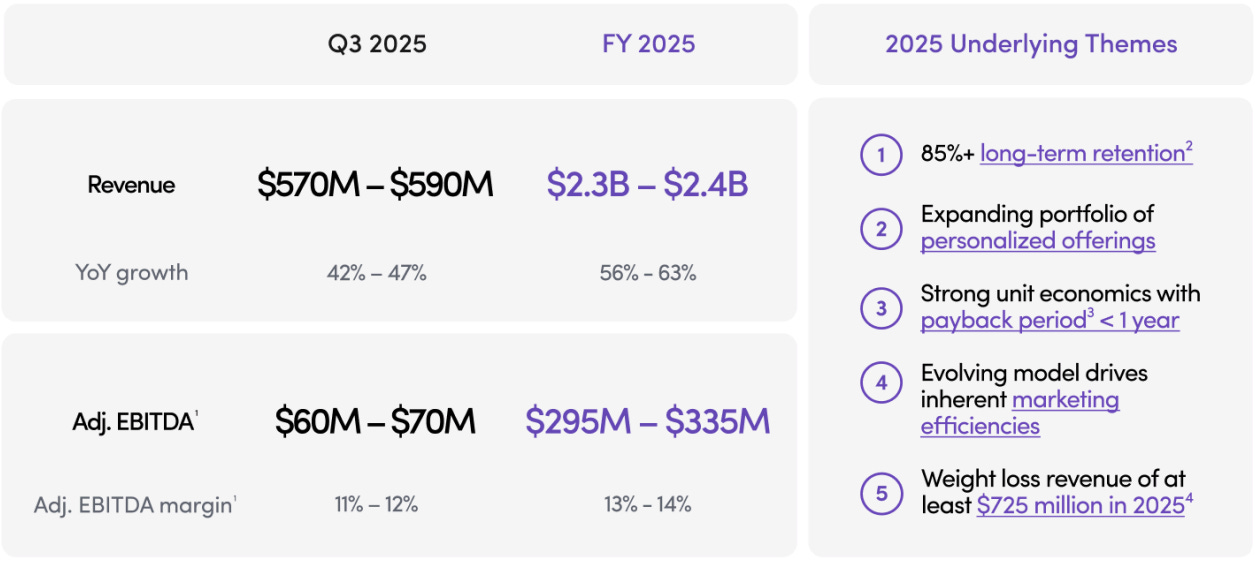

Management reaffirmed its FY guidance but the sequential one is once again, pretty disappointing.

We would be talking about 4.7% sequential growth but more importantly, we would need a Q4-25 revenue around $600M to reach the low end of their guidance which has not happened this year and will probably not as there should be no reasons to see accelerating sequential growth by then. No new products nor geography & potential continuous churn from GLP-1 users.

Investment Excecution.

As you understood: this quarter was underwhelming and should open some eyes; we won’t see hypergrowth anymore. Sure, the year could end at a 55% growth or more, but FY26 will be very different as Hims won’t be able to sustain this rate.

In brief, user base is healthy & I wouldn’t be too concerned on acquisition, but I am concerned on average revenue per subscriber & conversion/retention rates. This would yield a lower growth as users spend less on the platform and we don’t have any short term growth sources while comps will be harder in H2-25 & FY26. New products & geographies will take time & investments to develop & yield returns - assuming Hims succeeds which isn’t a given, hurting margins in the process.

This is how I see Hims short to medium term. Hence the selling of my position.

Over the long term? We’ll need to see if those new verticals - products & geography, can yield enough growth in the second part of 2026. This is entirely possible and the bull case is not dead, at all. Hims is still working on bringing convenience to the wellness/healthcare system.

You know, when we think about personalized treatment plans, it's not just about personalized medicine. Right? It's personalized content, personalized agents, personalized gamification, and and technology that they're able to use to stay adherent and to stay motivated.

Our mission is to have an experience that is guided by a growing selection of structured insights, combining each customer’s history with patterns drawn from millions of past, de-identified patient-provider interactions.

But the market doesn’t care about this. It cares about data and narratives. Right now, both are shifting negatively & I personally do not see any reasons to stay invested in Hims as they might succeed, but it will take time without any guarantee.

Better to sit out from here. Let others take the risks, let the market adjust. Observe. And I will gladly buy back in if valuation allows me, if we have more clarity on the short & medium term and if Hims shows early signs of success. Until then, I’ll continue to comment. But I won’t be involved.

Investing is about returns, not falling in love with our stocks.