Hims & Hers | Investment Thesis

The one who makes you feel better.

03/28/25 Update

Removed - Valuation which has nothing to do in an Investment Case.

Add - At-Home Testing | Compounded Drugs | EMR & MedMatch | GLP-1 Parenthesis

Updated - Financials with FY24 data.

I wrote my first piece on Hims almost exactly a year ago, early September when the stock was trading under $7 - good old times. Things have changed since then, and I have sold my shares, but I finally bought back in this month after the stock fell on the GLP-1 shortage fear.

But I’m getting ahead of myself. Let’s talk about the company & its business first.

Company.

Hims & Hers could be summarized as an online pharmacy - with some tweaks, more like a new version of what we call telemedicine, better, optimized & answering a real need.

The promise goes a bit further than a simple pharmacy or telemedicine service. We’re talking about a “Doctor-trusted & personalized solutions” service, 100% online from the consultation with a licensed professional to the delivery of your product, everything done through one app before you receive your product on your doorstep as rapidly as if you ordered anything from Amazon.

We’re not talking about a real pharmacy though, selling all kinds of drugs through the Internet. Hims focuses on “wellness” products in some very specific areas.

What they call “soft medicine” - although some mental health & weight loss products could be classified as not that soft, but all of their products have to be prescribed by one of the company's doctors, who are of course properly licensed & capable - at least as much as anywhere else.

“We depend on the Affiliated Medical Groups and their Providers to deliver quality healthcare consultations and services through our platform, and the Affiliated Pharmacies to provide efficient fulfillment and distribution of prescription medication.”

Every new subscriber has to fill out a questionnaire or pass through an interview & a consultation before being prescribed what he needs & receiving its products.

I’ve also checked where the drugs come from & their quality, a pretty important topic. Most come from partners, pharmaceutical companies to whom they buy generic or branded products. But Hims also owns some facilities in which they produce their own products and personalise others if needed - all FDA approved.

I was a bit concerned when I looked at it first as we’re talking about a telemedicine company who also sells drugs... Concerned about the quality, concerned about the authenticity of both the products & the practitioners and about the ethic of their business. Got reassured after digging.

There is no way to be 100% certain that everything is done perfectly, but it sure seems to be, and it of course is in the company’s best interest to be as clean as they can, as regulation in this domain isn’t joking.

In brief, Hims & Hers is the new telemedicine, providing online consults, prescriptions & treatments, leveraging internet services to provide the best end-to-end service, without any friction through a simple app. It works because management understood something no one else understood in the healthcare world.

“Consumers are increasingly expecting the same quality and level of service that technology has unlocked across other areas of their lives. This includes speed, convenience, transparency, affordable pricing and a personalized experience.”

And that is what they are offering.

Market.

It’s pretty tough to include Hims & Hers in any market because what they do is kind of new. Telemedicine isn’t, but Hims is more than this as they also sell proprietary & generic drugs while having an online delivery business & personalized treatments. I personally do not know any companies proposing comparable services.

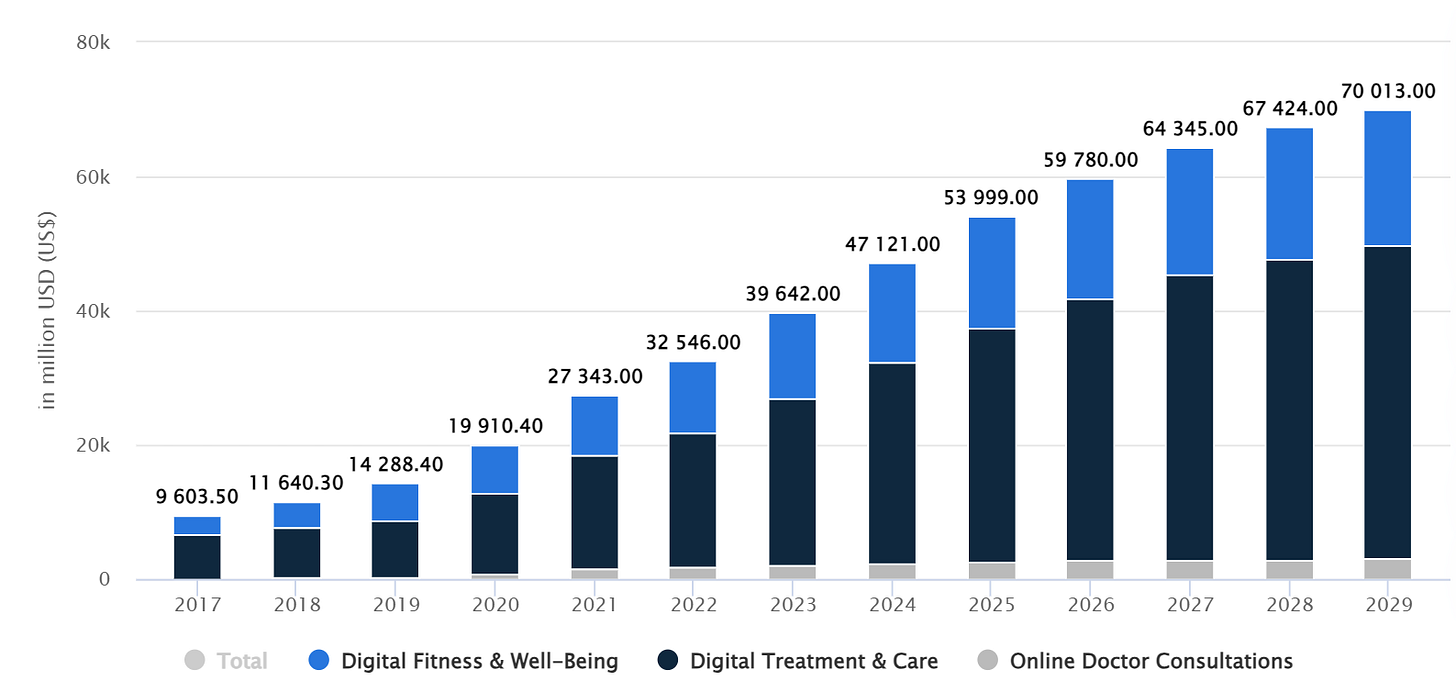

But digitalization of our world will continue over the years and accelerate.

Some expect the market to keep growing roughly 8% CAGR over the next five years to reach a size of around $70B - with an ARPU around $214.60. Hims would be roughly 3% of the global market in 2023 while not proposing lots of diversity in its products yet - this will change.

Those numbers only include the U.S., as things are very different in terms of health outside of America - especially in Europe, but we will talk about this a bit later as this is one of the risks around the company in my opinion.

The takeaway here is that telemedicine will very grow over the next years, rapidly, as the technologies improve and as Hims’ management said, customers want the good aspects of technology to be applied in everything - including healthcare. And Hims is very well positioned to capture a bigger & bigger share of that market as they propose a solution pretty innovative.

Competitive Advantages.

Now why is the formula working? Because it seems like many have tried to do the same but failed.

Personalisation.

I’ve used the word already but I didn’t detail what this is about, but I’ll start by letting management explain.

“Precision medicine is about using the right tools for the right patient at the right time”

As I said, Hims isn’t only about selling drugs to patients, it is about doing their best to help them get better, whatever their issues & most importantly whatever their conditions, as every genetics & bodies are different.

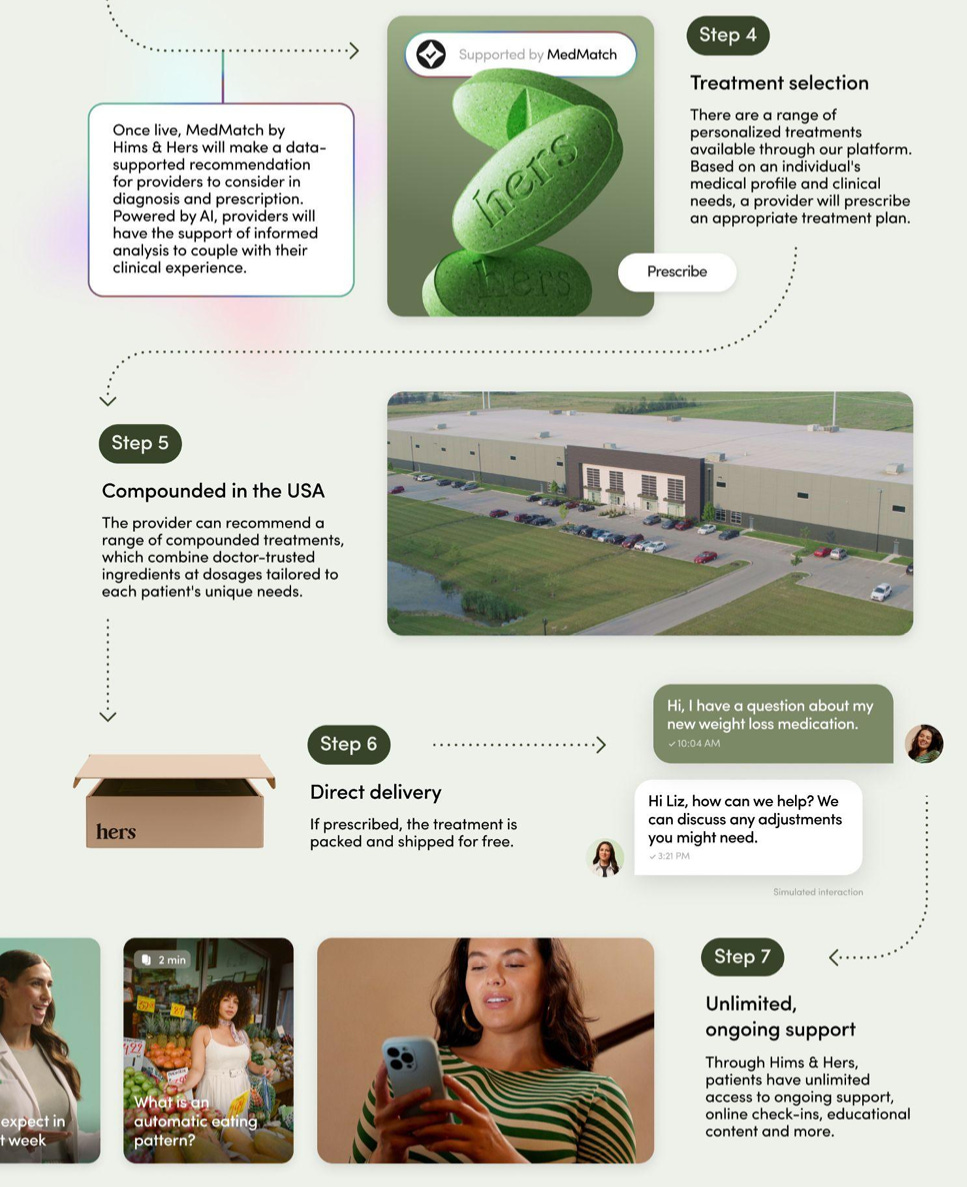

EMR & MedMatch.

At the heart of everything nowadays lies technology and Hims relies on two different platforms to deliver personalisation.

The Electronic Medical Records are a normal database to have for any drug provider or even any companies involved in healthcare, it is nothing but a database where the data of their patients will be stored.

MedMatch, on another end, is a beautiful creature leveraging this data through AI - or whatever you want to call it nowadays. The concept is simple, the model leverages the medical data from the company’s EMR - without access to identification data, to find correlations between disease, results, lifestyles, illness… Anything which can help provide a better service to its customers or anticipate their needs.

The objective is to leverage existing data to help finding the best suitable version of a treatment for any specific patient, first try. It avoids giving them generics which could cause secondary effects or so by leveraging the already existing & exhaustive data of millions of patients.

“By leveraging millions of anonymized data points from millions of customers, MedMatch models can identify treatments in real-time that may be best suited for a patient’s unique needs.”

A pretty powerful tool which can help many access to the best care possible. The service is not yet widely available, only trained on some specific verticals - weightloss & mental health for now. But in time, the objective is to deploy it everywhere.

This is the AI version of visiting different doctors for different opinions. From an app, cross referenced between millions of users.

Compounded Drugs.

This is their second advantage. Thanks to their different FDA laboratories, Hims can compound drugs & leverage its technologies to propose tailored drugs to their patients - in terms of dosages, formats etc…

“We are not bypassing the regulatory process or creating new drugs, we are delivering better, more comprehensive care through precision and personalization.”

There are clear rules to compounding drugs and Hims follows them strictly, doing so only during drug shortage - like they did for GLP1 semaglutide, or for clinical necessity - when proven that the patient cannot access his need elsewhere.

At-Home Testing.

In February 25, Hims announced the acquisition of an At-Home Testing facility, which will allow them to push even further their personalisation - and their data base. It’s pretty straightforward.

Clients can order testing kit for different tests targeting vital organs, potential disease, simple check-ups of specific health details. They receive the test kit at home, perform the test - everything is simplified so anyone can do it, send the samples back & wait for the results.

The list goes further but I didn’t want to overdo it, this already gives an idea of what they’ll propose and show that they also propose tests they do not have drugs for in their platform. This means they’ll either grow their offering focusing on those or will just deliver the service for their patients to have a centralised & easily accessible data for themselves - simpler than anything else.

A service accessible & interesting for all their patients, those with serious conditions, those with simple curiosity, those who need personalised drugs etc…

Those results are then sent directly through the app and Hims will be able to propose personalized treatments for everything tested, if needed & accepted by the patient. We’ll talk about the simplicity of their service after but we can assume that a simple process will be automatically started in a few clicks to then receive their package home a few days later.

Once again, this will help Hims grow their database & leverage MedMatch to deliever an even better services to existing & futur clients.

“Unlocking the next level of personalized healthcare.”

User Experience.

Simplicity.

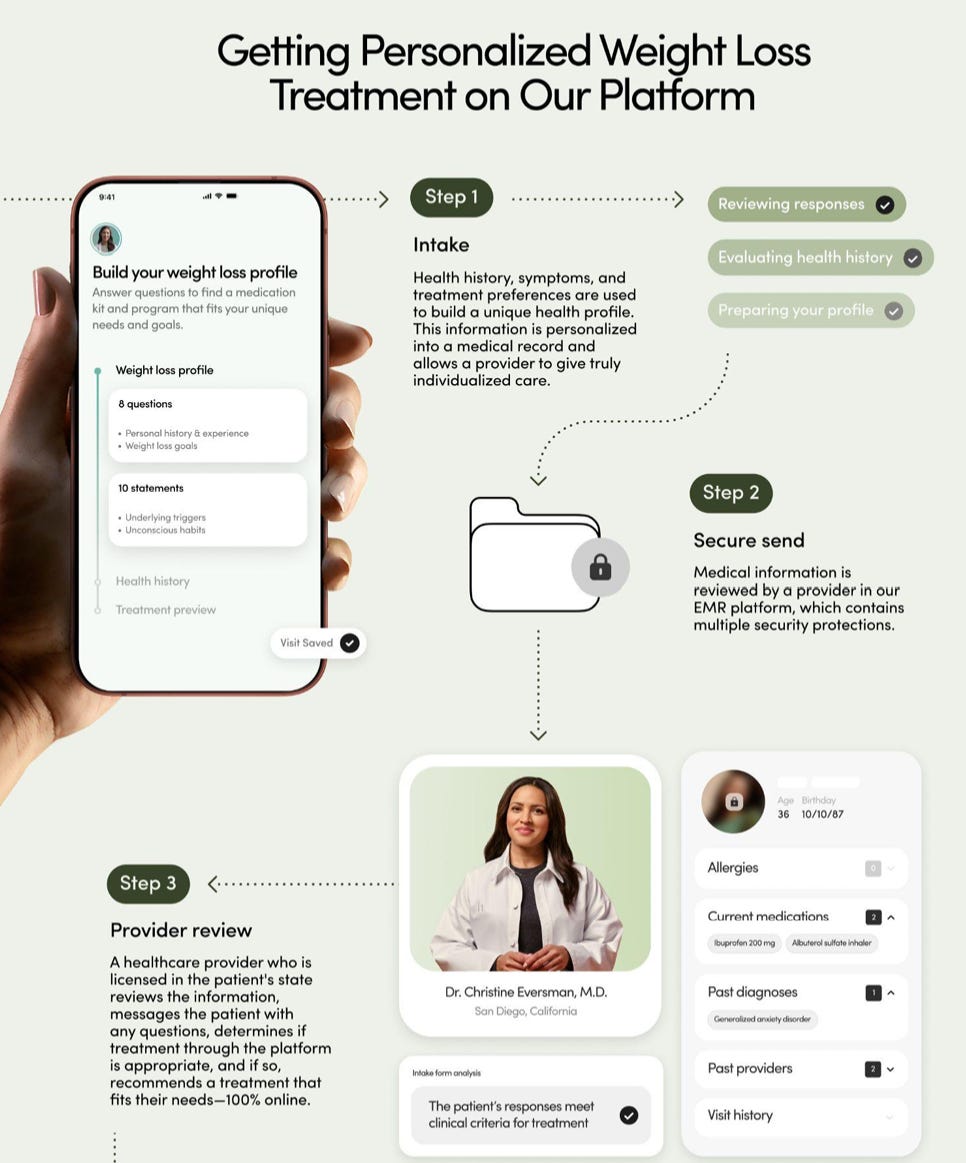

Management thrives for simplicity & it isn’t that easy when you’re working in healthcare. But they made it so for the users with a simple online process.

Here’s the example with their weight loss drugs, but it applies to almost all of their products - and it’s fairly rapid & straightforward.

Everything is online & done to optimize consultations, with forms filled out before the consultation & a user profile built before seeing a professional - the latter will have everything they need before even meeting the user.

The user will then be proposed personalized treatment according to their profile & need, once again, everything to be selected directly through the platform before subscribing. Billing & deliveries are then managed automatically while the subscriber has access to constant support. There’s nothing else needed after this point as you’ll regularly receive your package on your doorstep until you cancel your subscription.

The process itself is exactly the same as any other medical appointment, but Hims optimized & digitalized it while keeping it all under regulations.

Pricing.

The third most important point about Hims: their products are cheaper. And the reasons are pretty straightforward: Their business is Direct To Consumer (D2C), which cuts all intermediaries and the margins those would take on their products & services.

They also base their business model on subscriptions, which allow them to have a contract for a few weeks or months. Everything is cheaper when you have a committed consumer - and more expensive if you were to do a one-time buy.

They do not have any physical offices, which lowers their expenses big time. They of course own their laboratories & warehouse, but those are way less expensive to maintain than offices with workers in them. Although it comes with some drawbacks too - the major risk is that consumers in the health industry are pretty conservative, and some might want physical consultations.

All those aspects make their products & services more affordable to the consumers.

Privacy. Everything being done online creates more trust from the user as we are, again, talking about wellness drugs. It’s easier to talk about sexual problems online & receive your medication at your door than going to the doctor & then to the pharmacy - and doing it all again once your box is empty.

It doesn’t change much in reality as privacy would be the same with physical appointments, but it feels different for the user - and that’s what matters.

Products.

It is easy for the company to add new products to its business or to test consumer demand for something new without much expenses. They can also rely on partnership to bring in branded drugs on their platform.

Everything is easier to manage when you’re with an online business.

Retention.

We’ve seen that the company is great at attracting & keeping customers, and this is very important, especially in welness/healthcare. Once customers are used to a product & feel like it is helping them, they tend to stick with it.

Their users surely won’t stop consuming and won’t turn to any other brands or service providers if what you sell them pleases them. A user won is a user who’ll stay with a long term value. Quality is important.

Data.

And like every e-commerce business - because somehow Hims is an e-com, they own the data of their users. Most of it is private & regulated but we’ve talked already about MedMatch which has tremendeous value.

Playbook.

We know what Hims does by now, but we need to dig a bit deeper into the business, which is pretty simple but has to be divided into different steps for the company to thrive over the next years.

Attract Users.

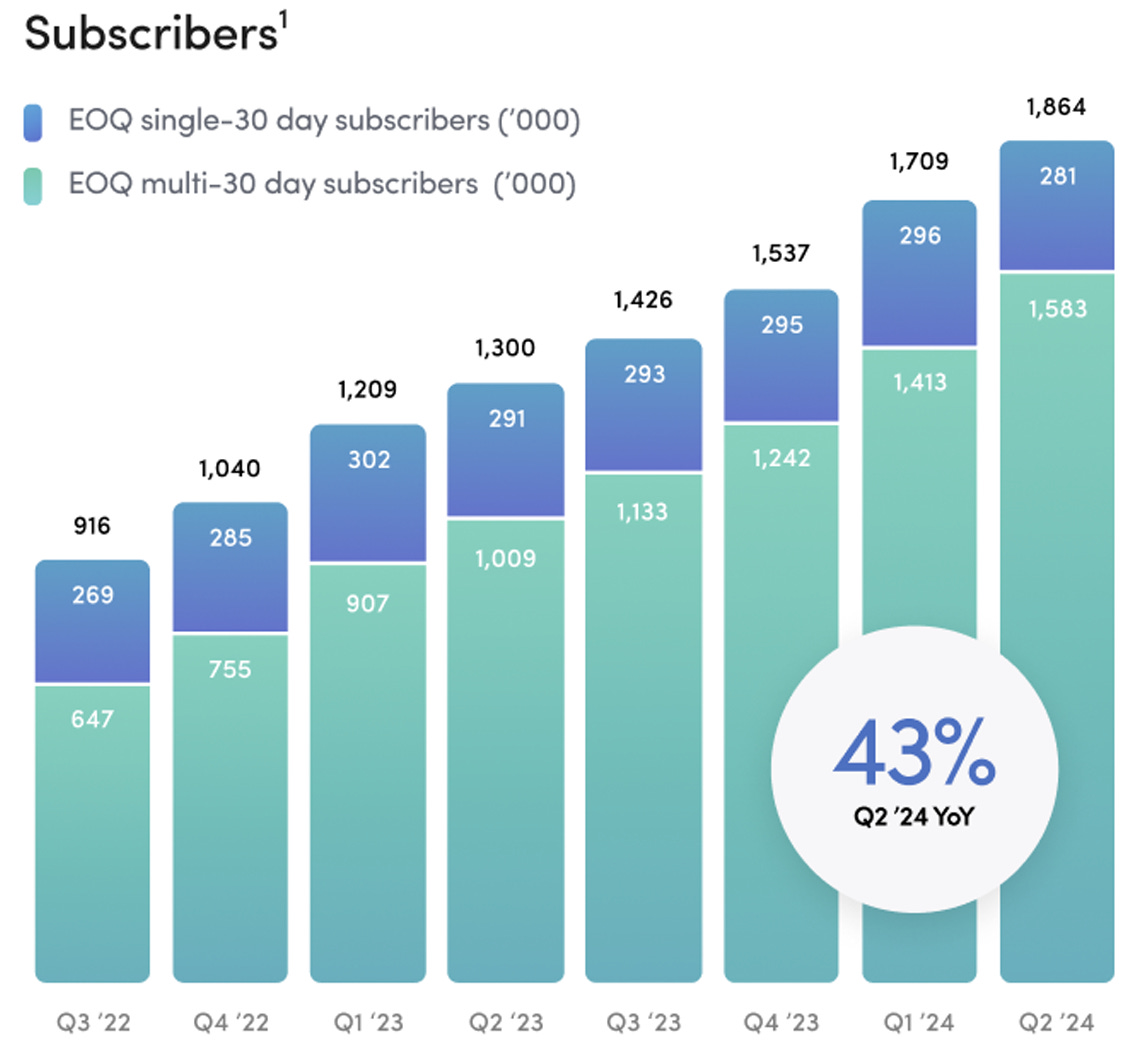

This is step one, and we’re still focused on it as of today. Things have gone very well so far.

Here’s what the company calls a subscriber.

“Subscribers are customers who have one or more “Subscriptions” pursuant to which they have agreed to be automatically billed on a recurring basis at a defined cadence.”

Any consumer is a subscriber on Hims as every service they sell has to be bought through a 30-days period.

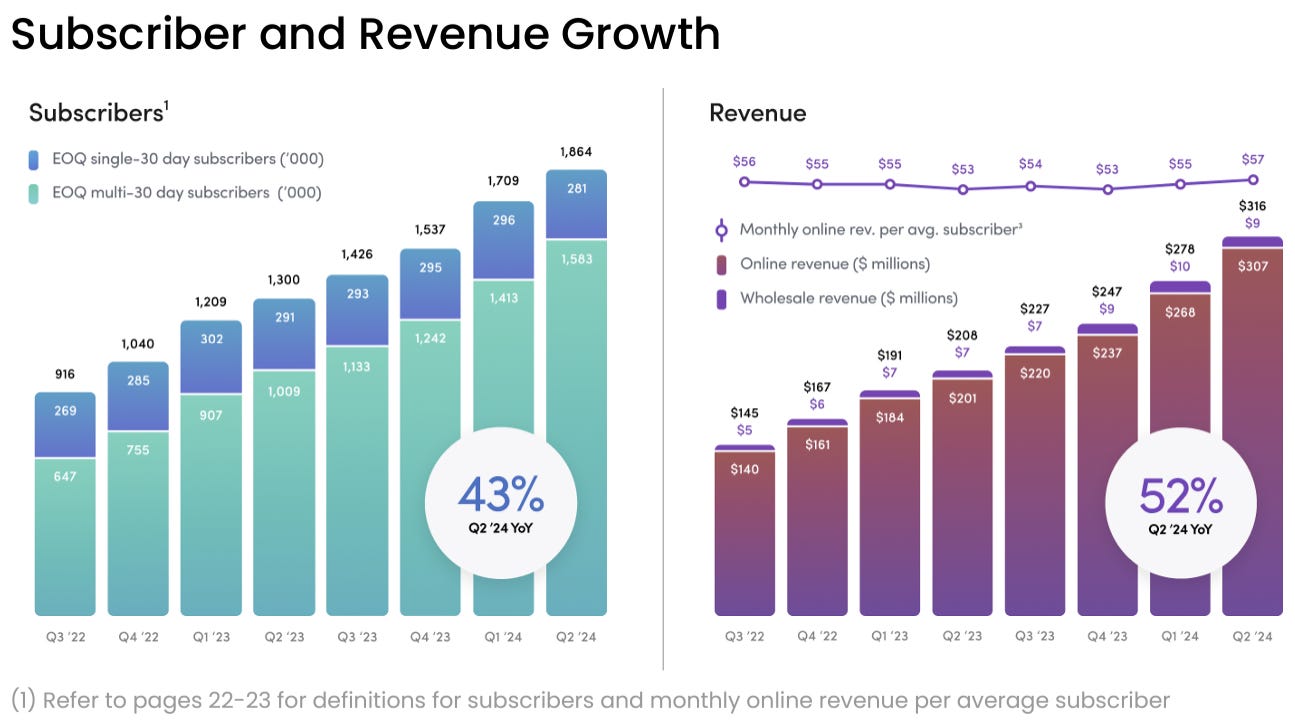

Subscribers are growing roughly 11% QoQ, with more than 25% of new subscribers turning into multi 30-day subscribers during the next quarter. The trend is pretty clear: Hims attracts more & more people and tends to keep them subscribed, both information being pretty strong proofs of a business that satisfies users.

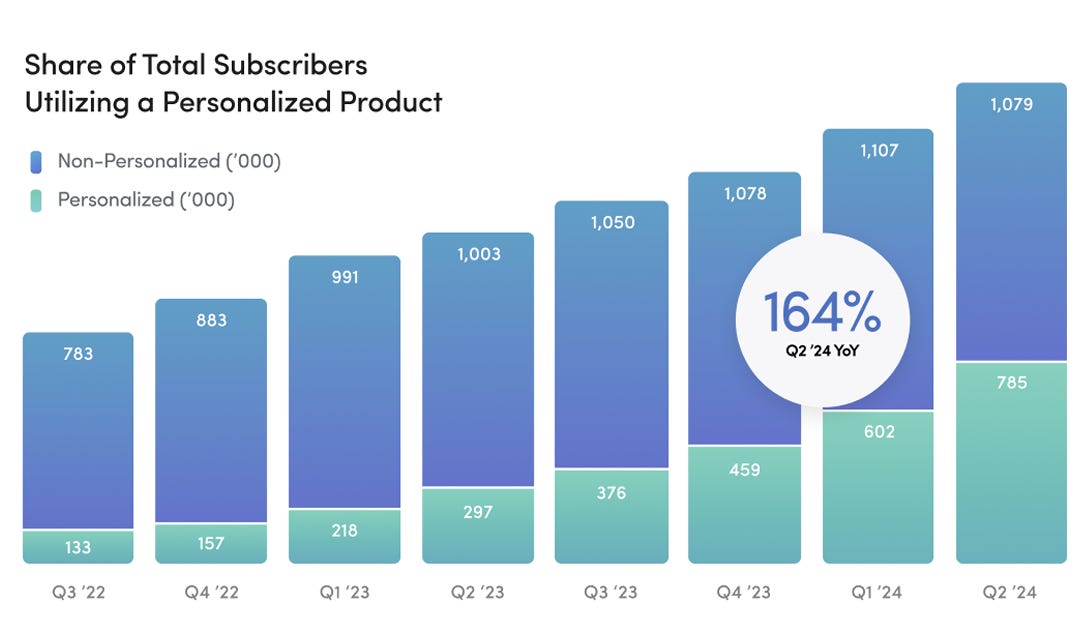

Grow consumption.

This might be where lots of investors’ ethics will block.

It isn’t like Coca-Cola or any other retail company, Hims doesn’t need its subscribers to always consume more drugs - also this also would boost revenues. They need them to consume differently.

They need to convert their simple subscribers to personalized solutions.

Once more, Hims is doing a great job at it so far as a bigger & bigger proportion of their global subscribers are now part of a personalized treatment, and this tendency should continue as management expects to have 1M of them by the end of this year - a 27% growth in one semester.

This will be Hims focus from now on and for the next quarter: to convince users that personalized treatments are much better for them.

Average Revenues Per Users.

This will grow the company’s ARPUs, which have stayed very stable over the past quarters.

This is the company’s second leverage to grow revenues. More users, with the average user paying more, means more revenues for Hims, and this will be done thanks to the personalized solutions & new products.

Those are the three most important metrics & in an ideal world, they’d all be growing together. But it requires different focus from the company and for now, the focus is on growing their user base and slowly converting them to personalized solutions - and they are doing this perfectly.

GLP-1 Parenthesis.

It’s important to talk about the semaglutide compounding at the moment as the stock market focused on this narrative heavily over the last year & continues to believe that this drug was what made Hims interesting.

It isn’t - to my opinion. Although GLP-1 was a huge source of growth.

Early 2025, the FDA ruled that the shortage on semaglutide was over which gave FDA approved compounders - like Hims, three months to stop their activity, which Hims complied to while the market crashed the stock.

As of today, Hims is stopping its part of the business which can be served by patented dosages, which means they will continue their business with patients which have a personalised dosage or new patients who need a dosage which cannot be found with branded drugs - following the FDA’s rules.

Their semaglutide compounded revenues aren’t $0 anymore & won’t be, but it also has to be kept in mind that weightloss isn’t only about semaglutide. The company intends to become much more.

The end goal is to become a wellness platform and to propose all kinds of services, drugs yes but also simple advice & wellness plans leveraging AI once more, with personalised eating & exercises for example.

Those could be boosted with different forms of oral medication with different objectives, be it weight loss directly or any other motivation/boost patients might need to reach their goals - tailored to them.

Besides working on personalised dosage for semaglutide, management is working to integrate compounded liraglutide, another GLP-1 molecule slightly less efficient than the branded semaglutide but competitive, thanks to their compounding capacities.

More informations on FDA’s regulations, compounded semaglutide, alternative drugs & take rate, growth & future trajectories for the company on Andrew’s interview commentary below.

Weight loss isn’t only about GLP-1. Long term, what matters is for Hims to deliver a great service for patients to achieve their goals, not a fast patch.

Risks.

You probably understood it; I am pretty excited about this company and their future, but it comes with important risks.

Regulation.

The healthcare industry is one of the most regulated with tons of control & very strict protocols to follow. As far as my research went, Hims was following everything that was demanded of them and only selling & owning FDA-approved drugs & infrastructures.

This doesn’t mean things won’t change, and when it comes to investment, it doesn’t mean that there won’t be lots of noise in the future, rumors or truth. The image of such companies has to stay perfectly clean because users put a lot of trust in it & in their products.

One misstep could cost them.

Competition.

Hims did it, so why others couldn’t? The company is still pretty small and owns a very small part of the market, so it wouldn’t be very hard for a big player to enter, or for a motivated one to start from scratch.

Every business has competition, but not everyone competes with Amazon, as the giant octopus also started a drug delivery/telemedicine service.

It isn’t as developed as Hims, but it is meant to offer the same service. And everyone knows Amazon and its tendency to throw cash to develop new services - they could focus on this one soon and would have the resources to create something big, bigger than Hims. Would it work? Can’t say, but they surely could create strong competition.

Or they could just buy Hims & Hers.

Expansion.

Hims is mostly present in the United States, for an obvious reason: regulation. It also sells some of its products in the United Kingdom but not much.

I do believe it will be pretty hard & costly for the company to expand geographically because regulations on telemedicine & drug sales are very, very different around the world - while relatively relaxed in the U.S. compared to many countries.

It shouldn’t be an issue short-term because the U.S. market is big enough & will take them long to conquer - and we’d already have great returns if they were to do so, but this is something to keep in mind. Not impossible, simply complicated.

Finances.

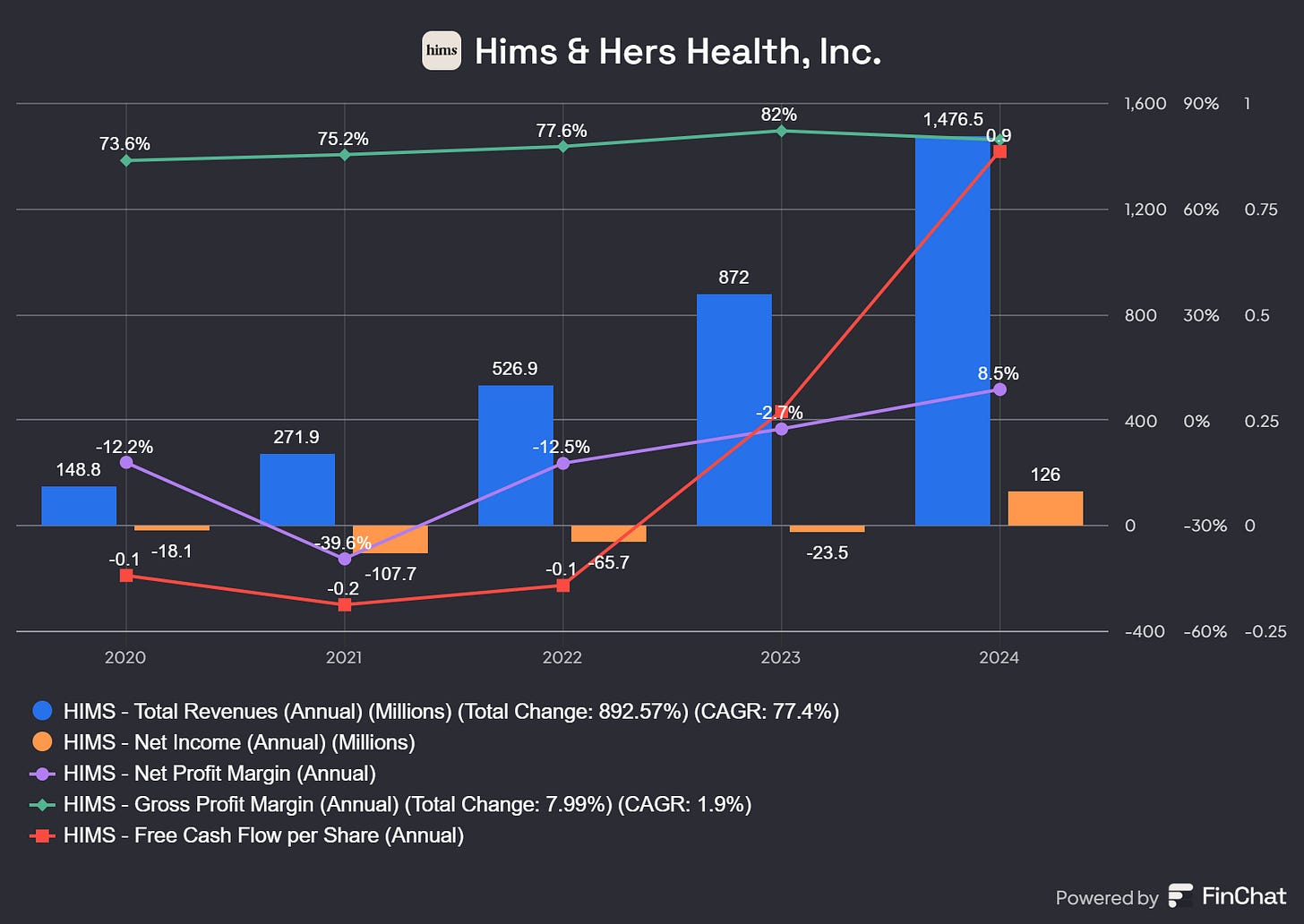

A first look at the company’s finances gives us an overview of a perfect growth story.

Revenues are grew 77% CAGR for the last five years & the company is now profitable with growing net margins, which will become a growing focus later.

The company’s balance sheet has $290M of net debt after years of financing through stocks dillution - something which should slow down those next years as the company is profitable. Income & free cash flow start to roll in & margins are rapidly growing.

And they’ll spend it on the business with investments that could optimize or develop it, second priority in to M&A if they were to find suitable companies to buy & lastly, to return value to shareholders. The proper order of things for any growth company although it might not please some.

Conclusion.

Hims bull case is about personalisation.

This is what they do & this is what we should focus on, a company which addresses a very old need through new technologies, adapting it to the actual wish for simplicity, rapidity & personalization. Selling the best possible products for their patients to feel better - something which has no price for many, with a top-notch service.

A business-focused management that always tries to provide new & better products and invest in itself, through M&A or other kinds of investment, with very healthy finances, now profitable with a strong balance sheet.

This is the story management is writting and I personally am in their train, I believe the company could become a new reference in healthcare and I personally do not know any competition to such personalisation, while I personally would love to have an application from which I could have access to so much information.

Hims the doctor in my pocket who knows everything about me & gives me what I need. Not what can be given. What I need, tailored to me.