Weekly Recap | December - W3

Portfolio Update, Inflation, Japan Carry Trade, Oracle Update, OpenAI Fund Raising, the SPEED Bill, Micron Earnings, Nebius Updates & More

Macro

This week’s data was a gift in the current narrative, with a weakening labor market - rising unemployment & fewer job openings, combined with cooling inflation. It’s the perfect combo for further rate cuts, though the data should be taken with a grain of salt. Or, as one macro publication put it.

Take It with the Entire Salt Shaker.

The CPI print arrived without any data from October and partial data from November due to the government shutdown. This means the data is missing significant chunks of information. I agree with the publication’s conclusion though.

I think it would be unwise to dismiss the results entirely, but I also believe it would be rash to take them at face value.

The YoY comparison are still valuable and show a slowing inflation.

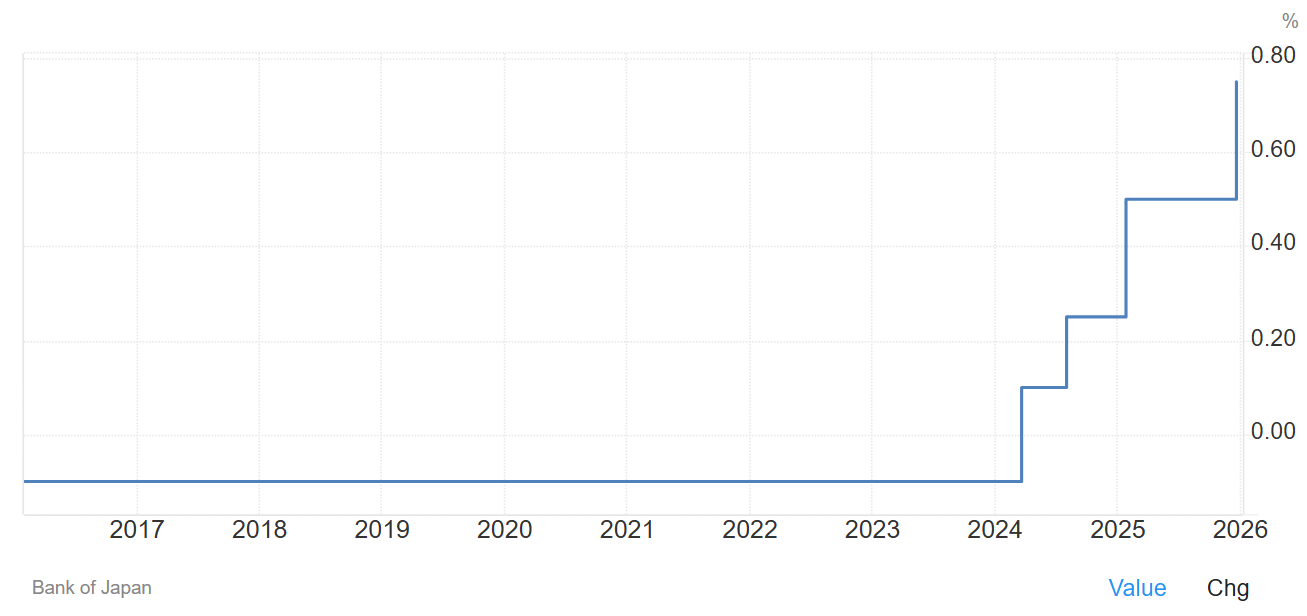

The Japan Carry Trade

You’ve probably heard about Japan lately as it generated tons of engagement on social medias.

Without diving into the entire history, their latest decision on interest rates does pose a risk to global liquidity. Although global liquidity is a very complex topic, there are thousands of sources for liquidity worldwide which constantly balance each others.

Yes, Japan has been a major one for decades - since 1995, and yes, that liquidity is slowing down, but it’s unlikely to crash the markets the way many fear.

In a few words, the situation was simple: as an international investor, you could go to Japan, borrow yen at the lowest rates ever - since they were negative, switch yens to dollars & invest in the U.S. market. It was a "free money glitch" used by hedge funds and large investors to leverage themselves.

But as Japan rose rates since 2024, borrowing there has become more expensive. And they rose 0.25% more this week. When you’re talking about billions in debt, a 0.25% hike makes a massive difference.

So yes, some deleveraging is happening. This partly explains the slowdown in tech as the market anticipated this. Markets rarely “react” to news that aren’t a surprise. It would have crashed if Japan hiked by 0.5% and pumped if they stood still. Since the decision hit the consensus, the market saw it coming and anticipated it. It will anticipate the next ones, too.

The BOJ made it clear that the hiking cycle will continue by asserting that it intends to keep raising borrowing costs if its economic outlook is realized, and the chances of that happening are increasing. It also said that underlying inflation is continuing to rise moderately.

I think the BOJ will continue raising rates at a pace of around once every six months or so.

Now it’s done. We might see a bit less liquidity from Japan but it will remain a massive source for long as rates remain very low compared to other accessible banking systems.

The market anticipated it, the deleveraging happened, and we’re moving on.

Another AI Update

I wrote five days ago that the AI trade wasn’t over and so much has happened since, mostly positives, which only reinforces my view.

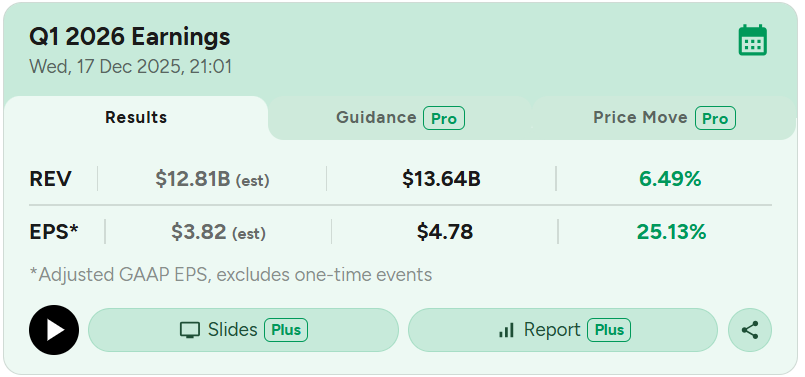

Oracle’s Situation Update

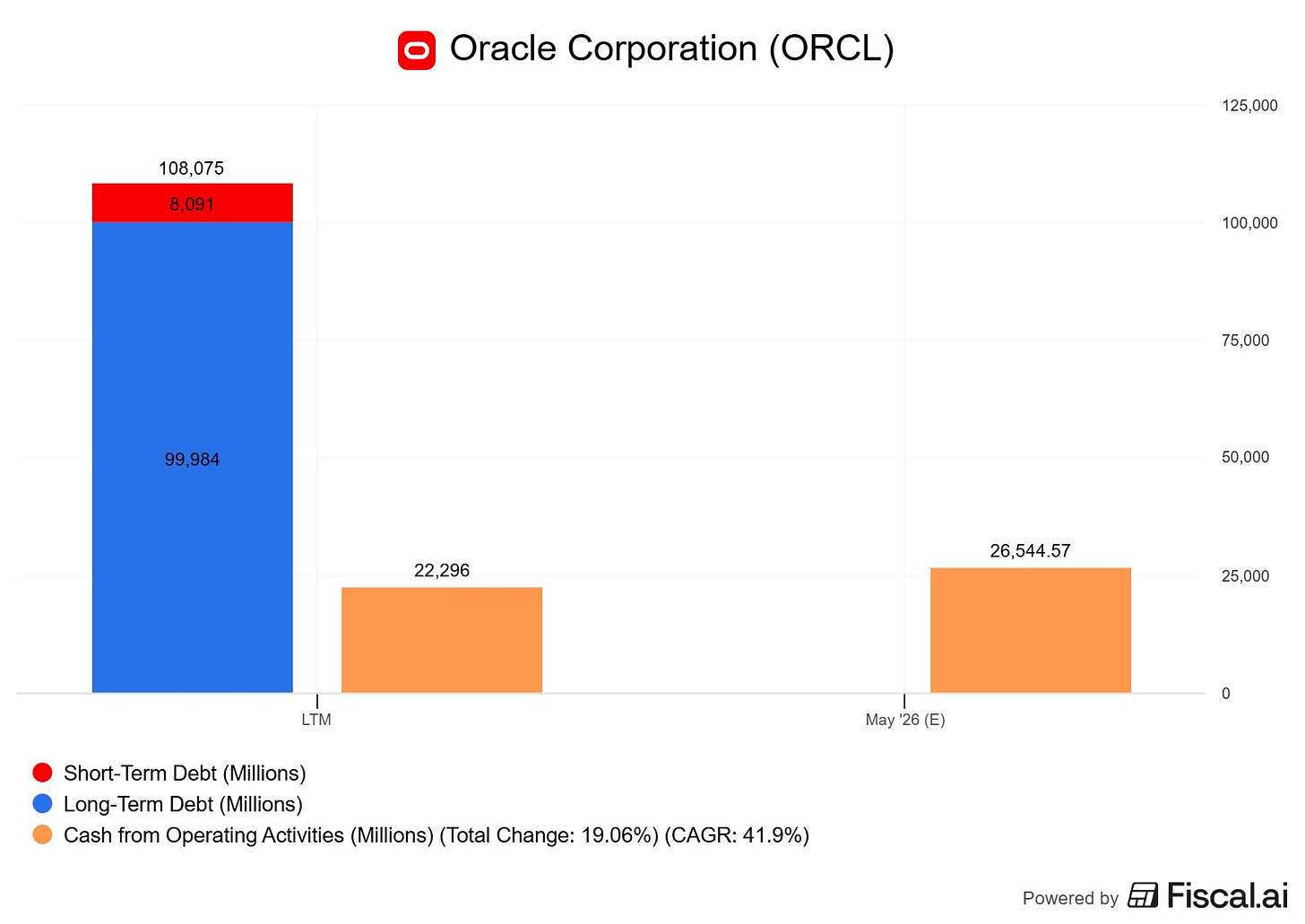

I talked a lot about Oracle then as the main source of concerns - or second main after OpenAI. One more reminder: the company has a very profitable business & is rapidly pivoting into an even more lucrative one: AI cloud services.

Over the last twelve months, Oracle generated about $22.3B in cash. They’re sitting on $110B in debt, with roughly $25B due in the next three years. They estimate cash generation will jump 19% YoY to ~$26.5B by the end of their fiscal year in May.

This means Oracle expects to generate enough cash in just one year to cover the next three years of debt maturities. As they build out more infrastructure, that cash flow will only grow. Sure, as long as they pour every cent into CapEx, they won’t pay the debt immediately and FCF will stay negative - which is what the bond & stock market are currently pricing in. But if Oracle ever decides to slow down CapEx - likely when deadlines approach, they’ll have more than enough to handle their obligations.

The challenge for Oracle is simple: build as much compute as possible as fast as possible. By FY28, the goal is to generate so much cash from AI services that the current debt becomes a nothing burger. Execution is the only real question left.

The SPEED Bill

And the government is stepping in to help. The House just passed a bill - heading to the Senate, designed to accelerate data center buildouts by fast-tracking federal permits. They called it the SPEED Act for a reason.

Many won’t like it as it bypasses certain environmental laws and procedures, it would be a massive tailwind for faster buildouts and logically faster cash generation for these companies.

Oracle’s Funding

But it still isn’t enough as Blue Owl, the funding partner of many data centers, notably Meta’s, walked away from a $10B deal because they couldn't agree on terms - mostly on rates or some conditions to insure them against failure. This shows that the credit market is stricter.

However, it took Oracle less than 24 hours to find other interested parties, including Blackstone. This proves that liquidity is still very much available for these projects, even if the market treats Oracle with a bit more scrutiny than a Meta or a Google. Nothing is signed yet, but there is an appetite under the right conditions.

The TikTok Bonus

Lasty for Oracle, the company will be part of the consortium owning and operating TikTok in the U.S. - after years of debate over data ownership.

They will own 15% of this portion of the business, which excludes advertising and the marketplace, meaning the equity isn’t the valuable portion of the deal. The optimism comes from retaining the compute demand from TikTok as Oracle will be the primary provider and the strategic place Oracle now is in as compute provider and data store of the application - a pretty sensible one.

This mostly boosted optimism, and we needed that lately.

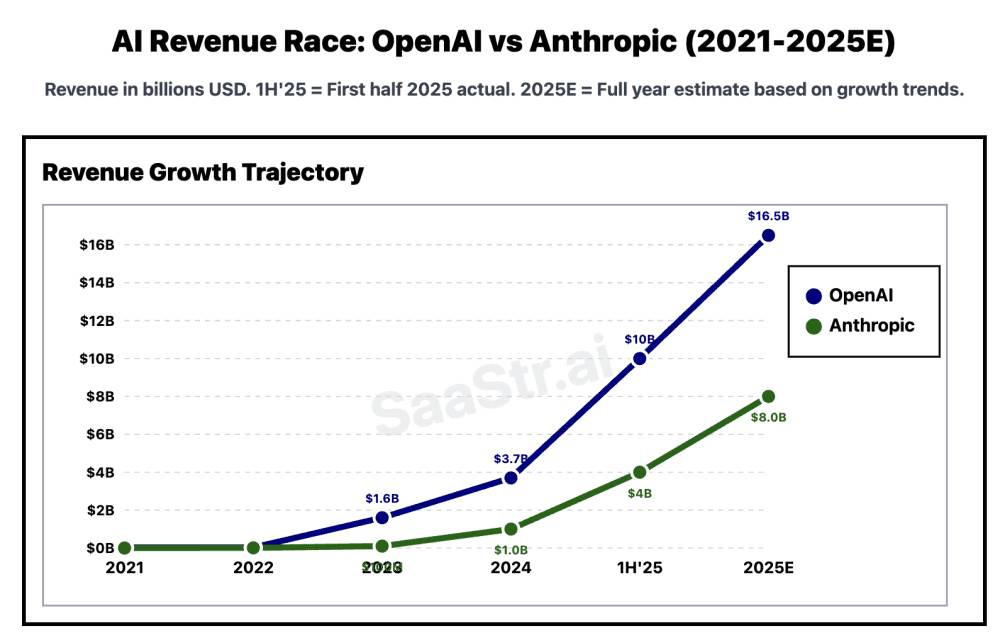

OpenAI New Funding Rounds

Some news on our favorite systemic risk, which everyone wants to invest on.

First, OpenAI is reportedly discussing another massive funding round - hundreds of billions more, which could value the company anywhere from $750B to $830B, from $500B today. Nothing is official, but finding enough fundings today to reach those valuations would be a major achievement and bring optimism again as a sign that liquidity is clearly still going and betting on its success - reassuring the market that OpenAI can honor its commitments.

Second, Amazon is could be in talks with OpenAI for a $10B investment in exchange for using their new Trainium chips. Another potential big new which would help the company financially first, having more compute second with what seems to be very efficient ASICs based on some reports.

Two very bullish news which explained the positivity we saw on the markets friday as the company continues to grow rapidly, and could have access to more fundings and more compute, allowing a constant and rapid growth - and cash generation.

Nothing official yet but it shows once again that global interest for OpenAI is not slowing down, and this is a good thing for the market. And that is even before a potential IPO.

Micron’s Earnings

Finally, Micron’s latest quarter showed massive demand for memory which makes sense: more AI means more data means more storage. They absolutely crushed their revenues and guidance conforting the market that demand for hardware was indeed through the roof.

Nebius Updates

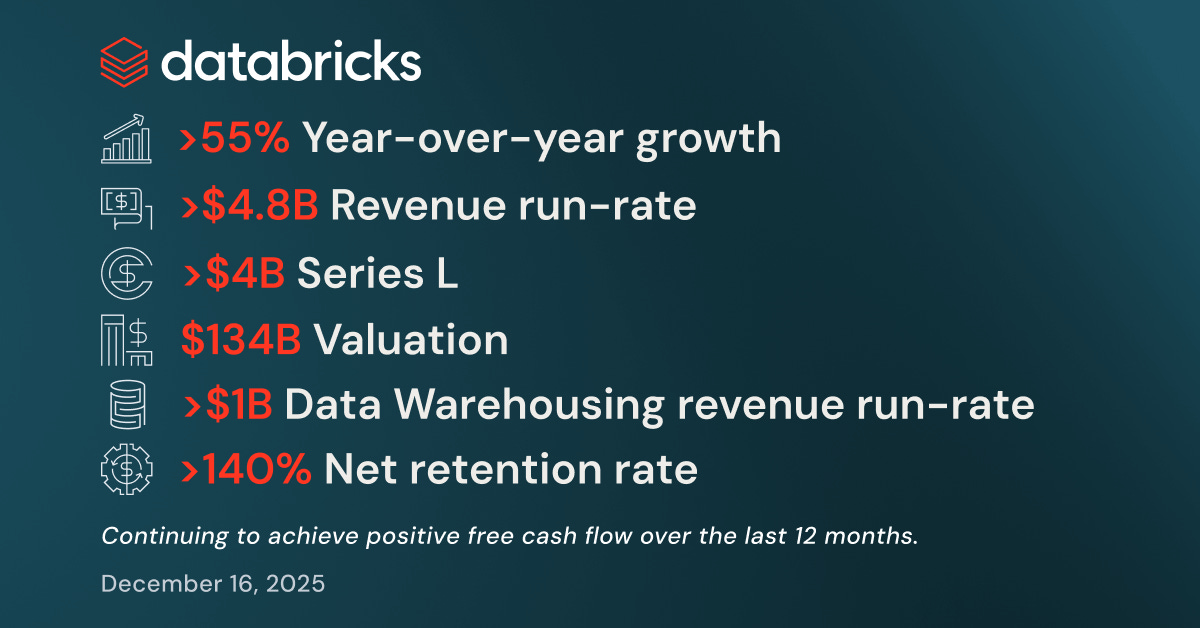

before talking about the company itself, it’s worth noting that Databricks - a direct competitor to Clickhouse where Nebius holds a ~30% stake, released very strong data this week once more conforting the market that demand for AI related services is, once again, through the roof.

They also closed another $4B in funding, pushing their valuation to $134B. There will be an IPO sooner rather than later for Databricks and that will be a catalyst for Nebius valuation if done during an AI optimist timeframe.

Nebius shipped new services this week to help clients verify GPU availability & reduce friction - a huge plus for speed-hungry developers. A continuous focus on developers’ goes a long way to attract enterprises in this sector.

They’ve officially delivered the first GB300 systems in the U.K.

In brief, this week brought major positives for the AI bulls even if the market isn’t very optimistic lately, the data continues to prove a rapidly increase in AI usage & demand, and hopefully we will see more proofs of financial support in the short term, helping on the concerns over leverage.

The market always bounces between optimism and pessimism.

Weekly Watchlist Update.

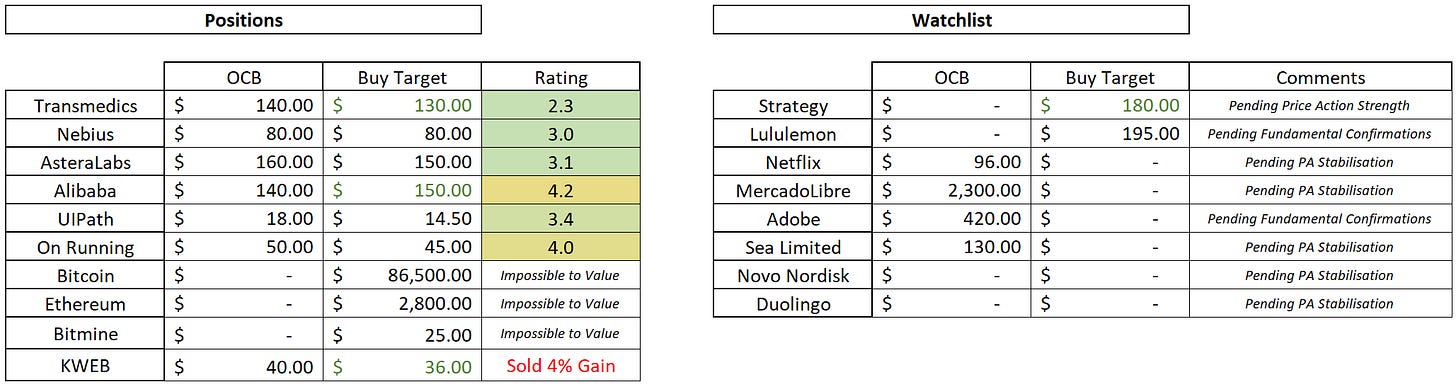

Here’s my watchlist and buying plan - both current positions and watchlist names. As always, buys & sells are free to access in my public portfolio:

https://savvytrader.com/wealthyreadingspro/buyandhodl

Optimized Cost Basis (OCB) - optimum average price for a long term position.

Rating - Buy < 3.5 < Hold < 7 < Trim.

Bold - updates compared to last week.

Green - Potential buy/accumulation.

TransMedics continues to behave as it has for the last six months, with higher highs and higher lows with a bottom at its daily 200. we’re down there now & if the pattern holds, we should see $150 within the next month. It remains a buy at these prices & I’m putting my money where my mouth is with reasonable margin here.

Nebius went to close its gap at $75, the best possible entry point I could have wished for - as shared in my last quarterly review. I’m not as excited as some on social media; we had a great Friday with positive news but I’m expecting some consolidation before the next leg up. Nebius doesn’t have his next higher low so we could easily retest $80 soon. I’ll be buying if we do as the value at this price is impossible to ignore if the AI demand remains that strong.

Astera Labs continues to hold its daily 200 around $140–$155. Its price action looks better than Nebius with a clear double-bottom. The market is nervous about compute providers but remains positive on semiconductor companies. Breaking $180 will be the definitive signal for a new leg up.

UiPath was bought this week and everything you need to understand the reason and the trade is here, still accurate. $15.50 is the perfect spot for accumulation, let’s see if the market gives it to us!

Alibaba printed a new local low and is toying with its weekly 21. It has lost this level a few times before, so I’m not worried about the uptrend. I’m slowly buying at this price and will be more aggressive if we hit the weekly 50, currently at $135.

The crypto market behaves as expected: there is always more pain before the next leg up. Traders trying to catch the bottom are getting liquidated left and right. I still believe the bottom is in, but we might see one “perfect” liquidation wick below that bottom to really shake everyone out. If that happens, I plan to add margin.

I’ll also rotate liquidity from Bitcoin to Strategy next week as I believe the upside is higher & the risk pretty low. The market is pricing the stock as if Bitcoin were to trade at $71,000 & I believe we will see $100,000 before $70,000 with optimism in AI driving risk assets higher. If I am right, Strategy could climb up to $230 at least, which would be 1x NAV assuming a Bitcoin at $100,000 - and the market would give a premium if Bitcoin were to push there.

From $165 at Friday’s close this is a 40% upside which I’d expect to happen before the end of Q1-26. This is high risk, high reward and pretty speculative.

On KWEB, I’ve sold my entire position. As I mentioned before, I have no issue with the bull case; I’m still very, very bullish on China. I’m just more bullish on other assets in my list at today's prices, so I’m rotating out of this less volatile position to fuel others.

Lululemon showed really strong price action after its quarter. I personally want to see proof of growing demand in the U.S. before starting a position, but for those willing to take the risk, the breakout retest at $195 is a perfect entry. I’m staying patient for consolidation, but we saw with American Eagle - which is up 133% in 17 weeks after a similar double-bottom retest, that patience isn't always rewarded.

If Q4 shows a rebound in Western consumption, Lulu could really fly. If the retest is given, we’ll need to chose if we take the risk or not.

Netflix is still in talks for the Warner Bros. acquisition after WBD management asked shareholders to reject the Paramount proposal. Netflix should win this bid. If it clears regulation, I expect the market to price in execution risks and dilution worries - that’s the "massive opportunity" we’re waiting for. We just need to stay patient.

As for the rest, nothing has changed. I expect Adobe to range, and I’m staying patient on Duolingo and others where the price action is still a bit rough.

Weekly Planning.

With christmas around the corner, and as we head into the holiday season, I want to wish a wonderful time to you and your families. And to those who celebrate it, I wish you a very Merry Christmas!

I’m still working on two write-ups: one detailing my investing style & another focusing on Nebius to study how “winners” behave and how we can best capitalize on them, plus an update on the position and company. Both should be shared by early January.

I’ll still share a weekly review if necessary - only if there’s important news or price action worth commenting on. Otherwise, I’ll take this time to unplug/slow down.

Once again, enjoy the holidays and your time with family!

Curious... If you are moving from BTC to Strategy, why not Eth to Bitmine?

Love this write up. Thankyou for this year?