Lululemon Detailed Q3-25

When a Fired CEO is a Good CEO

You’ll find the Lululemon investment strategy here.

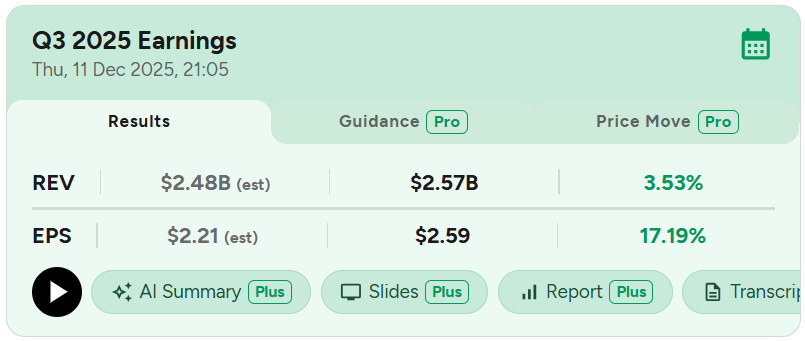

The market has been overly positive after the company’s report for one main reason; the company’s CEO is leaving in January 2026. It also helped that the company beat on expectations, showing analysts had become too bearish - mostly underestimating eastern demand.

That said, stocks don’t usually have V‑shaped recoveries so even if Lulu is up 10%+ today, don’t feel like you missed the train. I’d put it in the same category as Adobe: downtrend might be over, now comes consolidation.

Only Sentiment Changed.

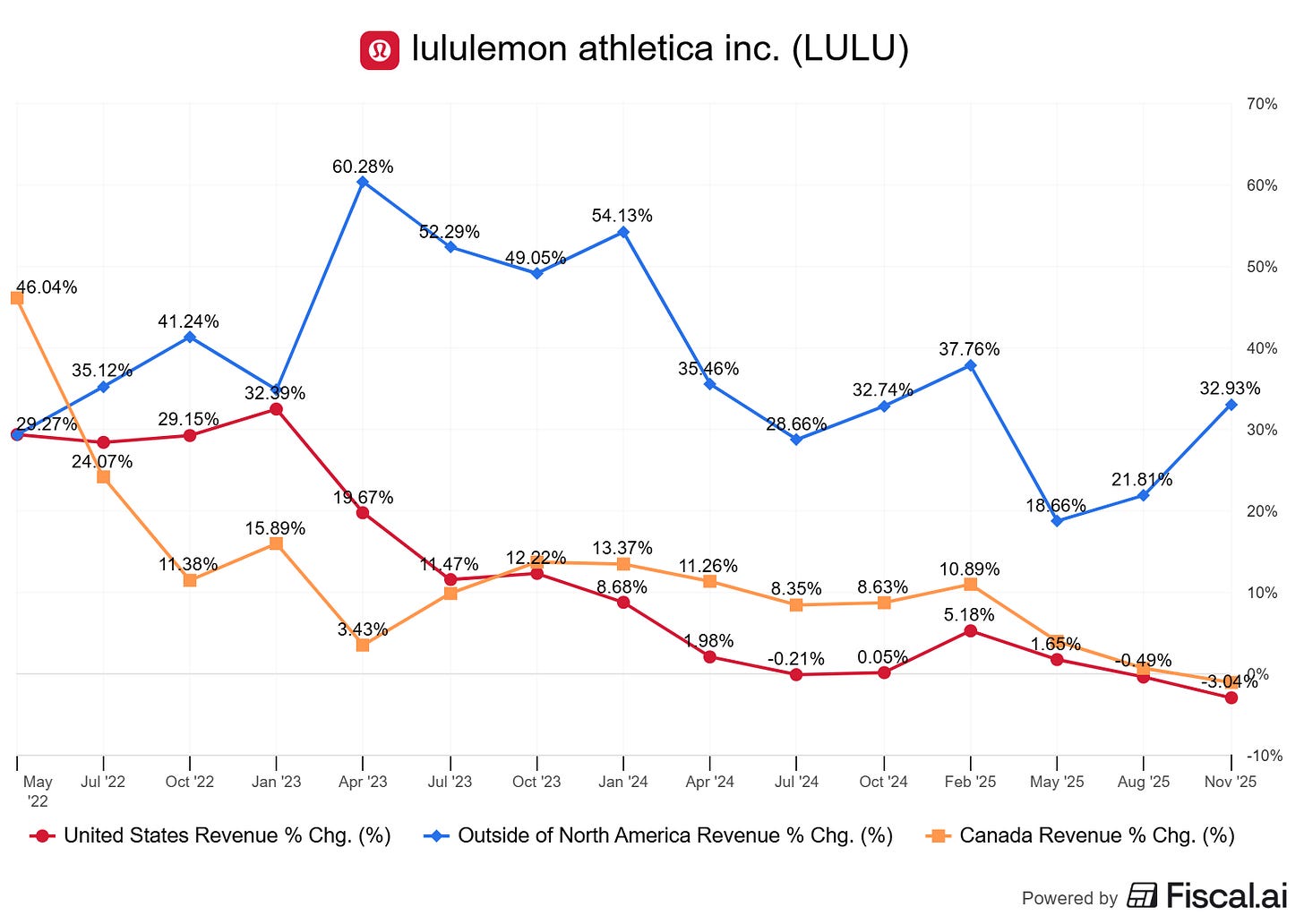

The problem remains weak western consumption with another decline in the U.S. & Canada while the rest of the world continues to grow rapidly, driven by China - where the real purchasing power is, as I’ve been saying for over a year.

We saw strong momentum in China, with successful activations and a focus on outerwear. We are gaining market share across all tier cities

Management confirmed again: the issue in the West isn’t lack of spending, it’s lack of product fit. Lululemon isn’t meeting client demand. That’s why the CEO departure is seen as good news; the “one person” behind the mismatch of the last 4–6 quarters is leaving, hopefully replaced by someone more “competent”. Strategies are already in place to better align with customers but a potential new vision for the brand excited the markets.

Data-wise, nothing changed: the West is weak and the East is stronger than expected, though still a smaller share of revenues - it’ll become significant fast at this pace.

Sentiment-wise, stronger demand outside of the west plus the CEO change makes the market hopeful. The idea is that new management will better understand today’s consumers while existing measures should start showing results in Q1‑26. The goal is 35% penetration of new styles by spring, with early tests already positive.

Our product innovation is driven by research to solve unmet needs across activities like run, train, yoga, golf, and tennis. We are introducing new performance fabrics and updating core franchises based on guest data and feedback.

Tests in visual merchandising are showing positive results, and our new web design is enhancing the visibility of new products.

The market, always anticipating, is rewarding the stock not for current results but for signals of a potential better future. If not, at least for the right choices being made. That’s why shares jumped 12% today.

Is the downtrend over? Maybe. Does that mean we’re only going up from here? No.

Stocks rarely have V‑shaped recoveries. You’ll see it happen once in a while with a Meta or Netflix, usually only when the market realizes its thesis was completely wrong or when fundamentals flip hard. I don’t think that’s the case here with Lulu, which still has structural issues - its products don’t match Western demand.

The turnaround could be faster than expected, but we haven’t missed the train yet. A 12% jump isn’t necessarily the start of an uptrend. We might’ve seen the bottom, but we’ll need more confirmations before a real trend reversal. That will take months, even with strong execution & a rebound in consumption - and that’s assuming new management is competent right away.

This quarter brought plenty of reasons to be optimistic and risk is relatively low at 2x sales. I get why some would want to buy in here. The $190 retest looks like a solid entry but I’ll personally stay patient. China is a great growth driver but until the U.S. bounces back, it won’t be enough to move the needle. And new management is a coin flip.

The potential is here, but for now I’ll keep Lululemon on the watchlist. It’s a A, maybe a A+ setup but I expect consolidation, not a V‑shaped recovery. I’ll keep watching from the sidelines. I believe there still are better elsewhere.