Sportwears Investment Thesis

On Running & Lululemon's opportunity in rising consumer optimism

Before diving into the main thesis, I need to touch on two quick “pre-subjects” that frame how I’m thinking.

My personal bearish bias on consumers - and why I might be wrong.

How the market perceives growth and assigns multiples.

Then I’ll detail my thesis on two names: On Running and Lululemon. I bought the first yesterday & will share my plan below. For the second, I’ll present the case but explain why I’m not buying just yet, plus my conditions to do so.

My Bias on Consumers

If you’ve followed me for a while, you know I’ve been structurally bearish on Western consumption. Post-Covid inflation stayed higher than expected, and new tariffs in the US aren’t helping. I’ve often talked about the double-speed economy.

The rich get richer (markets, assets, etc.), so they keep spending.

The poor and middle class lose buying power with inflation.

Even if that idea holds, I made a key mistake that comes straight from Economics 101 - or just basic arithmetic honestly.

The rich get richer faster than the poor get poorer.

Money makes money. The more you have, the more you make, at least until the markets break. And Trump has made it its mission not to let markets break.

While low-income households lose buying power, the speed at which rich households gain wealth is simply faster. Net-net, total spending trends up, and premium brands keep doing “fine enough”, or even really well if you look at On Running.

Yes, these benefits go to people who already have money. But the market doesn’t care about fairness; it only cares about spending, wherever it comes from.

Plus, the U.S. government has propositions for 2026: a potential $2,000 stimulus for lower-income households - which is known to spend every extra dollar, lower taxes, potential reduction of tariffs and lower interest rates which would relieve some debt payment pressure on households.

A great combo to boost consumption, even if only one measure were applied.

The Market’s Perception of Growth

From the market’s point of view, growth is just a number, and the market only rewards the number. A company growing 15% will always get lower multiples than with a 80% growth - within the same sector. Absolute dollar amounts don’t matter.

Growth is relative. It doesn’t matter where you start or where you’re going, the only thing that matters is how fast. Growth rate defines multiples. So even if your actual growth is lower than 5Y before or if you are generating less revenues than 2Y before, as long as there is a potential for growth acceleration, the market will reward it.

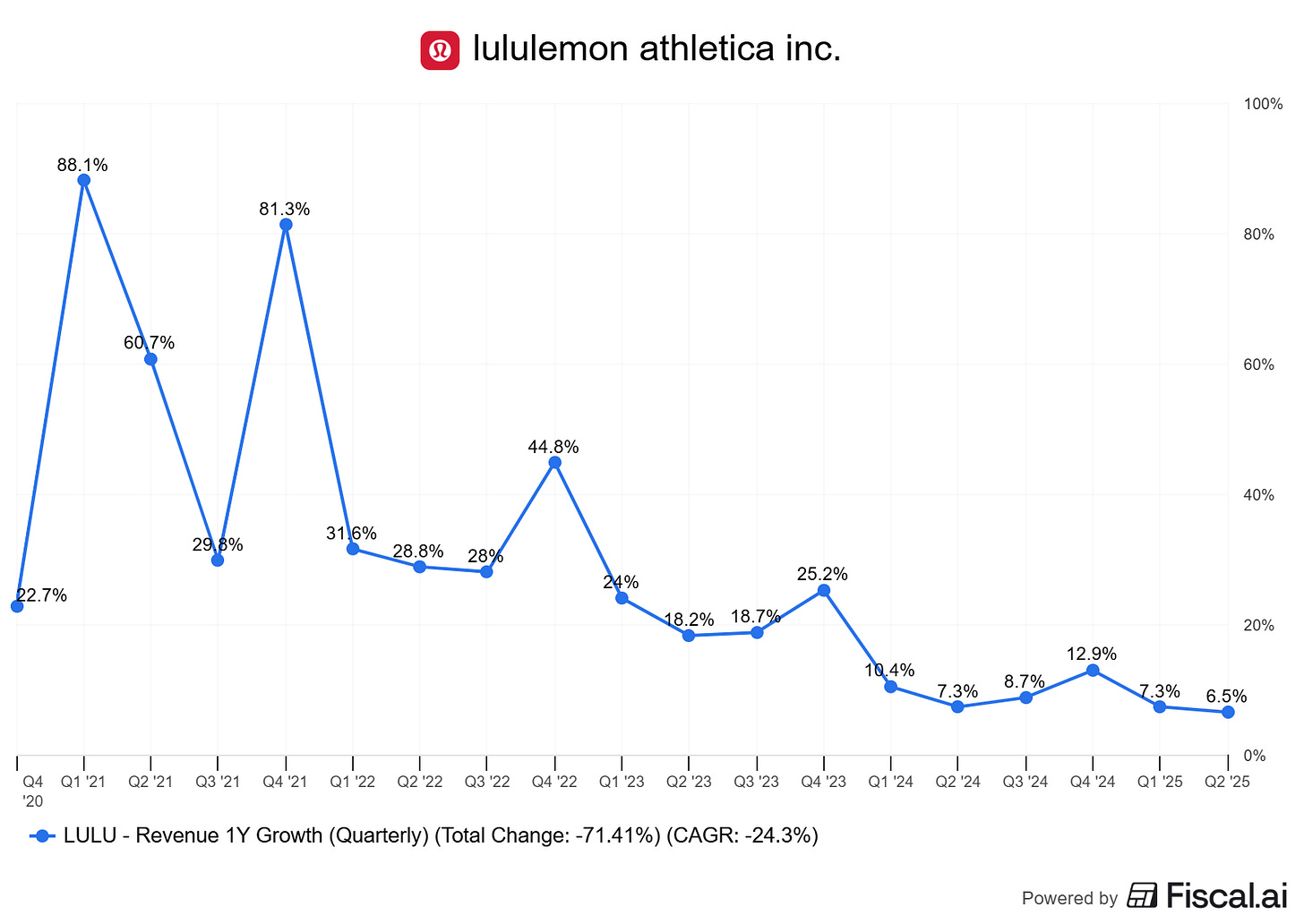

That’s why sportswear names are interesting today. They got crushed when growth slowed this year but now comps are easier, multiples are lower, and even a small improvement would look like acceleration.

And acceleration is what the market rewards most.

This setup is perfect for investors: we’re coming out of a period full of negative news, to the point where anything “not terrible” is actually considered good. Sentiment is in the gutter, comps are easy. Plus everything detailed above.

Pretty positive from an investor point of view.

On Running.

I could speak hours about On Running, but I won’t, you’ll find what you need in my investment thesis and in my review of the company’s last quarter. This is what the future leader of sportswear looks like.

I’m personally convinced as a consumer - me and my family use their products, but my bullishness isn’t just bias. The data confirms the brand’s dominance. While the sector struggles, On Running thrives.

The reason? Excellence.

Trade Plan.

This is a stock I’m comfortable buying.

Fundamentals are strong, demand comes from all around the globe, the company is still young and consumers are only discovering it in a massive market. Execution and marketing have been on point for the two years I’ve followed them. Valuation is more than reasonable in a sector that was ignored and beaten down but is now waking up. Price action was messy after the Covid crash, but we’re back above key moving averages after a great quarter.

On is a leader in sportswear right now: strong fundamentals, fair valuation, solid price action. Exactly the kind of gem we look for.

I bought on monday the restest of the weekly 50 but am aware that we could push lower to the weekly 21 around $45.

This would be an even better entry but a 4% lower price isn’t worth risking. I’ll buy more if we get there, but I’m fine starting the position today.

On valuation: the stock trades at 4.2x sales, while its average post-IPO was closer to 6x, with peaks at 8x. I wouldn’t expect those peaks again - with different consumers now than early 2024, depending on the U.S. government decisions on the subjects above - as a $2,000 stimulus would certainly boost consumption and optimism. But after their last quarter, returning to the average sales multiple seems the minimum.

In short: we’re buying the sector leader in demand, with multiple growth sources in term of products and geographies, rising profitability, below fair value, with strong price action.

I’d expect On to trade near its ATH within six months based on the current setup & renewed optimism in consumer names. Any extra positivity would be a bonus and could push the stock even higher.

Lululemon.

On the contrary, Lululemon is a wonderful brand that fell from heaven. The sportswear sector is unforgiving; king one day, hunchback the next.

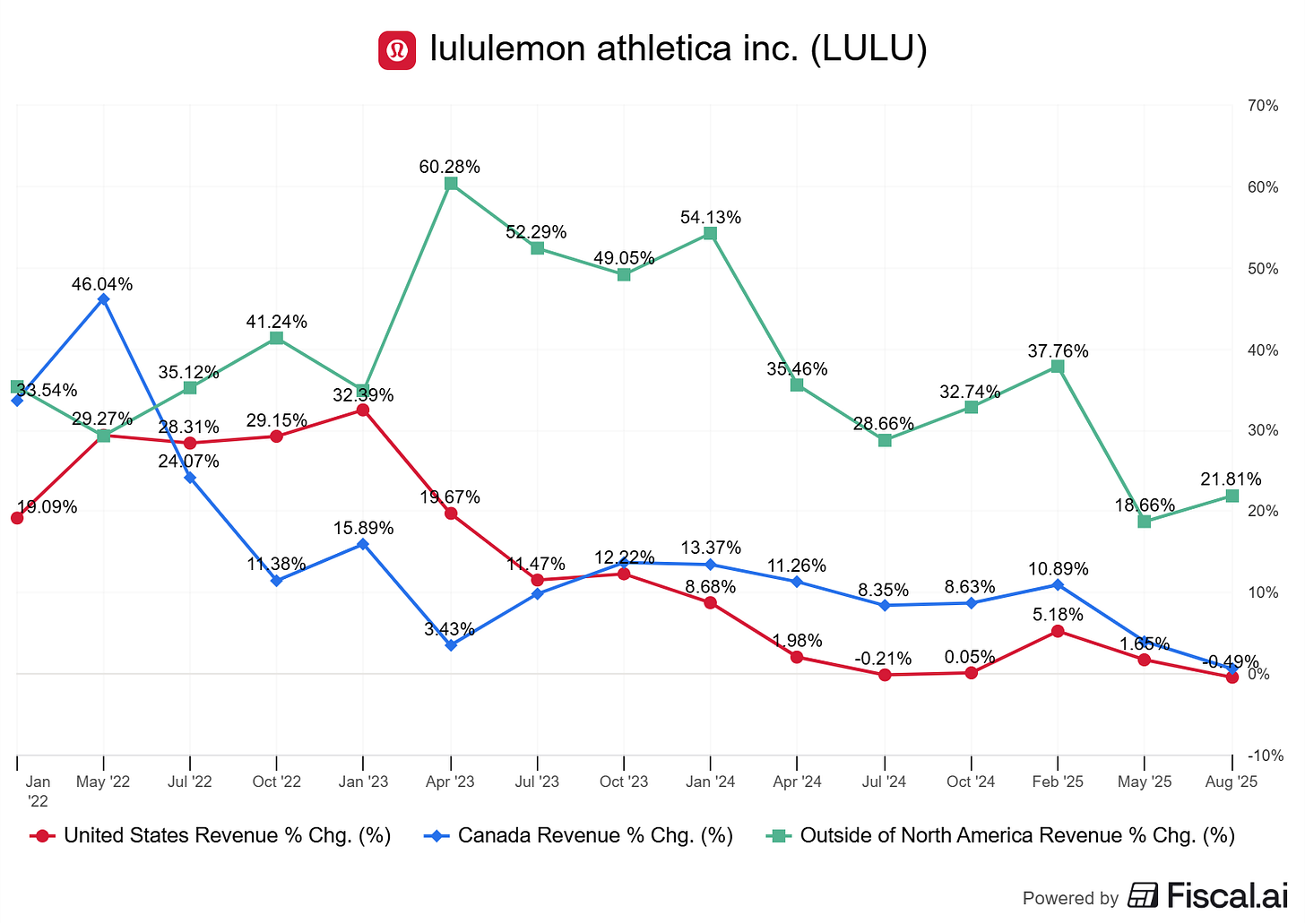

Bottom line, the Western market is slowing due to weaker consumption, while the rest of the world is still healthy.

Since the Western market makes up most of Lulu’s revenues - 60% to 71% including Canada, the picture is gloomy.

Management pointed to several issues: besides global weakness, they admitted to a product mix problem. Consumers want entirely new products, not just new colors or patterns on old ones.

The primary cause is that we relied too heavily on some of our core franchises across lounge and social for too long. We did not have the appropriate balance between existing and new styles across our casual offerings and the guests stopped responding as they had in the past.

That said, management confirmed consumers still respond well in certain categories. Most are just picky, unwilling to pay premium prices for the same model they bought three years ago.

We know that we have a very loyal guest who continues to trust and prioritize the brand for their high-performance apparel needs. And when we deliver new innovation across the assortment, they respond and are ready to purchase.

The takeaway from last quarter is that clients are still here, spending is here, but management & product teams aren’t matching demand. That’s where On Running shines - fresh and new, while Lulu, already a leader, feels stale.

Management is now working on true newness. Not just colors and patterns, but new products entirely.

We have closely assessed the drivers of our underperformance and are continuing to take the necessary actions to strengthen our merchandise mix and accelerate our business.

As a result of their work, we intend to increase new styles as a percentage of our overall assortment from the current 23% to approximately 35% next spring.

So we’re talking about a great company with issues. Not fatal, but persistent. And we know management is aware of them and working on fixing them. As they’ve already said that late 2024, the market has been unforgiving and has sold the stock harder than any other in the sector.

This comes with slower growth for the reasons explained above, as Lulu is growing at a much slower rates than it used to. Although for comparison, Nike’s revenues are still declining, yet it trades at 2x sales and 33x earnings.

Not sure how that makes sense; I’d assume the market rewards the eternal branch with a premium, but that premium seems too massive to me. Or on the contrary, Lululemon has been beaten down beyond reasonable - which is my take.

Lulu’s growth today comes entirely from international markets. But comps are about to get easier - Q3-24 was already weak, and we’ve had positive data about global Q4 consumption, at least on the cyber week.

The key question: what about the U.S.? Did management move fast enough with new models? Will the market respond positively to it?

It wouldn’t take much for Lulu to stabilize global growth, with international revenues offsetting flat U.S. sales. At current multiples, even stabilization could boost optimism but new product lines would be the real catalysts. The sooner the better.

The Plan.

Straightforward: I’m not buying Lululemon today. The opportunity is forming, but it’s not here yet. We need confirmation that management can reignite Western demand. That could happen this week, next quarter, later, or never.

But if they do, the opportunity will be there. Lulu won’t shoot 100% in a day like some AI names post-earnings. Patterns will form, retests will happen, it’ll take time.

The chart already looks clean: double bottom, breakout, retest. If fundamentals were stabilizing, it would be a buy. But today, risk is too high. If Thursday’s earnings show more weakness in the West, the market could punish the stock further or just let it drift. Neither helps us.

If it comes with good new, yes, it could be the start of a new uptrend. But without any way of knowing what will happen, this is more gambling than investing.

I wanted to present the name because Thursday’s earnings might give the data we’re waiting for. But we’re not there yet.

Thanks for the write up as always. Lulu has decent enough products and market penetration, yet as you and the management have pointed out - their stuff doesn’t feel new / hip anymore! Feel like younger peeps are leaning towards Alo nowadays despite the higher price tag. Let’s hope the management can turn this around.