On Running Q3-25 Detailed Review

Great results and massive optimism

Everything you need to understand On’s investment thesis is here.

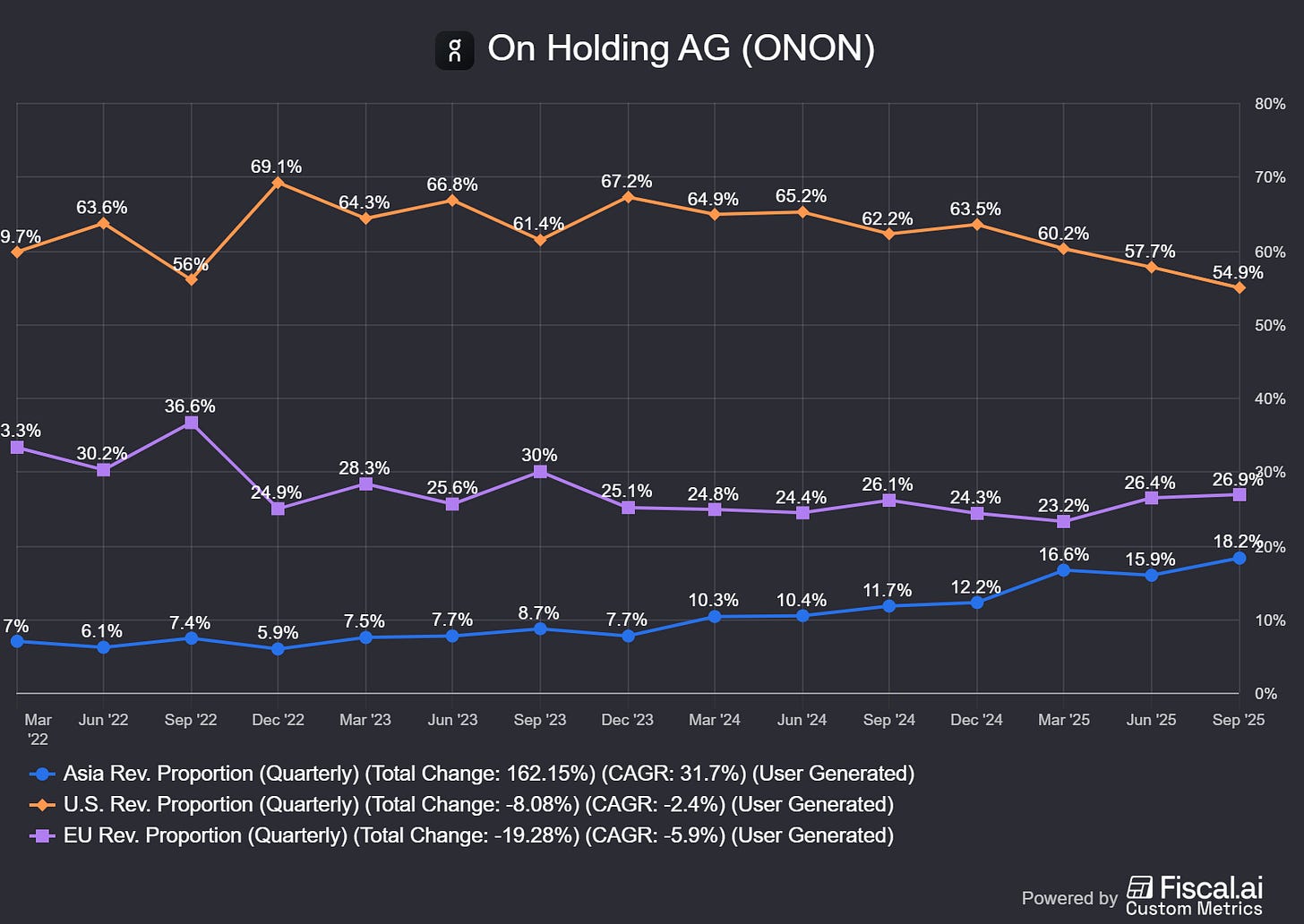

On Running delivered really convincing earnings considering the consumers’ health in the moment, at least in the west.

The global demand is a direct result of our customer strategy.

Business.

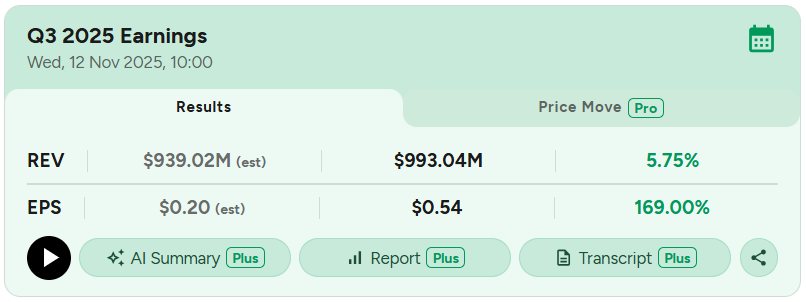

The most important metric is the DTC share of revenue, as it reflects demand for the brand itself - not just for shoes or apparel or consumers’ health. As usual, very stable with a growing trend.

DTC is key to gauging brand health and demand, but retail is crucial as an acquisition channel for first-time users and has plenty of room for growth in On’s case.

We still have about 60% of the key account doors from Foot Locker, Dick’s Sporting Goods, and Shady where On is not yet present. That is a multi-year opportunity.

Penetration is still very low.

There were also interesting comments on demographics, with rising demand from younger customers.

We are also seeing a clear shift towards younger customers in apparel, highlighting a sizable and well defined long term opportunity.

There is a clear shift in the sector and younger generations are the ones to look at to identify the next winner, as they usually stick with it for years, until something better or trendier comes along, and that doesn’t happen every day.

This shift comes from a very smart marketing from On, starting with Roger, who is an icon for all ages, but mostly with Zendaya.

You know, working with generational talent like Zendaya has of course helped a lot.

I shared months ago that she would have a massive impact on the company, and this is what is happening; her influence is really large.

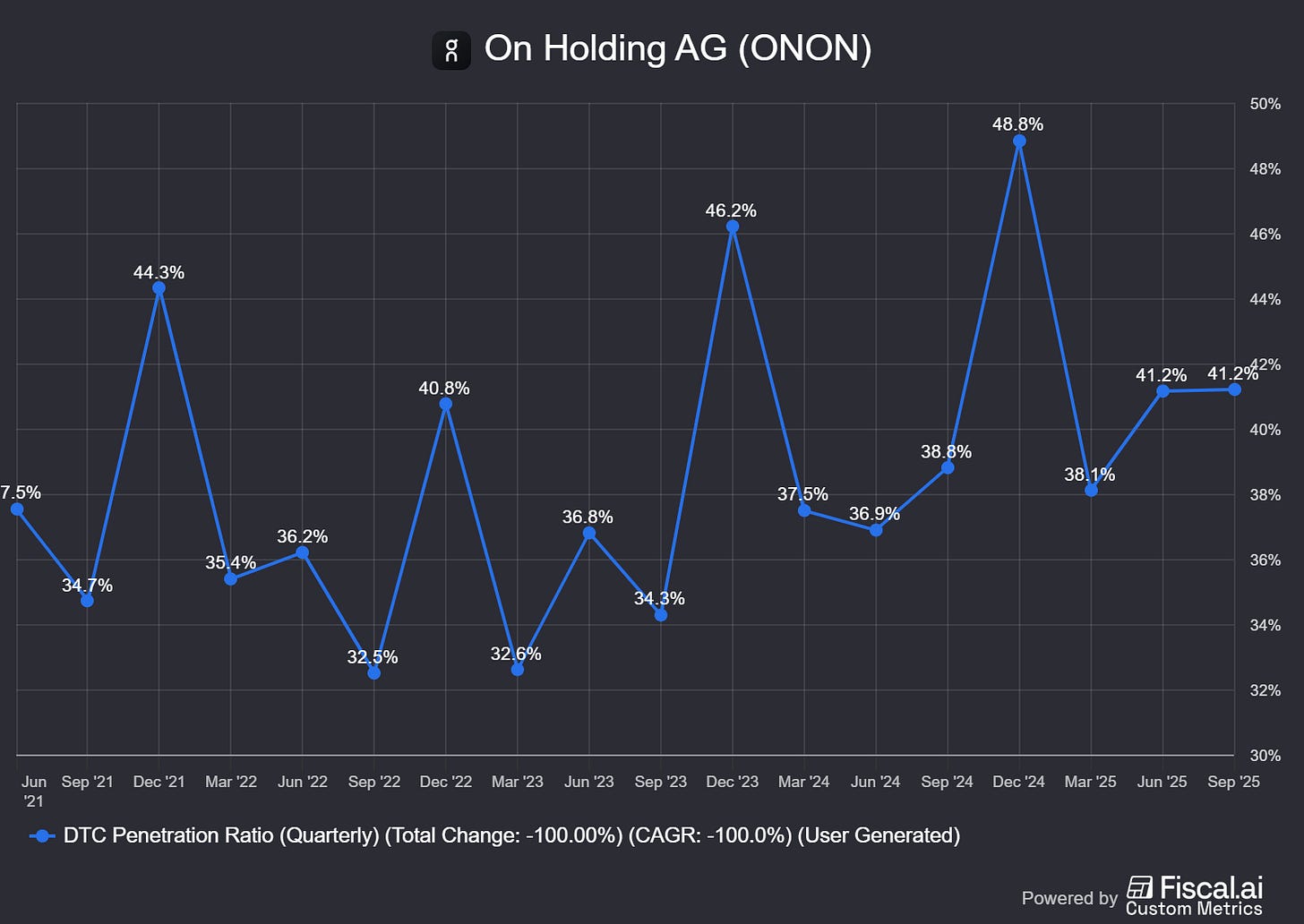

In terms of product mix, shoes remain the biggest revenue driver but demand for apparel is growing rapidly.

We have an exceptional strong running, training, and tennis business in apparel, and within running, we clearly see that whenever we do something from the performance side.

Importantly, we are not building apparel as an add on to our footwear business, but as a company within the company, serving the same communities but with a unique product offering and customer experience.

These products have higher margins and are key to spread the brand identity and visibility. A strong progression and clear proof of market fit, hitting exactly at what premium consumers want and are looking for, judging by the growth.

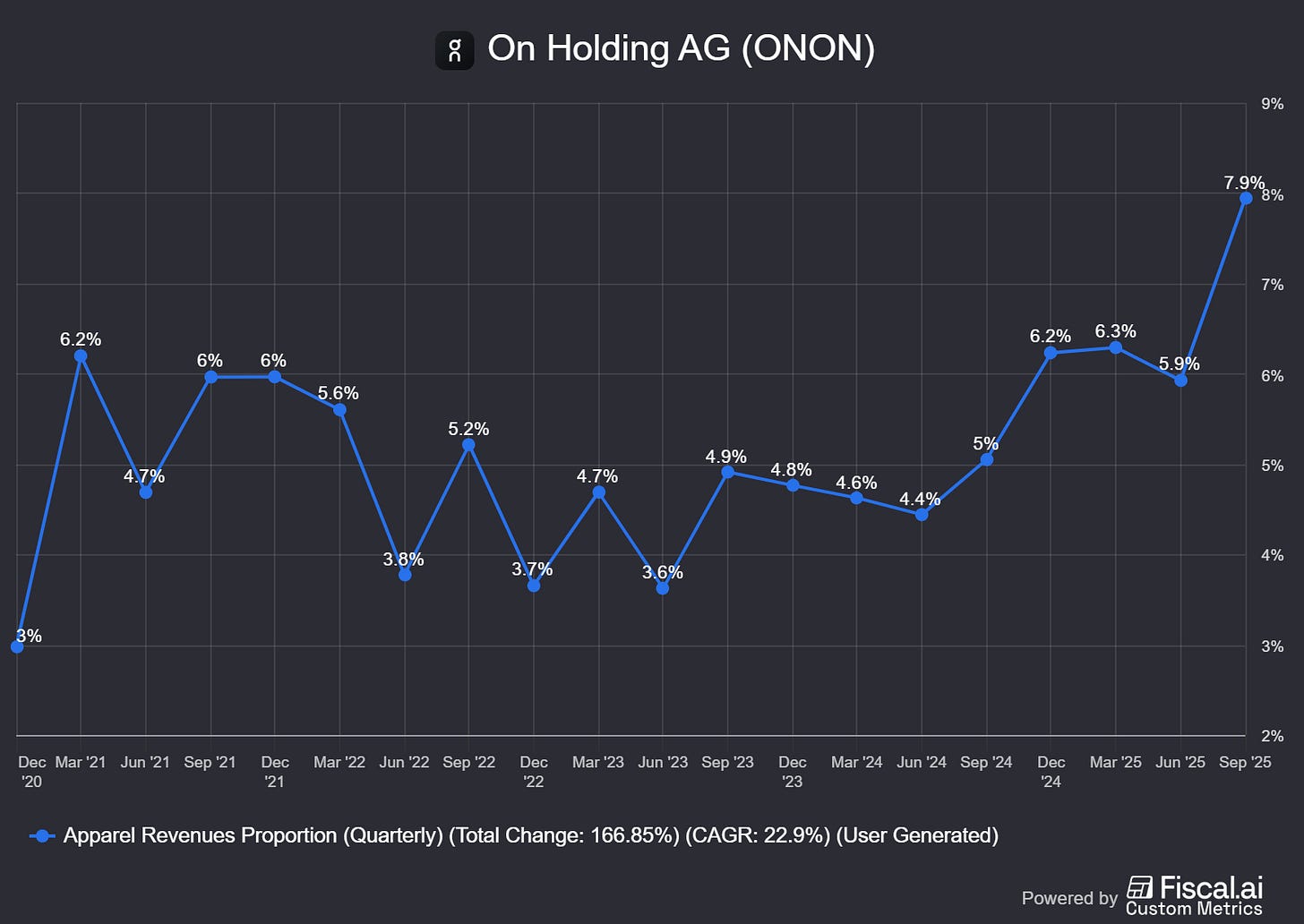

In term of geographies, the trend is clear. I said that the company’s future was in Asia, and we’re seeing that in the numbers.

It is the fastest growing region, with revenues up 94.2% YoY.

Nowhere was this connection in energy felt more strongly than in Asia Pacific, our fastest growing region. The momentum there is extraordinary.

We spoke about China. Singles Day was yesterday, 11:11. We have seen incredible momentum in Tmall. Our traffic there has been up by more than 250% and again, it’s a full price environment. We achieved our apparel target earlier than the end of 11:11.

The remarkable demand is broad based, with continued triple-digit growth in Greater China, South Korea, and Southeast Asia amplifying the success we see in Japan.

This is where consumer strength lies and it’s what’s hurting many legacy discretionary retail brands today. Most rely on U.S. growth while Asia is embracing new brands.

On is a new brand, expanding aggressively with massive demand in Asia, and healthy growth in the U.S. and Europe - up 10.3% and 28.6% YoY respectively.

On is also a premium brand, targeting premium wallets. This shows in the U.S. growth, which remains strong despite price increases, proving once again the satisfaction of its customers.

Happy to see that the price increases that we’ve done now in July of this year have been very well received and we see continued demand growth implying that our affluent consumers are not price sensitive.

A few words on Lightspray - On’s innovative product for high-performance runners. We discussed it months ago, but here’s a quick recap.

The product will launch next year and is already proving itself in elite competitions.

The ultimate proof point for our advanced footwear technologies came 10 days ago when Helena Obiri won the New York City Marathon against the stacked field of Olympic and World champions, breaking the 22 year old course record by almost three minutes. We are incredibly proud that she chose to race in the Cloudboom Strike Lightspray. This win clearly demonstrates that our newest technology is being trusted and adopted by the world’s best athletes in the most iconic races.

On top of that, On’s most groundbreaking technology, Lightspray, will help redefine the category and elevate our entire running assortment. In Spring Summer 2026, we will bring this championship level technology to everyday runners for the first time with the Lightspray Cloudmonster Hyper.

It will be a higher-priced, higher-margin product, and it’ll be interesting to see how demand and satisfaction evolve. Professionals clearly like it, based on recent records and use in competition.

Lastly, on efficiency, which is a key aspect of On as we know they had some troubles last year with their U.S. based warehouse, hurting growth, but it’s encouraging to see the company turning to AI techs to improve operations, and margins.

We are transforming the way we work. We have structurally reduced lead times and enhanced how we plan and run the business. With intelligent tools powering our integrated planning, we are building a faster and more agile company that is a stronger partner for suppliers, retailers, and consumers. More and more, AI becomes a core component to how we operate across all areas of the business and engage with our fans.

I’d love to know if they’re using Palantir - although I doubt it.

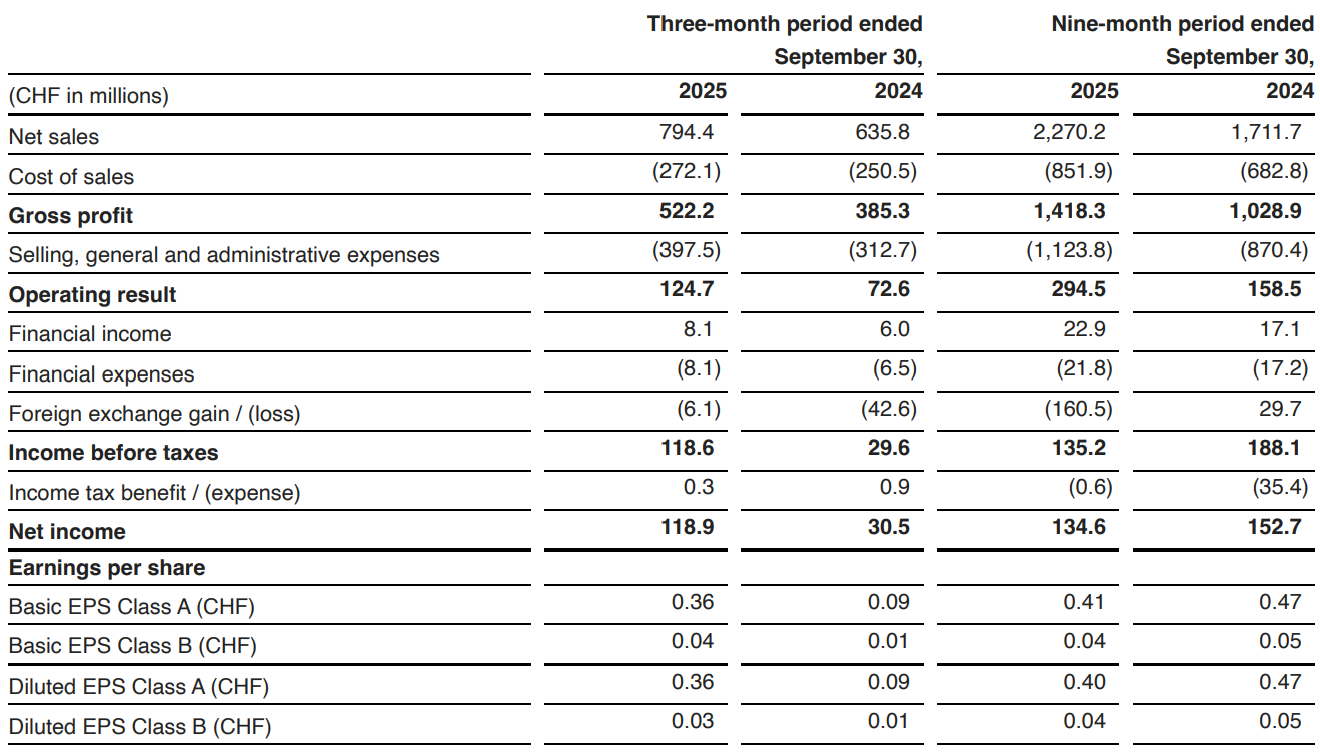

Financials.

Numbers are very good, but let’s not forget they’re in CHF and the dollar has been taking a dive lately, which actually hurts On’s revenues and growth as the company needs to exchange its dollars into CHF.

If CHF 1 = $1, then $1M of revenue = CHF 1M after conversion.

But when CHF 1 = $0.80, then $1M of revenue = CHF 800,000 after conversion.

On the contrary, when CHF 0.80 = $1, then $1M of revenue = CHF 1.25M.

The joy of currency mix.As the dollar is weaker, On’s reported growth was 24.9%, but would have been 34.5% in constant currency — meaning pre-defined and stable exchange rates. This situation, external to On’s business, is hurting their cash generation and growth. Results were better than displayed, which means the business and demand are really healthy.

Focusing on the business means looking at constant currency growth.

On the positive side, this FX situation also helped reduce costs, as On has some expenses in dollars — which were cheaper to cover with CHF. This resulted in margin expansion of around 100bps, although management confirmed this would also have been the case in constant currency.

In terms of cash, On sits on CHF 380M of net cash and generated CHF 85.2M of FCF.

As the dollar is weaker, On’s reported growth was 24.9% and would have been 34.5% in constant currency - meaning pre-defined and stable exchange rates. This situation, external to On’s business, is hurting their cash generation and growth but demand in term of product and volume is actually bigger than reflected in CHF.

Focusing on the business means looking at constant currency growth. And it’s strong.

On the positive side, this FX situation also helped reduce costs, as On has expenses in dollars which were cheaper to cover with CHF. This resulted in margin expansion of around 100bps, although management confirmed margins would also have expanded in constant currency.

In terms of cash, On sits on CHF 380M of net cash and generated CHF 85.2M of FCF.

Guidance.

This is where things get even better.

Our brand momentum is undeniable and the first weeks of Q4 have already shown our strategic gains. The fall winter 2026 sell-in has kicked off with ongoing strong momentum and our building order book for 2026 already reflects our partners’ deep confidence in our endless innovation.

Therefore, we are raising our 2025 guidance across all line items. We now expect constant currency net sales to grow by 34% year over year, well ahead of our previous guidance of at least 31% at current spot rates. Our constant currency growth guidance implies reported net sales reached CHF 2.98 billion. Alongside this top line raise, we now expect a gross profit margin of around 62.5%, a meaningful increase versus our previous guidance of 60.5-61%.

Net sales of CHF 2.98B would result in 28.6% growth FY25 including currency mix. Strong, especially combined with margin expansion. They also guided to a floor of 26% YoY growth for FY26, strong once again, especially considering the fear around consumer health in the west.

Investment Execution.

There’s no sugarcoating this: This is an excellent quarter, really impressive considering the skepticism around consumer discretionary and consumption in the west.

Demand is growing, not for shoes at large, but for the brand, for On Running’s shoes and apparels, and all data points to this positive trend.

Very satisfied as a shareholder.

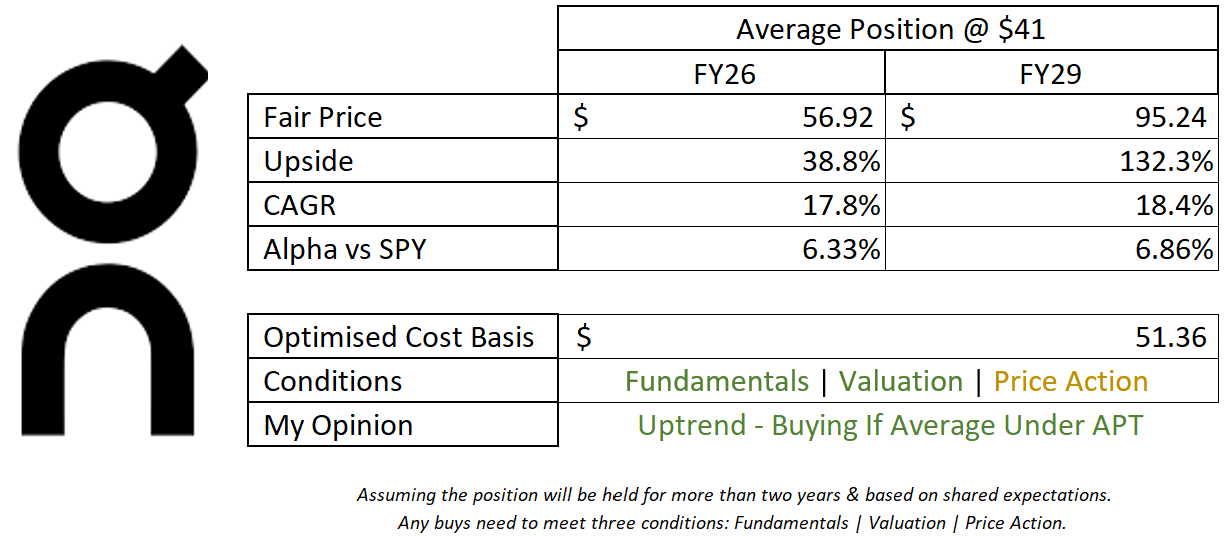

In terms of valuation, I see nothing to change in my thesis, which remains conservative - but that doesn’t hurt considering the worries around consumption. We did get some positive macro news today with potential lower tariffs in the short term and a possible cash distribution to households, but we should still be conservative.

This model assumes a 25% & 20% CAGR growth until FY26 & FY29 respectively, 16% net margins, 1% dilution, P/S & PER at x3.5 & x38 respectively.

That being said, price action has been awful due to those concerns and the earnings of most companies in the sector, which didn’t perform well - mostly older brands that thrived during COVID and face tough YoY comps, relying on Western consumers.

This is not On’s case; very new and fresh, growing rapidly in Asia and healthily in the U.S. and Europe, without tough comps and as a premium brand focused on premium wallets. This quarter shows there’s no slowdown in consumption, which doesn’t mean there won’t be if households struggle even more, but this is already positive to see such strength in a weak sector.

Long term? There’s clear adoption of the brand. Data is crystal clear.

In term of price action, we returned to April lows last week as the market punished On’s entire sector, without regard for the company’s profile. Even today’s original 25% candle ended up being sold through the day.

We’re in a clear period of weakness at the moment.

As for On; the data is clear, the company’s trajectory is clear & valuation is really weak right now, assuming they can sustain correct growth over the next years. Do I believe they can? Yes.

I hold my shares and intend to buy more.

Can’t help but think that LULU has a lot to learn from ONON!