On Running - Investment Thesis

The one who makes you walk on clouds.

I discovered On Running not too long ago but have loved it from second I set my foot in their shoes. I directly understood why this small Swiss brand was growing so fast and taking shares from the Shoe Dog’s brand.

[Company]

I won't go deep into the company's history, but there are two factors Ijuge important to share.

Olivier Benhard. The name probably doesn't ring a bell - I didn't know him either. Yet, He is a three-time duathlon World Champion, besides many more titles. Quite an accomplishment. Take some seconds to visualize it.

What i want to share here is that shoes matter to him at least as much as they mattered to Philip Knight. If you had to create any product related to an activity you excel at, you'd make something you want to use. Not something to sell fast. You’d focus on quality.

Switzerland. Yes, it is important. Why? Because the country is the homeland of quality, excellence, rationality, and organization. They are raised differently and it shows in their mentality. If you don't believe me, buy a flight and go see for yourself; you'll understand quickly. Olivier is Swiss and created the company with two others: Caspar Coppetti and David Alleman. I'll let you guess their nationality.

They're all still part of the top management today. That’s it for the two points I wanted to share first.

Business. We're talking about sportswear, mainly shoes. Or should I say, high-quality, premium sports shoes. Nike's territory. And we will compare both companies.

These are the most important part of their business today but the company is logically expanding to other products: apparel, daily footwear & other clothes, logical suits to their first products. The shoes are the cosumers’ entrance to the brand, once you've bought them and liked them (you will), you'll surely go back to find other products for your trainings. Feel free to browse through what they offer - and maybe buy something:

https://on-running.com/

But back to shoes. As I said, we're talking about a high-quality product here, and the company holds patents for their engineering they call the CloudTec and Speedboard.

https://on-running.com/en-pt/explore/technology

Those technologies are meant to give better performance and a better feeling while running.

https://patents.justia.com/assignee/on-clouds-gmbh

As I said, those shoes are built by someone who cares, knows the value of great shoes and want to give its customers the best.

"To athletes from athletes."

[The market]

This isn’t a new market as On evolves in the same space than Lululemon, the sportswear market. A wide market which is planned to grow to $750B by 2031 with a CAGR of 6.84%.

But this time we will continue with the entirety of the market as On sells shoes as well as apparel and clothes.

[The Playbook]

I’ve talked a lot about the competitive advantages of this kind of company; they’re very hard to identify and to build because differentiation is hard to create when you sell a common product. Selling sports shoes is done by many, and many have great products or patents - namely Nike. What makes yours better? Hard to say, isn't it?

So I won’t talk about any competitive advantage here as On is yet to build his. But I will detail the playbook On is following to differentiate itself - one that is known by many.

Quality. That is the number one priority. It isn't enough, but it is essential. On focused on it with research, patents, and close relations with professionals they sought to help them create better products. Olivier knew his subject but still went to ask other (not very well-known) athletes for their input.

Their shoes are some of the best and most comfortable I’ve used, ever. And after using them a lot and in very different conditions for months (namely hiking in rocks and water as much as on the road), they are as new - dirtier though. I really thought I had ripped them many times but nop.

As. New.

And their quality made noise as I’ve watched lots of runner YouTube & blog channels and On’s shoes are always on the top of their buying list in terms of quality or comfort.

Brand. "Just do it." & the swoosh. That's what Nike did best: creating its brand. Telling stories. And that's the number one thing to do once you have great products - which On does now. People want good shoes but they also want to be noticed. The swoosh started it, and M. Jordan made it unavoidable.

On isn't there yet, far from it, those things take time with important steps - I’ll detail a few. The football Euro cup and the Olympic Games will surely help, as Roland Garros did some days ago thanks to Iga.

Partnerships. This is the third page of the playbook or the 2.5 as it goes with the second one. To use the same example, Nike is what it is today thanks to Michael Jordan and On has to find its own - they found some very good deals already.

The first biggest one being with Iga Świątek, the current ATP #1 who just won the French Grand Slam some days ago - for the fourth time.

Entirely dressed by On, of course. She could be On’s Michael although I doubt Tennis will bring as much attention as Basketball did for Nike but who knows? She sure is a talent and gives the brand lots of exposure in the courts. But she’s not the only important face for On as the brain behind her shoes conception and the entire Tennis branch is none other than one of the most titled Tennis players of all time: Roger Federer - another Swiss, just sayin’. You saw him ealier.

"Since 2019, we are proud to call Roger Federer not just an investor, but a friend and partner who spends many days with us in the On Lab working on his namesake sneaker franchise and his tennis competition shoe."

It’s already lots of great names for one young brand but it of course doesn’t stop here. I won’t go through much more but if interested; the list’s here.

https://www.on.com/en-gb/explore/off-stories/athletes

Another notable partnership appeared a few days ago and not a small one in my opinion as it is with one of the most influential woman of the moment.

A different partnership though as we’re strictly talking advertising here and not sponsorship.

The truth is that On didn’t find it’s Michael.

They are working on it and marketing is working well to my opinion, converting many runners & sportives to On as I found out than many people around me already knew the brand and owned their shoes since years - with fidelity.

Global Expansion and Localization. Once your products are high quality and advertised by great partnerships & sponsorships, they must be easily accessible, be it from a store or online. On caught that early on.

"On is based in Switzerland, one of the world’s smallest countries. With few inhabitants, high mountains and long winters, there are not enough runners here to support a running brand [...] Today, we operate in more than 60 countries"

They even made their products accessible with free shipping on all orders. That's how you go viral - even if it costs you.

Products. Then, you diversify. On started as a running shoes company but has evolved since, following Nike’s footsteps. They moved to other sports like Tennis as we’ve seen, hiking & more. And there are two next steps from there.

Get out of shoes and propose apparel and other clothes. On is already doing that, socks and hats but also t-shirts, shorts, sweatshirts, and leggings. Anything that could be bought with shoes to complete your training outfit.

That’s where the company stands now and the next step is to fit every foot, athlete or not. They started to work on it not so long ago and already propose a few paris of sneakers - which I personally really like. It will surely take time before we see people with On outside of a sport court or a gym but this is the logical next step if the company wants to keep growing.

Ambition. Because those companies can never stop. They always need more product, better design, better publicity and larger reach. Shoes and sportswear brands fade fast so you need to be always present and adaptable.

"We will continue to make calculated, courageous moves when venturing into the unknown, whether that is with new territories, new products, new materials, new business models or new consumers."

Management is good, understands its products & market and work on it very well.

[Risks]

I won’t take much space here because On’s future only depends on two things.

Brand & Demand. Will the company be able to create a strong brand to which many consumers identify? This will depend on their ability to execute the playbook and find strong sponsorships & partnerships. Brands are here to tell a story and On has to find the story it wants to tell.

Demand will follow if they can achieve that.

Competition. Will they be able to thrive in an overcrowded market and take market shares from long-established institutions like Nike, Adidas, or Puma?

Those are the two key risks when investing in On.

[Finances]

As advertised, Swiss and nothing to do with Nike’s early days.

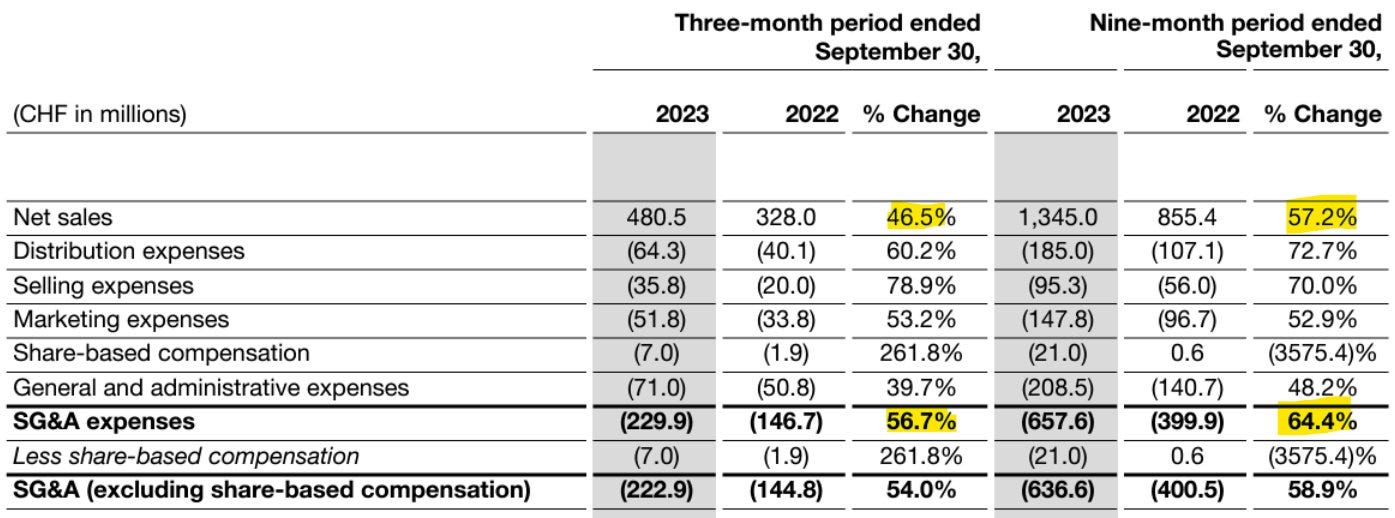

Revenues grew a bit less than 60% CAGR over the last 3 years and are expected to grow under 30% over the next 2 years. It’s very hard to know how things will be in the future as sales depend on lots of factors, notably growing their user base through better branding and new products.

Growth companies are very complexe to forecast.

Income. The company has never run huge deficits over its last years and has kept its focus on being profitable, although On exists for 14 years now, so who knows what happened before?

Still, the company is profitable since 2022, the year after it became a publicly traded company, which matters as it helped grow their balance sheet.

Balance Sheet & CF. A positive net debt & positive cash flow, although it isn’t that surprising for a Swiss company. Even more when FCF isn’t entirely due to share dillutions - only 10% of FCF comes from those.

Very healthy, growing revenues with income either positive or close to zero but rarely at a huge loss.

Shares outstanding. A classic for growth stock, to dillute its shareholders to fuel growth, roughly 1%-2% per year in On’s case. It shouldn’t be an issue for anyone who already invest in growth stock especially as On has the profile of a company which will buyback its own shares once growth is properly fueld.

Expenses & marketing. And that where cash goes when you try to build a brand and the company has been managing those very responsibly.

Those of course grew over the years but staid flat around 11% of revenues and management should keep them there. The more the company makes, the more they’ll spend to grow their brand - in currency value.

To maybe grow bigger than Nike?

[Opportunity]

We’re far from there, but you gotta start somewhere. The first question to ask is what can we expect in terms of growth for On over the next years, what could be reasonable?

This simply is to have an overview of where On is and where it could go with a growth a bit under 30% CAGR until 2030, which is above the company’s expectations. It would make On 15% of Nike - expecting a 5% growth, which is entirely arbitrary, or to be only 20% of what Nike is today and to hold 2% of the entire sportswear market.

This isn’t nothing but it isn’t spectacular either. This isn’t meant to be a projection but to show that those are realistic numbers.

Now if we were to push the comparison with Nike with some stats, Nike passed $2B of revenues in 1990 and grew 16% CAGR over the next 5 years. It remained under 10% of net margins, still does, and traded at a medium PER and P/S of respectively x20 and x1.5. It now is trading at x28 and x2.75 - the market changed eh?

To compare with On which passed $2B of revenues this year, the company has a net margin around 6% and intends to grow it above 15% during 2024 and is trading at a PER and P/S of respectively x95 and x6.4 - while forward PER should be under x40 if the company were to respect its FY-24 guidance of 30% growth and 15% net margin.

Not bad.

Returns are calculated with On’s actual price around $42 and I think we can safely say that the actual price doesn’t give lots margin of safety. It’s very hard to call a growth stock overvalued as everything can change from one quarter to another but one thing for sure: I am not a buyer at today’s price.

That being said, my base case is using a conservative growth and net margin with Nike’s actual ratios so I wouldn’t be surprised if On were to do better than this over the next five years while stopping its share dilution & maybe even starting buybacks. So, all together… We might not be very far from a fair price, as long as you believe my base case to be achievable.

I would assume that price to be around $40 but it still wouldn’t give much margin of error. I’d personally like it much better around $35, as the stock should retest its 52 weeks high breakout from its last earnings.

This is where I would be comfortable growing my position, assuming the fundamentals are still strong. Retesting this breakout is highly probable during the next months as even though the business is easier to analyze than many, the fact that On’s revenues are in CHF creates lots of confusion and gives the markets tons of excuses to react wrongly, as it did during the Q4-23.

https://twitter.com/WealthyReadings/status/1767536669429801340

Wasn’t the first time, surely isn’t the last time.

[Conclusion]

This is it, all I can tell you about On & my perspective for its stock. The company, its products & potential. Over the long term, everything will be decided by how well management can execute its playbook and nibble competition’s market shares while consistently proposing innovation and qualitative products.

As long as the company does so, everything should be fine for its stock over the long term although volatility is to be expected from a growth stock.

Thank you for reading it all! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!

Thanks for the article! I had heard about the company but hadn't looked properly into it yet - its PE ratio gave me vertigo -, so this writing gave me more perspective about it :)

At this prices I'm not a buyer either. It reminds me of Celsius right before this recent great correction. I would wait for something similar to enter, especially considering the price of their products, which aren't affordable to many consumers.

Cheers and keep up the good work!