Weekly Recap | December - W1

Substrack & Content Changes, Weekly Watchlist, FED expectations, Numerous Bullish AI News, PayPal Update and Cyber Week Data, Netflix Acquires Warner Bros, Weekly Planning & More

Substack Refocus & What’s Changing

You probably noticed a few changes lately - especially the name and profile picture. I updated them a bit too fast and it confused some people… a few even unsubscribed because they didn’t recognize the new name. That one’s on me. Hopefully this write-up clears things up.

We’re still on Above Average Returns, but I’m shifting a few things, and I want to walk you through it.

Why the Change?

My goal is to refocus the content on the core of my investing style: a concentrated portfolio with a few high-conviction positions. At the moment, my attention is spread across too many topics. I am not following my core positions closely enough, nor the new opportunities that are actually worth digging into.

It created noise which impacted my decisions and reduced the value I could bring you.

So starting now, the content changes - a little bit. For the better. Here’s how.

What You Can Expect Going Forward

1. Deeper Follow-Up on My Core Positions

From now on, most write-ups will focus on:

My active trades / current positions

My tight watchlist

That means clearer investment theses, deeper follow-up on each trade, more frequent updates & more content on narratives, catalysts, valuation and position management.

I usually run with around five key positions or “narratives.” Right now, they are:

TransMedics, healthcare, not sensitive to rate cuts, consumption or AI spending.

Nebius & Astera Labs, strong AI exposure due to what looks like a misspricing.

China (Alibaba & KWEB), for some international diversification.

Crypto, a reversal play, high-risk/high-reward.

PayPal, a position I’m no longer convinced about but didn’t close yet.

They’ll change over time, but the goal is to go deep on the few I believe are the best opportunities, explain why I own them, what changes, how the risk/reward evolves & how I adjust my positions and vision accordingly.

More focus, fewer distractions, stronger decision-making.

2. Long-Term Strategy Still the Same

I use the word “trade,” but nothing is becoming short-term. I still hold positions for months or years, not days. I rotate when the thesis changes or risk/reward shifts, like what’s happening with PayPal lately.

Being concentrated doesn’t mean shorter holding periods. When I find the type of opportunities I look for, they usually take months to play out. I proved that with Alibaba bought in the $80s a year and a half ago or TransMedics bought around $70 a year ago, with projections out to 2028.

Just to be clear: “trade” is simply the word I use for buying & selling. But the approach remains long-term.

3. A Tighter Watchlist

I’ll keep covering a smaller set of assets that:

Are fundamentally strong

Are close to fair value

Almost meet my buying criteria

Basically: next-in-line opportunities.

These names will get regular updates, but not as deep as core positions. When one becomes a real opportunity, then I go deep - like Google at $150 or ASML at $700 earlier this year.

Right now, my watchlist includes: Strategy, Bitmine, Lululemon, MercadoLibre, On Running, UIPath, Netflix, Adobe, Sea Limited, Novo Nordisk and Duolingo.

This will change as new opportunities show up. I’ll update their status weekly.

What I’ll stop doing:

Long detailed write-ups on great companies that aren’t great buying opportunities right now - like Google, TSM or Palo Alto. You’ll still see them in the weeklies & I’ll briefly cover their earnings, but that’s it until they get interesting again.

4. The New Content Structure

Nothing drastic changes in structure, just the names covered and more detailed write-ups when needed.

Core Positions & Follow up. Full theses on purchase, valuation, position updates, etc. This builds and maintains conviction with a very close follow up of the fundamentals & the position.

I already started with TransMedics through valuation work + conference reviews.

Earnings Season. Deep dives only for core positions and watchlist. Brief reviews for everything else. This is where I’ll find more time.

Weeklies. Mostly the same: watchlist & positions update, news, broader thoughts on macro and fundamentals. Those are meant to cover the market so we’ll continue to talk about it and not necessarily focus on my positions themselves.

I will tighten my watchlist so it only covers names I follow closely. If you really want the old format, tell me and I’ll see if I can merge both.

Monthly investing plan. A full overview of positions and watchlist, with strategies & updates, like I did last month.

Overall: Less noise. Fewer names. Much deeper content.

I want to focus on the few bets that matter, and optimize them in term of returns.

My content got as noisy as the market, and it’s time to fix that. Refocusing helps me invest better and I truly believe it will bring you more value. If I invest better, I write better. More signal, less noise.

Some may miss the “cover everything” style. I get it. But covering everything was eating too much time and became more distracting than helpful.

Time to focus.

I hope you’ll stick around, the content is only getting more precise, more useful and more aligned with performance. And I hope you’ll enjoy it even more than before.

Onto many more years of outperformance.

Weekly Watchlist Update.

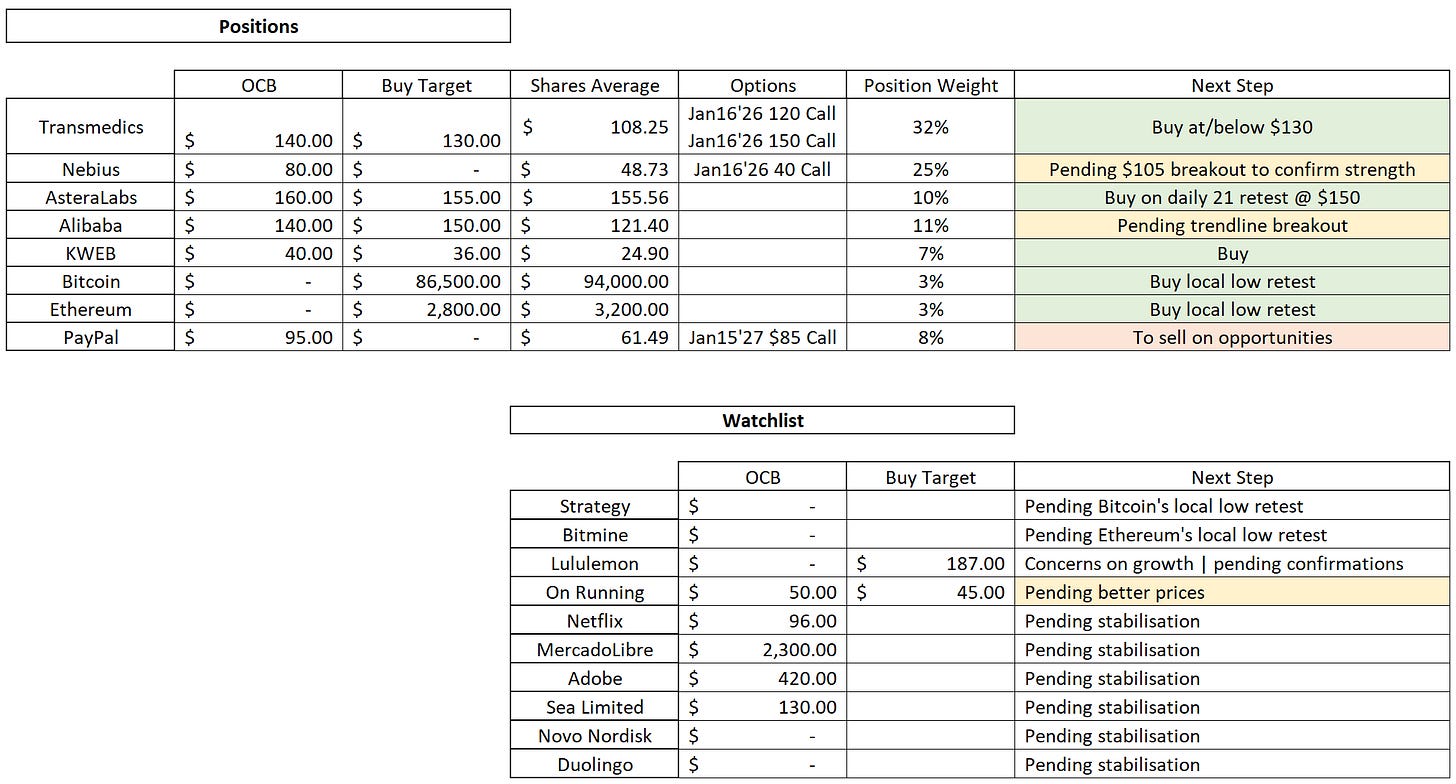

Here’s my watchlist and buying plan, for both current positions and the watchlist. First time with this format, I’ll improve it as we go. As always, buys & sells are free to access in my public portfolio.

https://savvytrader.com/wealthyreadingspro/buyandhodl

As I said, I don’t intend to maintain the old format anymore even though many liked it. It created contradictions between very long-term views and my strict entry criteria. For example, I understand if someone wants to buy PayPal today with a 5Y horizon, but the asset doesn’t fit my criteria today, so I wouldn’t buy.

Two valid opinions, different timeframes.

If you absolutely want the older long-term format for all assets, tell me, I can keep it. Otherwise, I’ll keep improving this new approach and focus on the watchlist.

Market & Macro.

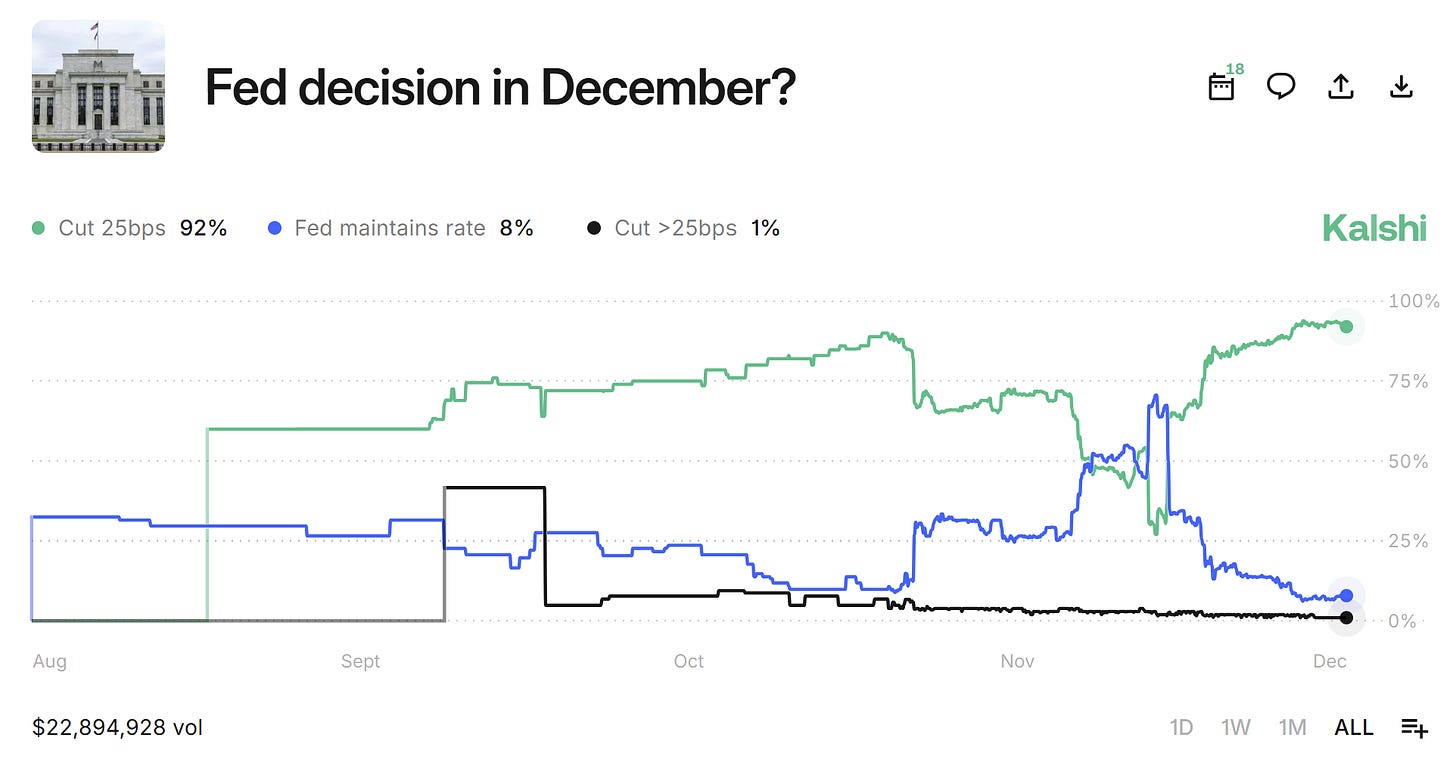

The most important news this week was the core PCE, the Fed’s key inflation metric, which came in in line with expectations. That was the last confirmation the market needed to price a December rate cut as almost certain.

Two weeks ago, I wrote that I didn’t buy the narrative saying the FED wouldn’t cut rates because we lacked inflation/labor data due to the government shutdown. That take aged well and some of the buys made during that panic turned out to be great entries. But still, it’s too early to celebrate.

We’re now in a setup where the Fed is expected to cut. Optimism’s already priced in. Their meeting is Wednesday and you should be mentally prepared in case they don’t cut. I still think they will, but just be ready in case.

If they don’t, keep in mind that Jerome Powell’s term ends in May 2026, meaning the next Fed chair will be chosen by Trump. That likely means less independence between government and monetary policy - at least with Trump in power. So if the Fed doesn’t cut Wednesday and markets tank, remember: this is only a push back for a few months, and rate cuts are coming, combined with stimulus, tax reductions, tariff adjustments, and probably more.

I believe a cut will happen in December. And everything else follows in 2026.

That’s why I’m being aggressive in the markets right now.

Watched Stocks and Portfolio.

AI Market Updates.

As usual: AI. This section will probably show up in every weekly until optimism fully returns, and as long as I believe AI keeps offering opportunities.

We got many topics today, with the same conclusion as always: demand for compute is massive, and companies are scrambling to find capacity anywhere they can. This creates bottlenecks everywhere, slowing deployments as demand is so huge that supply simply can’t keep up.

For weeks, news taken individually looked bearish, but taken together, everything points to a simple fact.

Demand. Is. Massive. And. Continuous.

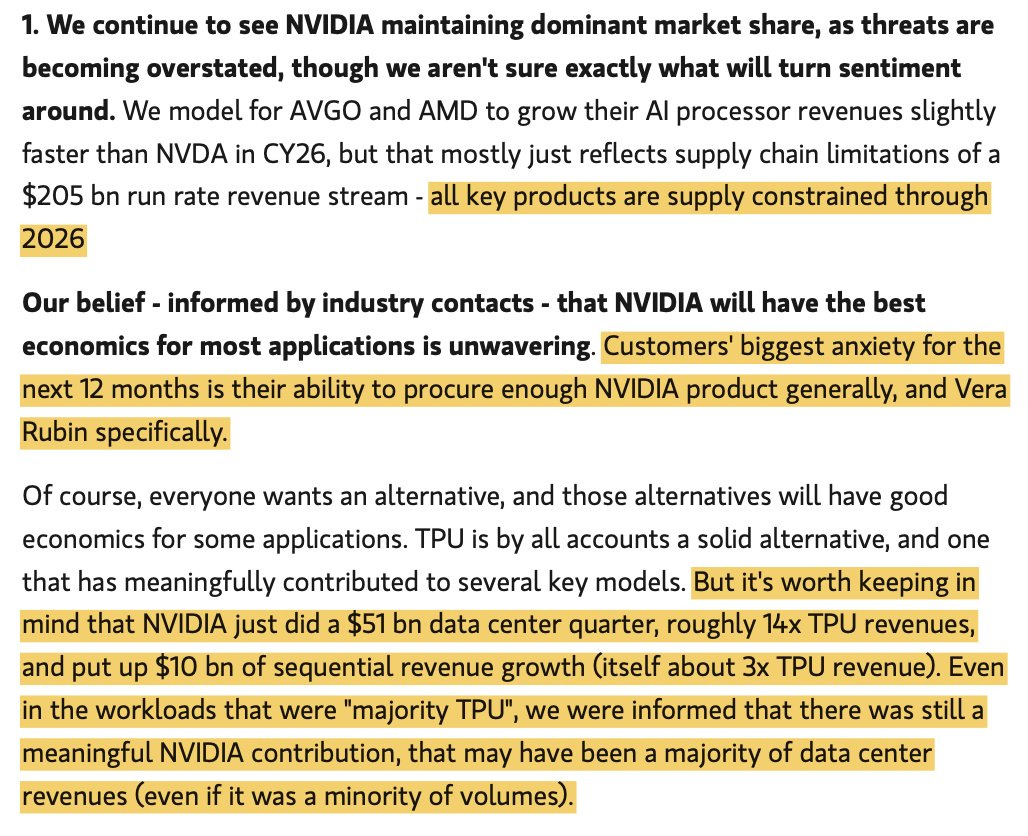

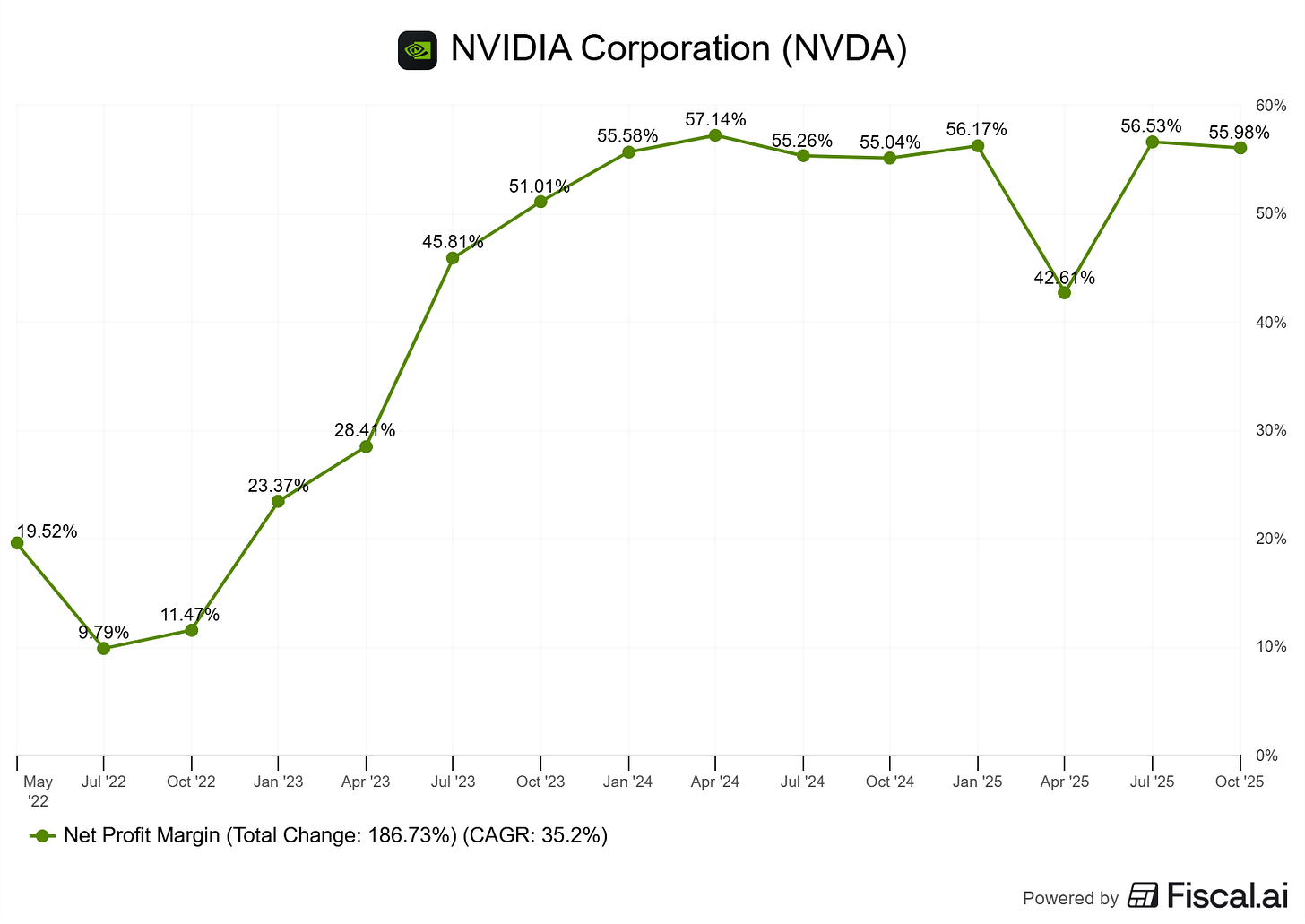

Nvidia is King.

As I mentioned in my Nvidia quarterly review, signals point toward strong demand for compute hardware.

This is an extract from JP Morgan’s tour in Asia and discussions with customers there.

You can read about things I detailed weeks ago here.

The supply constraints which impact Nvidia’s deliveries, despites a massive demand, detailed on this note. The bears always look smart because they take data individually. But the world isn’t that simple.

We’re also getting comments about Google’s TPUs and why demand is rising. Spoiler: it’s not because companies are choosing them over Nvidia. It’s because the overall demand is so enormous that clients are forced to use anything they can get. Something we also talked about after the Meta rumor.

Bottom line: we’re supply-constrained. Bear arguments make sense on paper and with news taken individually. But they collapse when you look objectively at the sector as a all, and not data set per data set.

Growing demand for Nvidia GPUs = growing demand for Astera Labs’ accelerators, which is why I hold the name.

And demand for hardware = demand for compute, which is why I’m holding Nebius.

I still cannot see the bear case in the data. Not even a sign of it. So I continue to be bullish. And this week’s new bearish argument won’t change this.

The Rebellion Exists.

Over the past few months, every company in the Mag7 announced work on their own in-house chips.

Meta → MTAI

Google → TPUs

Tesla → AI4

Microsoft → Maia

Amazon → Trainium

On its own, that sounds bearish for Nvidia, right? And so the bears went all in, as usual, but once again without context.

Demand is so huge that it’s worth spending billions in CapEx on top of buying Nvidia hardware. The “rebellion” is logical: nobody wants to pay a permanent 50% premium due to Nvidia’s monopoly. It’s cheaper long-term to invest in R&D.

But none of this means Nvidia gets replaced. Hardware is one thing, CUDA is the real advantage Nvidia holds on the world. These in-house chips will be complementary, not replacements. And many of them are far from production-ready.

The demand is so huge that it is worth having options for overly specific use case with in-house hardware. That is why companies develop their own chips, but those won’t be used for the bulk of the demand.

Amazon Partnership.

Another big one this week: Nvidia and Amazon announced a new partnership, not for GPUs this time, but to integrate NVLink directly into Amazon’s Trainium and other in-house processors.

Another proof that Nvidia isn’t dying.

Even if Amazon wanted to rely entirely on its own chips, it still needs the rest of the AI infrastructure to make them useful. And that infrastructure is partly Nvidia.

Google & Amazon.

A genuinely huge announcement: Google and Amazon are partnering to create a “bridge” between their cloud infrastructures. Companies have been begging for this for decades, and no one has ever offered it through a proprietary solution.

This changes everything for AI workloads and for the cloud market as a whole.

OpenAI Struggles.

You know this is the only real warning I see in the AI trade. OpenAI is intertwined with everyone and responsible for massive future spending, with no guarantee they can actually fund that spending.

And they’re starting to fall behind, mostly behind Google, but also others. Without spreading rumors, social media was full of reports of a “code red” sent internally to push the team to speed up on new features.

The AI race is still very much alive, but OpenAI needs to stay competitive for the entire AI trade to keep going. Too much rests on their shoulders now.

Short term, I’m not worried, their spending commitments are long-dated. I continue to believe they’ll IPO at a ridiculous valuation to fund their needs. They may not have another choice. And I still believe the IPO could mark the top of a potential bubble by then.

Lots of speculation, but worth watching closely.

METAVERSE.

Zuckerberg announced this week that Meta is slowing its Metaverse spending. Billions spent, very little demand, very little progress. Time to cut the losses.

That being said “reduced spending here” doesn’t mean “reduced spending overall.” It means reprioritization.

Within our overall Reality Labs portfolio we are shifting some of our investment from Metaverse toward AI glasses and wearables given the momentum there. We aren’t planning any broader changes than that

It would be foolish to think this spending won’t be spent anymore.

UIPath.

I’ve been studying UIPath for a few weeks now, and after their incredible earnings, it’s time to talk about it. The stock is up 30%+ since I said it looked like an amazing buy and of course didn’t buy it myself.

Sometimes your own rules protect you 90% of the time and frustrate you 10%. It is what it is. But the call was right & would be up 3–4x by now if taken earlier, so yes… still hurts.

That said, UIPath is shaping up to be a major potential winner of the AI cycle. In my December & FY26 prep, I said the next source of AI returns would be:

Hardware solving specific bottlenecks

Companies levearging AI to solve real-world problems.

UIPath is in the second category and could follow Palantir’s path in some ways. Expect more coverage soon - I need time to build a valuation model and structure a proper trade plan.

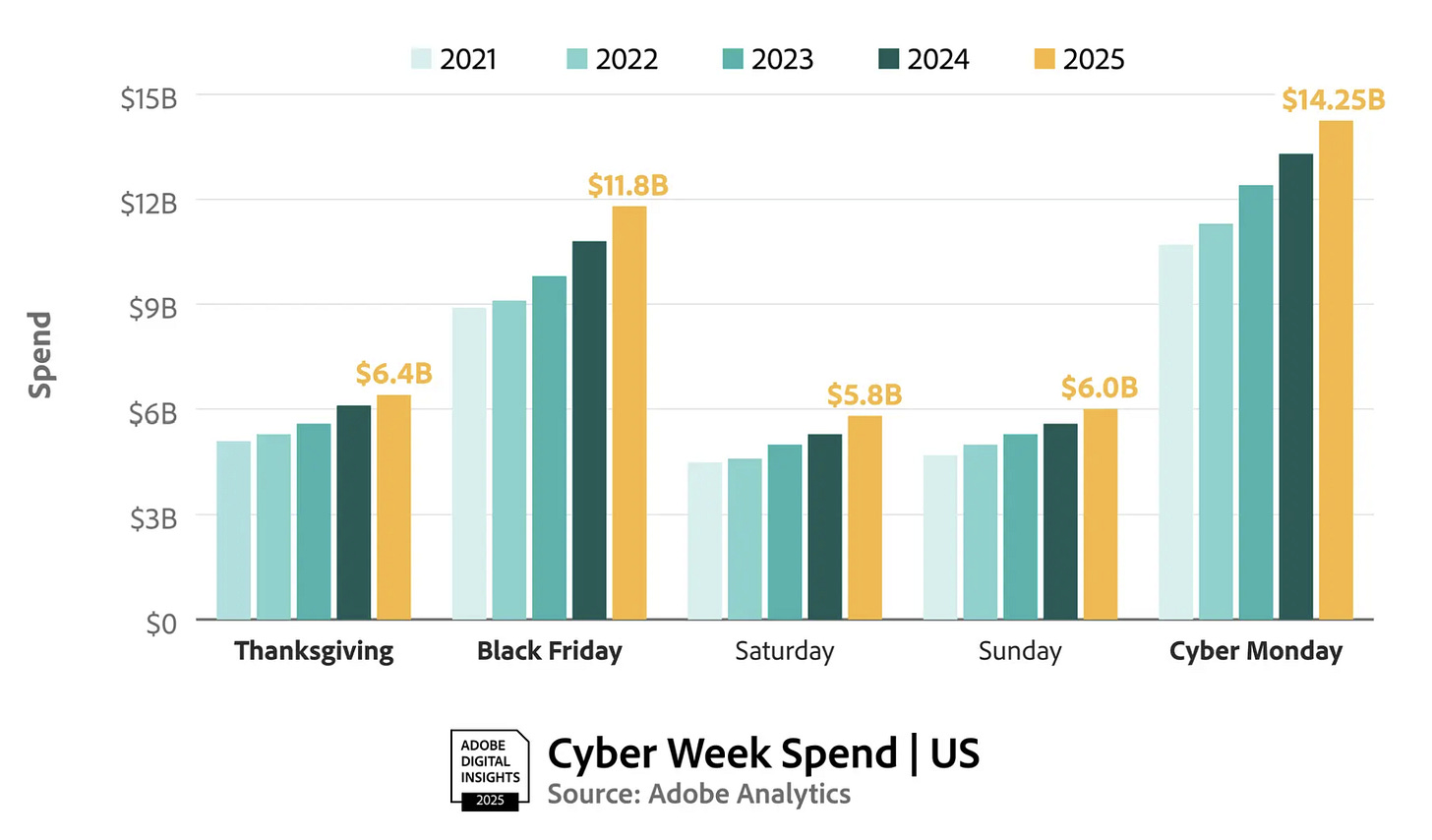

PayPal Black Friday & Consumer Strength.

In my last PayPal write-up, I said I’d eventually close the position when I need liquidity, but I expected Q4–25 to be very healthy thanks to holiday spending.

And PayPal released numbers showing very strong activity in usage, frequency, BNPL, everything, at the end of the cyber week.

Adobe and other data providers confirmed the same. Cyber Week saw +7.7% YoY spending across sectors. Adobe also tracks where the traffic comes from, and of course, AI-driven click generation went wild, with social media being one of the strongest drivers of spending.

Consumers showed up. Many used BNPL. My thesis seems to stand: holiday spending isn’t a luxury anymore, it’s cultural.

Netflix Buys Warner Bros.

Probably the biggest new of an already very full week. Rumored for months, now official: Netflix announced the acquisition of Warner Bros on Friday.

Warner Bros owns HBO and very popular franchises like DC Comic, Harry Potter, Game of Thrones, Lord of the rings - partially, and many more. These are just the famous ones, there’s a gigantic catalog behind them.

The market didn’t like the deal much as it comes with big spending, dilution & many interrogation marks on execution and timeframe for returns on investment. Personally, with the IPs and user base included, it’s hard to call this a bad trade, especially with Netflix reliability over the years to execute perfectly.

We’re talking about a $82.7B deal, financed by cash, future cash flow & dilution. Hard to anticipate how much but we’re talking about a 3% dilution floor which could go up to 10% of slightly more depending on how they’ll finance the rest of the cash required to pay for the deal - which could come from convertible notes or classic debt.

Regulatory and shareholders approval is still pending, but those who follow and have more knowledge than me seem to think it shouldn’t be an issue.

I see this deal to be a net positive for Netflix but it will take years for management to capitalize on it, as launching new series and leveraging IPs take long. And I would love for the market to punish the stock due to uncertainties, as I am almost convinced if so, this will prove to be a massive opportunity once again.

Time will tell. But Netflix is on the watchlist.

Weekly Planning.

I’m working on few write-ups right now, but priority goes to:

Sportswear sector investment plan

UIPath investment plan

These stocks are moving fast and I need to share the info. I am not sure I can finish both this week but know that I’ll be working on them and you will have them soon.

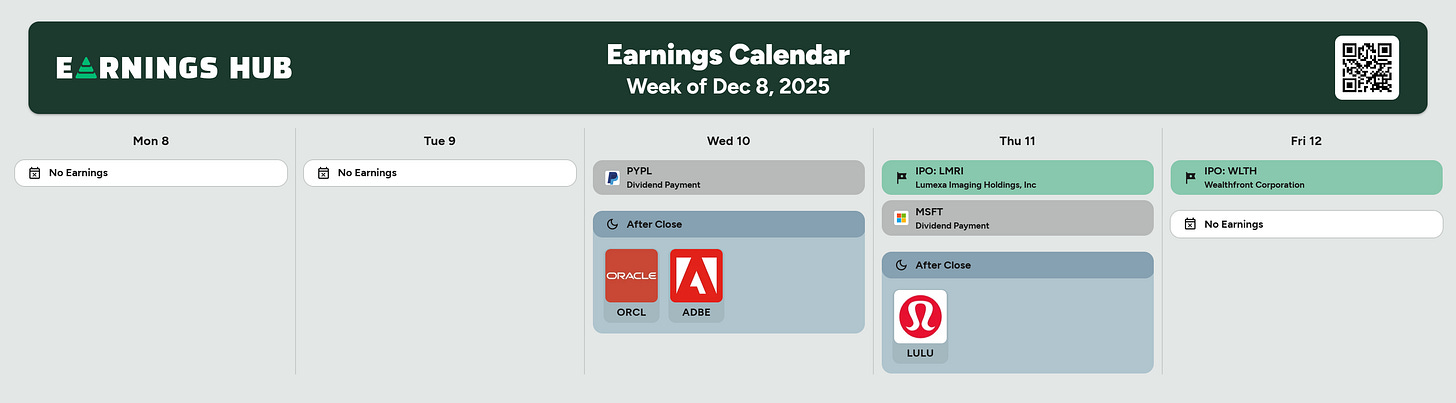

We also have both Adobe and Lululemon reporting this week, and both are on the watchlist which means they’ll be covered.

I have my usual expectations for Adobe: business as usual. The problem on this stock is about market’s perception, not fundamentals.

Lululemon’s stock on the contrary is behaving perfectly, boosted by positive data on consumer spending on other brands - notably Ulta last week. I will try to finish the sportswear investment plan wednesday latest to give you time to read it as Lululemon will be part of it and could be a great buy already.

I have more on the to do list, with a review of both my positions on Nebius and China, a refreshed investing playbook & updated substrack structure as things changed a bit, and the usual weeklies to come. No time to be bored as you can see, as I am working on reshaping the content and increase massively the value I can bring - & our returns.

I’m happy and excited with the refocus and the next steps of our journey. Once again, I hope you’ll be here for it.

Until then, I’ll wish you an amazing week!