AsteraLabs Q3-25 Detailed Review

The thesis is not confirms but early signs are encouraging

Everything you need to understand AsterLabs’ bull thesis is here.

Business.

Let’s start with a quick overview of the different types of ports - connectivity systems, that exist in hardwares, relevant to Astera Labs for its actual and future products. We have three categories, each designed for a specific kind of data communication.

PCIe now in its sixth generation (Astera Labs’ core focus), is used for high-speed connections within hardawres - linking GPUs, CPUs, SSDs & co within a system. It’s optimized for low latency and high bandwidth, ideal for AI.

Ethernet, which most people know from their home internet setup, connects systems across short and long distances. Higher latency than PCIe, but greater scalability, essential for data center connectivities.

UALink is the newcomer, engineered specifically for high-performance computing. It’s a direct competitor to NVIDIA’s NVLink and is expected to become the gold standard for AI connectivity. Adoption will take time, these transitions don’t happen overnight.

Back to Astera and its products, signs point to healthy and potentially accelerating driven by the AI sector’s momentum.

That being said, in term of demand for their product first, all signs seem to point to an healthy demand and potentially a continuously growing demand, first because of the dynamic of the AI sector.

Analysts forecasting Capex at the top four U.S. hyperscalers to surpass $500B in 2026.

And second because of Astera’s focus on future architectures; PCIe 6 today, which is starting to scale within datacenters and boost demand as AsteraLabs is a leader in those connectivity systems.

Growth within the quarter was broad-based across our signal conditioning, smart cable module, and switch fabric products. Scorpio P Series continued its initial volume ramp at our lead customer, and we are excited that our P Series revenue will further broaden with recent new design wins across a variety of AI platforms at multiple hyperscaler customers. Scorpio X Series is shipping in pre-production quantities, with a volume ramp expected throughout 2026. Our Aries portfolio continues to perform well, with PCIe 6 solutions contributing robust growth during the quarter. Our Aries 6 products are the industry’s first and only PCIe 6 retimer solutions, ramping in high volume today. Taurus drove strong growth during the quarter as incremental opportunities began shipping in volume across both AI and general-purpose systems, and we expect further growth in 2026 as we expand to 800 GB switching platforms.

These are strong results, and they come before Scorpio P scales and before X Series enter production. Demand from hyperscalers is growing, focused on Nvidia’s new GPU generation which is a great long term prospect and confirmation of the demand and need for their hardware - hyperscallers could go with Nvidia’s packaged solutions but don’t.

We are excited to report several new design wins at multiple hyperscalers during the quarter for Scorpio P Series fabric switches across a variety of AI platforms supported by both merchant GPUs, including NVIDIA’s GB300 and B300, as well as designs based on custom AI accelerators. Additionally, our Aries PCIe 6 smart retimer business and customer opportunities are now expanding as AI racks built around custom AI accelerators and new merchant accelerators begin to adopt PCIe 6. Overall, our PCIe 6 solutions contributed in excess of 20% of our Q3 revenues, illustrating our market-leading position.

Astera Labs is positioned to become a major player in AI compute optimization for next-gen data centers and most of this success comes from their integration into Nvidia’s custom racks.

So as we have said before, the opportunity for us for NVIDIA-based designs is when hyperscaler customers customize their design to deploy in their own infrastructure. But the opportunity for Astera comes when hyperscaler customers take the very high-performance GPU platform and customize it for their use cases.

The bull case remains Astera’s capacity to cross-sell its products to further boost compute optimization within data centers.

So in general, we do see that having a strong presence in the scale-up network allows us to pull in several other products and technology that we currently have and also working on in terms of future product lines that we intend to offer to our customers.

We don’t yet have confirmations of this happening since both P and X Series are still scaling, but the fact that Astera is part of these early conversations shows clear interest in their solutions from hyperscallers.

Now, onto UALink. Even though PCIe 6 is just starting to scale, the industry is already discussing the next generation of optimized connectivity, and Astera Labs needs to be involved, even if PCIe 6 is not going to disapear tomorrow.

Like we have highlighted many times, we are heavily engaged right now on scale-up. Today, most of the deployments are PCIe-like. And these are engagements that obviously will live for multiple generations, and that’s probably something that perhaps is a little underappreciated. We do expect that revenues to go into 2029.

UALink hardware will be additive to PCIe, not a replacement. Hyperscalers will deploy both technologies in parallel for years. And AsteraLabs is already part of the discussions to define the specification for these UALink hardware.

We are engaged with several leading hyperscalers and AI platform providers in the RFP and RFQ stages to align on the designs and applications that fit best with their technology and business requirements. We continue to expect a portfolio of UALink solutions to be available to customers in the second half of 2026, with early revenues generated in 2027.

And their new products, built on PCIe 6, were designed to be easily adaptable to UALink in terms of logic and capacity.

Our Scorpio X Series is developed today to support PCIe, and it can easily upgrade to UALink. Especially on the non-protocol-related functions. So overall, what I would say is that if a time comes when customers require alternate implementations, we are well set up for it.

Astera Labs is ready for both the lastest and the future technology deployments of optimized compute infrastructure.

Financials.

Really solid.

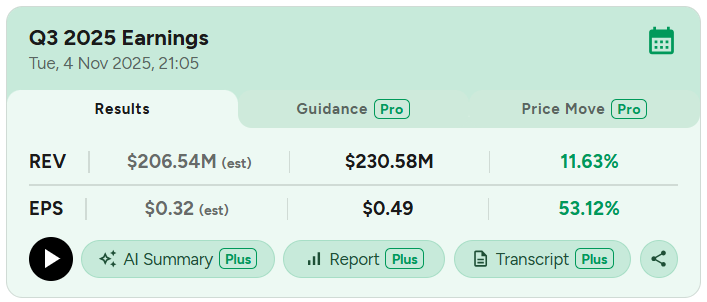

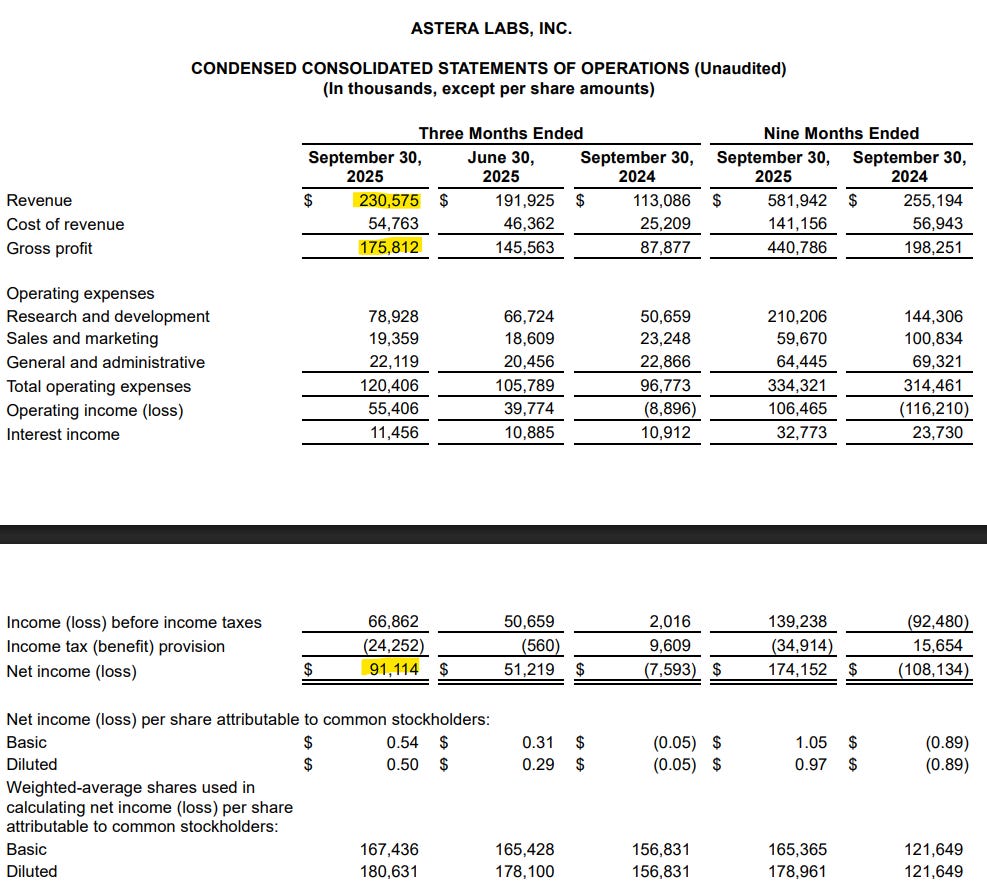

Growth stocks should be compared QoQ and Astera delivered a strong 20% growth sequentially, even though Scorpio P was sold in small volume and Scorpio X hasn’t shipped yet, while expected to be the main growth driver.

[Scorpio P] started to launch immaterially in Q2. The X series is in kind of low initial volumes right now, but then starts to ramp materially next year. What we said before is the X is ultimately a bigger opportunity, the scale-up opportunity. So at some point, and we’re not saying exactly when, it will be bigger than P.

Gross margins were stable and net margins are slowly expanding, which is impressive for a growth company - that is excluding the one-time tax benefit

In term of cash, the company sits on $1.13B of net cash and generated $65.9M of FCF impacted by $40.7M of SBCs. Strong for a growth name.

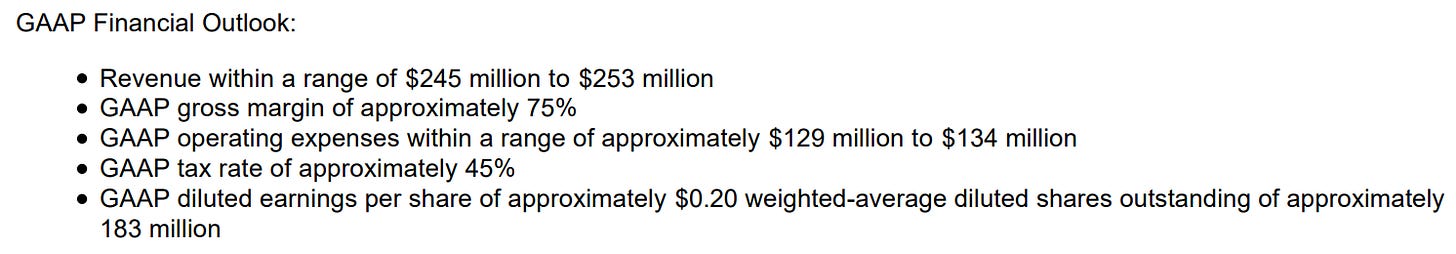

Guidance.

Management guided for 6.5% to 10% sequential growth.

A slowdown but we’re still more than healthy, no cause for concern considering that Scorpio P and X will scale meaningfully next year only.

Investment Execution.

This quarter doesn’t give us much about long-term growth capacity. The bull case is on Scorpio P and X, with P only selling in small volumes and X not yet shipping. The rest of Astera’s portfolio is generating growth without strong virtuous wheel, which is a strong foundation.

But the quarter shows the demand dynamics. Astera is engaged in conversations with hyperscalers for next-gen hardware built on PCIe 6 and for future UALink needs with around 10 different clients. This shows interest from major players in Astera’s technology.

The thesis remains unchanged: we need to see strong dollar growth from P & X plus traction across the rest of the portfolio as hyperscalers adopt Astera’s full stack. That won’t happen until these two products scale but will be reflected in FY26 guidance.

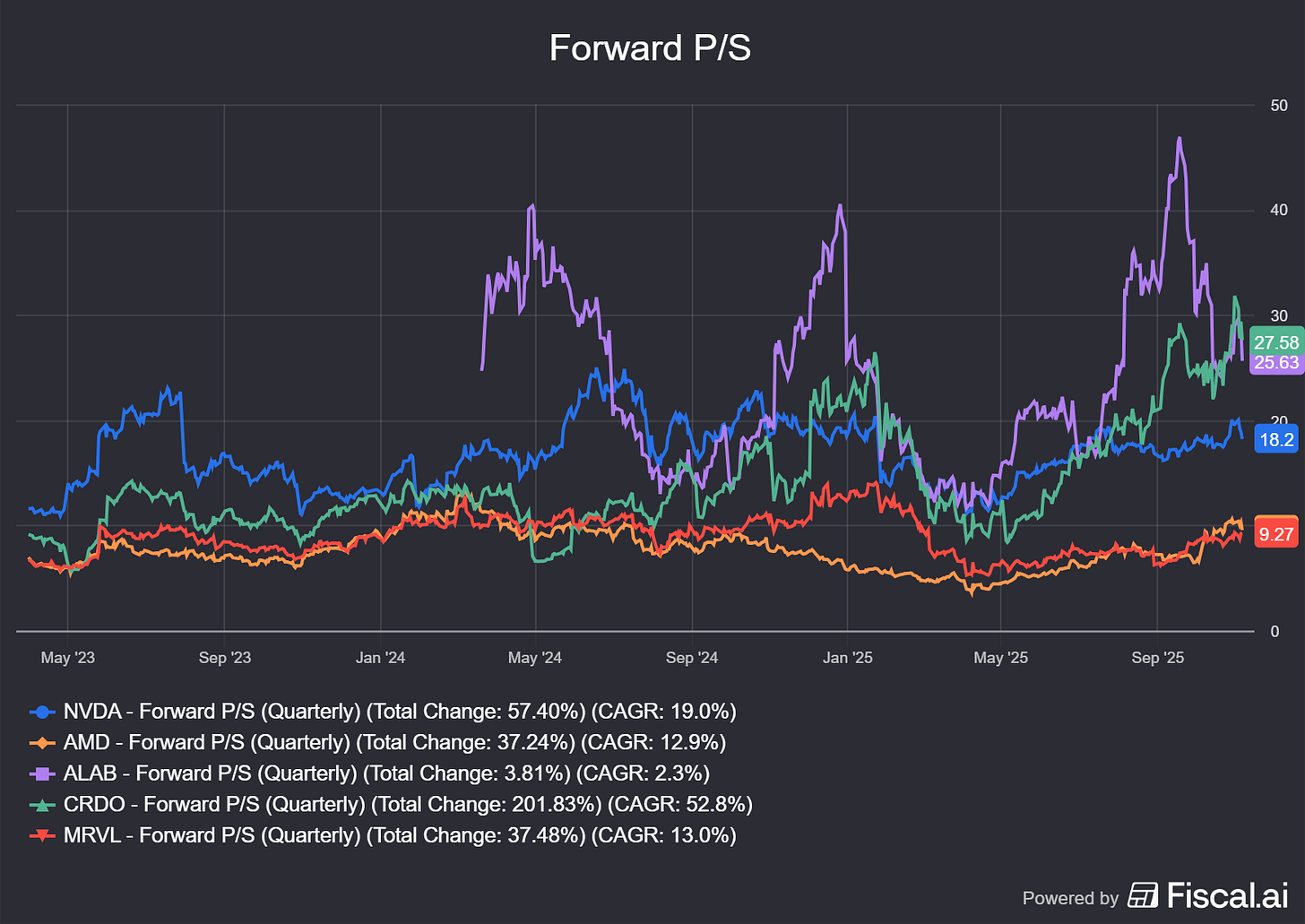

Analysts expect 40% revenue growth in FY26, which currently prices the stock at 29x forward P/S, kinda expensive for 40% growth.

Here are some comparable companies and their forward P/S for context.

The market is excited about this name and doesn’t leave much margin of safety at such multiples.

I’d prefer the stock closer to 20x forward sales, which feels safer for a ~40% growth in the AI hardware space. That implies a price around $140, which I’ve bumped to $150 to account for potential upside that’s hard to quantify. If Scorpio P and X deliver and trigger a virtuous cycle of cross-selling, Astera will grow faster than 40%.

To illustrate: Astera is guiding to 10% sequential growth at the high end without much contribution from X and with P just starting to scale. If that pace holds as P ramps and X begins shipping, FY26 growth could reach 48% YoY, without expecting additional growth from an ecosystem flywheel.

In short: $140 is the base case without acceleration. From there, you can layer in your own optimism premium. If you believe in the bull case, the stock is buyable today though I’d suggest a small position to account for risk.

Considering price action, sub-$150 would be ideal. It would close the gap, bounce off the daily 200, and form a double bottom - and we-re very close from it.

This quarter confirmed that multiple hyperscalers are actively considering Astera, not just for PCIe 6 deployments today but also for future UALink infrastructure. That’s a strong signal for long-term growth and cross-selling potential.

We don’t have confirmed growth yet, but the signs are encouraging. And often with growth names, the stock already ran when confirmation arrives.

I personally started a position today around $155. I didn’t last time we touched this level because I wasn’t sure where Scorpio would land in terms of growth. I still don’t know but management being in discussions with around 10 hyperscalers for PCIe and UALink designs seems enough to assume there’s real interest and a clear possibility for cross-selling.

The risk remains high. This is a growth name in a volatile sector lately. But today’s price feels reasonable to start a small position and re-evaluate things later.