Adobe Detailed Q3-25 Review

Good companies do not deserve great premiums

As I shared last week, reviews for my watchlist stocks will be less deep than before. I’ll focus more on the market’s point of view, with lighter business reviews. The goal is to bring value for investing, not just to follow companies.

The problem with Adobe remains the same, and it doesn’t look like it’ll change soon: we still have no proof that their AI services generate above‑average demand.

The market can’t reward the stock with higher multiples because it doesn’t see cash generation growth potential from a dominant position. What it sees is a steady continuation of an excellent business.

One analyst nailed it with this question:

You guys talked about monthly active users up over 15%. So the user base is growing. You talked about 3x growth in the usage of the models on a quarter-on-quarter basis. So the usage is ramping up. When can we potentially see this sort of grow the totality or stabilize or accelerate the totality of growth at Adobe? Meaning when can we see a year where ARR growth is stable on year-on-year basis or actually improving?

Because I think that’s what investors really want to see to get more confident in the stock and start revisiting the stock and coming back to the shares.

A Great Company.

Nobody is arguing that Adobe isn’t an excellent company.

Their objective is clear: leverage AI within creative and advertising. The potential is massive since advertising is a giant and fast‑growing market.

whether editing a PDF, refining an image, or generating a design. The advances in generative models and agentic capabilities position Adobe well to take advantage of the long-term opportunities servicing business professionals and consumers and creator and creative professional audiences.

And let’s be real: Adobe is healthy. Growth is stable across all branches, with clear AI adoption and growing commitment from clients.

This was confirmed by many comments during the call - though we should note most products are new so big YoY growth is normal in early adoption.

In Q4, globally, we drove record bookings of deals greater than $1M and achieved over 25% YoY growth in the number of customers with $10M plus in ARR.

We drove 2x QoQ growth in first-time subscriptions of Firefly.

Acrobat Web, which saw MAU increase over 30% YoY, strong adoption of Express in education with over 70% YoY growth of students with access to Express Premium, over 45 new partners added to the Express ecosystem in Q4 […] over 25,000 businesses purchased Express or Studio for the first time in Q4 alone.

Growing our base of creative users across Firefly, Express, Premiere Mobile, and other freemium offerings, MAU for these offerings surpassed 70M in Q4, growing over 35% YoY. Accelerating adoption of Firefly services within enterprises with over 100 new deals signed in Q4.

Nevertheless, adoption and usage are real. We can’t blame a $20B+ revenue company for “only” growing double digits. Maintaining that pace at such scale is already a huge accomplishment.

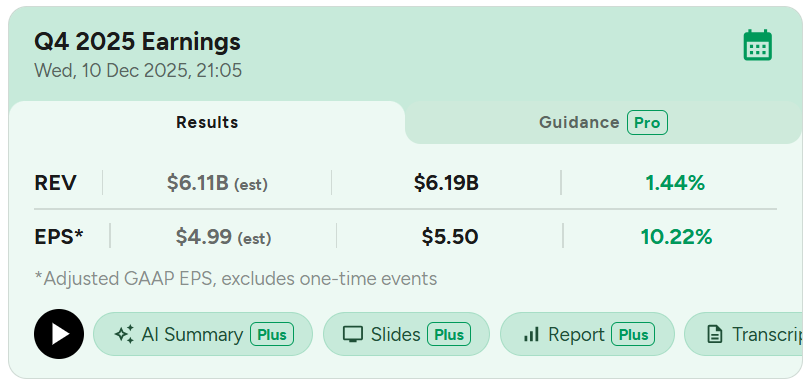

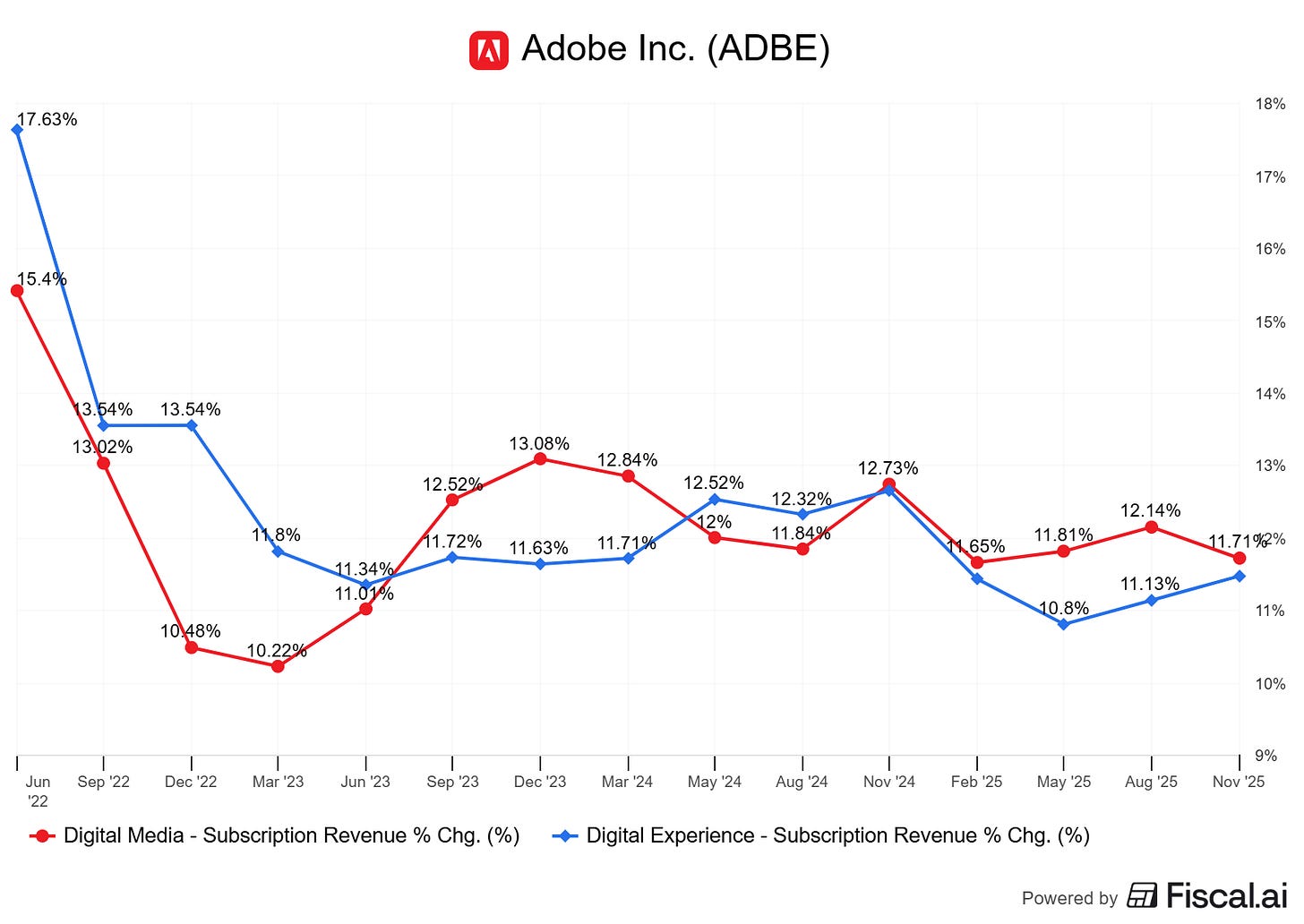

On the demand side: revenues grew 10.5%, ARR 11.5% and RPOs 13% which show a growing long‑term commitment from at least part of the user base - in dollar volume if not in numbers. The trend is clear & confirms management’s comments.

And there were many other positives this quarter.

Adobe Foundry, which lets clients train models on proprietary data to boost ad campaigns in fluidity, targeting and quality.

The partnerships with OpenAI and YouTube shorts to integrate Adobe’s creative tools directly in their apps, delivering value to more customers - although the question on monetization was asked and not really answered by management.

Semrush acquisition for $1.9B in cash to help Adobe propose to their clients new and upgraded advertising services in the AI era - within LLMs for example.

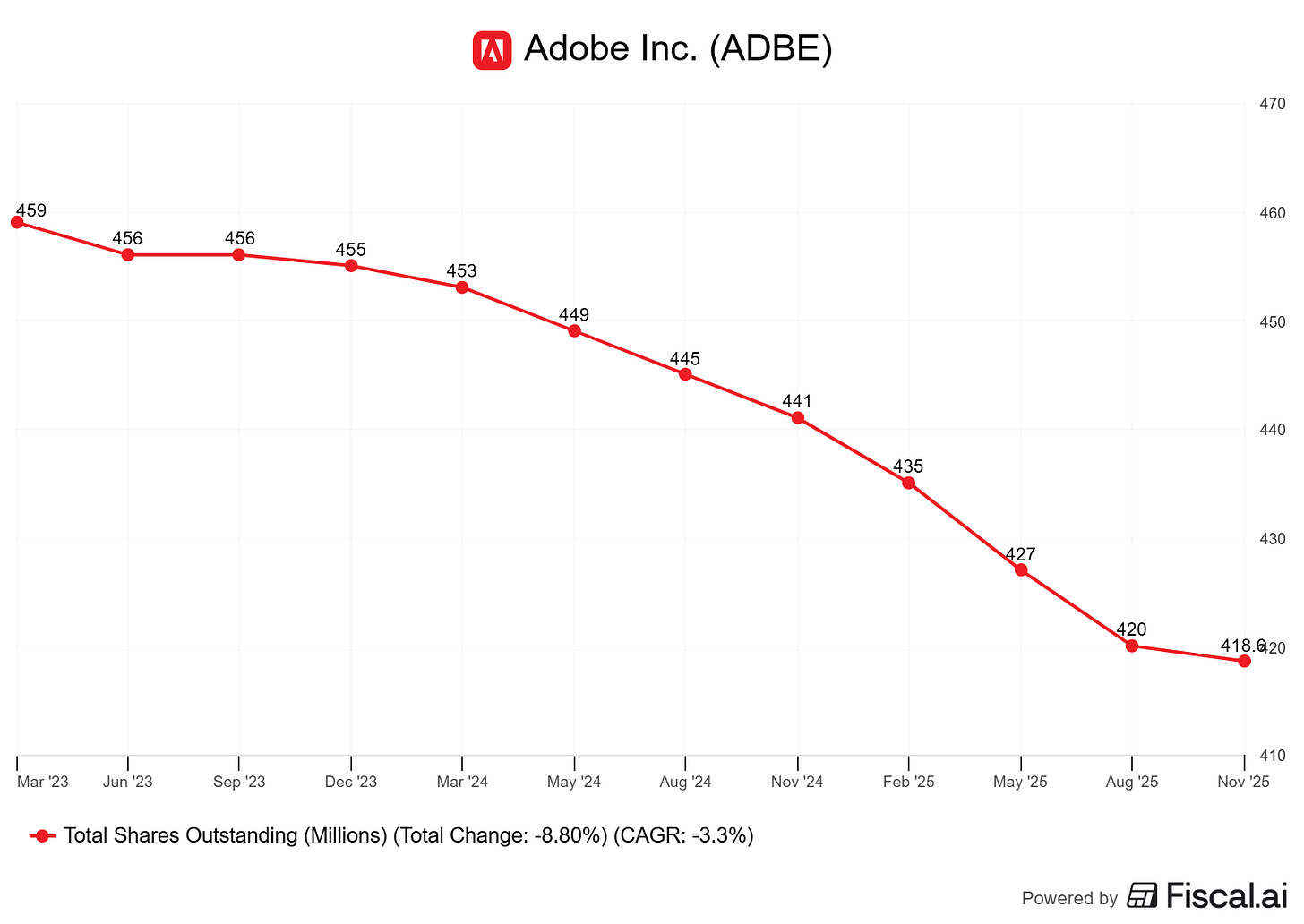

Ongoing massive buybacks boosting EPS.

Plenty of positives. Adobe is a wonderful company with a bright future, I have no doubts about that. But wonderful companies aren’t necessarily great stocks.

Enough For A Premium?

That’s the real question. Adobe trades at 6x sales & 21x earnings. Its lowest multiples in its history. But also its slowest growth and least dominant position.

The market rewards future cash flow growth. It wants proof that cash generation will not decelerate - at worst, and would rather have reasons for it to accelerate. Adobe shows stability with massive absolute growth, which isn’t enough.

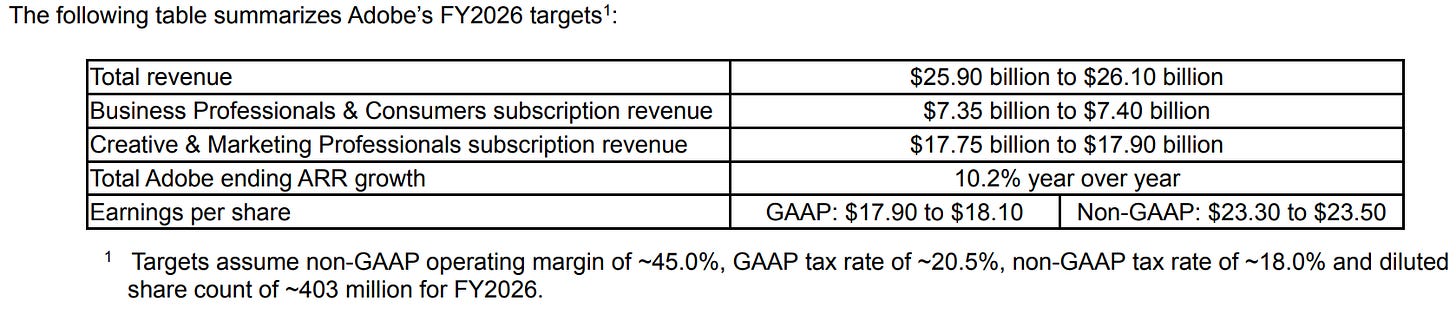

From our perspective, when we look at it, I think you have to look at it also in terms of the absolute. The target actually shows momentum across all of these audiences. If you think that we’ve accomplished approximately $2.6B, this actually starts our guide for fiscal 2026 at that level. I think from our perspective, it’s showing the momentum that we have.

And guidance doesn’t point to much more than stability with a flattish FY26 despites a small growth in ARR & a bigger one in RPOs. Which means they do not expect much acceleration during FY26 and therefore not much growth from their new AI services.

Midpoint revenue growth is 9.4%, lower than this year’s growth, and that’s an issue.

We’re talking about the leader in creative services and a giant in advertising, shipping hundreds of AI tools, and yet not able to stabilize growth, or accelerate it? That tells the market everything it needs to know. Either dominance is fading, or demand for these products just isn’t as strong as expected.

For the optimists, maybe guidance is sandbagged and acceleration will show up later in the year as demand builds and Adobe focuses on AI monetization.

I’d love to see that play out. But I wouldn’t bet on it today, right now it feels more like hope than investing.

Investment Execution.

As you understood, Adobe doesn’t fit my criteria today. The data was nice, demand is there, AI adoption is real, but not enough to justify higher multiples. Adobe remains a great, stable company with huge potential. Stability today could become dominance tomorrow. That’s what many expect.

But until price action supports the thesis, it’s just an opinion. And opinions don’t make money.

This quarter and FY26 guidance don’t answer the market’s concern: will Adobe thrive in the AI era? Until it does, Adobe is good, not great.

Yet, the market rewarded this quarter with green candles, a bearish trendline breakout and the reclaim of its weekly 21. Strong price action signals.

I wouldn’t get too excited. To me, this is the start of consolidation, not a new uptrend. We’ve been falling since February and the quarter had some clear positives. Printing a bottom during the next quarters while management cooks and hopefully delivers real AI‑driven growth seems plausible from here. Shooting to the stars doesn’t - to me.

Some will disagree and call Adobe a buy today, with longer timeframes and a more passive investing style than mine. Fair enough. I can understand why, even if I disagree, but I hope you can be patient. And I hope you’ll be right.

As always, I might be wrong. But to me, this isn’t an S‑tier setup. I’ll stay patient and keep following the company, this quarter was enough to keep my interest high. But clearly not enough to get my money.

The sell-off felt like a classic case of 'shoot first, ask questions later.' Wall Street saw the reporting methodology changes and assumed management was trying to hide a slowdown or seat compression from AI.

But the numbers didn't back that fear. The deceleration didn't materialize. To me, this looks like a mispricing driven by uncertainty. The market is slowly realizing there’s no 'smoking gun' in the financials, and I think that 14x forward multiple is going to get bid up as the fear fades.

Great framing on the quality vs price dynamic. The FY26 revnue guide decelerating to 9.4% while RPO grows 13% is basically management telegraphing they expect weaker near-term monetizaton even as commitments build. That lag could mean enterprise AI deals are closing but ramping slowly, or worse, the AI features just don't command pricing power yet. Either way,until ARR inflects positively the multiple stays compressed.