Catching the Crypto Bounce: The Playbook

My argued & detailed plan to catch the crypto bounce & maximize returns.

I didn’t think I’d have to write this trade so soon, and I’m still not 100% convinced we’ve seen max pain or that we’re ready for the next leg up. But when the signals show up, I try to put my personal bias aside and even if my strategy will include my bias, it is worth sharing it.

We’ll talk about four assets today, all following one strategy in my portfolio.

Right now, I own Bitcoin and Ethereum for about 6% of the portfolio & have a clear plan to buy Strategy & Bitmine; that whole bucket could grow to 20% if conditions are met - across the four assets with shares, options, and potentially some margin.

Let’s go through why I think these assets have room to run, the plan, the targets and what I expect.

Bitcoin & Ethereum.

Both Bitcoin and Ethereum move with global liquidity and momentum. I personally think Bitcoin is one of the best long-term assets, ever in term of fundamentals, and that Ethereum has a massive opportunity ahead, but these are personal convictions.

The truth is that the market treats both as speculative assets today, and therefore only buys them in risk-on periods.

Bitcoin.

The asset is down 27% from its $126,300 ATH in October, with a bottom 36% below the top. These are roughly the drawdowns you get in Bitcoin bull markets, and I’ve been watching for signs of a bottom for days.

As you can guess, I think we’re here now.

Vanguard.

Fundamentally nothing has changed for Bitcoin, but its recognition & adoption keeps growing. Four days ago we got the biggest capitulation signal possible: Vanguard will now sell Bitcoin ETFs on its platform.

One of the most anti-Bitcoin fund in the U.S. finally accepted that demand is too big to ignore, especially after watching every other fund make billions with their Bitcoin products.

Starting on Tuesday, Vanguard will allow ETFs and mutual funds that primarily hold select cryptocurrencies, including Bitcoin, Ether, XRP, and Solana, to be eligible for trading on its platform.

Hard to say if they fell under their customers pressure or their greed, but the result is the same. This boosted optimism across crypto. Vanguard is an $11T asset manager which means massive potential liquidity for Bitcoin. That’s step one for an uptrend.

Demand.

Liquidity alone isn’t enough, you need demand. Why would the market rotate back into risk, while it has been avoiding it for weeks?

This goes back to my December investing plan and my note made weeks ago (on the perfect local bottom) on why I wasn’t worried by the drawdown end of November. That was because of two reasons.

I expect the FED to cut rates in December. If not, then early 2026 at the latest. We had the inflation data today which confirmed my view as it was stable, which means the focus should remain on the labour market hence a new rates cut.

I expect AI-trade optimism to return, boosted by the optimism from the rate cuts and what was a strong earning season on tech names.

If both happen & with the U.S. government floating ideas like $2,000 stimulus checks, lower taxes, reduced tariffs, etc… markets love that stuff and greed would take the wheel once more.

Those were and still are my expectations.

ETFs, Leverage, Sentiment & Price Action.

Those come with more positive market situations.

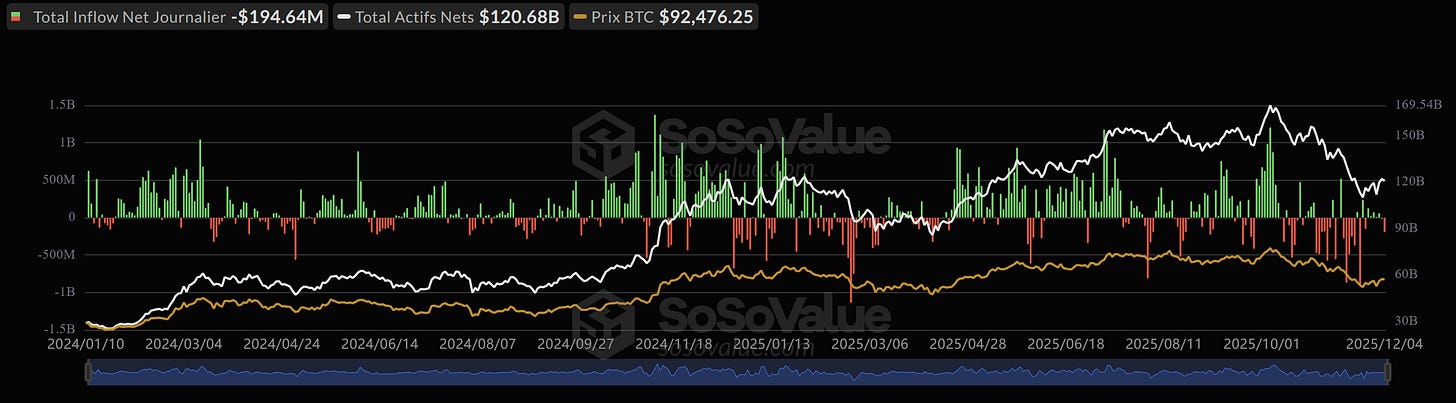

First, the Bitcoin ETFs have been net sellers for months but that selling pressure starts to slow down. Not reversing yet, but stabilizing since late November, even before the Vanguard announcement.

These flows matter because they’re the cleanest source of liquidity. The pattern looks just like the March/April dump: once selling slowed, Bitcoin bottomed.

Another massive source of liquidity - pretty unhealthy but necessary, is leverage. Too much of it forces the market to go where liquidity is: usually lower due to leveraged stop loss. And we’ve seen that play out over the last weeks with billions of dollars evaporated and thousands accounts liquidated.

After billions in liquidations, leverage has cooled off. Either traders don’t have money left, or they’re too scared to size up. Most liquidity now sits above price - from shorts who haven’t covered. It’s not huge, but the take away here is that sentiment got a reset. It was much needed, and it is done. Now, healthy liquidity takes the lead.

This situation is also shown by the RSI which hit levels not seen since the 2022 bear market. That says a lot on the sentiment reset. Price action is extremely similar to April’s low.

Besides April, this setup looks similar to plenty of historic pivots: April ’25, March ’24, Jan ’22, May ’21… This, to me, is classic crypto.

So yeah: the setup for a bounce is strong. A sharp 30% flush sending sentiment to the gutter, ETFs slowing their selling, leverage wiped and social media back to “Bitcoin is a scam” while the asset claims it daily 21 again.

The real questions are:

Is it just a bounce?

Do we get a new ATH?

And how long until the bounce?

My Plan.

Everything I wrote above for Bitcoin applies word-for-word to Ethereum. Just replace the asset name. Same structure, same signals. The only difference between both is your conviction and your appetite for volatility, as Ethereum will be riskier but also with a higher potential that Bitcoin.

I’ll personally buy both, and also intend to buy both Strategy and Bitmine so… But it is different for everyone.

Now, what’s next: Crypto loves to deliver more pain before big gains. Look at the dates I mentioned or the chart I shared: a new low almost always follows what looks like the “perfect” local bottom.

That’s why I’ve only bought 25% of my intended position. My indicators are flashing buy, but I’ve been in crypto long enough to expect one more slap. I started buying once both BTC and ETH closed above their daily 21, a first indicator of strength.

In the actual situation, it’s the right moment to start building.

But I wouldn’t be surprised at all to see Bitcoin revisit $80,000, dip a few hours below, then recover. If that doesn’t happen, fine. But as of today, I personally expect that to happen, so here’s my plan:

Buy Bitcoin spot at $86,000

Buy Ethereum spot at $2,860

Add on margin only if we dip slightly below these levels for a very short time - one or two days max, without bad news.

If we go straight up from today, I’ll re-evaluate and buy the breakouts aggresivelly.

Strategy & Bitmine.

Onto the proxies, and here’s the disclaimer: these are speculative assets on top of very speculative assets. Don’t play with these if you don’t have the stomach for high risk. We’re talking about the upper end of the risk spectrum.

Strategy is essentially a Bitcoin treasury, and Bitmine is an Ethereum treasury. Both are 100% focused on their respective asset.

For those who don’t understand what a treasury is, I’ve detailed Strategy’s treasury here. Whether you believe it works long term or not doesn’t matter here, this is a speculative bet, not a long-term hold.

I also broke down the company’s debt structure, which is wildly misunderstood, just here. Bottom line: they’re not at short-term risk - 2 years or so, of default. Not even close, compared to what you can hear.

With treasuries, the key is buying below NAV - Net Asset Value, multiples. Think of a company holding $1B of cash trading at a $990M valuation. You’d call that a gift, right? Because the business can still generate more cash, so it’s basically free.

Same logic with treasuries, except they don’t hold cash, they hold assets. If, like me, you think those assets are due for a bounce, then the value of their holdings should bounce too. Plus, those companies can still buy more assets at current prices & grow their value by doing so - which is the main thesis of buying a treasury, that the dollar you spend today is worth more assets tomorrow as the treasury will continue to buy it.

As of today, Strategy trades about 10% below the value of its Bitcoin holdings. This is called a discount as it means buying Strategy is cheaper than buying Bitcoin directly - classic sentiment reset.

This means the market either expect Bitcoin to continue falling or Strategy to sell its Bitcoin - which they won’t do. Keep in mind that a treasury selling its adjacent asset signs its death certificate. The purpose of those assets is to promise shareholders to own more of the adjacent asset per dollars in the future. They can only accumulate it, and never sell it. This would break the unsaid promise made to shareholders.

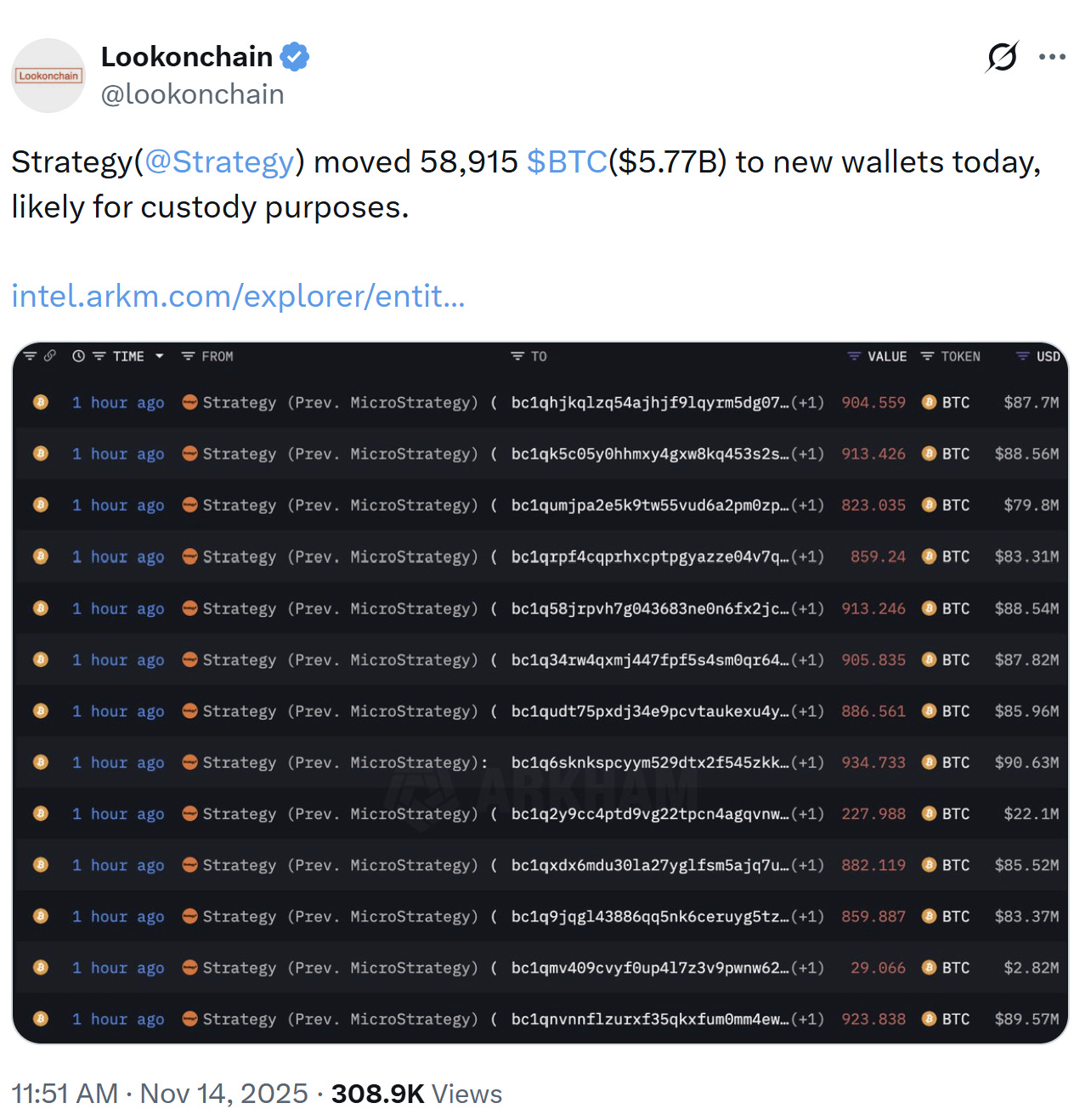

Without much surprise, we had some rumors this week about Strategy potentially selling some of its Bitcoin, as some on-chain data showed movements.

This is very likely a custody-related movement, as I shared on the post. It also is very normal for a treasury to move its asset around for safety. Nothing here indicates a selling and as I said: this would be the worst case scenario for a treasury to do so.

I do not expect it.

Obviously, if Strategy were actually selling BTC, that would invalidate this whole thesis.

Bitmine trades at a 15% premium above NAV, even though they still have cash to buy more Ethereum if they want so we could lower NAV including cash. The perfect buy is below 1× NAV, so Bitmine remains slightly expensive right now - due to less imperfect sentiment around Ethereum I assume.

In brief, if your view matches mine - that we’re near a bottom and should bounce or even start a new uptrend, then both assets are buys here. The real question is how to structure the trade.

My Play.

I personally haven’t yet pressed the button here because of my bias that we will see lower before seeing higher. Which could be wrong. I will buy depending on Bitcoin and Ethereum price action, not Strategy and Bitmine.

But I have two ideas in mind.

Buying Calls.

If I’m right and Bitcoin is currently in a setup similar to March ’25, it likely needs a few more weeks of consolidation before bouncing. That means no short-dated options. Based on historical examples, we need at least three months in my preferred scenario. So we’re not looking at anything before March, ideally further. As of now, June looks like the best target to me.

For strikes: I personally expect Bitcoin to bounce up to $120,000 and Ethereum to $4,000. Based on current treasury holdings - assuming no new purchases, that translates to roughly 1× NAV at $270 for Strategy and $40 for Bitmine.

Any optimism would push multiples above that, so those would be the “safe” strikes. So minimum June around those strike price.

Selling Puts.

This is the more “defensive” solution, with limited gains as you cannot make more than the premium received, but less downside as I would structure it to buy way below 1x NAV assuming lower price on our assets.

My deadline wouldn’t be any different: June.

Assuming Bitcoin returns to its bottom at $80,000, Strategy would have a 1x NAV at $180, which is today’s price as the company already trades at a discount. So any sold put below this price is already a great sold put to my opinion - especially as they yield 20% plus already today. For Bitmine, with Ethereum trading at $2,600, we’d need the stock to trade at $25 to trade at 1x NAV. Once again: any sold put below that price with a June deadline seems like a great sold put to me.

In both case, you’d be attributed shares of a treasury way below 1x NAV assuming the bottom in Bitcoin and Ethereum is indeed in at the said price, as if not the value of their asset could depreciate furter - that’s why we have much more risks here.

One could also envisage do to both - sell puts and buy calls, but that would be really aggressive - and could pay out greatly.

Shares

I also want to note that buying shares could also yield great results, as we are talking about volatility on top of volatility. The potential of those assets is proportional to their risks: very high.

I want to play options on those because I want to play the volatility and the immense potential. But that doesn’t mean shares aren’t a good strategy neither. Those write up are here for me to share my views and my plans. Not to be followed. They are meant as an example to structure your own strategies: and shares are an excellent strategy in many cases.

In Brief.

I already bought Bitcoin and Ethereum spot. Intend to buy more spot at $86,000 and $2,860 respectively, and even add margins if necessary around or below those price.

I remain patient on both Strategy and Bitmine but intend to buy options on both. The best case scenario would be to have Bitcoin and Ethereum push to the actual lows in the next days and give opportunities on both treasuries. If that happens, I would buy the four assets at the same time, based on the information shared above.

But I will update when/if this happens and what are my final actions.