MicroStrategy & Bitcoin.

A love story - written by Michael Saylor.

This is a write-up about MicroStrategy but it really is a Bitcoin story, and even if I will explain the details on how & why, you’d need to understand Bitcoin to understand why Saylo is doing this.

Now we can dig our subject.

MicroStrategy.

We have to start with the company itself & Michael Saylor, its CEO. They are known for their involvement in Bitcoin, but MicroStrategy is a healthy company providing all sorts of data analysis tools, intelligence software, cloud services and much more. It hasn’t been an exceptional company, but it has been stable since the internet bubble in 2000. It’s important to understand this before we go further; MicroStrategy has always been & still is a healthy company.

Michael Saylor has always been kind of a visionary, with strong opinions and a good understanding of important subjects ranging from technology to branding. He had this wonderful talk more than a decade ago about Apple, which can give you an idea of how well he can understand things.

This sets the stage for the company and its CEO.

After the 2000 bubble, MicroStrategy continued its operations, sold its products, became profitable, generated cash flow, and grew its balance sheet to something around half a billion dollars pre-covid, most of it stacked in low-yielding treasuries. A standard life for a company that survived the startup phase

Fast forward to COVID-19, a period that changed everything for Michael Saylor as monetary creation skyrocketed. Put simply, the U.S. grew the dollar’s monetary mass by 40% in two years, diluting each and every dollar holder’s buying power. Michael Saylor didn’t like it much and chose another path.

Ironically, his first interaction with Bitcoin was actually terrible, which is a standard reaction for anyone when they first hear about the asset. Skepticism is normal for hours, days, or even months. It takes time to understand Bitcoin.

He took time to study the protocol, the asset, its characteristics & workflow and decided to go all in seven years after this post, emptying MicroStrategy’s balance sheet to buy Bitcoins - 21,454 of them for $250 million or $11,652 per Bitcoin in November 2020.

Today, MicroStrategy owns 331,200 bitcoins acquired for ~$16.5B with an average price of ~$49,874, for an actual market value around $30B.

Why?

The "why" is easy to answer. Saylor’s narrative is that Bitcoin is the scarcest asset anyone could own - more than gold, and its value will constantly increase compared to any fiat currency over time as those are diluting their holders by design.

We are not talking about investing or performance; we are talking about preserving purchasing power - although Bitcoin is also the best performing asset of the last decade. So MicroStrategy is buying and as Saylor say,

“Yeah, I’ll be buying at the top forever.”

And that is because the short-term top is supposed to be the long-term bottom, structurally. That is how both Bitcoin & fiat currencies interact together and why buying the top isn’t a problem if you think about the next decade. The better question is: why wouldn’t you want to own the scarcest asset in the world? Why would you store your wealth on anything else but it?

Short Dollar & Long Bitcoin.

This is what MicroStrategy has been doing for years now: emitting debt to buy Bitcoin. The only difference is in the kind of debt they emit.

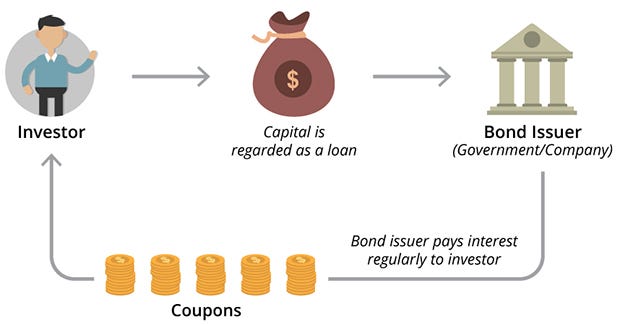

First of all, contracting debt is a mechanism of being short fiat as you get to buy an asset today and repay for it later in a currency that loses value; hence the debt will be easier to repay over time. We already talked about interest rates which are meant to control the amount of debt in circulation and can make loans quite expensive; so MicroStrategy doesn’t use banks. They issue bonds - another form of debt accessible to public companies.

The mechanism is simple: a company will ask the public for cash and repay them over time plus interest - called a coupon. It works for public companies exactly like it works for U.S. Treasuries; except Saylor added clauses to the bonds issued by MicroStrategy.

They wouldn’t pay much interest - less than 1% most of the time, but could be converted into stocks at expiration at a specified stock price, usually slightly higher than the price on the day the bond was issued.

He offered investors a “risk-free” bond with the right to buy MicroStrategy’s stock at a fair price if his Bitcoin bet were to work. The only risk taken by lenders would be if the company were to go bankrupt; even if that happened, its asset liquidation would certainly cover refunds as, remember, we’re talking about a healthy & profitable company.

The second “risk” concerns performance as getting less than 1% on your cash is very low - even lower than treasuries, but it was very clear in lenders' minds that they didn’t buy those bonds for the coupon; they bought the right to be present in case Saylor’s crazy bet were to work.

Virtually risk free bonds. With an insane potential. The first bonds were issued in December 2020 for five years duration with a 0.75% coupon and are convertible into MicroStrategy’s stock at ~$40 per share.

Let me illustrate that for you with MicroStrategy’s actual price.

Not bad?

This is what MicroStrategy has been doing & intends to continue doing as they issued new bonds yesterday paying… 0% interest. This means they are asking lenders for their money without any counterpart except refunding them in the future if they choose not to convert their bonds into shares.

You have to add that if MicroStrategy buys & holds Bitcoins, the asset price will automatically increase with limited supply; hence its balance sheet will increase along with the company’s value etc… Many will want to lend more to them, pushing this cycle further & further.

Up to here, some could call this a Ponzi scheme but the money obtained from new investors isn’t given back to old investors; it is used to buy the scarcest asset on earth & grow their balance sheet's value.

In brief, MicroStrategy bought Bitcoins with money they didn’t have without having to pay interest rates - or minimal ones. They got rid of their dollars & others’ with minimal risks to buy what they judge to be the best asset on earth.

Why Buy MSTR & Why Hold?

The first question would be: Why MicroStrategy and not directly Bitcoin? Two reasons.

First, MicroStrategy has for long been a proxy for owning Bitcoin for many institutions & fortunes who couldn’t legally buy the asset or who didn’t wish to as it requires cold storage, responsibilities etc… We now have U.S.-based ETFs but some institutions still do not have access or are too regulated.

Second, you can only buy so much Bitcoin with your own cash but MicroStrategy can always buy more than you & attract more liquidity than you ever could. This means they will always buy more; as they buy more, your shares of the company give you indirect ownership of more.

We can explain this through MicroStrategy’s Net Asset Value. The company owns 331,200 bitcoins valued around $30 billion and trades today at a $90.5 billion valuation or roughly 3x its assets - this represents its premium.

Imagine a world where the stock was flat, but the company kept buying & holding Bitcoins. This NAV would automatically decrease. This is true if you view things from a market perspective.

But if you are holding the company's shares yourself and say, you bought 100 shares of the company at market open this year. That would have cost you $6,925 & would have given you the indirect ownership of 0.1302 Bitcoin. With the same amount at the same date, you could have bought 0.1566 Bitcoin. MicroStrategy kept buying Bitcoin throughout the year, with the same investment you would be holding 0.147 Bitcoin today, 11 months later.

This example would mean you'd hold less Bitcoin than you could have but the importance is in the mechanism. Holding MicroStrategy will give you, with time, a growing portion of Bitcoins compared to what you could have bought by yourself. And the difference should become significant if you measure in decades.

Third, this is still speculative but Saylor hinted not long ago that MicroStrategy could provide some banking services based on their Bitcoin treasure, which would be the return to a Gold standard system, except with Bitcoin as the unit of value.

Risks.

Nothing is risk free.

Hodl or die. This is probably the biggest issue I personally have with MicroStrategy as they cannot sell any Bitcoins. If they were to, it would mean that the investment thesis of indirectly growing your Bitcoin holdings by holding MSTR would be wrong. And this could happen in a few scenarios.

Mainly due to the yield & bonds refunds they could have to pay/refund. Yields are very low but still requires to be paid in cash while the original investment needs to be repaid in full if holders refuse the convertion. For now, we can imagine most bonds holder will accept the conversion as we saw the potential gains were to be calculated in multiples.

But later on? If there is a demand for a few billions of refund, this could rapidely be dramatic as MicroStrategy would need to raise liquidity, most probably from its own Bitcoin reserve, breaking the trust of its shareholders first, but also creating a very strong selling pressure on Bitcoin, devaluing its own balance sheet exactly like it raised its value by buying & holding Bitcoins.

This could rapidely crash both asset’s value & trigger panic, although it wouldn’t change anything at all to the fundamentals, especially Bitcoin’s - as long as the software remains uncorrupted. But MicroStrategy might never come back from this.

Lenders. The first bonds will allow conversion to stocks late 2025. The fundamentals won't change but it doesn't mean that MicroStrategy's stock is up only. It means they'll continuously grow their Bitcoin holdings, but the stock will dump eventually as those will take profits, without any doubt.

Volatility. We focused on the fundamental part of things here, but I am entirely clear on what MicroStrategy really is for the market: a boosted & more speculative Bitcoin play. We reached valuations above 3x of the company's NAV and with Bitcoin above $90,000, it would require billions of dollars to make actual buyers sound in terms of Bitcoin holdings, which is ridiculous.

Bitcoin. I personally am very bullish on the asset, but it remains a software piece. It hasn't happened but it doesn't mean we won't have problems with it in the future and as I explained in the IC, the smallest problem on Bitcoin would mean it isn't worth anything. It works as long as the software remains uncorrupted.

Conclusion.

I hope you see clearer in the mechanism behind Michael Saylor's life bet & one of the most interesting subjects there is lately on the market. It might work, and I personally hope it does as I am a Bitcoin bull. But this will stay in the financial annals for decades, be it a success or a failure.

As long as MicroStrategy holds its Bitcoins and Bitcoin remains uncorruptible, I'll believe it will be a success, but I wouldn't touch the stock right now. I'll patiently wait for the NAV to come back to reasonable multiples and will gladly buy if we ever go under x1 again - which I believe we will.

I never understood the $MSTR frenzy but now I do! Thank you for articulating what Saylor has been doing.

glad to see another fan of MicroStrategy!