Ethereum | Investment Thesis

The future foundation of the financial world?

I called this write-up an investment case, but it really is an overview of what Ethereum is & could become. The subject is interesting & worth talking about, but even I would not call Ethereum a great candidate for long-term investment - on the contrary of Bitcoin.

It remains a great speculative asset during crypto bull runs, with correct fundamentals & an extremely strong potential, and I own some tokens since some years now after accumulating during the bear market. Mostly speculation though.

Before going into it, I’ll start by how stupid it is to compare Ethereum to Bitcoin. It’s like comparing a hammer to gold. Everyone would probably rather have gold, but the day you need to build a house, your gold won’t help you much. So let’s not compare them; Ethereum is built to be used while Bitcoin is built to be held; different assets, different purposes.

The Blockchain.

The only common point between both is that they are blockchains, which is a concept we went over in the Bitcoin IC already. But while Bitcoin doesn’t hold anything else than transactions in its blocks, Ethereum was meant to be used & configured, to manage contracts, complex tasks, etc...

Ethereum is a toolbox.

Trilemma.

We saw this concept in the Bitcoin IC; no blockchain, financial system, nor currency can perfectly possess those three characteristics.

Satoshi chose to focus on Decentralization & Security to make sure its currency would be free of any corruption. Ethereum, with different objectives, focused on scalability & security with the long-term goal of being used widely & efficiently. It doesn’t mean Ethereum is very centralized, but it is more so than Bitcoin.

Once again, Ethereum is a toolbox, a blockchain built to be developed, comparable to the internet. A toolbox, nothing else. It isn’t meant to be a currency nor a store of value; it is meant to be a customizable & decentralized platform.

Proof of Stake.

The PoS is the mechanism used by the Ethereum blockchain to validate transactions. It is fundamentally different from Bitcoin’s PoW as while miners compete in the latter, validators work together in the former.

It’s worth knowing that Ethereum was first built with a PoW and migrated a few years ago to PoS for different reasons - partly because it allows better scalability. If Ethereum wants to be used as the new global financial platform, it has to treat transactions rapidly & cheaply, and PoW is terrible for that.

Let’s start with a few concepts, and we’ll detail how it all works together after.

Validators. The Ethereum’s validators are the equivalent of Bitcoin’s miners; they are the entities which will propose, validate & add new blocks to the blockchain while making sure its rules are respected.

Stacking. This is the mechanism users follow to become a validator. They’ll need to lock at least 32 ETH to be selected, and these will be used as “hostages” to force them to behave properly & respect the blockchain’s rules.

Slashing. This is what happens to validators who do not behave. The punishment differs depending on the infraction, going from a reduction of the reward to a complete destruction of the staked ETH.

Gas & Fees. The incentive; Ethereum proposes a service and each user has to pay to use it. There are two fees, a fixed one for the usage of the service & a variable one depending on the prioritization of your transaction - fast equals more expensive. These fees are part of the validators’ rewards.

Epoch. An epoch is a defined period of time during which validators propose & attest the validity of a new block. Each epoch is divided into 32 slots (approx 6 min).

The PoS Mechanism.

Let’s put all these concepts together.

The blockchain randomly selects 128 validators for each slot in each epoch. Of those 128, one will once again be randomly selected to propose a block while the others will verify & approve it. All validators then share the rewards plus a small amount of newly minted ETH. The block proposer will get most of them, depending on how well they behave. If they select the best block - usually the one with the bigger fees as long as it respects the rules, without any controversy, they will get a bigger part of the cake. If their proposition was challenged, delaying the validation, their portion of the cake will be lowered.

The mechanism is meant to incentivize validators to behave but also to be optimized, which ends up accelerating block creation & growing the incentives, indirectly improving the quality of the service.

I won’t go into the comparison between PoS & PoW. Both are different & have different strengths & weaknesses. Different objectives.

Controversity & Centralisation.

This mechanism created a few controversies in the community for different reasons.

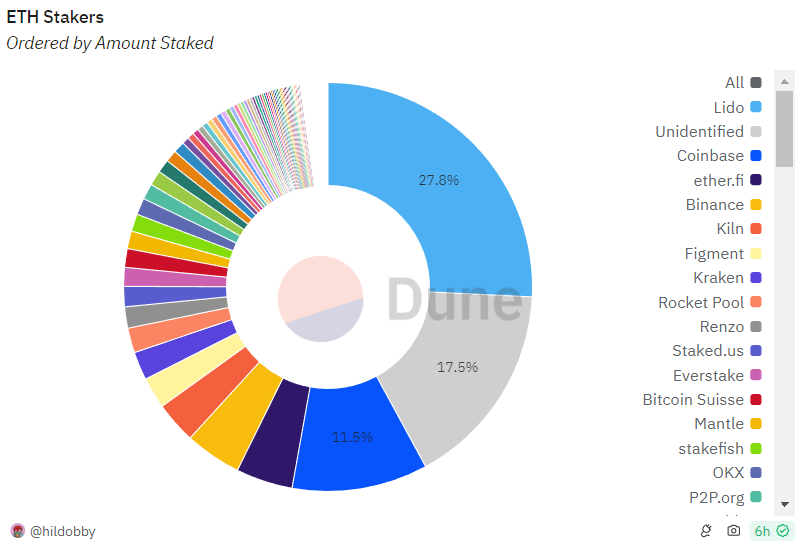

Weight of Stacking & Randomisation. The first one being that the weight of stakers influences the selection of validators, which means the more ETH you own on your validator, the more chances you have to be selected. It favored big actors & created a tendency to centralize staking & a bigger surface to attack the protocol.

Centralisation. The amount of ETH demanded to create a node requires more than $100,000 today, without including the technical expertise & infrastructure to set up a node. The effort isn’t worth it for many small holders as staking, like mining, became professionalized.

A few big entities now control most of the staking. Smaller holders lend them their own ETH while they build & ensure the proper behavior of their validators, distributing the rewards to lenders while keeping a small fee.

The competition between these entities is strong enough to not be a risk to the blockchain itself; we are far from a potential 51% attack or anything alike, but this tendency firstly creates a barrier to create nodes, hence to secure the network, and secondly widens the potential surface for any attack or centralized decisions.

Ultra Sound Money.

The migration from PoW to PoS brought a lot of different technical aspects to Ethereum, one of them being a modification of its token emission.

Unlike Bitcoin, Ethereum wasn’t meant to have a limited supply. This means it would have had a constant inflation as long as blocks were created, reducing the incentives as miners are rewarded with a depreciating asset.

This changed with the PoS migration, for the better as the dilution passed from more than 3% per year to less than 0.5%. Validators are now paid with a non, or almost non-inflationary asset, while that migration reduced their costs as the energy consumption needed to run a node is now almost 0.

The goal was to increase the token’s value over time and directly incentivize holders & validators. As of now, the yield for staking Ethereum is between 3.5% & 5%, almost exclusively coming from fees while the inflation is under 0.5%. And as the fees are paid in ETH, the rewards are also paid in ETH.

Those are good math.

The Potential.

Most will think these aren’t any real-world use cases & I tend to agree for now, but we’re talking about potential here.

As the world advances, I think we can all agree that we, humans, are looking for faster, more efficient & convenient tools; everything has to go faster and that tendency will continue. I also believe we all agree that our financial institutions are nothing if not slow & inefficient.

Ethereum aspires to change this. Bitwise understood & explained it better than most.

https://x.com/i/status/1803789737620078875

No more timetable, no more hundreds of validations nor compliance team when everything is digital & automatic. A 24/7 entirely automated system, faster than anything we know & pretty cheap to use, without borders.

This opens a new realm of possibilities.

The Dramas.

I will start by addressing the elephant in the room and talk about FTX, 3Arrows, UST & Co. I won’t go over what happened for each as you’ll find everything detailed by competent people on the internet if you’re interested. Let’s just say that 2021 was wild.

But none of those events had anything to do with Ethereum nor Bitcoin.

They tarnished the reputation of the entire ecosystem but all of those were due to greed, corruption, human mistakes, criminals, or all of the above. They had terrible repercussions & thousands lost a lot. But they were not due to the technologies.

No one blames the hammer when someone’s head gets smashed, nor the weapons during wars. There sure are a lot of issues in the crypto market but we have to blame the users, not the tools.

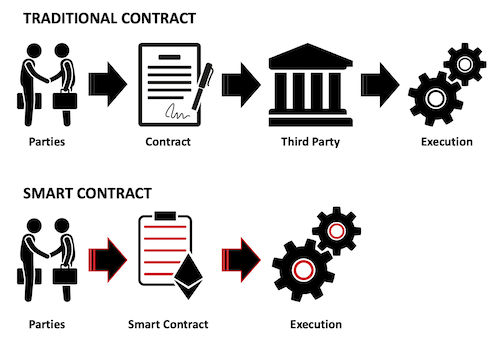

Smart Contracts.

This is the most important concept and the reason Ethereum differs from Bitcoin instead of competing with it.

Everything in our world works with contracts between entities or individuals. You have a job contract assuring your pay in exchange for your time, an assurance, a loan from your bank, and every time you buy something, you’re making a contract to exchange value against a product or service. Everything is a contract in life - even marriage.

Vitalik Buterin, Ethereum’s founder, built Ethereum on this concept.

Smart contracts are nothing but “software” written and signed between two parties with conditions, incorporated into the blockchain. Each time the conditions are met, the smart contract will enforce the parties to do their part automatically, certified & authenticated by the blockchain itself.

Ethereum will act as the fastest & decentralized third party, exempt from corruption, bureaucracy, or delay but also exempt from compassion.

Stablecoins.

These are one of the most bullish cases for Ethereum and what could become the new money pipes over the next years. It’s not that banks aren’t efficient (although they aren’t) but blockchains are better.

Stablecoins are easy to understand; they're dollars on blockchains. You cannot use your bank account there, so developers came out with stablecoins, and they rapidly became the most used cryptocurrencies.

They're nothing but digital dollars, and work like this.

Every time someone wants to interact with a blockchain, he'll need to transform his dollars into digital dollars, USDT if emitted by Tether, USDC if emitted by Circle, or PYUSD if emitted by PayPal - lots of possibilities. Once these stablecoins are on the blockchain, you can do whatever you want with them; interact with protocols, applications, smart contracts, send them, etc...

Everything with the advantage of being on the Ethereum blockchain, which means almost instant transfers, worldwide, for no costs without any restrictions - yes, also during weekends.

DeFi.

As I said, everything in life is a contract & some of the most important ones are the loans we make for different reasons.

Besides the fact that things can be fair or unfair depending on which banker you deal with, these are also in part responsible for crises like 2008. I am not saying banks are solely responsible for it, but wouldn’t it be better if everything was managed by software, without any arbitrage, only a cold-hearted software?

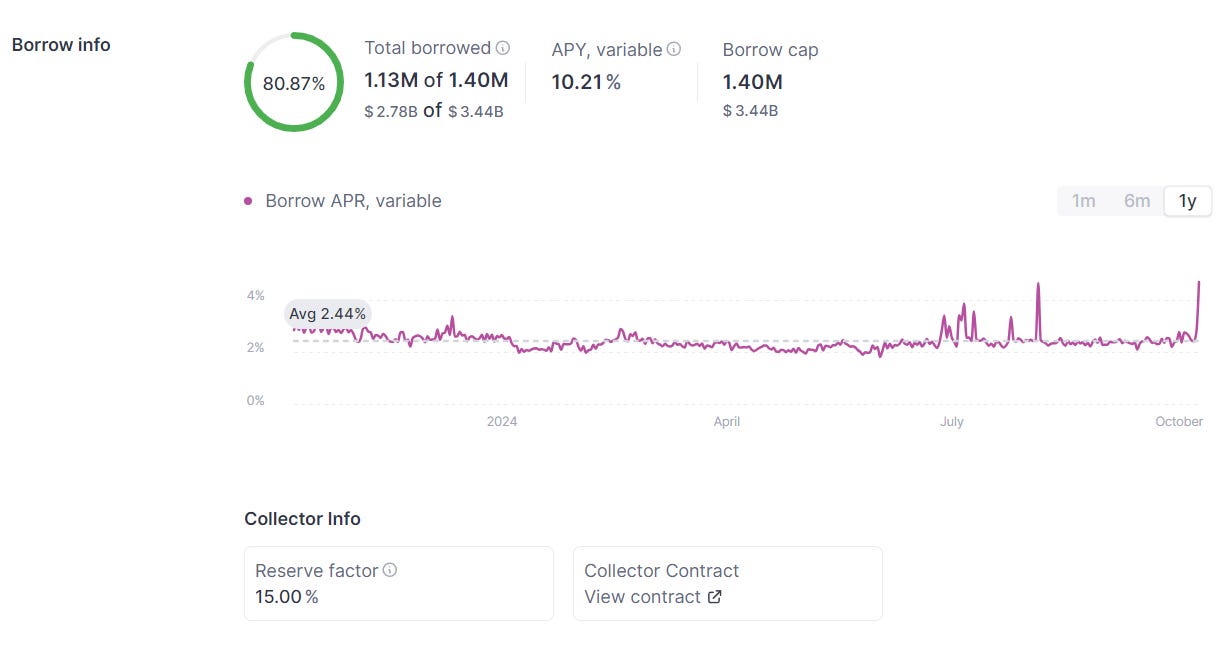

This is what is called Decentralized Finance (DeFi). Hundreds of applications based on smart contracts with which you can interact & yes, borrow money - mainly stablecoins but as we might enter a world where stablecoins become a normal currency… It’s pretty interesting.

Here’s an extract from my personal favorite, AAVE, when you try to borrow USDT.

It works as any lending tool would work, although no money is created here as AAVE isn’t a bank and doesn’t have the right to do so. Lenders give their money to the protocol in exchange for returns which vary depending on supply & demand.

Everything is controlled by smart contracts, its functioning but also its security, with restrictions like minimum reserves & a total borrowing power, not to overdo oneself and put every user at risk. No single person can modify their parameters as we’ll see later.

This tool is the perfect representation of what a capitalist market is. Some have something others need, and they can meet each other & interact with agreed-upon constraints & rewards.

Everything is a bit primitive now and has not much real-world impact as stablecoins & other cryptocurrencies have no legal value. But you can see the potential, and if I have to explain it, I’d say this.

Imagine going to your bank on a Sunday to borrow $10,000 which you need to buy something urgently, say, Monday. You have assets but cannot or do not want to sell them. You simply are short of cash. Here, you will be able to collateralize your assets & borrow this sum in a few seconds, use the stablecoins to pay your need & refund it over time. No paperwork, everything is validated by the blockchain, no arguments, no delay. Everything is set up to be automated.

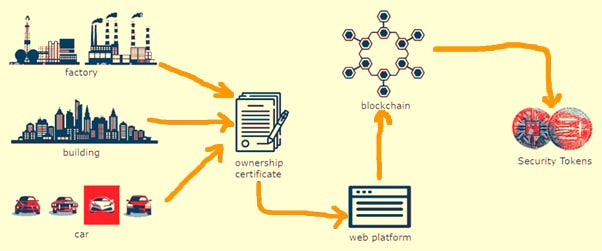

Tokenisation & NFTs.

Another tool which have been long criticized for how it was used - with reasons: Non Fungible Tokens. These are tokens of property, not only cats or frogs JPEGs - some of the most useless things ever. But the engineering behind is great.

A rapid definition.

“Tokenization takes real-world tangible or intangible assets (like real estate, art, company shares, commodities like gold or oil, or even intellectual property) and transforms them into digital tokens. These tokens represent ownership or rights over a portion of the asset.”

Might be hard to grasp the value, but it’s pretty easy.

Ownership comes with a notarized piece of paper attesting something is yours, and this is the reason you usually pay exorbitant fees to notaries. Imagine if property could be proven digitally and inscribed in an impossible to modify, verifiable & intemporal ledger. Some would call this a blockchain.

I could own my car, my house, my company, but also my stocks, anything in the world & have a digital proof for it, attested & controlled by an autonomous, unbiased software.

This would simplify lots of things, starting with the transmission of properties as selling your house could now be done in a few minutes, by sending your NFT to the new owner in exchange for on-chain payment.

Your house ownership is included in the blockchain; it clearly states it belongs to you with information such as when you bought it, how much, from whom, etc… You want to sell, an app exists on which one party puts the funds while the other one puts its house property token. Once the smart contract realizes both parties have done their part, the transaction is set up in a few seconds and inscribed forever in the blockchain. You now receive cash in exchange for your property title.

No third parties - except the blockchain. No delays.

We’ll talk later about how this is impossible for now, but once more we are talking about potential. Simplifying every transaction while giving the role of the trustworthy third party to an unbiased software.

Decentralized Autonomous Organization.

The fairer & most democratic way of doing… AAVE is a DAO, and even Ethereum works as a DAO for most things.

No crazy concept here, this is exactly like a company board.

Decisions have to be taken by unanimity or majority, depending on the smart contract configuration. Each owner of a decision token can vote during proposition. This is how AAVE has been developed from day one; the community proposes improvements or new functionalities & to vote on them. If accepted, they would be carried out.

Layer 2 & dApps.

I’ve used the term toolbox throughout this write-up to describe what the Ethereum blockchain really is because I believe it to be the best comparison.

Ethereum is kind of useless by itself; it is nothing but a foundation that can be used to build applications, exactly like the internet has been only used to interconnect computers. Developers then used it to build what we know today.

Everything described above already exists & was built on Ethereum; each application uses the Ethereum blockchain, network, security & interconnections. They wouldn’t work without it & Ethereum would be useless without them.

But Ethereum isn’t perfect and doesn’t answer all use cases, so some developers set themselves the objective to address more specific needs & built what is called layer twos. These also are toolboxes, but much more specialized ones positioned on top of the Ethereum network & use its network, security & interconnections before adding their own specificities. Some will focus on scalability, others on latency, others on privacy, etc… Ethereum is constantly growing, upgrading, updating.

More specified toolboxes added on top of an already pretty wide toolbox, lowering the amount of transactions & smart contracts transacting directly on the main chain. These layer 2 solutions will take up most of the work themselves & will simply finalize batches of transactions on the main chain, exactly like banks settle transactions from their users once a day, instead of exchanging money every second.

Except we are not only talking about transactions in the case of Ethereum; we are talking about anything smart contracts can do.

Back to Reality - ope, there goes gravity.

I just want to go a bit further into how all of this is completely unrealistic, as of today - and I am of course aware of it.

The technology is here & is functional, but everything isn’t about technology and for the world to shift paradigms & to go towards this kind of decentralized solution to manage property & legal ownership, investments & trading, or worse, monetary flows, would require tons of legal frameworks but most importantly, institutions & private monopolies to accept to let go of the control they exert on their domains.

That’s… Very, very unlikely.

Monopolies have been lobbying & spent billions to protect their ownerships of their domains & countries have gone to war to protect their control over monetary flow pipes & currencies. None would let those go, at least not willingly.

But the world tends to always turn towards the latest innovations & blockchains, decentralization, fast, secure & trustless solutions seem to be the next step, the better solution compared to our actual ones.

Things might unfold with a Darwin effect, when the technology will be transparent enough to be easy to use & most users will turn towards it if it proves its efficiency & security for years. Ethereum & the apps hosted on its network could take over the financial world exactly like Bitcoin over the monetary world right now: no one can control it, no one can forbid it, no one can stop it - although that’s only half true for Ethereum, which has much more risk of being shut down by some states as there is a clear foundation working on it, clear teams developing apps on it & more pressure points compared to Bitcoin.

Add to this the classic pressure points like complex bureaucracy, high taxes, or different regulations which could push users far from it, despite it being a better solution altogether.

Lots of unknowns, and there is a probability that Ethereum never reaches the picture I painted. I sure have less trust in it than in Bitcoin, but the subject remains interesting & worth considering as its potential is crystal clear.

Opportunity.

I don’t do price guessing & it either way is impossible to do it for Ethereum as it cannot really be valued, or compared to traditional companies.

I personally own some coins, staked, since years now which gave me pretty good returns between the yield & appreciation, but I do not intend to hold it through the next crypto bear market.

As of today, I do not believe the technology is ready to be widely used; it is too complicated & nerdy to understand & the actual apps aren’t transparent or user-friendly enough to be used by my parents or grandparents.

Until this happens, I won’t be a long-term holder of Ethereum.

But the potential is here. And accumulating a fundamentally appreciating & yielding asset with such potential can be interesting, assuming you believe in the thesis I exposed here.

In a few words, that the world constantly adapts, following a Darwinist theory, towards the more practical, rapid & user-friendly tool. Ethereum has everything it needs to become this tool in the future. And owning a piece of the internet would have yielded pretty great results since the 90s.

Conclusion.

I could have gone much deeper into many sub-subjects in this write-up, but my goal here was really to give an overview of what Ethereum is & what the crypto community behind it sees & believes in, not to give a detailed explanation of what it is like I did with Bitcoin. I could go much further later on if you guys are interested, but I’ll leave it here for now.

It isn’t strong enough to hold through thick & thin, to my opinion, as a long-term investment. Like with every crypto asset - except Bitcoin, I like to play the cycle & you already hear, and will continue to hear me talk about Ethereum as a great speculative asset based on strong fundamentals & potential.

That’s about it for now. Things might change in the future, for better or for worse & I sure will write deeper about it if things change positively. But we’re not there yet.

Nice, thank you!