Duolingo Is The Next Netflix & I Am Not Buying

Sometimes your best conviction isn't the best asset to buy.

We’re going to do something a bit different today and you might start seeing more write-ups like this in the future. I find them interesting to write and hopefully you’ll find them interesting to read.

I’ll detail why Duolingo is, in my opinion & many others’, one of the best opportunity in the market right now. And why I’m not buying it, despites that first statement.

I’m not contradicting myself. I believe in having a system & Duolingo doesn’t fit mine. I also believe it is important to separate opinions from actions in the markets. They are one of the rare place where you can hold two opposite ideas at the same time, and still make sense.

I’ll illustrate my arguments with Netflix’s case & explain how we can maximize returns in this kind of situation, and more importantly, how we can minimize risk and improve our sleep quality while doing so.

Current Situation & Convictions.

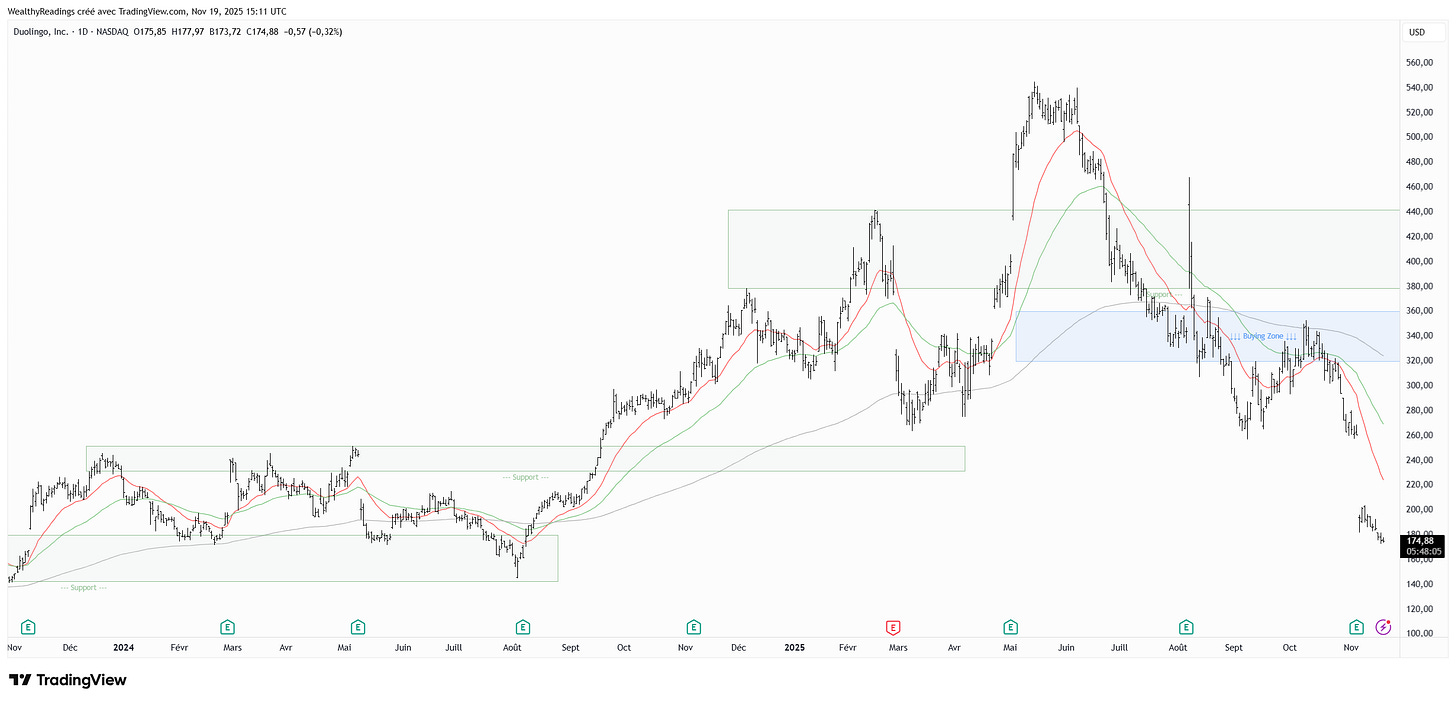

Some of you probably don’t need a reminder, that -25% day still hurts - it does for me, but I’ll do it either way.

Management shared last quarter that they will prioritize user acquisition and retention over monetization on their A/B tests, which means growth will slow down in the profit of a potentially growing user base - nothing is guaranteed. You can find more details in my full review of the quarter.

This shift came with a guidance with no sequential growth for the next quarter, which triggered market concerns that the growth story may have peaked and ended up with a strong punishment for the stock, not because the company is weak, nor because revenue or margins are expected to decline, but because growth is now harder, impossible really, to predict & many prefer to exit rather than hold uncertainty.

That being said, my convictions haven’t changed. Management is choosing to focus on the long term and on product quality. They are investing in a platform where users can thrive even more than they already do. That’s not bearish. Many could argue this is actually great management, focusing on the long term.

It just introduces uncertainty, and the market hates uncertainty.

Why I’m Not Buying

Despite Duolingo being one of my strongest convictions at today’s price, I’m not buying. Here’s why.

Execution Risk

My convictions are personal, they don’t magically become reality. Who says I’m right? Who says Duolingo won’t struggle in the short term or get disrupted by AI?

I personally don’t believe those downside scenarios. I believe Duolingo will become the leading learning platform worldwide, used by hundreds of millions every day to learn anything they want. I believe Duolingo will outperform schools and even be used by schools. I believe their personalized AI teaching methods will be better and funnier than anything we’ve seen before. But the road is long & nothing guarantees I’ll be right.

Convictions don’t make money.

Timing Risk

Duolingo is a wonderful company and should remain one. But we have zero visibility on how long management will focus on user experience and product quality before it shows in the numbers. And zero visibility on if it will even work. I’m convinced it brings long-term value, those are my convictions once again, but what if it takes five years to be reflected in the data? Or more?

Am I willing to hold through that?

Psychology

And most importantly, am I mentally capable of doing so? Can I hold an asset that may keep dropping for years and continue DCA into it while others pump?

Ask PayPal buyers five years ago, I do not think many are still holding their shares, yet the fundamentals are improving now, after years of struggles.

Some people can hold through such pain. I don’t think I can.

Concentration

This would also affect how I manage concentration. If I allocate liquidity to Duolingo, I can’t allocate it to other names, and right now, I believe some stocks offer much better potential and I would rather push liquidity on them.

Let’s see how Netflix behave in a very comparable situation few years ago and how we can take advantage of patience to maximize returns and minimize risks.

Netlix Comparison.

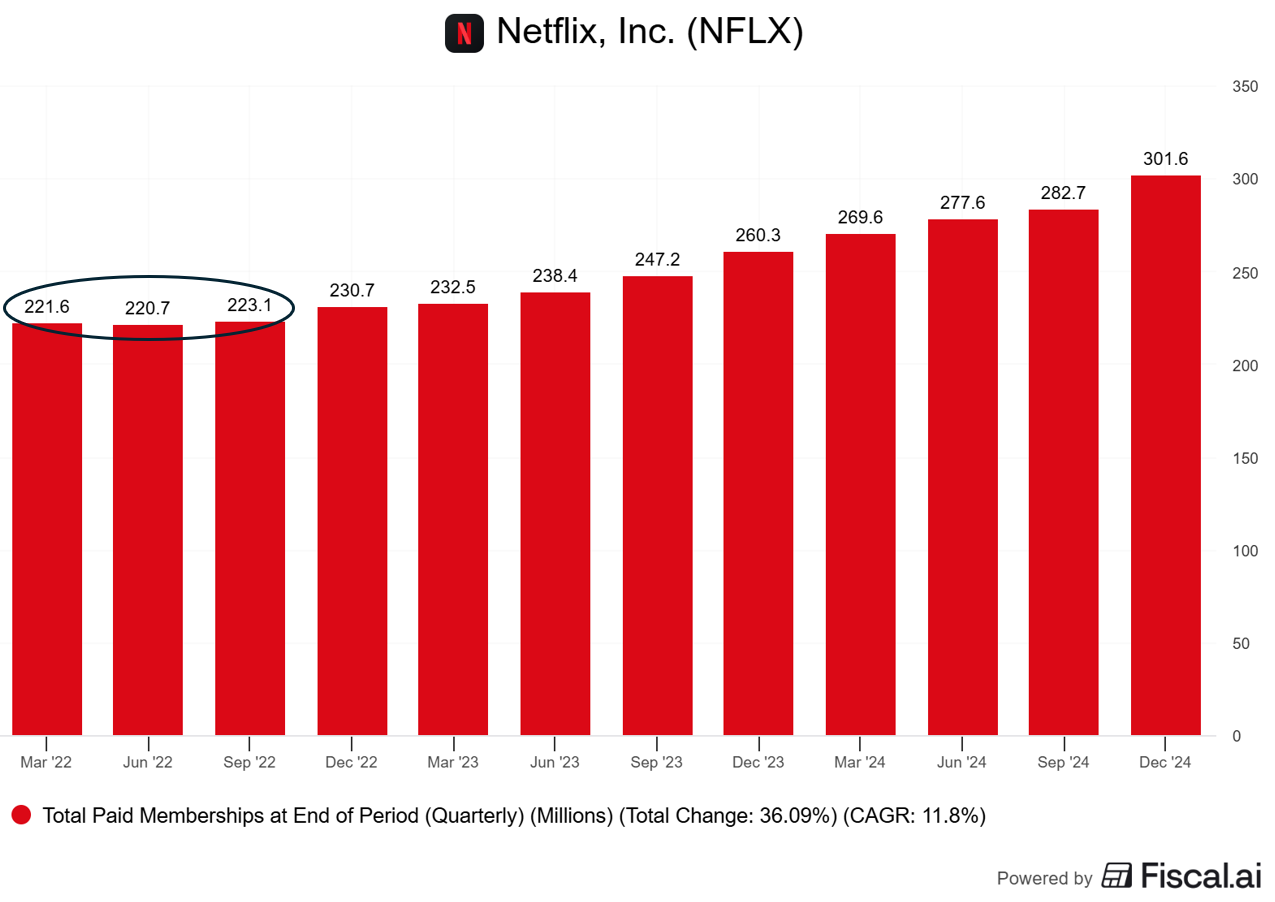

Back in 2022, Netflix fell 21% post-earnings, from $51 to $40 - post-split. The reason? Subscriber onboarding and guidance slowed down. The market concluded that Netflix had reached its ceiling in users and therefore in growth.

Before you tell me that nothing of the sort is happening to Duolingo, I hear you. But it isn’t true: monetization is slowing & that shows in a weak Q4-25 guidance.

The negativity continued into Q1-22. Not only was growth absent, but we actually saw a sequential decline. The stock dropped another 35%, from $35 to $23 - again, split-adjusted.

The market repriced Netflix with pessimism. Not because the company was broken or not growing anymore, or headed for bankruptcy, but because the market preferred to step aside and wait rather than invest on uncertainty.

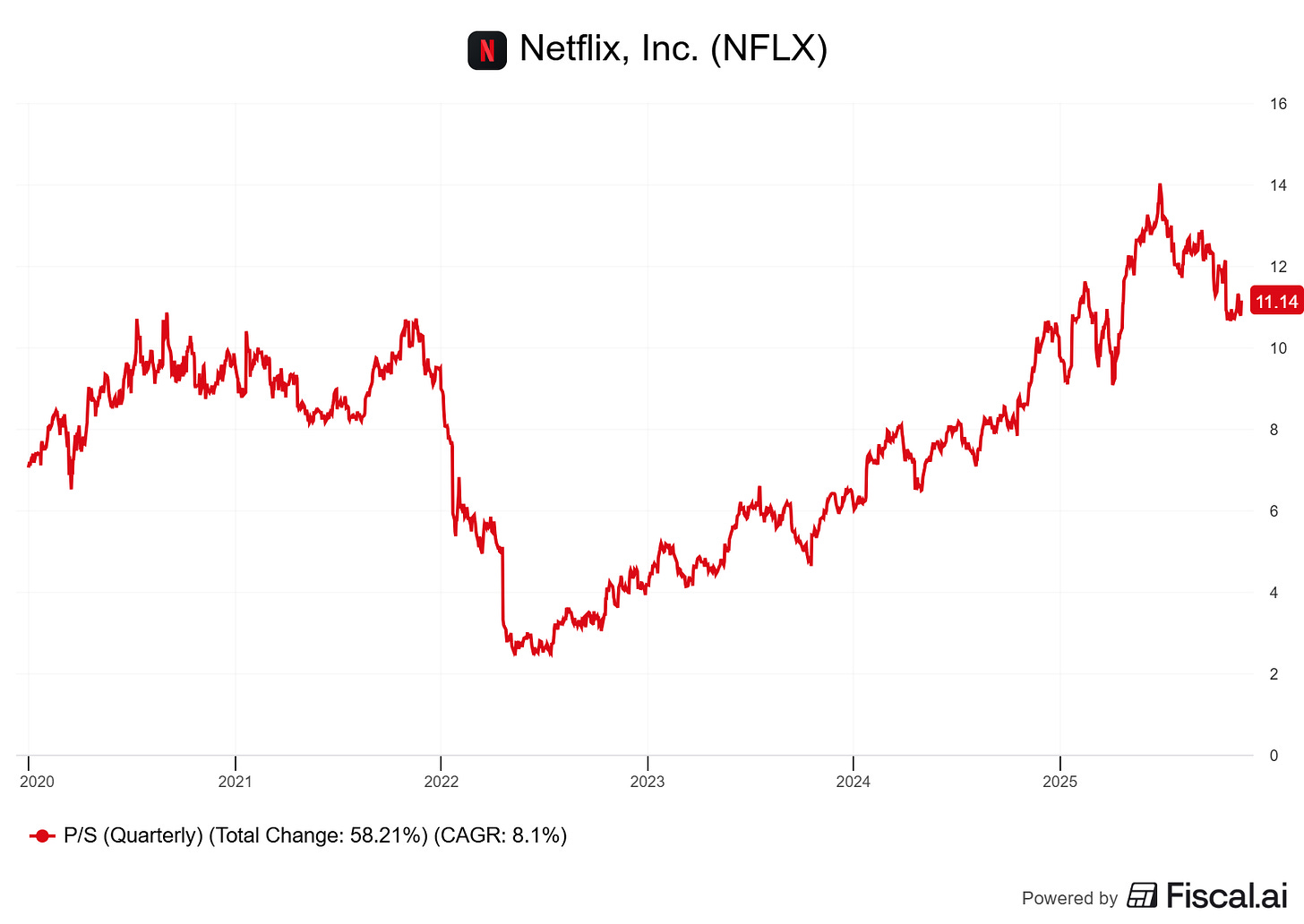

Netflix’s P/S fell from 10+ to below 3.

From that point on, the market had priced in so much negativity that Q2-22, which showed a tiny sequential growth and no overly positive guidance, was enough to stabilize the stock and even spark a small bounce.

The rest is history: Netflix reaccelerated and the stock is now up ~600% since the double bottom in June 2022.

Now let’s play the investing game on this situation.

Imagine you were fundamentally bullish on Netflix back then, the same way I am on Duolingo today, and decided to buy the dip because “it will obviously bounce back. Netflix is the future of streaming and a giant in the market.” And you were right.

If you bought after Q4-21 at $40, it took the stock 1 year and 4 months to get back to that price. No gains, just breakeven.

Assuming you averaged down from $40 to the bottom at $16, let’s say you built an average at the medium, around $28, Netflix didn’t revisit this price until October 2022, 10 months after your first purchase.

I’m not saying averaging down is a bad strategy. Many do it and beat the market. But it isn’t my strategy because it comes with the risks I already described:

Execution Risks: What if your conviction was wrong and Netflix never recovered?

Timing Risks: What if Netflix had taken 3 or 4 more years to come back, the same way PayPal still hasn’t recovered today?

Psychology risks: Are you absolutely sure you would’ve been able to hold through months of pain, buying while your portfolio kept shrinking? Most people would have given up and sold the bottom.

Price Action Matters.

Price action clearly showed the market didn’t want anything to do with Netflix for more than a year.

How could you know?

Constant rejections at daily moving averages

No clear bottom formation

Lower lows for months

Until when? Max pessimism, when Netflix traded below 3× P/S and the stock finally reclaimed its daily 21 - red line, broke out of a 4-month range, and three days later reclaimed its daily 50 - green line.

That was your signal that the market had turned, or at least was done with the selling. By then, you got confirmation on both fronts:

Fundamentals: Small sequential user growth in Q2 and a light, but not negative, outlook, at very low multiples.

Market: Price reclaimed major moving averages.

And this confirmation came below $28.

A great entry would’ve been on the retest of the daily moving average around $23, likely lower than the cost basis of most people who averaged down.

By doing this, you avoided most risks, slept better, and your average would’ve been better than if you had taken the painful road.

So what are the takeaways?

One quarter of slowdown does not define a company’s long-term future.

A falling stock can always fall further, regardless of our convictions.

Great companies often glow up, despite short-term fluctuations.

Price action is the ultimate truth & we’re often better listening to it.

Patience matters more than convictions.

Investing is about returns, not proving to the world that you are right, that you are the best. There is no return-focused reason to buy a stock just because of personal convictions. Your ego isn’t the source of your gains, on the contrary.

The system I use and share here every day is always the same:

Acquire knowledge. Understand fundamentals. Build convictions.

Track narratives, understand them & build a case for/against them.

Have a valuation model to price my watchlist.

Daily track fundamentals, narratives & valuation.

Buy only on price-action confirmations.

Leave your ego aside. Let the market tell you its truth.

Today, Duolingo continues to print lower lows and it might very well be undervalued by hundreds of metrics. But until the market accepts this, our opinions simply don’t matter, even if you were to be right.

Take the Netflix playbook. Learn from it.

Everyone is entitled to their own method. Mine is to wait for confirmations and those come from fundamentals and price action. They might take a few months… or a few quarters. But I’ll sleep better waiting for them instead of holding an asset with a question mark on its stock appreciation.

Duolingo is one of the best opportunities on the market right now. I firmly believe this. But it isn’t necessarily one of the best buys. I shared yesterday my best buys. Duolingo wasn’t on the list for all the reasons shared today.

That being said, everyone invests differently and many will prefer to average down. And once again, many beat the market that way. But I wanted to detail why I do not average down and how I will manage Duolingo during the next months.

With patience, until I have confirmations.

seems kind of absurd to me -

I somewhat agree. However, I don’t think that’s a fully rational investing approach. When you find a company that executes exceptionally and the numbers support the story, you shouldn’t necessarily expect the price to fall even further. It starts to become guessing game.

Of course, there should be a margin of safety that you’re comfortable with and that matches the level of risk. And when you invest in carefully chosen companies in which you have the highest conviction, Mr. Market shouldn’t change your view. You don’t want to predict the market’s mood — you want to own businesses that are, in the best cases, severely undervalued and overlooked.

If the price falls, you should be happy, unless the business itself and your thesis are falling apart. I don’t think that, for Duolingo investors, the thesis is falling apart. You may be right a dozen times, but beyond that, it becomes speculation.