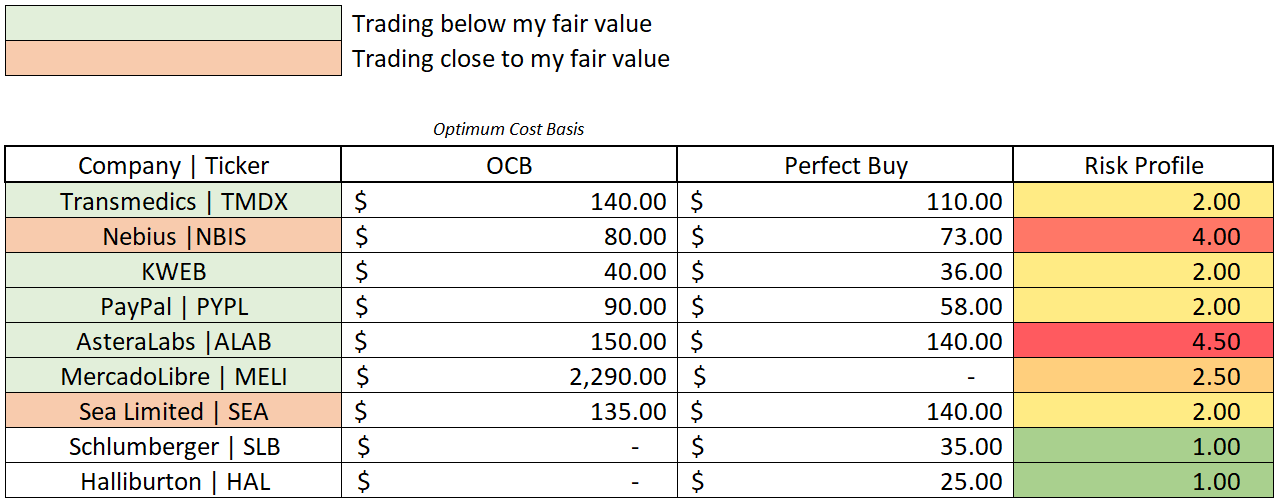

Today's Best Buys

Optimizing liquidity attribution.

I’ll start by clarifying what I mean by “best buy” as it varies between investors. For me, who focus on maximizing returns, liquidity attribution is a core concept. Liquidity is scarce and should flow to the stocks with the highest potential.

Spread it too thin and performance drops; concentrate too much and risk jumps - as it happened with Duolingo. The objective is to find the best risk/reward on the market and attribute as much liquidity as I can on it, until the balance shifts or another name presents a better opportunity.

My approach to the market is to have a handful high concentrated positions that I understand fundamentally and narratively. I buy only when valuation matches my models and price action is either trending up or ranging with a clear bottom.

Those are my three buying conditions. Applied strictly, very few stocks qualify at the same time, which creates concentration. Sometimes, like lately, a few more qualify, I have to ignore some and focus on other.

These are what I call “best buys”.

Strong fundamentals.

Positive narrative.

Below fair value.

Positive price action.

I can see a few today.

I won’t be buying them all, but I’ll share my thoughts on each.

My Top 5.

Transmedics.

Fair value: $150.

This is my #1 candidate right now, it checks every box. If you don’t know the company or its latest - very strong, quarter, you can read about it here.

The market worried about summer seasonality, but flight volumes are picking up in November and the company could beat its FY25 guidance - which has already been raised three times.

It’s hard to understand why a 30%+ grower with multiple new growth verticals trades at 7x sales; I expected flights volume to be the positive catalyst but the market chose differently as growth names are being punished lately, regardless of their sector.

I’ve looked for a real bear case but couldn’t find anything really interesting beyond the usual medical-sector risks of regulation, social security refunds or reputation.

Price action is a textbook breakout and retest, deeper than expected but mostly due to broader market weakness.

As I said a few days ago, if this name doesn’t work out, I won’t blame myself. It meets all my criteria, and not being aggressive when all lights are green would be a mistake.

Is it free money? No. Things don’t always work out. But I follow my system, that’s why I made Transmedics my top position and continue to grow its weight in my portfolio. This is a recession proof company within a defensive sector, treated as a growth stock by the market for reasons I cannot understand, with a very positive price action and a clear support on its weekly 50.

Nothing’s ever guaranteed. But Transmedics is the perfect example of what I look for in a stock.

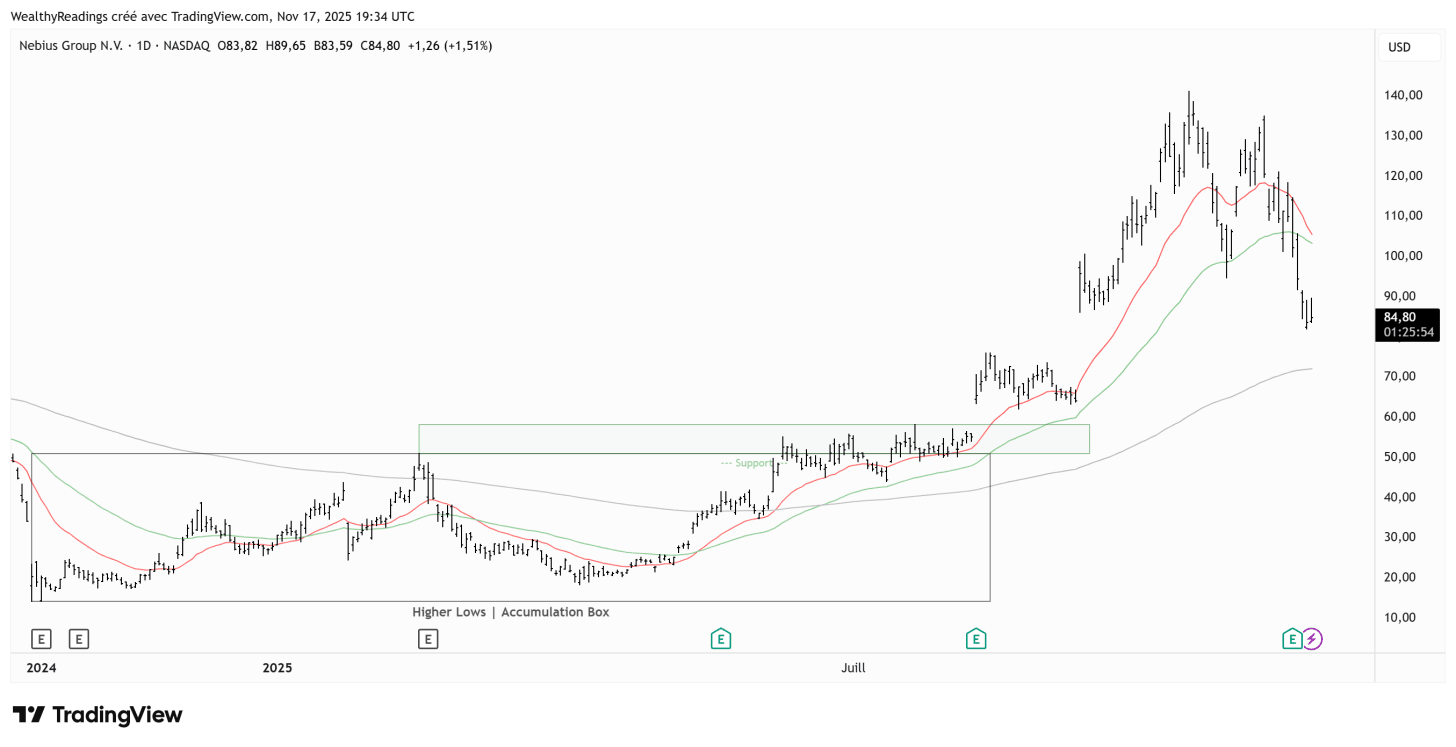

Nebius.

Fair value: $80.

The market is skeptical of the AI trade lately - combined with macro concerns, & fears that the industry is overbuilding infrastructure that won’t be needed in a few quarters, wasting capital and propping up companies that will collapse due to weak demand or poor economics.

We can’t know what things will look like in six months or six years. Buying this sector today is a bet on the future for those who believe AI is here to stay & enterprises will build AI services - apps and software, and be able to monetize them. There aren’t any signs of weakness in the demand today but this could change rapidly.

Nebius is a high-risk, high-reward growth name. In my view, it’s the best horse in the neocloud sector due to management, fundamentals, competitiveness, balance sheet, subsidiaries and equity investments. But at the end, it’s just another speculative investment based on personal beliefs about AI’s future.

In the short term, the market may continue to punish the stock without data-driven reason, the risk is that the markets are a psychological game and bearish narratives can become self-fulfilling once enough investors believe them.

Nebius can post the best quarters ever, just like it did in Q3, its stock will be driven by the narrative around AI and nothing else as if the market believes demand will slow, it’ll price the stock based on its appreciation of risks, not the company’s guidance.

Price action-wise, I see no reason to be bearish, even after a 50% drop. We could still go lower, close the post-Microsoft gap, and bounce off the daily 200.

A 50% drop on a growth name is not the end of a long term uptrend. This happened in April as well and was an amazing opportunity. But it will take more than a few days to recover, and we might not have seen the bottom yet.

I am bullish on the future of AI, do not find data confirming the market’s worry about a slow down in demand and believe Nebius is the best name outside of hyperscallers to be part of the AI compute demand narrative. I believe the market pessimism isn’t warranted and Nebius is here to stay long term, so this make it my #2 today.

KWEB.

Fair value: $40.

KWEB is essentially China’s Nasdaq, a tech-heavy ETF unevenly weighted. It’s my top pick for diversification and one of the cleanest setups in the market.

China is at the start of its AI and tech expansion and its government is pushing hard on innovation, consumption & demographics. If successful, this could boost the economy and its tech competitiveness.

KWEB gives exposure to China without betting on a single name. I prefer Alibaba but it’s a bit pricey today, KWEB is a great option if you want exposure with less volatility.

Many investors are biased against China, usually due to missunderstandings or cliché. Still, even without bias, geopolitical risk is real and government’s plans can fail. Japan hasn’t solved its consumption issues for decades and while the contexts is different with different mentalities and cultures, the risk exists.

Although the market seems optimistic with a clean breakout after three years of accumulation, and a perfect retest happening right now.

That name could dip to $35 or even slightly lower to retest its weekly moving average, which would give an even better buy, but the next logical step medium term with such setup is a second leg up.

PayPal.

Fair value. $90

The ugly duckling makes the list again, especially after a great quarter that broke key parts of the bear case, proving it could reprice its lower-tier services and deploy multiple partnerships and initiatives to boost growth and margins.

Partnerships with OpenAI, Google and Perplexity for agentic e-commerce

Stablecoins leveraged for B2B services

New advertising products

PayPal World

This looks like a delayed repricing setup. All signals are green and I expect PayPal to outperform the next year from today’s price. Although, as for Transmedics, nothing’s guaranteed and we have two main risks left on PayPal.

An execution risk. Many doubt agentic AI will generate volume and most other initiatives launch in 2026; the market is skeptical about their impact. It may take several quarters for the stock to be repriced, assuming execution goes well and demand for their new services follows.

Consumption slowdown: U.S. consumption is clearly slowing, especially with low-income households. Since payment providers’ revenues depend on volume, this could be an issue. For now, the slowdown is only for a specific portion of the economy, the famous dual speed economy, but a recession would hurt the company and the stock.

Price action shows the market doesn’t care about this name, with the stock stuck between $56 and $80 after a failed breakout earlier this year.

The bottom seems to be in above $55 and fundamentals are improving. This is a great time to accumulate to my opinion, especially in the mid-to-low end of that range, and wait for the fundamentals to impact the financials.

Bonus: AsteraLabs.

Fair value. $160

Everything you need to understand the bull thesis is here.

Like Nebius, AsteraLabs is being punished because the market believes AI buildouts are too aggressive & that we’ll need less hardware than expected. Nebius provides compute; AsteraLabs provides hardware focused on compute bottlenecks. Both are hit by the same negative narrative.

The bull and bear theses are the same than Nebius, though AsteraLabs carries slightly more risk to me due to its fundamentals. Its two core products, the ones expected to drive growth in the next years, haven’t shipped in volume yet. Last quarter confirmed strong interest and discussions, but we still need data in the order book.

In term of price action, AsteraLabs is ahead of Nebius: it already filled its daily gap and is bouncing off its daily 200.

Nothing says this is the bottom but it could be - I wouldn’t bet on it though. If so, this could be a great indicator of what to expect for other AI growth names.

Just like Nebius once again, it is a high risk high reward stock, arguably a better buy today based on price action but I personally prefer Nebius due to its fundamentals and will focus my liquidity in it, and let Astera for others, wishing them success.

It also perfectly illustrates how growth behaves short term: down 68% from its high to the April low… then up 458% a few months later on fundamentals and earnings.

Diversification from U.S.

MercadoLibre.

Fair value: $2,290

I struggle to understand what the market is punishing here. The only explanation is a global multiples compression due to its actual pessimism. Markets expand multiples when sentiment is optimistic and contract them the rest of the time, regardless of MercadoLibre’s multi-year 30%+ growth and perfect execution.

That’s why MercadoLibre looks like a buy today. Nothing changed fundamentally and Latin America is in a better place than a few years ago, if only because of lower rates. I prefer China and Asia, but MercadoLibre is probably the best western compounder to diversify away from the U.S.

Price action has been disappointing, with the stock losing its weekly moving averages.

I’d personally wait for confirmation that the repricing is done but the name deserved a mention in this list and many investors who do not look at price action will find value in it at this price.

I just isn’t for me.

Sea Limited.

Fair value: $135

I don’t have a deep thesis on this company but it is comparable to MercadoLibre. An e-commerce focused company with financials services, plus the usual entertainment layer, usual in Asian companies.

The advantage is that Sea is Singaporean. For those who want exposure to Asian e-commerce and rising household income without China’s geopolitical risk, this is it.

Compared to MercadoLibre, price action is clean. Not even clean: perfect.

To me, this setup is almost comparable to TransMedics with the only negative that it trades slightly above my fair price.

Value Investing.

Schlumberger & Halliburton.

Energy offers great value right now. After years of underperformance while liquidity chased AI & growth, capital is rotating toward defensive sectors like healthcare and energy.

Both Schlumberger and Halliburton look attractive. Price action has turned up, both names formed a clear six-month bottom and broke out of months of consolidation.

They’re not as exciting as growth tech and won’t offer the same upside, but if the AI trade fades and the market grows nervous, energy will be a strong hedge. And this isn’t a great look for the rest of the market when those names start to turn bullish.

Some may prefer cash or to average down other positions, but with solid dividends and improving price action, these two names could be interesting right now.

Other Interesting Names.

A quick shoutout to Adobe and Novo Nordisk, two great companies starting to form a bottom. I don’t see enough confirmations yet to include them in this list, but we’re getting close and they might make the cut in the next weeks. I could also talk about Neflix but the name remains a bit pricey, like Alibaba although both are awesome companies and opportunities long term. Just not perfect to be a best buy today.

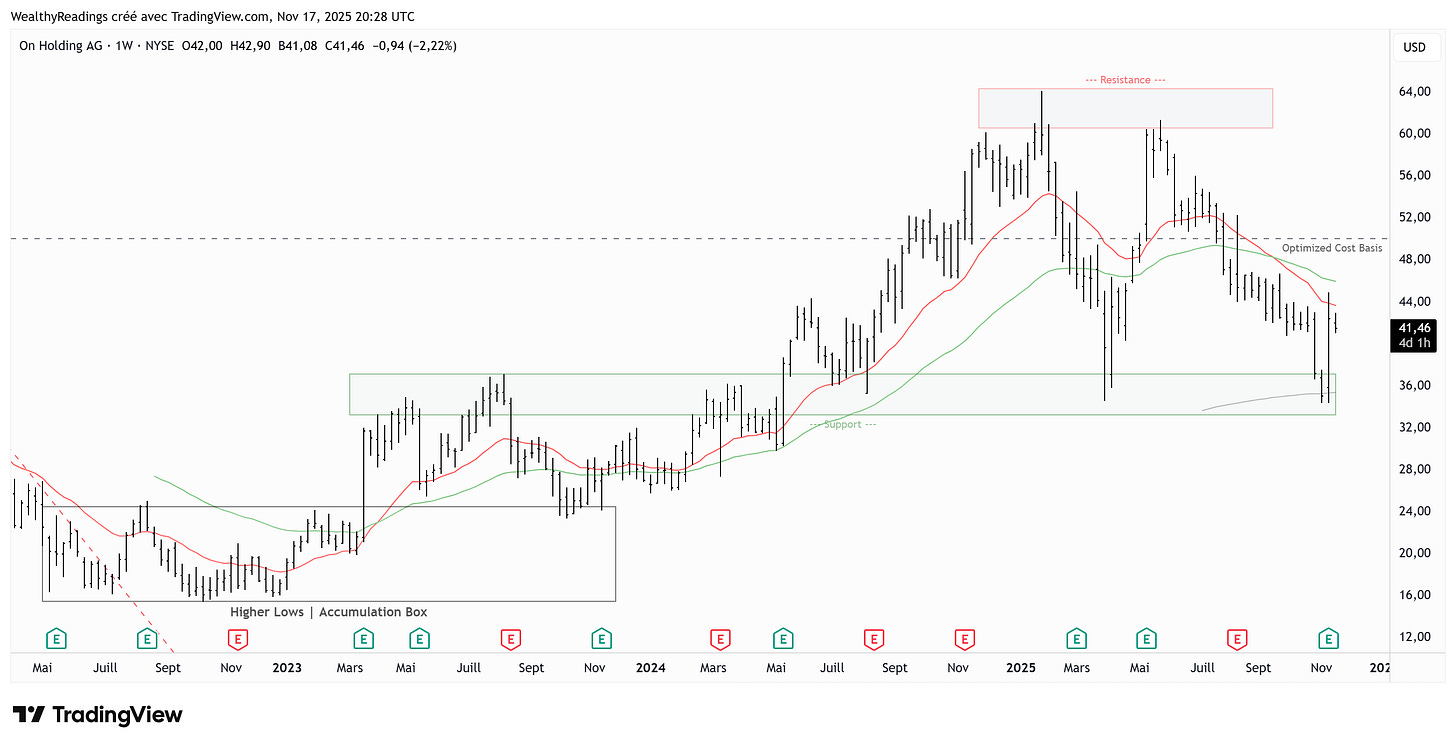

Another one for On Running who delivered hell of a quarter; the market is worried about consumption & isn’t ready to reward even the strongest names in this sector. The stock is still ranging between April lows and its previous highs and is clearly undervalued, but I don’t expect much medium term.

Even if the AI trade fades, liquidity won’t rotate into consumer discretionary yet.

I might be wrong, but I wouldn’t bet on it today unless you have strong conviction or enough liquidity - or the wish to, to diversify. I love the name, but I’ll stay patient.

KWEB was the best China ETF I settled on last week to buy. Also bought MELI and PYPL. PayPal gets beat on more than any stock due to years of nothing, but at this price, it seems like a no brainer.