PayPal Q3-25 Detailed Earning Review

A narrative-shift quarter.

If you guys are interested, you’ll get a 15% discount on FiscalAI through my referral link below. FiscalAI is the tool I use for KPIs in all my write-ups - powerful, data-rich and with great UX.

https://fiscal.ai/?via=wealthyreadings

Everything you need to understand PayPal’s bull thesis is here.

I’ve been pounding the table on PayPal for a long time and have shared multiple write-ups outlining why this was the moment and how to play it.

Strong fundamentals, upcoming features, weeks of partnership announcements and massive activity in the options market… The only missing element was a positive narrative and when fundamentals are strong, narratives eventually shift.

This quarter is exactly that: a narrative-shift quarter.

This is what this Substack is about & I’ll allow myself a small victory lap - even though this is still the beginning and we haven’t “won” yet. But this quarter highlights that my approach works: identify fundamentally strong companies and focus on clear data to find the best medium or long-term trades at the best possible timing.

I re-entered PayPal in June, accumulated from August & got aggressive with options in mid-September as every signal aligned.

End of October showed results.

I do my best to share actionable information, data you can use to make money, not just headlines or opinions. Strategies based on fundamentals, price action, & option flow. I share the information; you decide if/how to use it. The goal is not for you to copy my portfolio, but to build one you are comfortable with, based on that data.

It took months to get there. But we nailed this trade. And this kind of quarters is a great confirmation of a well oiled system. Many more to come.

With that said, let’s review this very strong quarter.

Business.

To understand why this quarter matters, we need to revisit PayPal’s bear case.

The payment processing industry is highly competitive and the winner would be the one offering the lowest pricing, meaning the lowest margins.

PayPal’s Braintree competed aggressively on price & the market believed their clients would not accept higher fees or move to the more expensive branded solution when cheaper options were available elsewhere.

In short: There was “no path” for revenue or margin expansion, and no one believed in PayPal’s innovation pipeline.

This quarter disproves both points. The most important takeaway is the clear shift in demand across PayPal’s products.

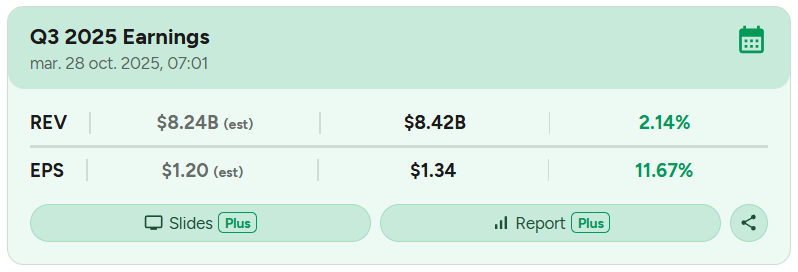

Revenue growth is accelerating across all verticals, except Braintree which slowed this year, logically. But margins are rising everywhere, including Braintree. Slower growth + higher margins from Braintree alone would be a concern. Combined with accelerating branded growth and profitability, this is the setup long-term shareholders have been waiting for, for years.

PayPal as a company saw a stable growth with higher margins as most of this growth came from Branded products or a revisited, profitable Braintree.

That is without any impact from next-gen growth drivers as none was deployed. That means there is additional upside on top of an already improving core business.

Demand for Branded is Growing.

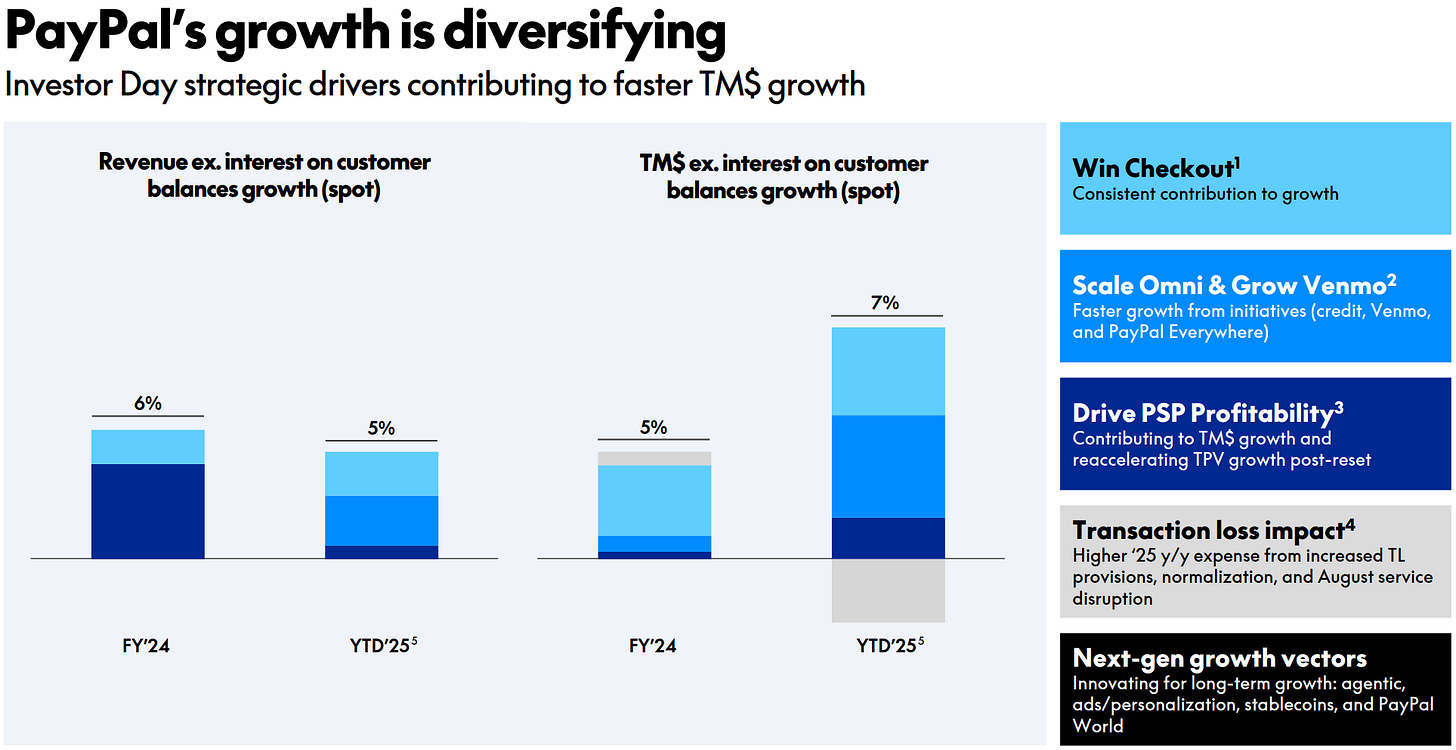

This is the key point. PayPal’s higher-margin branded services are growing because of the value they deliver, thanks to improvements made over the past two years under Alex Chriss’ leadership.

Multiple initiatives contributed to this shift: redesigning PayPal and Venmo, improving checkout technology, launching debit card products, expanding Buy Now Pay Later (BNPL), cashback, promotions…

PayPal debit card actives transact ~6X more and generate ~3X ARPA compared to checkout-only actives.

The focus on BNPL was a big part of those results, by pushing it upstream & growing conversion rates as consumers are tempted by BNPL. We’re talking about $40B TPV expected this year, up more than 20% YoY.

In testing, when our Buy Now, Pay Later options are presented upstream on a product page, we see a nearly 10% lift in branded checkout volume on average.

BNPL will expand to new geographies and payment methods. I personally believe this isn’t a good thing from an economic point of view, to allow such services, but we are talking about PayPal here so I won’t go further than saying this doesn’t reflect a really healthy consumer. From a PayPal point of view, it is undeniably a driver of conversion.

Venmo delivered strong numbers as well, TPV up 14% YoY, Revenue up 20% YoY, monthly Venmo debit users up 40%, 1M first-time debit users in Q3…

And a focus on a younger demography, good from a business perspective as young users logically stick longer and build habbits, while opening new opportunities for PayPal as merchants who want to target those users will need to propose Venmo to grow conversion.

Pay with Venmo monthly active accounts grew by nearly 25% in the quarter. We hit a new record with our Venmo debit card, which attracted 1 million first-time users in Q3, thanks in part to our college partnerships. Monthly Venmo debit actives grew by more than 40%.

It is starting to bring in very, very valuable merchants as well. Whether it is eBay or Ticketmaster, Sephora, Taco Bell, DoorDash, TikTok, these are all merchants that really want access to this demographic.

And this is before PayPal World rolls out, which will let Venmo users pay globally just like PayPal users, unlocking even more activity. This creates a network effect: more consumer demand → merchants must offer PayPal → more transactions → higher margins and more demand, etc…

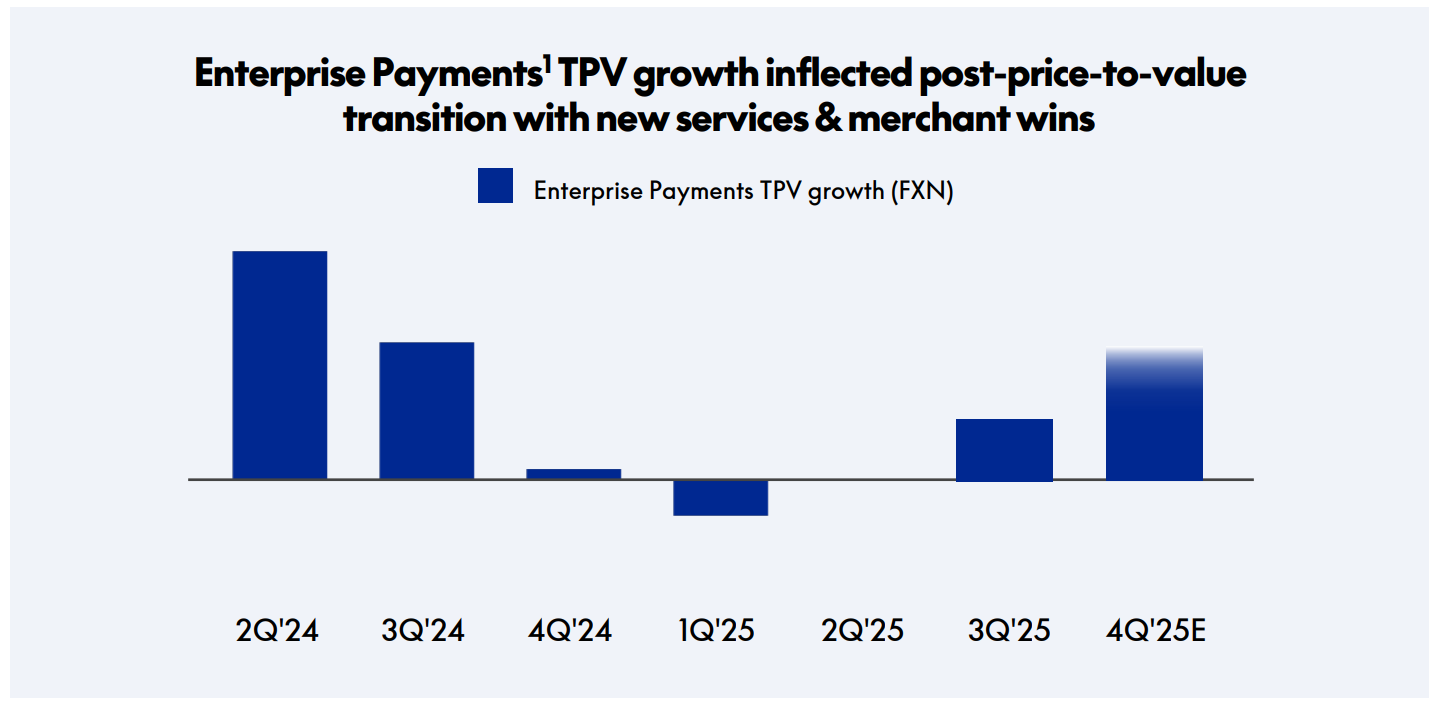

Braintree's Growing Profitably.

Once again, the bear case assumed merchants would refuse higher pricing and move to competitors. Alex Chriss took the bet: he repriced Braintree based on value. Some left. Most stayed. And Braintree TPV is back to growth, with higher margins.

This is a clear display of network strength. Merchants stayed because the risk of losing PayPal users was higher than paying slightly more in fees. While some - maybe most, simply accepted a higher price for a higher product.

We’re seeing merchants not only willing to pay for these capabilities, but actively requesting more of our services as they begin to recognize the benefits for their business. As we continue to expand our unified enterprise payments platform globally, we are bringing these margin-accretive services from day one.

The bear case is officially broken.

Margins & Usage Metrics.

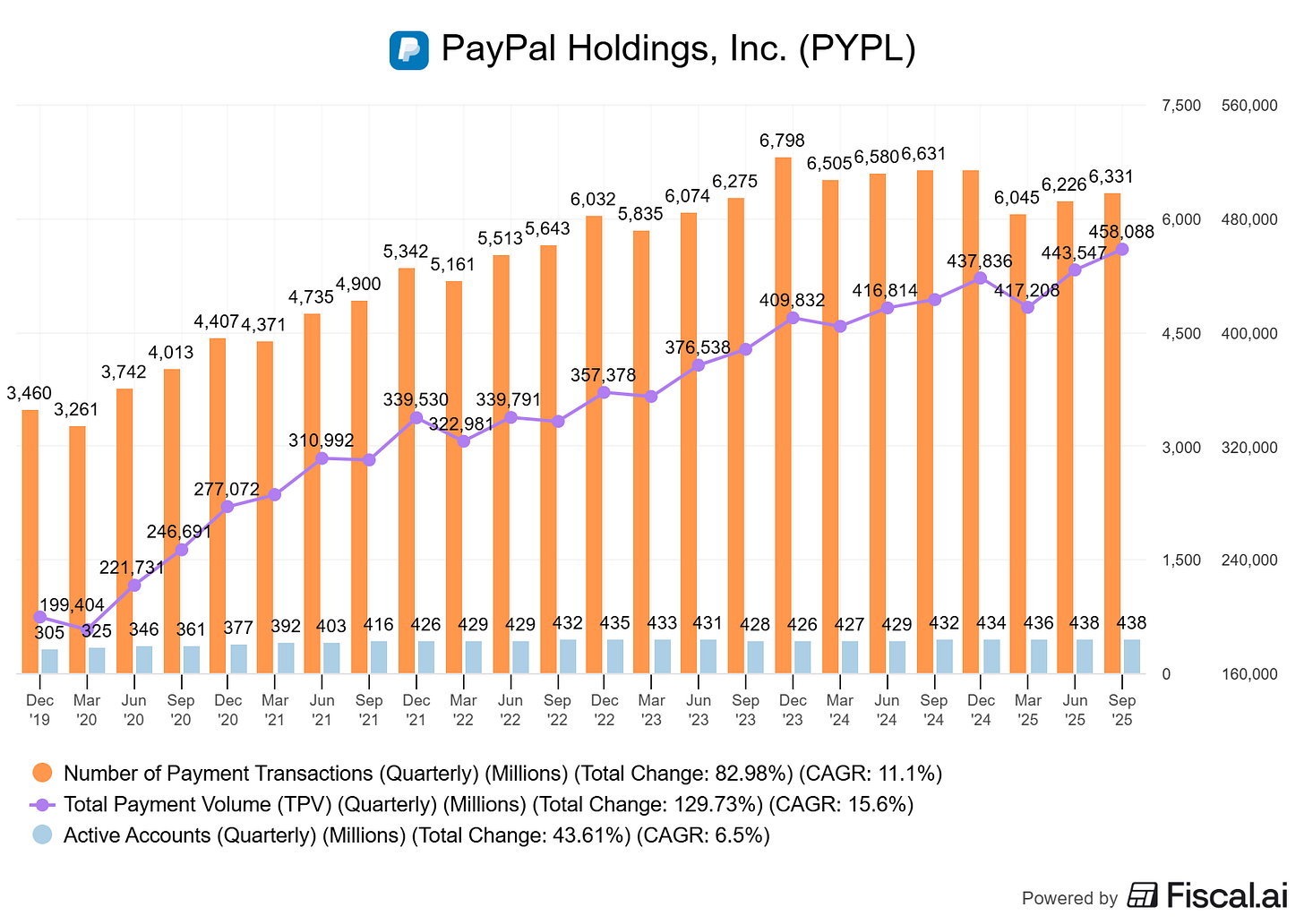

To step back and look at the company as a whole, the overall data is clearly positive.

Global TPV is growing at a steady rate. Some will focus on the lack of user growth or the decline in total transactions, but, once again, Pareto applies. Losing low-value users while higher-value users increase their spending is a positive trade-off.

And that’s exactly what is happening: fewer users & transactions, higher engagement from core users and, more importantly, growing activity in PayPal’s most profitable business segments.

Branded experiences TPV grew 8% on a currency-neutral basis in the quarter. This includes PayPal, Buy Now, Pay Later, Venmo, and our debit card programs, and is the single most important metric to track the progress on transformation from an online payments company to a commerce company.

This is what investors want to see. It would be ideal to combine this with user growth, but the acceleration in branded TPV matters more, it shows deeper engagement from the company’s core and most profitable customers, which is what drives the flywheel Alex Chriss talked about.

Our confidence in the financial impact of this strategy comes from the flywheel effects we see across our ecosystem. When customers start using PayPal or Venmo offline with our debit card, their online activity increases as well. We see a similar pattern with BNPL. Its use drives an uplift in overall activity and engagement. The data clearly validates our strategy and gives us confidence to increase our growth investments.

There are still some macro headwinds I’ll cover in the guidance section, but internal trends are moving in the right direction.

Alex also provided clear operational priorities for the coming months: scaling the new checkout experience across merchants, expanding biometric authentication,increasing merchant prioritization. They have a clear roadmap.

Agentic AI.

PayPal also shared that it will be the first integrated wallet within ChatGPT for agentic e-commerce. Many were surprised, I think it was just a matter of time.

We’re talking about 700M weekly users on a rapidly growing platform, with agentic commerce adoption accelerating. And this comes in addition to recent partnerships with Google and Perplexity. The strategic positioning here is powerful.

Today, we also announced our own agentic commerce services, which help merchants sell through multiple AI platforms, including Google, OpenAI, and Perplexity. Merchants will have one integration to access consumers through multiple LLMs.

PayPal built an LLM-independent system, meaning merchants configure once and deploy across every AI partner seamlessly. Logically, scaling these will require investment in both technology and marketing which will ramp through 2026.

Between the push into agentic and that, some of those investments are likely to be a near-term headwind to how fast transaction margin dollars or earnings grow next year.

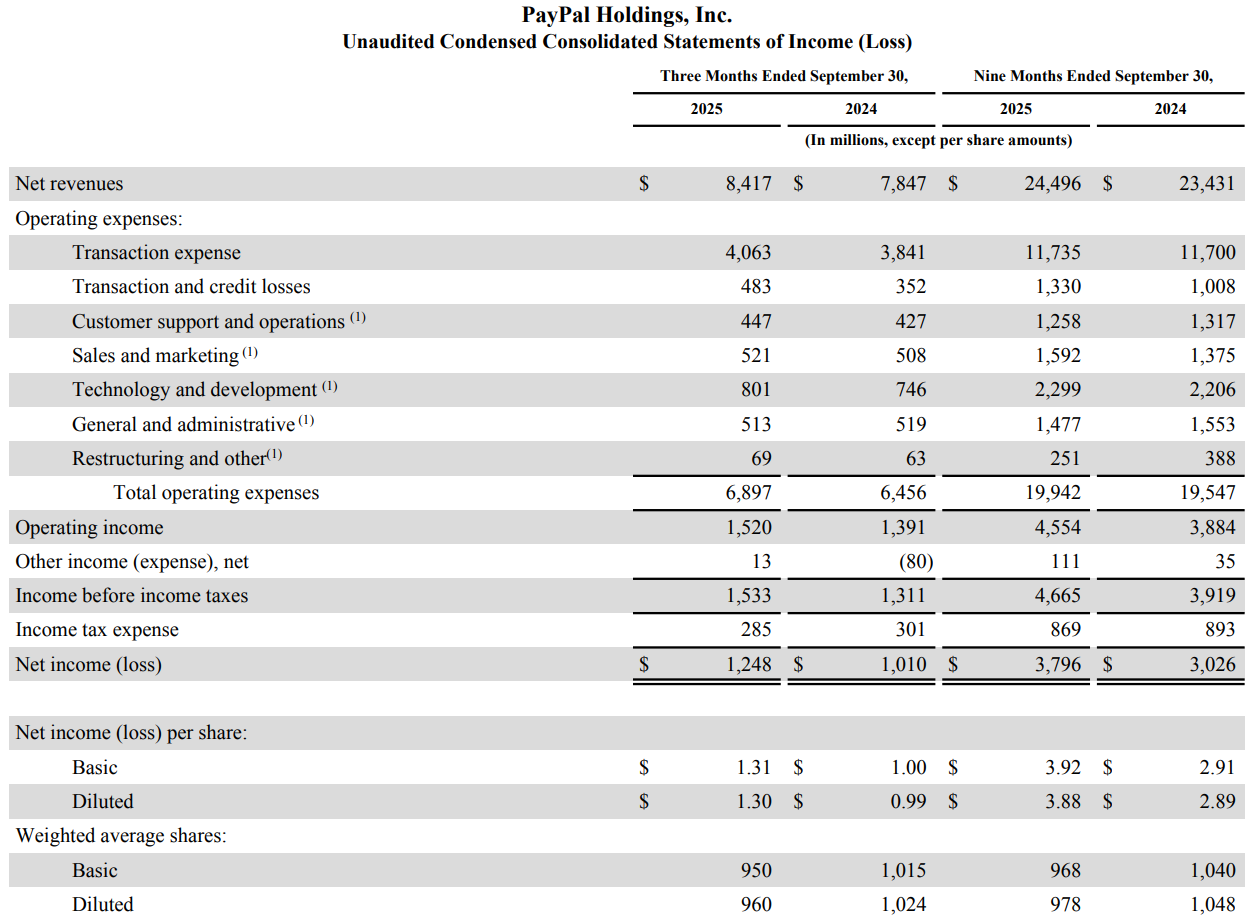

Financials.

No surprise here.

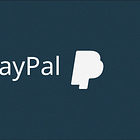

Revenue grew 4.5% for the nine months ended. Weak, but this quarter came at 7.3% YoY, a clear change in momentum. This should be the ground for the next years, which is enough for such a large company. Margins were flatish but net income increased 25.4%, hence a 34.7% YoY EPS growth, combined with buybacks.

In term of cash, PayPal ended the quarter with $3B in net cash, generated $2.3B in FCF and repurchased $1.5B in stock. Strong.

The company also initiated a dividend equal to 10% of profits, paying $0.14 per share this quarter with a quarterly schedule. This is a positive as management confirmed it will not slow the pace of buybacks, but complement them.

We see this dividend as strengthening our overall capital return program, working in conjunction with our ongoing share buybacks. Our free cash flow generation and balance sheet are strong and give us ample room to both deploy capital to drive growth and return capital in a disciplined way to shareholders.

Our free cash flow generation and balance sheet are strong and give us ample room to both deploy capital to drive growth and return capital in a disciplined way to shareholders. Put simply, this is the new PayPal, built for faster, more profitable growth.

They could have grown buybacks even more but having both simultaneously is better in terms of optics, it also attracts new investors and is a net bonus overal.

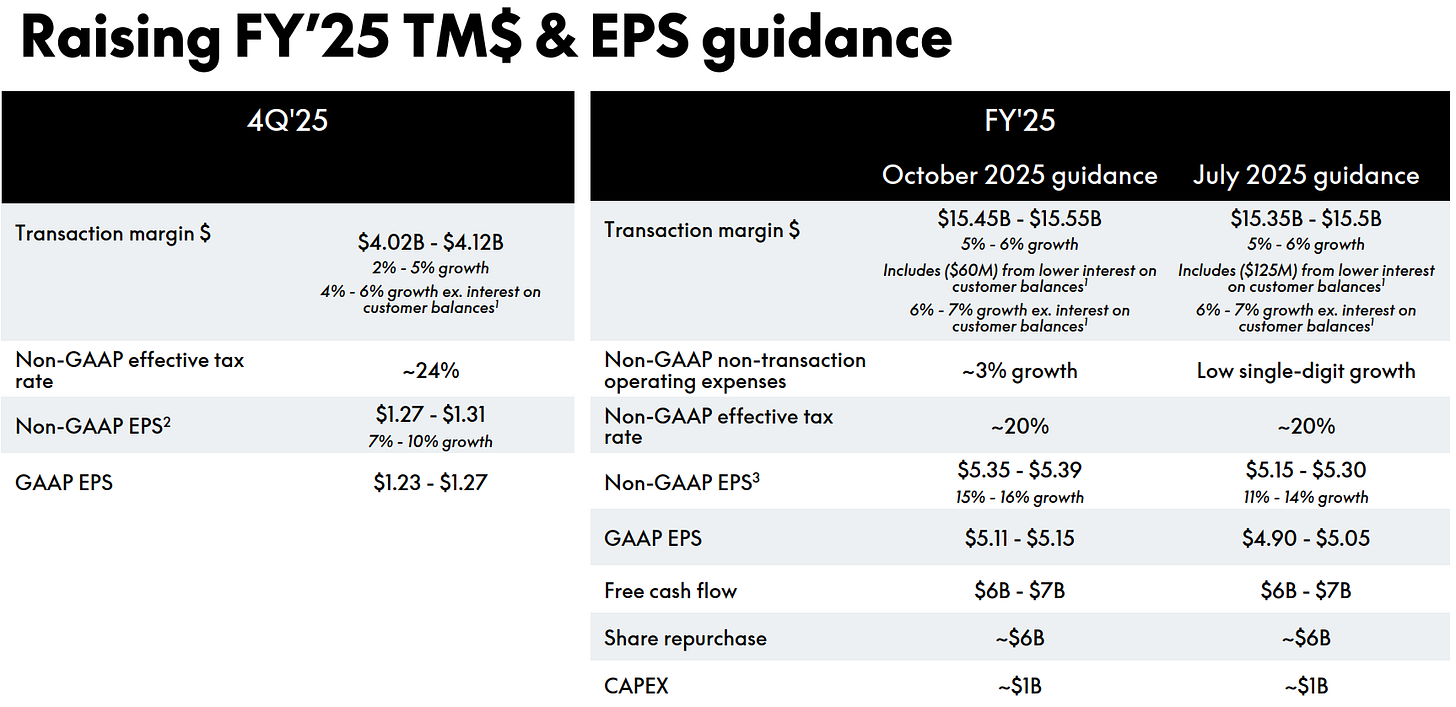

Guidance.

Guidance was raised despite rate cuts on interest income generated on customer balances, a clear sign of expanding margins once again.

Jamie flagged some consumer weakness, which is aligned with what I’ve been saying for months: inflation is still crushing lower and middle-income households and tariffs only adds pressure, even if not visible in the data yet - more on this on Sunday.

At the same time, this improvement was offset by pockets of softer consumer discretionary spending in Europe and the U.S. later in the quarter. Overall, we have seen relatively consistent growth in the number of checkout transactions, but basket sizes or average order value has decreased. While still early in a back-end loaded quarter, we’ve observed this trend continuing through October.

Investment Execution.

Braintree was the part of the business dragging everything down and most thought it unfixable. Alex went in, upgraded the branded experience, launched new features and repriced Braintree based on value. A risky move; merchants could have walked.

They didn’t. Switching costs and network effects were stronger.

Now. Braintree is profitable and growing. Venmo is accelerating. Branded TPV’s strong and improving margins. And we have new growth engines coming in early 2026: ads, PayPal World, stablecoins, all high-margin catalysts.

PayPal is now where no one believed it could be just a year ago. The restructuring work is done. What’s ahead is not easier but more interesting.

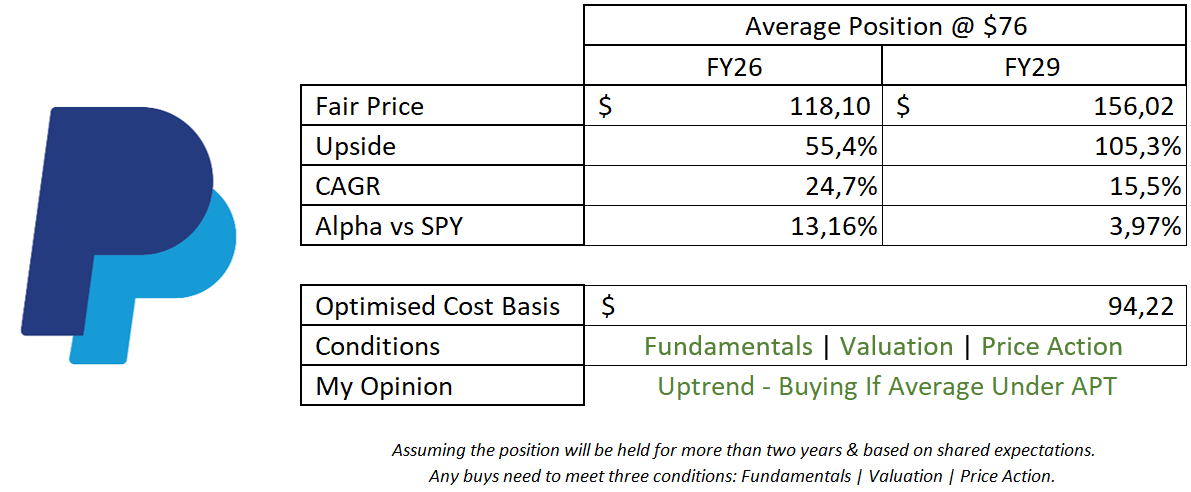

I’m not changing my accumulation target as it is impossible to anticipate the upside from the new verticals, the only possible method of pricing PayPal is on its core business improvements so I will only use those.

This model assumes a 7% & 6% CAGR growth until FY26 & FY29 respectively, 15% net margins, 4.5% return to shareholders & P/S & P/E at 25x & 2.5x respectively.

After this quarter, these assumptions look conservative. I personally consider this price more like a floor than a fair value target. I stay conservative because it avoids to fall in traps and be stuck. Better be picky. But after this quarter and with its actual trajectory, I don’t think saying that PayPal is a triple-digit stock is overly optimistic, as long as execution stays on track and consumer spending doesn’t collapse.

Price action isn’t rewarding this quarter as much as it should to me, which is typical for PayPal. The data is here. The re-rating will come, likely faster than most expect. The longer we remain in this $60–$80 zone, the longer I can accumulate.

My only near-term concern is macro as PayPal is tied to Western consumption and I am not overly bullish on that for the next 12–24 months. But that is external to the company. Internally, everything is going well and there are many more reasons to be bullish after this quarter.

I am in for the long term with shares and Jan ’27 $80 calls. The company is clearly improving and I’ll gladly continue to accumulate until the market opens its eyes.

Great write up mate well done

I will try and get mine out over the next couple of days