Swing Trade Setup - 09/19/2025

Portfolios' (over)Performance, Market Review & PayPal Swing Trade

I’ve always said that fundamentals, research & convictions matter, but beating the market comes down to execution. That’s what these write-ups will be about.

I will share through them every change in my active portfolio - stocks & options, reasonings & plans, before I even hit the buttons. I won’t update DCAs, I will only share my plans & new/closed positions in these write-ups. You can follow the rest directly on savvytrader.

https://savvytrader.com/wealthyreadingspro/active

I also recently opened a Buy & Hodl portfolio on which I will DCA $4,000 every month & focus on buying the best assets I can at the best possible price, 100% focused on fundamentals & valuation, without any active management.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Keep in mind that both portfolios have completely different goals and I can behave very differently on both for the same name - accumulating in the buy & hodl while selling in the active portfolio for example. Different rules apply.

My goal is to deliver alpha over the long term, not just six months under easy market conditions. If/when proven this content is valuable, it will be shared behind a paywall. No rush, though; it’ll stay free until proven valuable.

So here’s the deal: you get full transparency on my trades, right when I make them. If - and only in that case, it brings real & long-term alpha, it’ll be accessible only for a fee. I believe that’s fair enough, but feel free to provide feedback!

Nothing shared here is financial advice; we are all responsible for ourselves.

And before we start, a friendly reminder that you’ll find 15% off for any subscriptions to Fiscal.AI using my referral link - if interested.

https://fiscal.ai/?via=wealthyreadings

I am back at 200% after some great holidays - the first ones in a long time especially as a European. I let the market behind me a little bit but am now back to grind and deliver the best possible content to unlock above average returns, with many more things to come!

Market Review.

As you guys know, I have been waiting for a breather long now and continue to do so. I started to talk about it in mid-July when the S&P 500 was around 625, and it hasn’t happen. We had some red days, but we kept trending higher.

But even with a biased view, I kept accumulating assets because one cannot perfectly time the market; the only possibility is to balance our aggressivity, as Peter Lynch said.

Far More Money Has Been Lost By Investors Preparing For Corrections, Than Has Been Lost In Corrections Themselves.

Cash management is everything in the market. I kept buying the assets I judged worth liquidity, even while expecting a correction, and simply adjusted the amount of cash injected monthly, keeping a bit more aside than usual. Today, around 20% of my total portfolio is in cash, and every percentage point above this threshold goes toward assets. The rest is patiently waiting for the inevitable.

Performance & Portfolios Review.

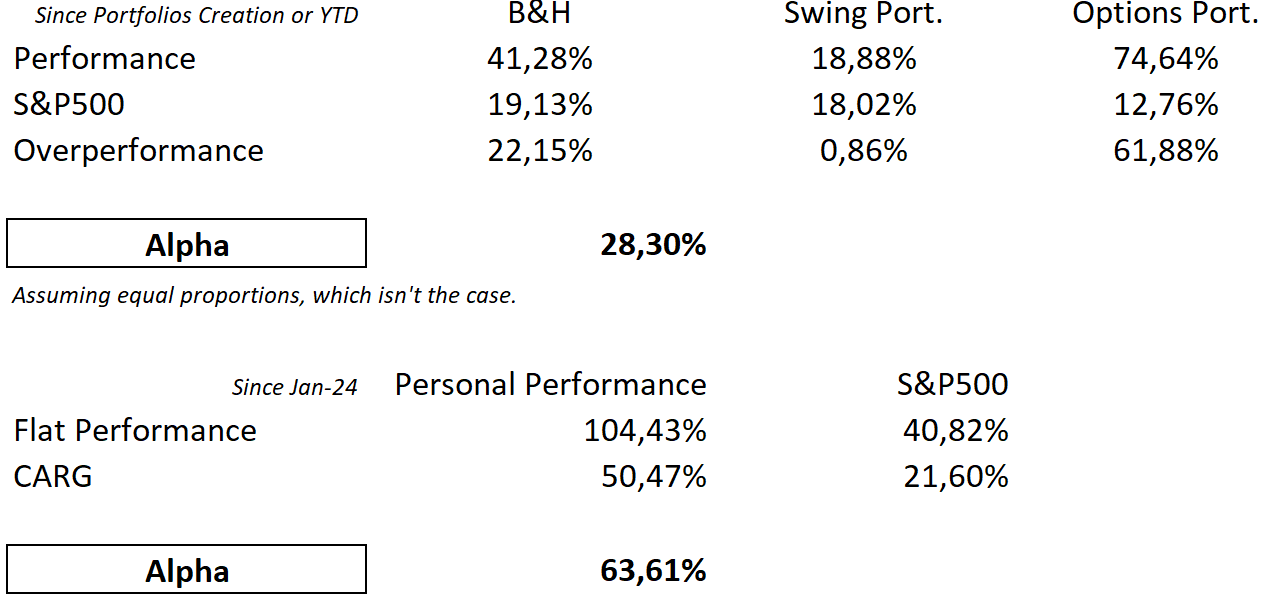

I will share two different performance metrics today, and will use the same in the future.

One is since I started sharing my journey online in January 2024, extracted from my personal investing accounts & aggregated in Excel - impossible to do better as I have four different brokers. I won’t be able to prove this performance with unalterable online tools, so this is “trust me” data, although you could find all my write-ups to retrace my performance, to some extent.

The other only with transparent tools; my options account which I regularly share, and both SavvyTrader accounts, whose authenticity cannot be denied.

I’ll let you choose the one you prefer, as I understand some may not take my Excel for granted - even though I can assure you it is accurate. Those can use SavvyTrader as a reference, as it is transparent, public, and unalterable.

Either way, both are leaving the S&P 500 in the rearview mirror.

As written in small characters, the three transparent portfolios are not equal in terms of proportion. Buy & Hold weights around 60% of my portfolio, options around 30% and swings around 10%. The real YTD alpha is better than displayed, but once again, that requires trusting my Excel files so I’ll leave it at that today.

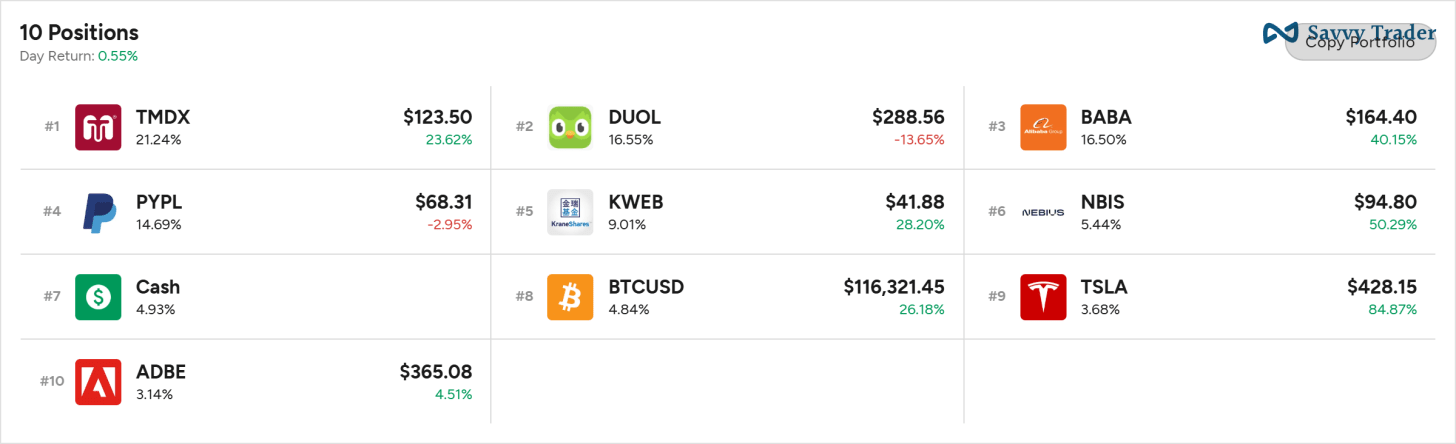

B&H Portfolio.

My long-term portfolio has been performing well lately, thanks to Nebius first and China then, as we are finally pumping after long months of waiting.

TransMedics remains my biggest position with strong convictions and will show its potential once flight data improves - it shouldn’t be long now as September is trending at 50%+ YoY growth.

A bit more patience but eventually, I believe this position will bring the portfolio to much higher highs as it weights around 20% of my total portfolio.

Duolingo remains a strong fundamental play with a bad narrative at the moment, but narratives shift fast. Their DuoCon was bullish in my opinion, showcasing a laser-focused team on its long-term vision, what investors should look for.

I continue to believe we’ll go higher; the stock might just need time to get there.

On China - Alibaba and KWEB, the market is finally waking up. Even better, this surge in price comes from local inflows, not external ones, meaning Chinese are investing. Whether the liquidity comes from institutions or households, I do not know, but the conclusion remains that government’s incentives to invest are working.

This has been the narrative all along: to bet on a change of mentality in the region while their stock market was undervalued based on many standards, and their economy not as bad as many made it look like.

I’ve been waiting for this for almost two years, but I can finally say it today: The Chinese equity bull market has begun, and it’ll be long.

Nebius is also a great opportunity with many potential catalysts, especially since the Microsoft deal. I have no intention of trimming and my position is much bigger than displayed here as I own lots of option calls. It actually is my #1 position.

I also shared on X yesterday that I personally wasn’t happy with how the coverage of this stock evolved on social media, with too many engagement farmers who don’t even understand the fundamentals of the company. I have no authority on the name, but if you discover Nebius, be careful about where/whom you take information from. There are some excellent people covering this name, but also terrible ones.

I initiated a new position in Adobe after their latest quarter, as I believe the stock has bottomed and I’ve always been bullish fundamentally. I was simply waiting for the market to give me the go.

The go was given, so I bought in and intend to accumulate slowly.

Last words on Bitcoin and Tesla, which are long-term assets that I will accumulate on opportunities, regularly. And we will talk about PayPal later.

My watchlist still includes great names like AsterLabs, On Running and ASML - which I considered a buy around $700 and shared as such but didn’t open a position, as I did not have enough cash to build a full position. Hopefully some of you did and enjoyed the returns.

As usual, we’ll follow them - and more, and talk about investing when the moment is right.

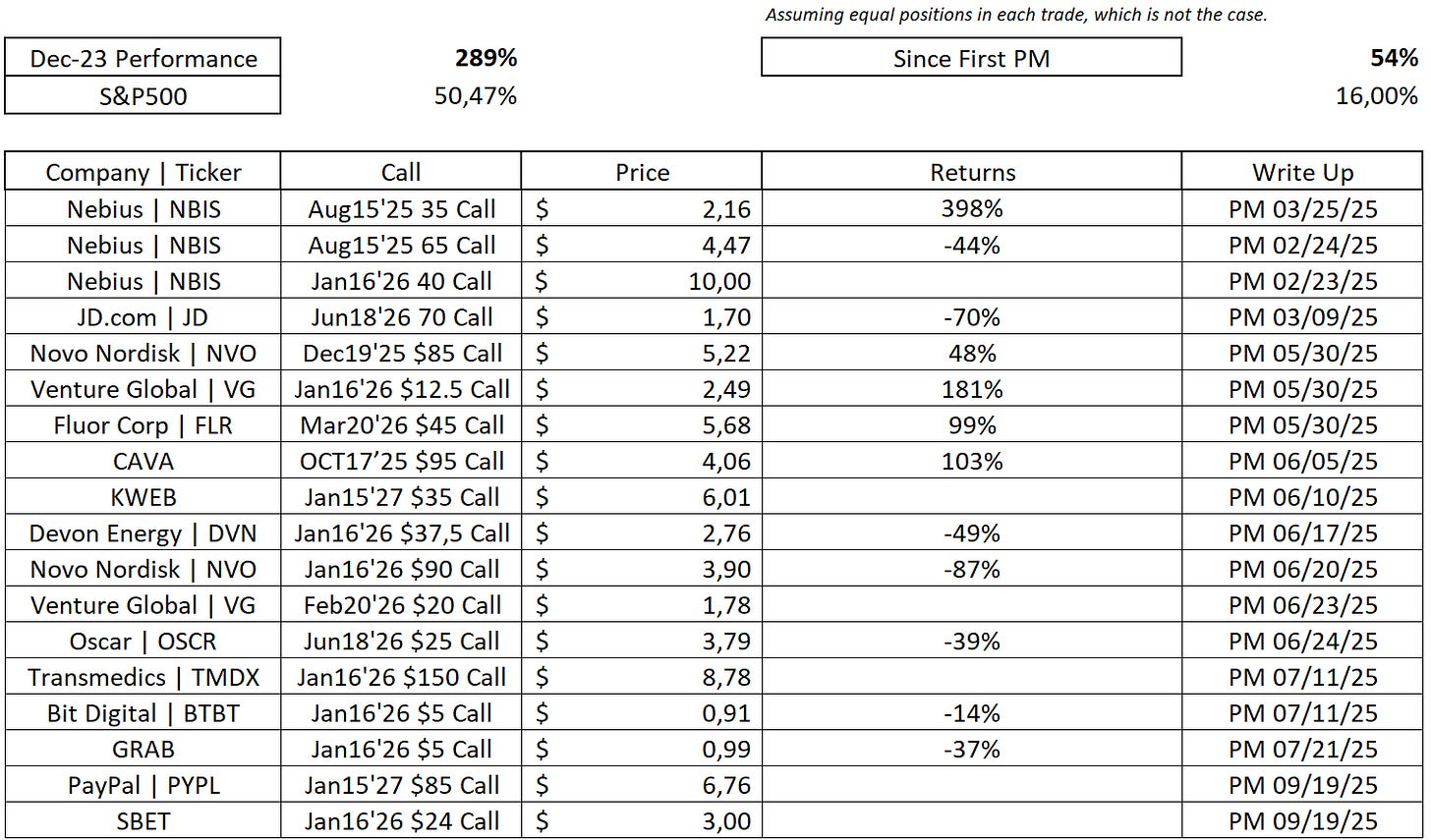

Option Portfolio.

Not much has changed in my options portfolio despite some accumulation and two new positions: one on SBET, which I shared in my September plan write-up - link below, and one on PayPal, which I will detail in the last part of this write-up.

I remain quite confident in my positions and will accumulate them if volatility comes.

Swing Portfolio.

In the swing portfolio, everything went as planned, with a clear focus on Ethereum and its derivatives, as detailed in the write-up below.

I have been a bit shy buying these assets as I expected a bigger drawdown, which can still come, but as I shared above, what matters is cash management. I am in and have cash to grow the positions when I feel more comfortable.

Sea Limited continues to behave like the perfect stock. Bitcoin has volatility but hasn’t finished its cycle yet. Make no mistake, the cycles will continue and we will have a bear market, as usual. These positions aren’t meant to be held, and we will need to get out at the right time. Not yet to my opinion.

The PayPal Trade.

PayPal has always been on my watchlist, although I sold the name some months ago as it was not moving and there were better opportunities elsewhere. I did well, as some of that liquidity went to Nebius, but I reconsidered my position in recent weeks and ended up buying a pretty big position due to the latest innovations and partnerships the company shared.

They already steadied the ship with improving core fundamentals - new checkout methods, Fastlane, advertising business, revamp of their apps, renegotiation of Braintree’s contracts… All of these were bullish & could pump PayPal higher.

But the company went further with two key innovations that convinced me to buy back in, and to go even more aggressively, as shared today, with option calls:

PayPal World & Agentic AI partnerships with Perplexity and Google.

These two innovations will be key for PayPal’s growth and financials, but importantly, they could turn the narrative around from being just a payment provider in a sea of providers to the dominant payment provider in the new AI era. This is what the company needs: a change in narrative. And I believe these projects could bring it, while the stock is still undervalued.

For all these reasons, I believe we are close to a bottom in terms of fundamentals and narrative for PayPal, and I struggle to see a downside at today’s price, while I can see many reasons for an upside. Hence the aggressiveness of the position, although you’ll notice I am taking my time, as the calls are dated for 2027.

If the company executes and its projects work as intended, we won’t be talking about an $80 stock by 2027. I consider this position as close to riskless as a position can be in the market, as risk zero does not exist. But the closest to it is PayPal at today’s price and situation.

Here is some more fundamental data.

Sorry you have 4 accounts :( a lot of convictions here - thank you for sharing!

Why are you buying options instead of equities?