August & September Investing Plan

What I Want to Buy, Why, How & When.

Something a bit different today as I will share my plan for both my B&H and my swing portfolios, in the same write-up. I will share the assets I am looking at and my plan for each so you guys have time to do your research and make your decisions in advance.

As usual, having a plan is important in investing, in order to press the right buttons at the right time, without emotions stepping in our way.

As a reminder, my B&H portfolio is my long-term portfolio, with a $4,000 monthly injection, focused on buying the best asset at the best price based on fundamentals, valuation & price action.

https://savvytrader.com/wealthyreadingspro/buyandhodl

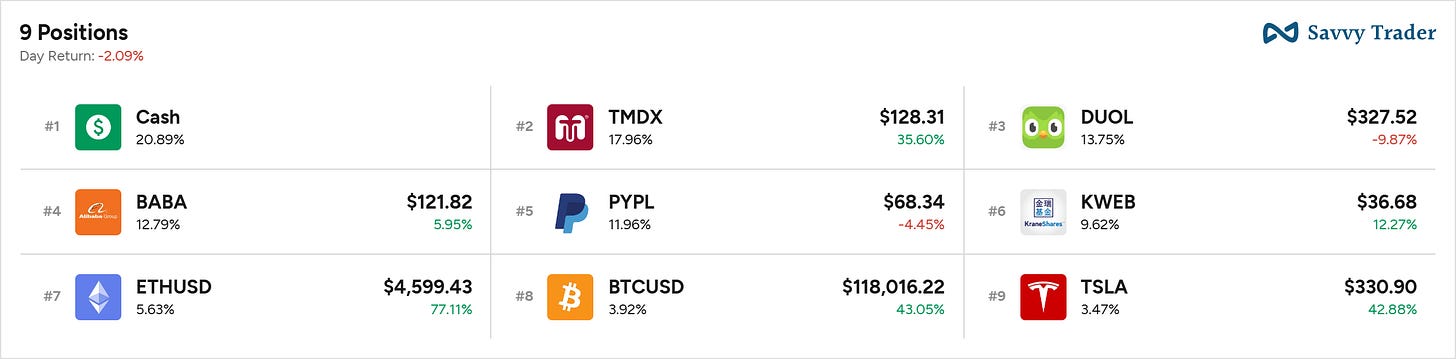

And my swing portfolios include both shares & options, one shared on Savvy and the other one shared on my portfolio modification write-ups.

https://savvytrader.com/wealthyreadingspro/active

And, if you’re looking for a 15% discount on FiscalAI’s subscriptions, it’s here.

https://fiscal.ai/?via=wealthyreadings

That being said, let’s dive in.

To Breathe or Not to Breathe?

I talked about a potential slowdown and a potential correction a month ago for the first time, the S&P 500 was trading at 6,300 points. I shared back then that I wouldn’t modify my portfolios much and would be patient, which ended up yielding results as the S&P trades at 6,450 points today.

Portfolios changed since, I built cash more aggressively & shared it transparently with you, with around 20% in the B&H portfolio and more than 40% in the swing portfolio. I continue to believe we will have a breather, for a few weeks, and that we are getting real close to it - maybe already there.

But it’ll give opportunities.

On the technical side, my reasons are the same - a diverging momentum on the SPY and a large extension from its EMA21 which has a high correlation with a correction on a sample of the last five years, detailed in both previous write-ups in the “Buy & Sell” category of my Substack.

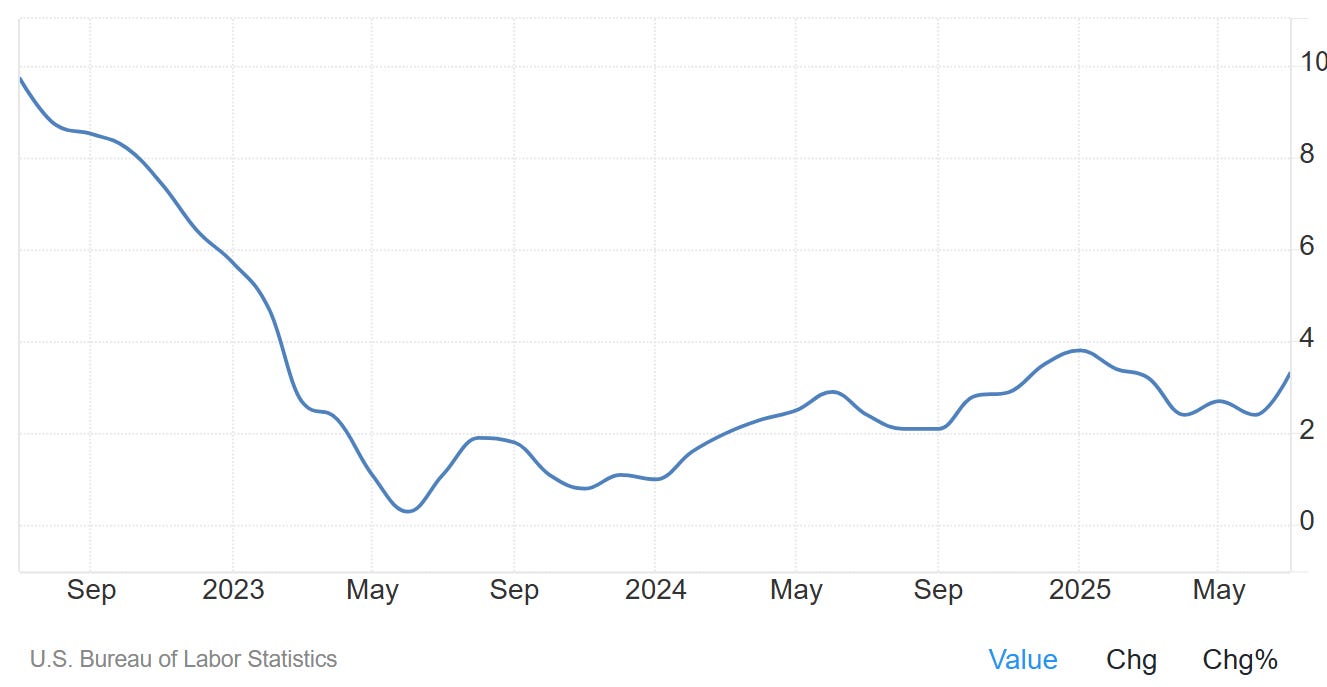

Thursday might have triggered it as the PPI - Producer Price Index, came much higher than expected at 3.3% for a consensus at 2.5%. This indicator is meant to share the prices at which goods are produced in the U.S. and a rising PPI usually means rising inflation as if production costs hike, either final prices also do or prices stay put, but companies’ margins decline.

This is obviously an issue at least for some sectors of the market, especially consumer-facing business or manufacturing. But it isn’t necessarily a problem for all of them, as software won’t be impacted for example - except if we start to see a consumption slowdown but we’re not there yet and liquidity is still massive.

We also have some negative seasonality usually in August, for different reasons, one a bit “exotic” coming from Asia as the region enters “Ghost Month”, a spiritual time during which ghosts and spirits come out from the lower realm. An unlucky period during which important decisions are usually postponed, including financial decisions. And Asia being a major liquidity source in the financial market, this slower period is usually impacting them - and you will find many studies concluding that the markets do not behave really well during this period. They do not necessarily crash, but usually flatten. This year, Ghost Month will start August 23rd and ends on September 21st.

I am sharing this because it has been proven true, but let’s not assume that the top will be on the 23rd and bottom on the 21st, that’s not how it works. Simply keep in mind that this period might see less net liquidity inflows from Asia.

I continue to be bullish medium-term as liquidity remains very high with massive debt and high interest rates paying yields to treasuries owners. So I intend to be patient & buy on all portfolios, if we indeed have a breather.

Here’s my watchlist.

B&H Portfolio.

First of all, I judge that my actual portfolio is pretty strong and intend to accumulate all of those names, at proper prices, as usual. Nothing surprising here, keeping in mind that I also own Nebius, On Running & Palantir.

A few words on On, which delivered great results few days ago & is getting pounded by the market like every consumer-facing name. The market is worried that if inflation returns, consumers will get crushed and won’t buy those products anymore as they are not necessary & pretty expensive.

I have no idea if that will happen but if it does, if you own the name and are confident in the brand’s capacity to go through tough times, lower consumption, and emerge as a key player in the sector in a few quarters to years, then this panic is an opportunity. If you’d rather remain patient, wait & see, there are other great names.

Besides my actual positions, I have two objectives for the next months, which will hopefully be filled rapidly.

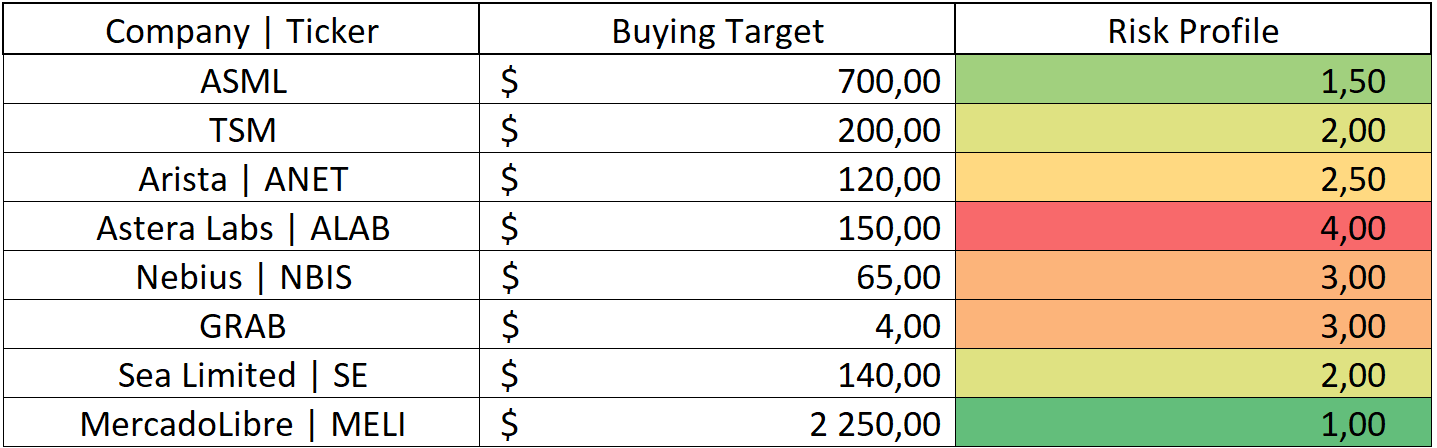

Grow my AI hardware exposition.

This is my main goal and I have a really precise list as I have worked on the subject these past months. You will receive all the investment theses during the next weeks, but here are the stocks & my plan for each first.

ASML & TSM. The investment thesis is ready and will be sent next week. Two stable giants, we shouldn’t expect fireworks from them but they will certainly provide great returns over the long term as the world will rely on their hardware to fuel the AI revolution further.

I am looking to buy ASML around $700, but would buy a bit higher if the market does not go there, and TSM around $200, possibly a bit higheras well to start the position at least.

Arista Network. I am still writing both Arista & Astera theses, they will probably share a write-up despite having different fundamentals, although both aim to optimize AI datacenters. Hopefully the market will give a retest below $120.

Astera Labs, which I feel bad missing as I postponed my research to prioritize other subjects. Hard to say what price would be perfect but filling the gap around $150 would already be a potential good entry.

Nebius, which I already own with an average around $30, so my objective would be to accumulate, probably with regular buys as it is the best opportunity in the sector in my opinion. Even though it isn’t a hardware seller, its business model relies on AI hardware rental so, comparable.

Its last quarter was extremely bullish & made it my number #1 priority to accumulate, for the long term.

There is an earnings gap around $60 to fill and I would love to get there, but I intend to buy even if we don’t and could grow my position to an average between $50 - $60 without any problem.

Besides those, I of course keep an eye on companies like Meta, Nvidia, Google and Palantir, but those would need a much bigger correction to make me buy.

Grow my international exposure.

I have a good position in China already with 20% of the portfolio, which I could grow a bit higher but am comfortable with at the moment. Alibaba and KWEB both give a great exposure in Asia at large between the e-com and the AI/cloud services, but I would grow my exposure a bit more through non-Chinese companies.

Those clearly won’t be a priority and I would pull the trigger only if I have spare cash, or if the price gets too depreciated to ignore - which is hard to believe, but who knows?

First, Grab. Still Asia, still exposed to the rising buying power & demand for comfort in the region, and it seems to me that deliveries & mobility is one of the best vertical to play those two variables. We also have fintech services which are really great in those developing regions.

I’d be looking to the $4 zone to buy, which would be really depreciated, or around $4.5 if I have enough cash to build an entire position - around 5% of portfolio.

Second, Sea Limited. Another great vertical to play rising buying power and demand for convenience is e-commerce, although Sea also has some fintech and a delivery service, a direct competitor to Grab.

I am already in with the trading account, but I would add it to my B&H below $140.

Third, MercadoLibre, for some exposure in Latam with the exact same reasons as the both above; e-com & fintech are great to play households’ purchasing power growth, and this would give exposure to another region.

I believe Meli is already at a good price for a long-term position. It would be my go-to of the three but again, I would like a discount and not just a correct price, closer to $2,200 would be better.

In Brief.

I will do a small visual as I also want to highlight the different profiles of those stocks. Some are riskier investments than others, which means a higher potential but also higher risk and building a portfolio requires both stability & explosivity.

The risk profile is meant to give an idea of the investment risk. Lower means a stable and established company at correct valuation, higher means a company which still needs to prove its fundamentals or/and a high or hard to determine valuation.

Higher risks also mean potentially higher rewards. I just believe it is important to keep this balance in mind, as a 100% growth portfolio will also be highly volatile and could completely fail, and everyone - me for example, doesn’t have the guts to hold this kind of portfolio.

I personally like to have a balance in my long-term portfolio.

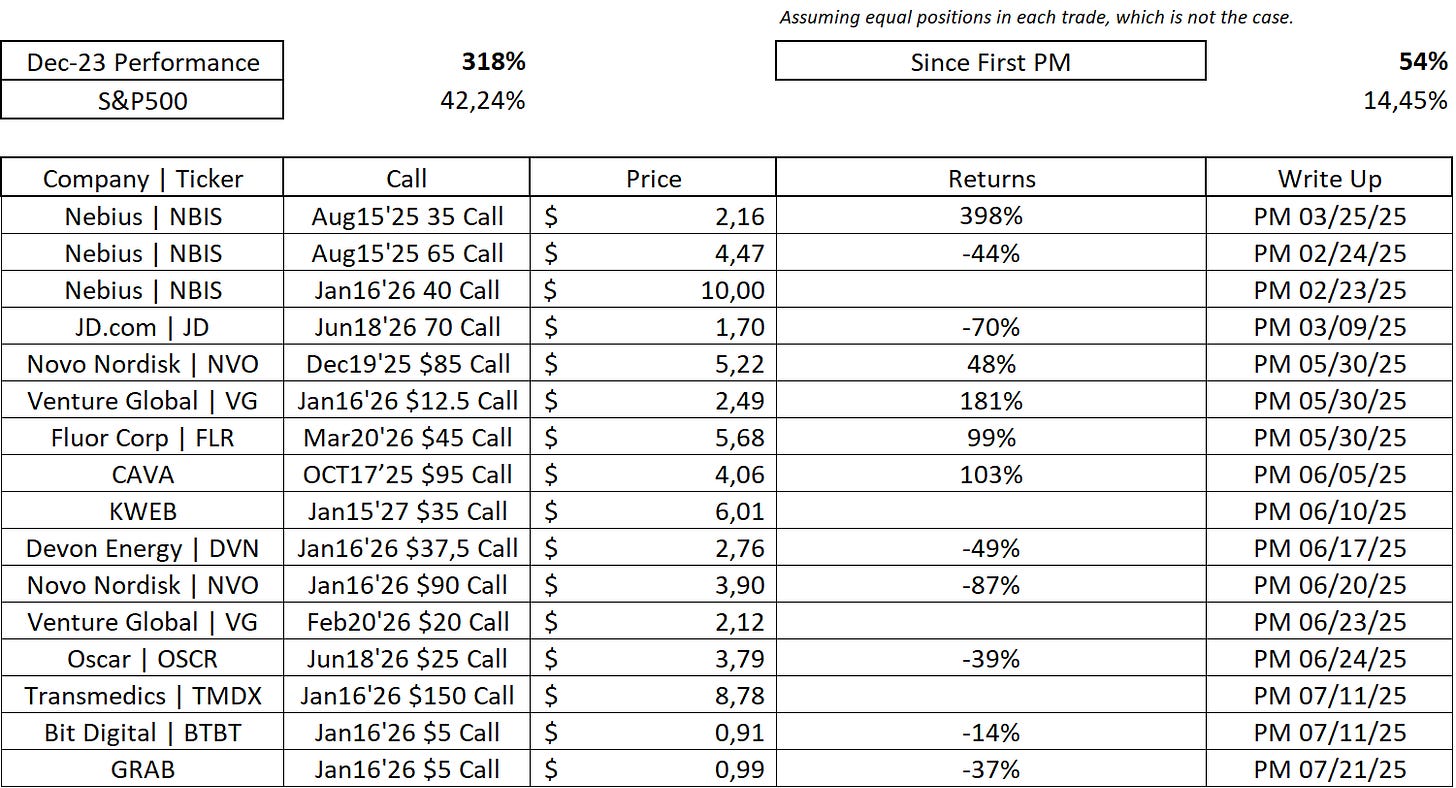

Swing Portfolios.

This is another story, this is where we fish for volatility and big returns. Here is the swing shares portfolio.

And here is the option portfolio, which only holds 6% of cash.

On the option portfolio, I probably won’t do much as I wouldn’t be able to buy a full position. If I were to use the cash it would be on Nebius, to accumulate KWEB or buy options on ETH treasuries, as we’ll talk below - focusing on the same price and as usual with expirations early 2026.

On the swing portfolio, I have liquidity & my eyes are set on one asset and its proxies only: Ethereum. I do not think I would start a trade in anything else during August, except if a big opportunity were to open.

My eyes are set on this beauty, and the plan is simple: buy $4,200 or so, accumulate the way down if it keeps dipping.

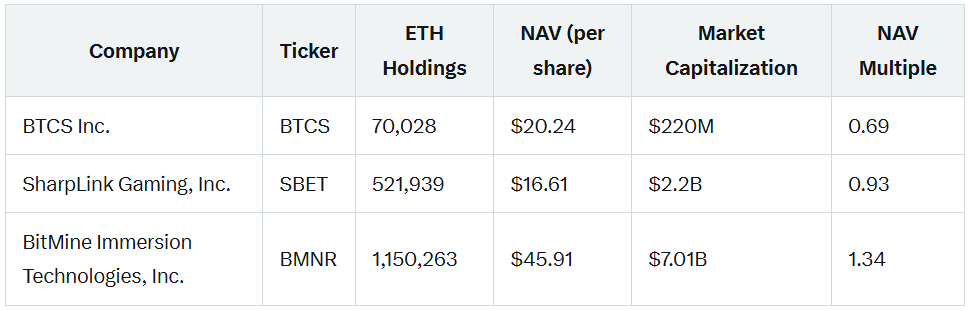

That would be the main plan, with more aggressive plays on treasuries, in this order: BitMine below $50, SharpLink on the $20 and BTCS below $4.5. At those prices, they are low in terms of mNAV & have exponential potential as higher prices mean more debt hence a lower mNAV. The usual narrative around crypto treasuries.

I already opened a small position on SBET at close, as we are around my price.

Also need to add that a smaller NAV doesn’t mean a better opportunity as the market focuses on the company who can grow its holdings the fastest, not the best NAV. And that company is BitMine.

I detailed a bit more the reasons for the trade below, we already talked about it a few weeks ago as I was already bullish - and in, on Ethereum.

The narrative and reflection is still exactly the same, with more confirmation now that the market is excited with Ethereum.

Keeping in mind, as we talked about risk earlier, this trade will be massively volatile. We’re talking potential 30% to 50% drawdown in a few days, so position size control and solid stomachs required.

We are not gambling. We are not here to blow up our accounts. We make & follow our plans in order to make money.

This is what I intend to do with my actual cash and my priorities. We also might not have a breather at all and continue with stable green candles, in which case I am well positioned already and will simply hold, sit on my cash and wait for that breather.

As I shared some time ago, no more over trading, no more exposure to assets I do not know perfectly. A surgical focus on returns & execution only.

Less is more.

Take a look at kaspi

First time hearing the correlation between Aug seasonality and “ghost month”. It doesn’t seem talked about much in Asian media. Thank you so much for detailing your plan, very insightful!