Portfolio Modifications - 07/11/2025

Cava, Transmedics & Bit Digital Inc.

I’ve always said that fundamentals, research & convictions matter, but beating the market comes down to execution. That’s what these write-ups will be about.

I will share through them every change in my active portfolio - stocks & options, reasonings & plans, before I even hit the buttons. I won’t update DCAs, I will only share my plans & new/closed positions in these write-ups. You can follow the rest directly on savvytrader.

https://savvytrader.com/wealthyreadingspro/active

I also recently opened a Buy & Hodl portfolio on which I will DCA $4,000 every month & focus on buying the best assets I can at the best possible price, 100% focused on fundamentals & valuation, without any active management.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Keep in mind that both portfolios have completely different goals and I can behave very differently on both for the same name - accumulating in the buy & hodl while selling in the active portfolio for example. Different rules apply.

My goal is to deliver alpha over the long term, not just six months under easy market conditions. If/when proven this content is valuable, it will be shared behind a paywall. No rush, though; it’ll stay free until proven valuable.

So here’s the deal: you get full transparency on my trades, right when I make them. If - and only in that case, it brings real & long-term alpha, it’ll be accessible only for a fee. I believe that’s fair enough, but feel free to provide feedback!

Nothing shared here is financial advice; we are all responsible for ourselves.

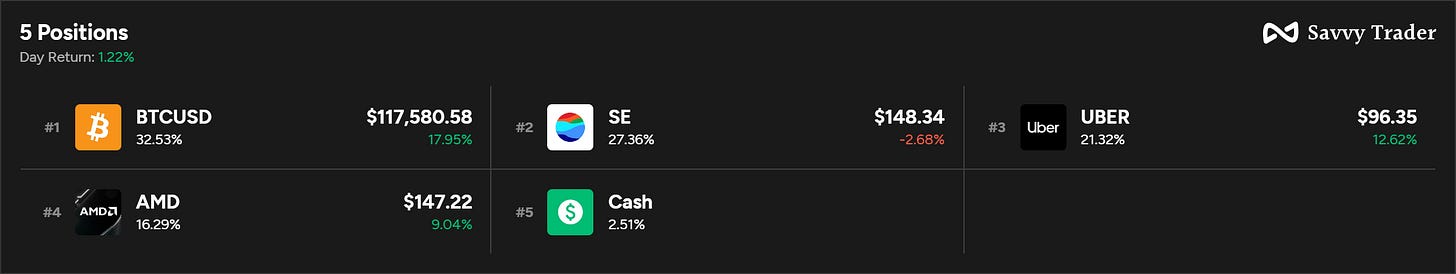

Active Portfolio - Grew SE position.

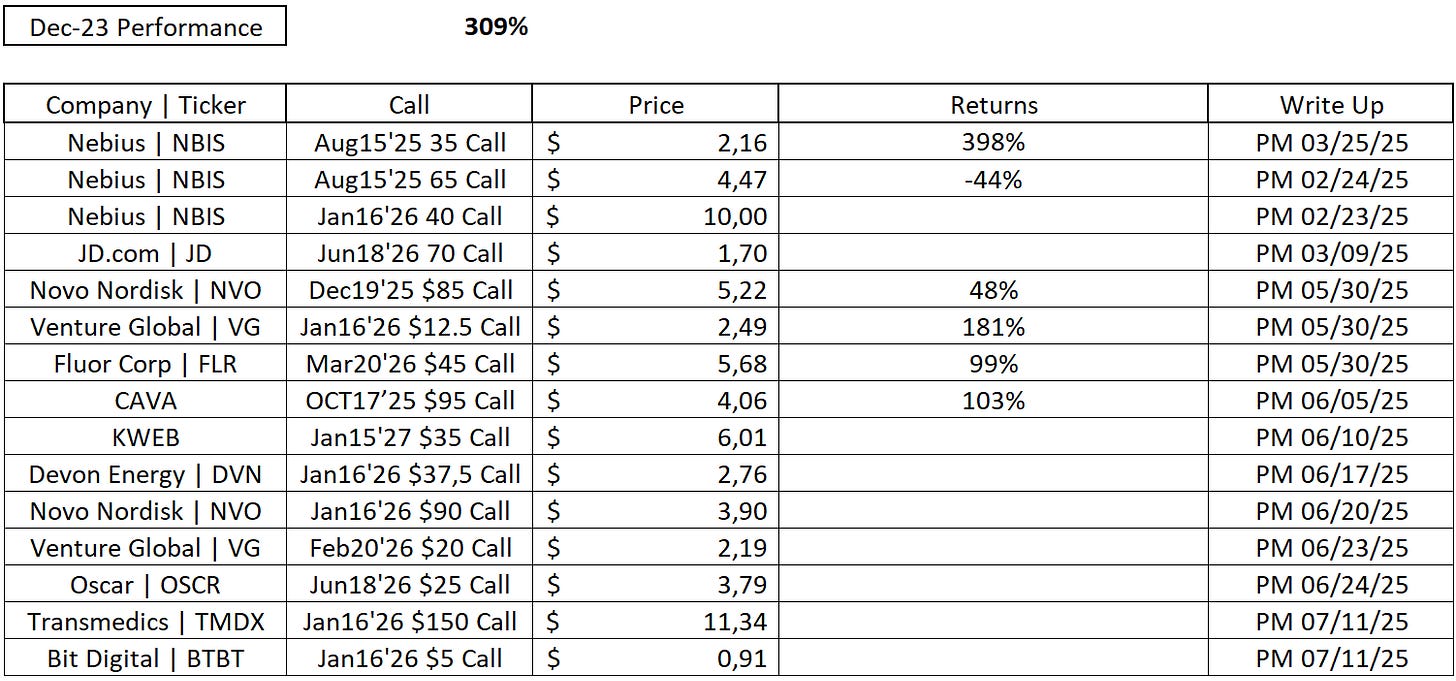

Option Portfolio - Sold CAVA OCT17’25 $95 Call.

Bought TMDX Jan16'26 $150 Call and BTBT Jan16'26 $5 Call.

Sold Cava OCT17’25 $95 Call.

No surprises here as I did as shared on Tuesday: I closed the position at $90. The trade returned 103% in a month, really huge. I prefered to close it entirely to have liquidity as the market is a bit shaky lately and it could come handy.

As I also shared on Tuesday, part of those profits went to my VG position, which now accounts for 30% of my option account.

Bought TMDX Jan16'26 $150 Call.

I only followed the plan shared 20 days or so ago.

The market is selling the name on a bad quarterly report from competition due to lower demand for lungs - which account for less than 4% of Transmedics’ revenues. I posted a note you can find below to detail my thoughts & why I am not worried - even buying.

I have been accumulating shares in the B&H portfolio since below $130, and I intend to continue to do so more aggressively if we go lower. And as we broke $110, I also bought my first option call on the name.

I am not too aggressive yet because we still have this gap below $100 which could be filled at any moment. I’d be aggressive then.

For now, we keep cool, accumulate shares, and nibble on aggressive positions.

Bought BTBT Jan16'26 $5 Call.

We enter the realm of pure speculation. Do not go further if you are not comfortable with everything-or-nothing positions based only on momentum. I do not do these very often but I sometimes like the adrenaline rush.

This position is really, really small - around 3% of the option portfolio.

On the argumentation part, it is quite simple: Everything points to Ethereum finally being recognized for its value, and BTBT might be the biggest benefactor of this, at least in the stock market.

On Ethereum: Stablecoins are making lots of noise with Circle’s IPO but also with big banks talking about it & many other countries, important companies, et cetera, which either intend to partner with issuers or develop their own services on the technology. We also had Robinhood’s token amking more noise and using Ethereum to transit & verify the information. And many more news which attracted demand which shows in the U.S. ETFs’ inflows.

The public is really starting to hear the name, Bitcoin is being accepted more & more, and this opens the way for other assets. Ethereum being the logical next step. If you follow the B&H portfolio, you know that ETH is my biggest position at the moment, already up 15% since purchased a few days ago.

Nothing is certain in crypto. But it might finally be Ethereum’s turn.

On Bit Digital: As for BTBT, the reason I believe it can be the one yielding the most returns is because management went all in on ETH. The company used to be a hybrid miner on both Ethereum & Bitcoin but decided to shift, converting their entire Bitcoin holdings into Ethereum.

The company now holds more than 100,000 ETH worth more than $300M with a capitalization of $980M, give or take, depending on when you read this.

It is impossible to value Ethereum or to have any idea of how high it could go, but if institutions continue to talk about it and hype stablecoins or other blockchain usage, if ETFs’ inflows continue to grow that much, with the S&P 500 and Bitcoin at all-time highs… Ethereum could be the next asset to receive liquidity as speculation unfolds, and if this happens, BTBT’s holdings will grow rapidly & boost its own capitalization.

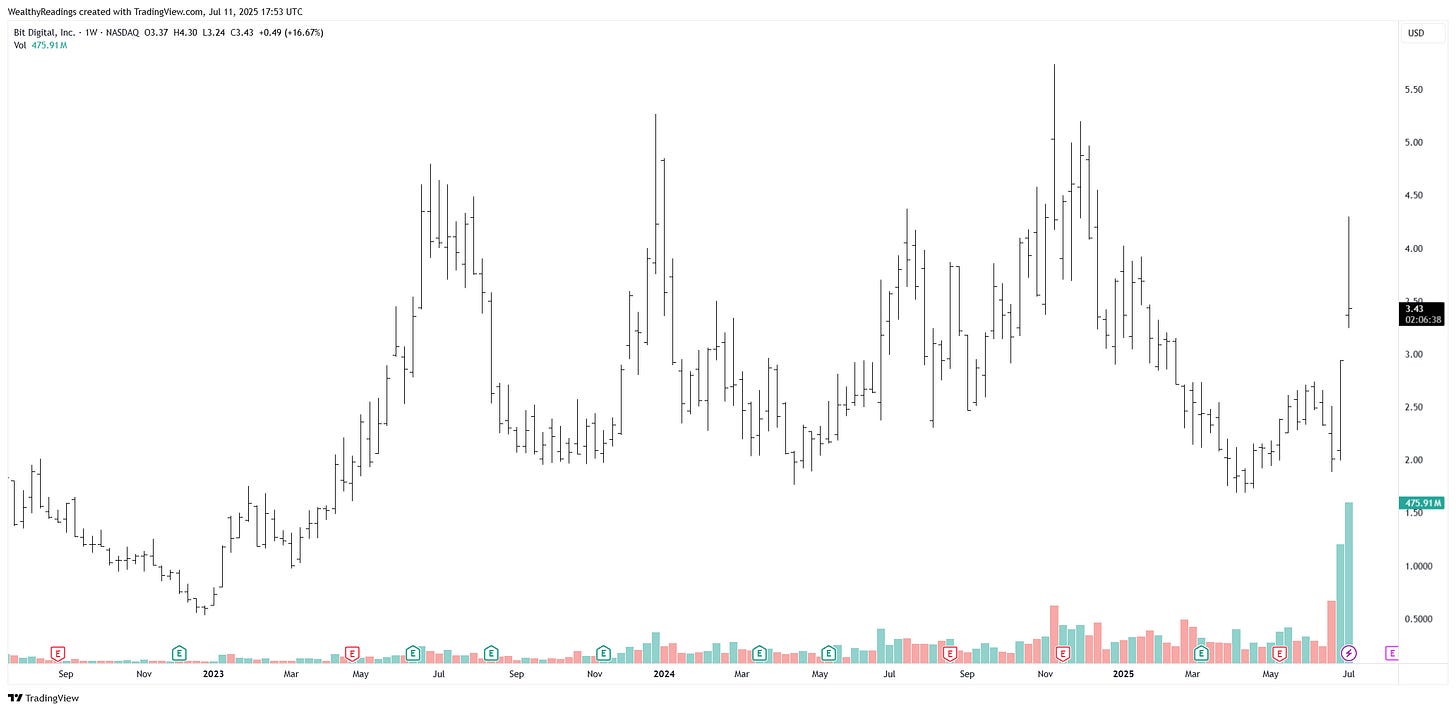

Stock price & volume exploded over the last few days as many - like me, imagine the party which could happen and take positions, creating a gap around $3, which would give a good entry, while the $2.7 retest would be perfect if it were to happen, as long as the Ethereum frenzy is still alive.

I did a small FOMO by buying today, not gonna lie, but again, the position is really small. I intend to increase it on the targets shared above but will keep it below 5%. I would not risk more on such speculation.

I try to share everything with you guys. I am on the train, both BTBT & Ethereum. But once again, this is pure speculation. Keep it in mind if you wish to follow and size your position accordingly.

Don’t blow up for speculation. It isn’t worth it.

BTBT will be an interesting one to see play out, given it's a leveraged bet on this bull market continuing to rip—great initiation of the call option on today's pullback though.