Nebius Q2-25 | Earning & Call

Hypergrowth, peak utilisation & expansion.

If you guys are interested, you’ll have 15% discount on FiscalAI subscriptions through my referral link. FiscalAI is the tool used for KPIs on all my write-ups, really powerful, valuable data & great UX.

https://fiscal.ai/?via=wealthyreadings

Everything you need to understand Nebius' bull thesis is here.

Business.

A quarter above expectations as the company confirms that it will be one of the key players of the AI revolution.

The narrative is simple, model training continues to grow & inference is slowly taking the lead in terms of demand as more applications are developed and commercialized, requiring more compute. And Nebius is one of the best provider due to infrastructure designs & optimized software solutions.

One of its advantages is the complete control of its infrastructures & as usual, vertical integration is a big part of success. They do not do it for all their datacenters, but focus on it when possible.

“Regarding the why greenfields versus build to suits or COLA options, we typically and we spoke about that a lot. We typically favor greenfields because we can control every aspect of the data center from the design to construction to the hardware installations and deployment and phasing. We can actually tailor the phase phasing according to our demand. And for us, it's cheaper to build than build to suit, and we are not locked into the long term leases. Also, by controlling the design of the building starting from the how fiber power is piped into building and design installation of our own racks and servers, we can achieve a lower total cost of ownership, probably around 20% less than the market average.”

I’d also like to do a parenthesis to highlight first, Nebius' commitment to offering the best possible service and second, a company which I am looking at really closely at the moment: Astera Labs.

Our platform runs on top of Nebio's proven scaled infrastructure, and we target to solve the biggest pain points in production AI, unpredictable latency, GPU bottlenecks, and, not enough flexible platforms to build on scale

GPU bottlenecks is a niche & one of the focuses of Astera’s hardware, and we start to hear about it more lately as compute providers focus on optimizing infrastructures. I’ll talk about it more later, but the best AI neocloud, relies on Astera’s hardware, others will and that could yield a massive opportunity for the next years in AI hardware. I am a bit late on the name but the opportunity might still be there.

With that introduction done, we can talk about the quarter but it won’t take long and could even be resumed in one sentence.

As we brought on more capacity, we sold through it. And by the end of the quarter, we were at peak utilization. If we had more capacity in the second quarter, we probably would have sold more as well.

Nebius is capacity constrained at the moment and this is explained by it being one of - if not the, best neocloud on the market in terms of pricing & performance, which of course generates tons of demand, with ARR growing from $249M in March to $430M in June while, once more: capacity was sold out.

Customer base.

This demand comes from any kind of company although Nebius is “small” in terms of compute and cannot attract the massive players which require massive compute. This has its benefits as relying on multiple smaller players disperses revenues, while relying on a massive one - like CoreWeave relies on ChatGPT for 60% or so of its compute, is more dangerous. What happens if ChatGPT changes provider?

This has pros & cons, but as the company expands its capacity, it also attracts bigger players which they can now satisfy.

As we bring on larger crust clusters, we are able to bring on new large customers who wanna purchase, greater and greater capacity.

We start to see this with three new clients: Shopify, Cloudflare & Prosus, big players in their field.

Shopify is, utilizing Nebius' AI infrastructure along with Toloka's training data in order to optimize every step of the merchant's journey. A very exciting opportunity for us. Likewise, Cloudflare is using Nebius to power inference at the edge, a very important part of their overall offering, as a part of their popular, workers API. Both relationships are growing, and both are scaling opportunities for us. We're also seeing other similar interests from other major technology companies and leaders in their categories reinforcing the opportunity overall in the market.

So there are no questions on the business health nor its or global AI demand. The question left is about capacities.

Expansion & CapEx.

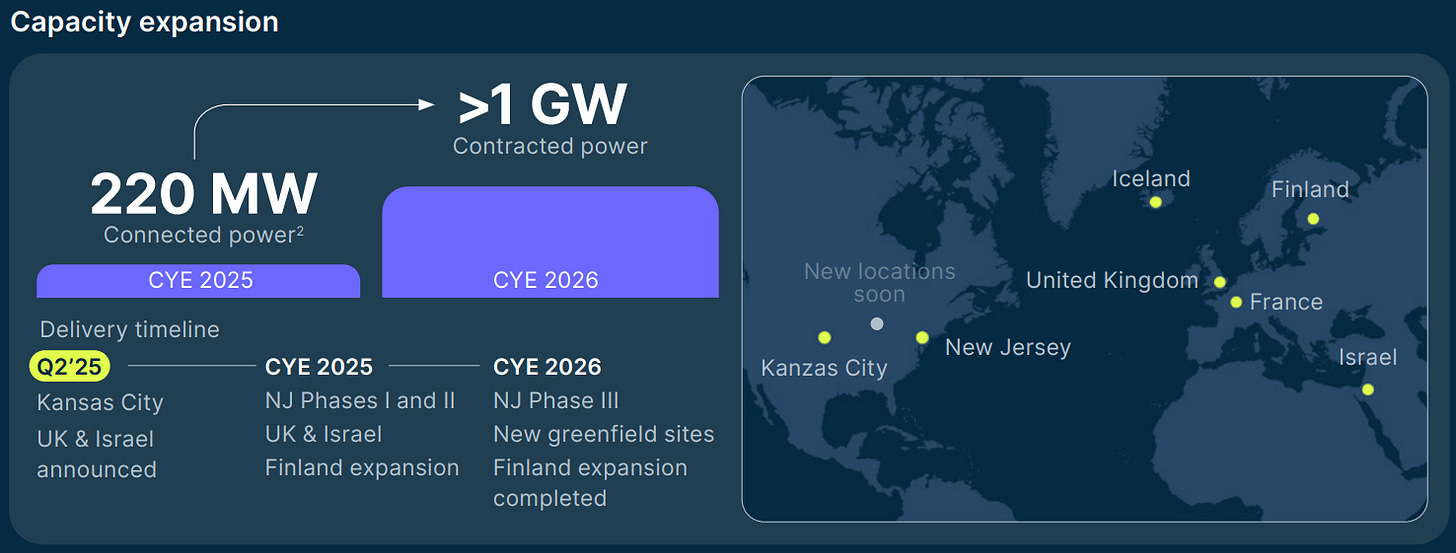

In terms of deployment, management is working on improving its locations, setting up their GPUs, and has other plans to build new datacenters with the objective to reach 1GWh by the end of next year.

By the end of this year, we expect to have secured 220 megawatts of connected power that is either active or ready for GPU deployment. And this expansion includes our data centers in New Jersey and Finland. In addition, we have nearly closed on two substantial new greenfield sites in The United States. And overall, we're in the process of securing more than one gigawatt of power by the 2026 to capture industry growth next year.

This would already be a massive expansion but we are still far from what hyperscalers propose at the moment and very far from an oversupply based on the actual demand. Those projections are extremely bullish without being overkill.

The second question is about financing those expansions & yielding returns as it is one thing to build datacenters but they need to bring cash in. This is why I prefer Nebius to CoreWeave - this & their client base which is diversified, as Nebius has many verticals left to finance itself. CoreWeave can always find new ways but is already pretty heavily indebted.

Nebius has a strong balance sheet, equities in ~~growing companies - ClickHouse & Toloka, two side businesses which can generate cash or be sold if necessary - TripleTen & Avride, although I personally would like to see Nebius hold on to both as they have massive potential, and a potential access to both market & bank financing as they did not cap those over the last quarters.

Planets are perfectly aligned for Nebius.

Tarriffs & Geographies.

Some words on tariffs notably as Trump said that chips imported would see a 100% tariff with some exceptions, which is beyond ridiculous to be honest and should not enter into effect - or I believe. This could impact Nebius, although Nvidia is part of the exceptions so it’s hard for me - and probably for everyone, to understand to what extent. This would either way impact the entire market, not only Nebius, maybe even less as they also have operations outside of the U.S., regions not impacted by tariffs.

Their operations in the U.K. for example are scaling healthily - without data, simply comments from management, while demand in the region, in Europe globally, is growing within very specific industries.

So, actually, we think we're gonna be the first to deliver B300 to The UK market, which we think which we think will be a a really interesting opportunity. And just generally how we're looking at the commercial opportunity there, You know, this there's a vibrant market of AI AI native startup scale ups in London and around. There's a big significant enterprise customer presence as well. I mean, you also what you've seen actually, what we've seen lately is that even some a number of the big global tech companies have been setting up regional hubs, regional R&D facilities, which we think will help to also drive the growth of the ecosystem.

Avride.

Some words on Avride which continues to grow and to be a great opportunity for Nebius in terms of cash generation.

Robot side, AVRide is expanding their coverage with the existing partners. They add new cities, new service areas, the restaurants with Uber. They're launching new university campuses in the project with Grubhub. And they're also entering the the new verticals. Just recently, they signed with a grocery delivery for the retailer HEB in Texas and also indoor operations in Japan that came through a partnership with Mitsu and FuruSan. On the autonomous vehicle side, Evarite is growing its fleet. As you know, they are partners with Hyundai, and they're expanding their road tests in Dallas. And they're looking forward to launch their road tax service with Uber later this year because they have they signed this partnership early.

Financials.

Once again, this is a hypergrowth play so we are not looking at profitability, although Nebius still has a pretty healthy statement compared to some of its competition.

Growth is pretty strong up 625% YoY and more importantly, 106% sequentially while being completely booked in terms of compute. The rest is also good with controlled costs, rising S&G which is normal & strong depreciation due to the nature of its business. Company is still unprofitable but what I see is potential as revenue growth will be enough to turn on the cash machine in the next quarters/years.

For now, income is positive due to their equity stakes which are not realized gains and should not be included in this statement. It does grow the value of the company but it doesn’t grow its cash generation.

In terms of cash, the company has $490M of net debt including leases and convertible notes and has a CapEx guidance of $2B for the year while having already spent $1.7B, the rest of its cash balance should cover their needs. They will need to find financing plans for next year but as we’ve seen, they have lots of options.

Guidance.

Management raised its ARR guidance without raising its revenue guidance which triggered some questions but there are no reasons to be concerned.

Because much of this capacity will come online by the end of the year, the impact will show up more in ARR than within the year revenue. That said, this late year ramp will create a strong foundation heading into 2026 and will support meaningful revenue acceleration next year.

As you can imagine, this is due to the confirmation of the demand for their compute & the coming growth of their capacities, leading to an even more bullish FY26 which should please the market.

Investment Execution.

Extremely bullish on this neocloud which I started a position on as a narrative trade but is becoming a big position in my portfolio which I see for the long term, as AI demand is here to stay & Nebius continues to prove that its services are above average in terms of quality, yielding a strong demand.

The only takeaway of this quarter is that Nebius is supply constrained and that supply is growing rapidly.

I won’t do valuation of Nebius as it isn’t possible to value this kind of hypergrowth stocks, everything is great as long as the market has no visibility on its ceiling, so I’ll also be there until then - and it could take really long to show. If I were to do some rapid math though, based on ARR guidance, Nebius is trading at 15x FY26 revenues, even lower as ARR will continue to grow in 2026 and as those do not include Avride and TrippleTen which are a growing portion of the company and have a pretty large potential. Far from expensive for an hypergrowth stock in the AI sector growing triple digits YoY…

Not a stock I would call very expensive, also CoreWeave is trading at a F.P/S of x8 or so, which would make Nebius expensive although I personally continue to believe the latter is a much more complete company with clear plans on financing, expansion and profitability & other growth verticals while I see CoreWeave as over indebted and limited, but that’s only my personal view on both.

So I intend to accumulate the stock over the next quarters. In term of price action, the accumulation part is done, the breakout was clear, the objective is now to buy retests.

Starting by this $60 gap.