Nebius | Narrative Trade

Catching the AI Model Training & Inference Wave.

Kind of a shame that I missed this opportunity, but I am finally catching up & sharing this write-up today for what could be a great short to medium-term narrative play, which could turn itself into a great long-term value - too early to say.

I have already talked about computing power farms from the energy point of view in my energy Investment Case & that is the category into which Nebius falls, although they combine their energy cost optimization with a B2B AI service. That's what we'll talk about today - and why I believe there is an opportunity here.

The market is all about narratives & we still are into the AI one, since months now but it doesn't seem to slow down, although jumping from one sub-narrative to another, passing from semiconductors to computing power hardware to cybersecurity and different software applications before circling again...

Business.

The story starts with a Russian company named Yandex which had to restructure after the war in Ukraine in 2022 as its tech Western business was heavily sanctioned and couldn't operate properly anymore in this region.

That restructuring led to the creation of Nebius, an independent entity which focused its business on AI infrastructure in the Western market, with its headquarters now in Amsterdam. The company went public at the end of 2024 and operates mainly from Europe.

Here is how they describe their main business:

“Building a global AI business which integrates essential components for successful AI development: infrastructure, data, and expertise.”

The company is divided in different business, which they either own & operate directly or in which they are heavily invested.

The majority of their revenue and potential is in their AI-centric cloud service: Nebius.

Nebius AI, the Computing Power Farm.

The business is pretty straightforward; They build, operate & maintain data centers and rent their usage to clients.

There is no need to prove the exponentially growing demand for these services as we have seen it happening for years with cloud services proposed by our giants Amazon, Google & Microsoft, which used to mainly offer storage for years.

Things changed those last years with AI rising & Nvidia selling computing power that didn't exist before. Now, companies & individuals aren't satisfied with storage; they want tools that would help them develop their AI services without the costs of deploying their own data centers.

This is exactly what Nebius proposes: they own & operate expensive AI-specialized hardware & rent it to those who need it, based on power consumption usage.

Our giants are obviously also part of this game & even Nvidia built its data centers to be part of it, but the demand for these products continues to grow & that tendency should continue over the next years if we believe the analysts but also the growth of those services sold by Google, Amazon & Microsoft, which have been stable with double digits for years now.

Applications.

Nebius focuses 100% of its business on AI-optimized hardware and only rents this to any company which needs either AI model training - the development of their AI based on their dataset, and AI inference - the live computing power necessary for their AI to work properly.

Their services can be used to train many kind of services like LLMs, image & video generation, internet querying, vocal conversations, etc...

Datacenters.

At the moment, the company owns and operates two data centers, one in Mäntsälä, Finland, and another in Paris since November 2024. This is where things start to become interesting and make Nebius very appealing.

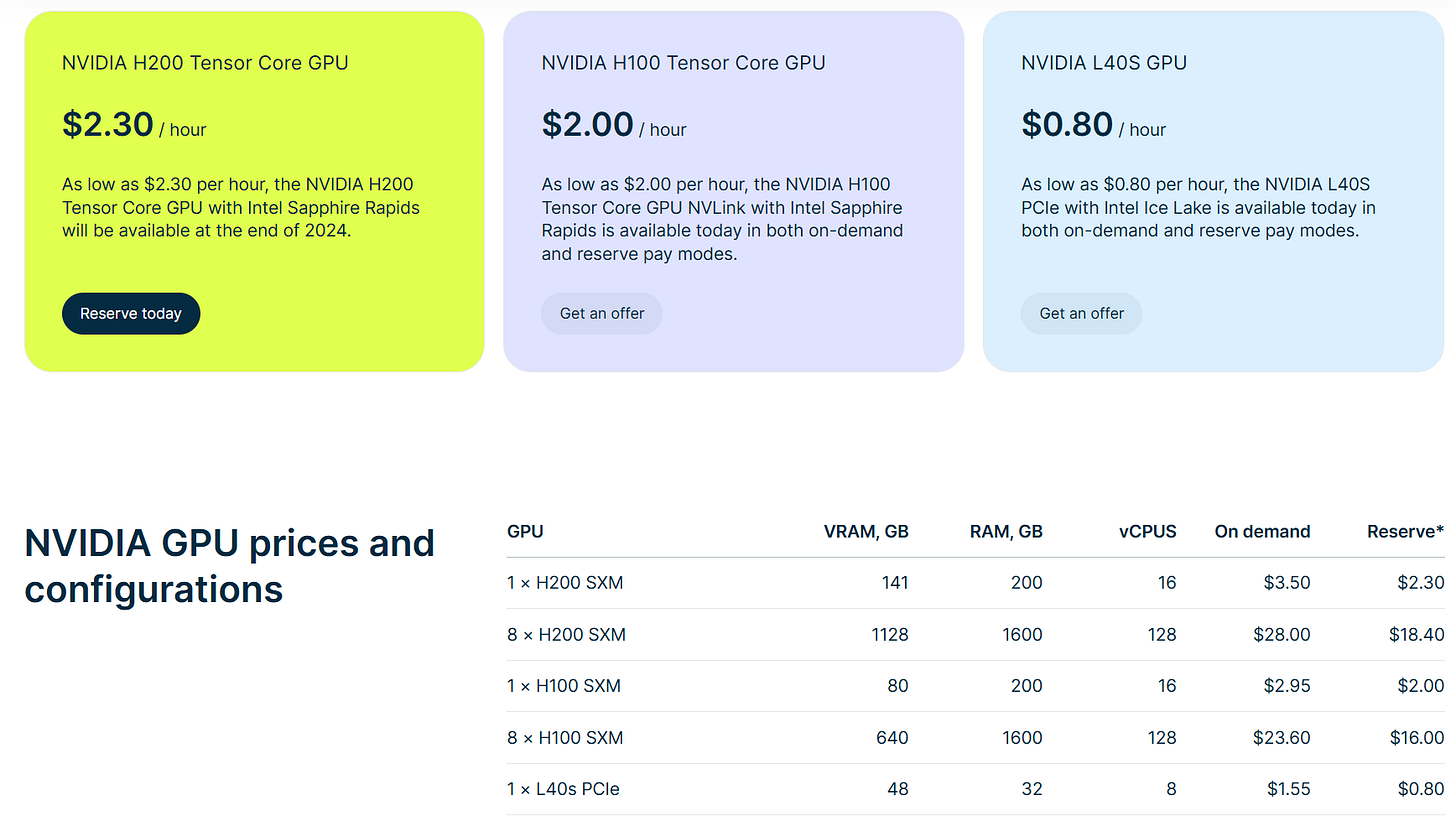

The company owns roughly 20,000 GPUs, mostly Nvidia's H100 and H200 - as I said, AI-focused, and is planning to expand this to 60,000 GPUs by the end of the year - with concrete plans to do so, some of which are already in motion.

One of the hardest challenges to overcome for these companies is the maintenance costs of their infrastructure - and that comes after the investment necessary to build those infrastructures. Hardware is expensive, but most importantly, electricity is expensive, and the management of the heat generated by that hardware is also problematic.

Nebius partly managed that by hosting most of its computing power in the big north. They first use free-cooling to manage the temperature of their data center, which is just a fancy way of saying they are using the exterior temperature to regulate the interior one & avoid overheating. Secondly, they resell the heat they produce with their hardware to the city where they are located.

“50%+ of the annual heating needs of the town were historically4 covered by the server heat from our data center.”

Cost efficiency might be the most important quality for those service providers. It allows them to compete in terms of pricing but also to optimize computing power and the diverse applications that they can sell to their clients. More possibilities at a lower cost equals bigger demand from an already growing and too big demand to satisfy.

This is how Nebius competes with the giants, by addressing its services not necessarily to the big players, but to the smaller ones who desperately need to build their own models to stay relevant but actually can't because of the prices.

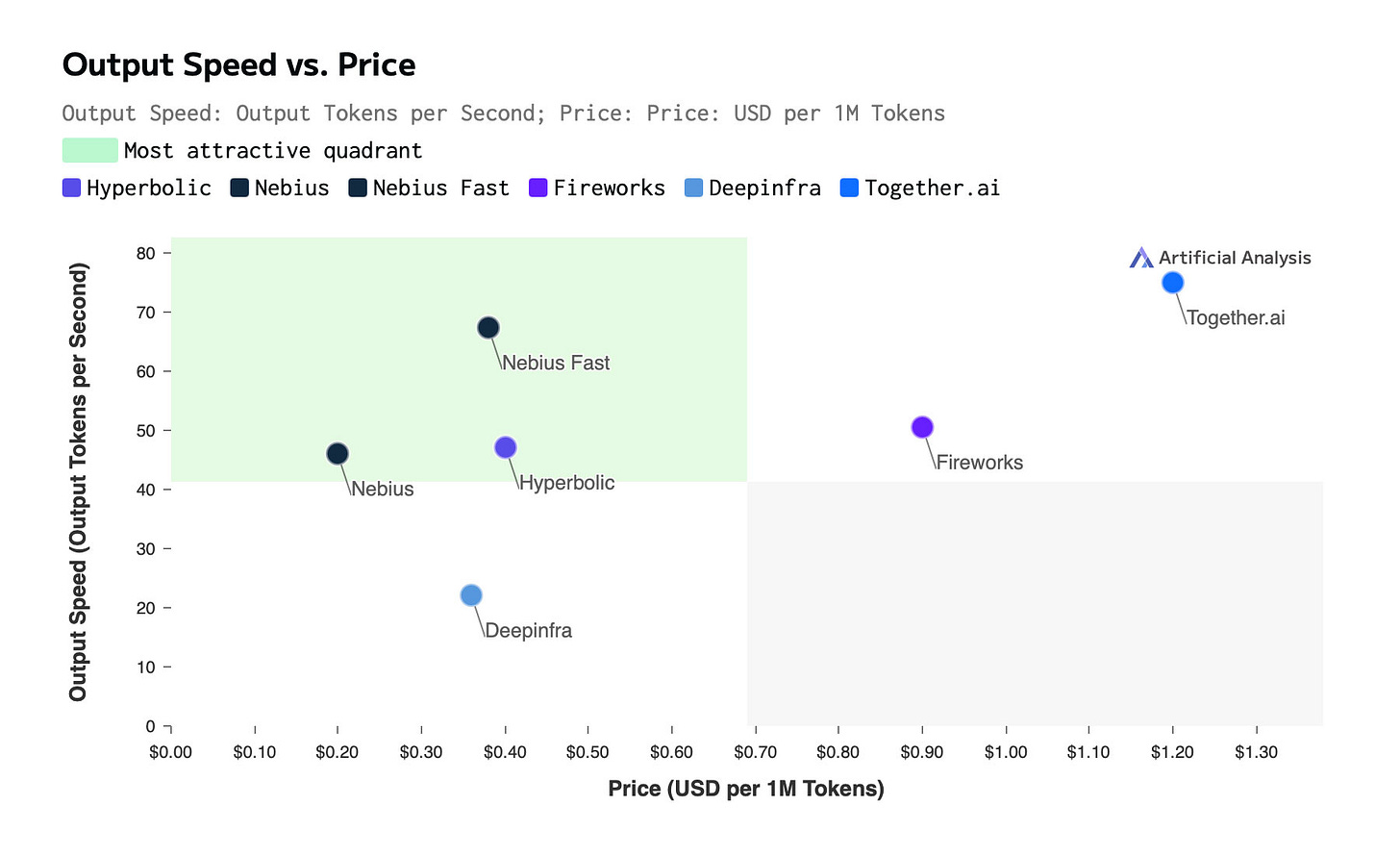

Nebius is able to deliver lower prices than the competition for comparable services because of its cost optimization, with their energy usage but also thanks to many much smaller processes which lower their costs at the end of the day - such as building their racks themselves.

Its second advantage is its European implementation, as it makes the company one - if not the - most powerful and competent provider in Europe with more than 40 different clients by now.

Market.

There are no demand issues & Nebius estimates that it’ll grow above $260B by 2030.

I would remain cautious with estimations as they are always wrong, but there are no doubts that this market will grow in the future as it becomes a need for most companies - if not all, to use AI tools.

The opportunity is here. What is left to see is if Nebius will be part of it & if they'll be able to capture enough market share to develop their business in a very competitive landscape, against three of the Magnificent 7 & other multi-billion capitalisation companies.

But again, for now, the issue isn't the demand but the supply.

Toloka, TripleTen & Avride.

I will go over them all rapidly as they are interesting but not really relevant to the bull case for Nebius - except for Toloka.

Nebius refocused Tolaka on data collection in 2023, with its business being to provide the necessary datasets for any AI training & run the necessary iterations to fine-tune the models. A necessary service for all model training which can be used through Nebius or by itself for companies with training capacities who miss data sets.

TripleTen is an online teaching platform focused on AI & high end techs, a business which could become interesting in the future as more & more skilled engineers are going to be needed to maintain those platforms. It also gives Nebius the possibility to train its own future engineers.

Avride is an autonomous driving branch focused on both cars and delivery robots. The truth is this branch has no products yet and is still in R&D, but again, this isn't part of the bull case - and I’m in Tesla’s team for that so…

Opportunity.

This is where things get interesting. Let's start from the beginning.

Nebius is still a very young and unprofitable company whose actual business model is to burn cash in order to grow its offerings & attract clients. So the bull case won't be based on profitability but growth.

And on that, it has delivered above expectations this year with a Q3-24 closing with a staggering 766% growth YoY and a 461% growth for the nine months ending, while the company's guidance talks about FY-25 being between $500M to $700M, or a minimum of 4x revenues compared to FY-24.

This insane growth would come from the expansion of their computing power, which would give the company more resources to be sold at any time. Passing from 20,000 GPUs in 2024 to 60,000 GPUs in 2025 could very well accomplish that even without taking the other branches into consideration.

“We anticipate capital expenditures in Q4 2024 to exceed the amount spent in the first nine months of 2024 as we plan to accelerate investments in GPU procurement and data center capacity expansion to support the growth of our businesses.”

These expenses are financed by the cash the company has generated when it went public and through different funding rounds, with the participation of some giants, including a company called Nvidia.

Nebius holds $2.3B of cash today without any debt, cash which, as said, is used for growing and operating their unprofitable business. This amount would easily allow them to run unprofitably for years, even after investing the expected $1B on their infrastructure.

Even more impressive, the company is planning to be profitable this year - or EBITDA positive, which isn't exactly the same thing. Although once again, the bull case here is about the growth, not the profitability.

What makes it interesting & highlights the rapid potential is that in Q3-24 alone, the company grew its client base 25% QoQ, surpassed $120M of ARR & grew revenues 2.7x QoQ, before the expansion of their data center in Finland or the launch of their data center in Paris.

The DeepSeek Mess.

This is about actuality, but I feel like I need to address the elephant in the room as we are still talking about computing power.

As a reminder, DeepSeek is a Chinese LLM wich came out last week which the team claims to have trained for less than $5M and which delivers comparable results to ChatGPT-4, which needed more than $100M to be trained - we’re talking about training prices here, not hardware investments.

This is scaring the market as it could mean that the capex spent on computing power & the one planned in the future could be useless since the Chinese were able to do more with less. That isn't entirely true though; that Chinese team was capable of optimizing something which only existed thanks to those already spent capex - something which was to be expected.

Any technology is meant to become less and less expensive and by doing so, meant to be used by more people. Computers and smartphones used to be for the richest companies only; we now all have a smartphone in our pockets. Software used to be the same, sold for five or four-digit licenses, most of those are now accessible for a small monthly fee. There were no way LLMs would be any different.

I understand it raises questions for future spending as many will argue it would be better to optimize our computing power like China did than to spend always more. Spending isn't always the answer.

But let's center this on Nebius. We are talking about a company selling computing power in a world where this computing power can become cheaper and therefore more accessible while demand is already too big to be answered.

Fundamentally, this means that if our Western companies can optimize their training software, they will grow their market reach and be able to propose more. If anything, in my opinion, this is a pretty bullish case for any computing power farm as long as there is a demand for training softwares, and the DeepSeek actual freakout doesn't change anything to this demand.

It raises questions about the need for more computing power, not for the need for AI training software.

Valuation.

This sets the stage for the business opportunity, but the investment opportunity comes with its actual valuation - which will fluctuate a lot today.

At $41.5, the company has a capitalization of $9.8B and an EV of $7.56B for a FY-24 guidance above $120M of revenues, meaning 81x sales or an EV/Sales of x63.

To this, we need to add the astonishing growth that the company is planning to have by FY-25 & their $500M of revenues, which would bring the company to a P/S of x20 & an EV/Sales of x15, reasonable for any company with triple-digit growth.

For some rapid comparison, Nvidia is trading above x20 forward sales with lower growth but also much more certainty in its business & competitive advantage.

The entire bull case holds on what will the company will be able to deliver during the first quarter of 2025 when their infrastructures finally grow to their full potential. If Nebius is capable of reaching the low end of its own guidance this year, then the company is actually trading at compelling forward ratios.

Otherwise… It will be another unsuccesful growth story.

Conclusion.

My optimism in this stock comes from different points.

First, its actual market & the enormous demand & need for any companies to build & train their own AI models. The future will be ruled by intelligent software capable of doing a human job & you cannot have this without training it.

Second, the actual bullish narrative around anything close to AI while AI training & inference computing power is also becoming a very big narrative.

Third, the advantage the company has over competition, mostly thanks to its pricing, only possible due to its cost efficiency. Management focused on saving every penny possible to strangle competition with comparable services for less - exactly like DeepSeek is doing with its LLM.

Fourth, its astonishing growth & capitalization on it, using its numbers to raise more capital to build bigger infrastructures & always fuel more growth. Momemtum is very important for any company, especially AI growth companies.

Nebius is supposed to be a growth story and has to deliver. Anything above its FY-24 will be seen positively & confirmations with a raised FY-25 guidance or a strong first semester will again force the market to keep the forward multiple aligned with its actual growth, or to even create a premium if Nebius grows its market shares as a potential go-to computing power provider.

Anything less would of course result in a violent reaction from the market as the growth story wouldn’t be worth any premium multiples.

Thank you for unpacking such a worthy company. The points in Conclusion are great - it really needs to prove itself of stellar growth.