Weekly Recap | July - W2

Updated Watchlist & Buying Targets, Tariffs, Market View & Investing Plan, Bitcoin ATH, TransMedics Dump, Hims Expansion, TSM Monthly, Energy Sector & VG, Arista Acquisition & More.

Macro.

Tariffs Review.

Might be time to do a tariff review, although my opinion on them is still the same: lots of noise for not much. It comes & goes without any sense as Trump’s administration is simply bullying the world around to try & get them to do what they want. July 9th was supposed to be the last delay, but wasn’t really...

There are some tariffs applied today, generating revenues: 30% on China as a baseline plus some specifics, 25% on both Mexico & Canada to non-USMCA goods - not much, and 18% on average for almost everyone else.

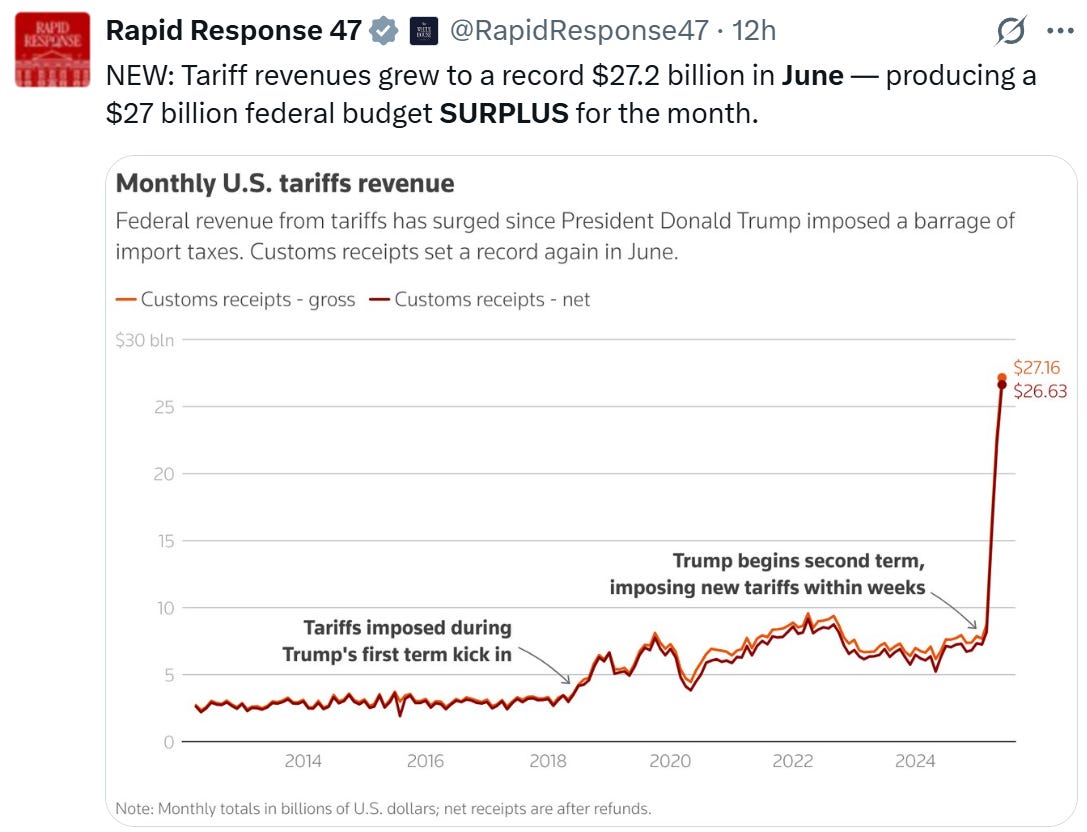

Media & X are going crazy as the Treasury closed the month in surplus, meaning they brought in more money than they lost - which didn’t happen since April 2022.

“On an annual basis, tariff collections have totaled $113B.”

I also would like to put things in perspective: June’s expenses only for interest on debt totaled $84B. This is to say that sure, tariffs will bring in revenues but they were never the solution to end the deficit - for those who still believe it is possible. You know my opinion on this: it isn’t possible & won’t happen.

And as investors, we do not want it to happen.

Now, thos tariffs revenues are a good thing - economically speaking & by themselves, I won’t say the contrary. But it shouldn’t shock anyone that increasing taxes brings in more money. It’s kinda obvious and was never the worry.

The discussion is how will this impact prices & consumption inside of the U.S., as it could create a vicious cycle of higher prices, lower consumption, lower demand & therefore lower import & tariffs receipts, et cetera, et cetera…

Today’s tariffs have an effect but shouldn’t be enough to significantly impact prices & consumption in the U.S. & currencies will absorb the biggest part of the potential inflation.

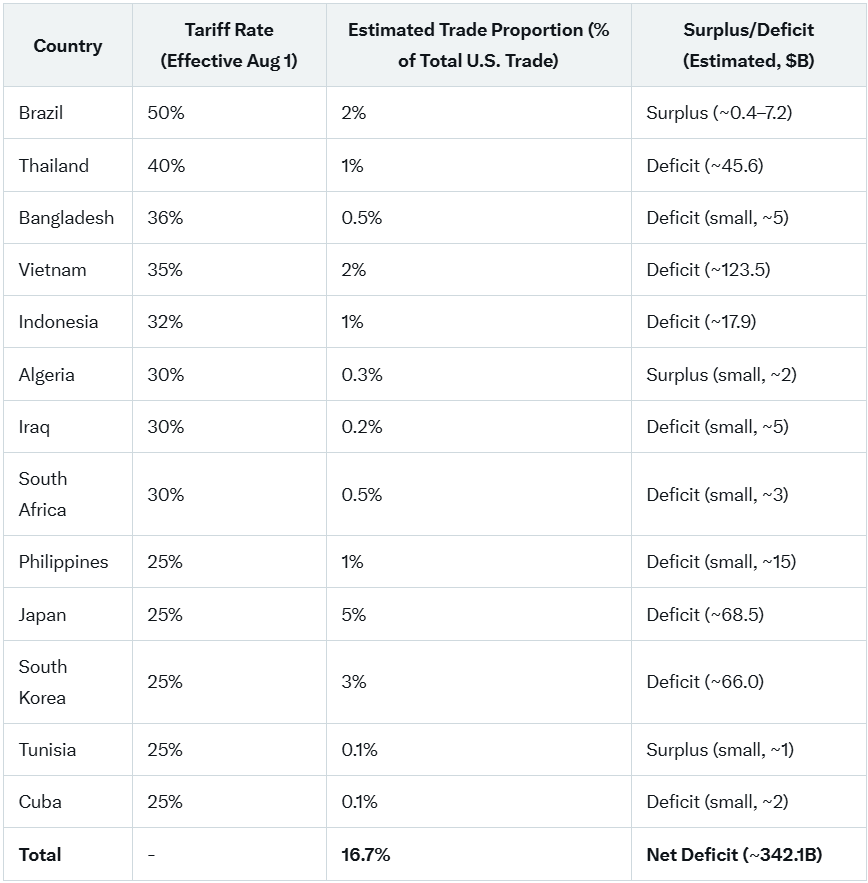

But Trump is not stopping & threatens more tariffs on other countries starting on August. We need to add to this list 30% on Europe announced saturday.

If you guys are able to cite all those flags, kudos, because there are a few I personally do not know at all and with which the U.S. does not really have trade with either way… The narrative of “punishing those who abuse the U.S. with unfair trade” is dead & burried by now, it is all about extortion.

Either countries sign Trump’s conditions. Either they get tariffed. And let’s see who hurts the most afterwards.

But I am here to focus on markets & economy, nothing else. So here are the affected countries and their importance in terms of trades with the U.S.

The biggest imports from Korea and Japan are cars & machinery of all kinds. Tariffs should impact companies with factories & households who want to buy Japanese brands. Brazil is energy, commodities & coffee. Asiatic countries - Thailand, Vietnam, Philippines etc…, mostly textiles. Europe exports medical products & some machinery as well, like Japan.

Most of those countries’ currencies already reacted & should continue to do so if the tariffs are applied as shared - unlickly.

In brief, once again: IF THOSE TARIFFS ARE APPLIED, they should not really impact global U.S. consumption nor prices drastically. Currencies will take a hit and specific sectors & goods will be impacted, slightly impacting households & companies which rely on them. Nothing dramatic by themselves, but it is another card put on top of an already unstable castle…

I personally think deals will happen & tariffs will be reduced or delayed, exactly like the last months, especially with Japan & Europe. But who knows? So far, the market understands the game & is not too worried.

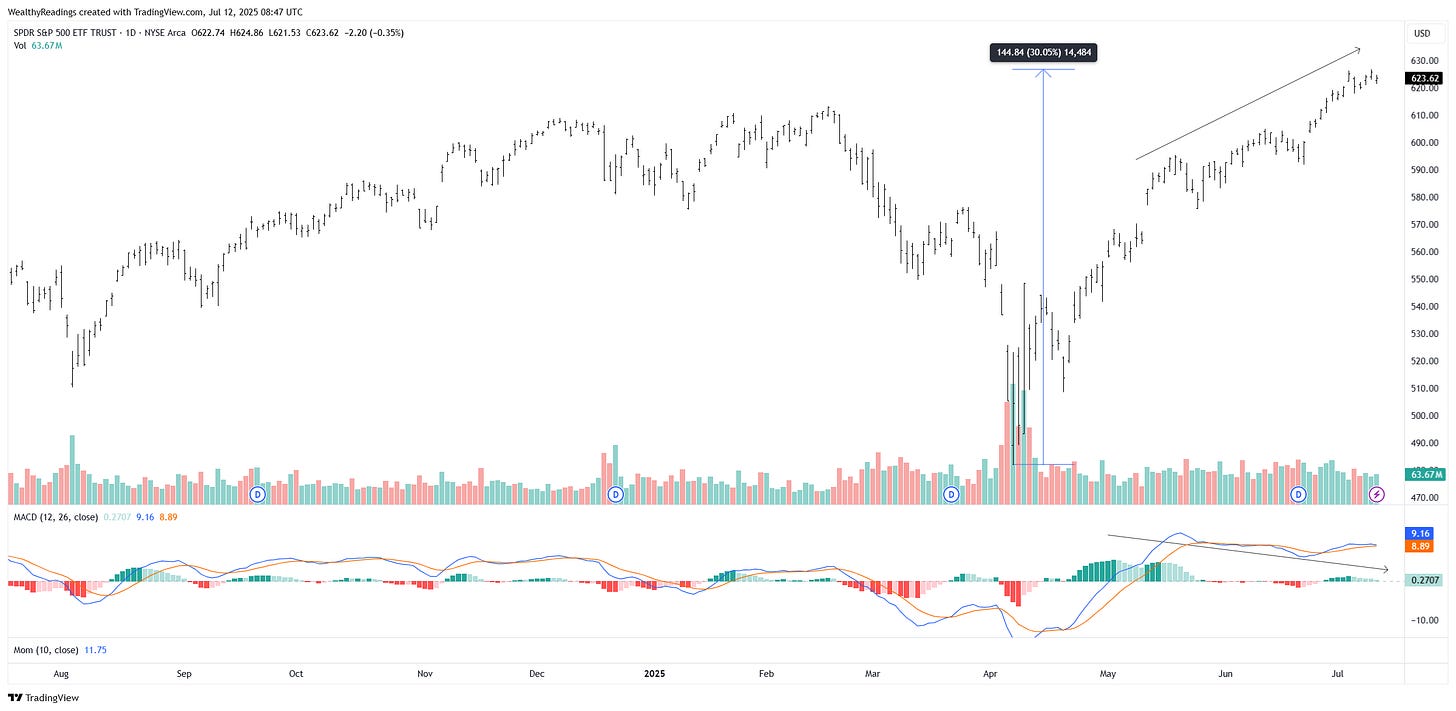

Market’s Reaction & Potential Pullback.

Even if it understands, it is not immune to fear & could overreact, probably not like it did in April but we are due a small correction after a 30% run without any breather in three months.

The S&P is extended with momentum divergence in short timeframes, we are back in greed mode & social media have constant posts showing portfolios’ ATH, with many more indications that the breather could be coming sooner than later.

Will it happen this week? I don’t know.

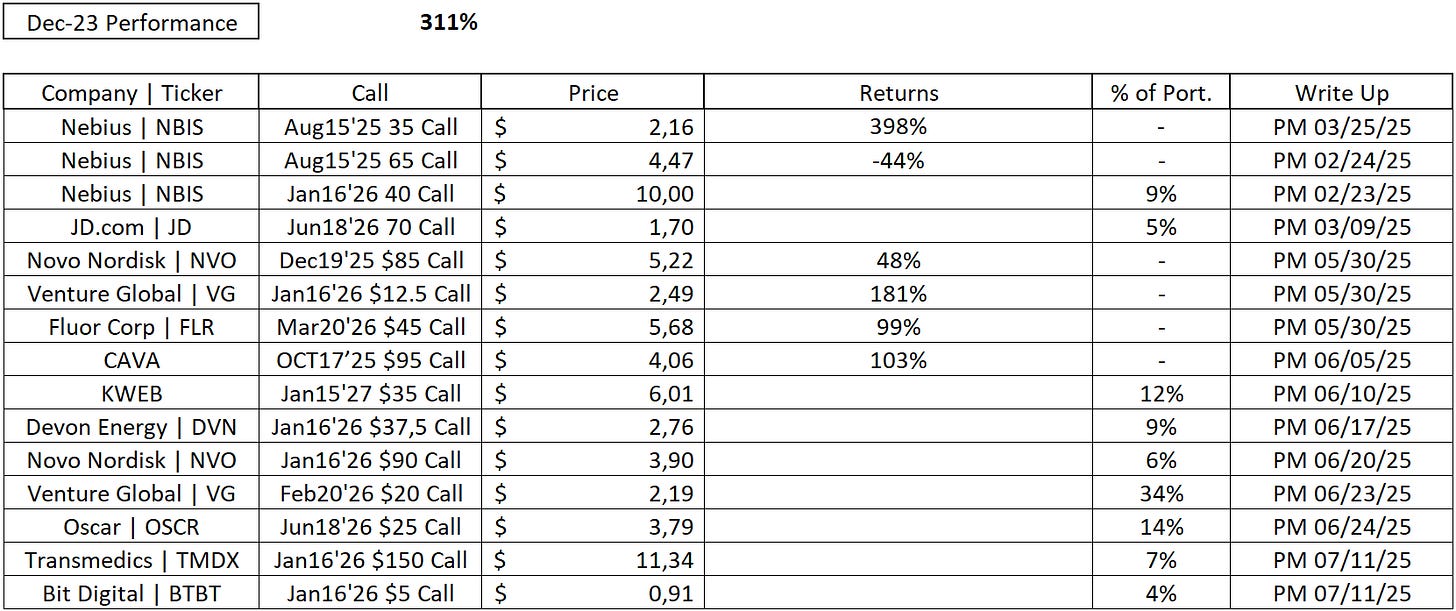

But being a bit cautious won’t hurt, having cash aside & an accumulation plan is enough. In my case, I still have 9% of the portfolio in cash and could close both Cava & PayPal’s position which are two lower conviction bets, to reattribute their liquidity towards higher convictions (Transmedics, Nvidia, Meta, Duolingo…).

On the option portfolio, I believe to be diversified enough not to hurt too much. The market works per sector lately and a pullback would not crush every stock while my liquidity is well spread - 17% in China which is already beaten down, 43% energy once again at low valuation & strong fundamentals, 13% in healthcare with Novo also beaten down, leaving 27% in growth with Oscar who took a huge beating already & somehow part of the healthcare industry.

A pullback would still hurt, but less than those with a highly concentrated portfolio on growth. I also have cash aside from Cava’s trade to average down if the pullback were to happen this month.

What matters is to have a plan, be aware of what you own and the reasons why you own it, and be open to every possibility. If the pullback happens, know what to do. If it doesn’t, also know what to do.

What matters is to not be in positions where our emotions take over.

Powell to Resign?

We had rumors on Friday that Powell was considering to resign from his chairmanship at the FED. Rumors, so who knows, but it wouldn’t send a healthy message if this were to happen. The distinction between fiscal & monetary policy is one of the reasons of foreign entities’ trust in the dollar & anything which would grow government’s control on monetary policies would erode that trust.

Let’s see what happens & not draw conclusions on rumors. Keep in mind that this would not be bullish “because the new guy would cut rates”. The market is better with rates as they are.

Watched Stocks and Portfolio.

Bitcoin, My Sweet Darling.

You guys should know by now that Bitcoin is the asset I am the most bullish on over the long term, and if you are skeptic please take an hour or so to read why so many believe in the asset.

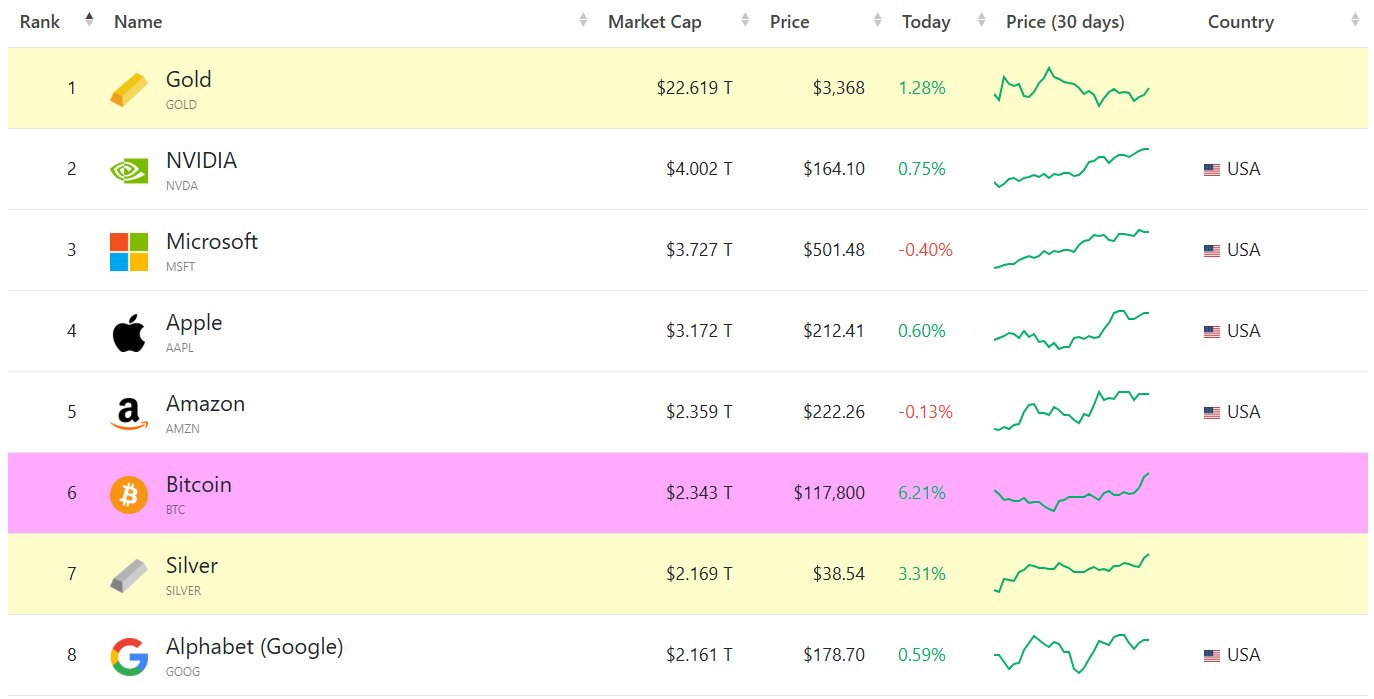

That being said, the asset reached an all-time high & now flirts with $120,000. I shared on X this screenshot with a comment saying that Bitcoin was a 10x from here to reach Gold’s capitalisation. And this isn’t meant to be provocative.

Food for thoughts.

Transmedics is Dumping.

The stock is finally breathing and giving me the opportunity I wanted to accumulate shares & to open a call position - bought on Friday. I shared my plan on Transmedics more than a month ago & applied it.

The reason for the selling is twofold to my opinion.

First, it was necessary. The stock ran 145% YTD to its high at $145, and is still up 89% YTD after Friday’s fall. It was only a matter of time before some profit taking happens, some leveraged players deleverage, etc… Stocks don’t climb in straight line, especially growth stocks.

This is, to my opinion, the biggest reason. But it was helped by some news.

Second, Xvivo released a tough quarter. The company is considered competition to Transmedics - with slightly different fundamentals, and released a huge organic revenue decline from their lung business due to lower demand within the U.S.

Lungs are less than 4% of Transmedics revenues so I personally do not worry at all and consider this dump a necessary market breath, nothing else.

More details on the note I posted Friday.

Small parenthesis, as I am using notes more & intend to refer to them in weeklies, it will save space, give you the informations earlier & I won’t have to write twice the same thing. Feel free to give feedback - if you like the notes & this way of doing.

Hims Weight Loss Drugs Expansion.

Management announced the expansion of their weight loss drugs branch in Canada, starting early 2026, with their entire portfolio - GLP1 included as Novo’s patent is set to expire at the end of the year in the country, allowing Hims to operate without any regulatory risks there.

It seems to be a really promising market, easier than Europe in terms of logistics. Will be interesting to see how this will impact revenues but I see this as a net positive for the company. More on the potential below.

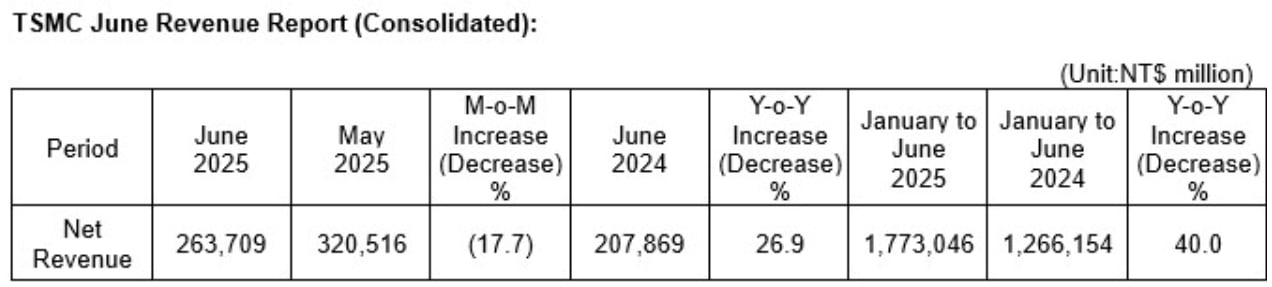

TSM Monthly Revenues.

Damn strong, as usual.

Demand for semiconductors is clearly not slowing down.

Arista Network Acquisition.

The hardware company acquired VeloCloud's operations from Broadcom for $1B or so - no clear details. A strong acquisition which will allow the company to onboard new products which complement perfectly their actual offerings and therefore propose more value to their clients.

"VeloCloud offers leading cloud-delivered SD-WAN solutions with integrated security, complementing Arista's wired and wireless switching portfolio. VeloCloud solutions comprise a range of edge hardware platforms featuring integrated secure firewalling and application-optimized SD-WAN, available with a choice of integrated Wi-Fi and/or 5G mobile connectivity. This portfolio of solutions provides expanded choice and performance for Arista customers."

Strong deal to my opinion.

Venture Global in Europe.

As you saw, VG is 30% of my option portfolio so I keep an eye on the fundamentals, which are really good as the company closed a massive deal to supply Germany, and therefore Europe, in LNG.

This was always part of the bull case as the old continent cut ties with Russia & needs to find new sources of energy, logically turning towards the U.S. as energy is a big part of tariffs negotiations - the U.S. wants the world to buy more from them.

Although as Trump still wants to slap 30% tariffs, who knows what more he wants.

We are talking about a 20 years contract for 0.75M tons per year. Massive for the company, and the stock didn’t really push as much as it should have on this news as Friday was a red day globally due to sentiment.

I remain really bullish.

Banking Data & PayPal.

The news came on Friday that regulations forcing banks to share some specific data for free could be revoked or modified, forcing fintech or any company, institution or individual to pay to access those data.

I am not an expert in financial regulation & financial APIs, so I cannot honestly tell you if this has a huge impact or not nor what specific data would not be available for free anymore - as some are open for free market regulations. My understanding is that PayPal owns tons of data locally so their usage of third party data should be lower than many other fintechs, but would still be impacted somehow.

It is still unclear on what could change, if something will change & how much it would impact each company - PayPal indeed but also SoFi or Robinhood & many more. Important to keep an eye on what’ll be done.

Energy Sector is Overlooked.

I regularly share this because it remains true: no one cares about energy stocks while energetic needs are bigger than ever. I shared a note with four great opportunities to my opinion.

Growth & value are nothing but energy transformed.

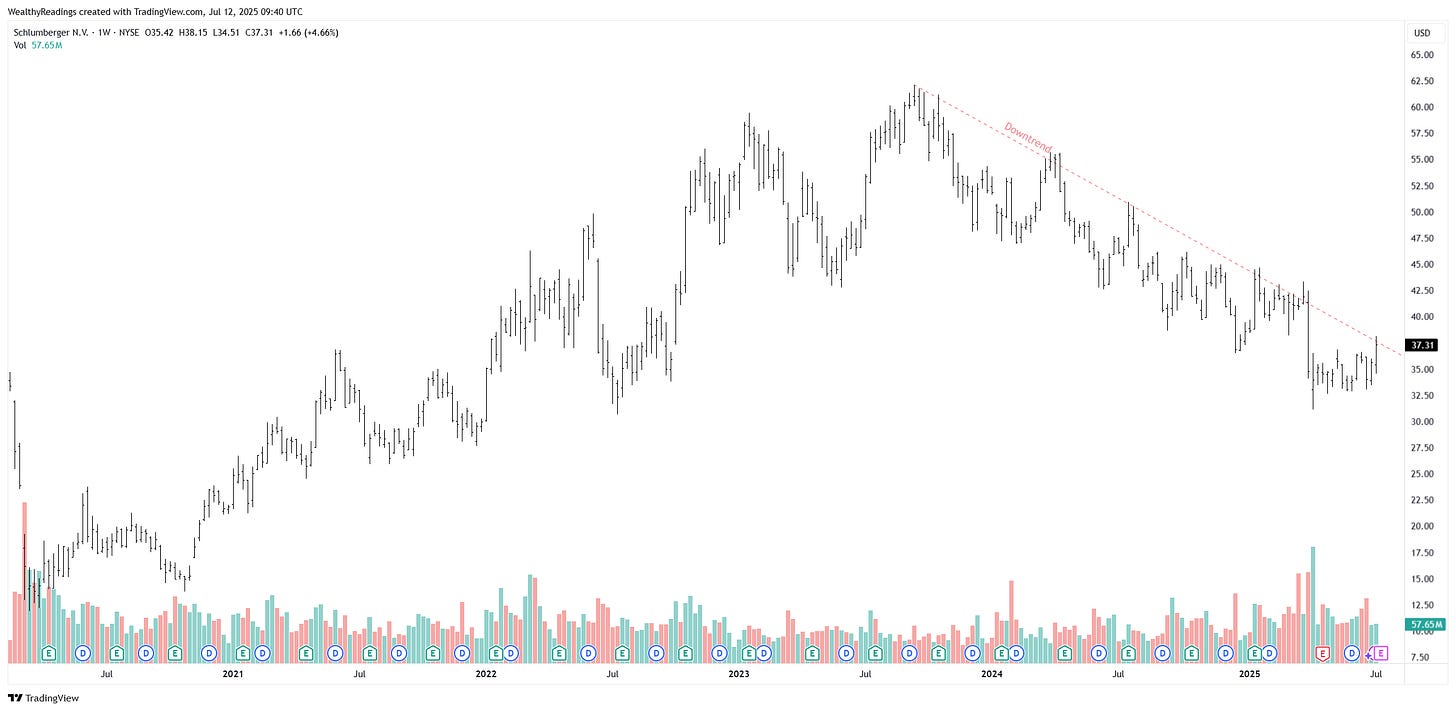

Fundamentals never really changed but valuation did. The entire sector fell for months but are now starting to give some positive notes. I already shared DVN & OXY on my portfolio modification some weeks ago but I need to talk about SLB today which is also giving encouraging signals.

Clear bottom, growing volume, battling with its actual downtrend… If this breaks, I will be in in shares for sure and probably in calls as well.

I am sharing this because anyone who wants to grow the defensive part of a portfolio should look into energy right now. Being overly aggressive with 100% growth stocks is not always the solution for performance.

China & Stablecoins.

While Europe continues to scream at the risks stablecoins could bring to the global economy - wrongly, Chinese companies are planning to include Circle’s into their applications… The world is upside down.

Ant Group, the company operating AliPay - the biggest everything app in China, & partially owned by Alibaba is working on this. I do not see the benefits for Chinese to access USDC & am curious on how regulation will accept this as it gives opportunities to Chinese to convert their local currency into a foreign one, which isn’t really great from the CCP point of view, but it still seems to be happening.

Lots of unanswered questions, but if Chinese companies include U.S. stablecoins… The hype is real. Fundamentally sound? I don’t know. But real.

Earnings Season is Back.

I do not feel like we had any rest since the last one, but that’s for the best. I might do a specific write-up for Netflix depending on what the company releases, but if we have another perfect quarter, I’ll only publish a note like I intend to do for ASML & SLB, with everything summarized in sunday’s weekly.

Specific write-up & Saturday’s earnings recap will come the week after as volume will grow then.

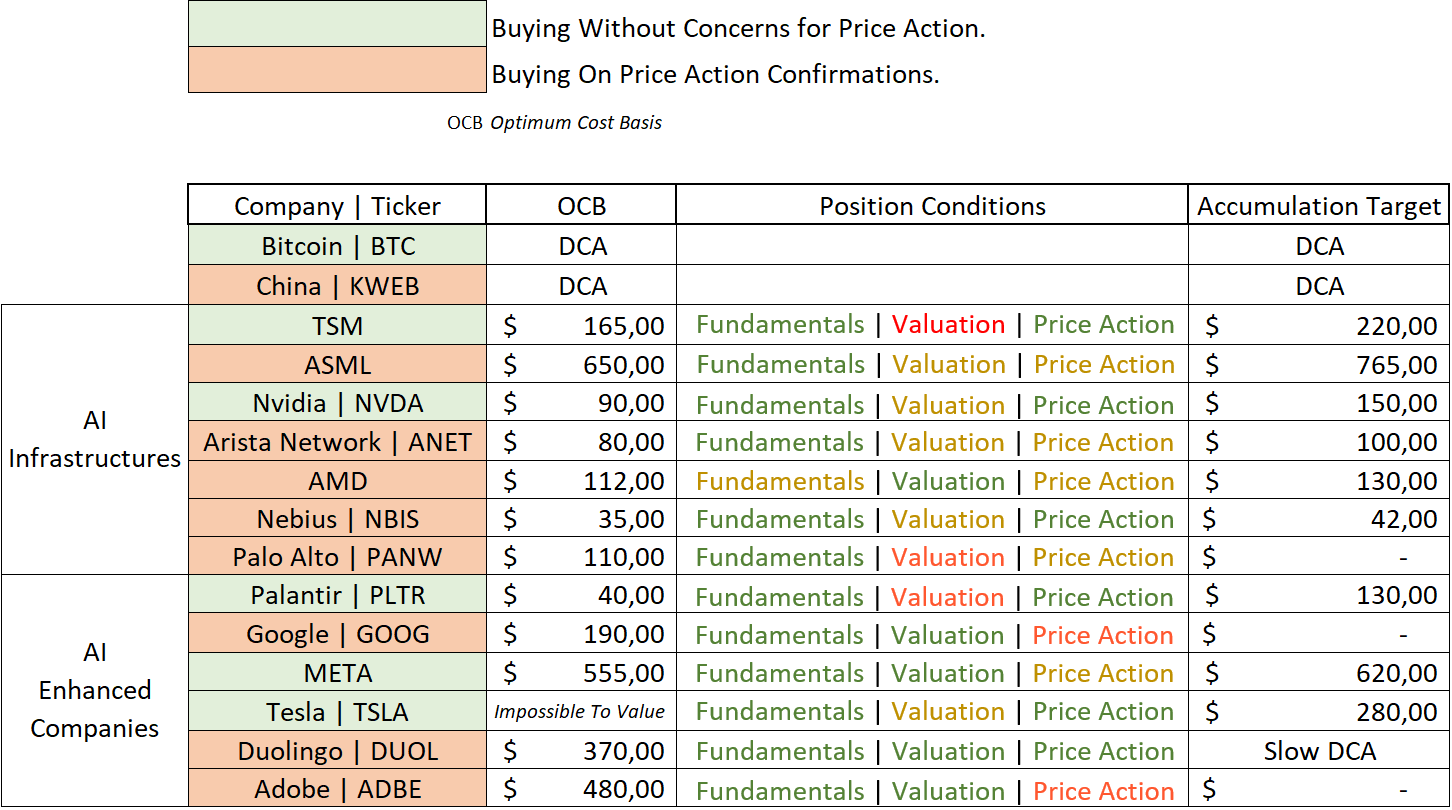

Weekly Buying List Update.

Here is my watchlist & buying plan. Reaching those prices do not mean I always pull the trigger, those are only my view of valuation & price action today, I only pull the triggers on the ones I believe to be the best liquidity attribution at the moment - purchases are shared on my savvy B&H portfolio.

“OCB” - Optimized Cost Basis, the optimum average price for a long term position.

“Accumulation Target” - buying target based on price action, to average up.

“DCA” - trading at a proper price to open a position or accumulate.

“Accumulation” - trading at a proper price to average up an already existing position with an average below OCB.

This is only my personal opinion and does not represent any financial advice.