Weekly Recap | July - W1

The Big Beautiful Bill, Tariffs Update, Olo Acquisition, PayPal New Feature, GPUs Regulations, Tesla Deliveries, Adobe & Figma, Robinhood's Tokens and my Updated Watchlist & Buying Targets.

I hope our fellow Americans had a wonderful 4th of July!

Macro.

We’ll start with a political subject so please, once more, I have no opinion and am not even American so I am not here to endorse or comment on Trump’s policies, but to talk about how it will impact the market & potentially the economy.

Don’t get offended.

The Big Beautiful Bill.

It finally passed Congress & was signed this weekend.

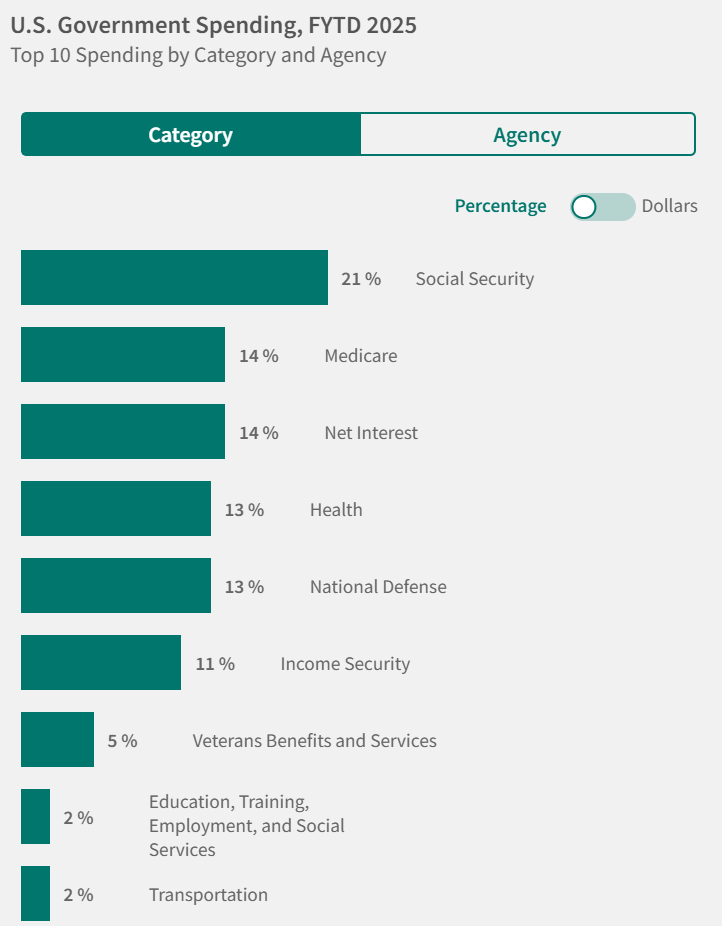

In a few words, we’re looking at tax cuts, increased benefits & facilitation of business for every type of household, reduction of Medicaid’s system - or reinforcement of its requirements, and a massive $5T increase in the debt ceiling to fund it all. We also have many things which do not interest us in this write-up (immigration, military funding, etc…).

The narrative behind this bill is to reward workers with buying power while reducing spending from social security - to increase it somewhere else.

As a reminder, from an economic point of view, the only way to reduce the deficit is indeed to cut social expenses. It can’t be done otherwise, so anyone wishing for less deficit has to accept it’ll come with lower social measures.

Now, let’s not be delusional, the U.S. will never slow down spending, it has & will only accelerate from here - something I have said since day 1 on these write-ups. You can’t go back from spending & deficit once you start as it would require an amount of pain no political party would accept to inflict nor voters would consciously put a ballot for.

And it is a good thing for investors - even American investors, as I said last week.

I’ll let you re-read the macro part if you want to learn more about this.

Tariffs Are Back.

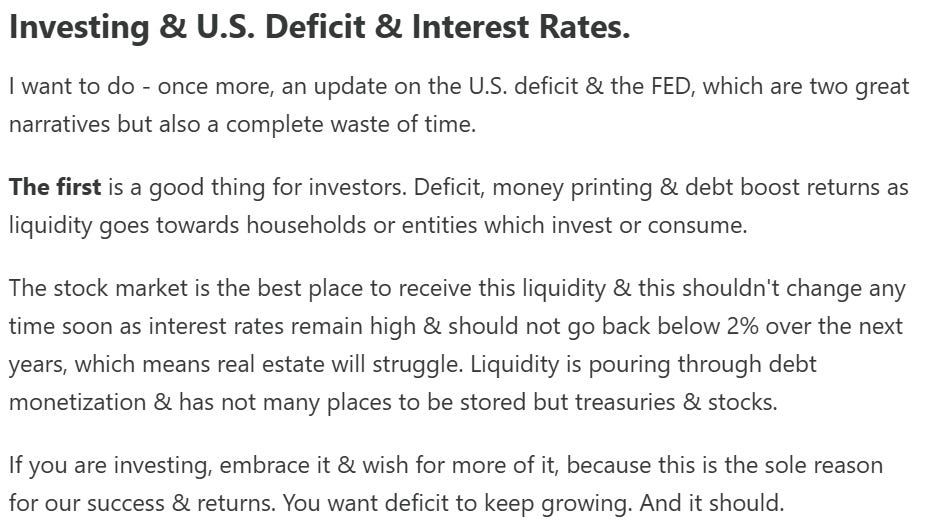

As I shared on my last Portfolio Modification, the worry we should have short term - on the foreseeable ones, is the end of the tariff delays on July 9th as Trump doesn’t seem to be in the mood for more delays - or so he says.

We’ll rapidly have news of who behaved badly, and even if I’d like to think that most is behind us, we’re never safe with this administration… It apparently hasn’t concluded anything with Japan for example and could hit stronger than expected.

Impossible to predict the decisions nor how the market will react, so let’s be ready for some volatility and to potentially buy some stocks if some sectors or geogrpahies were to be hit more than expected.

— Update —

As I am getting ready to send this report, there are some rumors that the tariff pause would be extended until August. I’ve not seen confirmations yet but it might happen when you guys get this report.

If this is true, the only predictable & short term bear argument would be gone - at least for a month.

Watched Stocks and Portfolio.

Olo Got Acquired.

I have to start with this news as Olo was one of the first companies I talked about in June 2024. I shared my investment thesis & my position at an average of $4.5 back then & held it all until this week, as the company was sold for $2B in cash to Thoma Bravo - or $10.25 per share.

This is the end of the story for me & Olo with a beautiful 127% returns in 13 months. The company will continue its business, and we’ll find new opportunities to attribute this liquidity.

PayPal’s New Features.

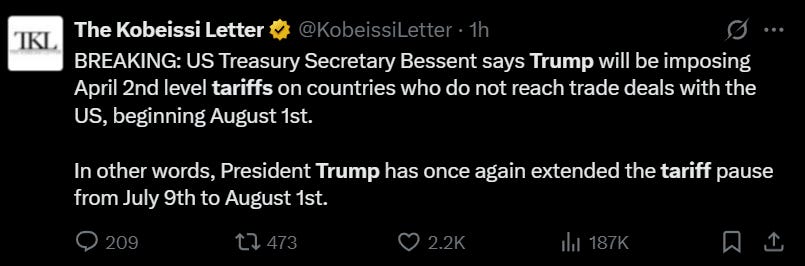

The company has been shipping features really rapidly lately, making its app easier to use with more functionalities for users & merchants. And they released this week their subscription management feature.

We all struggle to know exactly what we pay for, for how much & when. PayPal now proposes to manage everything in a centralized place, where any modification - in payment card for example, will affect all subscriptions, while enjoying PayPal’s cashback system.

This isn't reinventing the wheel. But it simplifies things & that is what most of us are looking for nowadays, especially since monthly subscriptions became the new standard. Another positive step towards retention.

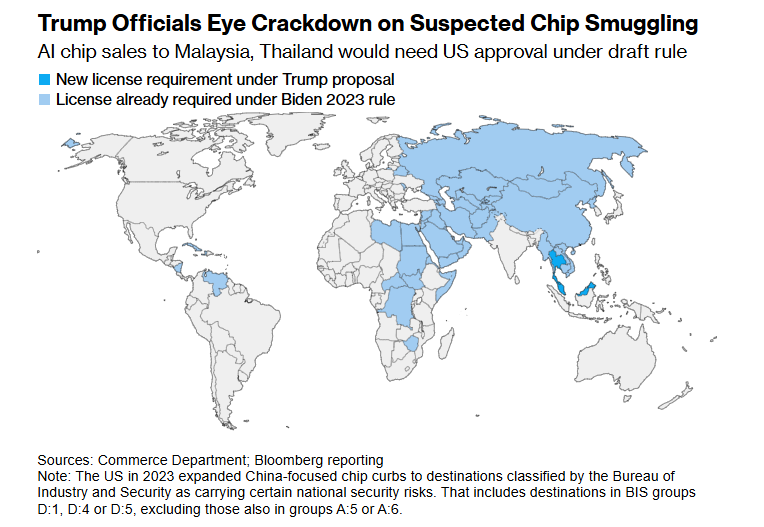

Chips Curb.

Trump’s administration is following on Biden’s regulatory framework when it comes to GPUs & high-end tech exports. They are looking to include Thailand & Malaysia to their “need approval before selling” list, with the objective to prevent GPUs & co to be sold to China through middle-men.

My personal opinion remains that it is better to give your adversary something as you will only push him towards innovation by cutting him off, but well. The technology war continues.

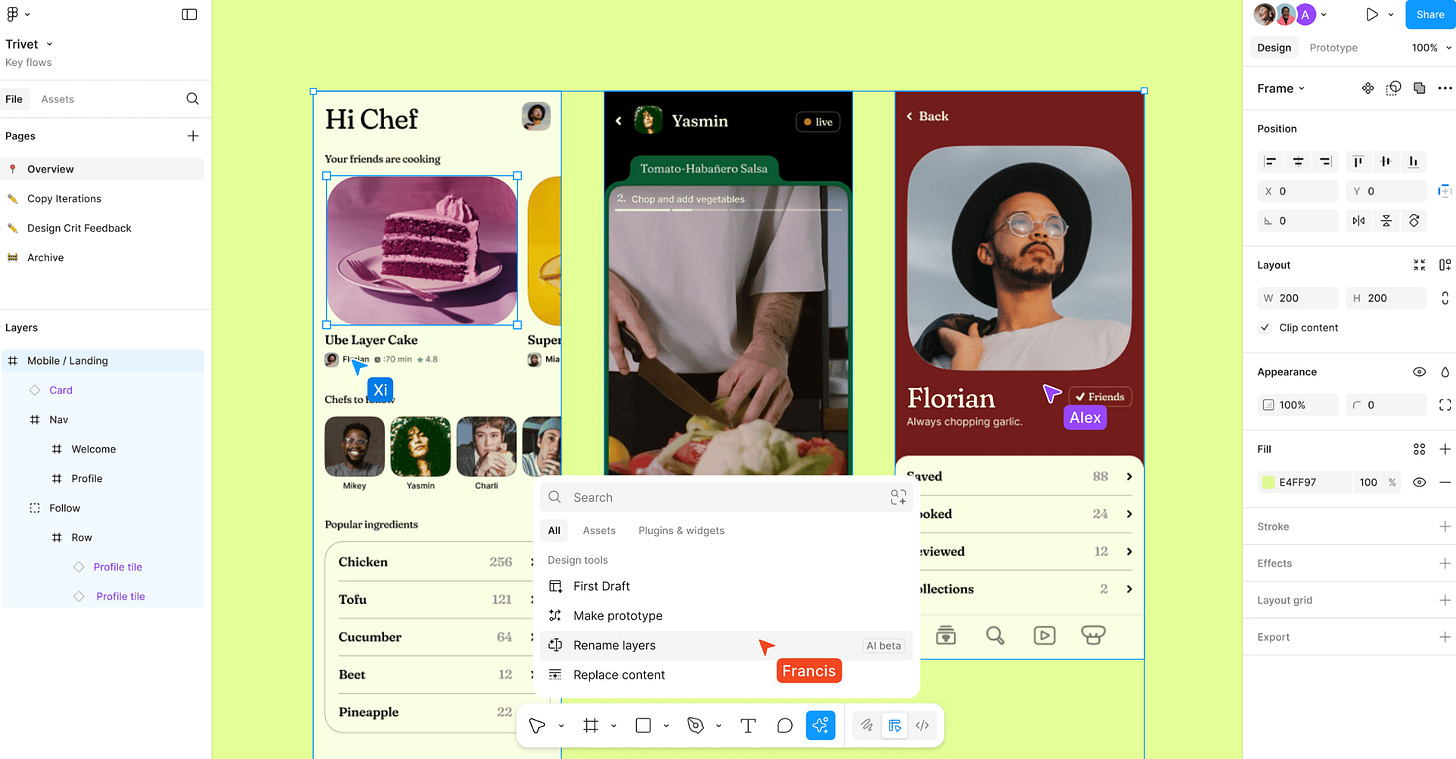

Adobe vs Figma.

Figma released its S-1 to file for an IPO, without sharing yet any information about the valuation at which they’ll start trading. If you do not know Figma, it is an online design platform focused on web interface creation.

It is a great platform & Adobe tried to acquire it for $20B early 2024 but the bid was canceled due to anticompetitive regulation - it would give Adobe too much control over the design sector.

So the company is now going public and I am really curious how the market will treat it, as if it were to be logical, it would sell the name over the exact same concerns as Adobe - AI will do the same for free soon. You know I do not share this vision and am personally bullish on Adobe, hence my interest in Figma.

How will the market treat it? And will it change its view of Adobe?

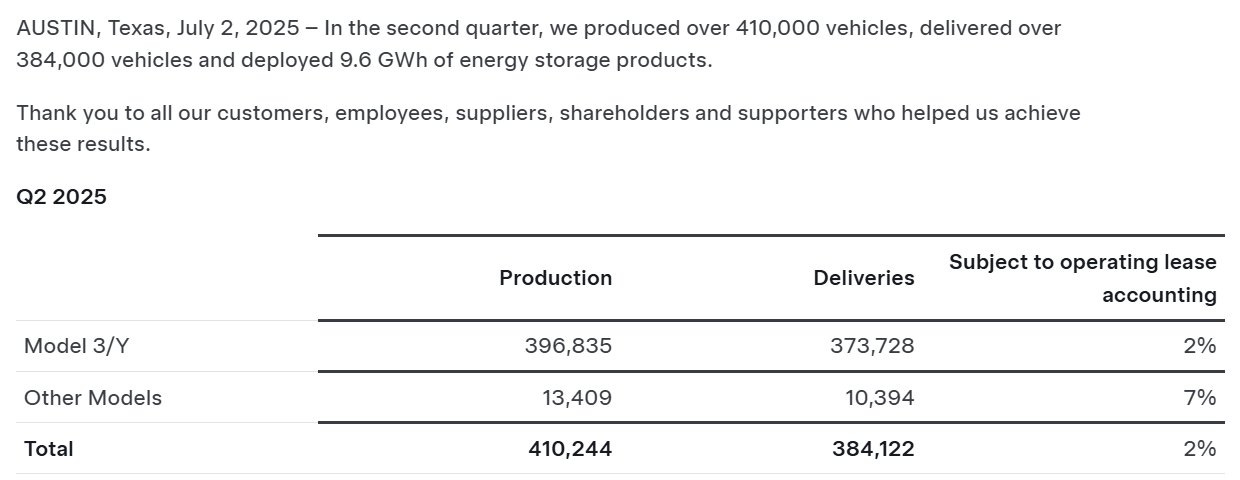

Tesla Deliveries.

You guys know I am a Tesla bull. But those numbers are bad. A 13% decline in EV deliveries & no QoQ nor YoY growth in the energy sector. Nothing changes for the bull case: autonomy, and I will hold my shares, but the slump is real.

On another subject, Elon is still making noise as he now wants to create a new political party to work for Americans - mostly when it comes to the deficit.

As usual over the last years, he is making himself a target & goes against some of the most powerful people in the world, working directly against shareholders’ interests…

Whatever our opinions are about him & his doings, it starts to be a problem for his brand & companies which are hurting in the meantime. Tesla should be his focus as any CEO of a publicly traded company.

Robinhood in Europe.

The company released its new feature, only in Europe: Tokenized assets.

What are tokenised assets? They are the future of finance & the reason for my bull thesis on Ethereum: a property title inscribed on-chain with all the advantages of blockchains - rapidity, availability, decentralization, etc...

A tokenized asset could be compared to an official ticket attesting your possession of an adjacent asset - stocks in today's case but it could be anything, including parts of real estate, private businesses, loans, art, etc... Robinhood proposes tokenized assets of SpaceX & OpenAI for example.

How will it work? Robinhood will keep custody of the real asset and sell tokens on its platform, allowing their users to access divisible stocks 24/5 - something new & valuable for Europeans.

Blockchain? Every transaction will pass through blockchains to authenticate, verify, validate ownership & process transactions. Robinhood’s service will run on Arbitrum, an Ethereum L2, meaning every transaction will pay fees to Ethereum - and therefore Ethereum holders, to use its technology.

How will users buy tokens? Exactly like any stock as there is no difference between both. Token owners will also receive dividends & their price will be identical to the stocks’ prices.

Are there risks? The only risks I see are those linked to asset custody. If Robinhood were to have issues, they could be forced to sell shares. But as long as the platform follows the law and does not do fractional reserves, there are no more risks owning a token than a stock as we rely on the broker’s honesty for both.

Depending on how demand goes, we could have some liquidity problems but I’d assume Robinhood would step in if necessary.

What are the implications? For Robinhood, this is one more step towards being the most interesting platform to use. We're talking 24/5 trading now accessible in the U.S. and in Europe with much more to come as tokenized assets will unlock much more.

For Ethereum, my bull case is getting confirmed a bit more every day. Robinhood - with many others, is working on migrating the financial world on-chain, on the most reliable blockchain for this kind of usage.

To talk numbers, stock markets have billions of daily transactions. A small fraction of it passing through Ethereum would generate hundreds of thousands of fees & therefore dividends for Ethereum stakers. And this is only the beginning as many other entities are working with stablecoins - PayPal, Mastercard, Visa, Circle…, which also leverage Ethereum.

I will not be a user of tokens. In our Western situation, I’d still rather own shares on my actual brokers, I do not see the point of using Robinhood’s tokens. I will use them if opportunities arise during closed hours as it is the only platform we have in Europe 24/5. But for my long-term holdings or normal transactions, tokens do not make much sense at comparable fees.

I am more excited by what it means for Ethereum which is seeing tons of action lately, with lots of financial institutions building services on its chain. I called my investment thesis on the asset “The future foundation of the financial world?”.

Might be happening.

Invest in America Act.

I talked three weeks ago about this bill which was meant to open an investing account for American newborns which could be used to invest in American assets.

Here were my thoughts.

Let’s see if those accounts go to Robinhood, or if households even have the choice… I have no idea how it will work in effect. But I continue to think the system is interesting and is obviously very bullish as it means fresh liquidity entering the market for each newborn - hence growing buying pressure.

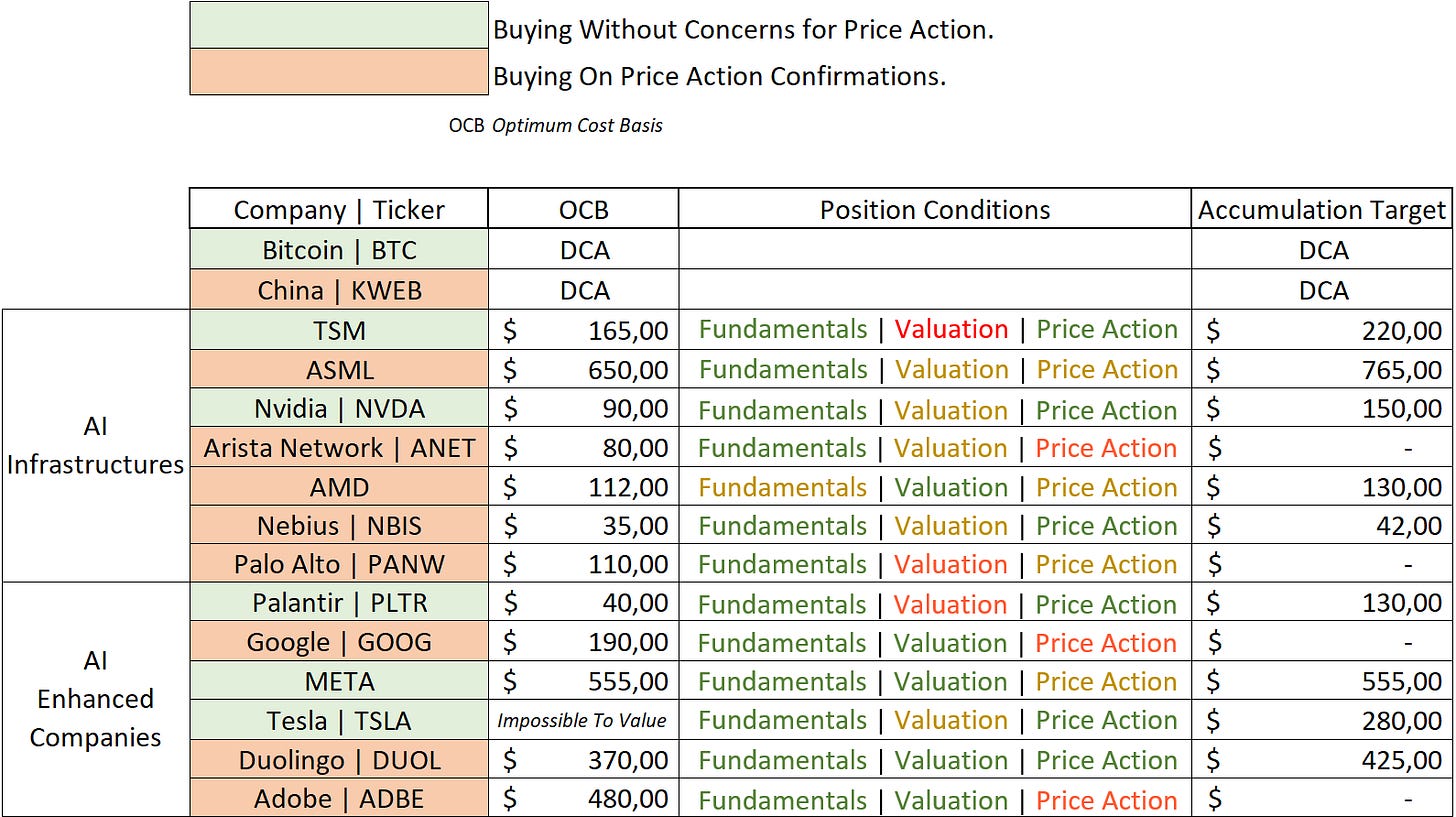

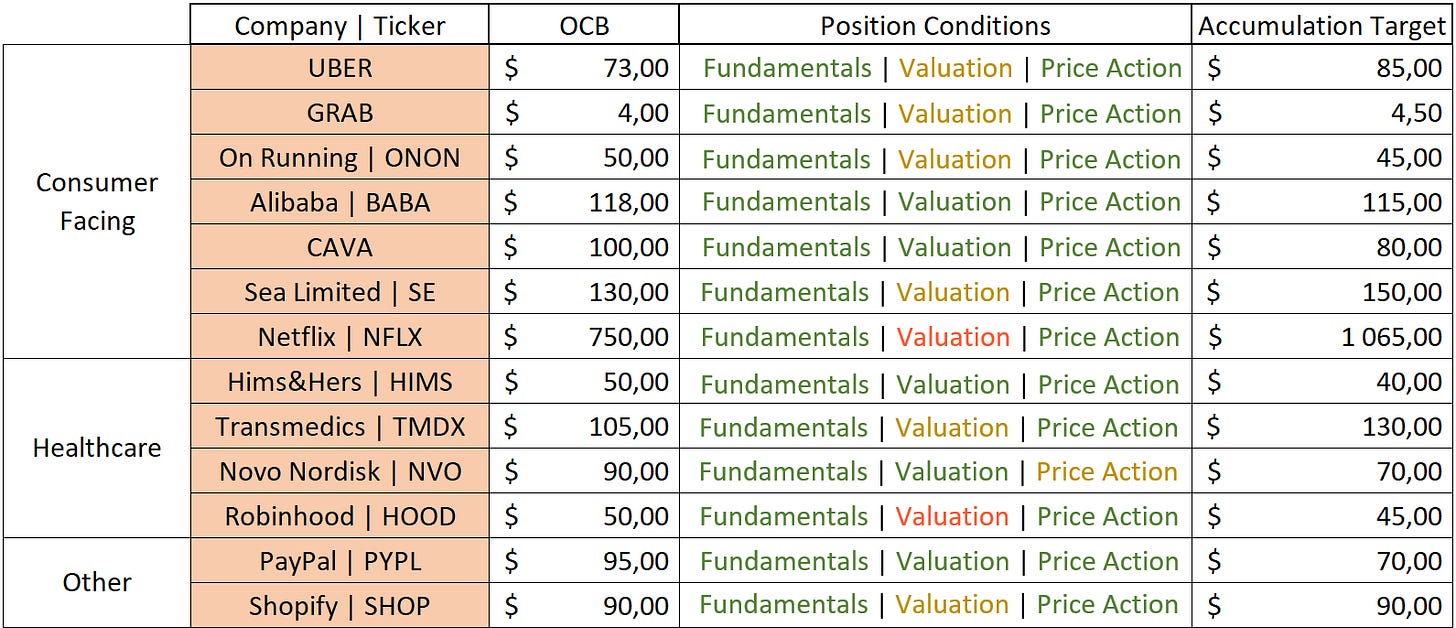

Weekly Buying List Update.

Here is my watchlist and the prices at which I would buy each.

“OCB” - Optimized Cost Basis, the optimum average price for a long term position.

“Buy Target” - actual best buying price based on price action in order to average up if we want, without pushing our average price above the OCB.

As usual, more details on price action in the welcome write-up.