Weekly Recap | June - W4

Iran Update, GDP & Inflation, U.S. Deficit, Interest Rates Don't Matter, Dollar Review, Hims & Novo, Google AI Usage & TPUs, Tesla Deliveries, Mastercard & Stablecoins and Watchlist Buying Targets.

Weekly buying list & price targets at the end of the write-up.

Macro.

Iran Update.

Lots & nothing happened. I said I’d be worried if U.S. bases were attacked, and they were, but only for the narrative of it. Iran called to prevent its strikes in order to show something but risk nothing. So I’d say we reached my second scenario & I behaved as said: I bought the retests on growth stocks & shared it.

The ceasefire was respected since it started; the only question is for how long will this lasts - the sad truth is that it very probably won’t.

GDP & Inflation.

Two important data points although to be honest: none matter.

PCE & Core PCE are the preferred inflation measurement for the FED as it excludes volatile components like food & energy, and came slightly hot at 2.7%, up 0.3% YoY & 0.1% MoM… Moving on.

As I shared many times, inflation is not an issue and shouldn’t be anymore as long as U.S. institutions do not print their way out of the probable economic slowdown.

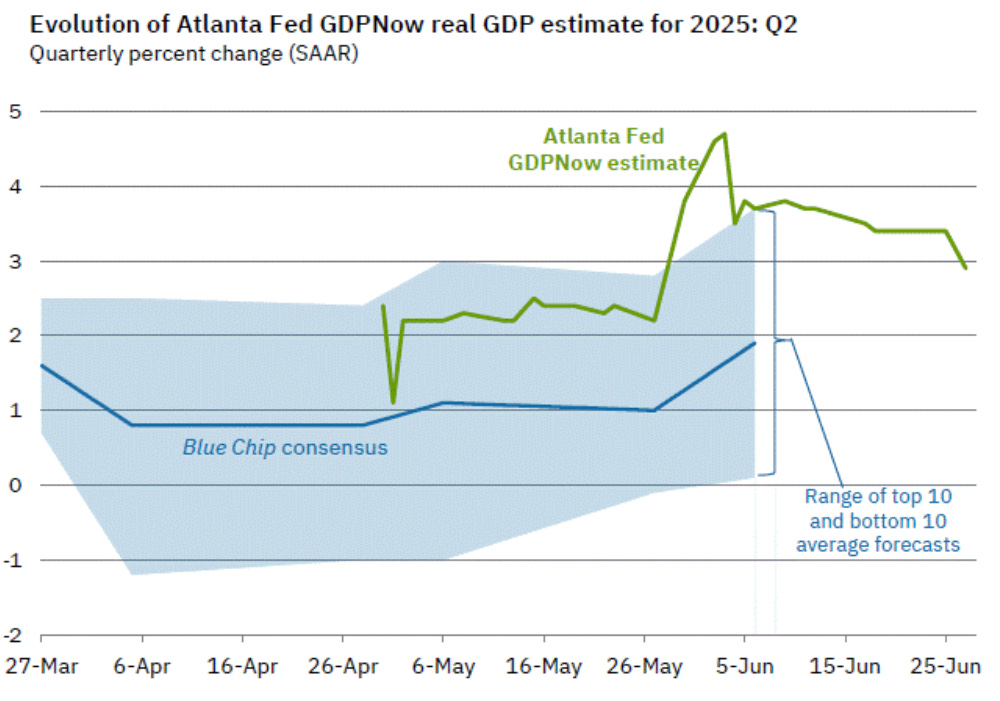

The quarterly GDP, which does not matter as the tariffs fear forced many companies to frontload their imports & build inventories. As trade deficit is a component of GDP, it completely biased the data with the quarter down -0.5%.

In the meantime, projections for Q2 are around 3%.

Why? Because imports slowed so much that most companies have a surplus thanks to their inventory.

In brief: GDP is unusable in the current condition & does not really matter.

Investing & U.S. Deficit & Interest Rates.

I want to do - once more, an update on the U.S. deficit & the FED, which are two great narratives but also a complete waste of time.

The first is a good thing for investors. Deficit, money printing & debt boost returns as liquidity goes towards households or entities which invest or consume.

The stock market is the best place to receive this liquidity & this shouldn't change any time soon as interest rates remain high & should not go back below 2% over the next years, which means real estate will struggle. Liquidity is pouring through debt monetization & has not many places to be stored but treasuries & stocks.

If you are investing, embrace it & wish for more of it, because this is the sole reason for our success & returns. You want deficit to keep growing. And it should.

The second does not matter in the current economy because the FED’s tools control the private market’s sources of financing. Higher or lower interest rates will influence the global rates of financing for households, companies, etc… Today, those entities are not the source of the deficit, government expenses are.

We are in the famous fiscal dominance I detailed here.

The FED has no power in this situation and cannot slow down the economy - at least within the U.S. Higher interest rates mean higher yields for treasuries holders. Having high rates is not optimal, but lowering them would not change anything if not done with a significant cut - bringing them back below 2% which would bring inflation back as well to some sectors, not the objective.

This narrative gives something for the market to look up to. But economically, it won’t change anything to have rates at 4% or 3% as liquidity comes from debt monetization either way.

And once again, this is a good thing from an investor PoV because when these kinds of conditions start, they don’t revert. Deficit will grow. Printing will continue. Rates won’t matter. It will fluctuate violently, but it cannot be fixed easily.

Be ready for volatility during the next years & probably huge returns. Why? Because liquidity is created en masse & has nowhere else to go but the markets.

The Dollar.

Few words on the dollar, which keeps falling as foreign institutions continue to struggle to manage their own currencies in the new order Trump created - more independence from the world, especially from Europe & Japan.

This pushed the dollar in a violent downtrend to places not seen since… 2022.

This is not good or bad per se. I all depends on where you are or what you do. So I won’t go over the details here.

What is certain is that a falling dollar is a good thing for most of the world as it lowers the weight of their liabilities. Most countries have debt labeled in dollars, so when their currency - which they can print, gets stronger, they can refund those debts or contract more at a more reasonable price.

A weak dollar is a condition for international equities to shine. In pair with lowered interest rates - which might happen, and access to energy - which is not much an issue lately with oil prices falling.

Might happen, might not. But I continue to preach for international exposure in the current conditions. Being 100% allocated to U.S. assets seems unconscious in my opinion, with Asia being my bet, but Latin America could also do wonders.

Exposure outside of the U.S. doesn’t necessarily mean buying foreign equities, but being exposed to assets having a huge chunk of their revenues from those regions.

Watched Stocks and Portfolio.

Hims & Novo Nordisk.

We talked a few weeks ago about the partnership between Novo & Hims, allowing the second to sell the first’s branded GLP-1 solutions on its platform, which was bullish, not for the product itself but for what the partnership implicated - trust between the companies & acknowledgment of Hims’ compounding business.

Here’s what I said then.

“[This partnership] diminishes the risks of Novo suing Hims for pattent infringement - you usually do not partner with someone you’ll sue.”

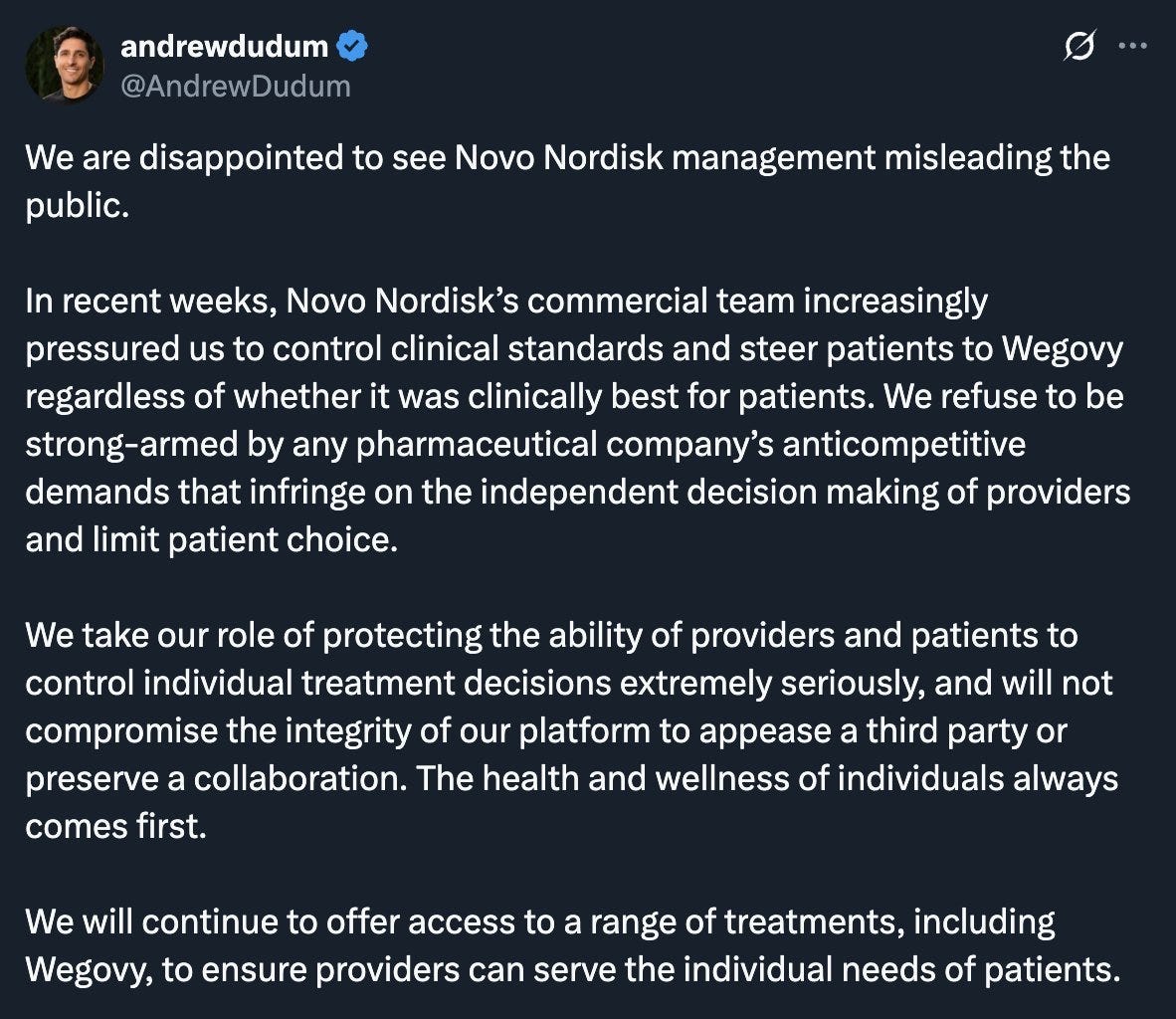

The honeymoon is apparently over as Novo broke the partnership with strong words for Hims’ management & service.

"We will work with telehealth companies to provide direct access to Wegovy® that share our commitment to patient safety – and when companies engage in illegal sham compounding that jeopardizes the health of Americans, we will continue to take action.”

Andre Dudum, Hims’ CEO, answered those allegations with his own statement, which in my opinion gives much more color.

It seems that most of the issues come from Hims’ compounded product and the way Hims privileges it above Novo’s products. The partnership was meant to distribute Wegovy, not to offer it as an alternative to Hims’ in house compounded product.

This seems to be the source of the disagreement: Novo wanted this to stop if only for Hims to advertise Wegovy first while Hims wanted to continue its own business. Both opinions seem understandable.

The implications of this breakup are pretty important, especially legally, as the risks for Hims to be sued by Novo for patent infringement or missleading advertising just skyrocketed after such allegations.

And Hims doubled down a few days after this breakup by advertising even more their compounded solution, which kinda looks like a huge middle finger to Novo.

This doesn’t seem bullish to me. It looks like the last stand of a company that knows its product is not going to be available for long & wants to absorb as much revenue as possible until then.

The truth remains that Hims’ compounded solution is legal because of a loophole, a gray area in FDA regulations not meant for those kinds of products and which could change. It would take time to make it happen, but it could.

In brief, the relation between Novo & Hims clearly worsened, and lawsuits are more probable now than ever. It is impossible to know how long it would take, the reasons for the lawsuit - advertising or compounding, who would win & what could be the consequences, or even if Novo would take the risk to sue but either way, lawsuits would be terrible for the stock of both companies, and that’s what matters.

It wouldn’t change a thing to Hims’ fundamental bull case - to bring convenience & ease to wellness care through a personalized service. But it could drag the stock down for years.

I am personally holding my position but might trim slightly, if only to get my original investment back as the position is still up triple digits even after this week’s dump. I didn’t really make my decision yet, but I will not close the position entirely.

It’s all about risk management & probabilities here.

Google AI Usage.

YipitData confirmed this week that Gemini added 13M new users MoM - more than ChatGPT during the same period. I shared many times that Search was not dying; usage was simply shifting from old tools to new ones.

This is what starts to be seen in the data. Google is not dying & will emerge, in time, as an AI leader. That’s my conviction.

Compute is Changing.

Google convinced OpenAI to use its in-house GPUs - called TPUs, “in a meaningful way” which is a big step for the company & for the GPU industry at large.

Nvidia has been the king for any kind of compute need with AMD being used some times, but if Google was capable to convince a customer to use its TPUs, it means they proved that they propose equivalent performance - at least for a marginal use, for lower costs. It means the entire industry might be shifting from the king to cheaper but efficient enough infrastructures for some AI usage.

There have been rumors for long about this potential shift, and this compute demand should have gone to AMD if we were to believe social media. But it seems there is another player in town.

Less performant but less costly infrastructures apparently have a use nowadays.

Uber Advantage Mode.

Uber launched its advantage mode this week.

I've had few discussions with Ubers & most of them complained that good behaviours were not rewarded, until now as this mode will boost revenues of good drivers.

Drivers meeting those conditions.

Cancellation rate of 8% or less

Star rating of at least 4.85

Driving Insights score of 75 or more

Will access to those upgrades.

5% more earnings per trip on UberX and other non-premium ride types.

More Exclusive ride requests

Priority for Trip Radar matching at airports

Something will should have existed long ago and is only available in some U.S. cities for now, hopefully more broadly soon as this kind of incentives will boost quality & good driver supply for the platform.

Mastercard & The Stablecoin Frenzy.

The payment giant is going to push & work on adopting stablecoins globally & make them available for their clients.

As I shared in my Circle investment thesis, stablecoins are going to be really important for the future of payment, and every company will work either to emit them or include them as a service.

The winners will win big.

Tesla Self-Deliveries.

This should not be big news as we’ve been waiting for it, but it finally happened: A Model Y drove itself from the factory to its owner.

Pretty cool, right?

I think we should acknowledge that, sure, Tesla has competition when it comes to ride-hailing autonomous vehicles. But it has none when it comes to self-driving for households. It’s not perfect yet. But perfection is not the objective; better than humans is, and we’re closer than ever.

This is my bull case for Tesla.

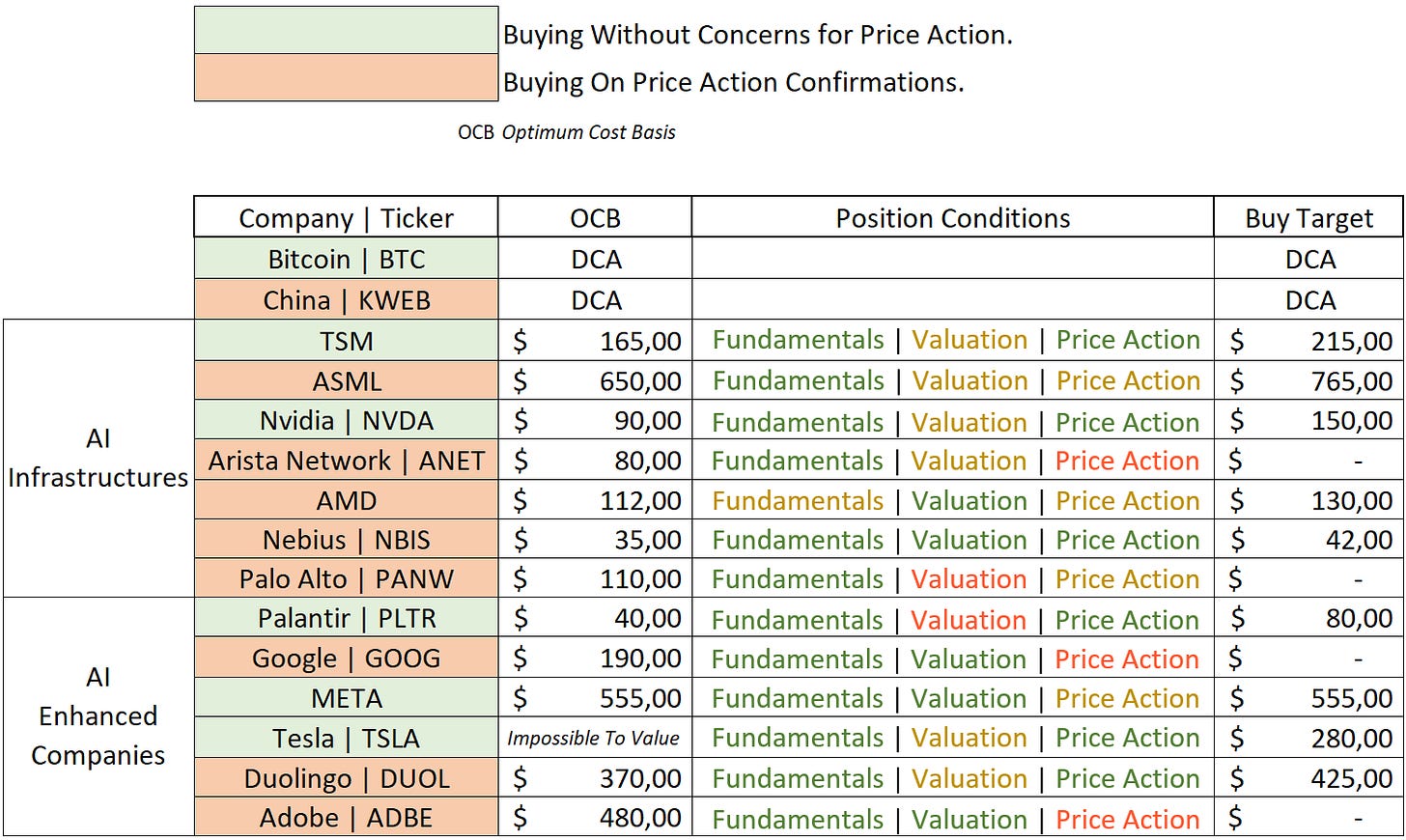

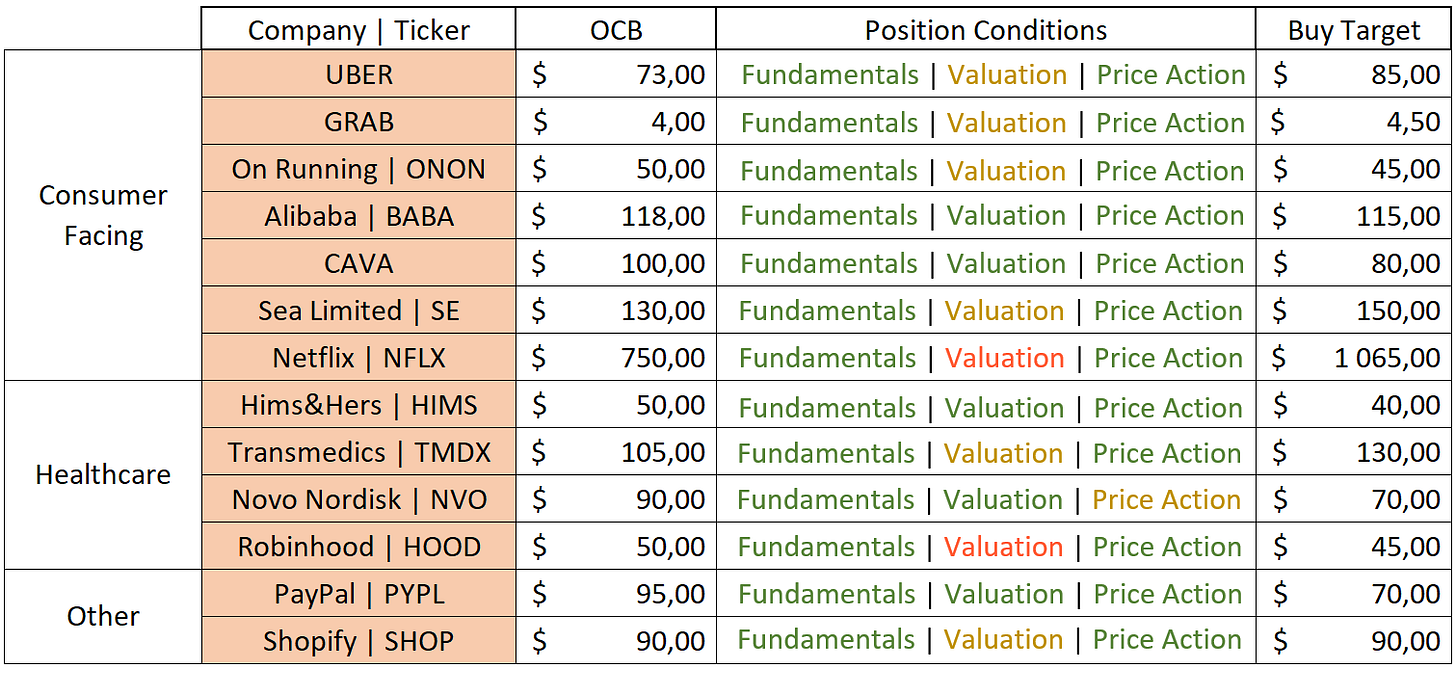

Weekly Buying List Update.

Lots of modifications in the buying list as price action moved a lot over the last week. Here is my watchlist and the stock at which I would buy each - “Buy Target” and the average I consider to be fair based on the latest data, and wouldn’t cross for my long term positions - “OCB”.

As usual, more details on price action in the welcome write-up.

I like it!

I'm glad! Thanks a lot!