Welcome | Everything You Need to Know.

Investment Strategies, Portfolios, Important Write-Ups, Watchlist, Buying Price Targets, Detailed Charts, Trade Plans & More.

Here’s your onboarding onto our journey to beat the market & generate wealth.

If you’re seeking clarity to navigate the markets, arguments to control your emotions, clear execution plans to guide your investing or precise, data-driven summaries to save you time, you’ve found the right place. Everything you need is right here.

Get ready to dive in. Hit subscribe & let’s conquer the markets.

This write-up breaks down what you’ll get by subscribing - the content I deliver & the strategies I use to generate alpha, plus my investing plan for each stock I follow - my current watchlist, buy targets & up-to-date charts.

I’ll pin this write-up to my profile & update it regularly for you to always have access to fresh information. You guys can come back whenever you need to find my buying targets, trade setups, must-read write-ups or review my investing strategies, updated with the latest data.

Your journey to outperformance starts here.

On an unrelated note, if you are interested by a subscription on Fical.AI which is the best platform for any investing KPIs and the one I use on all my write ups, please consider using my referal link & get 15% discounts!

https://fiscal.ai/?via=wealthyreadings

Substrack & Objectives.

Here's what you can expect from your subscription - everything is free for now.

In brief, a complete & regular follow-up of the best assets with clear and transparent strategies & trade execution in order to beat the market with confidence.

Few deep macro reviews per year to have a broad idea of the economy’s health or the geopolitical situation & how those could impact the markets. I always invest but am being more cautious in certain conditions & more aggressive in others.

A detailed investment case for every company on my watchlist, including a review of the company's fundamentals, financials & potential in order to know what we own & build convictions. These write-ups are the base of my investing strategies as I only focus on strong fundamentals.

Quaterly earnings detailed review of every company on my watchlist - and some more, in order to control that the investment thesis is progressing.

Portfolio modifications to share my swing & option trades - on the day I execute them, with the detailed reasoning & plans.

Weekly news every Sunday, where I detail the important subjects of the week on the macro, important subjects & companies I follow.

More. Some event reviews, portfolio & performance reviews, clarification on trade or execution, economic principles, or anything I feel like talking about & can bring value to our journey - always centered around investing/economy.

If that feels like something you’d be interested in, you just need to click below.

Everything is free for now as I consider that good content is not enough to deserve monetization, but performance is. Everything will remain free until I prove, through trustworthy tools - SavvyTrader & my option portfolio, that my methods beat the market & I can help you achieve above-average returns.

My content will be monetized through subscriptions once proven valuable.

I have no clarity on when, how nor for how much yet, but most execution content - portfolio management write-ups, SavvyTrader portfolios & buying targets, will very probably be behind a paywall at one point.

Once again, everything is & will remain free until I prove myself. I just want to be as straightforward & transparent as possible on where we are headed.

Important Content.

Portfolios.

I update three different portfolios based on two different strategies.

Buy & Hodl.

DCA portfolio with monthly liquidity injection. Long-term positions on the strongest fundamental assets with a focus on valuation & price action for buying. Trimming on overvaluation or to de-risk, only closing positions if my bull thesis is invalidated.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Active Management.

Fixed starting amount, focused on swing trading on the best possible setups only with options & shares. The shares portfolio is available here.

https://savvytrader.com/wealthyreadingspro/active

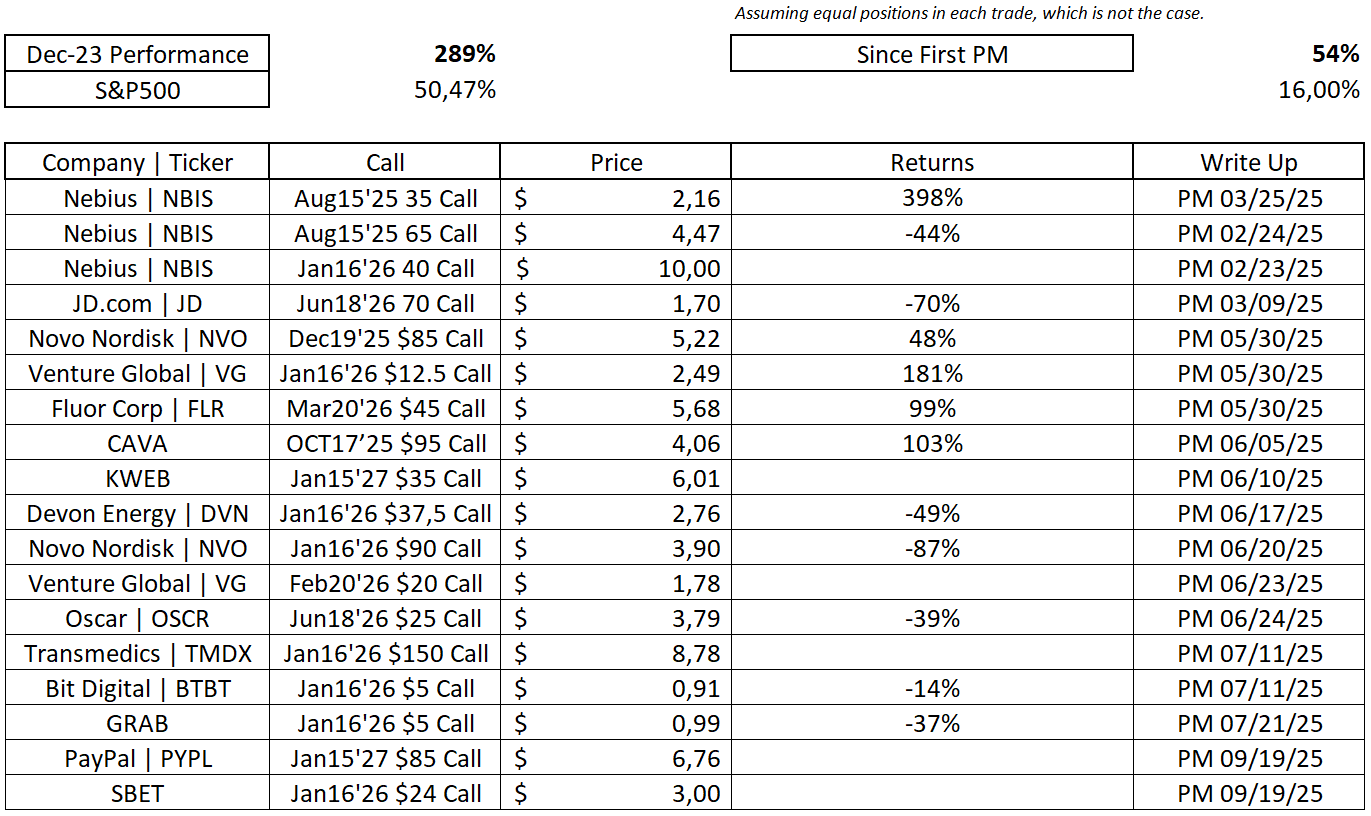

The option account is my personal portfolio, here is the actual composition & perf - I share it on every portfolio modification write-ups.

Updated 09/20/25.

Write Ups.

Here is the important content to understand my actual position & view of the markets which is pretty bearish as I personally expect a recession before end of FY26 & a market correction in the same timeframe.

My Investment Method.

I will try to detail my investment methodology as clearly as I can, but I can resume it in a few words: go big to buy & hold great companies when their stock goes up. There is a huge misconception in investing that falling stocks give great opportunities, I could not disagree more. We make money when our stocks go up, not the contrary, so we should focus on those.

If you prefer visuals.

In words.

Before everything comes macro. I always buy stocks, even in uncertain conditions, but macro impacts the way & the amount I buy or trim. It's important to have a big picture so we are not emotionally impacted during volatile periods.

Focus on fundamentals. I look for strong fundamentals & simple business models. If anything in a company's fundamentals does not please me, I move on. I am binary on the assets I want to own as it is always better to own more of an excellent company than to settle on good companies because “why not”.

Less is more.

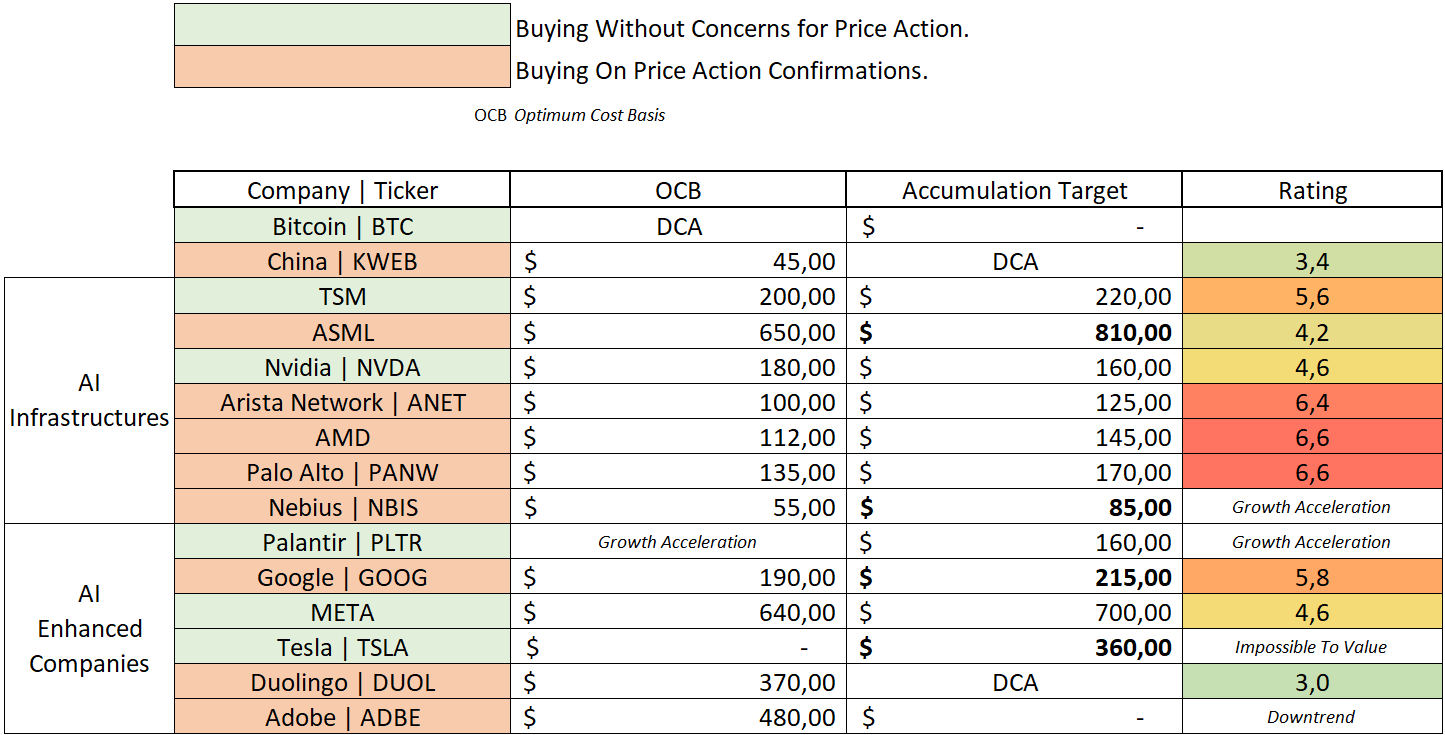

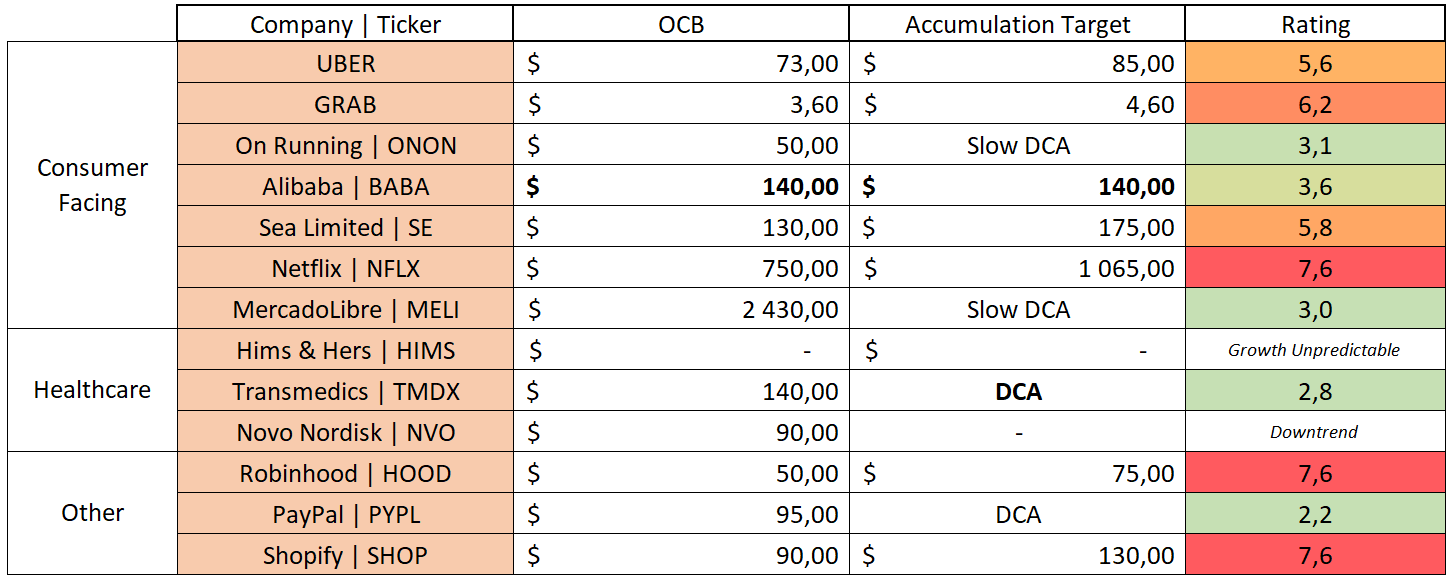

Second, valuation. I have a simple framework based on revenue growth, margins and fair multiples to estimate the price of a stock in 2 & 5 years and therefore the best buy price possible to return more than the S&P500 - the optimized cost basis (OCB).

It doesn't mean I cannot buy a stock which price trades above my OCB - again, I love to average my stocks up. It means I need my average position's price, my cost basis, to remain around this value, which I update every quarter with fresh data.

Third, price action. I only buy positive price action. Uptrends or ranges with bottoms set in long timeframesy. I focus on buying the low points of any healthy range & the breakouts/retests of any uptrend - the regions marked as support on my charts.

Here’s a visual with yellow dots being what I consider to be perfect buys.

The black box represents the first higher low after breaking the downtrend, indicating that the market is probably done with the selling so we should start buying the range. Every other purchase is a retest of breakouts - resistance which turn into supports, the best confirmations of bull trends & the best way to average up our position, focused on keeping our average below the OCB.

Why don't I buy downtrends?

Downtrends are the market's way of telling you that something is wrong. Sometimes, the market overreacts but other times it understands things that we don't and price action is the only way to notice it.

If you missed something & bought the downtrend, you will end up owning degrading fundamentals. If the market were wrong, you still could go through quarters or years of underperformance until the market realizes its mistake. You also take the risk that fundamentals degrade during your holding period, and what should have been an overreaction is now a real fundamental issue.

The markets do not care about valuations during downtrends and stocks can go really low, much lower than what analysts’ predictions think. It is 99% of the time better to observe & wait for price action to stabilize than to buy the downtrend and waste liquidity & performance on a falling knife.

Whatever the reasons, I personally see no point in buying a stock which isn't in a clear range or in a bull trend as at the end of the day, our objective is performance. On the other hand, good price action must be rewarded. When the conditions to buy are met, it is important to go big not to miss opportunities.

I see no point in buying downtrends for anyone focused on performance.

In brief, I am very strict with my buying process and not many companies meet all criteria at any point in time. But when they do, I know the conditions are perfect to buy & to buy big.

Watchlist & Buying Prices.

You’ll find below my watchlist with my optimized cost basis for each stock & my buy target based on price action - to average up.

Optimized Cost Basis (OCB) - optimum average price for a long term position.

Accumulation Target - buying target based on price action, to average up.

Rating - Buy < 3.5 < Hold < 7 < Trim.

“(Slow) DCA” - trading at proper conditions to open a position or accumulate.

Bold cells are updates compared to last week.

Updated 09/20/25.

The spreadsheet is very insightful. I am stealing the format!

Very comprehensive.. Appreciated!