Economy & Macro | The Markets' War

Detailed Macro Situation Review & Portfolio Modification.

Bit of a special write-up today. I wanted to detail what was happening in the markets, share my view on it & detail how the active portfolio is positioned to stomach what is probably coming.

I comment on it because I find it all very, very interesting & exciting, and I believe it can interest some of you, but keep in mind that most of my liquidity is following the plan I shared with you a few days ago.

Boringly, steadily, I buy assets, focusing on my favorite ones while keeping most of my cash aside as I continue to think that we’re going lower the next months.

This write-up is about the economy, about how the world’s powers are starting a real trade & economic war with the markets as their battlefield. A situation we’ve probably never seen before and which is fascinating for the nerd that I am.

We live in really exciting times.

Treasuries & Yield.

I shared last week that my understanding of the tariffs was nothing but a plot to scare the markets & lower treasuries’ yield. A plan which worked well, until Friday... Since then, the markets understood the situation the U.S. was in and decided to punish them for it.

As a result, the yield which closed on Friday under 4% for the first time in months, is now back to 4.5% at the time of writing, with no signs of the surge slowing down. This translates into billions of dollars more to pay to creditors, it isn’t just a chart without any consequences. It’s the real deal.

Many people have different opinions on what is hapening, I’ll share mine today.

In my book, the story written is one of a U.S. president who thought he had the cards but clearly underestimated who he was playing against and the market at large. His bluff backfired & puts him now in an insufferable position.

The Global Trade System.

Our modern system is pretty simple, or can be simplified. One country emits a reserve currency that all others use for their trade & financial institutions. In our world, this currency is the dollar, and everyone uses it.

In the monetary world, if everyone needs a currency, it means this currency will be one of the strongest ones as all day, every days, other countries sell their own currency to buy the reserve one, inflating its value compared to theirs. This mechanism is the reason why Americans have such strong buying power, because the dollar is constantly being bought while others are constantly being sold.

This is the perk of being the global reserve currency. You’re strong.

The inconvenience is that having a strong dollar also means producing locally is much more expensive. Say I am Tim Cook, Apple’s CEO, and I need to manufacture iPhones. If I were to build factories in the U.S. and hire American workers to build my product locally, I would pay in dollars and sell in dollars. But if I build my factories elsewhere, I will first have the perk of paying in a less strong currency - I will save money on this already, but also pay for everything cheaper - very much cheaper, because the demand elsewhere isn’t equivalents to America’s buying power.

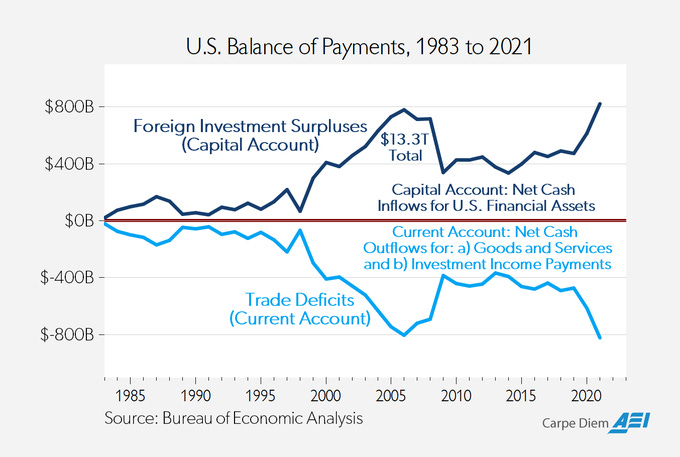

This is a part of the Triffin paradox & explains why global reserve currencies are always pushing their industries away, because it is cheaper for them to buy from oversea than to produce locally, for everything. And this is why the U.S. have a deficit with most countries they trade with.

As a consequence, the U.S. became a financialized economy while other countries - those which used their cards right & accepted to be paid for hard work, became industrialized. I detail this on my China IC.

The U.S. need goods, preferably cheap goods, which can only be done outside of the U.S., while the world needs dollars. And this is how everything is balanced.

In exchange for those cheap goods, the U.S. provides a stable currency. When the U.S. buys those goods, the sellers purchase American debt - treasuries, and all other kinds of financial assets. In brief, what the U.S. loses in their trade deficit, they make up for it by liquidity inflows into financial assets - especially treasuries.

I share this because things have been changing these last days, and it’s important to understand how it is supposed to work when things go well. Also to detail why I said many times that Trump’s rhetoric was completely wrong to start with, as his argument for tariffs was that the U.S. was being “ripped off”, Which is factually wrong, at least if you look at the global picture.

Treasuries & Stocks Correlation.

I shared some months ago the difference between assets to compose a good & stable portfolio, and said that gold & treasuries were the best assets to own during troubled economies or recessions - which usually go with deflation.

The correlation has been almost perfect for the last two decades; every time we had economic issues or slow down, stocks fell while bonds & gold rose.

It is easy to explain why: during tough or uncertain times, investors prefer to put most of their liquidity in “safe” assets, as if companies sell fewer products & stop growing, you do not want to own their stock.

And this should be the situation we are headed toward right now. I’ve shared for months that the economy was already sluggish, but it got worse after Trump took office and worse again with his tariffs.

As of the time of writing, Trump came back on his tariffs reciprocal decision - which made no sense as I said many times, and gave a 90-day delay to make deals, except for China. And this is the mistake. Before detailing why, here are the actual tariffs in place & effective today.

10% tariffs on all countries globally.

25% tariffs on automobile imports to the US.

25% tariffs on steel and aluminum.

25% tariffs on imports from Canada and Mexico.

145% tariffs on imports from China.

As I said, the economy was already sluggish, so this is more than enough to plunge it into recession for sure and rapidly. We’ve already seen some Chinese products being removed from shops or prices being increased, and this won’t help consumption nor American buying power & confort.

And yet, the markets do not behave as they should.

Who Has the Cards?

So, if we follow, up to here, a normal behavior would be stocks down, gold up & yield down. What we have is stocks down, gold up & yield up. There is a flight to safety, but to only one asset: gold - which I called the best assets to own if tariffs & Doge went all in back in November. Yields going up means there is a strong selling pressure on treasuries, and this is a very big problem.

Why?

Because, as I shared last week, America’s debt depends on this specific yield, and as long as it remains high, the U.S. is bleeding money they do not have.

The question remains: why is there such a strong selling pressure on this market while the actual conditions should encourage many to fly toward it, not from it?

My personal answer is simple: Trump picked a fight, or more precisely, tried to bully his lenders and those got pissed, flooding the market with treasuries. The selling pressure is pushing the yield higher every day, and the situation is simply unsustainable for the U.S., who will have to cave sooner or later.

As to who is selling, I have no certainties, but I personally have only one name that comes to mind with the shoulders and balls big enough to have a face-off with America.

The music changed at the White House. We went from speeches like.

“We can’t continue to allow China to rape our country, and that’s what they’re doing. It’s the greatest theft in the history of the world.”

This kind of narrative went on for a few days. The 10Y continued to rip. It changed to.

“China wants to make a deal. They just don’t know how quite to go about it. You know, it’s one of those things they don’t know quite – They’re proud people.”

To which, a few hours later & some more points up on the 10Y, China responded.

“We must solemnly tell the US that a tariff-wielding barbarian who attempts to force countries to call and beg for mercy can never expect that call from China.”

Today, strangely, as the 10Y continued to rise higher.

“White House says President Trump is open to making a deal with China.”

But China isn’t picking up the phone yet. If you didn’t know who had the cards, I’m sure you have an idea by now, and this is pretty impressive as we are seeing a clear shift of strength in the financial world right in front of our eyes. It’s hard to know what the consequences of it will be, but the world has changed really rapidly over the last years, even months.

And it continues to do so.

What Now?

The market is clearly aware of what is happening and waiting for a resolution, which could come in different forms.

A deal with China, with a probable cancellation of the tariffs but most importantly, anything for them to stop selling treasuries. My personal interpretation is that they have all the leverage they need right now, which will make it hard to Trump...

The Fed steps up, which wouldn’t be a great thing as it would force them to take special actions to buy treasuries. Without any communication with China, they’d simply enter a liquidity war, and it would hurt everyone even more.

Something breaks, which means some debts cannot be paid or some institutions go under because of the actual pressure on the market. It’s by definition impossible to anticipate where or what, but that would mean nothing’s been done for long and I personally don’t see it happening. It would probably create the first intentional financial crisis triggered by a stubborn government.

While all of this unfolds, the stock market is not dumping anymore because everyone is expecting a rapid resolution & betting on it. Any deal on tariffs with China should fire up the markets, both U.S. & Chinese like a few days ago when Trump canceled the reciprocal tariffs. The narrative would certainly be that if those two were to talk it out, we could avoid a recession hence the panic is unjustified. The FED stepping up would mean liquidity injections to some extent, which would please the market but it would also mean potential inflation with the definite end of QT…

What is for sure is that the market isn’t healthy right now & something is going to happen. We simply do not know what & everyone is putting its chips on its guts feeling. Lots of speculation.

Portfolio.

I tried to position the portfolio as well as possible for this situation, following what I wrote & shared above with the portfolio composition write up.

As I believe a deal with China will - has to, happen, and I believe China has the upper hand, I now have a very strong position in Chinese equities with KWEB and Alibaba. It was a possibility for Trump not to give them the calls, but he’s shown these last days that he wasn’t stubborn enough to break everything, between him coming back on the tariffs after failing to pressure the treasury market and him coming back on his word to wait for China’s call… He shouldn’t be as responsible as we believe, and if China were to have its way, Chinese equity would love it.

China has another alternative, as their economy is actually in deflation or close to it. They can easily stimulate as we’ve talked about a lot, to compensate for the loss of the U.S. market - or potential loss. This would probably push equities higher, not a very healthy pump though. But they have tools to fight this out, more than the U.S.

I also kept some U.S. blue chips as I believe stocks will fire if a deal is reached. This is short-term as I still believe a recession is coming, no matter what, but both Google and Meta are pretty cheap right now and as the market expects the bounce, those two might be winners if we have a relief and a “recession canceled” moment after a potential Chinese deal.

Lastly, I grew my defensive part with treasuries myself as, once more, if a deal is made, China won’t be dumping anymore and the fear of recession in time will bring liquidity back onto them. This will also be true if the FED steps up & injects liquidity.

While gold is here to stay as long as uncertainty remains and to be the best asset in this kind of very unknown situation.

It is a balanced portfolio: 30% China, 30% defensive, 30% blue chips with most of the excess in gold. It is possible for a short period of time to see everything pump at the same time. Unlikely but possible. But it is fairly certain that something will give and pump at best two of those positions, balancing the returns until we get more clarity on where the markets will really go in time, and act on it.

That’s all for me tonight. I hope you found this interesting. Feel free to ask questions or to disagree; I’d love to have other opinions and hear other interpretations of the situation. I can’t be sure I’m right - so much is happening behind closed doors. And remember that most liquidity is either way attributed to the long term portfolio, less stress there, there’s no need to take too much risks in today’s conditions.

One thing for sure, I’ll need more popcorn. I’ll see you on Sunday!

Thanks for the write-up! Delicate times..! Looking out how Trump's rethorics change from now on 👀

Vance said in a recent interview that the U.S. borrows and buys from “Chinese Peasants” and “that is not a recipe for economic prosperity.” I’m not sure if he’s ignorant or purposely using simplistic ignorant rhetoric to justify their actions. Seems to hide the fact that you make perfectly clear, the relationship between the strength of the dollar as a reserve currency and the building out of manufacturing abroad and cheap goods. Obviously inflation will weaken the dollar, but does this tariff war and international softening towards U.S. debt pose an existential threat to the dollar as a reserve currency globally? I would tend to think so, and that would be pretty catastrophic for the U.S. economy. The result being probable runaway inflation, and sky rocketing yields for treasuries.