Macro & Investment Narratives

Review of the Actual Macro Conditions.

I’ve written my last Investment Narrative in November & shared my view for the next few months back then. This write-up will take things from there & update what’s needed.

Back in November, I felt confident enough short-term but said things would certainly get tough rapidly, depending on how hard they’d apply their measures - mostly about DOGE and tariffs. Not to send myself flowers, but the truth is I’ve been spot on a lot - except on how hard the government would go.

But don’t take my word today; take my word back then - in November:

“Short term, I am happy with the current market. There are some signs of heat without any doubts, but we’re far from ridiculous & bubbly valuations. I will continue to slowly build my gold & Chinese position, monitor what Trump administration intends to do and research the oil & gaz sector to be ready.

The crypto market is heating and I personally do not believe I will stay in for very long. I intend to get out the second things smell smoke. But we’re not there yet, and I will share with you the day I sell it all.

Medium term, my personal take on Trump’s DOGE and tariffs is that they’re all teeth and no bite, as it is much harder to trigger a recession intentionally than to continue creating debt. I do not expect significant reductions of it nor of its emission rhythm, which means the economy will continue in fiscal dominance, hence a continuous money creation the FED cannot do anything about.

This means a continuous decrease in buying power for the have-nots and the lower portion of the haves, a thriving assets market boosted by liquidity but also a necessary recession at one point - hence the slowly growing gold & Chinese position, as a recession in the U.S. will drag liquidity somewhere else.”

And the market kept giving until February or so, while DOGE went strong from day one and Trump decided that implementing tariffs on everything & everyone was the right thing to do. My go-to strategy was the good one.

Except that, as I shared already, I didn’t follow my own advice, hence the pretty bad - terrible really, performance on the active portfolio over the last two months. That’s what we’re here to talk about & remedy.

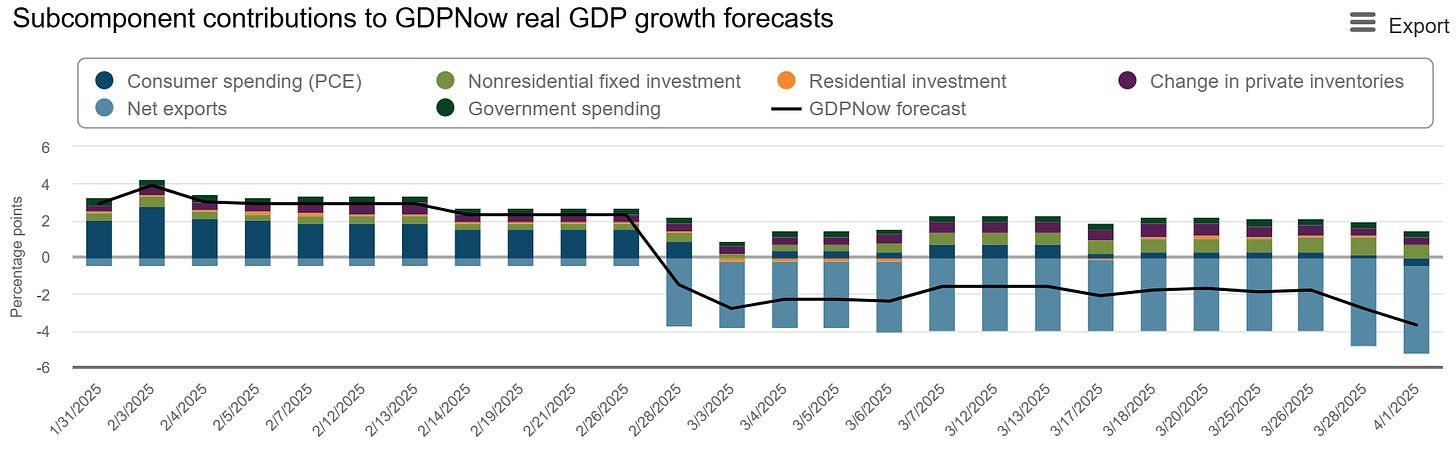

We have new conditions, mostly what I expected, and the market is clearly showing us that it’s had enough. The actual sell-off is mostly due to the uncertainty around tariffs and the proof that Trump and others have no regard for the market while we start to see weakness in some areas of the economy.

So let’s review.

Macro Review.

I won’t go back to the concept of fiscal dominance; it’s an important one & everything is detailed in the previous write-up. Obviously, nothing’s changed - the fiscal policy is still dominant and the monetary policy still doesn’t matter.

Tariffs.

This is something I got wrong - partly.

I personally assumed Trump wouldn’t start by implementing tariffs at a large scale but would focus on solidifying the economy, reducing taxes & growing consumption. In brief, create the conditions to then be tough on tariffs.

But nope. He went all in. Although to be fair, he went all in on its bullying strategy but not on applied tariffs. Before April 2nd, the only live tariffs were 20% on China, 25% on steel and aluminum, and a 25% on everything façade for Canada and Mexico - excluding everything in the USMCA agreement which includes almost everything…

Until today.

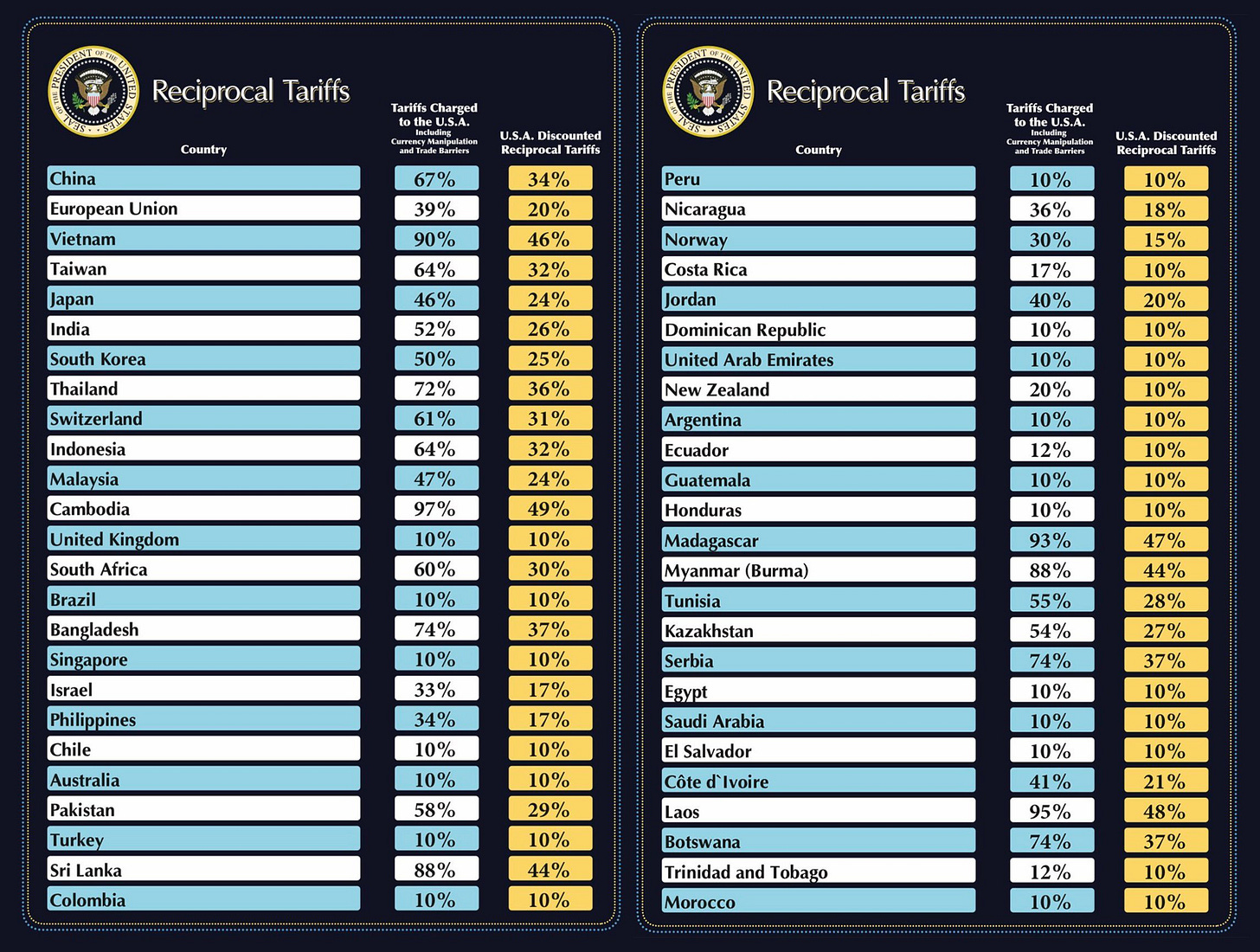

Trump unveiled its reciprocal tariffs plan which is simple enough: A base line of 10% tariffs on everything, to everyone (with some specific exeptions like energy, semis, minerals unavailable in the U.S. or some pharmaceuticals for example) growing up to 50% of what each specific country is applying to the U.S. For example, if China is applying a 70% tariff on U.S. products, so the U.S. will apply 35%. Countries without tariffs or lower than 20% will have a fixed tariffs of 10%.

I have to add that I honestly don’t know where the data comes from. Europe doesn’t have 40% tariffs on all U.S. imports, this is nonsense. Here’s a list of tariffs applied in Europe towards the U.S.

Most tariffs are for protectionist reasons, to raise the prices of products that are also produced locally, to encourage consumers to choose domestic goods, which is why they usually are specific & not global. To my knowledge, no countries apply tariffs to everything - except the U.S. now. We also have to consider volume. It is possible to have high tariffs on products which aren’t much imported & low tariffs on products which are massively imported, which completely changes the average ratio.

It also is really unrealistic to measure 'currency manipulation'. Countries obviously do it - including U.S. using their reserve currency status to raise debt, but it’s impossible to assign a precise value to it.

I have no idea where those numbers come from, but they aren’t real. It seems like a way to justify the U.S. position by making others look worse while the reality is much different in practice. I just had to clarify this.

Here’s some details, to go into effect on the 9th.

It is only a sample as it should be applied to every countries, so you get the idea.

Everything is negociable. If the countries reduce their tariffs, the U.S. will do the same, keeping reciprocity at 50%. The bullying isn’t coming to an end but it is clearer now and we sure will see a lot of news during the next months, some coutries caving, others forming alliances or finding new partners… The game changed.

Trump reiterated that the income from those tariffs will be used to finance tax cuts and other local investments.

As for the consequences, my opinion didn’t change: tariffs are passed to consumers. This is the first part of this report but you will rapidly see that I am not confident on consumers so anything raising final products prices is clearly not bullish. In time, assuming things do not change - they will, currencies will also adapt to the tariffs, while some are simply not enough to change anything - China for example. Short term, more pressure on an already shaky consumer.

This clearly isn’t bullish for the economy, nor for the market.

Inflation.

Inflation is controlled but not back to the Fed’s fictitious goal of 2%, and it won’t be for a while. I continue to believe we will need to learn to live with stronger inflation & struggle to see how the FED can bring it down without significant measures they cannot take.

Fiscal dominance will continue to monetize debt - print dollars, and most of this cash goes to wealthy corporations or individuals who can continue to hire or consume, hence not slowing down total consumption in dollar value, as we’ll see later.

We start to see lower highs & lower lows the last few quarters; the trend is improving, but it’s far from enough. I’d also like to add that inflation is cumulative to last year’s prices. The increase rate is slowing down but in real life, prices continue to increase - just less quickly.

And this continues to pressure most American households & the government, as the market is starting to accept that inflation will take a long time - if ever, to return to 2%, which means Treasury yields aren’t going down significantly hence coorporations & individuals holding bonds continue to get paid.

In brief, I do not believe inflation can be controlled by the Fed - and by "control," I mean reaching their 2% target, and their projection from the last FOMC showed it, with a stable Core PCE inflation for the year. We remain in a situation in which no entity can do anything as their actions cancel each other & none is ready to take a drastic step - like voluntarily crushing the economy. The FED’s work isn’t done yet, but they are already planning to slow down QT & cut rates twice this year. Not because they think they can, but because they have to. Not sure it’ll be enough for inflation to go back to 2%.

I have the same conclusion than in November: We’ll need a recession to do so.

Consumption.

I was making the case six months ago about the haves & have-nots, and we now see it in data. This clearly shows that most consumption FY24 came & continue to come from the highest-income households.

Stimulus checks were sent without any controls. Most of that liquidity either went into consumption or into the market, and those who chose the latter became richer, faster. Then, inflation came; those who could live on their paychecks did while their assets rose in value. As inflation continued & continues, more struggle.

The difference today is that what was a possibility is slowly becoming a given for most market participants, as the strongest retail brands struggle or start anticipating issues. We’ve seen it with Starbucks and Nike for some time; we now see it with Lululemon, which slashed its guidance for the next year. Why? Fear of a lack of consumption.

And they’re not the only ones; many data points the market looks at are reaching the same conclusion.

I also made the case in the last write-up that most consumption growth since 2022 was due to inflation, not consumption in terms of products or services volume. You can imagine that nothing has changed today - on the contrary.

Doge.

The second thing I was wrong about - I called it “all teeth and no bite” but they did bite. Not too much, but more than expected.

According to their official websites, the Doge cut the equivalent of $140B through various initiatives - contracts, grants or lease terminations, workforce reductions (estimated at over 20,000), and other readjustments.

As I’ve said many times, this money - whether legitimate or not, isn’t injected into the economy anymore, which isn’t a good thing at the end of the day.

We have to see things from two different perspectives. It’s terrible to see taxpayers’ money wasted, stolen by corruption or else and every citizen would love to have an efficient government with controlled expenses. But from a market perspective, any liquidity given to households is good as it grows consumption, investments or else. Things which are a net positive for an economy.

Cutting those expenses means cutting someone’s income, for legitimate reasons or not. In the context of everything shared above, it means you’re applying even more pressure on an already pressured economy & consumption. It might be for the greater good long-term, but it means short-term pain.

And to be entirely honest, DOGE is saving on waste, but it doesn’t mean less debt is emmited by Trump’s government. This first trimester saw the highest debt emission per day if we were to exclude the Covid simulus & the interest rate spike in 2023 - which forced the governement to emit more to pay its own debt.

DOGE’s goal is to cut waste & corruption which is a good thing, but I have many times made the distinction between DOGE’s goal & debt emission. They’re not here to slow its emission; they are here to make the use of taxpayers’ dollars more efficient. And that is what they are doing.

As for the actual situation, the U.S. is pinned down by its current debt and that will be tough to change short term. Their number one spending category is social security - which cannot & will not be touched, Trump said it and confirmed it today again. Their second is the interest on debt. And the only way to pay for it is to issue more debt.

We’re talking about $36,674,167,400,000 at the time of writing. Currently paying around 3.3% interest as the debt is composed of different time frames treasuries, we’re talking about $100,000,000,000 per month. After a quarter of work and the elimination of the most obvious useless spending, DOGE has saved a month of interest while the government issued more debt than the year before, on which it will have to pay interests.

Doge is interesting & valuable. But it isn’t significant, we’d need easily ten times that to finally start to make a difference. The U.S. was built on debt, and this cannot be changed, even with initiatives like Doge.

Fiscal dominance cannot be reversed.

My take remains the same as when I first commented: if Doge were to go all in, they’d hurt consumption, liquidity & tons of jobs, certainly pushing the U.S. into a recession.

I still believe it today.

Labor Market.

No data is perfectly accurate, but I think it’s pretty safe to say that the labor market has been fairly stable over the last year, even including governmental positions impacted by DOGE.

Although on the other end, U.S. unemployment continues to bounce, printing higher highs & higher lows, which is also normal in conditions of liquidity tightening. The trend isn’t encouraging but we still are within an acceptable range.

The market has been really resilient and it is what’s pressing the Fed to continue its tightening as long as inflation isn’t tamed & back to their 2% final target.

Credit Default Swap.

First, what are they? I’ll use Grok’s definition.

“A credit swap, more commonly known as a credit default swap (CDS), is a financial derivative contract between two parties designed to transfer the credit risk of a specific debt (like a bond or loan) from one party to another.”

In brief, they are contracts I can buy to offload part of a debt I am uncomfortable with. I would pay a premium in exchange for a compensation if the risk materializes - typically a default on the debt.

The chart below shows the spread (difference) between a basket of CDS and risk-free Treasuries. As the CDS premium grows, it means most market participants are getting nervous & demand a higher premium to protect buyers in case something happens - like a recession, forcing the company to default on its debt. It’s a great indicator of the market’s perception of the economy.

I never talked about these because they were healthy in November, but they finally started rising not so long ago, which tends to confirm that the market - or at least part of it, is expecting some turbulences.

It’s still very reasonable compared to historical levels, but we’re definitely starting to see a first higher high, which highlights growing concerns.

Macro Conclusion.

The situation isn’t better nor considerably worse since November. What changed the most is the perception of the economy by market participants, as my assumptions start to materialize in data & signs that consumption is starting to slow down.

The first guilty of it is inflation, which came from the enormous stimulus during Covid which the FED nor the government can leash. Add to this the enormous & growing debt that the U.S. need to keep contracting to pay for their own interests. Interests which remains high because the market believes inflation won’t slow down. And inflation isn’t going down because of the constant liquidity creation from fiscal dominance - to pay the actuald ebt, which goes to the pocket of companies & individuals which use it to consume or hire… Hard to find a solution for those intertwined problems. Although I have a one.

A (forced) recession.

Slowing the economic cycle would force companies to lay off employees, reduce global consumption & push most companies to cut production. This is how you fix inflation, by slowing money’s circulation. Reducing inflation is step one to lowering Treasury yields, thus reducing U.S. interest costs, decreasing the need for debt & making it possible for entities like DOGE to work & optimize spending, effectively reducing debt.

This is what the Fed’s Quantitative Tightening was supposed to do. It didn’t - or not enough, because of fiscal dominance - this mechanism of funneling money to a few big players who can sustain the economy even if most struggle. It was enough to bring inflation down slightly, but it wasn’t sufficient. And it showed that the Fed simply cannot do it with its tools.

The second problem is that a recession could work, but it also requires the U.S. to let Schumpeter’s creative destruction play out. Historically, the government has bailed out failing businesses, taking their debt onto its shoulders to avoid repercussions. A recession could be enough to fix the current problem, but bailing out companies would just postpone today’s issues into the future. If the goal is to address the debt, they can’t keep doing this.

The only alternative I see besides a recession is a constant fight to keep consumption strong. This would require liquidity injections and would reignite inflation - which is what we need to fight in the first place. It would be excellent for the market short term, though, but it seems far-fetched to imagine a liquidity boost in the current conditions - and the Fed is clearly against it. It would need to come from the government, and they’ve given no signs of such a move. But who knows?

This is how I position myself, and I struggle to see any outcome other than recession. As for when… Impossible to predict. It could come naturally as consumption slows, or be triggered by tariffs for example. But I don’t see a way around it - probably sooner rather than later.

Hence this write-up.

If the recession were to happen, or if the market were to go lower for a long period of time, what matters is to know how we will manage it. My opinion is that anyone with the capacity of investing monthly should hope for this to happen. Many have called for “generational opportunities” in the market lately; they’re wrong. But if we do fall, have a recession as I believe, we will see those opportunities.

I personally dream of them.

Headline Driven Market & Geopolitics.

Cherry on top, Trump came back on office with its bully tactics, screaming to the world that it’ll have to pay to access the U.S. consumer - who is hurting already. I focus on the economy but we also have to consider the geopolitical impacts of his methods & bold claims - whether true or not, truth doesn’t matter in geopolitics, only perception does.

“They can't come in and steal our money, steal our jobs, take our factories, and take our businesses and expect not to be punished. They’re being punished by tariffs.”

It’s always hard to know what is true, what will be done & what is just bullying. But by doing so, he is bringing instability & complex geopolitical relations with both “allies” & “enemies”, without any distinction.

Some countries or regions rely on the U.S & will have to cave to their demand, even if it hurts their economy as they’d have much more to lose otherwise - hello Europe & NATO. But it isn’t the case for every country and this strategy could very well push some towards rivals - hello China.

This isn’t something the U.S. wants, to see “allies” make deals with China. I’ve talked enough about China so I won’t go over it again, you know my opinion - the country is trying to get away from its dependency towards U.S. consumption, turning its growth internally or towards neighbors.

And I am bullish on them succeeding, which wouldn’t be a good thing for the U.S. and yet, this kind of bullying is helping them. And this is a big deal as if the tariffs war intensifies & some countries side with China, the consequences could be huge.

And it feels like it started already as both governments start to play their mind games. One day Trump pushes more tariffs. The other, Xi says they will block Nvidia H2O imports. To what Trump answers by rising tariffs & Xi answers by forbidding local companies to invest in the U.S., et cetera, et cetera… Their game affects the entire world, but it is just that: a game. With tons of losers & not many winners.

And we have no way of knowing what is true, what will be applied, when this will end or what is coming next. They could continue to say things left & right, creating more uncertainty as a consequence, in the market but also for companies who need clarity to operate - exactly like we had over the past months as many tried to load their stocks to front run potential tariffs.

How do you want to run a business if the two biggest countries of the world change the rules every day? And as a correlation, how do you want the stock market to react to this situation - as this remains the central part of my content?

It’s impossible. And we gotta take advantage of this.

The Two Portfolios.

As I said, anyone young enough with cash flow & capacity to monthly invest should hope to have a recession, bear market or whatever the name given to a potential downtrend or high volatility.

To take advantage of it, with different strategies.

Active Portfolio.

I have made the mistake when I started to put everything in one portfolio.

I had to manage different positions with different objectives the same way. I am changing this & will focus this portfolio on medium/long term swings & trend following on strong fundamental assets, with a focus on price action.

https://savvytrader.com/wealthyreadingspro/activePortfolio

There is always peformance to find somewhere in the market, some assets which are doing better than the S&P500. The goal is to find those assets & to play them right, following the playbook shared here.

It will take me a few months to migrate the actual assets & methodology as I still own some assets which werre meant to be held for the long term - like Hims & Hers. But at term, this is how this portfolio will be managed. Aggressively.

Buy & Hodl Portfolio.

This portfolio will be entirely different.

The objective will be to find the best assets possible for the long term - assets which are unique or with a tremendeous potential, to buy, accumulate & hold for years or decades, only selling if valuation is streched or if fundamentals change.

https://savvytrader.com/wealthyreadingspro/BuyAndHodl

You will receive next week a detailed write up on how I will manage the assets - how I buy & accumulate, which assets are on my watchlist, at what price I intend to strat buying them with an argumented ordre of priority. Everything will be detailed.

I couldn’t add everything on this write up as it would be too long first, but also treating two different subjects.

Bit more patience, I am polishing it.

Conclusion.

We are entering a very unclear period, with lots of unknowns.

This is something the markets hate as to invest, we need visibility but this is also the periods during which wealth can be created. Anyone investing regularly in the best assets during bear markets ended up much richer a decade later. What matters is to have a plan, a stomach, to work & to remain consistant in order to distinguish the companies which will emerge stronger.

My personal opinion is that we will enter one of this period. It might be short, like during covid or the FED tightning period in 2020 & 2022 respectively, or it might take longer if something breaks like in 2008 for example. I also can be entirely wrong and nothing will happen, the government will try to bail with more debt & assets prices will continue to rise. I prefer to plan for the first scenario as it seems to be the more likely, but there is a reason why we shouldn’t entirely get out of the market: we can never be sure of what will happen.

What matters is to have a clear plan. I shared my vision of the economy with you now, what I believe will happen & I will share my plan with you next week for the buy & hodl portfolio, while continuing to keep you in touch regularly for the aggressive portion of my investing.

Market is about grinding. So we’ll keep grinding. To beat the S&P.

Thanks for the thoughts!

Unbelievable speed in publishing this article!