On Running Q2-25 | Earning & Call

On clouds.

If you guys are interested, you’ll have 15% discount on FiscalAI subscriptions through my referral link. FiscalAI is the tool used for KPIs on all my write-ups, really powerful, valuable data & great UX.

https://fiscal.ai/?via=wealthyreadings

Everything you need to understand Nebius' bull thesis is here.

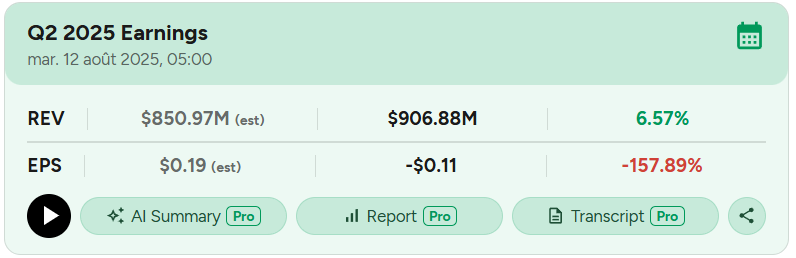

Do not worry about the massive EPS miss; everything will be explained.

What truly excites me is that we're not just creating footwear, we're building iconic franchises. Don't expect us to swim in a sea of sameness. We're going to do it highly elevated as a premium brand and very distinctively.

Business.

The quarter can be resumed by this simple sentence from management, but I will go a bit deeper than just this, which is obvious & was expected.

We saw strength across every region, channel and product category

But yes, On continues to impress, its brand grows all around the globe, for any kind of activity from performance sports to leisure & even lifestyle and for every age, with a large focus on young adults - a great demography as long-term customers.

We started in running, but we successfully expanded to trail, outdoor tennis and training, moving us closer to our vision of being the most premium holistic sportswear brand.

Product & Channel Mix.

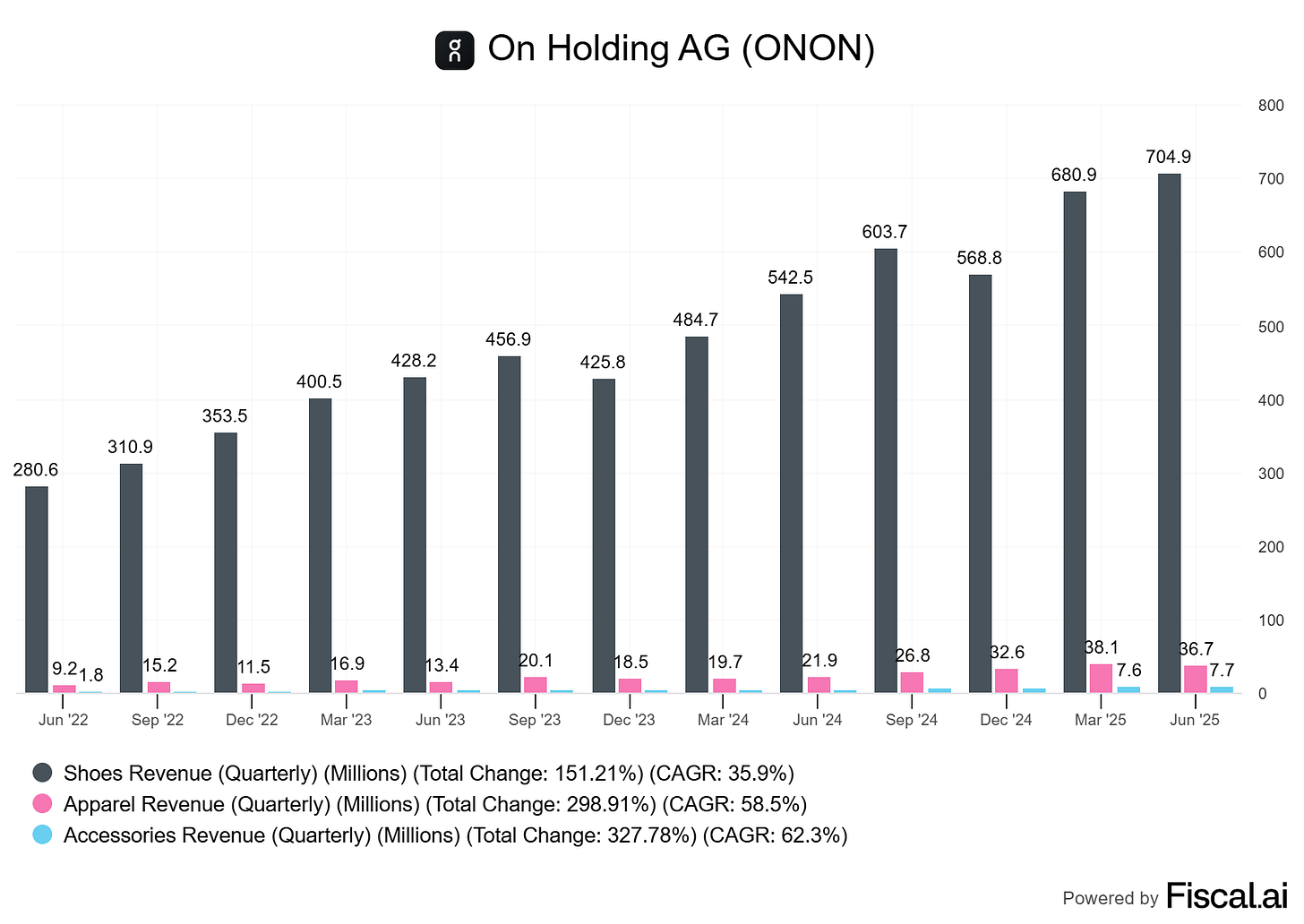

Shoes continue to drive revenues, but we start to see a growing demand for apparel & accessories - the sign of a growing brand & not only appreciated products.

I mean, we're seeing an incredible energy in apparel and that's driven by wider scale adoption of apparel in addition to footwear. So what we're currently seeing is that also first and second time buyers of the brand are very aware of apparel and they're adding kind of apparel to their basket

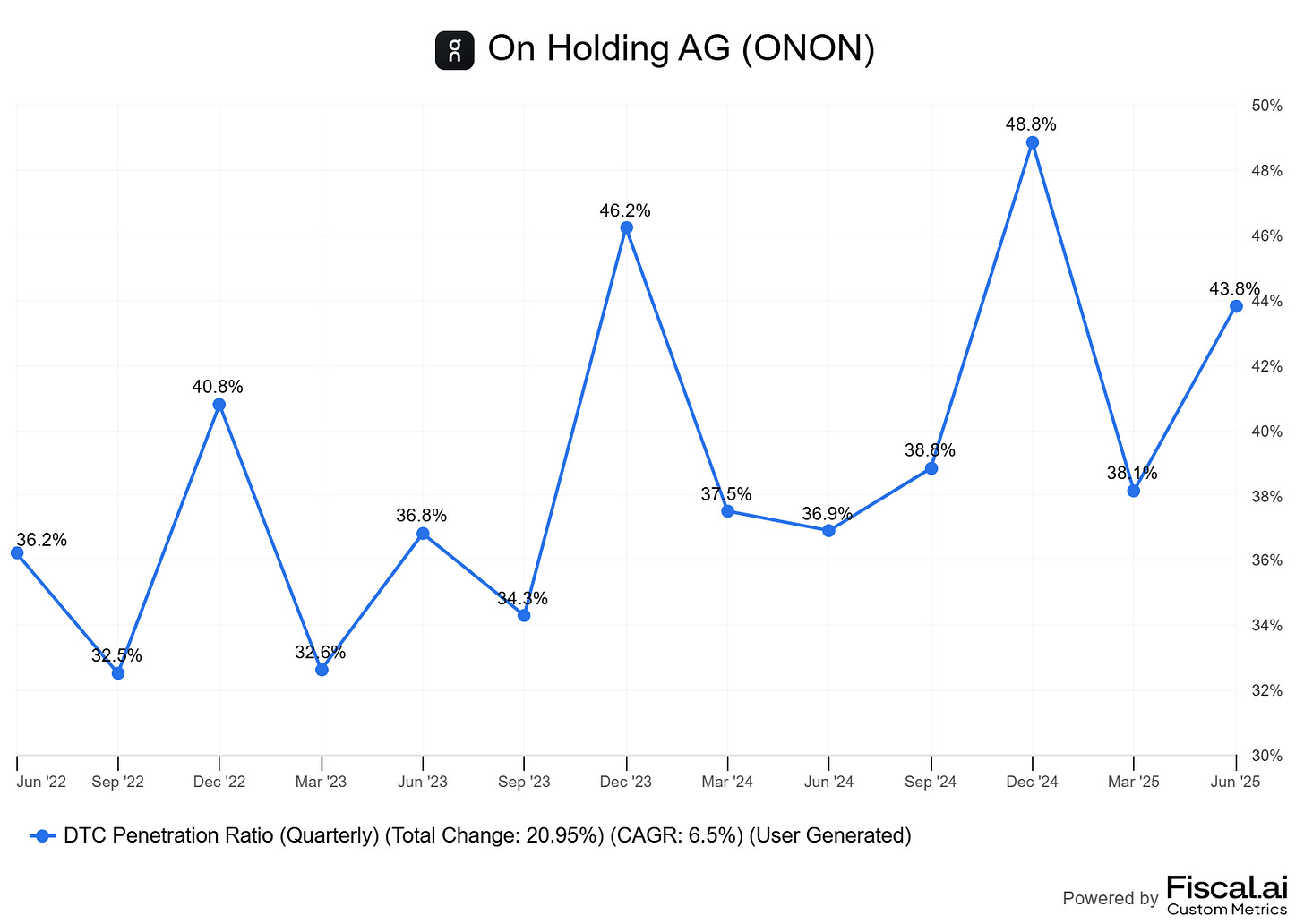

Another sign of strong demand for the brand, and as usual the most important metric for any kind of retail brands, is the DTC sales. Growing DTC sales mean that customers come for the brand, not to buy shoes or T-shirts. I repeat this for each & every quarter but it is a fundamental concept for brands.

Customers do not want shoes. They want On’s shoes.

This results in 43.8% of total sales done through On’s channel, which is a much more optimized & profitable one for the company.

This is the result of years of work, marketing first, especially this last year with Roger Federer in front of the camera & Zendaya as an ambassador or through her movie Challengers - which has a good minute dedicated to On, and sponsoring with many performers now wearing On, starting with Iga Świątek who won Wimbledon a month ago with a very dry 6-0 6-0.

This, plus that, plus some pretty iconic stores at iconic locations - and a great product as it remains the heart of everything, like their new store at Singapore’s airport, and you get yourself a growing & healthy brand.

In retail, our flagship stores remain key in driving the success. Our Paris Shams LC store continues its strong growth a year after opening. And our L.A. Abertis store saw the highest year-over-year growth in the Americas, powered by strong community engagement.

This is only one of many.

We now operate 54 owned stores worldwide, and these are just places to transact. There are special experiences where product, brand, community and storytelling come together.

I have shared in my investment thesis the importance of having stores, and that this has been highlighted years ago by many brands but iconically: Apple.

Geographies.

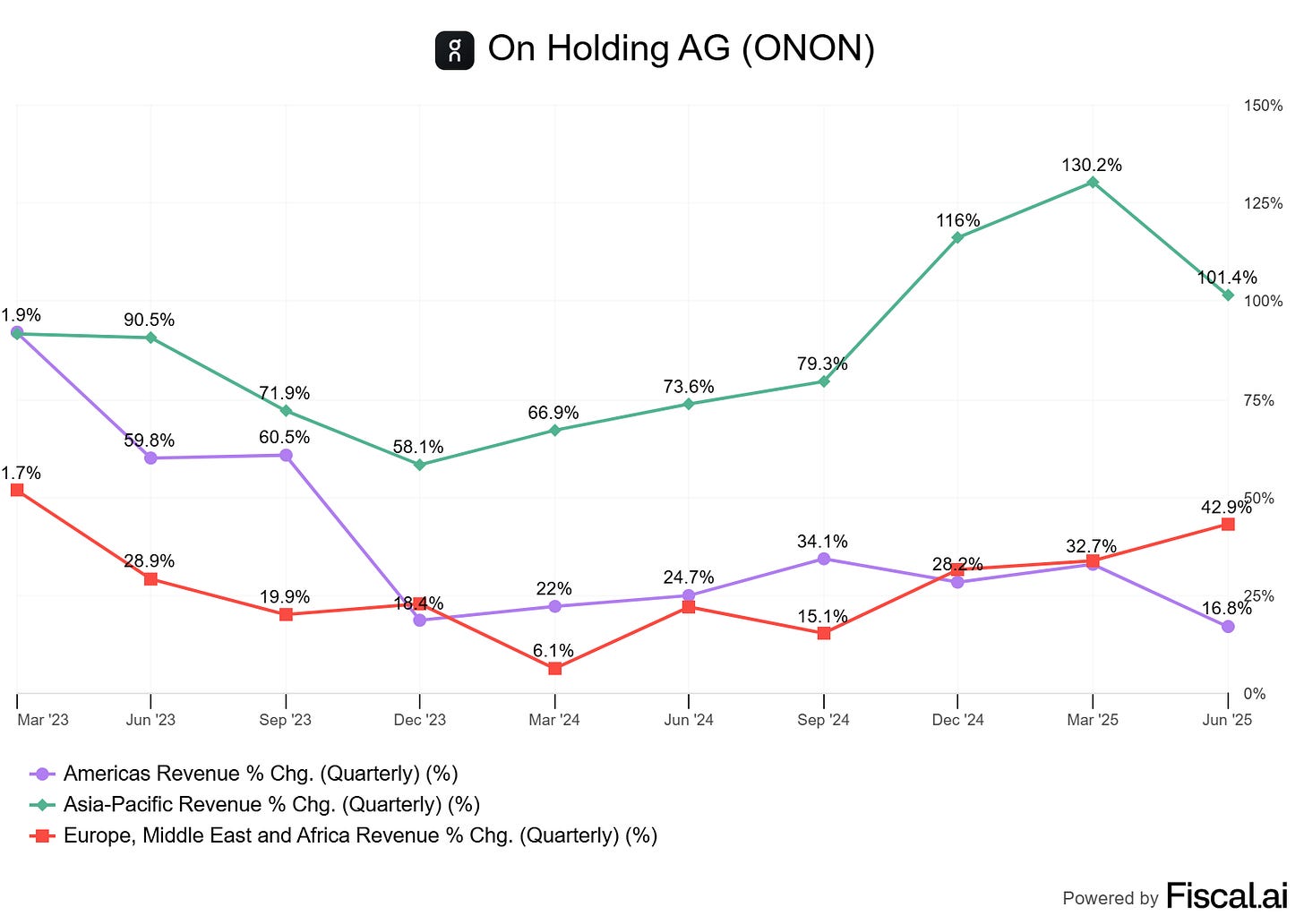

For another great piece of news - and we will start on the less great right after, On is growing all around the world with acceleration of demand in Europe and, although this quarter was a bit slower but not impacting the global dynamic.

In Greater China, net sales more than doubled, driven by more than 50% same-store growth in our own retail stores, even higher growth rates in our e-comm channels and the addition of powerful new retail stores.

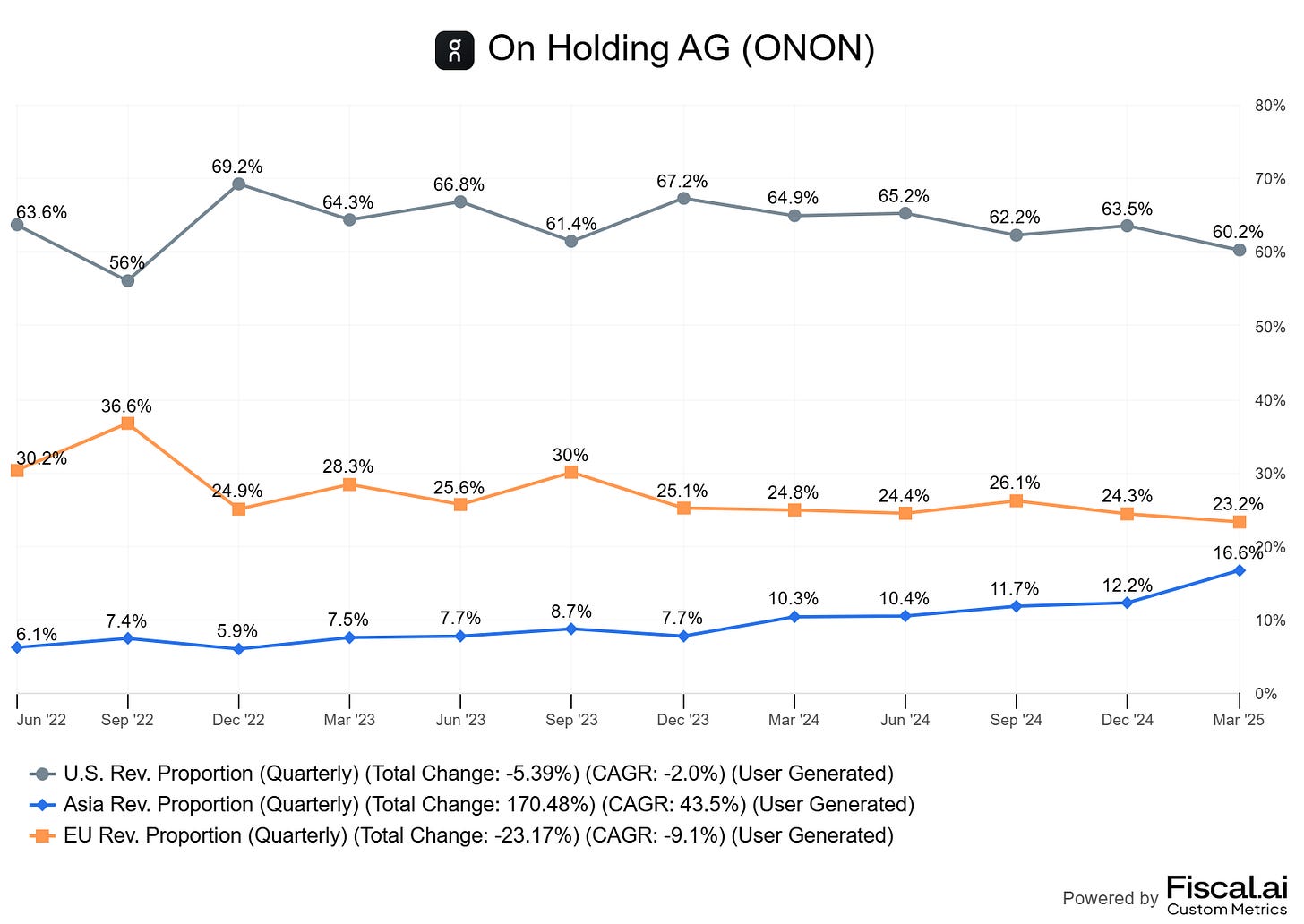

The U.S. remains the largest market with a good margin, but as On continues to focus on its growing geographies - Asia, the region will reduce its dominance while Europe is already outpaced - and I assumed it would take less than a year for this to happen early 2025.

This geography mix is important as we now enter into the less good part of the report.

Tariffs & Macro.

The actual trade war is no surprise to any of you, and for those who don’t know - lots apparently on X, On doesn’t manufacture in Switzerland; it manufactures in Vietnam, which now has a 20% tariff.

And On’s strategy is to leverage its premium brand without any regard for those tariffs.

As a premium brand and as a fast-growing brand, we have multiple opportunities to compensate for these impacts of our cost sold. And with that, you've seen we are confident in increasing our gross profit margin outlook for the year. And we're also confident that we can maintain our gross profit margin in line with the long-term aspiration that we communicated at our Investor Day, which is 60% plus.

Increased tariffs plus flat to increased margins automatically means higher prices for consumers - U.S. consumers as tariffs are for imports in the U.S.; this doesn’t impact sales or prices in Europe & Asia.

So, if you still wonder who pays the tariffs…

If you read me since a few months, you know my answer is the consumer. It doesn’t show yet because of the massive inventories built by U.S. companies pre-tariffs, but when imports rise again, prices will follow, and exporters won’t pay those taxes.

On’s growth will rely on the U.S. consumers’ willingness to pay a higher premium than usual for the brand. It’s impossible to know if they will or won’t, but at the end of the day, consumers have a flat amount of dollars to spend each month & a 10% increase on On’s products’ prices might push the balance towards not buying.

I am only raising this as it is important to be aware of it.

Financials.

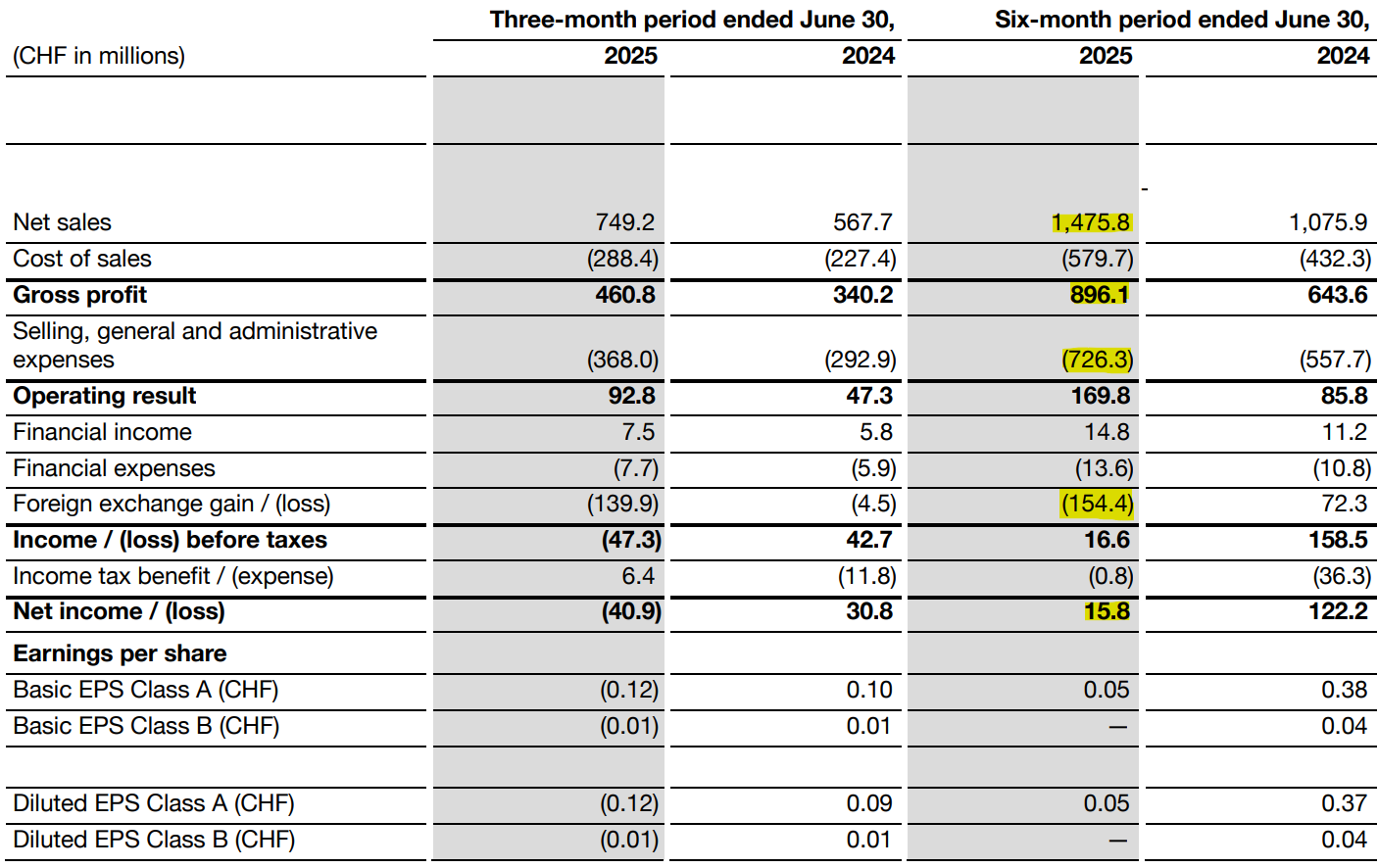

As usual and explained a many times, currency mix is a massive headwind for On and the reason for the EPS miss I said not to worry about.

Revenues for the semester grew 37.2%, above expectations. Gross margins expanded from 59.9% to 60.7% due to lower freight expenses & a rising proportion of DTC sales. Expenses grew 30% YoY to support the brand’s marketing & expansion but resulted in expanding operating margins from 7.9% to 11.5%. Those are the data that matter to us and show that the business is growing & being optimized.

From there, net income declined 87% because of the currency mix. The mechanism is the same as always; when you operate worldwide in a strong currency, you end up converting your sales your local currency and when you operate in the strongest currency in the world - the Swiss Franc… You lose in the exchange.

Around 145M CHF lost due to currency mix, which is massive.

Again, this isn’t something the company can control; most of it happened due to the trade war as currencies rebalanced to absorb the shock of tariffs and the potential shift in global trade. One year will show a strong Franc, and another a weak one, which will then yield higher profitability.

Guidance.

The company raised its guidance due to those results & its actual strong momentum with record July sales.

Considering our strong performance in Q2, continued powerful momentum in the first weeks of Q3, a strong order book for the fall/winter season and the continued efficiency tailwinds driven by our focus and commitment to operational excellence, we are increasing our 2025 guidance across all line items with high expectations for net sales growth, gross profit margin.

We expect net sales at constant currency rates to be up at least 31% year-over-year, ahead of our previous guidance of at least 28%.

This guidance includes tariffs, a potentially weaker consumer in the U.S. and in Europe, despite tougher comps as H2-24 was already strong.

This says a lot about their confidence.

Investing Execution.

I am really satisfied with this quarter, which continues to show a growing demand for the brand itself, all around the globe, despite its premium pricing, while management is executing perfectly and fixed their inventory/shipping problems they had late 2024. The currency impact is a non-issue.

Really satisfied.

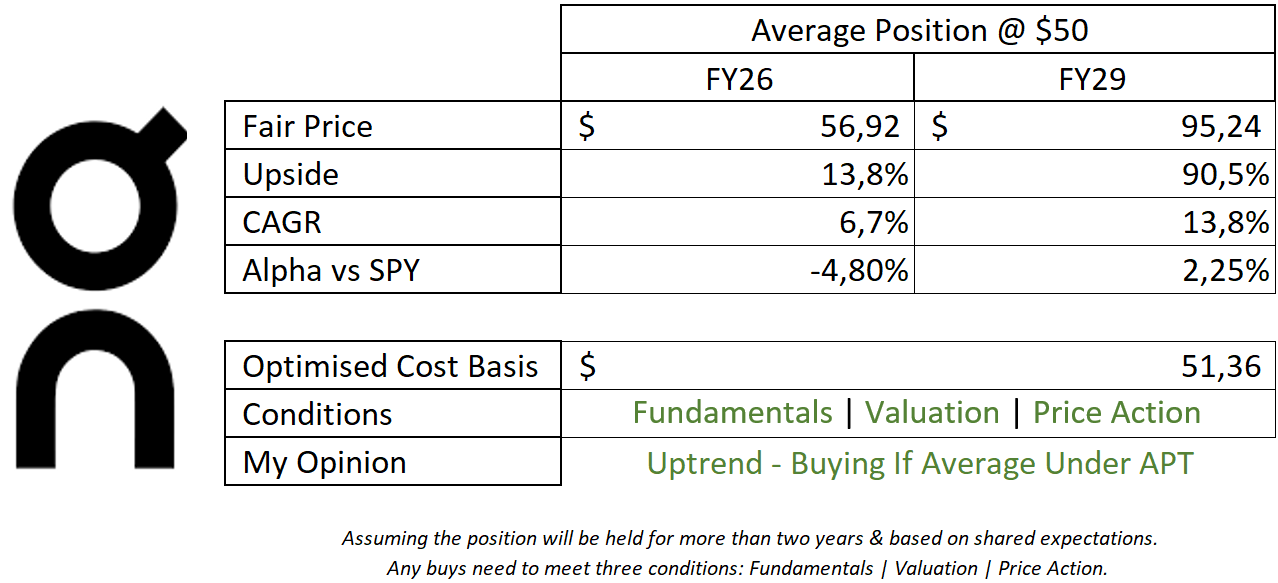

I will not change my valuation model despite its conservative growth as we need to include the risk of a lower volume due to pricing & tariffs, but under normal conditions, On would deserve a higher premium.

This model assumes a 25% & 20% CAGR growth until FY26 & FY29 respectively, 16% net margins, 1% dilution, P/S & PER at x3.5 & x38 respectively.

Price action continues to be bitchy because of the actual situation, and most apparel companies are getting butchered by the market, so On’s actual strength is pretty impressive.

I personally continue to be patient and to accumulate slowly, with the clear idea that the next year(s) could be a bit challenging for the brand with a potential consumers’ weakness in the U.S. and tariffs, but a strong conviction that the brand will do well & emerge as a leader in sportswear.

Now the lesson is not to buy from the US :)

If possible ahah