PayPal Q2-25 | Earning & Call

The thesis is materializing.

Everything you need to understand PayPal’s bull thesis is here.

Business.

We have been waiting long now for improvements to finally show up in the data & it finally starts to. In a nutshell, Braintree clean-up is reaching its end, branded updates are driving a growth in usage & new products start to roll out aggressively and users are pretty satisfied, while more innovations are in the pipeline.

Things are going well fundamentally. Even if the market doesn’t see it yet.

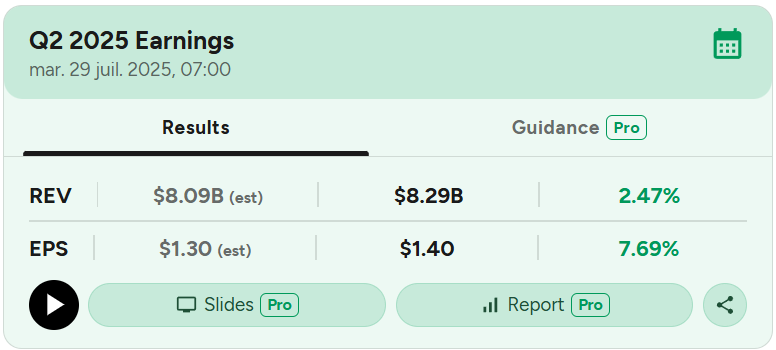

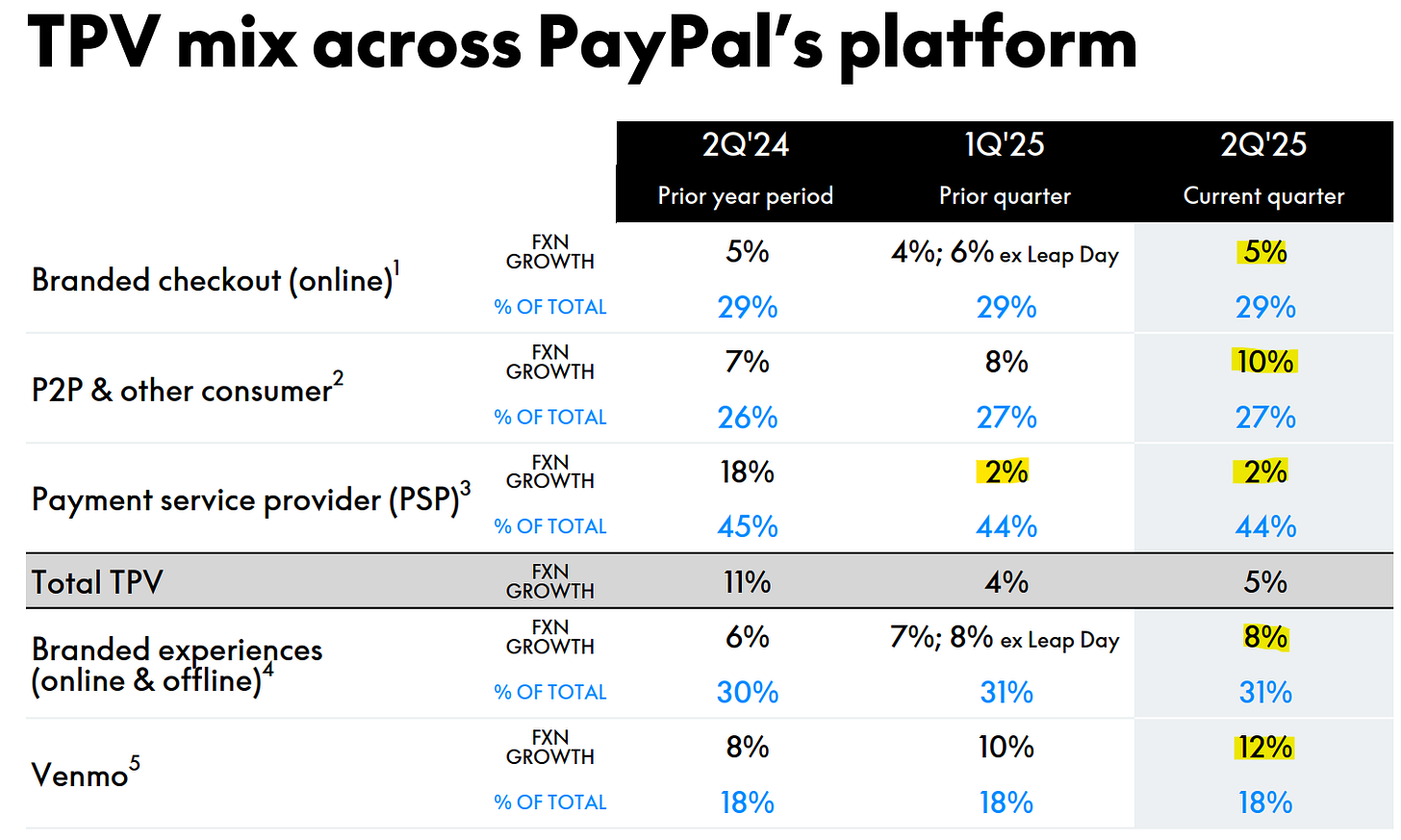

Starting with the first uptick in TPV growth in years - since Alex Chriss took over the company, which ironically goes with fewer transactions per account.

And this uptick is fueled by the right sources.

Alex had four key verticals to leverage to bring PayPal back on track. We’ll go over each & see that all of them are on the good trajectory.

If we look at our four strategic growth drivers: winning checkout, scaling omni and growing Venmo, driving PSP profitability and scaling our next gen growth vectors.

Branded Solutions.

Starting with the heart of the business which consumers use more often. Transactions per active account are globally down to 58.3 from 59.4 last quarter & 60.9 a year ago. But they are up 4% if we only look at branded services. They also are spending more through those services.

Transactions per active account ex PSP grew 4% as more people use PayPal and Venmo more often […] I'm proud that we drove 8% currency neutral growth in Branded Experiences TPV this quarter.

This is about winning checkout and PayPal is still solid here, with a big portion of this growth coming from new services like BNPL.

In the second quarter, BNPL volume grew more than 20% and monthly active accounts climbed 18%. When consumers choose BNPL, their average order value is more than 80% higher than a standard branded checkout transaction.

Without much surprise, consumers tend to buy & spend more with money they do not have… But this is how our consumption economies work and we're here to talk about PayPal, and this is a great source of growth for the company.

Omni & Venmo.

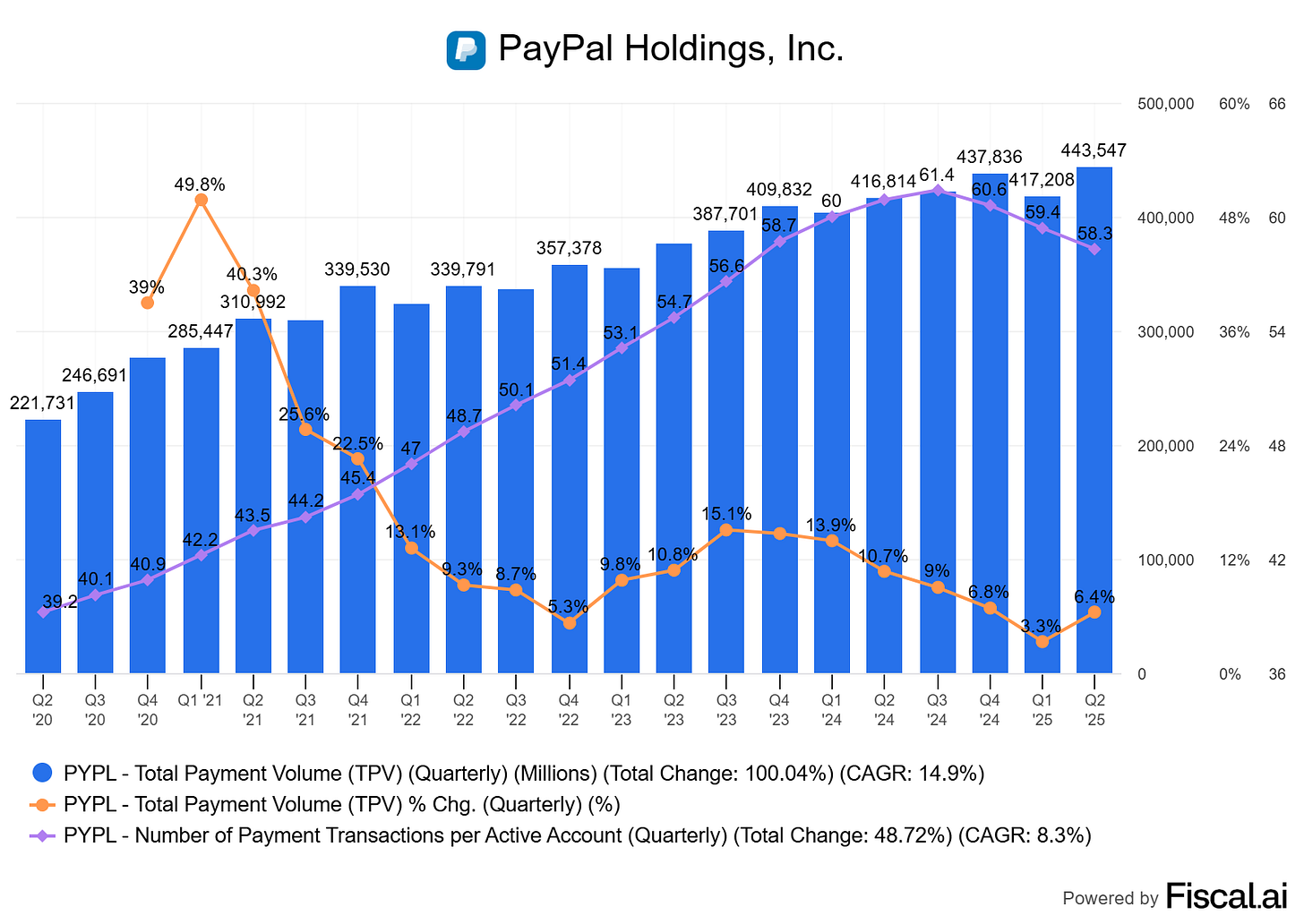

Those two verticals are also doing really well & management found the way to tap into Venmo’s users.

In Q2, we grew Venmo revenue by more than 20% marking our highest revenue growth rate since 2023. TPV grew 12% accelerating QoQ to the highest growth rate in three years. This momentum stems from deliberate product innovations over the past year and dynamic marketing campaigns that are repositioning Venmo from a peer to peer payment tool to an everyday commerce platform. The result is that our Venmo user base is not just growing, it's engaging in commerce with Venmo.

Pay with Venmo TPV was up more than 45% in the quarter, and we achieved an approximately 25% increase in Pay with Venmo monthly active accounts as our merchant network continues to broaden.

This tendency should even grow stronger with PayPal World - more on this a bit later.

PSP - Braintree

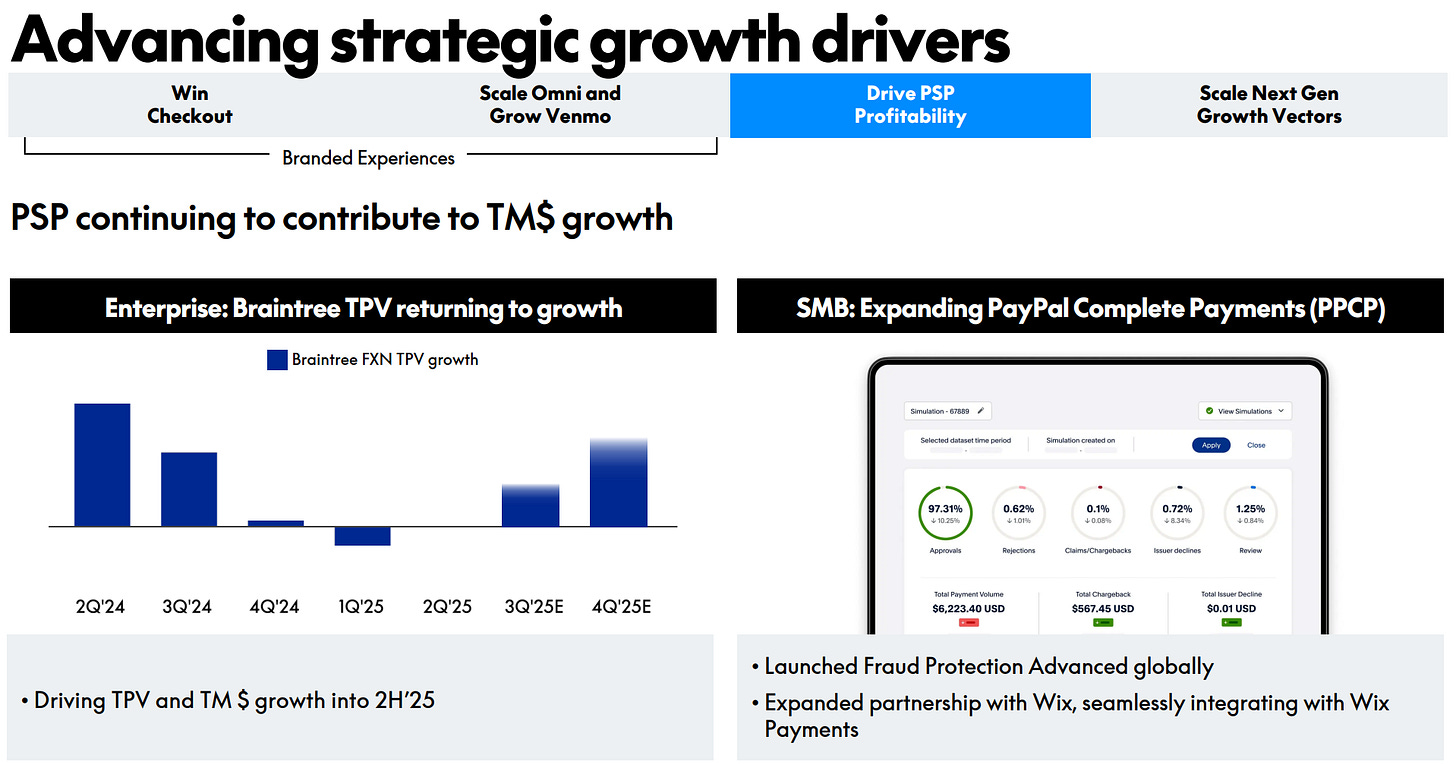

Braintree was a big subject when Alex arrived as he wanted to get rid of unprofitable growth, as Braintree was used as a volume driver by the previous management team, meant to grow TPV & merchant acquisition without any focus on volume’s quality.

This was put to an end quarters ago as the new management renegociated the use of this service with merchants, which led to a big slow down in growth, until this quarter, according to management.

You can see the massive slowdown in Braintree’s growth while every other service is accelerating, with a stable branded growth.

I want to reflect on one of my first earnings calls where we shared our plan to reset our largest merchant relationships to price our services to the value we deliver. The consequence of that reset was pressure on growth in exchange for long term profitability. Now we are on the other side of that and can confidently say that our strategy worked.

This was the last quarter of growth deceleration from Braintree. Management is now confident enough to share that the next quarter will not only bring growth, but profitable growth as it should happen with healthier contract.

We can assume that most accepted the renegotiations & the new terms - a positive as it shows that PayPal’s brand is valued enough for merchants to accept a repricing instead of going towards a new provider, or that new merchants do. Either way, this is a net positive.

This slowdown was planned. And it might be over. If PSP returns to growth due to the renegociation of Braintree’s contract & all other branches are either with a stable or an accelerating growth… Total growth should finally show this uptick.

New Growth Verticals.

As I said, there are lots of innovations ongoing for PayPal, very positive ones.

FinTech is in its infancy, and we believe the next five years are likely to see more change in how people shop than the last two decades combined.

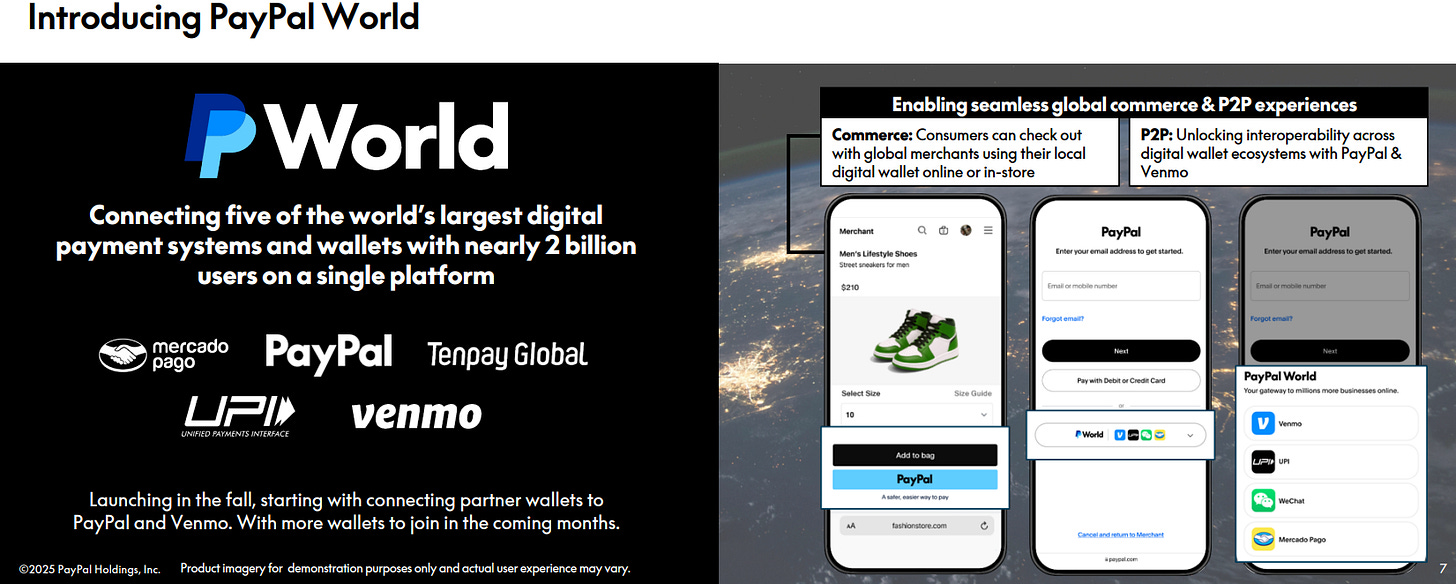

PayPal world.

I already talked about PayPal World last week & was on point on most assumptions, so I will refer you to my note.

And as I shared, it will be a pretty powerful feature as it is meant to be transparent for the end user & massively grow the TAM of any merchants partnering with those payment providers - really valuable.

I was unclear on how monetization would work but Alex confirmed that to PayPal, this is comparable to a TAM expansion with comparable economics to their branded solutions, which seems really bullish but bit strange to me.

This means our connections for branded checkout will extend beyond our 400,000,000 customers to more than 2,000,000,000 consumers worldwide, and that will continue to grow […] And for us, that's just expansion of TAM at the existing economics that we have.

We will need some quarters to have feedback although once again, the volume will be lower as we are talking about cross-border payments only, but comparable economics to branded services would be a really big win for PayPal.

This service is a multi-win really as any provider would expand their reach, expanding their merchants’ reach and their customers’ shopping opportunities. Advantages worth a small fee as it comes with no inconvenients for anyone.

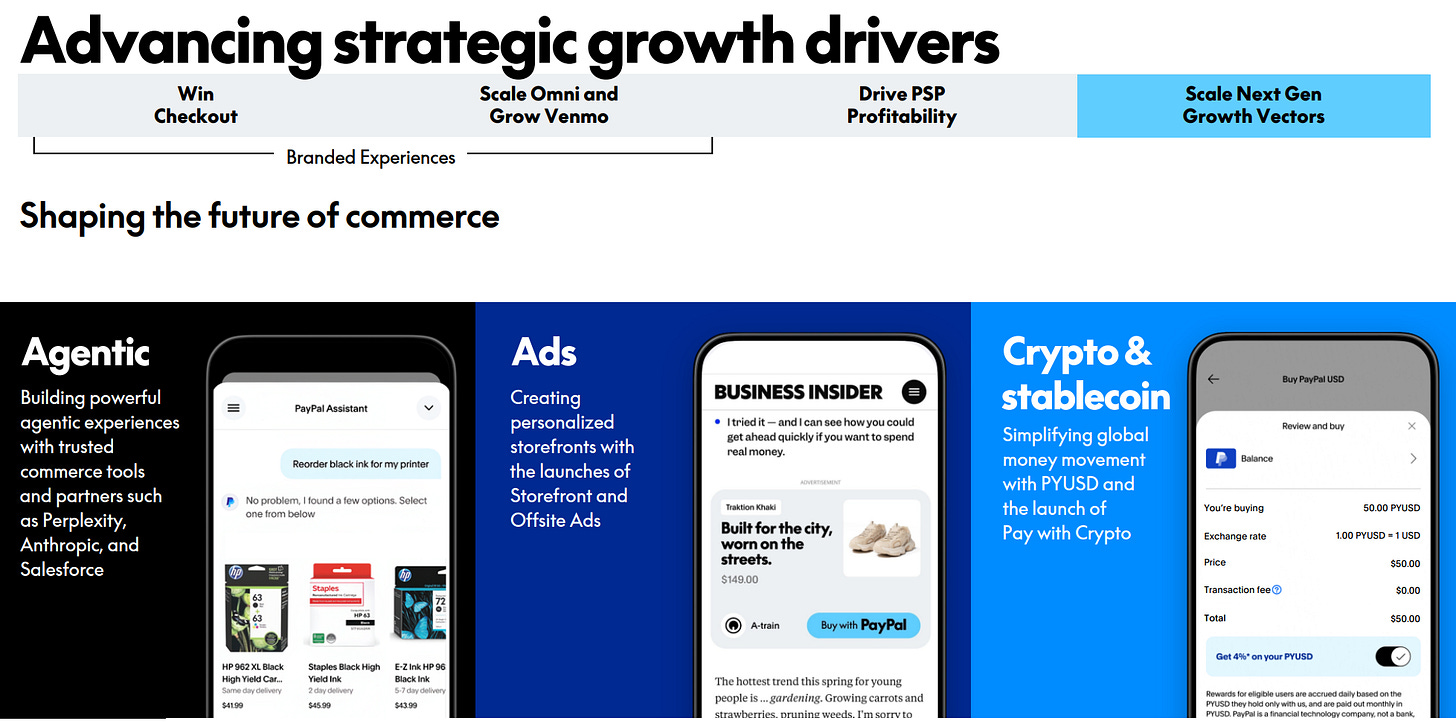

Agentic, Crypto & Ads.

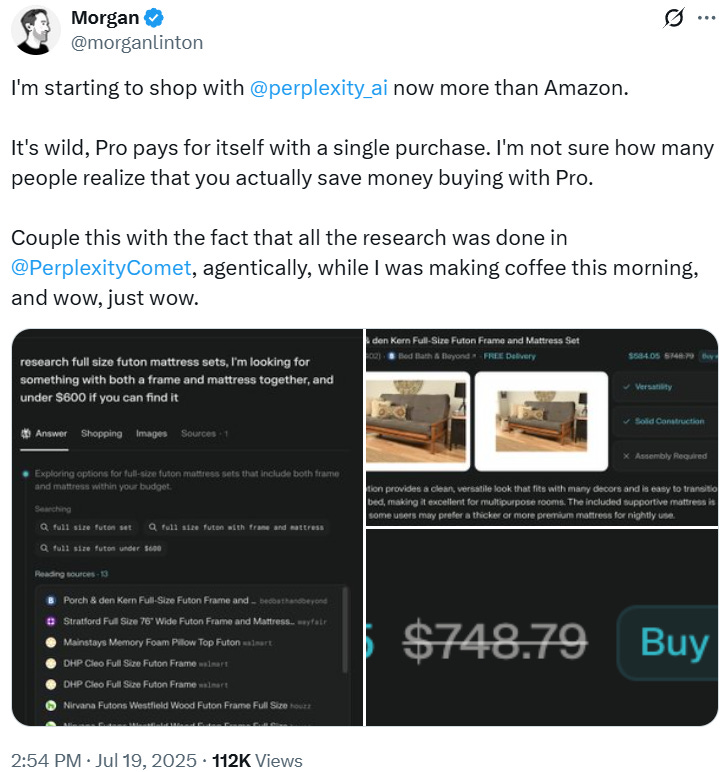

Those are ongoing projects, starting with the most impressive: PayPal’s onboarding onto LLMs so anyone can find the best deal without worrying about how to purchase them as PayPal will be the default checkout system.

As you've seen through our announcements over the last few months, the major players in AI, including Perplexity, Anthropic and Salesforce, are working with PayPal to create powerful new agentic commerce experiences.

This is a big deal as e-commerce will be changed in the future, exactly like we stopped asking Google Search simple questions, we will not go towards specific e-coms anymore, we will ask LLMs to do the research for us.

Only PayPal proposes this for now.

Ads is the classic business, and could become a great source of revenues as users spend more time on their apps.

And crypto/stablecoins is the logical next step as you guys know I am bullish on the future of finance & payment being on-chain - faster, cheaper, easier. PayPal is already leveraging its stablecoin internally & will do so even more, lowering internal costs in the process & expanding services.

They also launched “Pay With Crypto” this week, which allows users to have a direct conversion between any crypto held on their PayPal wallet into dollars or any other currency in order to pay with their classic methods - online, cards, etc…

Those are only projects - already working & shipped, but have a huge potential in the next years.

Consumers.

Some rapid comments on consumers, as PayPal has a clear view on their health.

As we move through the quarter, we observed a slight softening in retail spending in The U. S, most apparent in areas likely impacted by tariffs such as Asia based marketplaces with higher exposure to goods sourced from China

Overall, consumer spending and the labor market have proven resilient, but we continue to closely watch how tariffs and other trading friction might impact global economic activity, spending and supply chains over time

Pretty comforting comments globally, except for Chinese e-commerce plays - which I am in through Alibaba although its international section is not really my bull case, so it isn’t much of an issue to me.

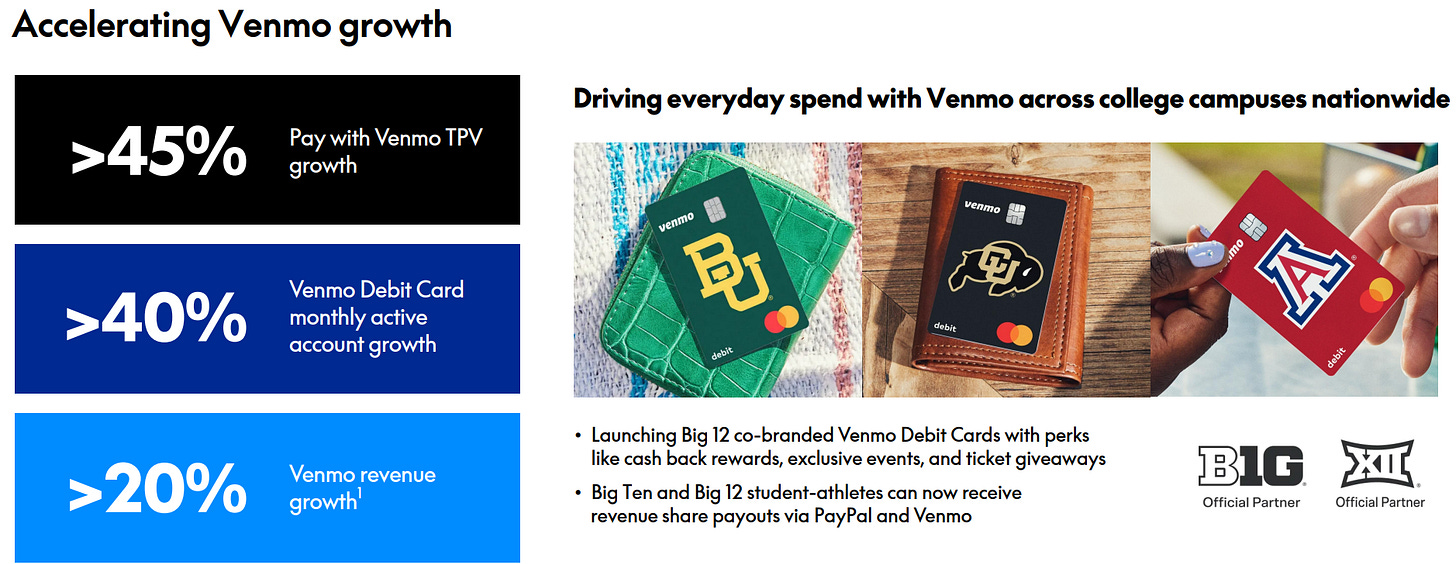

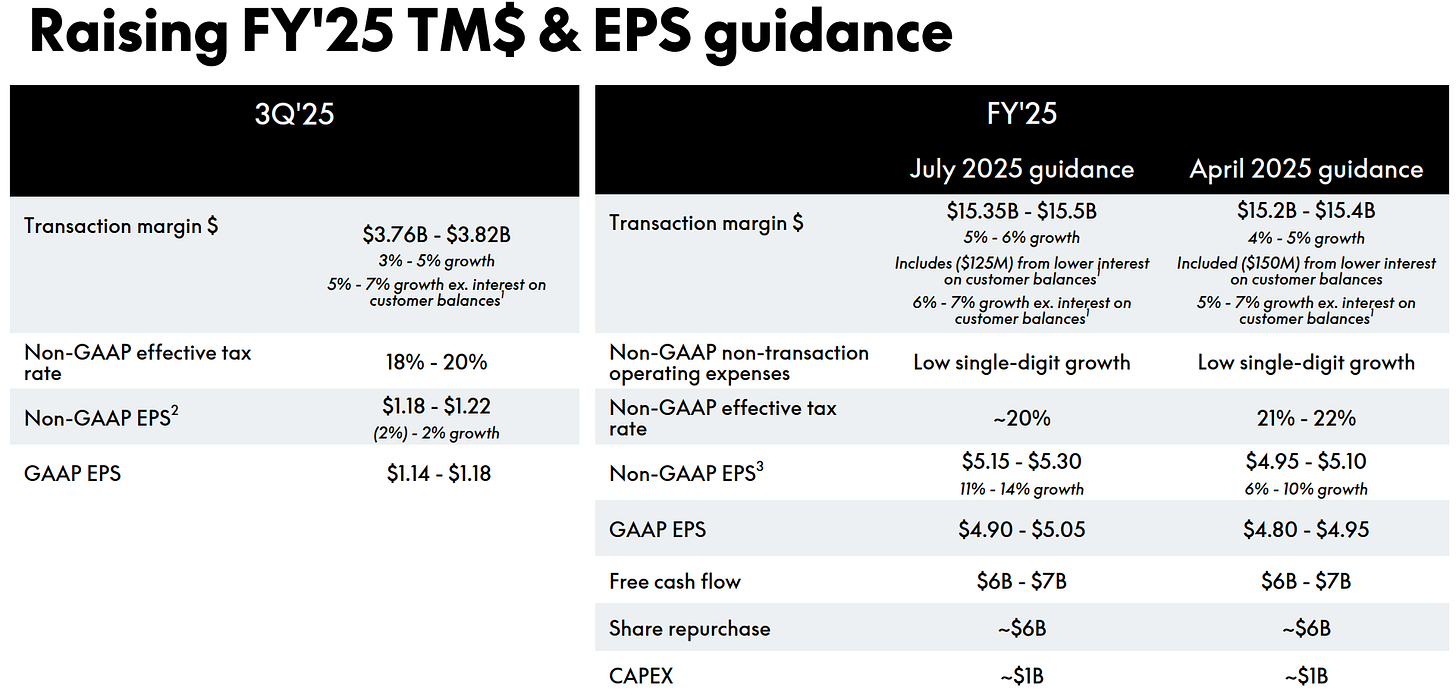

Guidance.

Management is confident in its process as they are even raising guidance.

The last quarters were quarters without growth from PSP. The next quarters should be quarters where PSP gets back to business & this fuels confidence in achieving better results as branded is stable & Venmo is accelerating.

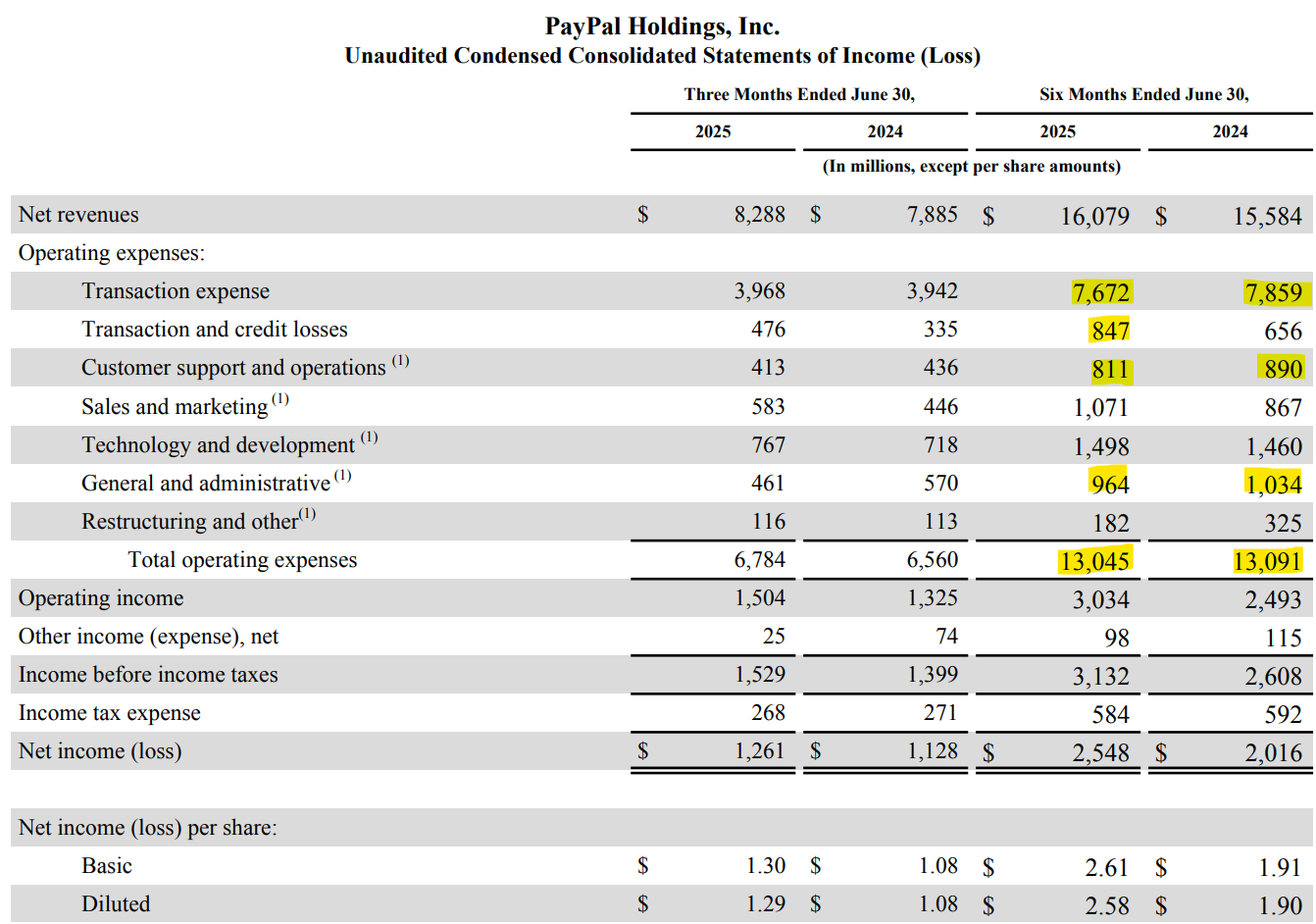

Financials.

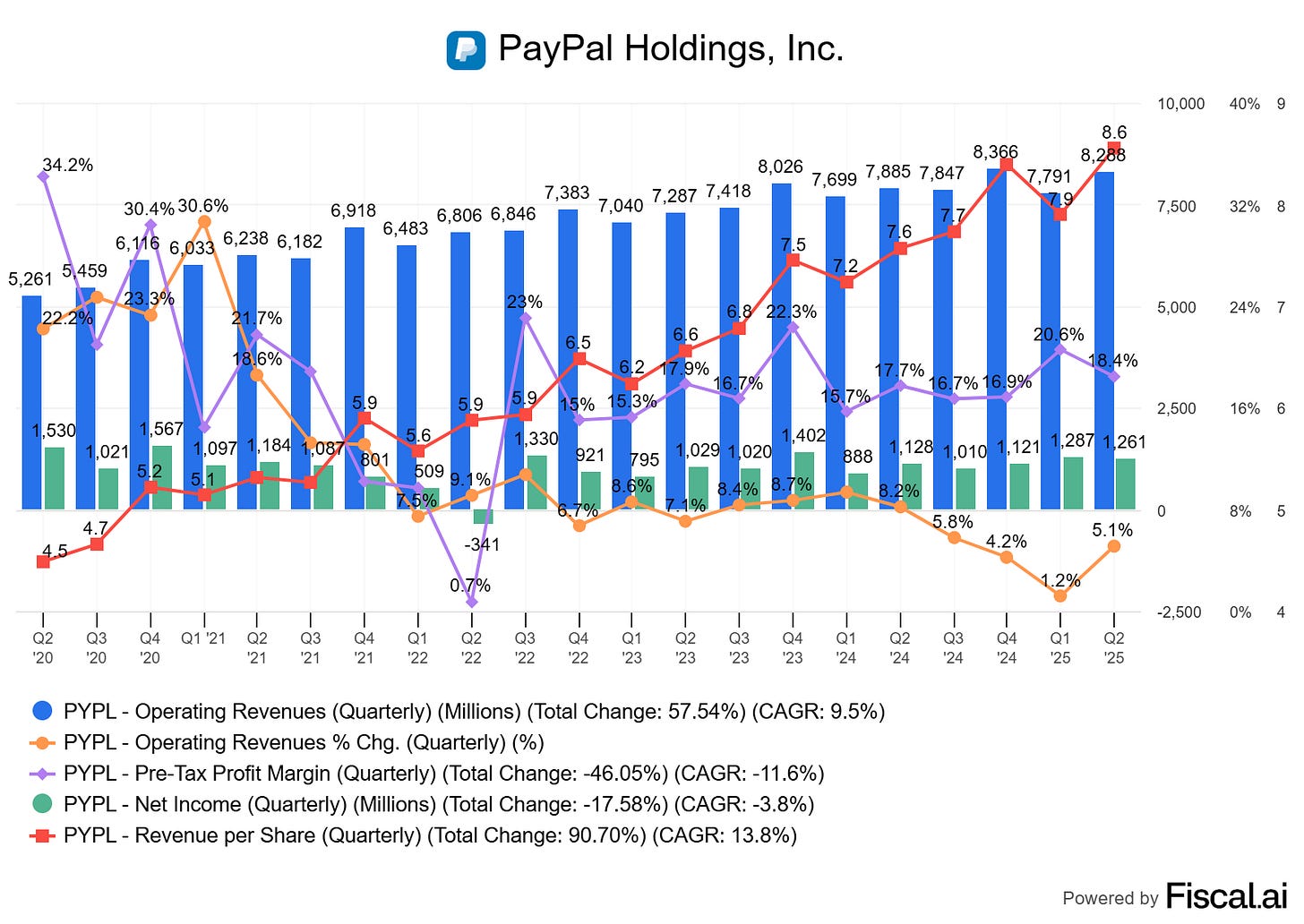

This could be part of the disappointment from the market as Braintree’s headwinds cancel other branches’ tailwind, and financials remain flavorless.

Revenue growth has an uptick as well after a year of slowdown, margins continue to expand & revenue per share is growing rapidly as PayPal is buying back shares. But nothing stands out. Tendencies are positive though. And they are mostly due to business improvements.

Revenues grew 3.1% YoY H1-25 but it comes with lower expenses - as management cut on some of Braintree’s unprofitable growth, and supports and G&A are down YoY. This screams better efficiency within the company, and sure marketing spending is higher but this isn’t a bad thing as the brand needs it to share its new features, and there is also an uptick in losses which is part of the business & fluctuates.

The data is positive.

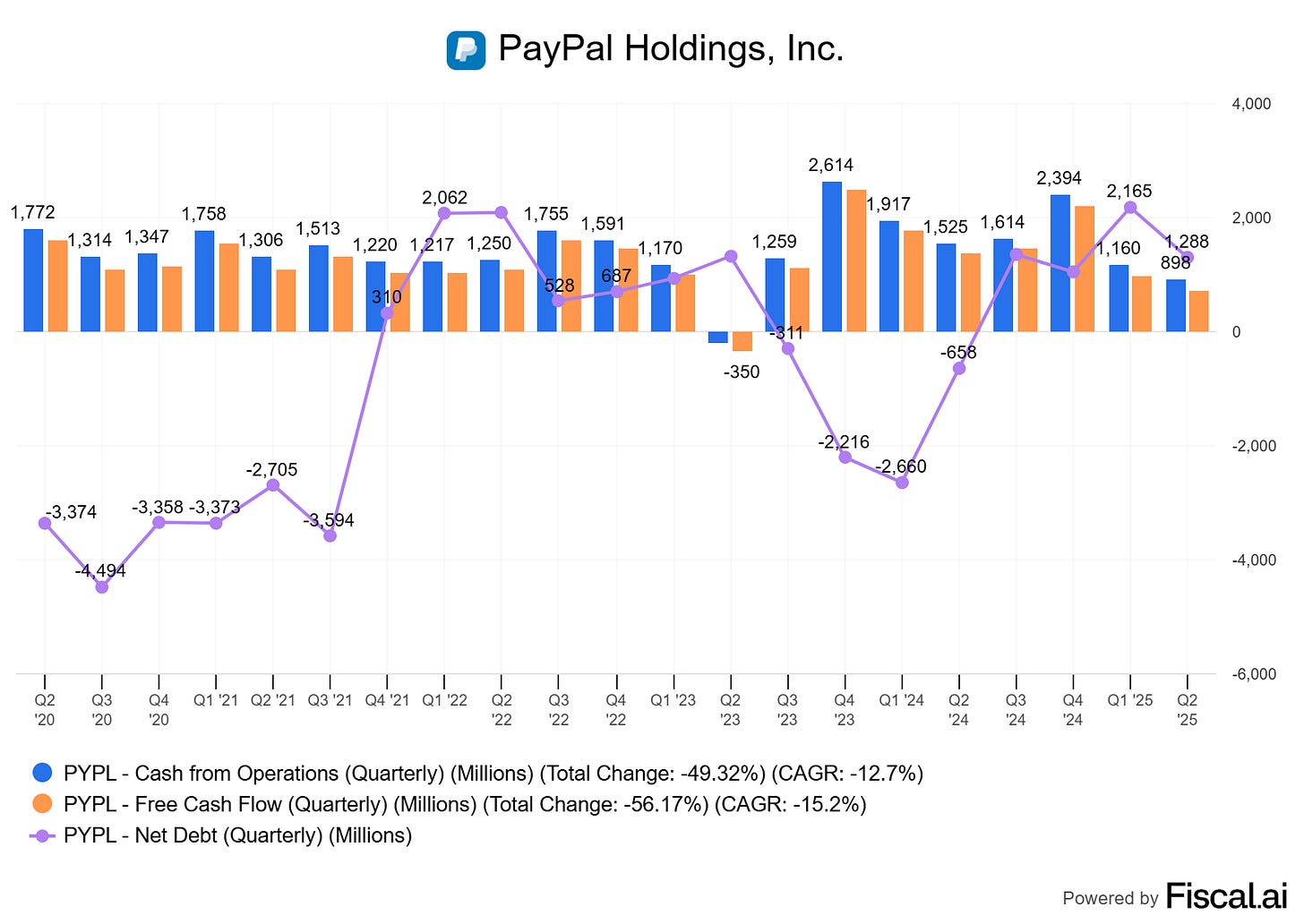

In terms of cash, the company has $10B of cash for $11.3B of debt & $692M of FCF for the quarter, which is really healthy and allows the company to continue massive buybacks with a net reduction of 3.3% year to date - massive.

To note that FCF was impacted this quarter by some timing issues.

Adjusted free cash flow, which excludes the net timing impact between originating and selling European buy now pay later receivables was $656,000,000 Adjusted free cash flow was negatively impacted by timing shifts in working capital

The data doesn’t look promising as FCF generation is declining over the last year but as I shared during this write-up, the business is improving & cash generation will be the last data to tick up as it will happen after Braintree is back to growth and doens’t impact negatively the company anymore.

Investment Execution.

The market doesn’t like the quarter because it continues to lag & take time to turn the company around, and even if the data starts to be interesting, it simply isn’t enough for most who are losing patience or not satisfied with what they see.

In my opinion, PayPal is on the right track and is doing what needs to be done, while returns to shareholders continue to be massive. I was part of those who lost patience some months ago but PayPal World, their agentic checkout & now the proof that Braintree’s pain might be over were enough to get me back in.

Many of these efforts that are contributing to growth this year will continue to ramp into next year and add to our confidence that we are on track to achieve our growth outlook for branded checkout TPV.

If you are patient & continue to control the narratives, PayPal should yield returns.

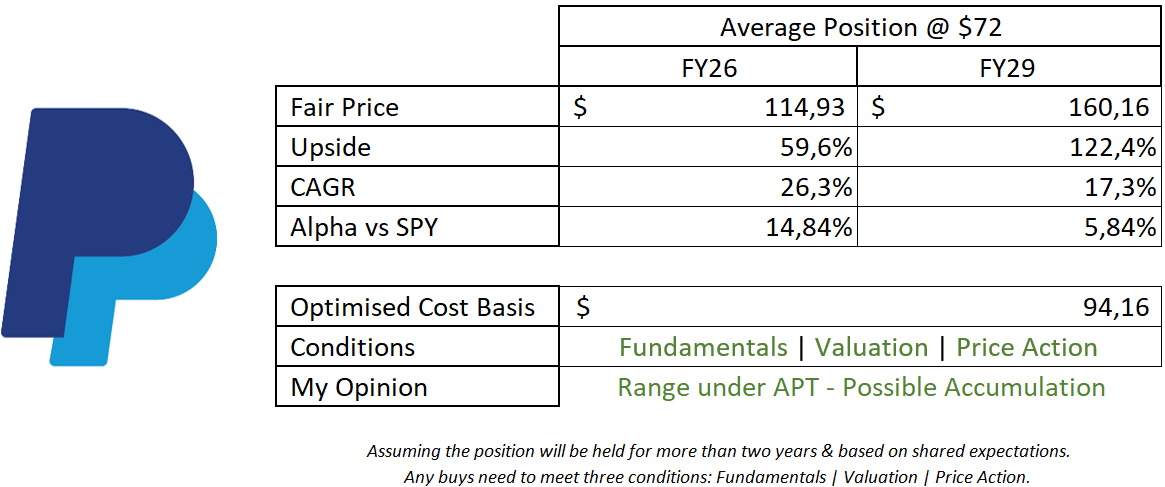

In terms of valuation, the story remains the same: There are no undervalued stocks without growth, so as long as the company’s growth doesn’t tick up, multiples won’t either. As you understood, I believe growth will tick up for the reasons shared above, but my assumptions remain really conservative.

This model assumes a 5% & 6% CAGR growth until FY26 & FY29 respectively, 15% net margins, 4.5% return to shareholders & P/S & P/E at 25x & 2.5x respectively.

Again: conservative in terms of growth, which means in terms of multiples as well. If PayPal ends up ticking up growth in the next years, we can expect its fair price to rise as fair multiples will also rise.

Returns are tied to PayPal’s capacity to return Braintree to growth, improve branded & yield returns with its new services. It is a turnaround story, not a growth one, and the last quarters continue to show that it is happening.

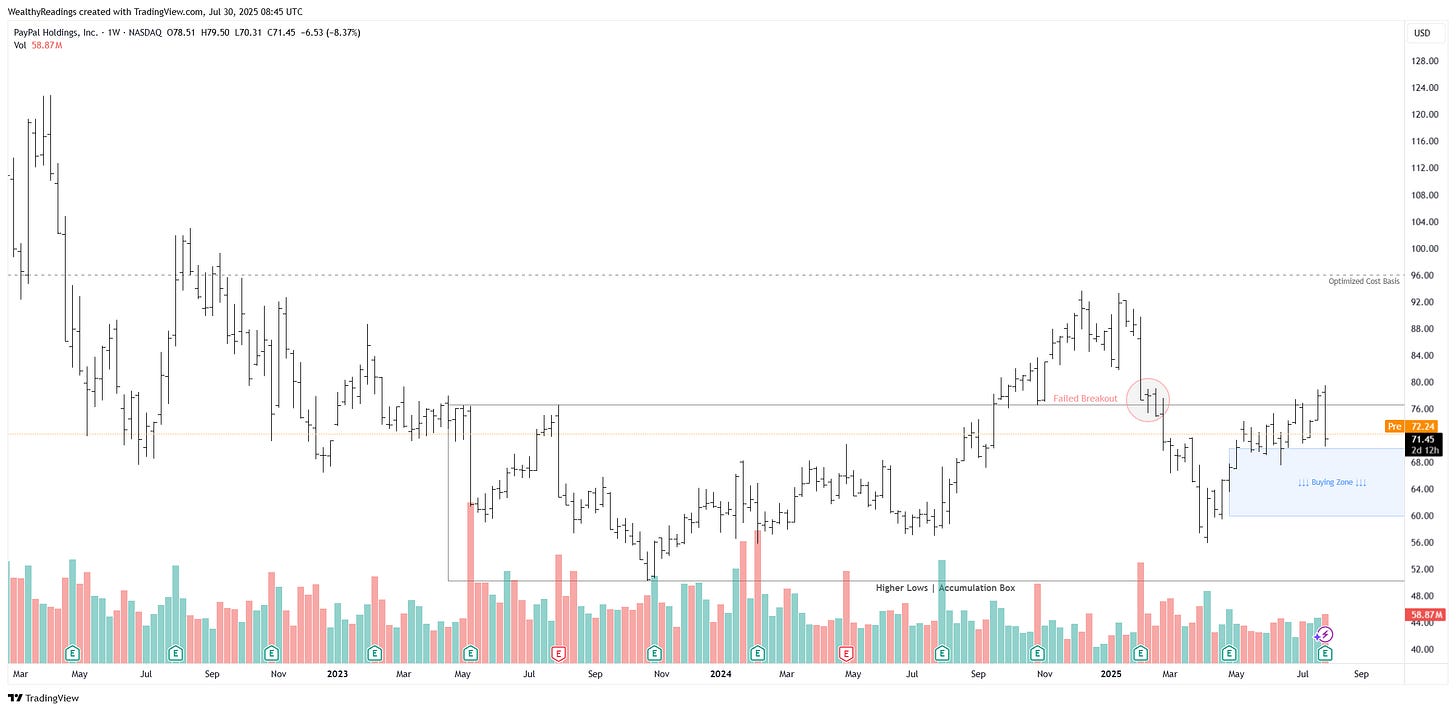

In terms of price action, we are still stuck within this wide range. I won’t really look at price action until we try another breakout above $80.

This is an accumulation phase, not an uptrend. I personally accumulate as I believe in the turnaround story as PayPal shifts great services and is fixing the issues with its core business, and data starts to show it, just not financially - yet.