Circle | Investment Thesis

The one who wants to revolutionize the financial system.

Stablecoins are unknown creatures, but with time, I am personally convinced they will become one of the most used technologies around the world. They are probably the most interesting blockchain innovation - after Bitcoin.

Before reading about Circle, I advise you to read about Ethereum, as blockchains are the foundation for stablecoins to work. We will go over the basics today, but a better understanding of the technology can help.

Stablecoins & Blockchains.

Let’s start by explaining what blockchains are & how they work. They are the support for stablecoins, the pipes for everything to be interconnected exactly like our payment systems connect banks & payment providers altogether.

I will also ignore all the scams, bad reputation, and dumb speculation happening in the crypto world. We only talk about legitimate technology and fundamentals here, and blockchains are legitimate. It’s their usage that, in some conditions, isn’t.

So, blockchains… This is exactly what they are, chains of blocks that usually contains transactions, exactly like a physical ledger would contain pages of: “A sent $X to B.” The serious ones go a bit further than this with built-in controls to ensure security, transparency & more, depending one what their developers focus on.

Stablecoins are creatures that can be exchanged on most of them - if not all. They are the crypto world’s currency and everything can be purchased/is quoted against them, exactly like everything is quoted in dollars in the real world. You can buy Bitcoin or any speculative asset with stablecoins on blockchains, just like you can buy stocks with dollars on any exchange.

Stablecoins are literally the blockchains’ dollars.

The first question could be: why not use dollars then? because the technology doesn’t allow it; our traditional financial and payment systems are not interconnected with any blockchains and institutions refused to do so. Innovation found its way and blockchain enthusiasts created their own dollars: stablecoins, which are based on real dollars and have the same value at any point in time but transact on different networks.

By now, there are many stablecoins leveraging various technologies, but we will only focus on centralized ones, where everything is controlled by a single entity: the issuer.

The issuer will take dollars & transform them into stablecoins. No magic involved, the issuer will simply conserve the dollars on its bank account and “mint” (create) dollars on the blockchain (stablecoins). They take care of the technical part of the exchange only, what is done with them is not their problem anymore.

Clients can pay to buy stablecoins and see their dollars disappear from their real bank account while their blockchain wallet is funded with the same amount - as stablecoins’ value equals dollars’ value. From there, the client can do whatever he wants with them on the blockchains - buy crypto or anything else, loan money, play with leverage, use any blockchain service, etc…

In time, if the client wants to bring their money back into the traditional dollar system, they will go through the issuer again, exchange their stablecoins for dollars, and see their blockchain wallet value decrease while their bank account increases.

Stablecoin issuers are the bridge between the blockchain payment system and the traditional payment system.

And Circle is one of them.

Business model.

Stablecoins issuers’ business model is really simple, with three sources of revenue.

First, transaction fees. When a client converts dollars for USDC - Circle’s stablecoin, the issuer takes a small fee. The ones buying the stablecoins are usually institutions and brokers in large volume; individuals use the broker’s liquidity afterward.

Second, interest rates. When any client converts dollars into stablecoins, the issuer keeps their dollars in its bank account - at least in Circle’s case, which isn’t always true but we will focus on this today. Which means that for any USDC in circulation, there are the same amount of dollars in Circle’s bank accounts. To be honest, there even are more as Circle holds excess cash to protect clients’ capital in case of issues, like what happened few months ago with the Silicon Valley Bank.

No institution nor company keeps its cash in a bank account - we’re talking billions of dollars. No, they treasuries to have a return on this cash, and stablecoins issuers are not different: they buy short term treasuries with their clients’ capital & collects the interest rates until maturation.

Circle is collecting interest rates on other people’s money. And… that’s it.

In exchange, it provides USDC, guarantees that each stablecoin is backed 1:1, ensures safety & provides liquidity for users to access their funds whenever they need.

Third, the Circle Payments Network. A payment system based on blockchains - both Solana & Ethereum, to settle transactions more efficiently than through the traditional financial system - as we’ll see just after.

The service went live in May this year and already has a few users, but it will take time for global adoption as it’ll face tons of challenges we’ll discuss later. But this could be a big source of revenue later - depending on adoption.

Value Proposition of Stablecoins.

We saw what Circle is doing & how it makes money; now we need to see why its service is valuable.

Traditional Payment System.

Let’s start with what already exists. We usually don’t bother to understand how things work behind the scenes. Most of our interactions with the financial system involve passing our credit/debit cards in front of a POS terminal, or connecting to our apps and pressing our screen to wire money. We’ll have to go a bit deeper today, as this is what blockchains and Circle aim to change: how things work behind the scenes.

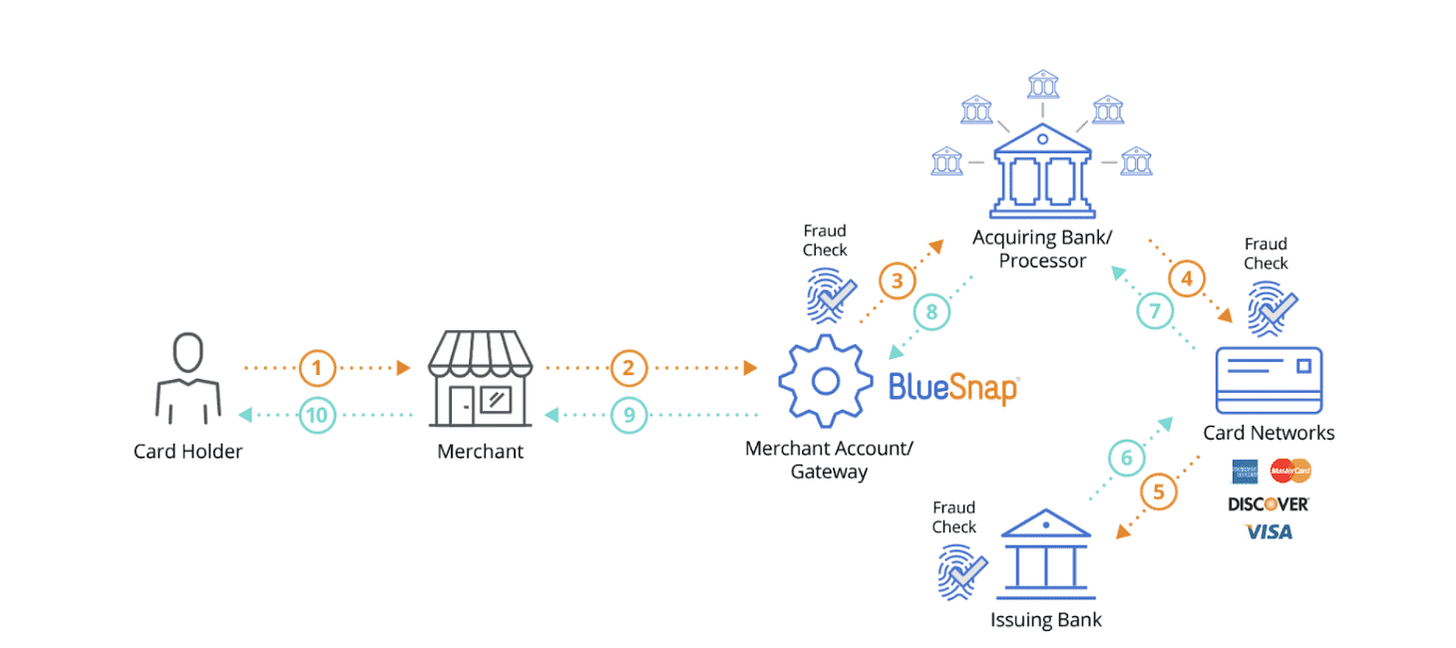

Here is the workflow of a classic card payment when you go grocery shopping.

Each blue icon represents a different company, while the merchant and cardholder are obviously independent from those blue icons. One simple action - passing your card on the merchant’s POS terminal, triggers a request going through at least four different companies which all add value to the system & are paid for it.

Here’s a list of companies you can find for each category.

As I said, each intermediary is paid for the service it provides, which means all steps have a fee. These can be based on the transaction’s amount, fixed, dependent on volume, etc… and are mostly on the merchant’s side - although repercuted in the prices of what you buy. We don’t see them, don’t know them, but they exist.

On average, merchants pay between 2.5% and 3% in fees on the total value of the transaction, only for classic ones - like you going to your local store with a funded bank account.

Things get messier if we talk about Buy Now Pay Later, debt, foreign currencies, or any other kind of payments like intercontinental bank transfers - these become really messy, expensive & slow.

The idea is to show that the current system is really complex, even when using the simplest example & without going into details. Traditional financial systems are a huge, complex mess. Blockchains want to change that.

And stablecoins can.

Blockchains System.

They can because they leverage blockchains. In truth, any serious crypto could disrupt the current system - including Bitcoin, but we need more than great technoogy to do so: we need trust, regulation, serious management & some centralization. Technology isn’t everything, even if many wish it were.

Stablecoins transact on blockchains. And blockchains have advantages.

They do not have middlemen. Everything is managed by the blockchain. Where we have five or six intermediaries in the current financial system, we would have only one with a blockchain, and an automated one. The workflow would look like this.

It has a lot of steps but none of them involve any third-party company, business, or service. They are just different steps, automated on the blockchain to confirm the transaction and the safety, validity & feasibility of the transfer.

A blockchain transaction has as many steps than third parties in the traditional system.

They are cheaper. This depends on the blockchain but as we’re talking about Circle, let’s look at Ethereum and Solana. Both have a similar fee structure that depends on blockchain usage & is based on priority. If there’s a long waiting line, the one who pays the most passes first.

As shared above, what matters is that there are no middlemen between the issuer of the transaction and its receiver. Those are the ones who take fees in between, but as blockchains can do all the work themselves, the only fee for the transaction is the blockchain fee. No contractual fees based on volume, amount, frequency or time. Blockchains only charge a fixed fee based on its charge, which can be optimized in most of the case to be close to nothing.

On average, a transaction on Ethereum costs $0.50, regularly below $1, with some rare spikes above. Solana’s average fee for the last year is $0.0035 per transaction, with spikes below $0.05.

They are faster. Some would disagree with it but it is true. With our financial system, the time between the initiation of the transaction & the moment the merchant has the money available in their bank account, days can pass. We usually don’t see it, as some banks update balances immediately, but the money has not really been transfered.

Plus, we’re talking here about the easiest scenario; let’s look at others.

Data comes from Grok, but Gemini and ChatGPT confirmed it.

Transaction settling - between emission & reception, is usually below 5 minutes on Ethereum and below 30 seconds for Solana.

They are always online - except Solana. Note in the screenshot above how it always specifies “business day”. As you probably know, bank settlements don’t work well on weekends and holidays.

Blockchains are online 24/7.

A small note on Solana, though, which is known to have had some issues in the past with three or four complete blackouts of the blockchain, where no transactions were validated anymore. This is an issue, but even with those major problems, Solana was online more than any bank in terms of hours.

In brief, blockchains allow you to send $1 million to your friend in the Middle East on Sunday, May 4th, in a few minutes for less than $1. This is the value blockchains bring to the world and stablecoins are the most trusted asset transacting through them.

Future Potential.

We talked a lot about transactions, which are the most important & used feature of a currency, but not the only one as we also have loans, Buy Now Pay Later, investments, etc.. Everything we can do with dollars, we should be able to do with stablecoins. Even more as blockchains are programable, without much limitations, meaning we could plan, anticipate or restrict our currency usage as in.

“I want 10% of each income on my wallet to be invested into the S&P500 through the next 30 days with an equal amount of purchase each day.”

This will be possible. In time. Engineers are working to bring these kind of services to blockchains, and some already work really well, replicating what can be done with dollars and going even further for others, but nothing is yet regulated or simple enough for widespread use.

Eventually, we can assume that Circle will offer more services based on its stablecoin. And that blockchain services will offer many more leveraging those stablecoins.

Adoption and Usage Trends.

Stablecoins in general are starting to become really important in the actual economy, although, to be honest, most of their usage is for speculation in the crypto market as they are the most used trading pair on exchanges. If you want to trade, you need stablecoins.

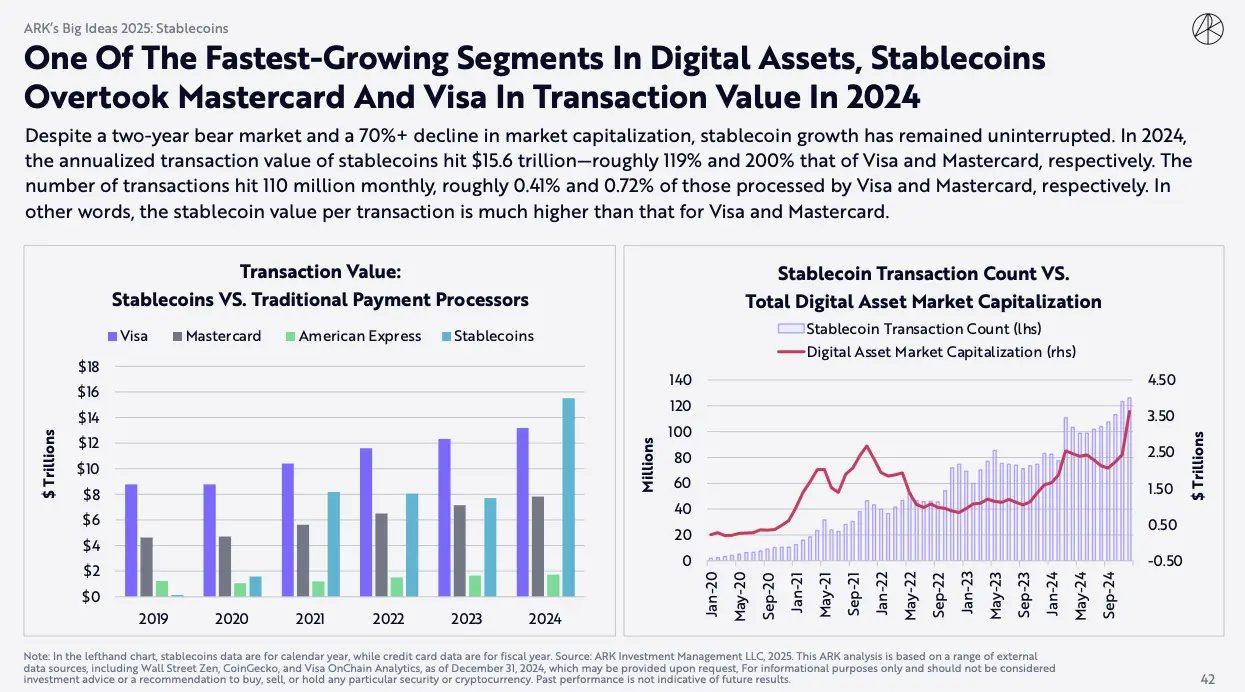

Nevertheless, they reached $27.6 trillion in transfer volume in FY24, surpassing Visa & Mastercard combined - not a small feat.

But the trends are changing, and more uses are emerging as many around the world wake up to their potential.

First, as a transaction medium - as I shared through this write-up. With the Circle CPN already used by a few companies after being online for less than a month. No major players are yet using the infrastructure, but many advise and follow the project - Santander, Deutsche Bank, Société Générale, Standard Chartered, to name a few.

Second, as a payment medium, as USDC is now accepted by many merchants, online & on-site, through different payment processors which means we have middlemen still but fewer than in the current system, hence lower fees for a better service.

Third, as a store of value. We often forget this case because we are privileged, living in the West, but most of the world doesn’t have access to a stable currency and lives under regimes with tight financial controls. Blockchains & stablecoins allows them to store value & send money across borders.

Some Words on Complexity.

A quick word on the complexity inherent to blockchain technologies and how it could slow down stablecoin adoption. I’ll just make a rapid parallel with the current financial system, which is more complex than blockchain technologies but which we use every day without any problems.

Complexity isn’t an issue for usage, as long as developers take it into consideration. This is what has been lacking for years but also what many have worked on during this time, and we’re starting to have really easy-to-use blockchain applications nowadays, and many more will follow.

So no: blockchain complexity won’t be an issue. Its usage will be made simple.

Strategic Importance.

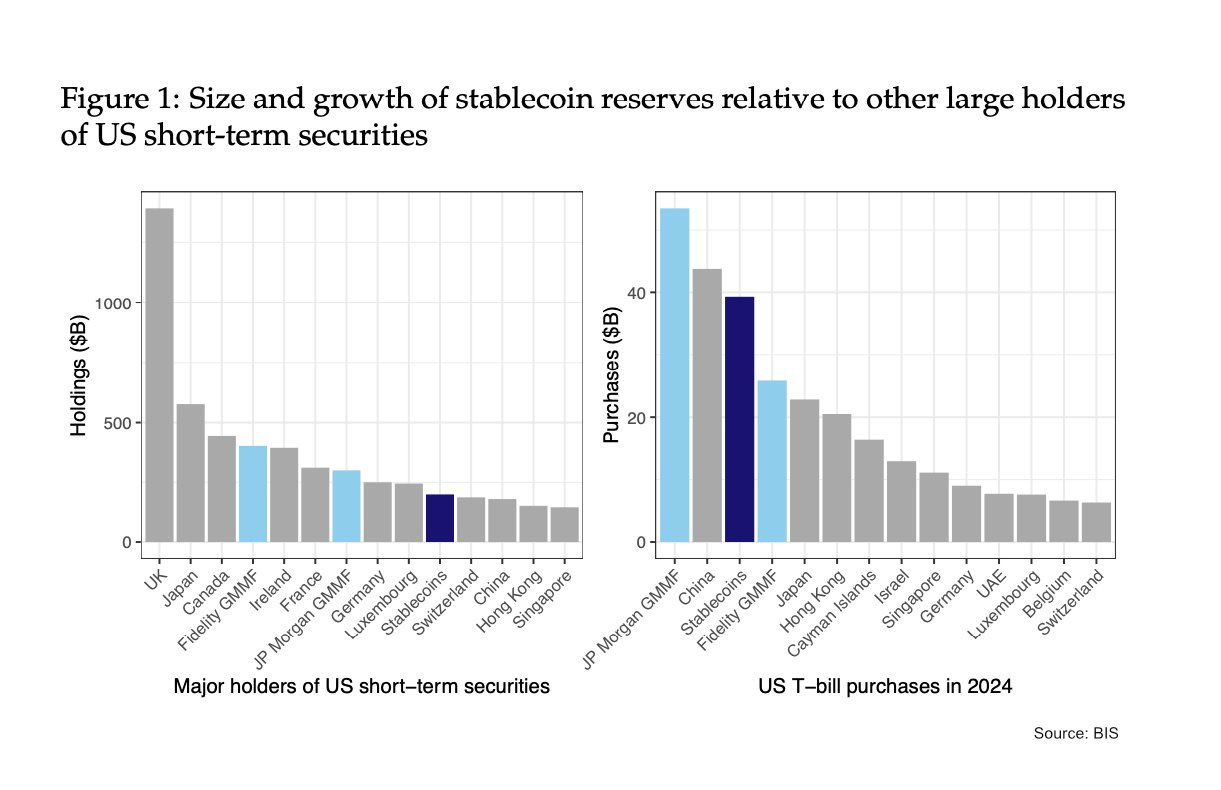

Stablecoins are a strategic technology for countries, for a simple reason: their business model is based on a country’s debt financing system.

Every penny spent to change any currency for stablecoins ends up funding the United States’ debt through purchases of short-term Treasuries, and as cryptos have gained traction over the years, stablecoins globally have become the third-largest purchaser and tenth-largest holder of short-term U.S. Treasuries.

Anyone interacting with cryptos is basically funding the United States.

We do not have - or I didn’t find, any USDC usage geography data, but what is certain is that 99% of this liquidity wouldn’t have ended up in U.S. Treasuries to start with, and tons of it comes from other countries and financial systems, hence had no chances to ever end up in U.S. short-term Treasuries.

Take me for example, as a European owning stablecoins, I helped funding the U.S. - very modestly, when purchasing them, while I would never have bought them by myself, and my bank would have preffered European bonds. And yet…

Stablecoins are a new source of funding for countries. And regulators understand this.

Risks.

Competition.

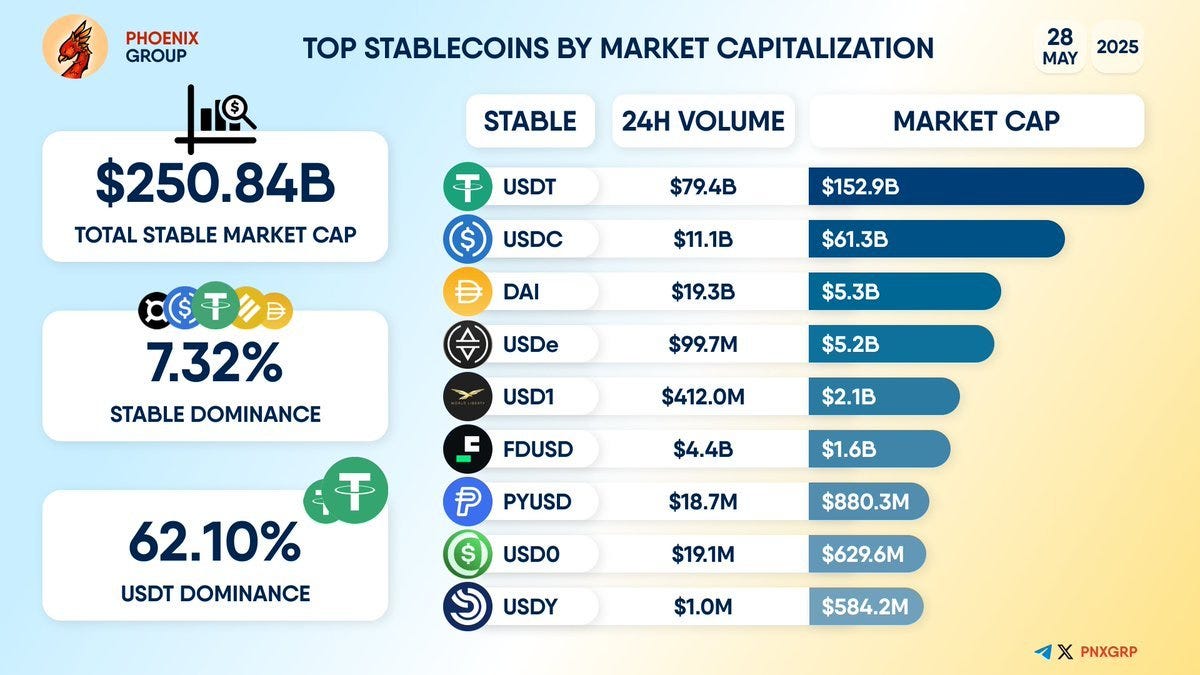

One of the risks surrounding Circle is competition. The barrier to entry in the sector is relatively low. As I shared in this write-up, stablecoins are nothing but on-chain dollars so anyone capable of developing a smart contract on Ethereum could create one. And indeed, many stablecoins exist.

USDC isn’t even the biggest one. Its main competitor, Tether & its USDT, is more than twice as large in terms of capitalization with a 62% dominance over the entire market. We also have PYUSD, PayPal’s stablecoin which is built with comparable mechanisms - 1:1 backed by real dollars.

And these are the ones existing today; we could have many more in the future from massive institutions like Visa or Mastercard. Even Facebook, back when the company was named that, tried to build its own stablecoin.

So yes, competition is a real risk.

But there’s more to it: even if the technology is easy to replicate, what matters with stablecoins is trust, and Circle is the most trusted issuer on the market. First, because it is built on a 1:1 backed system by real dollars, and second, because it is regularly audited & regulated with banking frameworks.

When it comes to trading cryptocurrencies, many will use USDT because it’s easier. But when we look at the bigger picture and what stablecoins could be used for - international transfers, multibillion-dollar company partnerships, etc… Circle is the only trustworthy enough issuer on this list.

Things might change, and we need to keep an eye on it.

Reliance on Interest Rates.

As of today, over 90% of Circle’s income comes from the short-term treasuries yield & this shouldn’t change. The business model relies on leveraging customers’ liquidity, which means when interest rates go down, Circle’s revenues go down.

A 50-basis-point cut on billions will have a huge effect on their revenues.

We need to keep an eye on stablecoins’ adoption and demand worldwide to confirm that the technology has what it takes to indeed disrupt, or at least upgrade the actual financial system. If this happens, Circly will be able to have a strong source of revenue with its CPN where it charges fees - still lower than the tradintional financial system, for a better service globally.

Regulations.

Circle committed early to respect U.S. regulations; it acknowledged that this was its bull case: to become the official and trusted stablecoin service. So, it went through all the necessary controls & continues to do so.

But we should add transfers and payments regulations to those, as they are closely monitored by U.S. institutions. Circle will need to respect traceability, identification, centralization & controls not just for its core business but for how its infrastructure is used by its clients.

Everything is not perfectly clear yet in the United States around stablecoins and blockchains in general. But regulatory frameworks are being built and those are another thing to keep an eye on.

Financials.

There won’t be much to comment on here, as the company only released its S-1 - the necessary document to IPO.

As shared above, interest on cash accounts for 99.1% of total revenues & those grew 15.6% and 87.8% YoY over the last three years - really decent growth as interest rates rose sharply FY22.

Distribution costs represent the spending from Circle to promote its USDC through its partners - Coinbase & others, and transaction costs are the dollars spent on on-chain fees for its stablecoin transactions. These two are the most important expenses, giving Circle a gross margin of 39%.

On the rest of the costs, it’s important to note that Circle includes compensation in its revenue statement, and these are the primary expense of the company - 53.5% of total expenses in FY24. It’s hard to know how management intends to manage its compensation plans for now, but they sure were pretty huge.

The pre-tax margin was at 9.2% in FY24, with lots of leverage to grow in the future, as now that Circle is publicly traded, it will have to optimize its financials to look better than it actually does.

Valuation.

A quick word on valuation & my opinion on how we should see Circle going forward. I do not believe it is the case right now, but I personally intend to compare Circle to Mastercard and Visa when it comes to valuation.

In my opinion, Circle has a comparable business.

But it doesn’t have the same status yet. We need to see growth in its stablecoin usage, diversification in terms of revenue streams, compliance with any payment and transfer regulations, and many partnerships to use USDC. It has started with companies like Uber & Shopify, but it needs to accelerate before others have the time to develop & distribute their own stablecoins.

USDC needs to become the most trusted & used stablecoin, rapidly.

While the fundamentals get stronger, Circle also has to prove that it can become a company focused on its shareholders, like most financial companies. The business model is simple, and margins should be higher with tight expense control & value returned to shareholders.

If it can pull this off, Circle will deserve to be compared to Visa and Mastercard in term of multiples in the market.

Conclusion.

Stablecoins are a better technology leveraging better infrastructure: blockchains. They allow everything to happen faster and for lower fees. They could simplify the entire payment and transfer industry, and many of us would be happy to see it happen.

This seemed to be a stablecoin investment thesis more than a Circle investment thesis. But the truth is that the distinction between the two is very small, as Circle is the only audited, centralized, and regulated stablecoin issuer on the market. If stablecoins were to become an opportunity - as I believe and have made the case for here, Circle is the most likely to win as it is the most trusted issuer.

As of today, when it comes to financial institutions & businesses, Circle = stablecoins.

That being said, I do not believe Circle is a great investment at the moment. I believe it is important to know about stablecoins and the best issuer on the market, but it is too early to speculate on their success. We need more time, more fundamental proofs and more revenue streams as interest rates should decrease and Circle’s revenues with them in the next quarters, more clarity on how banks are going to react and if they can take over the stablecoins market, etc…

This investment thesis is to be aware of the subject and have the necessary knowledge of the technology. So when/if the opportunity arises, we only have one thing to do:

Press buy.

Stripe, Adyen, and checkout have already consolidated the payment infra. What is your rebuttal to that? What makes you think they can compete in terms of auth rates, fraud prevention, and TCO? Especially given the amount of unstructured payment data these platforms now have?

Applauding you for another quality writeup. Appreciate so much of your time and effort.