Adobe Q3-25 Detailed Review

It might finally be time.

If you guys are interested, you’ll have 15% discount on FiscalAI subscriptions through my referral link. FiscalAI is the tool used for KPIs on all my write-ups, really powerful, valuable data & great UX.

https://fiscal.ai/?via=wealthyreadings

Everything you need to understand Adobe’s investment thesis is here.

Simply put, Adobe is the operating system for creative work. Adobe combines creativity and marketing in the enterprise, offering the most differentiated solution to serve the growing needs of Creative and Marketing Professionals.

Business.

There is a lot to touch on for this quarter, most of it is positive as once more, Adobe proves that the long-awaited disruption is simply not happening. Many of you know that I am bullish on the name and believe that Adobe will be the best at leveraging AI for creative purposes, like I believe Duolingo will be the best for learning purposes.

Why? Because specialization makes better software, that has always been true and will certainly remain true with AI models.

Our strategy to harness AI is focused on infusing it across our category-leading applications to provide more value and delivering innovative new AI-first products.

We released Project Turntable, a popular sneak from MAX last year into illustrator helps users rotate their 2D art work to accurately visualize different angles, eliminating a frequent and time-consuming task. Innovations like these directly translate into measurable value for customers by cutting production times enabling more content output and raising the overall quality of creative work and have driven strong migration to our new Creative Cloud Pro offer. In Q3, we added a slew of new capabilities, including avatar generation, sound effects generation and updates to the growing list of integrated generative models.

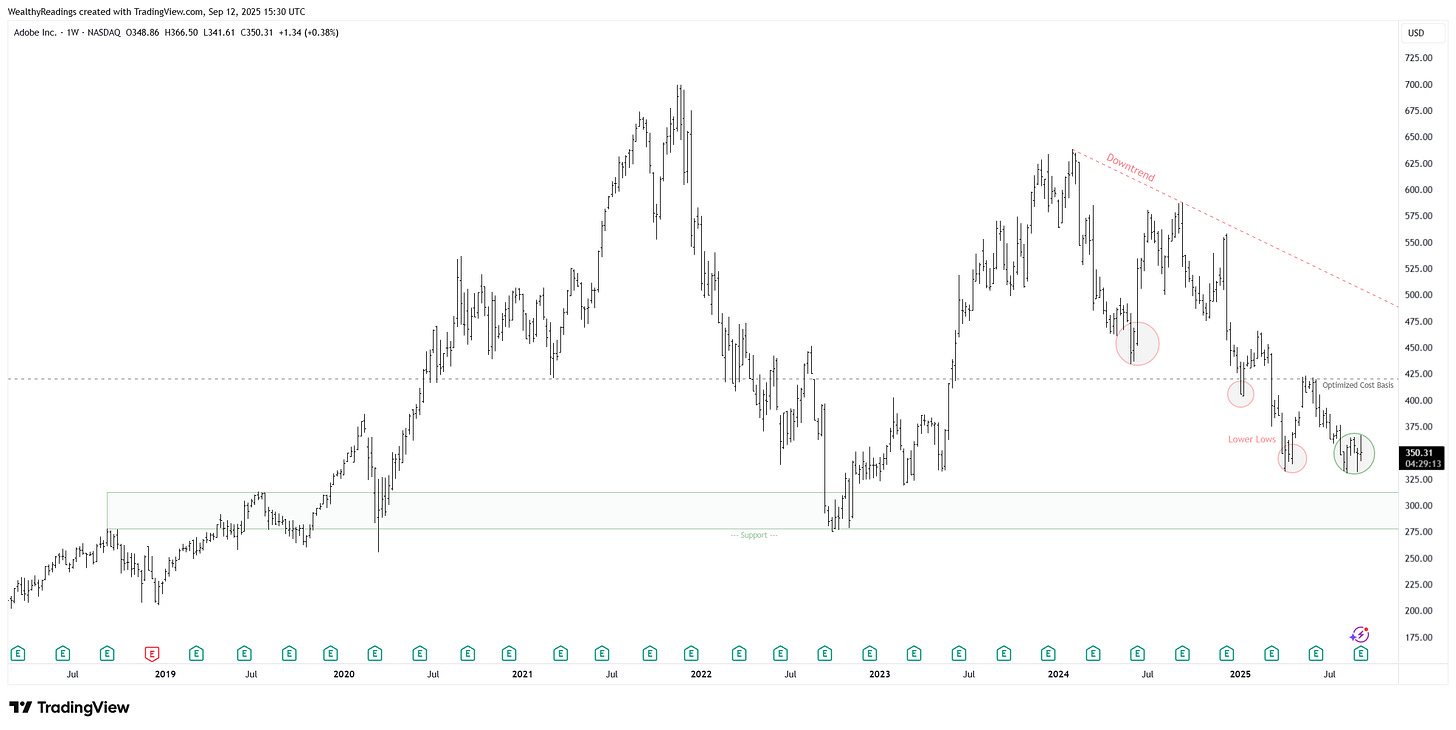

But the market disagreed with me, for long. This might be changing as the quarter is good, and the stock seems to be bottoming.

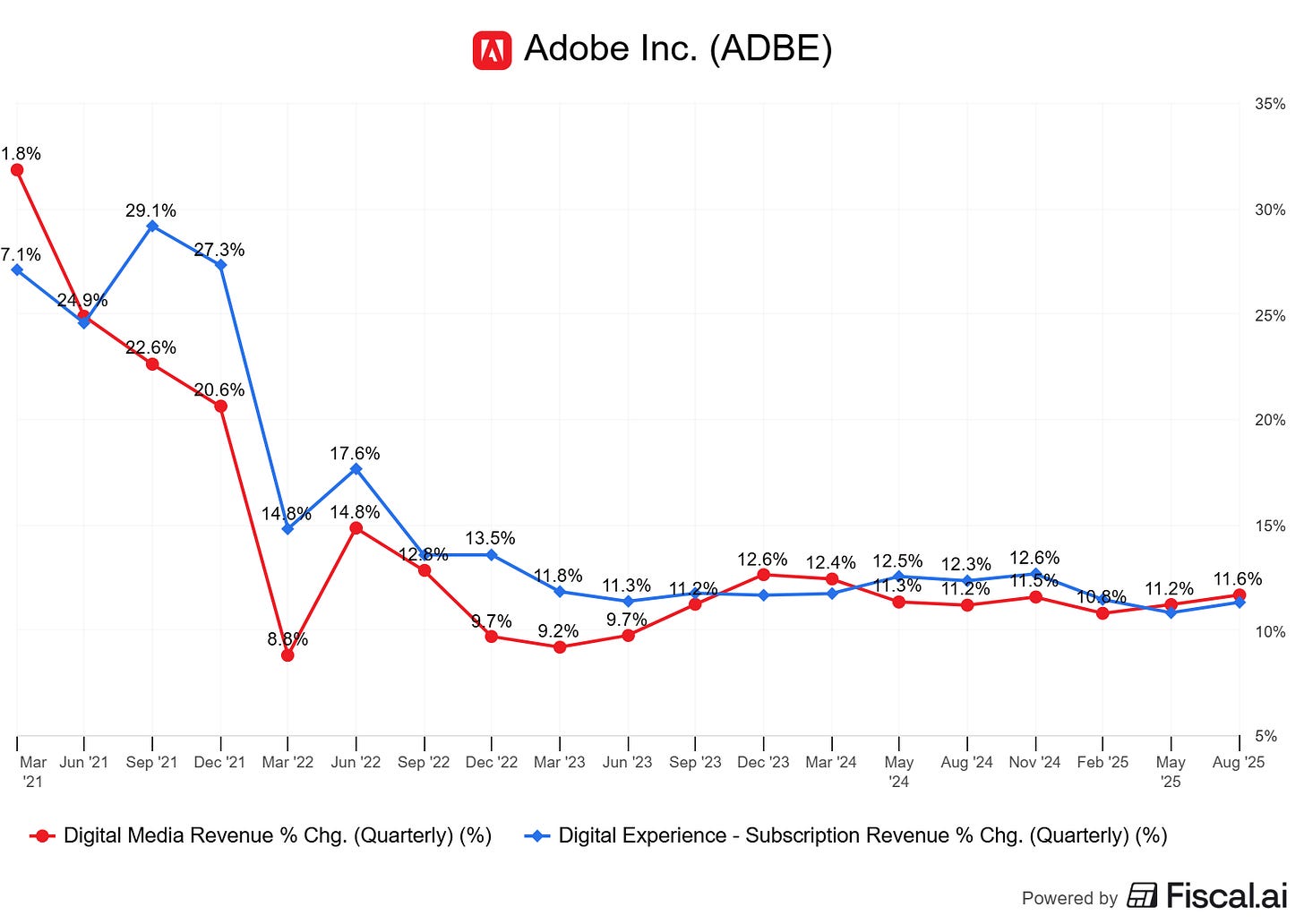

In terms of fundamentals, both branches of the company are growing healthily, with a stable double-digit despite tougher comps.

This is not what a disrupted business looks like. Their creative branch should have stopped growing entirely three years ago, when ChatGPT was released, if the disruption rumors were true.

But growth continues.

Digital Media.

This is due to their specialization & early focus on AI years ago, developping their own model and growing their ecosystem around this new technology. This focus paid off, with their year-end target reached more than a quarter earlier.

Notably, ARR from our new AI-first products including Firefly, Acrobat AI Assistant and GenStudio for performance marketing has already achieved our end-of-year target of over $250 million.

Once again, this is not the trajectory of a dying or disrupted business. A double-digit growth due to their new AI services, user acquisition and strong retention.

Firefly App MAU grew 30% QoQ. Firefly App continues to attract next-gen creators with first-time Adobe subscribers through the app growing 20% QoQ. Generative AI consumption accelerated with 29 billion generations and video generations growing nearly 40% quarter-over-quarter.

Over 14,000 organizations added Express in Q3 alone, a 4x increase in the quarter versus a year ago. Express usage within Acrobat nearly doubled QoQ.

Creators, we're seeing -- because of the third-party models, but also because more and more of those integrated workflows and the work we're doing with Firefly models themselves. We saw over 20% of the growth in that on new users to Adobe. So we're pulling in a lot more new users.

I also said months ago that professionals will not rely on average/free tools, because they are unreliable & it seems to be true as those continue to grow their partnerships with Adobe.

Increasing demand for GenStudio, our comprehensive content supply chain solution, enterprises drive content velocity and AI automation, continued strength in customer retention and expansion and strong execution in deals over $1 million across key verticals and geographies.

For the Business Professionals and Consumers Group subscription revenue was $1.65 billion which represents 15% year-over-year growth as reported or 14% in constant currency.

This report has a lot of quotes but they show that Adobe’s usage is not slowing due to AI or LLMs, on the contrary; specialized AI models are a tailwind and general models are simply not good enough, can’t compare for most usages, especially for creativity.

Even then, Adobe made the choice to integrate those within its ecosystem to give its users the choice. They can use Firefly, but they can also use ChatGPT and others within their ecosystem.

We're delivering an end-to-end ideation to creation solution in the new Firefly application to make it a single destination for creators' workflows. It includes our own first-party commercially safe models and lead third-party models. We are seeing strong adoption of the standalone Firefly subscription offering.

Adobe continues to prove that its creative business is not at risk.

Digital Experience.

And its other businesses are not either, be it for advertising or PDF. I will once again share it through quotes, because there isn’t much more to do.

Our Workfront, Frame, AEM Assets, Firefly Services and GenStudio for performance marketing products, which are key components of the integrated GenStudio solution now exceed $1 billion in ARR growing over 25% YoY.

Ending units for Acrobat AI Assistant grew 40% QoQ and AI Assistant engagement with conversations and summarizations grew approx 50% QoQ.

We're seeing continued adoption and momentum for Adobe Experience Platform AI assistant, with 70% of eligible AEP customers leveraging this functionality.

Consumption of Firefly Services and custom models grew 32% and 68% QoQ, respectively.

A question was also raised on a potential lower usage of Adobe and growing usage of single-platform advertising - Meta or Google, which management answered by saying that traditional advertising would either way be obsolete very fast, replaced by LLMs conversations and that what mattered was to be relevant with LLMs inference… To which they are building a service called LLM optimizer.

We're seeing continued adoption and momentum for Adobe Experience Platform AI assistant, with 70% of eligible AEP customers leveraging this functionality. As AI transforms consumer behavior, it's reinventing marketing and customer experience. Brand discovery is shifting from primarily search to include generative engine optimization. AI becomes the new UI guided by conversations rather than menu clicks.

Adobe is not behind in terms of AI, in terms of creative software, nor in terms of advertising.

Financials.

Nor in terms of financials.

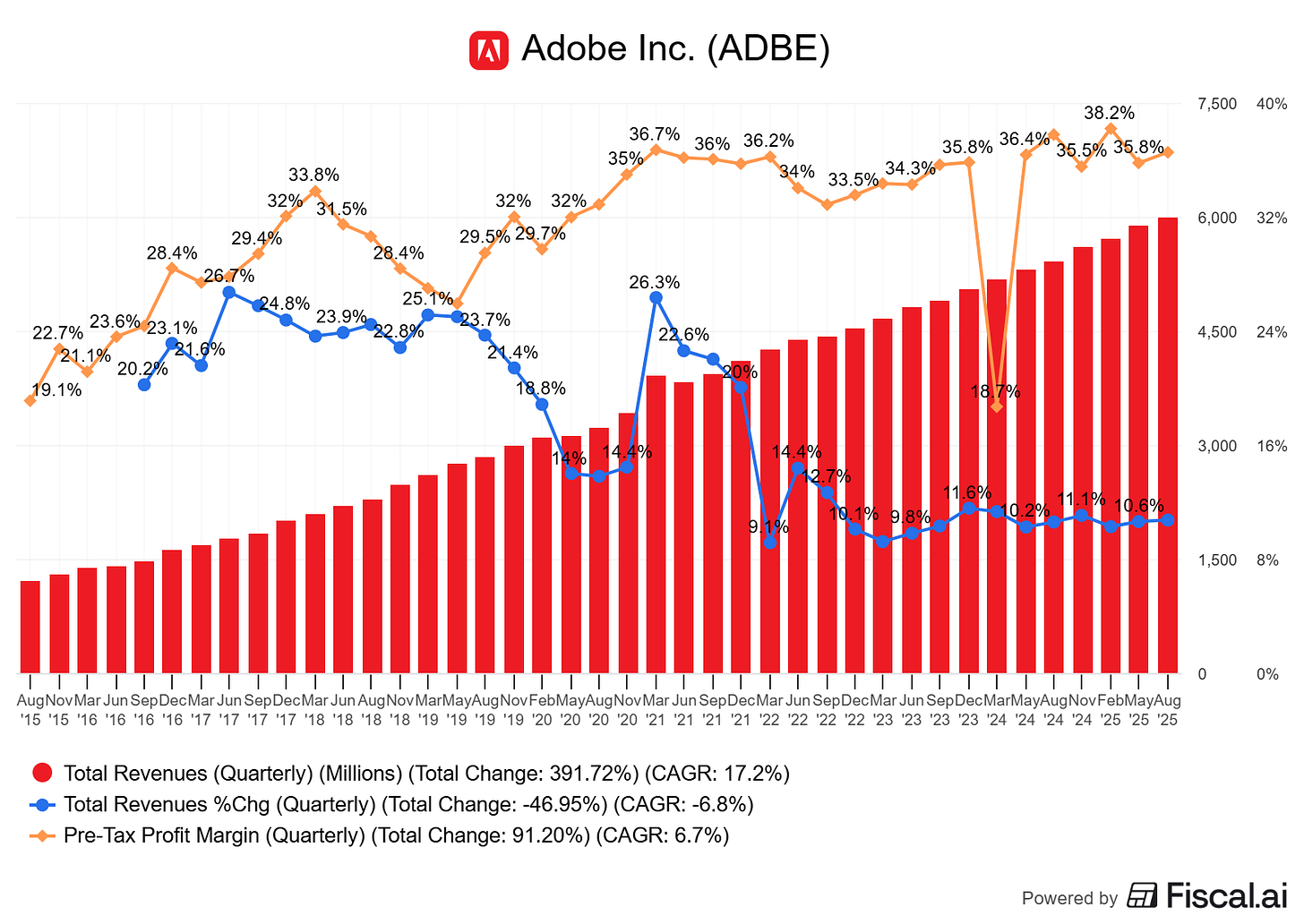

Growth has been extremely stable for years now, exactly like their pre-tax margins, still around 35% despite a growing usage of AI - which is impressive as most companies accept a tradeoff on their margins short term to attract volume.

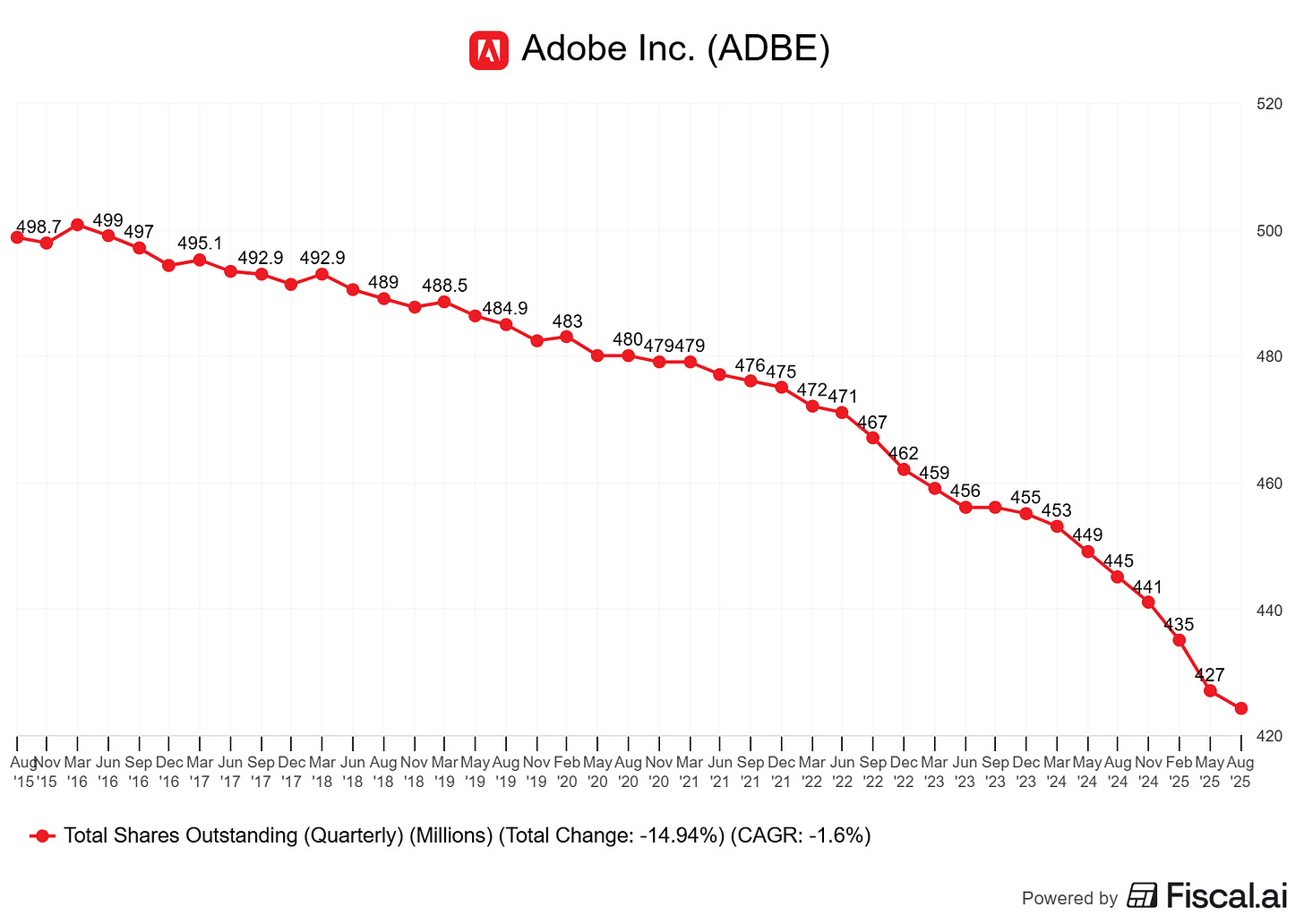

In terms of cash, they sit on a -260M net cash position, really healthy considering their $2.126B of FCF this quarter, which ended up being almost entirely used to… Buy back shares, $2B during the quarter. There are no better use of their cash at the moment & shareholders should be happy to see a buyback acceleration while the share price is impacted by a negative narrative. Management apparently intends to continue as they voted a new buyback plan pushing their dry powder up to $10B.

This kind of financial engineering ends up raising EPS faster than it should and lowers trading multiples, which usually catch up on averages.

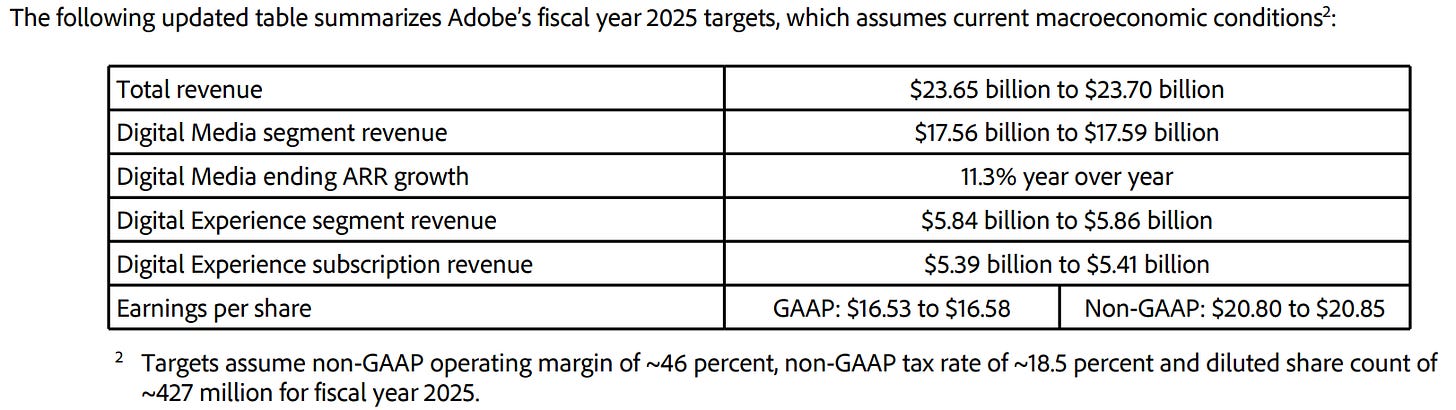

Guidance.

Management raised its FY25 guidance as the business is simply better than expected.

This would close the year with double-digit growth in terms of revenues and a much higher EPS growth, which is probably the most important metric for developed companies.

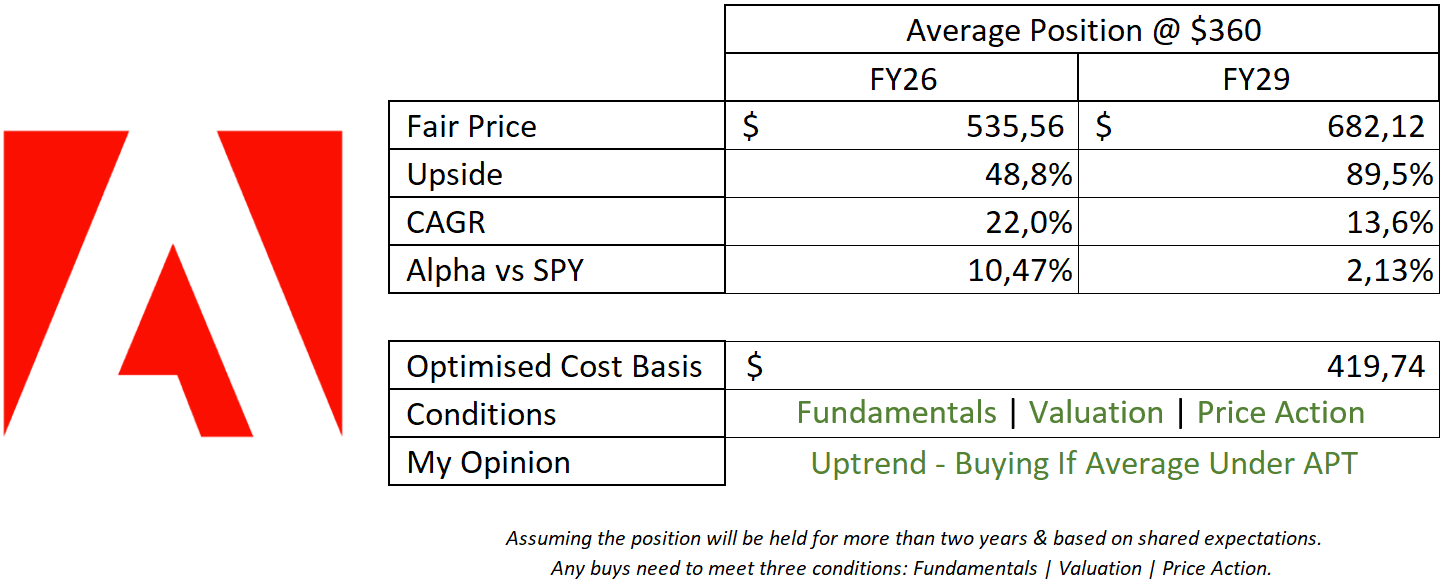

Investment Execution.

I struggle to see why anyone would continue to doubt Adobe as three years later, not only AI and ChatGPT-like LLMs did not disrupt its business, but actually enhanced it. The company grew steadily since then and continues to raise its guidance, while the market is scared of a never coming disruption.

I continue to believe, as shared earlier, that AI will be a tailwind for highly specialized software, and Adobe is one of them. I have been patient for more than a year, for the market to give signs of a bottom, and we might finally be there.

I initiated a position after this quarter.

The real question is about the potential upside, as even if Adobe is being recognized, it is hard to know at which multiples. The stock traded at medians of x47 & x13 during P/E & P/S resectively the last decade with higher growth, and won’t deserve those multiples anymore with its actual growth. So I lowered my expectations & still believe we can reach above average returns, but I have no certainties on what the market will settle for in terms of multiples, even after realizing that AI isn’t a threat.

This model assumes a 9% & 7% CAGR growth until FY26 & FY29 respectively, 30% net margins, 2.5% return to shareholders, and a P/S & P/E at x35 & x8 respectively.

This model seems fair, not conservative nor bullish, simply fair, in all metrics assuming that Adobe is part of the AI revolution and deserves AI softwares multiples.

I know everyone doesn’t share my bias nor my bullishness when it comes to this kind of software, but to me this is where lies the next AI growth leg, in consumer centric services through AI-enhanced software.

The market seems to finally realize it as we start to form a double bottom. There are no assurances that this will hold, but those are the first positive price action signs since quarters.

Combined with a great quarter - proof that AI is a tailwind, that LLMs aren’t a threat, that fundamentals remain strong with growing usage from both retail & professionals and for all of its products, plus a good valuation to my opinion… I have everything I need to start a small position.

It will remain less than 5% without more confirmations, and I will slowly accumulate it. Adobe will be a stable “daddy” stock in my portfolio to balance with the growth plays and might not be for everyone, but I firmly believe the stock is worth liquidity. It won’t be a priority, but it deserves to be there.

Adobe is getting cheap, quite attractive to be honest!! Customer delight is certainly not the reason behind it reoccurring revenue, its more like customer captivity. Yet, I believe at prices below $300, it presents good entry point which kinda provides a cushion against this melting ice cube.

https://open.substack.com/pub/latebloomr/p/adobe-adbe-adobe-a-cash-generating?utm_source=share&utm_medium=android&r=5bgci5