Transmedics Q3-25 Detailed Earning Review

The market doesn't like diamonds.

If you guys are interested, you’ll get a 15% discount on FiscalAI through my referral link below. FiscalAI is the tool I use for KPIs in all my write-ups - powerful, data-rich and with great UX.

https://fiscal.ai/?via=wealthyreadings

Everything you need to understand Transmedic’s bull thesis is here.

Business.

This was a strong quarter with significant updates. First, management confirmed that seasonality is behind us.

We are confident that this seasonal impact is behind us, as we have seen volume rebound in September and into early Q4.

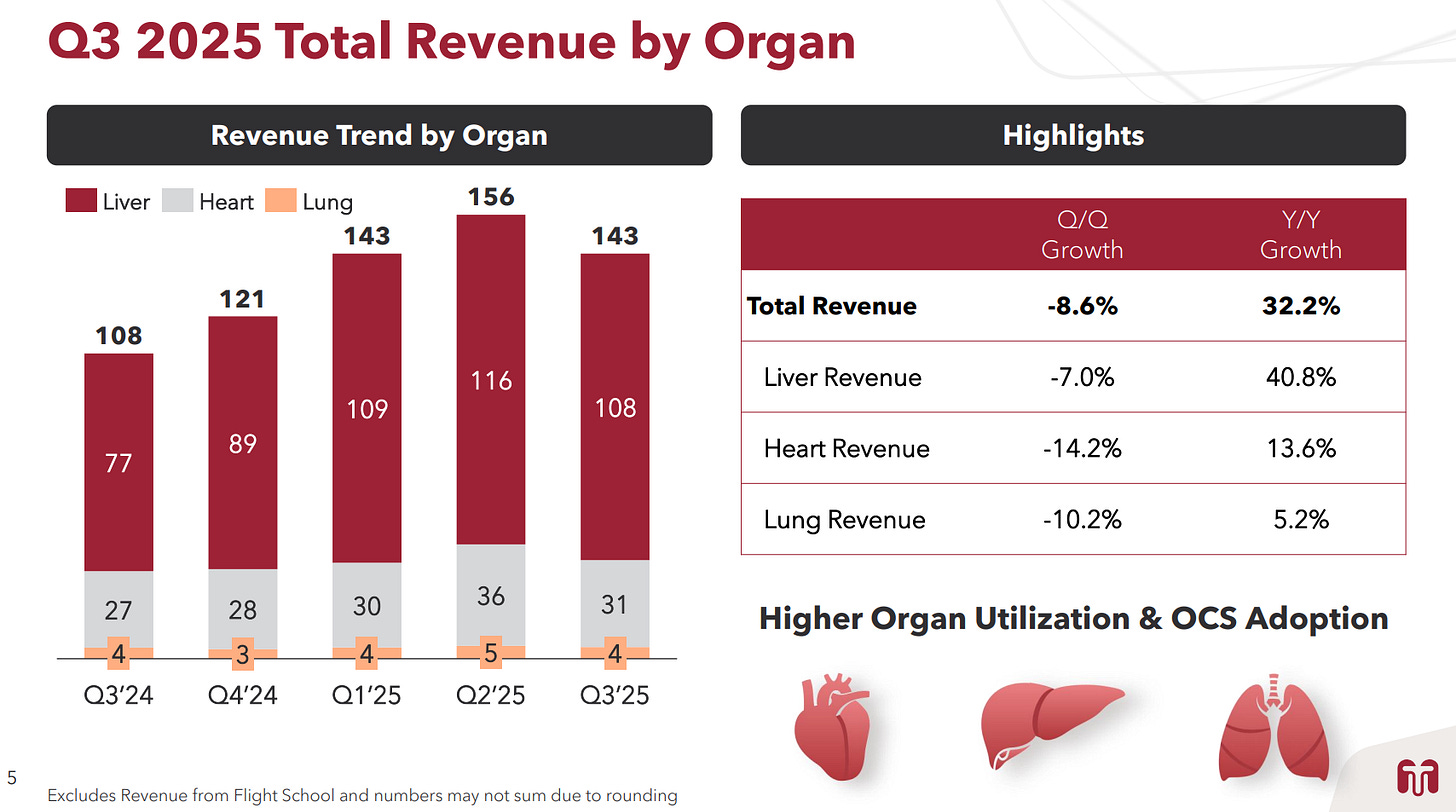

Both products and services revenues are growing across all three organs Transmedics serves and the company seems to be gaining market share as revenues per organ are outpacing transplant volume growth in the U.S. - which means a bigger share of the pie assuming no price increases which is management’s policy.

We experienced year-over-year growth across all three organ segments, driven by higher overall utilization and center penetration of OCS NOP in the U.S. Specifically, we saw YoY growth of nearly 41% in liver, approximately 14% in heart, and 5% in lung revenues in Q3.

Sequential comparison aren’t really valuable due to the seasonality weakness in Q3.

On the services side, Transmedics internally operated 78% of flights, targeting the low-to-mid 80% range short-term. This wasn’t done yet due to contracts and limitations on longer-distance flights, as their fleet is only short-range jets.

I think in 2025, we see a ceiling in the low 80s or 80%, roughly speaking, just because of some of the existing contracts that are supporting other logistics providers in the U.S. The other element to that is the long-distance transport. Remember, our planes are short distance, or relatively speaking, they’re light jets. Any Hawaii missions, we have to do it on third-party aircraft because that’s a longer jet

More internal flights equals higher revenue and margin contribution. The company is maximizing utilization of its 22 jets - a new one was added in October, and is even testing double-shift pilots to increase mission count per plane.

Basically, what will be happening, is that the same number of planes will fly a higher number of missions, maximizing the return on capital.

This is a short-term tailwind for growth and cash generation.

Lungs, Hearts Trials & Kidney OCS

Both next-generation OCS trials are moving faster than expected, with first patients expected in Q4 2025.

The heart trial is split into two FDA-defined phases with volume limits, while the lung trial has only one phase with a much smaller quota. Management expects these limits to be lifted early 2026 after answering the FDA’s last questions.

What I’m saying is that limitation or cap is going to be removed or these conditions will be removed once we address all the remaining questions for FDA, and that will come in Q1 of 2026 or early 2026. The trial will be uncapped and unconditional. It’s going to be open. We are going to enroll and book our first revenue in Q4

The Kidney OCS will be unveiled in H2-26, with clinical trials as soon as 2027.

Yes, we are unveiling the design of the technology and the product. There will be a significant trial in the U.S. and maybe even an international trial. This is all going to be a revenue-generating trial. We’re excited about that trial because this trial is also going to be powered for superiority. It will have a huge ramification not only on the clinical outcome for patients, but also financial ramification given that CMS is the sole payer for end-stage renal failure expenses in the U.S. This is a trial that I hope and I believe CMS will be watching very keenly. They will support it because it will have a huge cost efficiency given the increased improved outcomes and higher utilization of kidneys that should be afforded by this

All programs are ahead of schedule.

European & Global Expansion

Transmedics will launch in Italy in H1-26, with revenue contribution expected in H2-26. This expansion happened much faster than expected.

To that end, in September, we were excited to announce our plans to launch our first ex-U.S. NOP program in Italy. We are now actively establishing up to four hubs to serve as launch points for that program, strategically covering both northern and southern Italy. We are also actively staffing up our Italian clinical support teams.

It is important to note that we are planning to start building an EU air and ground transplant logistics network similar to the one we have established in the U.S., however, appropriately sized to meet the European needs.

Europe represents ~60% of the U.S. market, with ~10,700 lung/heart/liver transplants annually and ~17,000 kidney transplants. Smaller but still a massive opportunity with clear infrastructure gaps.

Based on our knowledge today, they are having significant challenges of even securing logistics to move organs even within Italy.

Italy is only step one, with further expansion discussions already underway across Europe and elsewhere. We are talking worldwide expansion. Soon.

But the first steps remain the integration in Italy and Europe as the region is complex in term of regulations which is a tailwind and an headwind at the same time. It is very hard to get in, but once in very hard to be displaced.

Europe is not a homogeneous geography. We have to be respectful and design our National OCS Program to be tailored to each country’s specific clinical and regulatory requirements. Italy is going to be a very important first step.

We need to focus on our first kind of beachhead in Italy, deliver on our promises, and deliver world-class service, achieve success there. We believe wholeheartedly, especially in Europe, success delivers success.

If it works in Italy and it works well, this is going to propagate across Europe. If it works in Italy, it will work anywhere in Europe, just given how the Italian environment is very complicated and has a lot of needs.

This represents a major medium-term growth tailwind, potentially as early as H2-26 with more news to come for other geographies. The only negative will be the required investments to make those NOP operational short term, which will pressure margins but in order to generate growth.

ROI is never guaranteed but it is always better to invest in the business than not.

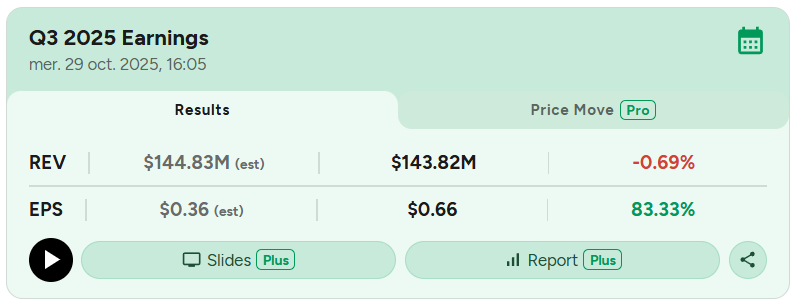

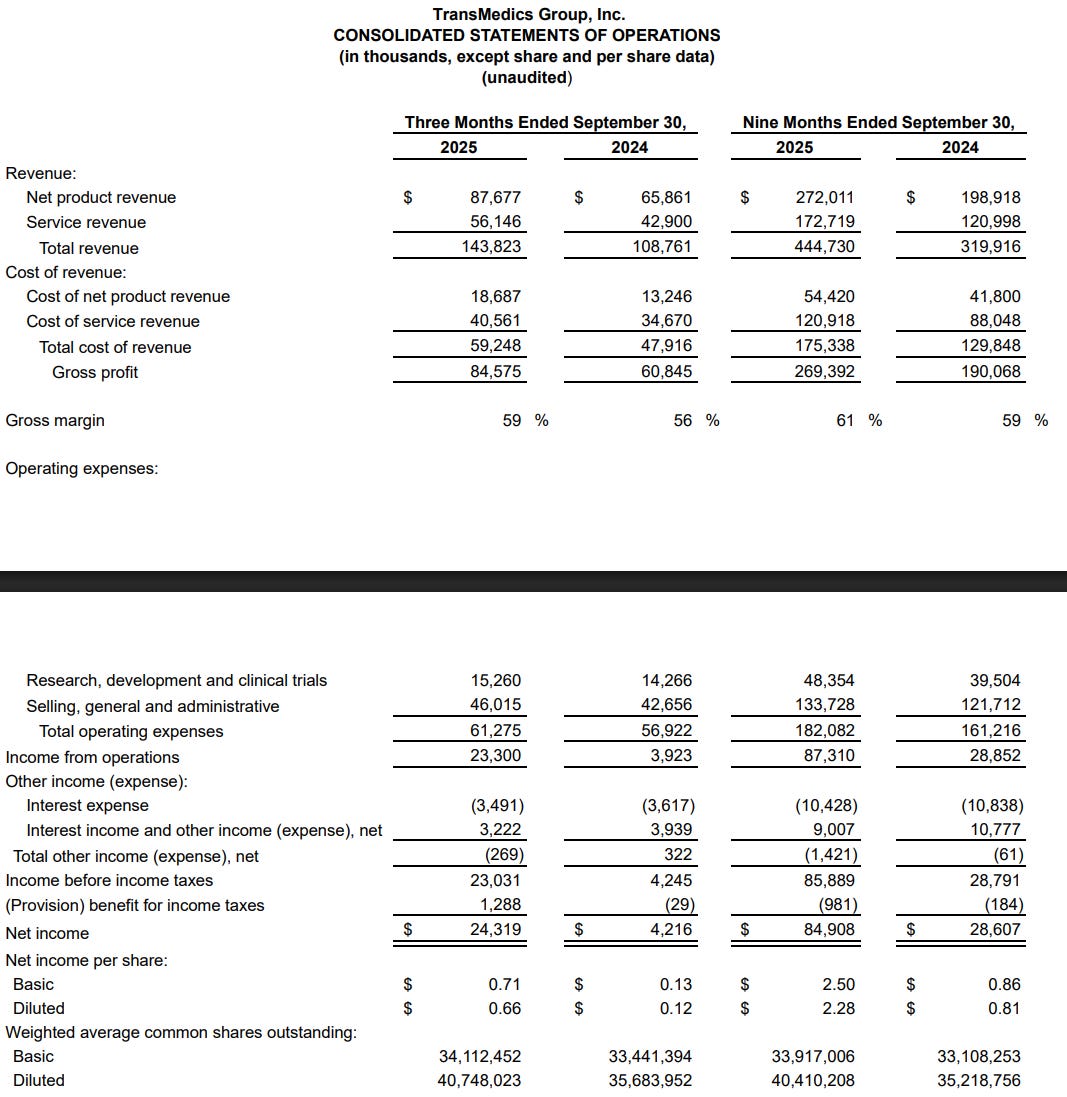

Financials.

Once again, comparing sequentially is irrelevant for seasonality-affected companies like Transmedics - don’t do that.

Revenues are up 39% YoY for the first nine months which is already strong, but not even the most impressive part of this report. Margins expanded, with gross margin rising to 58.8% from 55.9% and net margin to 16.9% from 3.9% YoY. Net income increased 197% YoY as a direct result, significantly boosting cash generation.

Looking ahead, margins will face short-term headwinds due to expansion investments. Offset by tailwinds from increased fleet utilization which should accelerate growth and profitability. Hard to know which will happen first and be the strongest but we have to keep those two variables in mind for the next year.

In terms of cash, the company generated $61.2M in FCF and holds $53.2M in net debt, an amount that could be paid off in a single quarter. Very strong position for a growth company. Share-based compensation are negligible to me at around 15% of FCF.

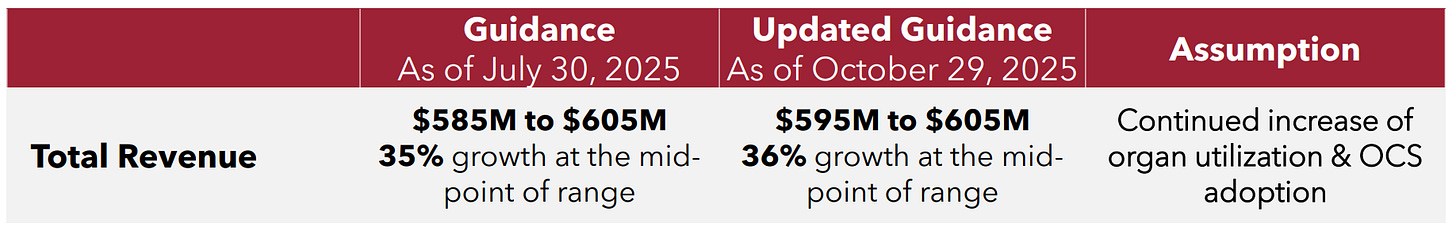

Guidance.

We can safely assume Q3 was above management’s expectations as they raised their midpoint guidance once again - third time this year.

Management also confirmed that contributions from the heart and lung trials are not included or only minimally in this guidance, hence potential upside which came with this kind of comment.

Of course, as you know, our philosophy has been to not only achieve, but as much as we can go above and beyond. We’re confident with where we are right now..

Strong confidence here.

Investment Execution.

There is nothing to be disappointed about here despite market’s reaction, which I find surprising given the quarter. Seasonality is behind us and the final quarter of the year is starting with a rebound and renewed confidence.

We have lots of short-term catalysts with both heart and lung trials starting and Italy’s NOP. More medium term tailwinds with potential additional European countries and long term, the Kidney OCS could unlock another growth vertical, multiplied by the geographies Transmedics will be involved with by then.

Together with the scalability of our model, these results continue to validate our ability to deliver strong financial performance and sustain momentum through the rest of 2025 and beyond.

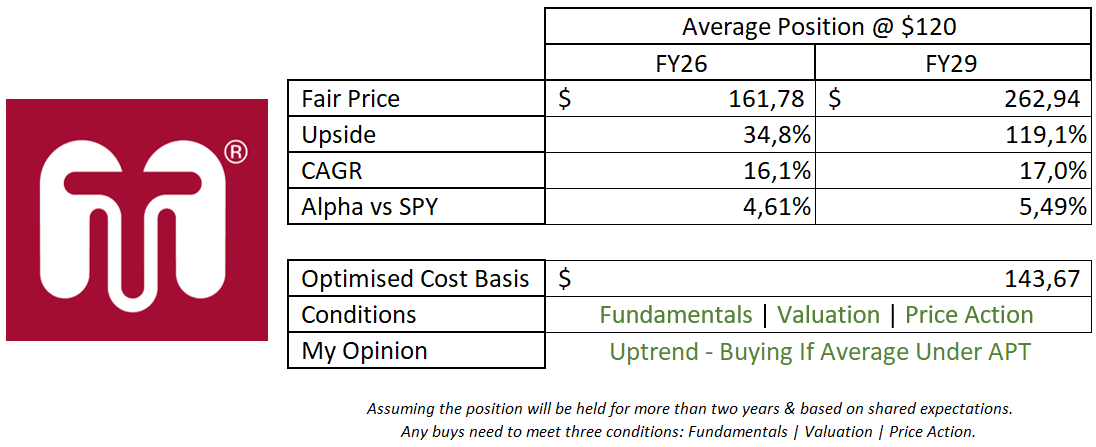

My valuation didn’t cahnge. I continue to be conservative, as usual.

This model assumes a 35% & 25% CAGR growth until FY26 & FY29 respectively, 21.5% net margins, 1% of dilution & P/S & P/E at 35x & 7x respectively.

I already hold a position at a much lower average and am comfortable continuing to accumulate if the stock opens with a large gap down, very possible considering the post-market reaction.

The stock was around $122 then. As I shared earlier, a retest of the breakout trendline after a strong quarter would be a great entry/accumulation point, as it also is aligned with the daily 21 EMA and 50 EMA - two key short term moving average. All of these levels converge around $120 and given the strength of the quarter, you can guess my plan is if we open there.

I may even reduce other positions to increase Transmedics. I remain very confident in this name; seasonality is behind us and multiple positive catalysts are in front. I’ll be patient before adding aggressively given the size of my position, but signs point to continuing accumulation to me. We should start seeing some re-ratings this week, positively to my opinion as the raised guidance points to confidence in the business.

In brief, depending on open tomorrow, I could rotate some of my liquidity towards the name in both shares and calls as I remain confident and this quarter, which was impacted by seasonality, showed some real strength.

As always, this is my book, not investment advice. These are simply my opinions.

Thank you for the writeup! If I may ask, how do you justify that P/S and P/E? How are these conservative?

Hands on the buy button! 😁

Thank you for taking us through an excellent quarter, very encouraged by management's plans and confidence.