Transmedics | Investment Thesis

The one who saves your life.

We'll venture into healthcare today with Transmedics, a different sector that I usually don't look at… but Transmedics is different, involved in the organ transplant business - legally, of course. A sector where demand won't slow down and a pretty critical service for clients.

I know we're talking about healthcare, critical patients & more, and those subjects are tough to address. But I am writing about economy & stocks here and chose to approach this write-up with a light spirit.

Problematic & Situation.

I'm not a doctor, far from it, but I've tried my best to learn as much as I could about Transmedics, the transplant industry technically, legally & economically, and more. So we're going to start with a broad picture of the subject.

Transplants.

Transfering organs between bodies is a pretty phenomenal achievement which our doctors practice regularly for a few decades now, although techniques & reliability have drastically improved over the years. It is now considered a "normal" activity, at least something which most hospitals in the west do properly for various organs.

We ended 2023 with more than 46,000 operations.

More than 100,000 patients are still on waiting lists for different organs and this is only the beginning as the need for transplants is not slowing, on the contrary, due to different factors.

Medicine improvements. Many diseased which used to kill younglings or young adults are now easily treatable and our life span considerably increased - up to an average of 77 years now.

But as we evolved, the world followed and we now have diseases which used to be rare that now became common and which we do not know how to cure yet and those became more & more frequent. Technological improvements have also made possible what is now called "cerebral death," where deceased patients' organs continue to function and are therefore made available for harvest.

There would be much more to say but those two factors are an example of what have been influencing both the need and the means for transplants.

Chronic Disease. It refers to diseases that can be controlled but cannot be cured - cancers, kidney dysfunctions, diabetes... We can also consider organ damages that have occurred throughout life, from accidents, diseases, unhealthy lifestyle habits…

Our lifestyle has completely changed over the decades, favoring these.

“Incidence of end-stage organ failure has been rapidly rising worldwide due to demographic trends that contribute to chronic diseases.”

Some of these conditions, which were impossible to cure a few decades ago, can now be treated by transplanting a new & healthy organ instead of a damaged or dysfunctional one.

Cost-efficiency & life quality. Transplants are the best method to cure most of these conditions as treatments are really expensive & often inefficient. Management team explains it well:

“Organ transplant provides the longest life expectancy and best quality of life compared to other therapies for end-stage organ failure. [...] These improved survival rates, in turn, result in favorable economics for transplantation on the basis of quality-adjusted life years.”

A stagnant sector.

Despite the rising necessity of such medical treatment, not much has changed in the last couple of decades - except surgical techniques. But the end-to-end service remains largely what it was twenty years ago - or even more.

Lack of Innovation. I could make the case that the lack of innovation is often due to a lack of competition, often the case with public services- hospitals here. The service works just fine, and there was no need to improve it, but as the demand & need for it grows daily, the service must improve - we're talking about human life here, not the camera of the new iPhone.

The biggest proof of this is Transmedics' management admitting that competition in their sector is almost non-existent.

Cold Storage. One of the biggest challenge in organ transplant is their preservation after harvest. The current method involves keeping organs in an ice bath which has tons of inconvenients. I’ll let management speak.

“Cold storage deprives the organs from oxygen, resulting in time dependent injury (ischemia). This injury correlates with post-transplant complications and restricts the viable time for organ procurement and transplant, which limits the time and distance possible between donor and recipient and results in low utilization of the donor pool and limits the number of transplant procedures performed annually.“

And.

“Given the non-physiologic environment, cold storage does not allow for any therapeutic interventions to optimize the condition of the donor organs [...] It is well demonstrated that donor organs benefit from some form of optimization to replenish depleted levels of substrates, hormones, and electrolytes that are significantly altered or used up during the donation process.”

And lately.

“During cold storage, the organs are not physiologically active, nor functioning; thus, there are no means for evaluating the suitability of these organs for transplantation. This further limits utilization of available organs as donor populations worldwide are growing older and have concomitant risk factors that benefit from sophisticated diagnostic evaluation capabilities to predict whether the donor organ is suitable and safe to transplant.”

These are the issues Transmedics resolved first.

Business.

This was a rapid overview of the situation. What's important to remember is that transplants are the best methods to cure chronic diseases or organ failures - both medically and economically, while these conditions are more & more frequent - a trend which should continue.

Not much innovation has happened over the decades but Transmedics is now trying to set a new standard in patient care & service quality for transplants.

Organ Care System.

Transmedics introduced a better system known as the OCS. I won't include a video here because I'm not sure if everyone wants to see it, but I would recommend searching for one online. It's quite impressive.

I'd even recommend looking at some images of what cold storage actually is, to realise the difference between both systems - although ice & a bucket sure are cheaper.

The OCS system is divided into three parts:

The console. A platform equipped with all the necessary tools for doctors to monitor basic information, designed to be easily transportable and to fit into the transplant workflow. This platform can be used for any organ.

The perfusion set. A sterile, biocompatible single-use disposable set that stores the organ and circulates blood with all the accessories needed to preserve it.

The OCS solutions. A set of nutrient-enriched solutions used with blood to optimize the organ’s condition outside of the human body.

“We designed the OCS technology platform to perfuse donor organs with warm, oxygenated, nutrient-enriched blood, while maintaining the organs in a living, functioning state; the lung is breathing, the heart is beating and the liver is producing bile.”

As of today, three organs can be harvested & preserved on the OCS platforms, as you can see in the screenshot above - and again, you should watch a video if you're not averse to seeing blood.

The OCS is designed to keep organs in the best possible condition, closely mimicking the environment of a living organ within our bodies. This technology offers many advantages over cold storage. To highlight a few:

- Reducing ischemia (“inadequate blood supply to a specific part of the body”) or extending the initially limited time window between organ harvest & transplantation as the organs are maintained in optimal conditions.

- Enabling organ optimization once harvested to maximize post-transplant outcomes.

- Enabling diagnostics of the harvested organ with acceptable clinical standards to evaluate its suitability to transplant.

& more.

National OCS Program.

The OCS is the heart of Transmedics' business but they have built around it. Their ultimate goal is to renew & upgrade the entire organ transplant workflow which would drastically upgrade the life-quality of the patients and the frequency on which transplants are made.

The NOP is an end-to-end top quality transplant system.

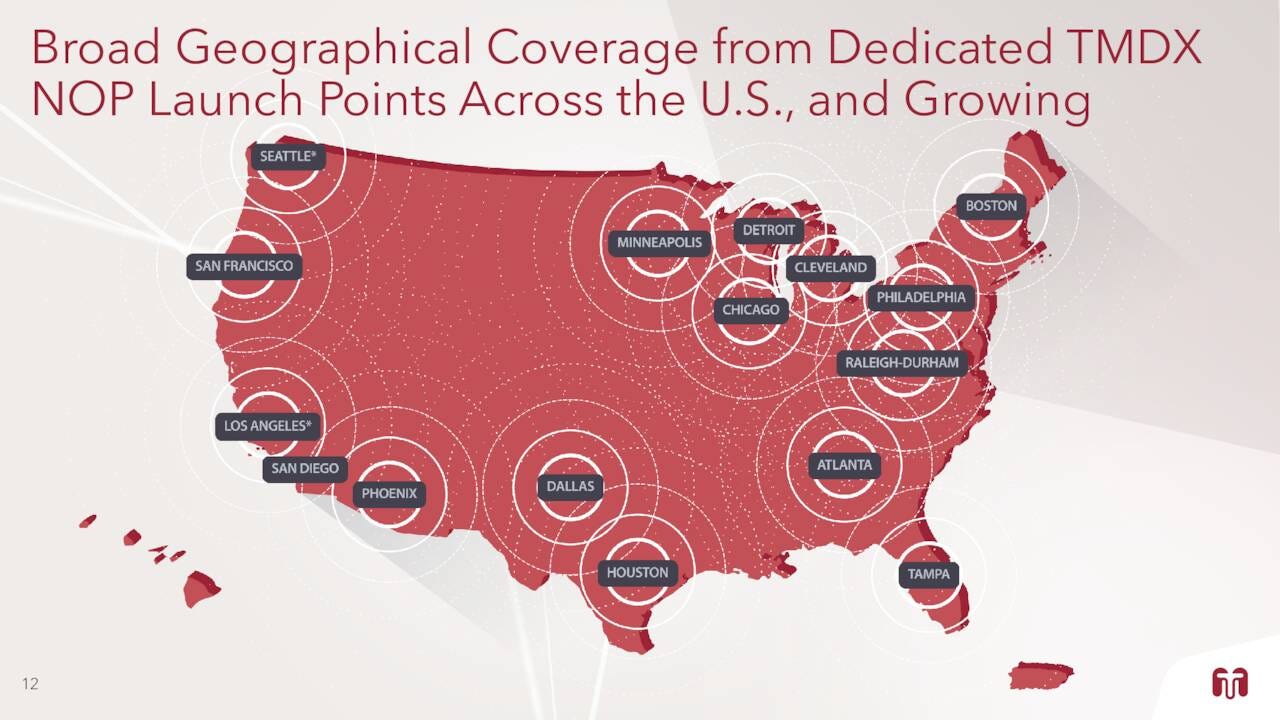

Hubs. Transmedics has developed numerous hubs across the U.S. which serve as operational bases. These are strategically located based on harvest statistics.

Each hub is staffed with a team of surgeons available 24/7 and is fully equipped with the necessary to harvest & store organs using the OCS. Transmedics also rent their facilities to external medical teams.

This is the first part of their end-to-end transplant service: always being ready in crucial regions with skilled teams and appropriate equipment to harvest, store and monitor organs on their OCS systems, waiting for a patient who needs them.

Transport. The second part is to transport these organs. Transmedics acquired Summit Aviation in August 2023, a charter flight operator, along with 13 fixed-wing aircraft. They also provide ground transportation, all available 24/7, just like their surgical teams.

This setup enables them to transport organs without delay between their hubs or to other locations where the final patient awaiting transplantation is situated.

Transmedics offer these services from end-to-end or case by case. It isn’t everything or nothing.

Combinaison.

This is how Transmedics tries to transform the entire transplant industry and upgrade it, with better products but also a better service .

When organs are available, they would be harvested at Transmedics hubs by their teams and stored in their OCS before being transported to another of their hubs where the final patient awaits his new organs, transplanted by Transmedics’ team once again.

Relying on one company for everything also means you'd rely on skilled & specialized professionals for all tasks. This improves the entire workflow, the quality of the organs, the surgery, the coordination, and the transportation. It also minimizes miscommunication or errors between different entities.

All of this correlates to better service & life quality for the patients.

Business Model.

The business model is pretty simple, the company has two primary revenue streams:

Its products themselves by selling the OCS, the perfusion set & solutions which are usable only once obviously. This leads to recurring revenue as each transplant is monetized.

And its services through the NOP platform which include transportation, usage of their infrastructures or medical teams.

Insteresting fact; management confirmed that most of their OCS sales are done through the NOP which means there's a very strong traction for "clients" to use the end-to-end service or at least to work in Transmedics’ facilities. More than just an interesting fact, it is a very important precision.

Insurance.

We’re talking healthcare, we need to talk insurance.

Having their services refunded by public insurances is mandatory for transmedics, their business wouldn’t work without them. An organ transplant costs between $400,000 & $2,000,000 depending on the organ itself so you can imagine not many could pay for this directly.

Transmedics is operating in the United States at the moment and is hard at work to export its products over seas, in Europe mainly. So we’ll divide this in two parts as the system are different between geographies.

America. Each service & product proposed by Transmedics is refundable through existing, standard commercial transplant builling mechanisms.

Reimbursement is available through Medicare & Medicaid. I won't extand myself into the entire process since I don't fully understand it (being European), but what's crucial is this:

“Nearly half of U.S. lung, heart and liver transplants are covered under the Medicare and Medicaid programs, with the remainder being reimbursed through private payors.“

Transmedics' services are reimbursed with a history of multiple years of billing. This is essential for the company & its future.

Europe. Work in progress. Transmedics is still seeking long-term reimbursement there & in the U.K. Expansion is a big deal for the company and would easily double its potential if they suceed - more on this later.

But as said above, this won’t change anything if their services aren’t refunded and it’s impossible to predict when or if this will happen. It seems like a net benefit for Europeans to accede to this technology but no one never knows with Europe.

Regulation

Another crucial topic when discussing health care but this section will be brief, just to say that every infrastructure, service 6 product Transmedics sells is regulated and overseen by the FDA & other American institution while being studied by European & English ones.

These regulations are a prerequisite to access public inssurances so if the company gets them in Europe or in individual countries, it means they follow all the requirements.

Advantages.

I believe the case is clear already but I'll highlight some points individually.

For Profit. This is an advantage over the public system. For-profit companies drive innovation because they must provide value while governmental agencies do not face the same pressures to innovate or improve, they do not need to stay relevant.

A for-profit company also needs to build a sustainable business model and can’t just sell to the wealthy who can afford the service; they need their services to be accessible to everyone, as their revenues depends on volume.

They work to innovate and to provide the best & most affordable service. I'll let management speak for themselves on this:

“We believe the OCS and the NOP drive significant benefits to all stakeholders in the field of organ transplantation. For patients, we believe the OCS and the NOP provide additional access to life-saving transplants and allow for quicker recovery following transplantation. For hospitals, we believe the OCS and NOP provide a means to increase transplant volume, treat more patients, enhance provider status and improve transplant program economics. Finally, we believe the OCS and NOP provide payors with a more cost-effective treatment for end-stage organ failure and reduces exposure to significant post-transplant complication costs and extended hospital stays.”

End-to-end Service. Transmedics’ air transportation service is only a year but they now can manage the entire process with their own teams & equipments. This significantly improves the quality of care and organization.

There's no longer a need to coordinate between two hospitals using external transportation systems and potentially different surgical teams. In addition to providing the best hardware through the OCS, they offer superior expertise with competent and specialized personnel for all tasks.

No competition. Being a pioneer is always great business and Transmedics has no competition , no other company offers a similar end-to-end service.

There is competition from both public & private entities for each service individually, including their OCS hardware - only two companies are developing alternatives to cold storage:

“We are aware of only two other companies providing warm perfusion systems, OrganOx Limited and XVIVO Perfusion AB, both of which offer single-organ warm perfusion systems for the liver and lung, respectively.”

This is already a limited competition for the hardware itself while there are none for the end-to-end service. If I were a patient or a hospital or any adgency, I would work with Transmedics and use its entire infrastructures instead of buying individuals hardware to those two companies.

Seems like a competitive advantage.

Risks.

Lots to say here, starting with fundamentals.

Regulations. We talked about how important regulation is for Transmedics to access reimbursement programs, but this can create lots of friction.

For their actual products but also for their next ones as innovation always takes longer with such drastic rules, and institutions usually don't make things easier - just see how Musk can't fire rockets because of two birds.

International Expansion. There's a lot of potential for growth in the U.S. but the real bull case starts with international expansion, which relies, again, on regulations. If Transmedics doesn't reach an agreement with over seas countries, it might take years to have its products sold elsewhere or maybe never even happen.

Inssurances. As I've said many times already, their entire business works if their products are & continue to be assured by public institutions. If this changes or if they are not able to get coverage overseas, the company will not bring in any revenues as no one could afford their services.

Scandals. Scandals can hurt a stock for no reason. Rumors are easily spread and very harmful, even if they're not true, even if they're not Transmedics' fault. Although a scandal capable of killing the company would mean something was fundamentally wrong from the start.

Growth stock. Transmedics is a growth stock at the moment and every growth stock is dependent on its growth rate which it can’t slow down. The slightest misstep could send the stock down by double-digit percentages in hours. This won't matter if the company still executes, but it's important to keep in mind.

Finances

A very different profile than what I usually present and it barely fits into my conditions, but when you deal with growth stocks, you've got to adapt. Fundamentals are more important than financials in this case.

We’ll go over it all in details.

Revenues. These grew around 130% CAGR over the last three years. We can expect to maintain this growth but projections are still high above 50%. This shows a growing demand a& need for their products.

Income. A barely profitable company but barely is what twists it from non-investible to investible for me. Growth stock have to focus on acquiring market share and growing revenues so it isn’t an issue but this new found profitability is a proof of concept, a proof that Transmedics’ business is healthy and can generate cash once optimized.

Optimization will come later, it ins’t the priority now.

Cash & Debt. As you can see, there's a lot of both... Transmedics is using every lever possible to finance itself: share issuance & debt. All of it goes toward expanding & improving its business which is exactly what we want to see.

This isn't an issue as long as these investments are converted into growth, and as we've seen with revenues, things are moving pretty fast while NOP & transportation are still relatively new - things could even speed up.

Debt is pretty stable now but shares continue - and will continue, to grow, feeding this cash pile over the next quarters, allowing the company to continue investing & aggressively conquer market shares.

Although being profitable might reduce the company's need for cash.

Free Cash Flow. Newly found profitability isn't enough to generate FCF and the cash brought in by share issuance is all going into investments, hence a negative FCF. Again, as long as these investments yield growth, it isn't an issue.

Optimization will come later.

Opportunity

Transmedics could be called a hypergrowth story with its strong historic CAGR & guidance. Hypergrowth stocks trade at higher ratios but will also be hit harder if growth slows. Add to this its relatively low capitalization - around $5B at writing time, and you're with a pretty good cocktail for volatility.

Before we start, my investment timeframe is probably a decade here as long as the business executes, so I'll be okay buying at higher ratios than usual.

Geography. The need for transplants is growing rapidly due to our new lifestyle & chronic diseases as we've seen earlier. There's no reason this trend should slow down in the west and there are many reasons that demand grows in other regions as life quality & lifespan also rises.

Numbers talk about a $5.45B market in the U.S. and Transmedics declared $241M of revenues the same year, or 4.4% of the entire sector. The world market size is estimated around $10.11B in 2023 and expected to grow to $22.94B by 2030. This is the market Transmedics is targeting by then.

We've seen how important the OCS is for the industry, and these will be the company's primary source of revenues in other geographies as implanting an NOP infrastructure will take years.

Crystal Ball. Future is impossible to anticipate but we've seen how far ahead their technology is and lots of hospitals & surgeons in the U.S. now attest to their quality & reliability. This is a sector where you only buy the best and do not change as long as they're doing their job while healthcare & preserving the population's lives is a priority for all of our countries. These are very sticky products; it's not like a smartphone you can change brands each year just because.

Assuming Transmedics gets regulatory approval in all of Europe in the next years, would it be crazy to assume that Transmedics could control between 5% & 10% of the market? Or even more?

That would bring us between $1.15B & $2.3B of revenues in 2030.

Valuation. We can add some internal insights as the company is estimating an 80% YoY growth in 2024, bringing their market share to around 7% based on 2023 data. Rapid growth, hard to imagine a brutal slowdown during the next three years considering the nature of the product - again, very sticky.

That's why it seems hard to imagine revenues growing less than 50% CAGR up to 2026, a correct assumption even without international expansion, as NOP is new and will certainly scale rapidly.

I estimated the needed growth to reach these 5% & 10% market shares of the sector by 2029, not 2030. Assuming my base case is real for 2026, it would mean almost no growth between 2026 and 2029 to reach 5% of the global market share and around 30% CAGR during that period to reach 10% of the global market share.

I do not believe for a second that such a company would not grow between 2026 & 2029, but I also have a hard time imagining a more bearish scenario than my own by 2026. So, my personal thesis will be between the 10% global market share & what I called the bull case which counts on a rapid international expansion - for the best product of a growing & needed sector designed to save & improve lives.

A word on margins: between 9% & 12% doesn't come from my imagination; the latter is the last six months' company margin but they talked during the last quarters about growing expenses and investments which could lower margins short-term. I didn't want to make too many assumptions long-term, so I kept them flat.

Multiples. We won't focus on the P/E ratio on a growth stock as the company isn't focused on profitability, plus we should have more share dilutions in the next years as the company is indeed profitable now, but not quite enough to sustain itself & its growth.

My base case up to 2026 would end up with a higher P/S than the industry but nothing outrageous, taking into consideration the value of the company & its growth. Transmedics deserves a premium, and I really believe x6 / x7 is reasonable by then.

But what matters is the long term. I think we can all agree that if the thesis holds, Transmedics certainly won't trade at x4 sales while growing above 30% CAGR with the same fundamental strength.

Conclusion

This is why I am already buying Transmedics around $140. This is a long-term investment and I am entirely aware of the potential volatility, but as long as the thesis holds & the company executes, I only intend to buy more.

I feel like I am repeating myself a lot during this write-up and I hope it's not too heavy to read, but Transmedics' products do seem like a new paradigm in a pretty important - vital really, sector. The OCS isn't new and we're starting to see support for the product coming from specialists. This should push its adoption internationally -depending on insurance regulations.

This is the bull case. A needed & much better product in all aspects for a constantly growing demand worldwide, without any reason for regulators not to include it in their own healthcare plans as it will improve drastically their people’s lives. It doesn't seem unachievable in the long term but the road is long until then, and the volatility will require a strong stomach.

I am already invested and will follow closely how things evolve.

Very nice article! Thanks for sharing. I have been reading a lot about the company recently and it feels that buying shares not only could help me financially but also would make the world a better place :)

The only caveat that I saw in your thesis buying at $140 was seeing the young President & CEO selling shares at that price and even above repeatedly during this year; not sure your thoughts on this.

Now is definitely giving a clearer buying opportunity at ~$85.

First time hearing about this co so learnt a lot- thank you! Will definitely look deeper into this name.