MercadoLibre Q3-25 Detailed Earning Review

The market disrespected this stock.

If you guys are interested, you’ll get a 15% discount on FiscalAI through my referral link below. FiscalAI is the tool I use for KPIs in all my write-ups - powerful, data-rich and with great UX.

https://fiscal.ai/?via=wealthyreadings

Everything you need to understand MercadoLibre’s bull thesis is here.

This will be a pretty short report as everything continues to run smoothly.

Business.

As a reminder, MercadoLibre’s success depends on LatAm’s retail purchasing power as the company’s revenues come from two consumer-centric verticals: financial services and e-commerce. Everything is detailed on the investment thesis.

And this means the region and its households are affected by macro factors so every MercadoLibre quarter will comes with a bit of economics. The news this quarter was mostly positive with the FED cutting rates once again which will relieve pressure on the countries’ burden and allow them to invest even more, creating jobs and growing consumption power in the meantime.

We also had the midterms in Argentina and Milei strengthened his influence within government. Not an outright majority but enough to block the opposition and give his administration far more room to act.

Despites our views on his politics & even if it means more austerity, the goal remains to stabilize the economy and attract investors - and it’s working, plus lower inflation. It also unlocked a $20B financing package from the U.S., which was contingent on Milei’s victory.

Turning to the company itself.

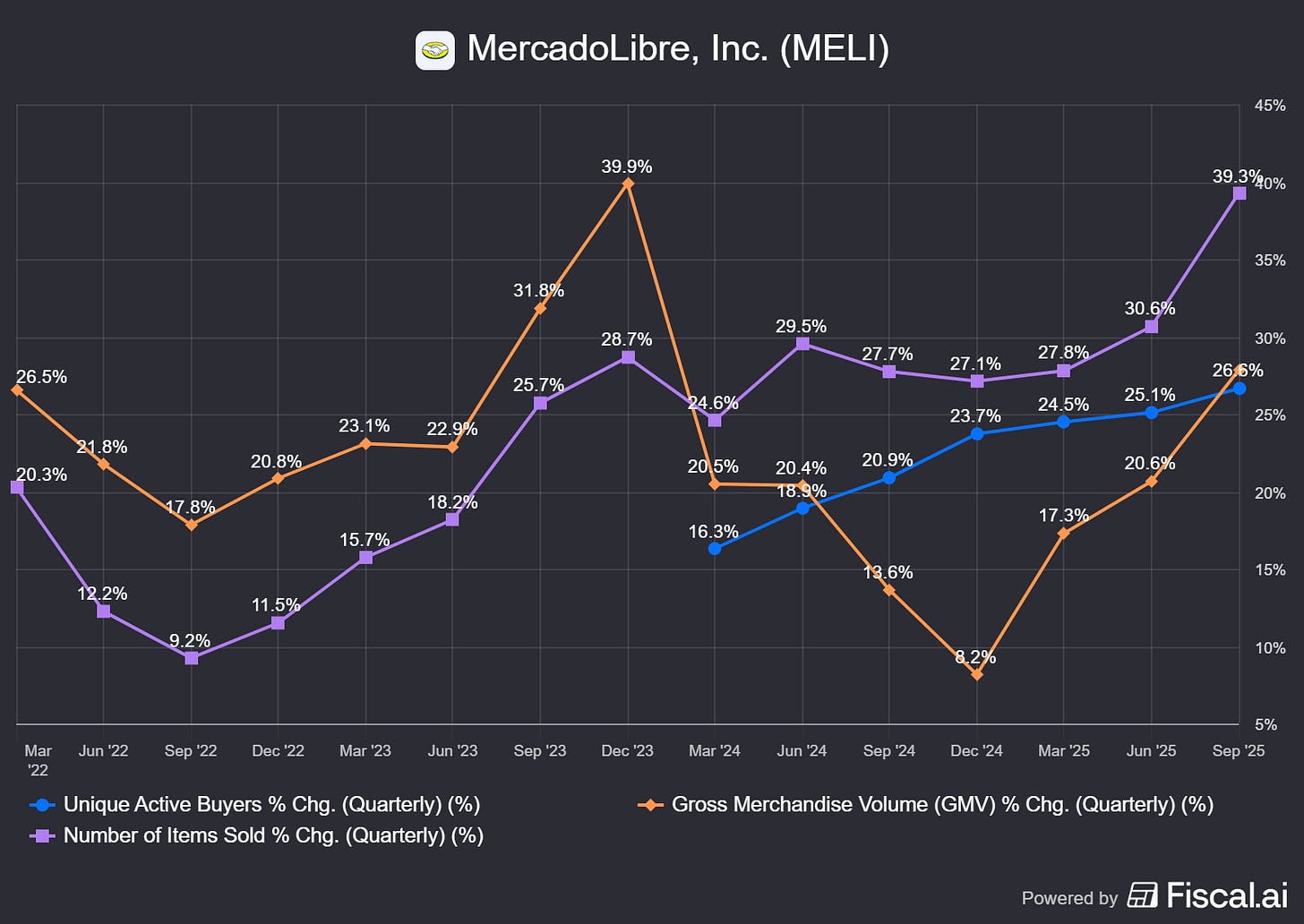

Its e-commerce remains very healthy, with 33% YoY revenue growth. To keep it simple, the platform sells more items to more buyers, and growth continues to accelerate.

Brazil was particularly strong this quarter, boosted by the recent reduction of the free-shipping threshold.

The recent reduction in the free shipping threshold in Brazil has already delivered strong results, with both GMV and items sold accelerating in the quarter. We also saw strong growth in buyers with improved conversion rates, retention, and frequency of purchase.

Absorbing shipping costs create a virtuous cycle of more buyers and sellers.

More sellers are coming to our platform, and the number of listings has increased sharply in the BRL 19-79 price range.

This was a double win for MercadoLibre as the added shipping costs were offset by logistics efficiencies due to volume growth.

That’s a decrease in cost of shipping in local currency sequentially. The reason for that is because, as we mentioned, the extraordinary growth that we’re seeing in volume is helping us dilute fixed costs of our logistic operations.

This set the third consecutive quarter of revenue acceleration in Brazil with similar trends in Mexico & other markets. Argentina was solid but growth is slowing due to local politics.

In Argentina, growth of GMV, buyers, and TPV remained resilient in Q3, but trends slowed through the quarter due to the challenging macro backdrop.

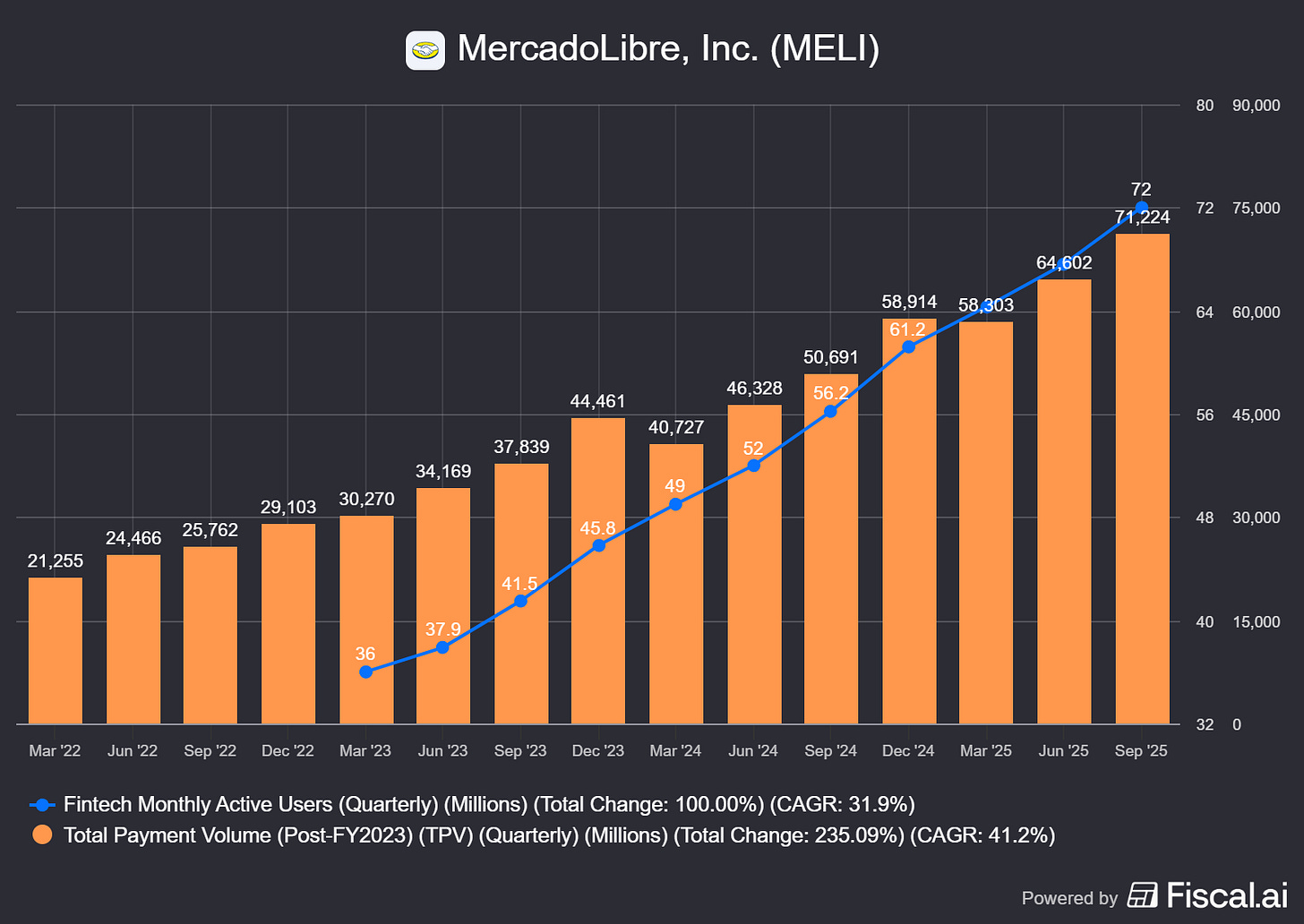

For financial services, I didn’t find much color on the call but the business continues to expand.

More users, more usage and more assets. A clear growth of usage which happens thanks to a better value proposition.

Financials.

No signs of slowdown here.

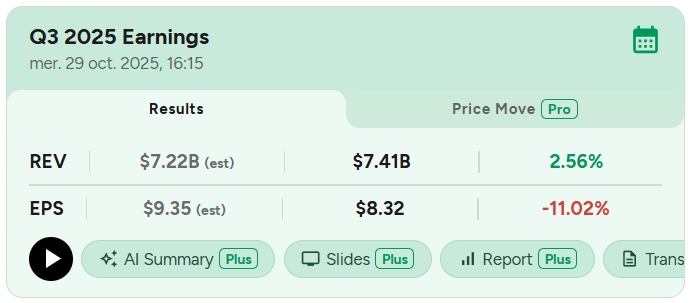

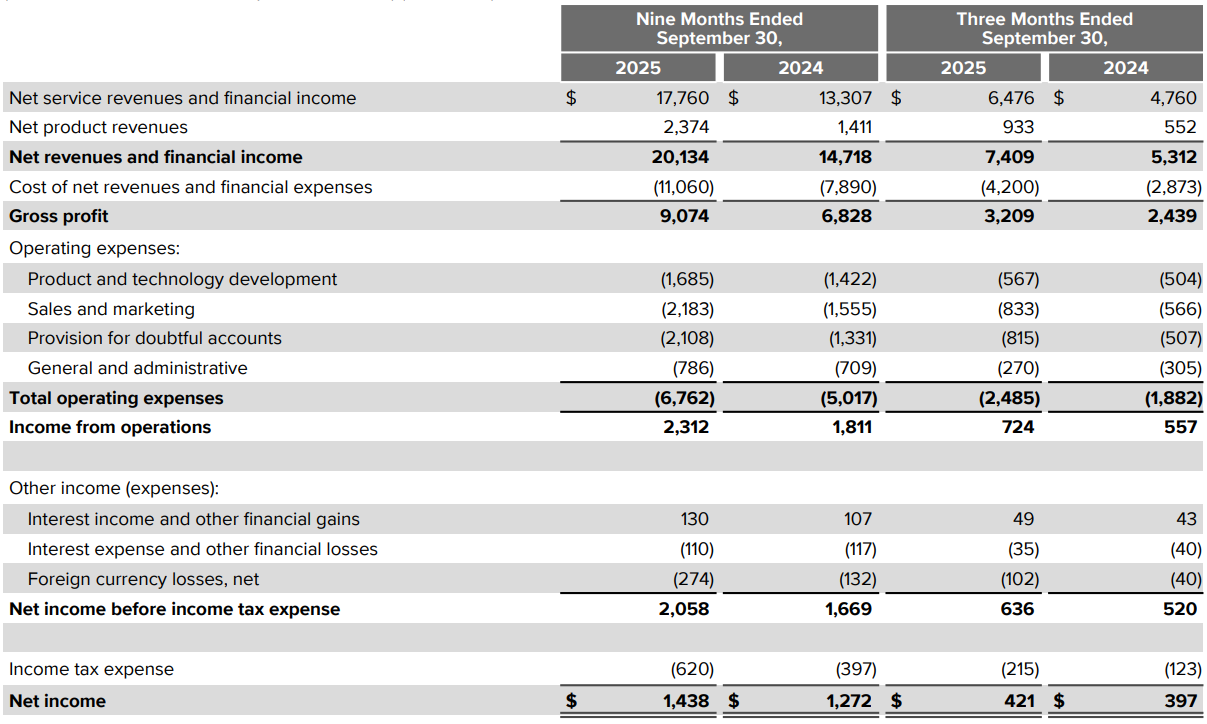

Revenue grew 36.8% for the nine months ended and MercadoLibre hasn’t reported a sub-30% growth quarter in years. Gross margins was stable but operating margins declined slightly due to higher expenses to accelerate growth.

In term of cash, The company generated $2.6B in free cash flow and holds $3.58B in net debt - still a very solid balance sheet.

Investment Execution.

Another excellent quarter for MercadoLibre, no surprises. Management continues to execute, and the business remains strong. This is what we want as investors: a stable compounder.

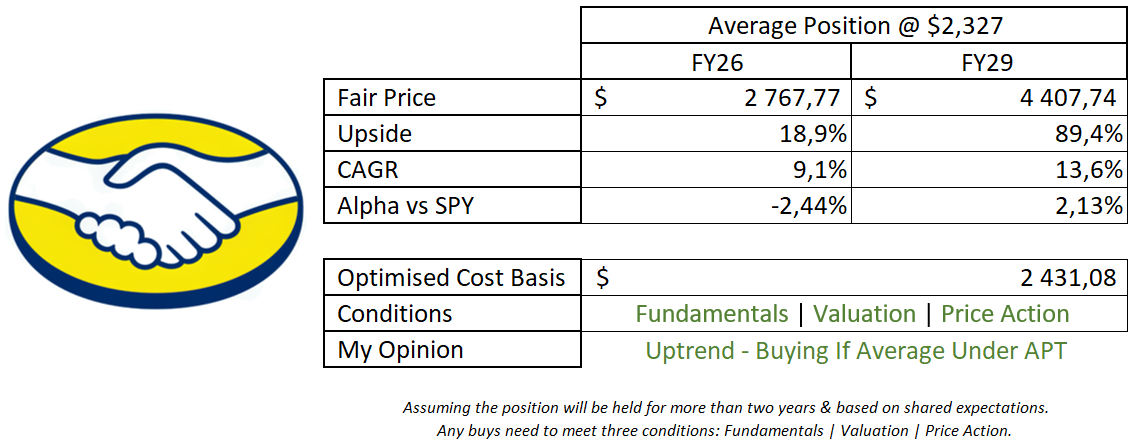

I have nothing to change in my valuation.

This model assumes a 25% and 20% CAGR growth until FY26 and FY29, respectively, 9% net margins, no dilution, and P/S & P/E at respectively 5.5x & 40x.

The stock is still buyable, even after the post-earnings pump. I’ve said before that a retest of the weekly 50 would be a great entry point, and that is exactly what happened.

The stock has always had a perfect price action, retesting both previous breakouts & its weekly 50EMA. We might do it again, which would give a really great entry.

I also shared the last few weeks on each weekly that the name was a good buy. And without much surprises, this was the perfect playbook.

You’d be up roughly 6% buying the weekly 50 retest and much more if you averaged in below. I didn’t add as I did not have liquidity and focus on Chinese equities for non-U.S. exposure, but I hope some of you did.

LatAm has bright years ahead, and MercadoLibre will benefit directly.

A great company, textbook compounder and a great name to own with the right accumulation strategy to beat the market consistently and without worries.

Concur that execution is key. Not easy to do a short term play on this name. Great long term thesis though.

You gave a sharp, balanced review that highlighted both the operational execution and the macro backdrop supporting MercadoLibre’s growth. I liked how you connected Brazil’s shipping strategy to logistics efficiencies because it illustrated how scale economics enhance margins despite rising costs. Recent Morgan Stanley analysis also flagged LatAm e-commerce volumes as outperforming global peers on digital payments integration. How do you see MercadoLibre sustaining this advantage if regional rate cuts start to stabilize next year?