Buy & Hold | Today's Five Best Buys

Portfolio Performance Review & The Five Best Stocks to Buy.

I’ve always said that fundamentals, research & convictions matter, but beating the market comes down to execution. That’s what these write-ups will be about.

I already share my aggressive position through the Portfolio Modifications write-ups; it is only normal that I do the equivalent for my Buy & Hold portfolio. I won’t share each transaction but regularly send this format to share the stocks I consider to be the best buys under current market conditions.

Returns over the long term depend on the prioritization of our liquidity, which should flow from our highly valued assets towards the best opportunity at any point in time. These write-ups are meant to present those best opportunities, based on my opinion & the companies I follow.

You’ll find the portfolio below if you wish to subscribe & have alerts for transactions at the moment I do them.

https://savvytrader.com/wealthyreadingspro/buyandhodl

My goal is to deliver alpha over the long term, not just six months under easy market conditions. If/when proven this content is valuable, it will be shared behind a paywall. No rush, though; it’ll stay free until proven valuable - quarters of outperformance.

Nothing shared here is financial advice; we are all responsible for ourselves.

Performance Review.

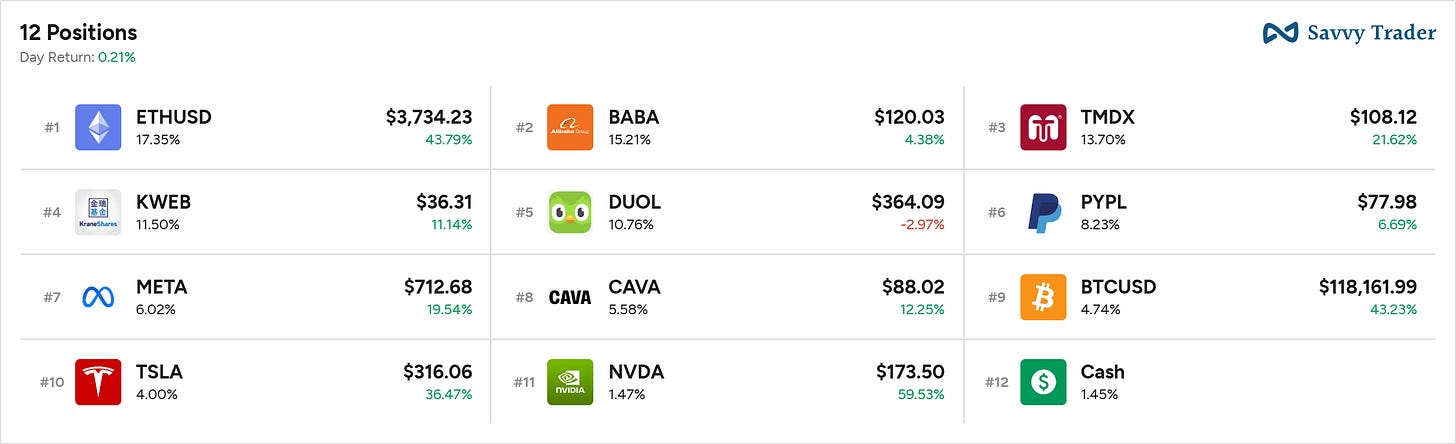

Here is the portfolio’s composition.

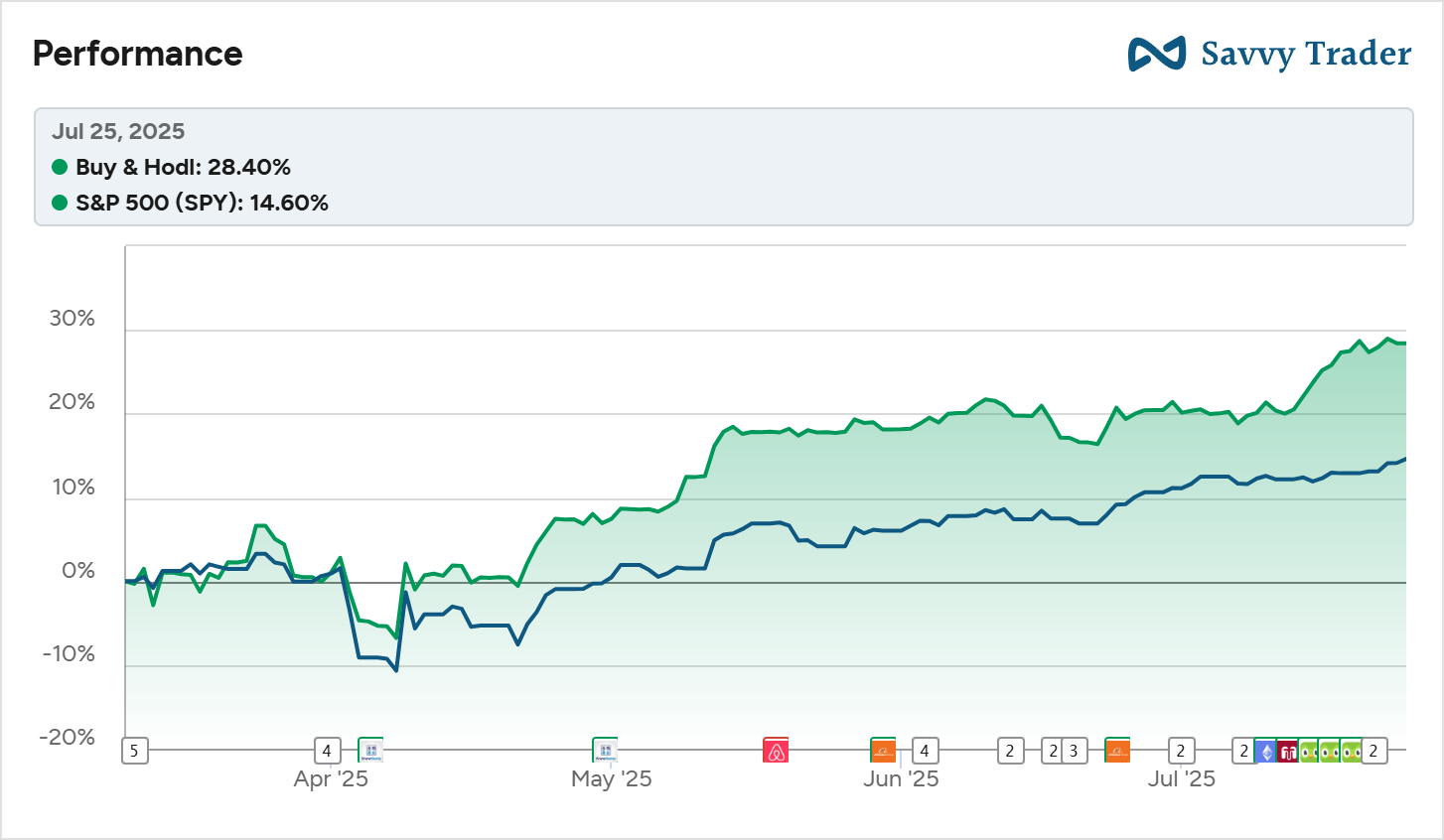

Portfolio is still fairly recent as I opened it in March only, but the outperformance is already interesting, beating both the S&P500 - which is my benchmark, and the Nasdaq, which returned 20.1% since March 10th - when I started this portfolio.

Clearly satisfied by the result. Every position & buying target was shared either on the weekly updates or during the quarterly reviews on which I share an updated valuation & price action review for each company I write about.

Everything to say that if I can outperform the market, you guys have everything you need on here to do the same, hopefully even better!

My Top 5 Purchases.

These are the 5 stocks I consider to be the best buys under current market conditions based on valuation & price action; fundamentals are already a given for each of them.

Transmedics.

This is the name to read about right now if you don’t know it yet.

It isn’t a surprise. I talked about the company a lot because the market continues to punish it for no reason - or so I believe. Sometimes it is because a competitor is not doing well, others because of some short reports or articles which do not even mention them… You’ll find it all here.

My take was & remains that the stock returned triple-digit YTD & had to breathe, my target was the gap opened during the last earnings report, between $98.5 & $108.8. This gap was filled to the cent in one candle on Tuesday and gave a great opportunity, while bouncing on its weekly 50EMA, which are watched levels by many traders for bull trend continuation.

A confluence of too many bullish signs to be ignored.

I continue to believe a fair average price for a long-term position to be around $110 or so, with really conservative growth assumptions which should be largely beaten if the company continues on its H1-25 track. So fair average price could be higher.

The best buy on the market at the moment in my opinion. TransMedics represents 13% of my total portfolio with both shares & long-term calls.

KWEB - China.

Many continue to refuse to invest in China, and I somehow can understand why, but I think differently as we are clearly entering a multipolar world & liquidity during the next decade will not behave as it did the last, with China being a clear contender to receive lots of it.

And I don’t seem to be the only one to think so.

I cannot value an ETF, but I certainly don’t think Chinese tech companies are properly priced - Alibaba to start with, so the tech ETF certainly has a lot of potential assuming that liquidity finds its way towards the Middle Kingdom.

There are two ways to see this price action, but only one reason for it to move: the next trade negotiations which should happen the coming week in Sweden.

This will be an important short term catalyst but I remain convinced that over the long term - 2 years plus, China will do wonderfully and attract more capital as the world realizes that the country is much more capitalist than our bias makes it look like.

I hold both shares & long-term calls for 13% of my portfolio and will accumulate more aggressively if we were to break out this three-year accumulation range.

PayPal.

As usual, the ugly duckling remains a good buy, or so I believe.

Not much to say about valuation or price action, but lots to say about innovation as PayPal is once again one of the first solutions to embrace new technologies - just like it was one of the first to embrace online payments.

The company is building a processing network for travelers & leveraging stablecoins to do so - and more, all while being the payent system to offer its solutions to LLMs, which are going to redefine online shopping, drastically.

PayPal’s stock is dirt cheap as the market believes the company won’t see any growth nor margin expansion & is incapable of adapting or bringing value. I believe this isn’t true, and if I am right, I would capitalize on both the future growth or margin expansion & the catch-up to fair value.

Only owning shares, much smaller position than the previous ones as it is also a more “speculative” one - as in the market could need long before appreciating the stock.

Duolingo.

The famous language learning app which will apparently be disrupted by ChatGPT, like so many others… Something I do not believe in & detail here.

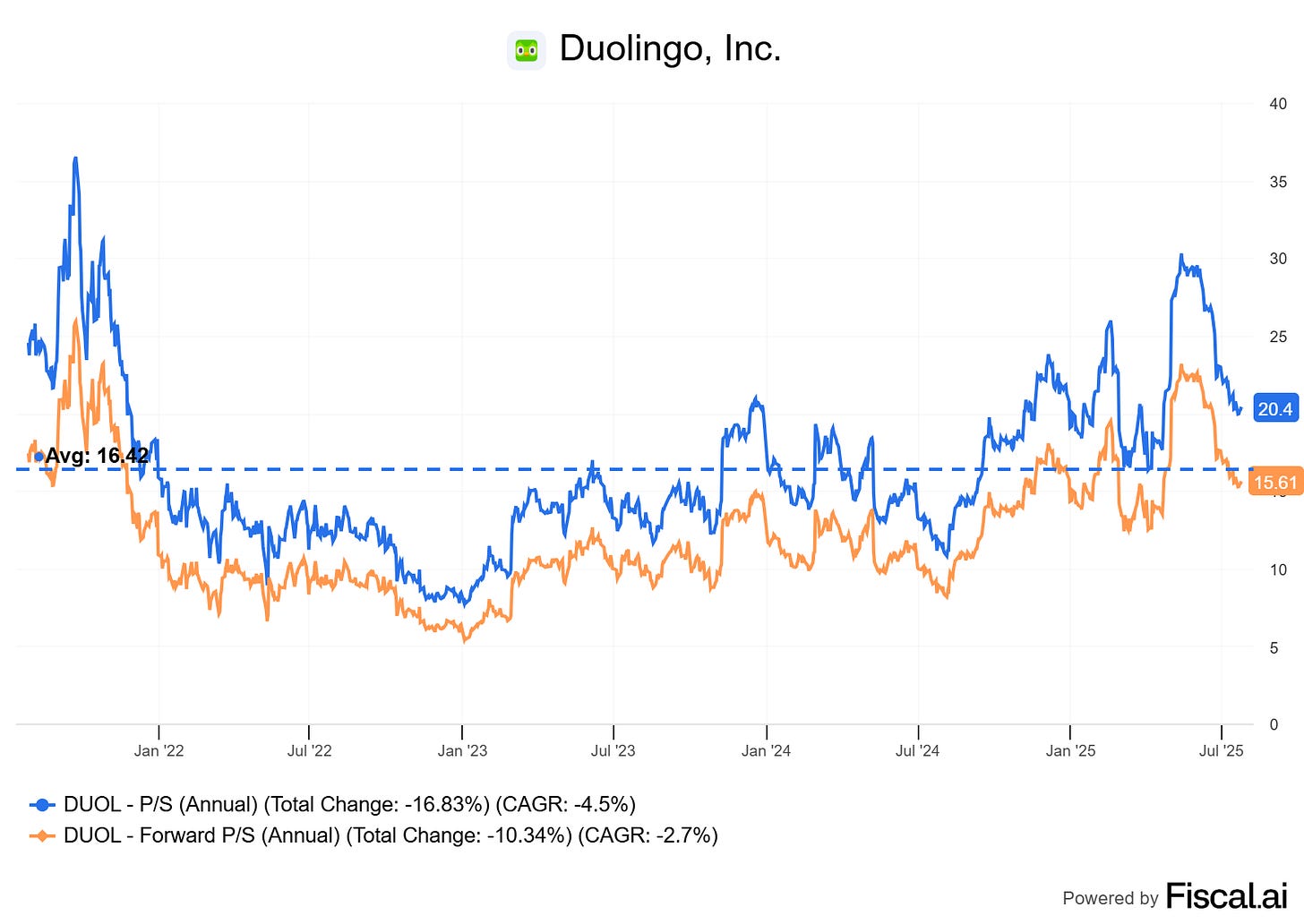

Many consider that the owl is still expensive & they are not entirely wrong, but we are in a bull run and great companies are always expensive, except during crashes or bear markets & we never know when those happen - and usually don’t sit on cash piles when they happen, so we still end up missing opportunities.

If you focus on forward ratio, Duolingo is trading at its average sales multiple for FY26, which means you are basically buying one year & a half of revenues in advance. I am okay with that & started my position here, slowly, and will increase it if we go lower.

I also am helped by price action as the stock gave back lots of its gains due to simple market mechanisms - investors took profits. We are back on the weekly 50EMA, which is once again a wonderful support during bull trends, and are closing in on not only one but two daily gaps between $338 & $362 and $406 & $433.

We could go lower in my buying zone, but I wouldn’t worry as I’d accumulate as we do so. And lots of signs point towards continuation more than bear market. I believe Duolingo is a learning methodology which can be applied to any subject & when they do, they’ll basically become an online school.

I only own shares on the name and am accumulating slowly.

MarcardoLibre.

As shared above, I am bullish on China, but I am more largely bullish on international equities as markets are about liquidity & as it leaves America - to some extand, some of it would rather bet on Latin America than Asia, which is something I went about rather lengthily on my investment thesis.

The stock is trading around its 3Y multiple average & slightly above my accumulation target, but as for Duolingo: excellent companies are always bit expensive & it wouldn’t be surprising to start a small position here, and certainly not a bad idea to accumulate an already existing position.

The stock has always had a perfect price action, retesting both previous breakouts & its weekly 50EMA. We might do it again, which would give a really great entry.

I have no position on the stock yet because I do not have enough liquidity to buy with a significant position and believe the four other stocks are better liquidity attribution - except PayPal maybe. I would prioritize it above Duolingo & PayPal if we retest the weekly 50EMA in the next two weeks, but not at today’s price.

Thanks love the clear analysis and PA for meaningful entrypoints.

This is serious and well-balanced work, not just stock picks but a strategy of positioning with intention. I appreciate how you frame execution as the differentiator, especially in a world where conviction too often lacks clarity.

Your coverage spans the spectrum: TransMedics as a misunderstood Tower moment, PayPal as a Magician reinventing its tools, MercadoLibre moving with the world’s Wheel. Even your China and Duolingo theses reflect archetypal tensions — The Star's distant hope versus The Lovers' choice under pressure.

Thanks for sharing your compass. This isn’t just buy and hold — it’s pattern recognition in action.