Duolingo Q3-25 Detailed Review

This one hurts

Everything you need to understand Duolingo’s bull thesis is here.

Don’t let the screenshot fool you. This quarter hurt.

I’ll detail everything and conclude on what I will do with my shares. As usual, I’m not here to please bulls or bears. I’m here to be objective and share real data focused on making money. Nothing else. I’m bullish on Duolingo, but this quarter raised issues, and we need to talk about them.

Let’s start with the hard questions:

Was this quarter thesis-breaking? No.

Was this a bad quarter? Not per se.

Does the market reaction make sense? Yes.

I’ll begin by explaining why the stock fell 20%. Then we’ll go through the quarterly data as usual: financials, guidance and investment execution where I’ll share what I intend to do and how to think about this name going forward.

The Problem.

Management is shifting focus toward user engagement rather than monetization. The market doesn’t like it. It rewards cash generation, not engagement, & prioritizing the latter will hurt the former and there’s no way to know if this strategy will pay off.

The market is pricing in the risk that Duolingo might fail to maximize engagement in the short term and therefore fail to maximize cash generation in the long term. It is also pricing a lower growth due to this decision which deserves lower mutliples.

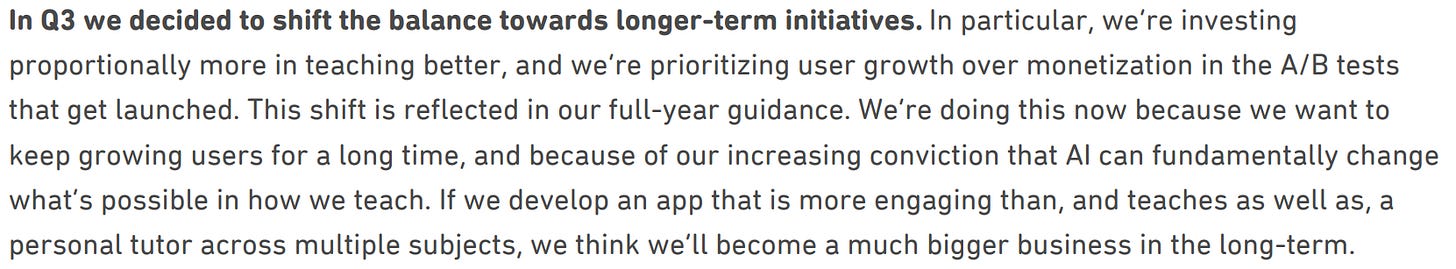

Here’s what management shared:

So we’ve talked to you all and our investors for a long time about wanting to maximize, platform LTV. And what Luis is describing is a, change of, you know, small proportion right now that is going to help us grow users for a long time, get users to do more lessons, learn better, spend more time on the app, and in general, be more engaged Duolingo users. And we think that if we do that and we do that effectively, we’ll both grow users for a long time, and we’ll increase platform LTV for a long time.

Long-term shareholders should be happy to hear this. A platform with more engaged users is a platform that generates more money. I personally agree. But there are still questions:

How does it work?

Why are they doing this?

Will it work?

When?

What are the impacts until then?

How does it work? It isn’t not the market’s first question but key to understanding the potential impact.

Duolingo is known for running A/B tests: different experiences are shown to different groups to observe behavior. For example, Group A gets energy, Group B gets hearts, and management will control which groups behaves like the want the most.

What’s changing is the priority. Duolingo used to balance everything but now they’re clearly shifting focus to user engagement - acquisition and retention, even if it means sacrificing monetization. They will ship updates to make the platform better even it if makes less money.

That’s just so so okay. We’ve always had to, make trade offs between whenever we run an experiment. Some experiments improve all metrics. Great. That’s an easy call. But there are times when experiments improve one metric but hurt another. I’ll give you a fictitious example. If right now, a free user free users get 25 energy units at the beginning of the day, and every exercise that they do spends one unit. If we were to do an experiment that decreases that from 25 to say 24, we know that would make us more money. That it’s just us because more people run out of energy, so more people end up wanting to pay to subscribe. However, we also know that would decrease daily active users because it would frustrate some of the users. What we mean is that what we you know, the change that we are doing is that we are going to be prioritizing user growth over monetization in this type of judgment call.

Crystal clear.

These kinds of A/B tests are what led Duolingo to switch from hearts to energy, and for many other features which improved the app over years.

We’re very happy with energy. It did exactly what we wanted it to do. It increased bookings and also increased DAUs.

This doesn’t mean monetization will go to zero. It means focus shift to quality.

Why do this and why now? One of the most important questions and no one has a definitive answer. But there are two possibilities.

It has to be done and there’s no perfect time. The company wants to become the best ed-tech platform in the world. You can’t do that by focusing on monetization and ignoring quality. That’s management’s view.

We see a huge opportunity. Over the next few years, education and the way people learn are going to change fundamentally. And it’s because of AI. And also because of AI, we see we have line of sight now to create an app that can teach really well much better than anything that humanity has seen before. If we’re able to do an app that teaches just that well, way much much better than we have now, we would be talking about billions of users, and that’s what we wanna shoot for here. So this is why we are investing in the long term.

And we think that that’s worth it because it’s a huge opportunity. So the risk reward seems right.

There are issues on the business. User acquisition is slowing or churn is raising & forces management’s hand. They’re doing this from a position of weakness.

I don’t have an answer but I have an opinion.

I think they’re acting from a position of strength. They know AI is powerful. They know they can become the best personalized teaching platform in the world. And they know they have to move fast; before someone else does.

Why do I think that? Because I’ve seen no signs of weakness - yet.

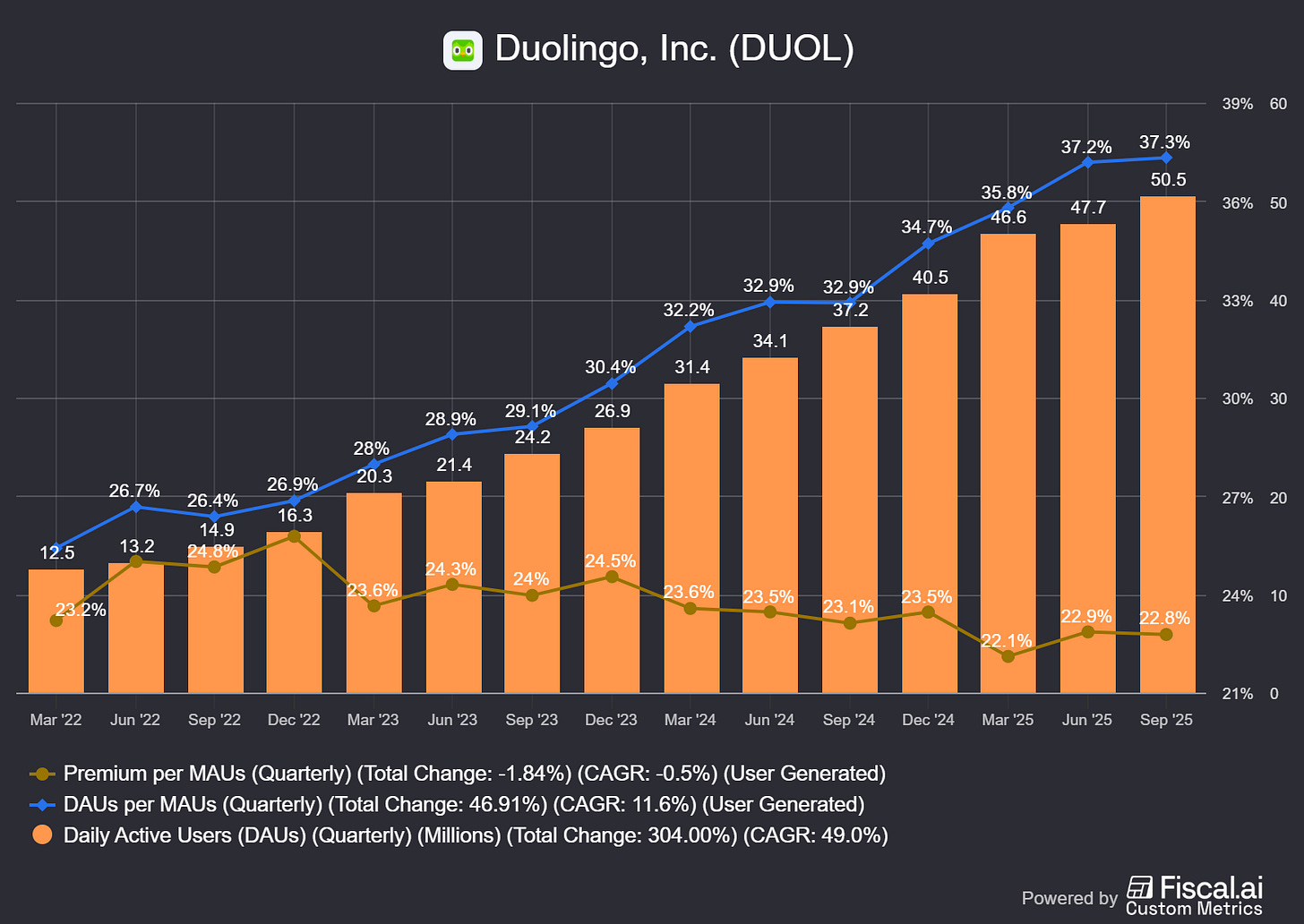

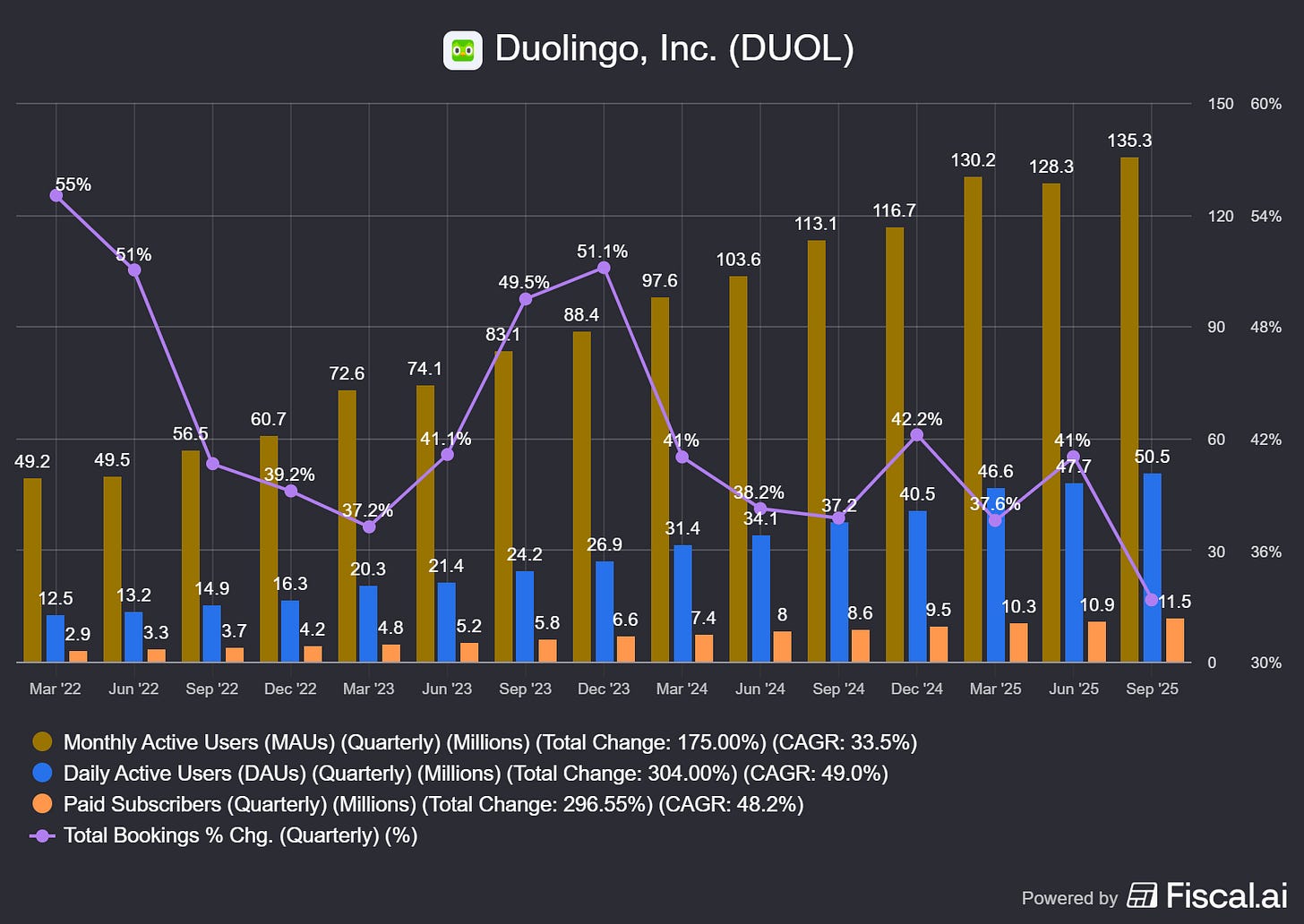

These trends aren’t those of a struggling business. We’re talking about 50 million daily users with stable volume growth. Yes, growth in percentages is slowing but that’s normal. Every company’s percentage growth slows past a certain size.

Duolingo has been adding 2M+ DAUs like clockwork. The last twelve months saw the biggest DAUs addition in its history. Retention is strong, with DAUs per MAUs rising. Usage is growing. Conversion from monthly users to premium is stable; slightly declining but nothing alarming considering volume.

We also had a number of product improvements that helped with retention, so that that was great

That’s my bias. But some data could point to the contrary - notably guidance.

Will this work, and when? The million-dollar question.

The market’s reaction doesn’t mean it won’t work. It means: sell first, price the risk, re-evaluate later. And management didn’t help much with some of their comments, although those are honest and that’s what we want as shareholders.

And so would we expect some of that to persist into 2026? Sure. But, again, I think as a general framing of this, it’s a relatively small, you know, financial impact from this kind of reprioritization.

So we’re probably gonna be seeing that. And our hypothesis, but it is a hypothesis that I very much believe in, is that that will translate to user growth. It’s just not going to be linear or quick.

As to how long this is going to take, this is you know, it’s an interesting question. I mean, I think you’re asking something to the effect of, like, well, is this gonna hurt bookings, and is this gonna hurt bookings forever? You know, I I don’t think that’s the case. It’s just going to take some time for us to see, financial results over these long term investments that we’re doing. But we’re going to be acting for a while like there is a humongous opportunity because there is one and, you know, until we get it. But but I think we’re going to be seeing good results from this even, you know, much much sooner than that.

The key takeaway: they don’t have a timeframe. This shift started this quarter and will continue until… they’re satisfied. Without guarantees.

What are the impacts until then? Another million-dollar question, with more answer this time. The number one priority over the next year is to maximize engagement and improve quality - courses and the way Duolingo teaches. The platform needs to get much better and offer more, which requires investment.

The first impact is increased spending.

And and what that look like looks like is that we are putting more relative investment in things like teaching better, if we teach better, what that does is that that helps user growth. But there’s a lag. You know, just whenever you improve your courses, users do grow, but it takes a while for that to happen. And then user growth, there’s a lag to get to monetization because people take some time to subscribe.

This is about improving the service. They’re not planning to launch new classes for now, just to enhance existing ones as much as possible, leveraging AI for personalization.

It definitely accelerates our road map in, more coverage of languages [...] And what you’ll see us do is you’ll see us go faster in terms of, adding content to these top nine languages. And and right now, for most of them, we don’t get you to the place where we wanna get you, which is the a Duolingo score of one thirty, which is where you can get a knowledge job in that language. You will see that over the next few months, we’re going to be adding content that can do that for all the top nine languages. The other thing that you’ll see is you’ll see us, just add a lot more, different modules in in the way we teach languages that, that are just a lot smarter at teaching you. I mean, they’re gonna adapt a lot better to you. And you’re also going to see us, just use a lot more things that use AI in the background to allow for many more free responses so that, you know, it adapts a lot more to you.

More spending for a better service and a lag before this translates into growth. This is what the market is pricing now:

Growth will slow down short term, we know that. But we don’t know if these investments will yield better growth later.

Lower growth deserves lower multiples.

Guidance.

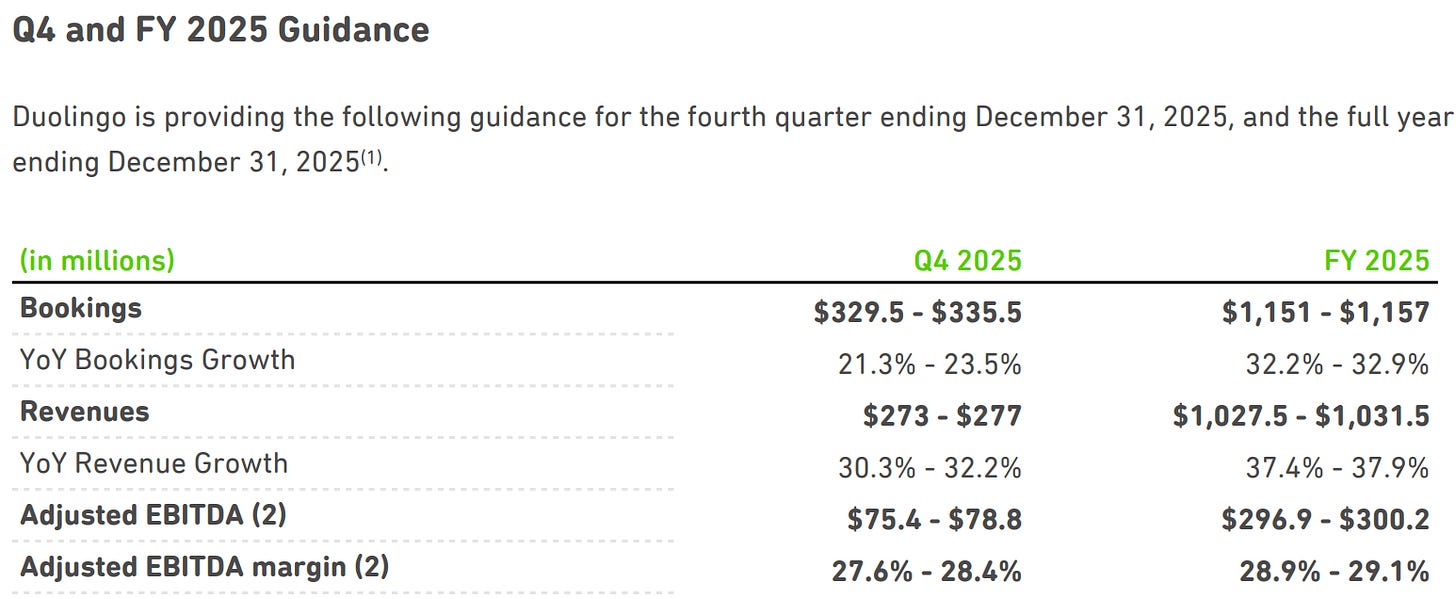

We need to talk about guidance now because it’s an issue. Management is guiding for no sequential growth. Duolingo’s slowest sequential growth over the past four years was 7%, so this is a first and raises a serious question: what’s happening?

Even with this shift toward engagement, growth shouldn’t flatline like this. That’s the argument driving many investors - and the market, to believe there may be deeper business issues, and that this shift is being made from a position of weakness.

On the other hand, the FY guidance midpoint was raised which suggests Q4 weakness was already expected by management since Q3. The market was expecting a stronger Q4 and a FY guidance raise.

From my perspective, Q2 and Q3 showed no signs of weakness that would justify this Q4 slowdown, so I’d assume one of two things:

Management is being conservative on retention, especially for Duolingo Max as many annual plans expire in Q4 and they have no view on renewals.

Or they’re seeing something we can’t yet see.

Either way, this guidance dynamic is strange, even considering the shift in focus.

In Brief.

This was lengthy, but now you have all the details.

The bottom line: management is choosing to improve the platform and focus on user acquisition and retention, profitable or not. They want better courses and a stronger service; to build the AI-powered personalized learning app Duolingo is meant to be. That’s the bull case.

Doing this requires testing and decisions incompatible with short-term monetization. It requires more spending and implementing what users respond to, things that increase time spent on the app and learning.

Management is focusing on fundamentals. And they accept that monetization might take a hit.

And the market is pricing two things.

lower growth - which will happen.

The risk that these investments won’t pay off.

The market only cares about earnings. It doesn’t care about service quality in the short term even if if creates long-term value. Do not reduce earnings. This is the market’s golden rule. That’s what’s happening.

Business.

Let’s talk about the quarter itself. It was solid, if not for the concerns and the first signs of the new focus.

Unsurprisingly, the user base continues to grow, surpassing 50M DAUs which is pretty massive. Conversion to premium is healthy and MAUs are also growing well. But total bookings growth slowed to 33% YoY. Still a big number, but clearly decelerating, likely due to the last two months when management started their focus on engagement.

This seems to be working.

There was good news on Duolingo Max which now represents around 9% of total subscribers, up from 8% in Q2. Not the fastest growth, management acknowledged that - another reason for their focus on service quality over monetization. You can’t monetize unsatisfied users for long.

Upgrades are coming, including dual-language video calls with Lilly to help beginners speak more - and therefore learn more.

We’re seeing that when we give that to beginner users, they actually speak more words per call because they’re actually able to do something. And so we think that this is gonna, really help with max conversion.

More is coming as AI is more accessible as token prices drop. Duolingo remains one of the few companies with a profitable AI-based service.

In terms of cost, look. Costs are coming down. They’ve come down just without us doing anything […] for us, the usage of AI is is anyways profitable.

Worth noting.

Chess is also doing well, with the fastest growth across the company, even faster than the original language courses, also due to a biger starting user base. People love it.

Our chess course has been around for three, four months. But so far from what we can measure retention over the last three to four months is slightly higher than language learning.

More features are on the way like PvP and global improvements.

Lastly, we had the classic questions about AI disruption. The answer? Exactly what I’ve been saying for months: ChatGPT can’t retain users for months or years, the time it takes to learn a language. And translation has never been, and won’t be a threat, however well it works.

You know, I believe in 100% of the Google IO conferences over the last ten years, they have showcased simultaneous language translation. They do it every single year, and it’s good. It works. But this has been happening for the last ten years, and we have not seen the desire to learn a language go down at all. In fact, it has come up.

But the most important quote, one aspect the market always misses.

And I think the biggest reason for that is because if you look at our users, they fall into two big categories.

One big bucket is people who are learning a language as a hobby. It doesn’t matter whether a computer can do that. It’s the same with chess, by the way […] Computers are way better than humans at chess, but still, you know, we have millions of people wanting to learn chess […] so it doesn’t matter if it’s a hobby.

The other big group of people that are learning a language with us are people who are learning English, and they actually wanna learn English.

Translation has limits and it isn’t the right methods for most situations. But I strongly believe this is evident only to non-native English speaker.

Financials.

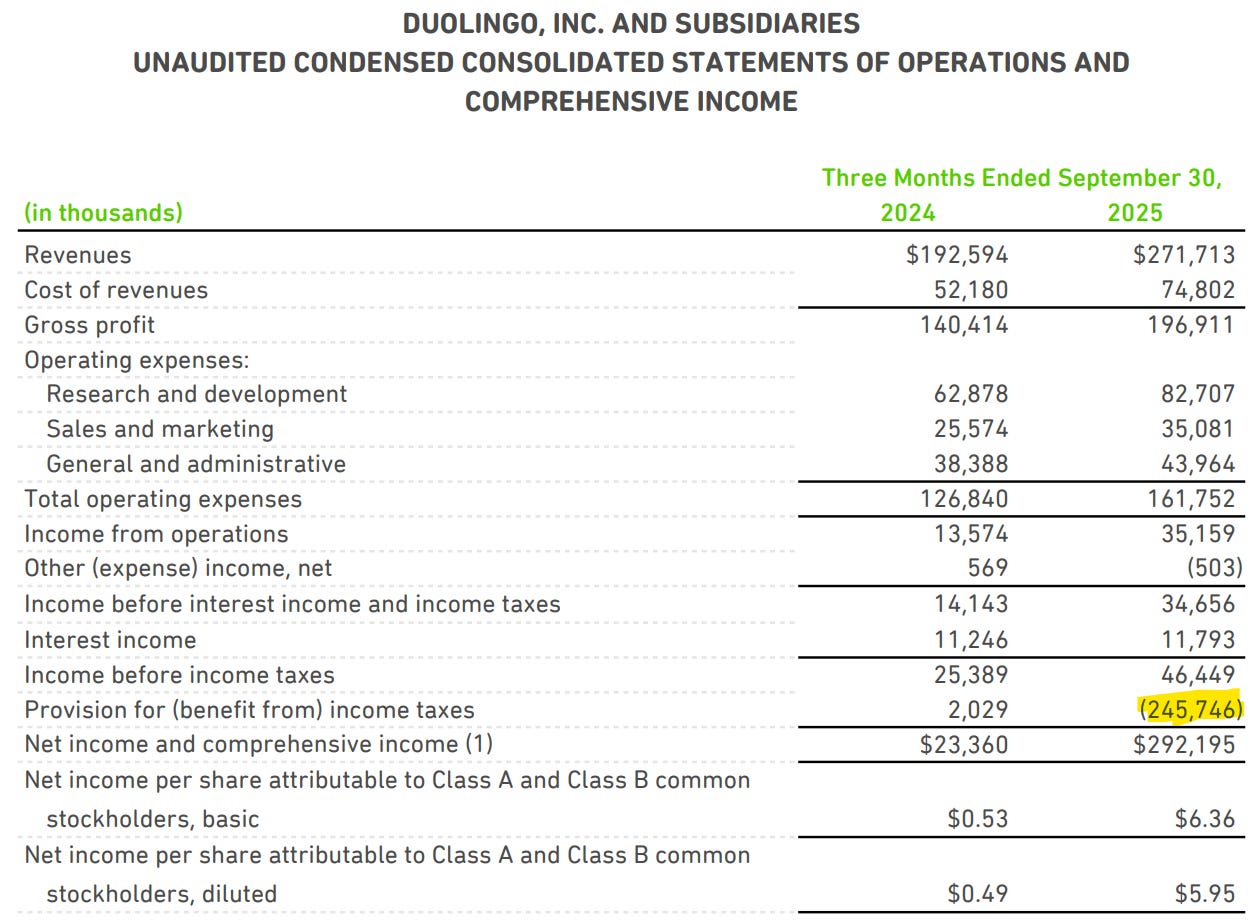

This quarter’s revenue didn’t matter much, the market didn’t even look at it.

They are healthy though, revenues grew 41% YoY and margins are stable. The only point of attention is this tax benefit which boosts the net income but the number would have been very healthy even without it.

In term of cash, Duolingo sits on $1B of net cash and generated $86.7M of FCF with $35.6M of share-based compensation.

Investment Execution.

You’ve read it all. It was long, and we’re not done yet. I’ll wrap up with the different - two, perspectives one might have on this quarter and how to think about the stock, which is down 27% at time of writting.

Long Term Investor.

This investor focuses on the fundamental narrative and long-term. What he sees this quarter is a management team willing to slow monetization and spend more to build a better app, one users can extract more value of, learn better through personalized exercises and spend more time on the platform. That, in turn, attracts more users.

So it’s gonna be years until we get to a point where we have an app that I think is just the best possible way to learn any major subject. So we will be investing for a while, and that that’s important to know. I should say, though, we’re not really guiding to next year, but we’re very excited about a lot of the initiatives that we’re gonna put out in the product for next year. We’re gonna have much better video calls for beginners. It’s something we’re calling guided video calls. The app is gonna be a lot more social. In the next few months, we’re gonna have the all of the common core K12 content in the math. Our chess course is gonna have player versus player, and it’s doing super well and growing really fast. We’re gonna have a full revamp of our music course. And for the top nine languages that we teach, we’re gonna be able to teach from zero to Duolingo score one thirty, which is where you can get a job in that language. So there’s just a lot of, a lot of things that we’re very excited about

There are risks, of course. These investments might take time to pay off, or might not pay off at all. But languages matters and Duolingo is more than a language app, so success is not guaranteed but convictions are strong enough to accumulate. We’ll talk about it in a decade.

When Duolingo is the most used global ed-tech platform around the world.

Market Participant.

This investor listens to the market first because you make money on stocks that go up.

Duolingo is going through structural change with no clarity on the impact or timeline. The long-term conviction may be the same but this investor won’t allocate liquidity to a falling stock. There are better opportunities until we have more clarity.

Risks matter more than convictions.

My Opinion.

First, I can’t do a valuation on Duolingo. Their new focus could be hurting sequential growth and if that continues into 2026, the current 30% YoY growth could drop to 10% or less, who knows? If that happens, multiples will be crushed.

Duolingo still trades at 12x sales after a 27% drop. For perspective, Adobe trades at 6x sales and grows around 10%. Growth deceleration will happen. The last million-dollar question is: by how much?

FY26 guidance will be key for this stock. Until then, there isn’t much to say.

I’ll remain a shareholder. I don’t intend to sell - yet.

My conviction in management and the long-term vision is strong enough to hold. The next catalyst is in three months, and I plan to sit tight until then with one exception: if a stronger conviction name offers a buying opportunity and I need liquidity, then I will take it from Duolingo. We’re talking about a handfull names here as my convictions on Duolingo are strong - stock like Meta or TSM, but it could happen.

I’m already heavily invested in the names I believe in. I don’t feel the need to increase those positions. Until then, I have no reason to pull liquidity out.

As for buying more Duolingo, I’ll pass. I’ll wait for price action to stabilize, which will take weeks, and reevaluate then. I won’t rush into anything. No one knows what we’d be rushing into. As always, I’d rather buy at a higher price with more clarity than try to catch a falling knife. I am a market participant with enough convictions to hold my actual stake. That’s me, you can be different.

But this is not just a braindead market overreaction. Patience is key here.

Which app are you using on the first picture?

Duolingo is no longer just a language app. It is turning into an ed-tech platform for kids, competing with YouTube Kids and Roblox for screen time. Parents want learning that feels like play, and once Duolingo gamifies more subjects, its virality will soar. The stock dip looks like an opportunity.